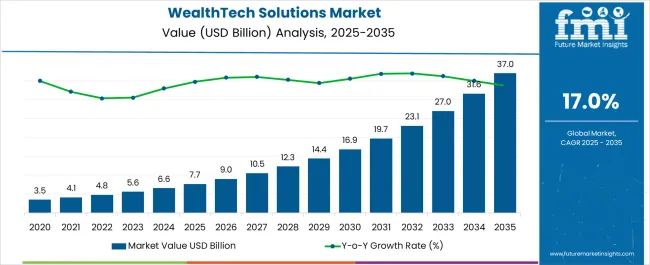

The WealthTech Solutions Market is estimated to be valued at USD 7.7 billion in 2025 and is projected to reach USD 37.0 billion by 2035, registering a compound annual growth rate (CAGR) of 17.0% over the forecast period.

| Metric | Value |

|---|---|

| WealthTech Solutions Market Estimated Value in (2025 E) | USD 7.7 billion |

| WealthTech Solutions Market Forecast Value in (2035 F) | USD 37.0 billion |

| Forecast CAGR (2025 to 2035) | 17.0% |

The WealthTech solutions market is expanding rapidly as financial institutions accelerate digital transformation to improve client engagement, portfolio management, and operational efficiency. Increasing investor demand for personalized financial services, coupled with the rise of digital advisory platforms, is driving adoption of advanced WealthTech tools.

Integration of artificial intelligence, machine learning, and data analytics is enabling more precise insights, risk assessment, and tailored investment strategies. Regulatory encouragement for transparency and data security has further reinforced the use of digital wealth management platforms across global markets.

The outlook remains positive as banks, wealth managers, and independent advisors seek scalable solutions that enhance customer experience, ensure compliance, and optimize operational costs within an increasingly competitive financial services environment.

The WealthTech solutions segment is projected to contribute 54.70% of total market revenue by 2025, making it the leading component. This growth is driven by the rising demand for integrated digital wealth management platforms that streamline advisory services, automate investment processes, and deliver real time portfolio monitoring.

Institutions are increasingly adopting end to end WealthTech solutions to enhance efficiency, reduce manual errors, and provide investors with transparent insights. The ability of these solutions to integrate with legacy systems and adapt to evolving regulatory frameworks has strengthened their adoption.

As financial institutions prioritize digital capabilities to attract and retain clients, WealthTech solutions continue to hold a dominant share in the component category.

The banks segment is expected to hold 48.60% of total market revenue by 2025, positioning it as the most significant end user category. This leadership is attributed to banks leveraging WealthTech to strengthen customer relationships, expand advisory offerings, and provide digital first investment solutions.

Banks have been early adopters of advanced financial technologies to meet client expectations for seamless and personalized services. WealthTech integration has also enabled banks to optimize compliance, risk management, and operational efficiency.

By utilizing data driven insights and digital platforms, banks are able to enhance financial planning, broaden their wealth management portfolios, and improve customer retention. Consequently, the banks segment continues to dominate as the primary adopter within the end user category.

WealthTech solutions are active wealth planning management tools that can be used efficiently in serving ultrahigh-net-worth and high-net-worth clients. WealthTech solutions can help customers to achieve their financial goals efficiently.

It is also used for robo-advisory, digitizing retirement assets, automation of processes/outsourcing, digitized customer relationship management, and extensive financial data analysis. WealthTech solutions also provide strategic planning for integrated cash flows, employer stock modeling, complex tax planning, strategic estate planning, and legacy planning among others.

The WealthTech solutions provider strategy has been consistent with its more conservative approach to product innovation, which enables them to integrate newer technologies in an evolutionary manner. This strategy also helps the WealthTech solutions provider enhance its customer base and product offerings.

For instance, in December 2020, HSBC launched wealth-tech solutions in Singapore to enhance support for its retail banking proposition. It offers such institutional analytical capabilities to retail investors in Singapore.

Drivers

The demand for WealthTech solutions is increasing due to capabilities such as financial data analytics, machine learning capabilities, and portfolio rebalancing. Such factors are driving the growth of the WealthTech solutions market during the forecast period.

These WealthTech solutions fulfill new-age customer needs such as automated rebalancing, tech-enabled financial solutions, and portfolio construction, for large banks and small advisory firms. WealthTech key players are focusing on transforming the industry by identifying inefficiencies along the entire financial services value chain.

This WealthTech solution offers different benefits such as more effective portfolio management, improved customer experience, better assets liquidity, cost transparency, and, improved advice. The reliability of such benefits drives the WealthTech solutions market growth.

Challenges

The WealthTech solutions are more expensive and the lack of process, methodology, and resources affects the market growth, to a certain extent. Furthermore, lack of financial investment awareness, and poor transaction infrastructure network, are some factors hampering the WealthTech solutions market growth.

Some of the prominent players providing WealthTech Solutions are

These vendors are focusing on product up-gradation and feature enhancements to fulfill the unique financial needs of the customers. Moreover, these vendors also offer financial advisory services to their clients, which helps them to sustain market competition.

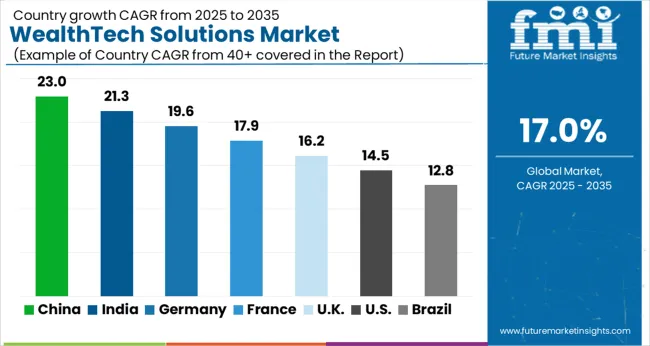

On the basis of geography, North America followed by Europe accounted for the largest market share as many WealthTech solutions providers are present in these regions due to advancements in financial services technology and high business growth rate in this region.

Moreover, emerging countries such as India, GCC countries, and Southeast Asian countries offer lucrative growth opportunities for high-net-worth customers and clients, to manage their financial investments and wealth generation.

The WealthTech solutions market report is a compilation of first-hand information, qualitative and quantitative assessments by industry analysts, and inputs from industry experts and industry participants across the value chain.

The report provides an in-depth analysis of parent market trends, macroeconomic indicators, and governing factors, along with market attractiveness as per segment. The WealthTech solutions market report also maps the qualitative impact of various market factors on market segments and geographies.

The global wealthtech solutions market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the wealthtech solutions market is projected to reach USD 37.0 billion by 2035.

The wealthtech solutions market is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in wealthtech solutions market are wealthtech solutions, services, _system integration, _consulting services and _support & maintenance.

In terms of end user, banks segment to command 48.6% share in the wealthtech solutions market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5PL Solutions Market

mHealth Solutions Market Size and Share Forecast Outlook 2025 to 2035

Long Haul Solutions Market Size and Share Forecast Outlook 2025 to 2035

eClinical Solutions and Software Market Insights - Trends & Forecast 2025 to 2035

E-tailing Solutions Market Growth – Trends & Forecast 2020-2030

Connected Solutions for Oil & Gas Market Insights – Trends & Forecast 2020-2030

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Solutions Market Size and Share Forecast Outlook 2025 to 2035

Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Payment Bank Solutions Market Size and Share Forecast Outlook 2025 to 2035

Aviation IoT Solutions Market

Eye Tracking Solutions Market

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hormonal Acne Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Sensitive Skin Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Solutions Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Neuromarketing Solutions Market Size and Share Forecast Outlook 2025 to 2035

Cable Cleaning Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA