The solution styrene butadiene rubber (S-SBR) market is projected to grow from USD 14.0 billion in 2025 to USD 21.8 billion by 2035, registering a moderate CAGR of 4.5%. Analysis of the market maturity curve indicates that S-SBR is in the late growth phase of the adoption lifecycle. This stage is characterized by steady market expansion driven by established applications in tire manufacturing, industrial rubber products, and emerging use in high-performance automotive components.

The gradual increase in annual market value, from USD 14.0 billion in 2025 to USD 21.8 billion by 2035, suggests that the market is experiencing stable adoption with incremental penetration across existing and niche applications. Early adopters in the tire and automotive industries have historically fueled demand, supported by the superior performance of S-SBR in enhancing rolling resistance, wet traction, and overall tire durability.

As awareness and confidence in performance benefits become more widespread, adoption is expanding into secondary segments such as industrial belts, footwear, and polymer blends. Nevertheless, the relatively modest CAGR reflects a market approaching maturity, with slower incremental growth compared to nascent rubber chemistries.

The adoption lifecycle highlights that the S-SBR market is transitioning from rapid growth to saturation in core sectors while gradually penetrating new application areas. This pattern indicates that future growth will be supported by efficiency improvements, technological enhancements, and selective product differentiation rather than broad-based market expansion, reflecting a mature yet evolving market trajectory.

| Metric | Value |

|---|---|

| Solution Styrene Butadiene Rubber (S-SBR) Market Estimated Value in (2025 E) | USD 14.0 billion |

| Solution Styrene Butadiene Rubber (S-SBR) Market Forecast Value in (2035 F) | USD 21.8 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The solution styrene butadiene rubber (S-SBR) market represents a specialized segment within the synthetic rubber and polymer industry, emphasizing high-performance applications. Within the overall synthetic rubber market, it accounts for about 7.2%, driven by demand in tire manufacturing for enhanced wet grip and rolling resistance. In the automotive tires and components sector, it holds nearly 8.1%, reflecting adoption in passenger car, light truck, and commercial vehicle tires.

Across the industrial rubber products market, the segment captures 4.5%, supporting conveyor belts, hoses, and sealing solutions. Within the elastomers and polymer blends category, it represents 3.9%, highlighting its role in compound performance improvement. In the performance materials and specialty polymers sector, it secures 2.7%, emphasizing its contribution to high-value and technologically demanding applications.

Recent developments in this market are focused on performance enhancement, sustainability, and integration with green chemistry initiatives. Innovations in solution polymerization techniques have improved molecular weight distribution, reinforcing mechanical properties and processing efficiency. Key players are expanding capacity for high styrene S-SBR grades to meet automotive tire performance standards. Collaborative research with tire manufacturers has led to formulations optimized for reduced fuel consumption and enhanced safety.

Bio-based monomer development and eco-friendly production methods are gaining traction, reflecting environmental and regulatory pressures. Digital compound simulation and process automation are improving consistency and scalability. These advancements demonstrate how performance, efficiency, and environmental considerations are shaping the styrene butadiene rubber market.

The solution styrene butadiene rubber (S-SBR) market is witnessing steady growth, supported by increasing demand from automotive manufacturing, industrial applications, and performance-driven product development. The current landscape is shaped by heightened adoption of S-SBR in tire production due to its superior rolling resistance, fuel efficiency, and abrasion resistance properties. Regulatory pressures on fuel economy and emission reduction are prompting tire manufacturers to integrate high-performance S-SBR compounds, strengthening market penetration increasingly.

Strategic expansions in production capacity, along with advancements in polymerization technology, are enhancing product quality and supply reliability. Raw material price volatility and competitive pressures from alternative elastomers are being managed through diversification of feedstock sources and innovation in formulation.

The market outlook remains positive, with emerging economies driving consumption growth due to rising vehicle production, infrastructure development, and increasing adoption of premium tire categories. Continuous research into eco-friendly and bio-based variants is expected to augment long-term demand further and support sustainable revenue expansion.

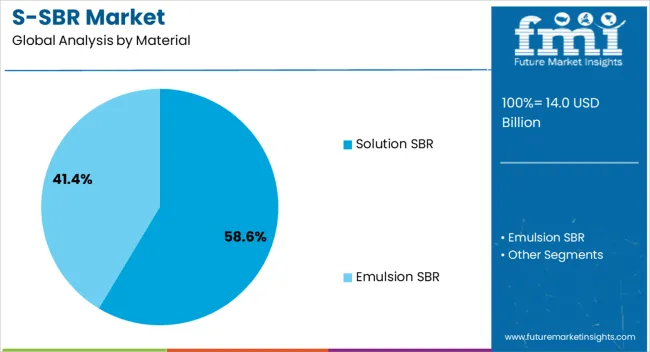

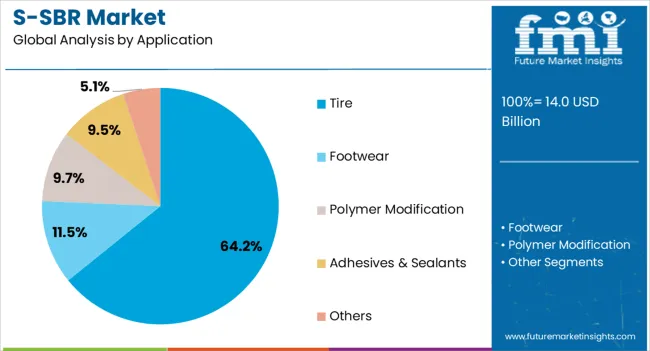

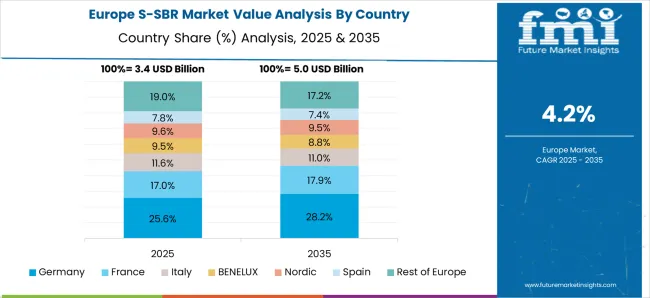

The solution styrene butadiene rubber (S-SBR) market is segmented by material, application, and geographic regions. By material, solution styrene butadiene rubber (S-SBR) market is divided into Solution SBR and Emulsion SBR. In terms of application, solution styrene butadiene rubber (S-SBR) market is classified into Tire, Footwear, Polymer Modification, Adhesives & Sealants, and Others. Regionally, the solution styrene butadiene rubber (S-SBR) industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solution SBR segment, commanding 58.6% of the material category, has maintained its dominance through its proven performance advantages in critical applications such as high-performance tires. Its superior elasticity, abrasion resistance, and low rolling resistance characteristics have made it the preferred choice for manufacturers aiming to meet stringent regulatory and performance standards.

Market growth in this segment has been reinforced by large-scale capacity investments from global producers and optimization of polymerization processes to deliver consistent quality. The resilience of demand has been further supported by strong automotive sector activity and a shift toward premium and green tire categories, which rely heavily on solution SBR formulations.

Supply chain integration, coupled with advances in compounding technology, has enabled producers to meet diverse application needs while maintaining cost competitiveness. Over the forecast horizon, this segment is expected to retain its lead, supported by technological enhancements and expanding demand from both developed and emerging automotive markets.

The tire segment, representing 64.2% of the application category, has been the primary demand driver for S-SBR, owing to its critical role in enhancing fuel efficiency, traction, and durability. This dominance is being sustained by global regulatory mandates for reduced vehicle emissions and improved fuel economy, which directly influence tire formulations. Continuous innovation in tread compound design and blending techniques has increased the share of S-SBR in both passenger and commercial vehicle tires.

Original Equipment Manufacturer (OEM) demand, supported by growing vehicle production in Asia-Pacific and other high-growth regions, has been a major contributor to volume stability. Replacement tire markets are also playing a significant role, as consumers seek long-lasting, high-performance options.

Supply-side developments, including optimized logistics and regional production hubs, are reducing lead times and enhancing availability. The segment’s future growth trajectory is expected to remain robust, underpinned by the global automotive industry’s transition toward energy-efficient and sustainable mobility solutions.

The market has witnessed substantial growth driven by the rising demand for high-performance synthetic rubbers in tire manufacturing, automotive components, and industrial applications. S-SBR offers enhanced abrasion resistance, low rolling resistance, and improved wet traction, making it a preferred choice for fuel-efficient and high-durability tires.

Market expansion is further supported by advancements in polymerization technologies, growing automotive production, and rising adoption of electric and hybrid vehicles. The material’s versatility allows formulation for passenger cars, commercial vehicles, and specialty tires, while regulatory focus on environmental standards encourages the use of S-SBR to improve energy efficiency and reduce carbon emissions in tire products globally.

The automotive sector, particularly tire manufacturing, has emerged as a major driver for S-SBR adoption. The material’s superior mechanical properties, including improved wear resistance, elasticity, and rolling performance, allow tire manufacturers to meet evolving safety and efficiency standards. Passenger cars, trucks, and electric vehicles increasingly require tires that balance fuel efficiency with performance, which S-SBR can provide. Moreover, regulatory pressures to reduce vehicular emissions and enhance road safety have incentivized manufacturers to incorporate S-SBR into new tire designs. Continuous demand from replacement tires and aftermarket segments, combined with increasing vehicle production in emerging economies, has reinforced S-SBR consumption across the automotive supply chain.

Significant R&D in polymerization methods, catalyst optimization, and blending techniques has enhanced the quality, consistency, and performance of S-SBR. Modern solution polymerization allows precise control over molecular weight and styrene content, improving wet grip, rolling resistance, and durability in tires. Advances in compounding with fillers such as silica and carbon black further optimize mechanical and thermal properties for diverse applications. These technological improvements also enable S-SBR formulations for specialty industrial applications, including conveyor belts, hoses, and seals, expanding the market beyond tires. Innovation in sustainable and low-emission processing further strengthens the material’s appeal for environmentally conscious end-users and manufacturers.

The rise of electric and hybrid vehicles has created new opportunities for S-SBR utilization. EV and hybrid tires require low rolling resistance to maximize battery range while maintaining safety and traction performance. S-SBR’s superior viscoelastic properties allow tire designs that reduce energy losses and improve efficiency without compromising grip or wear resistance. Growing adoption of these vehicles in Europe, North America, and Asia-Pacific has led manufacturers to increase S-SBR procurement to meet specialized performance requirements. This trend, combined with the push for energy-efficient transportation solutions, is expected to continue driving market growth for S-SBR across passenger and commercial vehicle tire segments.

Environmental regulations and sustainability initiatives are shaping the S-SBR market by encouraging the development of low-emission, energy-efficient tires. Standards focusing on rolling resistance, fuel efficiency, and tire wear have promoted the use of high-performance synthetic rubbers.

Manufacturers are responding by incorporating S-SBR in tire treads to reduce carbon footprint and comply with global regulatory requirements. The emphasis on recycling and circular economy practices is encouraging the development of more sustainable S-SBR production methods and formulations.

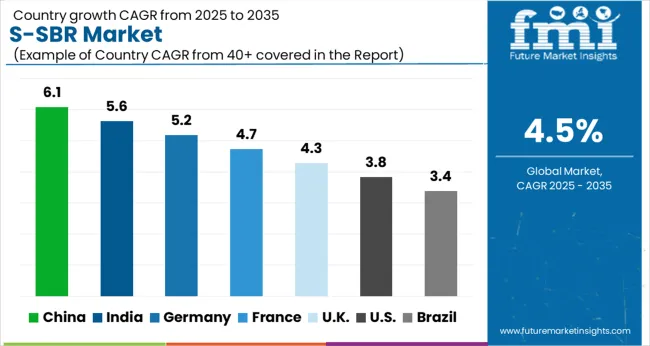

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

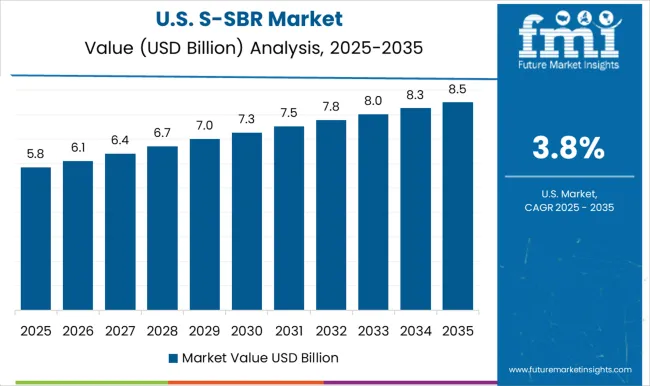

| USA | 3.8% |

| Brazil | 3.4% |

The market is expected to grow steadily, supported by demand from the tire and automotive industries. China leads with 6.1%, driven by large-scale production and adoption in high-performance tires. India follows at 5.6%, benefiting from expanding automotive manufacturing and infrastructure development. Germany achieves 5.2%, where advanced engineering and stringent performance standards fuel market activity. The United Kingdom records 4.3%, supported by innovations in specialty rubber applications. The United States attains 3.8%, with consistent growth from tire replacements and industrial uses. These nations collectively represent key hubs of production, market expansion, and technological advancement in S-SBR. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 6.1%, supported by the expanding automotive and tire manufacturing sectors, rising industrial demand, and the push for high-performance materials in various applications. Increased production of passenger vehicles and commercial trucks is driving the need for synthetic rubber with improved wear resistance, heat tolerance, and mechanical strength.

Continuous investment in research and development is enabling advanced S-SBR variants suitable for diverse industrial applications. Manufacturers are focusing on optimizing supply chains, enhancing product quality, and meeting growing domestic and export demand. Environmental compliance and sustainability initiatives are shaping production processes, driving adoption of eco-friendly alternatives, and influencing strategic partnerships among key stakeholders.

India is projected to witness a CAGR of 5.6%, fueled by the growth of the automotive, construction, and industrial manufacturing sectors. Increasing use of S-SBR in high-performance tires, belts, hoses, and other industrial components is supporting demand. Manufacturers are leveraging advanced polymerization techniques to produce S-SBR variants with superior abrasion resistance, elasticity, and durability.

Government initiatives promoting domestic manufacturing and exports are further strengthening market opportunities. Adoption is also driven by evolving consumer expectations for high-quality, long-lasting automotive products. Key industry players are expanding production capacity, improving supply chain efficiency, and forming alliances to tap into regional and global demand.

Germany’s market is anticipated to grow at a CAGR of 5.2%, supported by the robust automotive, manufacturing, and engineering industries. The demand for high-quality synthetic rubber is increasing due to its superior mechanical and thermal properties, enabling better performance in tires and industrial components. Environmental and safety regulations are promoting the use of sustainable and eco-friendly S-SBR products.

Market players are investing in research and development to enhance product consistency, durability, and efficiency while complying with stringent EU regulations. Strategic partnerships and collaborations are helping manufacturers expand their market footprint and respond to evolving industrial requirements.

The United Kingdom is expected to grow at a CAGR of 4.3%, supported by industrial demand for durable and high-performance synthetic rubbers in automotive, manufacturing, and specialty applications. Increasing replacement of natural rubber with S-SBR for better wear resistance, elasticity, and chemical stability is encouraging adoption. Manufacturers are focusing on product innovation, process optimization, and compliance with environmental regulations.

The market is witnessing collaborations and technological partnerships aimed at enhancing production efficiency and broadening applications. Adoption is also influenced by the growing need for cost-effective solutions in commercial and industrial sectors while meeting global quality standards.

The United States market is projected to grow at a CAGR of 3.8%, driven by increasing automotive production, industrial applications, and rising demand for high-performance tires. S-SBR is widely used in products requiring superior abrasion resistance, durability, and elasticity. Manufacturers are prioritizing sustainable production methods and advanced polymerization technologies to improve quality and reduce environmental impact.

Strategic investments, technology collaborations, and capacity expansions are enabling companies to meet evolving industry requirements. The market is further influenced by consumer preferences for long-lasting automotive components and the demand for synthetic rubbers in specialty industrial applications.

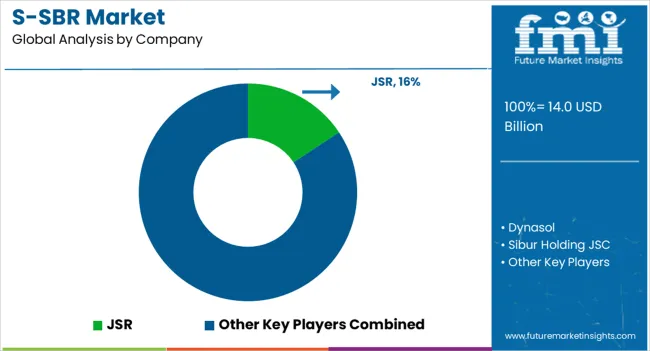

The S-SBR Market is driven by the increasing demand for high-performance tires, industrial applications, and enhanced material durability. JSR, Sumitomo Chemicals, and Asahi Kasei Corporation are prominent providers, offering S-SBR grades with superior abrasion resistance and wet grip performance suitable for passenger and commercial vehicle tires.

Dynasol and Dynasol Elastomers contribute with tailored polymer solutions that improve rolling resistance and fuel efficiency, supporting the automotive industry's sustainability objectives. Sibur Holding JSC and Lanxess provide a diverse range of S-SBR products with applications extending to industrial rubber goods, adhesives, and coatings, emphasizing processability and performance consistency.

Dow Chemical and Taiwan Synthetic Rubbers focus on specialty S-SBR grades that enable innovation in tire treads, enhancing grip, and longevity. Styron and Chi Mei Corporation deliver high-purity S-SBR variants, supporting advanced compounding requirements in both domestic and export markets. China National Petroleum Market leverages integrated production capabilities to supply large-scale S-SBR volumes, meeting rising global demand. These providers enhance the market by emphasizing product quality, operational reliability, and innovation, aligning with the growing need for sustainable, high-performance elastomer solutions in automotive and industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.0 Billion |

| Material | Solution SBR and Emulsion SBR |

| Application | Tire, Footwear, Polymer Modification, Adhesives & Sealants, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | JSR, Dynasol, Sibur Holding JSC, Sumitomo Chemicals, Asahi Kasie Corporation, Taiwan Synthetic Rubbers, Dow Chemical, China National Petroleum Market, Lanxess, Dynasol Elastomers, Styron, and Chi Mei Corporation |

| Additional Attributes | Dollar sales by rubber type and application, demand dynamics across tire manufacturing, automotive components, and industrial sectors, regional trends in high-performance rubber adoption, innovation in polymerization, durability, and rolling resistance, environmental impact of production and disposal, and emerging use cases in eco-friendly tires and advanced rubber composites. |

The global solution styrene butadiene rubber (S-SBR) market is estimated to be valued at USD 14.0 billion in 2025.

The market size for the solution styrene butadiene rubber (S-SBR) market is projected to reach USD 21.8 billion by 2035.

The solution styrene butadiene rubber (S-SBR) market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in solution styrene butadiene rubber (S-SBR) market are solution sbr and emulsion sbr.

In terms of application, tire segment to command 64.2% share in the solution styrene butadiene rubber (S-SBR) market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

NGS Solution for Early Cancer Screening Market Size and Share Forecast Outlook 2025 to 2035

5PL Solutions Market

High-Resolution Anoscopy Market Size and Share Forecast Outlook 2025 to 2035

mHealth Solutions Market Size and Share Forecast Outlook 2025 to 2035

Super Resolution Microscope Market Insights - Size, Share & Forecast 2025 to 2035

G-3 PLC Solution Market – Smart Grids & Connectivity

Docketing Solution Market Size and Share Forecast Outlook 2025 to 2035

Long Haul Solutions Market Size and Share Forecast Outlook 2025 to 2035

eClinical Solutions and Software Market Insights - Trends & Forecast 2025 to 2035

E-tailing Solutions Market Growth – Trends & Forecast 2020-2030

Connected Solutions for Oil & Gas Market Insights – Trends & Forecast 2020-2030

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

WealthTech Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Solutions Market Size and Share Forecast Outlook 2025 to 2035

Geospatial Solution Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

E-Learning Solution Market by Solution, Deployment, & Region Forecast till 2035

eDiscovery solution Market

Intravenous Solution Compounders Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Payment Bank Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA