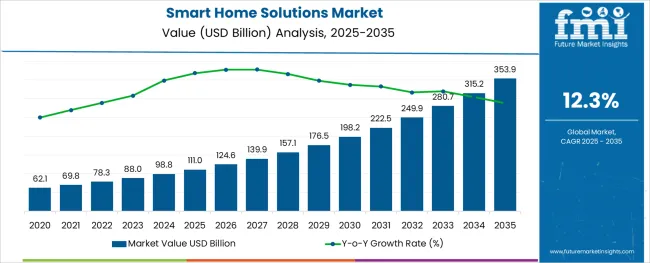

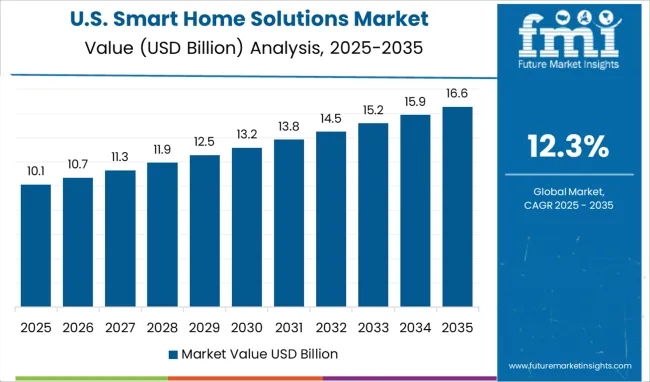

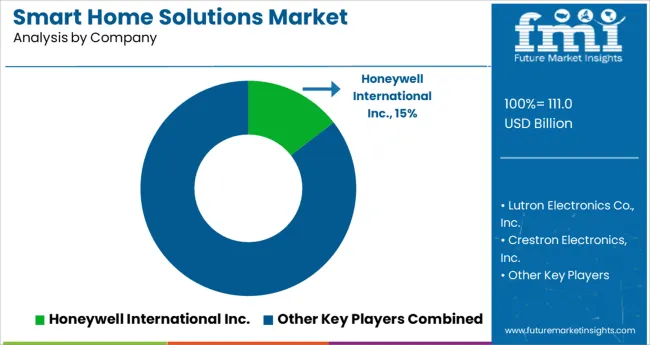

The Smart Home Solutions Market is estimated to be valued at USD 111.0 billion in 2025 and is projected to reach USD 353.9 billion by 2035, registering a compound annual growth rate (CAGR) of 12.3% over the forecast period.

The smart home solutions market is undergoing dynamic evolution, propelled by increasing consumer demand for energy efficiency, remote accessibility, and seamless device integration. Growing adoption of IoT-enabled products has transformed residential spaces into connected ecosystems, where smart lighting, HVAC systems, security cameras, and voice assistants operate through centralized platforms.

Advancements in AI and machine learning are further enabling predictive automation, with user behavior and environmental data shaping personalized home experiences. Governments and utility companies are promoting smart infrastructure through rebates and regulations favoring energy-conscious technologies.

Concurrently, the consumer shift toward wellness, convenience, and lifestyle-focused technology is fostering demand for scalable and interoperable solutions. As 5G connectivity, edge computing, and smart city infrastructure expand globally, smart home platforms are expected to benefit from improved reliability, real-time responsiveness, and cross-platform integration, positioning the market for sustained growth across both developed and emerging regions.

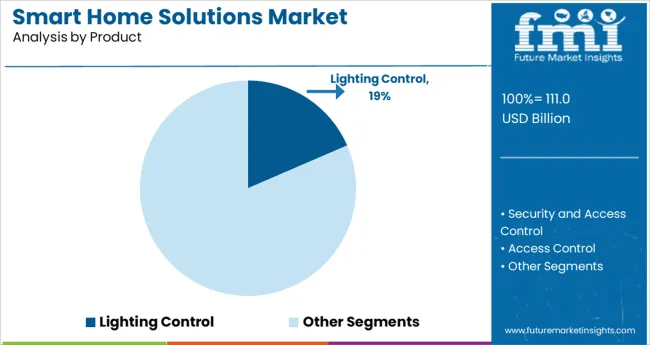

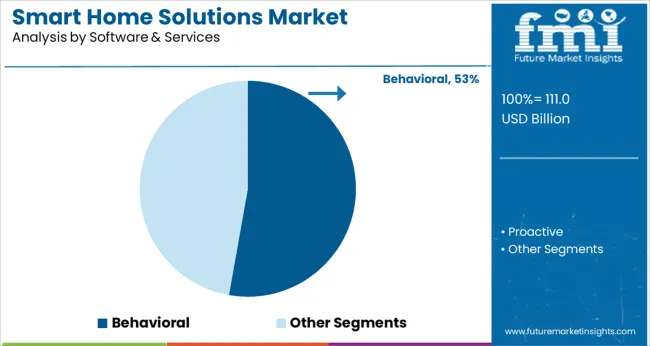

The market is segmented by Product, Software & Services, and Sales Channel and region. By Product, the market is divided into Lighting Control, Security and Access Control, Access Control, HVAC Control, Entertainment, Smart Speaker, Home Healthcare, and Others. In terms of Software & Services, the market is classified into Behavioral and Proactive.

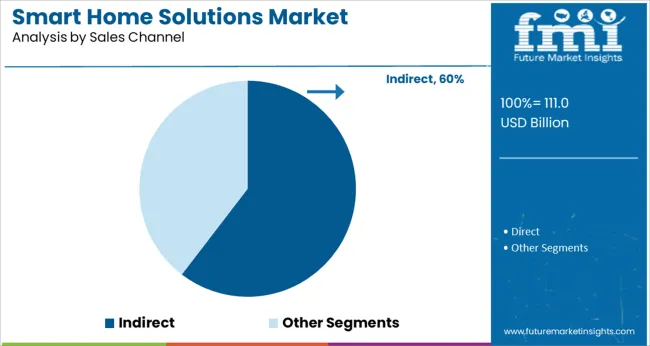

Based on Sales Channel, the market is segmented into Indirect and Direct. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product, Software & Services, and Sales Channel and region. By Product, the market is divided into Lighting Control, Security and Access Control, Access Control, HVAC Control, Entertainment, Smart Speaker, Home Healthcare, and Others. In terms of Software & Services, the market is classified into Behavioral and Proactive.

Based on Sales Channel, the market is segmented into Indirect and Direct. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Lighting control is anticipated to account for 18.5% of the smart home product segment revenue in 2025, establishing it as a significant contributor within the market. Its prominence is driven by rising consumer preference for ambiance customization, energy conservation, and convenience.

Smart lighting systems have evolved from basic dimming features to integrated control systems that adapt to user presence, daylight levels, and behavioral patterns. Compatibility with voice assistants and smartphone applications has further enhanced accessibility, making lighting control one of the most adopted entry-level smart home technologies.

Additionally, lighting serves as a foundational layer for broader home automation, enabling easy upgrades to multi-functional systems. The combination of aesthetic appeal, energy efficiency, and user experience enhancement has solidified lighting control as a leading category in the smart home solutions product lineup.

The behavioral category is projected to hold 52.8% of the software and services segment revenue in 2025, making it the dominant segment. This is attributed to its capability to analyze user activity, environmental conditions, and energy consumption patterns to deliver actionable insights and adaptive controls.

Unlike predefined or rule-based systems, behavioral software solutions continuously learn and evolve with user habits, optimizing comfort, efficiency, and automation. Utility providers and home automation firms are increasingly incorporating behavioral analytics into energy management platforms, enhancing demand response and usage efficiency.

Additionally, these services support predictive maintenance, personalized routines, and context-aware automation, which have become key differentiators in competitive smart home ecosystems. As consumers increasingly seek seamless and intuitive living experiences, behavioral software is expected to remain central to smart home intelligence and control.

The indirect sales channel is forecast to contribute 60.4% of market revenue in 2025, making it the primary distribution route in the smart home solutions market. This dominance is driven by strong partnerships with third-party retailers, system integrators, utility companies, and e-commerce platforms that enable wide-scale reach and bundled solution offerings.

Consumers often prefer expert-guided installations, particularly for integrated systems that require customization and connectivity across multiple devices. Indirect channels also support value-added services such as on-site consultation, warranty management, and post-installation support, enhancing buyer confidence and satisfaction.

Manufacturers are leveraging indirect routes to build brand presence and educate end-users through showroom experiences and demonstration setups. The trust built through channel partners, along with scalable distribution capabilities, has ensured indirect sales maintain their leading share across residential, commercial, and builder-developer verticals.

The advanced security features are the prime reasons that are driving the market growth for smart home solutions. Its implementation of security features like gas leakage detectors, fire detection systems in the house, and more are driving people towards further adoption of smart home solutions.

They perform basic functions like turning off the lights, dimming lights, and other complex functions like automatically lighting up the exit route in the event of a fire alarm, and more, which is propelling the demand for smart home solutions globally.

It is witnessed that connectivity has emerged as a high-end novelty across a wide range of home devices that include security cameras, thermostats, and utility meters. It is expected that in the coming years connectivity is likely to become a more pervasive trend to the extent of being an embedded standard in every household device and equipment virtually.

The sales of smart home solutions are rapidly increasing probing to the easy and convenient remote access of every device from other locations. One can keep a watch on the activities that are going around within the house through video surveillance systems.

The use of data analytics software and solutions with home automation systems helps the owners determine the electrical equipment in the home is operating efficiently and achieving the targeted usage goals. This helps in the identification of the areas that require improvement and energy efficiency upgrades.

It is also anticipated that the integration of power line communication technology in smart homes is likely to add a positive contribution to the expansion of the smart home solutions market globally.

It is identified that there are some factors that are likely to curb the growth of the smart home solutions market in the upcoming years. The cost of smart home solutions is high compared to the existing devices.

Consumers are most likely to choose products that offer convenience and energy efficiency. The shipment usually depends on the utilization and requirements of homeowners and the smart home devices involve other upfront costs like installation charges and maintenance costs. These costs limit the adoption and acceptance of smart home solutions by customers, as well as many other organizations, and are projected to curb the growth of the smart home solutions market during the forecast period.

It is projected that North America is going to dominate the global smart home solutions market during the forecast period. Currently, the North American region is cumulatively accountable for 42.3% of the total market share for smart home solutions.

Owing to the increased awareness about the concept of home automation, the populace of North America is highly spending on the adoption of smart home devices. There is an increased number of working individuals in a house, and the families of the North American regions are financially capable of using these solutions at home and are driving the smart home solutions market size in North America.

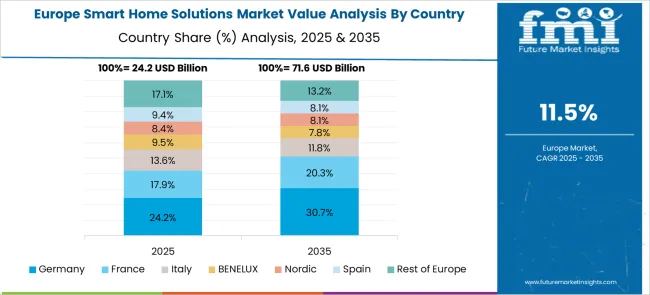

Europe is anticipated to acquire a significant share of the smart home solutions market in the upcoming years. Due to its broad range of products and the advancement of technology in this region, the market size is substantially increasing.

At present, Europe is accountable for 20.4% of the tot market share of smart home solutions. This growth is also backed by the presence of some of the prominent market players in the European regions, coupled with initiatives like the alignment of core communication technologies with residential facilities to maximize benefits.

There are rigorous innovations made to the smart home solutions market by emerging companies. They are cooperating with other well-known organizations to create and deploy unique smart home solutions. They are focusing on building cutting-edge technology that allows them to operate with minimal consumption of energy and in an efficient manner.

For instance, in January 2024, Vivint Smart Home, Inc. and Mosaic Acquisition Corp. announced a merger, with the aim of the merger to make the organization a public-traded company along with enhancing smart home platform offerings.

Some of the other start-up companies gaining momentum in the smart home solutions market are Latch, House, SimpliSafe, Sense, Wyze Labs, Pro.com, Openpath, Nanoleaf, Notion, Ring, Endel, and more.

What is Trending amongst the Key Market Players in the Smart Home Solutions Market?

Recent Development

The key start-up companies are seeking solutions that make the end user’s life more comfortable, and meaningful and provide a higher quality of life. They are getting indulged in mergers and acquisitions for further development of smart home solutions.

For Instance, In August 2024, Schneider Electric and Livspace, a home interiors and renovation platform announced a partnership. The partnership aims to create a smarter house for the future. The alliance is going to use Schneider Electric’s superior home automation technology and Livspace’s interior design experience to revolutionize the Indian home interior market. This experience is likely to include a wise home automation solution.

In the same month, August 2024, SmartRet.com, LLC, a provider of smart home and smart building automation, announced a merger with Fifth Wall Acquisition Corp. This was aimed at expanding the company and going public.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 12.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product, Application, End-User, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Honeywell; Siemens; Johnson Controls; Schneider Electric; ASSA ABLOY; Amazon; Apple; ADT; ABB; Robert Bosch; Sony; Samsung Electronics; Ooma; Delta Controls; Control4; Axis Communications; Comcast; Smarthome; Crestron Electronics; SimpliSafe; Armorax; Canary; LG Electronics; Lutron; Legrand |

| Customization | Available Upon Request |

The global smart home solutions market is estimated to be valued at USD 111.0 billion in 2025.

It is projected to reach USD 353.9 billion by 2035.

The market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types are lighting control, security and access control, access control, hvac control, entertainment, smart speaker, home healthcare and others.

behavioral segment is expected to dominate with a 52.8% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA