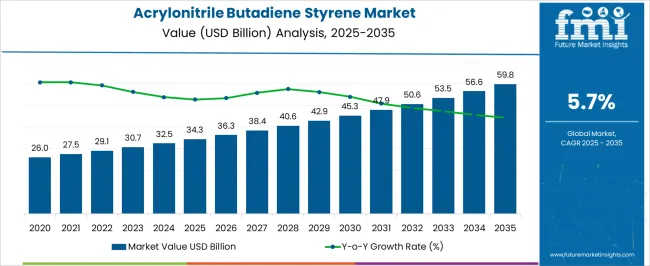

The Acrylonitrile Butadiene Styrene Market is estimated to be valued at USD 34.3 billion in 2025 and is projected to reach USD 59.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. The growth curve shown in the chart reflects a steady upward trajectory with moderate acceleration through the forecast period. Early years, from 2020 to 2025, illustrate consistent but moderate growth, moving from USD 26.0 billion to USD 34.3 billion as industries such as automotive, construction, and consumer electronics gradually increase demand for ABS. Between 2025 and 2029, the curve steepens slightly, with market size climbing above USD 40 billion, reflecting intensified use of lightweight and durable plastics across manufacturing sectors.

From 2029 to 2035, the trajectory demonstrates a more mature phase, where expansion continues at a slower but steady pace, reaching nearly USD 60 billion by the end of the period. The YoY growth rate line supports this interpretation, showing an early dip, followed by a mid-term peak around 2029–2030, and then a gradual decline as the market stabilizes. This curve shape suggests an S-like growth path where initial adoption is followed by acceleration and eventual moderation. The trend highlights ABS as a critical material balancing strong industrial demand with market maturity.

| Metric | Value |

|---|---|

| Acrylonitrile Butadiene Styrene Market Estimated Value in (2025 E) | USD 34.3 billion |

| Acrylonitrile Butadiene Styrene Market Forecast Value in (2035 F) | USD 59.8 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The acrylonitrile butadiene styrene (ABS) market is expanding steadily, driven by its versatile applications in various industries, particularly home appliances. The demand for durable and lightweight materials has increased as manufacturers seek to improve product performance while reducing costs. ABS offers excellent impact resistance, heat stability, and ease of processing, making it a preferred choice in appliance manufacturing.

Technological advancements in processing methods have further enhanced ABS material properties, supporting its growing adoption. Increasing consumer preference for energy-efficient and aesthetically appealing appliances has also influenced material selection.

Rising urbanization and disposable incomes have boosted demand for household appliances in emerging economies, contributing to ABS market growth. Looking forward, the market is expected to grow as manufacturers continue to innovate and optimize production processes, with injection molding technology playing a pivotal role in shaping product design and manufacturing efficiency.

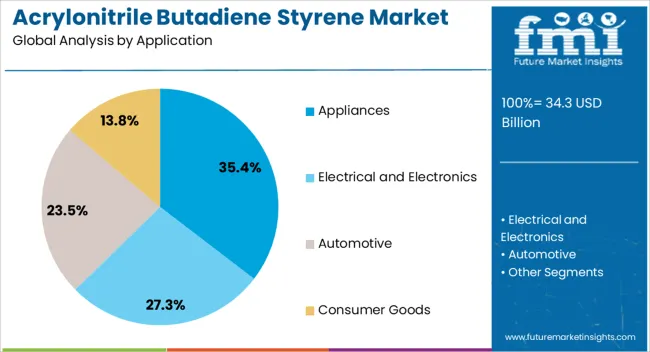

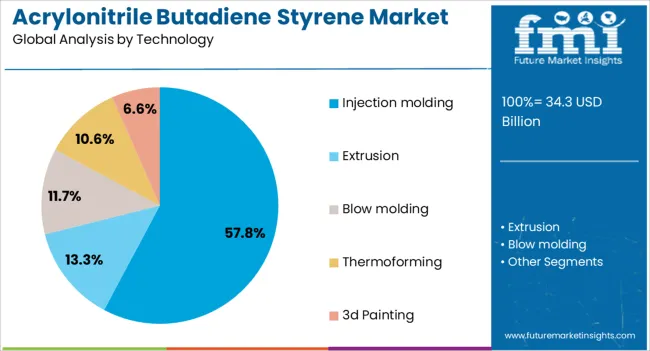

The acrylonitrile butadiene styrene market is segmented by application, technology, and geographic regions. By application, the acrylonitrile butadiene styrene market is divided into Appliances, Electrical and Electronics, Automotive, Consumer Goods, Construction, and Others (Packaging, etc). In terms of technology, the acrylonitrile butadiene styrene market is classified into Injection molding, Extrusion, Blow molding, Thermoforming, and 3d Painting.

Regionally, the acrylonitrile butadiene styrene industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Appliances segment is projected to contribute 35.4% of the ABS market revenue in 2025, maintaining its position as the leading application. This growth is supported by ABS’s excellent mechanical strength and heat resistance, which are essential for durable and reliable household appliances.

The material’s ability to be molded into complex shapes without compromising performance has enabled innovative appliance designs. Manufacturers have increasingly used ABS to produce components such as housings, panels, and internal parts in refrigerators, washing machines, and other appliances.

Consumer demand for products that combine durability with appealing aesthetics has reinforced ABS’s role in appliance manufacturing. Additionally, the growing appliance market in urbanizing regions has expanded the application base for ABS materials. As appliance manufacturers continue to prioritize performance and cost-effectiveness, the Appliances segment is expected to sustain its leadership in the ABS market.

The Injection Molding segment is projected to hold 57.8% of the ABS market revenue in 2025, establishing itself as the dominant technology. This segment’s growth is driven by the ability of injection molding to produce high-precision, complex, and consistent ABS parts at scale.

Injection molding offers manufacturers the flexibility to design intricate shapes and textures while maintaining structural integrity. The process’s efficiency and cost-effectiveness have made it the preferred manufacturing method in sectors that demand large volumes of parts, such as appliances and automotive.

Technological improvements in mold design, automation, and cycle time reduction have further enhanced injection molding’s appeal. Additionally, injection molding allows for the use of recycled ABS materials, supporting sustainability initiatives. With increasing demand for customized and lightweight products, injection molding is expected to remain the leading technology for ABS processing.

ABS continues to gain ground in automotive, electronics, construction, and additive manufacturing. Its strength, design flexibility, and recyclability sustain its role as a vital industrial polymer.

Acrylonitrile butadiene styrene (ABS) has become central in the automotive industry, holding strong relevance due to its combination of rigidity, impact resistance, and process flexibility. Manufacturers favor ABS for dashboards, trims, and interior panels where weight savings directly improve fuel efficiency and reduce emissions. Its moldability supports complex designs that meet consumer expectations for modern aesthetics and durability. Substitution of heavier materials such as metals and some composites has reinforced demand across electric and conventional vehicles. Partnerships between auto OEMs and polymer suppliers have strengthened R&D for ABS-based blends. With rising pressure for efficiency in automotive production, ABS maintains its standing as a vital polymer choice for mass-market and high-performance vehicle segments.

Electronics manufacturers are increasingly deploying ABS for devices requiring durability, stability, and an appealing surface finish. Laptops, smartphones, home appliances, and gaming consoles integrate ABS in external casings and support parts, taking advantage of its resilience under frequent use. The ability to deliver glossy surfaces and precise detail has elevated ABS to a preferred position over alternatives in applications where design appeal is as critical as performance. Its compatibility with advanced molding techniques also enables slim, lightweight devices demanded by global consumers. With electronics markets expanding across Asia Pacific, Europe, and the U.S., ABS continues to capture share. Its balance of mechanical strength and appearance supports both mainstream and premium categories in consumer electronics.

Construction and infrastructure projects have extended the adoption of ABS into piping systems, decorative panels, and protective casings. Contractors and builders choose ABS for its strength, ease of fabrication, and ability to withstand daily wear in demanding environments. Its performance in plumbing and protective fixtures has supported growth in both residential and commercial building projects. ABS is increasingly viewed as a reliable polymer in construction areas where flexibility and low maintenance are valued. Product developers are also expanding offerings of fire-retardant and chemically resistant ABS grades for specialized use. With global construction activities remaining steady, the sector continues to present opportunities for ABS growth in both developed and developing regions.

The growing popularity of 3D printing has provided ABS with renewed momentum. Makers and industrial designers value its balance of printability, strength, and finishing options. ABS filaments are widely used in prototyping, educational labs, and small-batch manufacturing, making it one of the most common materials in additive manufacturing. Simultaneously, recycling efforts are targeting ABS to reduce production costs and extend lifecycle value. Advances in collection and reprocessing are encouraging manufacturers to integrate recycled ABS into consumer goods, vehicles, and appliances. This dual role in innovation and circular use reinforces ABS as a polymer capable of evolving with modern industrial needs. Its adaptability ensures long-term competitiveness against rival materials in global markets.

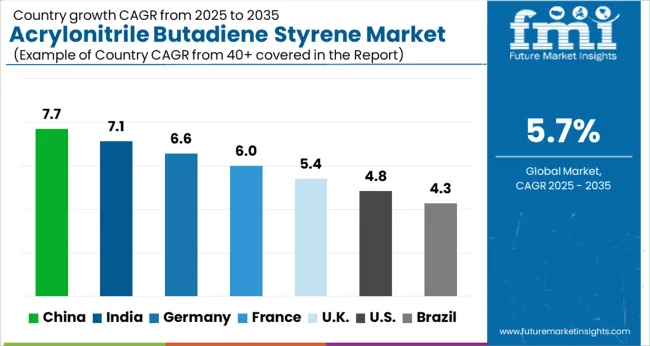

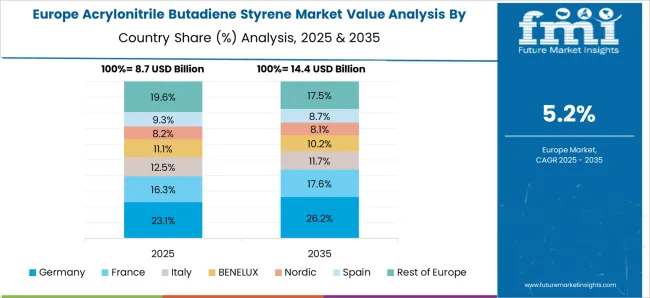

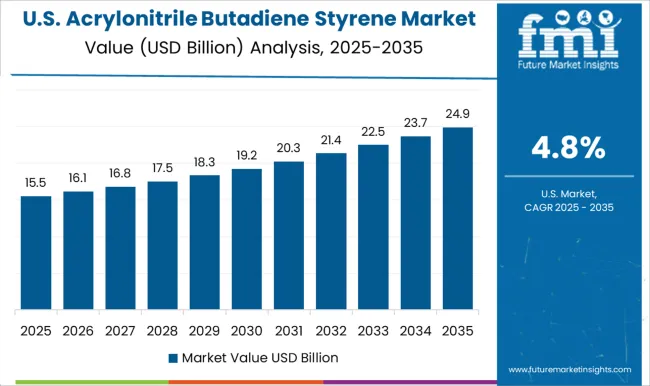

The acrylonitrile butadiene styrene (ABS) market is projected to grow globally at a CAGR of 5.7% between 2025 and 2035, supported by expanding automotive applications, rising electronics production, and wider use in construction and consumer goods. China leads with a CAGR of 7.7%, fueled by large-scale automotive manufacturing, electronics exports, and robust plastics processing capabilities. India follows at 7.1%, driven by strong demand from household appliances, rapid industrial growth, and expanding automotive assembly. France posts 6.0%, shaped by consistent demand in construction fittings, electronics casings, and specialized polymer blends. The United Kingdom stands at 5.4%, supported by innovation in 3D printing applications and appliance production. The United States records 4.8%, shaped by appliance replacement cycles, stable automotive production, and continued use in consumer electronics. The analysis spans over 40 countries, with these five serving as benchmarks for capacity expansion, supplier engagement, and long-term manufacturing strategies in the global ABS industry.

China is anticipated to record a CAGR of 7.7% during 2025–2035, well above the global benchmark of 5.7%. From 2020–2024, the CAGR was lower at around 6.1%, shaped by gradual expansion in automotive plastics and large-scale adoption in electronics casings. The stronger growth projected ahead is fueled by surging EV production, major electronics export contracts, and wider use of ABS in 3D printing filaments. Regional producers are expanding capacity, lowering reliance on imports, and strengthening integration with downstream industries. Local availability of raw materials and policy support for polymer-intensive sectors ensure that ABS maintains a competitive advantage across multiple industries.

India is forecasted to achieve a CAGR of 7.1% during 2025–2035, above the global average of 5.7%. Between 2020–2024, CAGR stood at 5.5%, supported by early-stage appliance adoption and selective auto-sector demand. The pace accelerates ahead due to rising household appliance penetration, infrastructure-led construction materials, and higher consumption of ABS in molded components. The consumer appliance industry, led by refrigerators, washing machines, and AC units, has become a major pull factor. Expanding automotive assembly and growing investment in electronics assembly plants also strengthen India’s trajectory. Domestic polymer players and joint ventures with global manufacturers are securing supply capacity to meet growing downstream requirements.

France is projected to deliver a CAGR of 6.0% during 2025–2035, higher than the global 5.7% rate. During 2020–2024, CAGR was measured at 4.9%, shaped by modest adoption in automotive interiors and steady demand in consumer electronics. The improvement stems from stronger automotive programs, greater emphasis on lightweight components, and rising incorporation of ABS in construction fixtures and fittings. Appliance manufacturers are also switching to ABS for its ease of processing and finish quality. France’s role in premium automotive and electronics is increasing its pull for high-grade ABS blends. Partnerships with R&D centers are supporting specialty compounds that enhance fire resistance and finish consistency.

The United Kingdom is expected to post a CAGR of 5.4% during 2025–2035, slightly below the global average of 5.7%. Between 2020–2024, CAGR stood at 4.2%, held back by limited automotive expansion and early-stage adoption in 3D printing. The rise to 5.4% reflects improvements in recycling capacity, stronger demand in consumer appliances, and higher penetration of ABS in additive manufacturing applications. Demand is being lifted by industrial design prototyping, household products, and commercial 3D printing services. Water utility infrastructure and construction fittings also offer incremental growth. Greater import reliance still poses a challenge, but domestic recycling and integration into design-intensive industries provide momentum for the next phase.

The United States is projected to record a CAGR of 4.8% during 2025–2035, slightly under the global average of 5.7%. From 2020–2024, CAGR was 3.9%, reflecting moderate use in appliances and steady demand in automotive interiors. The improved growth rate ahead is supported by aftermarket automotive components, appliance replacement cycles, and growing integration of ABS in electronics casings and 3D printing filaments. Demand is also sustained by appliance giants increasing reliance on durable plastics for design-focused product lines. Research collaborations are creating specialty grades to meet fire safety and mechanical standards. While cost competition from substitutes remains, ABS continues to hold ground due to its balanced performance-to-price ratio.

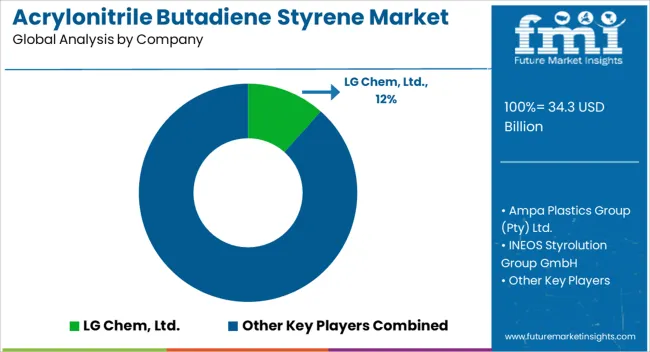

The ABS industry features a mix of integrated resin majors, specialty compounders, and engineering plastics converters. Key participants include LG Chem, Ampa Plastics Group, INEOS Styrolution Group, Dow, CHIMEI, Toray Industries, Röchling, Kumho Petrochemical, ELIX Polymers, SABIC, Trinseo, China Petroleum and Chemical Corporation SINOPEC, Formosa Chemicals and Fibre, Asahi Kasei, and BASF SE. Feedstock access, global compounding networks, and depth of application support for mobility, appliances, electronics, construction fittings, and 3D printing filaments influence market share.

Supply security and rapid color matching have become decisive in winning high-volume appliance and automotive interior programs. INEOS Styrolution, LG Chem, SABIC, CHIMEI, Kumho Petrochemical, Formosa, and SINOPEC are positioned as capacity leaders, serving multi‑region customers through standardized ABS grades and tailored compounds. ELIX Polymers and Trinseo focus on specialty ABS, including high heat, low gloss, and medical compliance variants.

Toray and Asahi Kasei emphasize partnerships with automotive and electronics OEMs where tight dimensional control and surface finish are critical. Röchling and Ampa Plastics Group operate as converters and distributors, translating resin properties into finished parts and sheets for regional buyers. Dow and BASF participate through engineering polymer portfolios, additive packages, and compounding know‑how that support flame retardancy, low VOC interiors, and paintability. Competitive strategies center on secure styrene and acrylonitrile supply, advanced compounding for color and texture, and application engineering that shortens qualification cycles. Greater use of recycled content, closed-loop takeback for post-industrial scrap, and resin traceability programs are being promoted to meet buyer specifications without compromising mechanical performance. Pricing power depends on contract terms linked to benzene, butadiene, and styrene indices, while service differentiation rests on fast technical troubleshooting and regional stocking.

| Item | Value |

|---|---|

| Quantitative Units | USD 34.3 Billion |

| Application | Appliances, Electrical and Electronics, Automotive, Consumer Goods, Construction, and Others (Packaging etc) |

| Technology | Injection molding, Extrusion, Blow molding, Thermoforming, and 3d Painting |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LG Chem, Ltd., Ampa Plastics Group (Pty) Ltd., INEOS Styrolution Group GmbH, Dow Chemical, CHIMEI, Toray Industries, Inc., Röchling, Kumho Petrochemical, ELIX Polymers, SABIC, Trinseo S.A. (Styron), China Petroleum & Chemical Corporation (SINOPEC), Formosa Chemicals & Fibre Corp., Asahi Kasei Corporation, and BASF SE |

| Additional Attributes | Dollar sales, share, end-use industry demand, regional growth hotspots, raw material pricing, recycling trends, competitive landscape, capacity expansions, and long-term application outlook. |

The global acrylonitrile butadiene styrene market is estimated to be valued at USD 34.3 billion in 2025.

The market size for the acrylonitrile butadiene styrene market is projected to reach USD 59.8 billion by 2035.

The acrylonitrile butadiene styrene market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in acrylonitrile butadiene styrene market are appliances, electrical and electronics, photocopy, vacuum cleaner, air conditioner, washing machine, laptop & desktops, others (CCTV camera, etc), automotive, interior, exterior, consumer goods, Lego, Others, construction and Others (packaging, etc).

In terms of technology, injection molding segment to command 57.8% share in the acrylonitrile butadiene styrene market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acrylonitrile Market

Acrylic Styrene Acrylonitrile (ASA) Resin Market- Growth & Demand 2025 to 2035

Bio Butadiene Market Size and Share Forecast Outlook 2025 to 2035

Polybutadiene Rubber Market

Polybutadiene Market

Nitrile Butadiene Rubber (NBR) Latex Market Size and Share Forecast Outlook 2025 to 2035

Styrene-Butadiene-Styrene (SBS) Block Copolymer Market Size, Growth, and Forecast 2025 to 2035

Styrene Butadiene Rubber Market 2024-2034

Solution Styrene Butadiene Rubber (S-SBR) Market Size and Share Forecast Outlook 2025 to 2035

Styrene Compartment Boxes Market Size and Share Forecast Outlook 2025 to 2035

Styrene Acrylic Emulsion Polymers Market Size and Share Forecast Outlook 2025 to 2035

Polystyrene Films Market Size and Share Forecast Outlook 2025 to 2035

Polystyrene Packaging Market Analysis - Size & Growth Forecast 2025 to 2035

Alpha-Methylstyrene Market Size and Share Forecast Outlook 2025 to 2035

Extruded Polystyrene Market Size and Share Forecast Outlook 2025 to 2035

Expanded Polystyrene for Packaging Market Insights – Growth & Forecast 2025 to 2035

Expanded Polystyrene Market

Specialty Polystyrene Resin Market Growth – Trends & Forecast 2024-2034

Expandable Polystyrene Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA