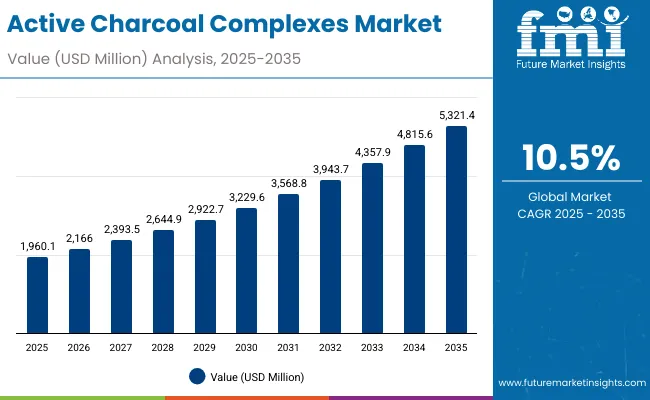

A valuation of USD 5,321.4 million is projected for the Active Charcoal Complexes Market by 2035, rising from an estimated USD 1,960.1 million in 2025. This reflects an absolute increase of USD 3,361.3 million over the decade, equivalent to 171% growth. The market is forecast to expand at a compound annual growth rate (CAGR) of 10.5%, resulting in nearly a 2.7-fold increase during the ten-year period.

Active Charcoal Complexes Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,960.1 million |

| Market Forecast Value in (2035F) | USD 5,321.4 million |

| Forecast CAGR (2025 to 2035) | 10.50% |

Between 2025 and 2030, the market is expected to grow from USD 1,960.1 million to USD 3,229.6 million, adding USD 1,269.5 million in value. This first half of the forecast window is projected to account for approximately 38% of total decade growth. Steady demand for detoxifying and oil-control formulations is anticipated to drive growth, supported by consumer preference for natural ingredients and dermatologically safe products. Within this timeframe, bamboo-derived charcoal is expected to outperform other sources, while masks and cleansers gain wider adoption across skincare regimes.

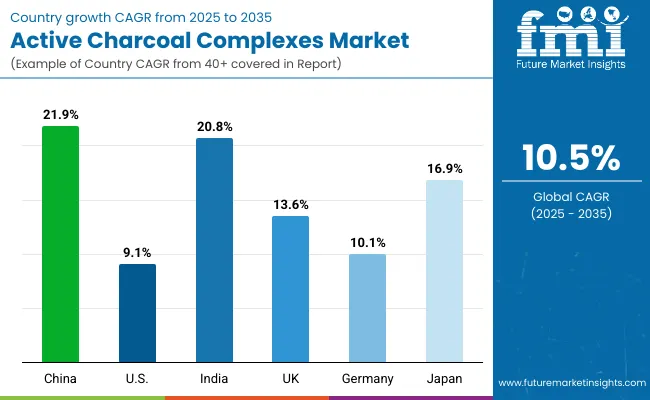

The second half, from 2030 to 2035, is likely to contribute USD 2,091.8 million around 62 % of total growth as the market reaches USD 5,321.4 million. Expansion is expected to be reinforced by ingredient innovation, e-commerce penetration, and wellness-driven consumer behavior. Emerging markets such as China and India, with estimated CAGRs of 21.9% and 20.8% respectively, are poised to lead this transformation by adopting sustainable sourcing practices and region-specific product development.

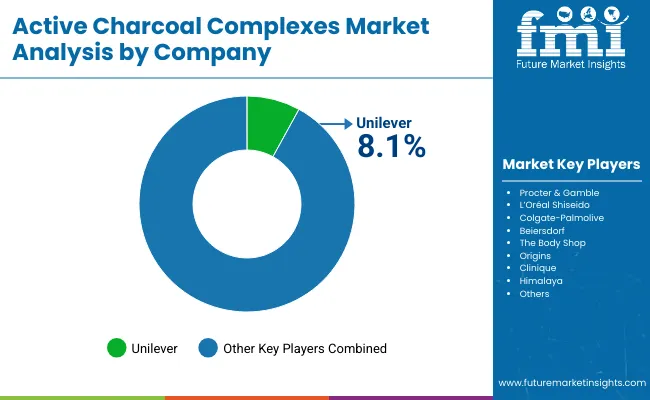

From 2020 to 2024, the market grew from USD 1,140.5 million to USD 1,851.8 million, driven by increasing consumer preference for toxin-absorbing skincare solutions. During this period, leading manufacturers controlled approximately 65-70% of revenue, with Unilever and L’Oréal emerging as dominant players due to expansive distribution networks and robust branding.

Hardware-equivalent revenue models were not applicable in this segment. Instead, growth was propelled by continuous product innovations, sustainable packaging trends, and expanding penetration in male grooming and natural cosmetics. Recurring purchases of mask and cleanser formats maintained demand velocity.

In 2025, demand is projected to surpass USD 1.96 billion, and a major shift toward natural, sulfate-free, and hybrid skincare products will define the next wave of competition. Digital-first beauty brands emphasizing ingredient transparency, multifunctionality, and dermatological validation are expected to disrupt incumbent market positions.

Value will increasingly be captured through clean-label positioning, direct-to-consumer (DTC) strategies, and personalized skincare solutions powered by AI-driven skin diagnostics and microbiome-focused R&D.

Widespread consumer demand for clean-label and natural skincare products has been observed as a core driver of growth in the Active Charcoal Complexes Market. The detoxifying and deep-cleansing properties of activated charcoal have been increasingly preferred in face masks, cleansers, and toothpaste applications. This growth has been supported by heightened awareness of pollution-induced skin damage and rising interest in oil-control and exfoliating routines. Products formulated with bamboo-derived charcoal have been favored due to their perceived sustainability and plant-based origin.

Global expansion has been further accelerated by the shift toward wellness-centric self-care, especially across Asia-Pacific markets. Dermatologist endorsements and scientific validations have reinforced consumer trust, while e-commerce platforms have enabled rapid product adoption. Strong growth has also been triggered by premiumization trends and ingredient traceability, both of which are being prioritized by millennial and Gen Z consumers. Continued innovation in charcoal sourcing and multifunctional formulations is expected to sustain momentum across both developed and emerging economies.

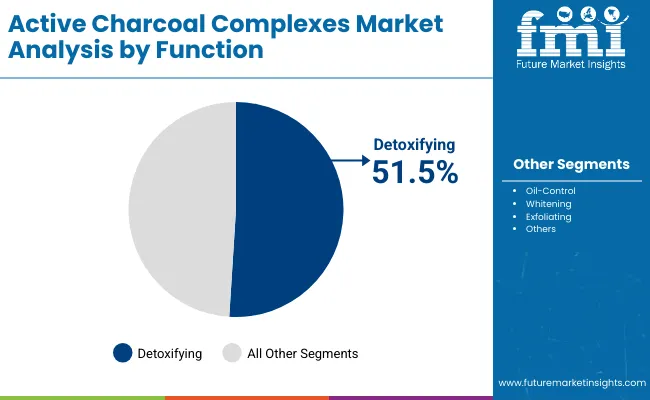

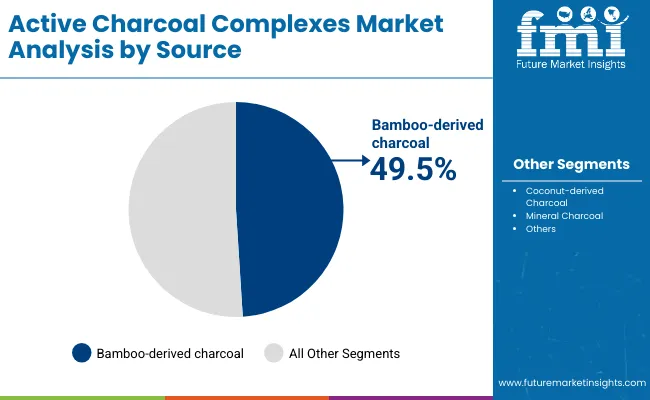

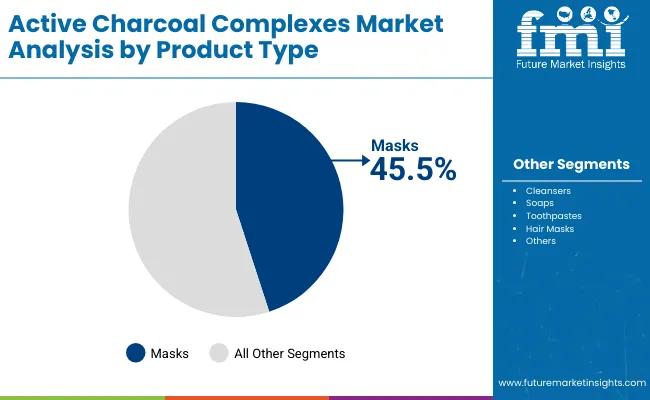

The Active Charcoal Complexes Market has been segmented by function, source, and product type to provide a structured understanding of its demand dynamics. By function, products have been categorized based on their intended dermatological benefits, with detoxifying and exfoliating applications showing high traction. Segmentation by source reflects consumer preference for ingredient origin, distinguishing between bamboo-derived charcoal and other charcoal types.

The product type classification encompasses format-specific preferences such as masks, cleansers, soaps, and toothpastes, driven by evolving skincare and oral care habits. These segments have been shaped by regional consumption patterns, regulatory acceptance, and emerging trends in personal care. Over the forecast period, strong growth across all segments is expected to be observed as sustainability narratives, efficacy claims, and wellness-driven routines continue to influence purchasing decisions.

| Function | Market Value Share, 2025 |

|---|---|

| Detoxifying | 51.5% |

| Others | 48.5% |

The detoxifying segment is forecasted to lead with a 51.5% value share in 2025. Growing awareness around pollution-induced skin damage has accelerated consumer interest in charcoal products with pore-cleansing benefits. Dermatologically positioned detox solutions are gaining preference, particularly among urban users. With charcoal's high absorption capacity, products in this segment have been formulated to address oily skin, acne, and environmental exposure. In response, leading brands have been expanding detox-focused product lines. Continuous innovation in hybrid detox products and the rise of skin-prep routines in beauty regimens are expected to reinforce segment dominance through the decade.

| Source | Market Value Share, 2025 |

|---|---|

| Bamboo-derived charcoal | 49.5% |

| Others | 50.5% |

Bamboo-derived charcoal is anticipated to hold a 49.5% share of market value in 2025. This rise in preference is being driven by its association with sustainable sourcing and eco-friendly marketing claims. Brands are increasingly highlighting bamboo charcoal as a cleaner, renewable alternative, appealing to environmentally conscious consumers. The material’s high surface area and toxin-absorbing ability have made it ideal for skincare and oral care formulations. Asian countries, especially China and Japan, are expected to lead usage of bamboo-based charcoal due to local availability and cultural familiarity. As carbon-neutral formulations gain traction, the bamboo-derived segment is likely to strengthen further.

| Product Type | Market Value Share, 2025 |

|---|---|

| Masks | 45.5% |

| Others | 54.5% |

The mask segment is projected to contribute 45.5% of total value in 2025. Charcoal masks have been popularized as instant detox solutions that offer visible skincare benefits. Positioned as premium self-care products, masks are favored in weekly routines and are widely promoted through beauty influencers. Peel-off and cream-based mask formats have gained significant attention, especially among younger and urban consumers. While daily-use formats like cleansers continue to grow, masks retain a strong perception of efficacy and indulgence. Product innovation, including charcoal-infused sheet masks and blendable clays, is expected to boost engagement. Expansion in e-commerce and clean beauty positioning will likely sustain this segment’s upward trajectory.

Growing awareness of micro-pollution, ingredient transparency, and sensory-driven skin detoxification has redefined consumer expectations, prompting advanced ingredient innovation in the Active Charcoal Complexes Market. Yet, structural bottlenecks in sourcing and standardization continue to shape market behavior across regions.

Customization of Functionality through Ingredient Hybridization

Product development has increasingly been influenced by the integration of active charcoal with probiotics, botanicals, or clays to offer multi-functional outcomes detox, brightening, and oil-balance in one formulation. This hybridization approach is being adopted not only to differentiate offerings but also to increase consumer compliance in repeat purchases. Functional layering has allowed brands to expand into adjacent personal care verticals without diluting core charcoal positioning. As a result, innovation pipelines are being structured around dual-benefit and time-efficient product concepts, especially in masks and rinse-off categories.

AI-Led Personalization in Charcoal Skincare

AI-powered diagnostics are being embedded into retail and online platforms to match consumers with ingredient-specific regimens. In this context, active charcoal has been algorithmically positioned for urban skin types, oily zones, and pollution-exposed profiles. This analytical personalization is enabling brands to justify charcoal’s efficacy via micro-targeted skincare journeys. Tech-integrated ingredient recommendations are expected to redefine how active charcoal is marketed, tracked, and optimized across skin segments particularly in Asia, where smartphone-based skincare mapping has seen widespread adoption.

| Countries | CAGR |

|---|---|

| China | 21.9% |

| USA | 9.1% |

| India | 20.8% |

| UK | 13.6% |

| Germany | 10.1% |

| Japan | 16.9% |

The Active Charcoal Complexes Market has demonstrated uneven geographic momentum, shaped by regulatory frameworks, consumer education levels, and ingredient localization capabilities. Across major economies, varying rates of adoption have been recorded, reflecting differences in dermocosmetic maturity, raw material accessibility, and digital beauty penetration.

Asia-Pacific is expected to remain the fastest-growing region, led by China with a CAGR of 21.9% and India at 20.8%. In China, growth is being reinforced through bamboo-derived charcoal innovation, sustainability branding, and high mobile-commerce integration. In India, market expansion is being enabled by herbal hybridization, influencer-based consumer acquisition, and mass retail activation across Tier 2 and Tier 3 cities.

Japan, at 16.9% CAGR, is gaining traction through anti-aging charcoal formats and wellness-oriented personalization in skincare. The UK and Germany are forecast to grow at 13.6% and 10.1% respectively, where dermatologically tested, clean-label products dominate shelf space and pharmacy distribution channels. Both countries are emphasizing efficacy claims and ingredient disclosure norms.

In contrast, the USA market, projected to grow at 9.1%, remains driven by established brands leveraging detox narratives and product bundling strategies. Consumer demand in North America is more function-led than ingredient-led, with emphasis on visible results, clinical support, and online dermatologist recommendations. Going forward, growth leadership is expected to remain concentrated in Asia.

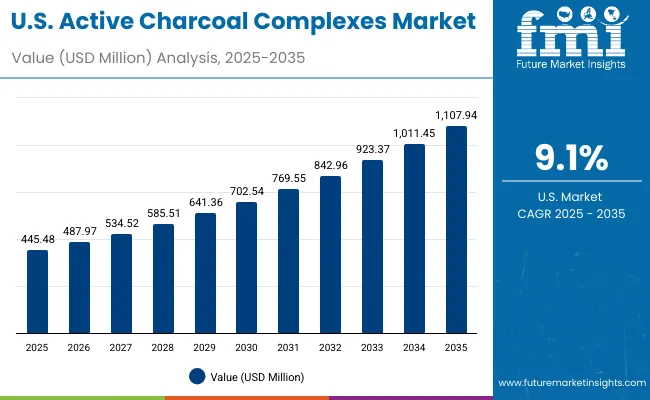

| Year | USA Active Charcoal Complexes Market (USD Million) |

|---|---|

| 2025 | 445.48 |

| 2026 | 487.97 |

| 2027 | 534.52 |

| 2028 | 585.51 |

| 2029 | 641.36 |

| 2030 | 702.54 |

| 2031 | 769.55 |

| 2032 | 842.96 |

| 2033 | 923.37 |

| 2034 | 1,011.45 |

| 2035 | 1,107.94 |

The Active Charcoal Complexes Market in the United States is projected to grow from USD 445.48 million in 2025 to USD 1,107.94 million by 2035, reflecting a steady year-on-year expansion. A CAGR of approximately 9.1% has been estimated for the period, underscoring consistent consumer engagement across both mass and prestige skincare categories.

Growth is expected to be shaped by rising demand for detoxifying skincare regimens, dermatologist-backed endorsements, and clean-label formulations. The integration of charcoal-based products into daily routines has been accelerated by product bundling strategies and cross-category marketing in oral care and facial cleansers. While legacy brands continue to lead distribution, private label entrants are capturing niche opportunities in functional skincare and male grooming.

Digital-first platforms are enabling wider reach for charcoal-infused offerings, especially through influencer-driven education and skin-type personalization. Urban centers have emerged as early adoption zones, though suburban markets are witnessing increasing traction due to retail availability and dermocosmetic awareness.

A CAGR of 13.6% has been projected for the UK Active Charcoal Complexes Market between 2025 and 2035, reflecting an expanding base of ingredient-conscious skincare users. Growth is being facilitated by sustainability-driven preferences and regulatory support for clean-label formulations.

Consumer behavior is being reshaped by heightened sensitivity to air pollution and oil-related skin issues. Ingredient traceability is being prioritized by Gen Z and millennial shoppers. Brand storytelling centered around bamboo-derived charcoal and zero-waste packaging has found strong resonance. As omni-channel distribution expands and value-tier brands innovate, charcoal’s role in mainstream beauty routines is expected to deepen.

India’s Active Charcoal Complexes Market is forecast to expand at a CAGR of 20.8% from 2025 to 2035, positioning it among the fastest-growing countries globally. Growth is being driven by Ayurveda-modern hybridization, local ingredient processing, and mass-scale retail activation.

Domestic brands are integrating active charcoal into traditional beauty narratives, offering products aligned with sweat-prone, oily, and acne-sensitive skin types. E-commerce platforms and regional D2C brands are educating first-time users via influencer-based outreach. Product acceptance is also being influenced by festival-season skincare routines. As FMCG giants increase rural distribution and pricing strategies, broad-based adoption is likely to be sustained.

China is expected to lead the global Active Charcoal Complexes Market with a CAGR of 21.9% between 2025 and 2035. Market evolution is being shaped by bamboo-derived charcoal demand, government sustainability goals, and domestic R&D in clean beauty.

Consumer demand has moved beyond novelty toward results-backed performance, especially in urban tier 1 cities. App-based skin diagnostics and AI-led personalization have increased conversion in online channels. The market is increasingly influenced by dermatologist-led livestreaming, which boosts uptake of specialty charcoal formats. Localized ingredient sourcing, eco-labels, and QR code-enabled transparency are expected to further accelerate market penetration.

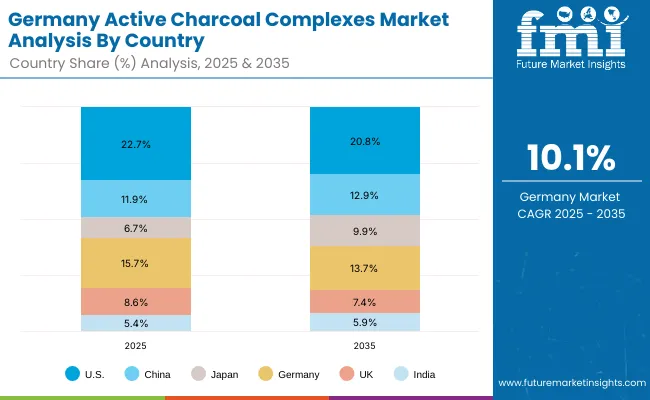

| Countries | 2025 |

|---|---|

| USA | 22.7% |

| China | 11.9% |

| Japan | 6.7% |

| Germany | 15.7% |

| UK | 8.6% |

| India | 5.4% |

| Countries | 2035 |

|---|---|

| USA | 20.8% |

| China | 12.9% |

| Japan | 9.9% |

| Germany | 13.7% |

| UK | 7.4% |

| India | 5.9% |

Germany is projected to grow at a CAGR of 10.1% through 2035, supported by clean-label regulations, pharmacy-led distribution, and consumer preference for clinical-grade skincare. Charcoal-based products are positioned more as functional than trend-led in this market.

The German market places high emphasis on efficacy, ingredient minimalism, and dermatological validation. Active charcoal is being formulated into rinse-off products with controlled dosage, often paired with anti-inflammatory ingredients. Preference for fragrance-free and pH-balanced formulations is impacting product development. As sustainability certifications and recyclable packaging become mandatory, manufacturers are revising formulations and marketing. Future volume growth is likely to arise from science-backed innovations rather than promotional hype.

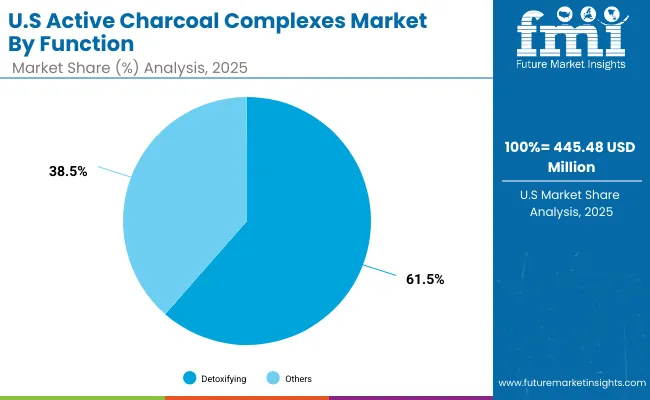

| Segment | Market Value Share, 2025 |

|---|---|

| Detoxifying | 61.5% |

| Others | 38.5% |

The Active Charcoal Complexes Market in the USA is projected at USD 445.48 million in 2025. Detoxifying formulations contribute 61.5% of the value share, while other functional products hold 38.5%, highlighting a clear consumer tilt toward detox-focused solutions. This dominance of detoxifying products is expected to persist as wellness-oriented preferences intensify and as consumers increasingly associate charcoal-based ingredients with skin and body purification benefits.

This functional skew is being reinforced by rising demand for holistic solutions that address urban pollution, oxidative stress, and skin sensitivity. Continuous marketing campaigns by global brands are educating consumers about the superior toxin-absorbing properties of active charcoal, thereby accelerating adoption. The preference for detoxifying products is also expected to drive product innovation, with multifunctional variants integrating skin-brightening, oil-control, and exfoliating benefits.

The surge in e-commerce penetration is likely to further amplify access to premium detoxifying formats, as online platforms provide opportunities for tailored recommendations and targeted advertising. Increasing focus on natural, sustainable ingredients in the personal care sector will encourage wider availability of bamboo- and coconut-derived charcoal solutions in the USA market.

Competitive dynamics are anticipated to favor brands that invest in digital engagement, influencer marketing, and clean-label positioning to secure consumer loyalty. Integrated product portfolios combining detoxifying efficacy with sensorial appeal will likely become a differentiator, reinforcing the value premium for leading players.

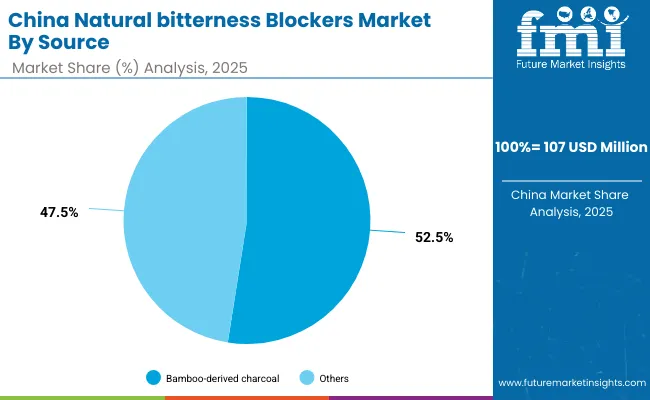

| Segment | Market Value Share, 2025 |

|---|---|

| Bamboo-derived charcoal | 52.5% |

| Others | 47.5% |

The Active Charcoal Complexes Market in China is projected at USD 232.91 million in 2025. Bamboo-derived charcoal contributes 52.5% of the market value, while other sources hold 47.5%, underscoring China’s strong alignment with plant-based and sustainable raw material adoption. This preference is anticipated to deepen as consumers increasingly prioritize eco-friendly ingredients, driven by cultural familiarity with bamboo as a traditional source of health and purification benefits.

Bamboo’s high adsorption capacity and its association with natural detoxification are expected to position it as the preferred material in premium skincare and oral care categories. Regulatory encouragement for natural ingredients and clean-label formulations is likely to support faster product approvals and accelerate innovation pipelines. Market leaders are anticipated to leverage bamboo’s local availability to optimize supply chains, reduce costs, and meet growing demand across urban and semi-urban centers.

Rising disposable incomes, combined with the influence of social media and KOL-driven (Key Opinion Leader) marketing, are projected to amplify consumer education and accelerate adoption. Cross-border e-commerce channels are also expected to contribute to premium product penetration, particularly among younger, digitally engaged consumers who seek authenticity and transparency.

Competitive intensity is expected to increase as both global and domestic brands expand portfolios with bamboo-based SKUs, focusing on multi-functional benefits such as whitening, pore-cleansing, and oil-control. Local sourcing strategies and sustainable production practices will likely serve as key differentiators, strengthening brand equity and consumer trust.

The Active Charcoal Complexes Market is moderately fragmented, with global leaders, mid-sized innovators, and botanical-centric specialists competing across skincare, oral care, and personal hygiene applications. Global FMCG players such as Unilever, L’Oréal, and Colgate-Palmolive have maintained a strong foothold, leveraging established brand equity, global distribution, and deep R&D pipelines. Unilever is estimated to have led the global market in 2024 with a value share of 8.1%, primarily through its detoxifying and deep-cleansing product lines across brands like Dove and Pond’s.

Mid-sized players including Beiersdorf, Shiseido, and The Body Shop have focused on sensitive skin and ethical ingredient positioning, offering targeted charcoal-based formulations under Nivea, Senka, and Tea Tree lines respectively. Their strength lies in dermocosmetic performance and regional customization.

Brand portfolios like Origins, Clinique, and Himalaya have catered to niche and natural product segments, emphasizing botanical infusion, sustainability certifications, and Ayurvedic crossovers. These companies are expanding through e-commerce channels and D2C strategies, especially in Asia and the Middle East.

Differentiation in this market is moving beyond detox claims toward hybrid functionality, ingredient traceability, and personalization ecosystems. Strategic investments are being redirected toward skin-microbiome-safe actives, AI-powered product pairing, and refillable packaging formats to support long-term consumer loyalty.

Key Developments in Active Charcoal Complexes Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Market Size | USD 1,960.1 Million (2025) |

| Component | Skincare Formats (Masks, Cleansers, Soaps), Oral Care (Toothpastes), Haircare, and Others |

| Functionality | Detoxifying, Oil-Control, Whitening, Exfoliating |

| Source | Bamboo-derived Charcoal, Coconut-derived Charcoal, Mineral Charcoal |

| Product Type | Masks, Cleansers, Soaps, Toothpastes, Hair Masks |

| End-use Channels | E-commerce, Pharmacies, Mass Retail, Specialty Stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, South Korea, India, Brazil |

| Key Companies Profiled | Unilever, L’Oréal, Colgate-Palmolive, Procter & Gamble, Beiersdorf, Shiseido, The Body Shop, Origins, Clinique, Himalaya |

The global Active Charcoal Complexes Market is estimated to be valued at USD 1,960.1 million in 2025.

The market size for the Active Charcoal Complexes Market is projected to reach USD 5,321.4 million by 2035.

The Active Charcoal Complexes Market is expected to grow at a CAGR of 10.5% between 2025 and 2035.

The key product types in the market are masks, cleansers, soaps, and toothpastes, with emerging formats in hybrid and multi-functional skincare.

In terms of product type, the “Others” segment (comprising cleansers, soaps, and toothpastes) is projected to command 54.5% of the total market share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Active & Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Active Network Management Market Analysis by Component, End Users, and Region Through 2025 to 2035

Active Oxygens Market Analysis by Product Type, Application and Region: Forecast for 2025 to 2035

Competitive Overview of Active and Modified Atmospheric Packaging Companies

Market Share Distribution Among Active, Smart, and Intelligent Packaging Manufacturers

Market Share Insights for Active Packaging Providers

Active Spoiler Market Growth - Trends & Forecast 2025 to 2035

Active Optical Cable Market Insights - Growth & Forecast 2025 to 2035

Active Damping Smartphone Case Market Growth - Demand & Trends 2025 to 2035

Active Humidifier Devices Market - Demand & Forecast 2025 to 2035

Active Packaging Market Analysis - Demand, Growth & Future Outlook 2024 to 2034

Active & Modified Atmospheric Packaging Market Trends & Forecast 2024-2034

Active Wear Market Growth – Trends & Forecast 2024-2034

Reactive Arthritis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Reactive Tire Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Inactive Dried Yeast Market Analysis – Demand, Growth & Forecast 2025 to 2035

Reactive Hot Melt Adhesive Market Growth – Trends & Forecast 2024-2034

Reactive Diluents Market Growth – Trends & Forecast 2022 to 2032

Reactive Softeners (Textile Industry) Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA