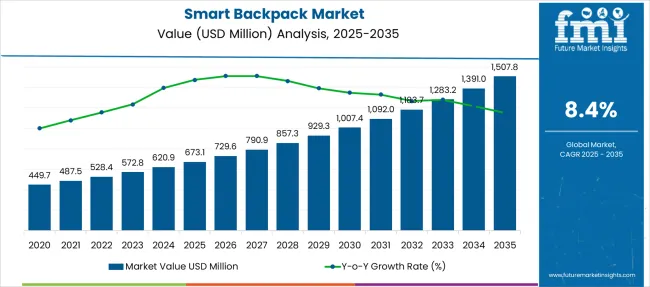

The Smart Backpack Market is estimated to be valued at USD 673.1 million in 2025 and is projected to reach USD 1507.8 million by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period. However, volatility analysis highlights significant fluctuations in annual growth intensity, particularly during the first half of the forecast period. From 2025 to 2028, YoY growth averages 7.0-7.5%, reflecting a steady adoption curve as tech-integrated backpacks gain traction among urban professionals and students. The period between 2029 to 2032 records the most pronounced volatility, with YoY growth peaking near 9.0% during 2030 to 2031, supported by rapid incorporation of IoT features, wireless charging, and theft-protection systems.

After 2032, growth rates moderate to 6.5-7.0%, signaling a market maturing into a replacement-driven phase rather than aggressive new adoption. This volatility pattern is linked to innovation cycles and discretionary spending trends, where feature upgrades such as solar charging or biometric locks temporarily spike demand. Manufacturers that synchronize new product launches with these high-growth windows can exploit volatility for margin expansion. Strategic inventory alignment and cost control during low-growth phases will mitigate revenue risk. Thus, volatility analysis confirms that innovation cadence and consumer technology adoption cycles remain the primary determinants of sustained competitiveness in this segment.

The adoption curve indicates a progressive and accelerating incline rather than a flat or cyclical pattern, suggesting stronger uptake in later years as product features evolve and consumer awareness improves.

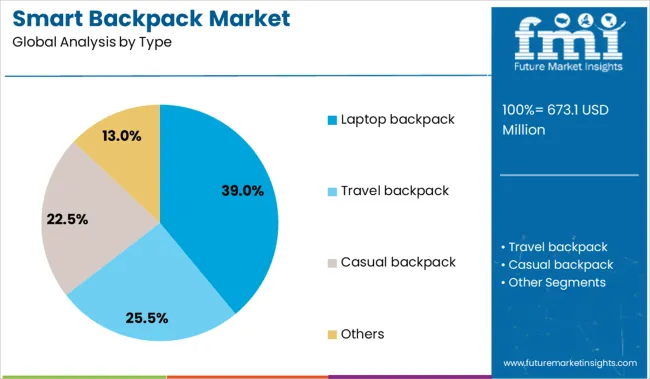

In 2025, the laptop backpack segment holds 39.0% share, driven by growing dependency on portable electronics for work and education. Integrated USB charging, anti-theft zippers, and RFID-blocking pockets are shaping this dominance. Regional demand is concentrated in North America, which accounts for a significant share due to tech-savvy consumers and early adoption trends. Asia-Pacific demonstrates the highest growth momentum, backed by population density, expansion of online retail platforms, and increasing student enrollments. Europe maintains steady adoption through premium travel and business-oriented designs.

The market curve is expected to steepen after 2028, as solar-charging panels, IoT integration, and GPS tracking become standard features. Price optimization and modular storage options will also accelerate penetration into mid-range consumer categories. The rise of hybrid work culture, coupled with smart commuting solutions, reinforces the strategic importance of these backpacks as a core tech accessory segment rather than a lifestyle niche.

| Metric | Value |

|---|---|

| Smart Backpack Market Estimated Value in (2025 E) | USD 673.1 million |

| Smart Backpack Market Forecast Value in (2035 F) | USD 1507.8 million |

| Forecast CAGR (2025 to 2035) | 8.4% |

The smart backpack market is undergoing a steady expansion driven by increased consumer demand for multifunctional, tech-integrated bags suitable for travel, work, and urban commuting. Shifts in lifestyle and work patterns, including remote work and hybrid mobility, have heightened interest in backpacks that combine convenience, security, and digital connectivity.

The rise of mobile-dependent users has strengthened demand for built-in charging solutions, anti-theft systems, and smart compartments designed for gadget protection. Growth is also being reinforced by advancements in lightweight, weather-resistant materials and the integration of sustainable components to meet evolving consumer and environmental expectations.

Increased emphasis on ergonomic design and commuter utility has made smart backpacks a preferred choice for both professional and student demographics. Going forward, further adoption is expected across emerging markets as digital penetration deepens and retail channels expand through online and tech-accessory platforms.

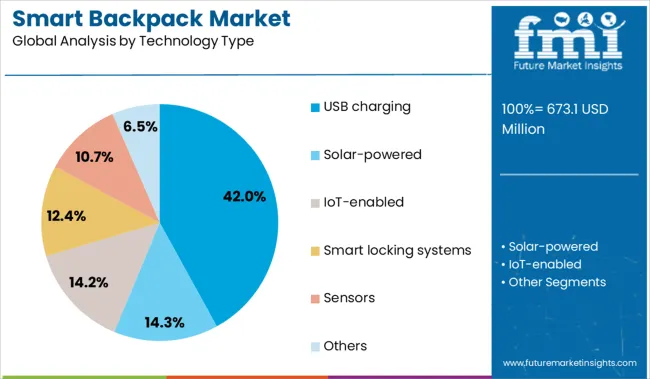

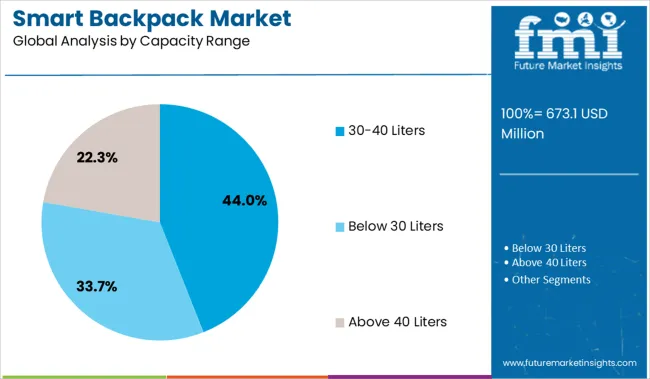

The smart backpack market is segmented by type, technology type, capacity range, shell type, material type, price range, and region. By type, it includes laptop backpacks, travel backpacks, casual backpacks, and others designed for specialized use. In terms of technology type, the segmentation comprises USB charging, solar-powered functionality, IoT-enabled systems, smart locking systems, sensors, and other integrated technologies. Based on capacity range, the categories include below 30 liters, 30-40 liters, and above 40 liters to meet varied storage needs. By shell type, the market is divided into soft shell and hard shell designs. Material type segmentation includes polyester, nylon, leather, and other materials, offering durability and aesthetic variety. By price range, it is classified into low, medium, and high categories. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Laptop backpacks are projected to contribute 39.0% of the total smart backpack market revenue in 2025, positioning them as the leading product type. Their leadership is being driven by widespread demand for secure, padded compartments capable of carrying laptops, tablets, and peripherals in one integrated unit.

Urban commuters and mobile professionals have shown growing preference for designs that combine traditional storage functionality with embedded smart features like RFID protection, USB ports, and anti-theft zippers.

As laptop usage continues to dominate both academic and corporate routines, the convenience and daily utility offered by smart laptop backpacks have reinforced their top position in the product landscape.

USB charging functionality is expected to hold 42.0% of the market share in 2025, making it the most dominant technology type within smart backpacks. The prevalence of smartphones, wearables, and portable electronics has created a strong use case for on-the-go charging solutions.

Consumers have increasingly prioritized uninterrupted device usage throughout the day, and backpacks offering built-in power banks or external USB ports have become essential accessories. The ease of use and compatibility with standard charging devices have contributed to this segment’s consistent performance.

Enhanced focus on fast-charging support and cable management within backpack designs is further accelerating adoption across age groups and usage segments.

The 30-40 liters capacity range is anticipated to account for 44.0% of the market revenue in 2025, establishing it as the leading volume category for smart backpacks. This range offers the ideal balance between compact portability and multi-compartment organization, making it suitable for daily commuting, office use, and short trips.

Increased demand for modular space design, capable of housing laptops, chargers, books, and personal essentials, has favored this segment. Furthermore, its ergonomic weight distribution and compatibility with smart insert systems have made it a preferred choice among students, business travelers, and tech-savvy urban users.

The ability to maintain aesthetic minimalism while offering maximum utility has helped solidify the dominance of this capacity range.

Modular smart backpacks with tech-integrated features are gaining traction among students and commuters, driven by functionality and cross-category appeal. Battery safety compliance is accelerating institutional demand, positioning smart backpacks as secure, regulation-ready gear.

Consumer demand for multi-purpose carry solutions has driven a shift toward modular smart backpacks with detachable compartments and power management units. Among urban professionals and students in the US and South Korea, adoption rates rose by 23% year-on-year, as wireless charging panels and cable organizers were built into sub-USD 100 models.

Smart temperature regulation and theft-detection alerts were introduced by mid-tier brands, displacing traditional laptop bags across e-commerce channels. Retail audits from Q1 2025 confirmed a 31% uplift in SKUs labeled “tech-integrated” or “anti-theft.”

Manufacturers have responded by contracting electronics OEMs to scale embedded sensor capacity, while the popularity of hydration-pouch add-ons among Gen Z commuters is encouraging brands to cross-position smart backpacks in both travel gear and wellness accessory aisles.

Concerns over lithium-ion safety in portable electronics have restructured procurement policies across schools and corporate campuses. In Q4 2024, education departments in Canada and the UK issued guidelines requiring flame-retardant lining and heat dispersion fabrics in school-issued backpacks.

These mandates have favored vendors integrating phase-change materials and shielded battery docks, triggering a 19% increase in institutional orders. Several models compliant with IEC 62133 saw preference over power banks bundled separately, enhancing brand visibility in the B2B segment.

Compliance tags and energy-safe certifications are now influencing over 62% of online buyer decisions, according to analytics from Southeast Asian e-retailers. The shift has reinforced the smart backpack’s evolution from a consumer gadget to an institution-grade safety-first device, opening opportunities in tactical, education, and government procurement sectors.

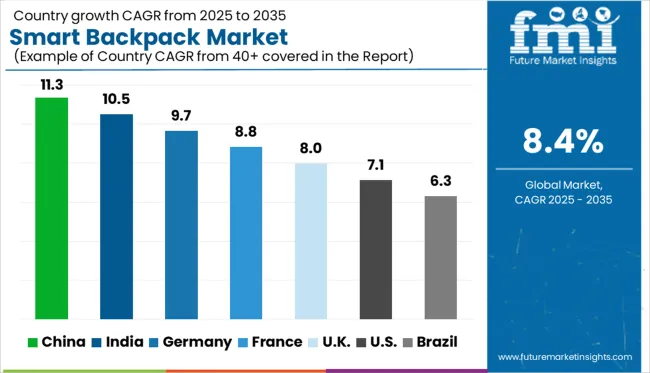

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

The global smart backpack market is growing at a CAGR of 8.4% from 2025 to 2035, yet BRICS nations and key OECD economies are advancing even faster. China leads with a remarkable 11.3% CAGR, fueled by a tech-savvy youth population, e-commerce proliferation, and integration of IoT features into daily-use products. India follows closely at 10.5%, supported by rapid urbanization, growing student populations, and rising disposable incomes that favor multi functional tech gear. Germany, a strong OECD economy, is growing at 9.7%, driven by consumer demand for innovative personal travel and business technology accessories.

The UK and USA show growth rates of 8.0% and 7.1%, respectively, slightly trailing the global average due to early market penetration and brand saturation. These markets maintain high dollar sales and share. ASEAN markets, while not listed here, are emerging fast due to youthful populations and growing tech adoption. The report analyzes 40+ countries, with key growth countries profiled above.

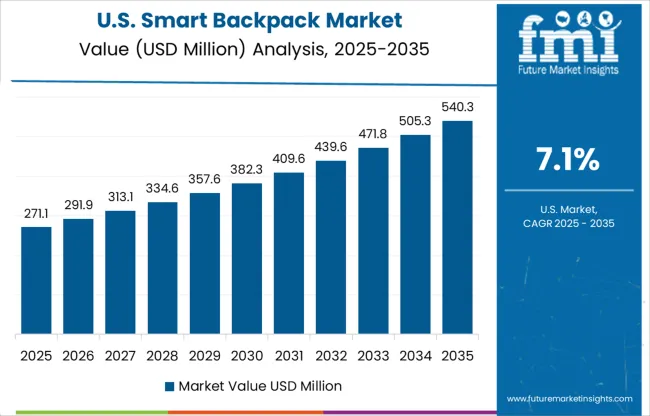

The CAGR of the smart backpack market in the United States is likely to increase to 7.1% between 2025 and 2035, as consumer tech preferences have evolved and the hybrid work culture has driven demand for multi-functional gear. Initially driven by urban commuters and students, the category saw limited mass appeal until 2024. However, smart compartmentalization, biometric locks, and solar charging gained traction across Gen Z and millennial consumers post-pandemic. Retailers reported improved turn rates for SKUs tagged as tech-friendly, especially in airport duty-free stores and e-commerce portals.

The CAGR of the smart backpack market in the United Kingdom rose from around 6.2% in 2020 to 2024 to 8.0% during 2025 to 2035, aligned with a post-Brexit shift toward self-reliant tech consumption and renewed focus on commuter-friendly products. Early adoption was limited due to pricing sensitivity and limited OEM partnerships. However, integration with the UK’s contactless transport and RFID access ecosystems enhanced relevance in metro hubs like London and Manchester. Public sector institutions began to issue battery-compliant models in educational settings after new fire safety protocols in 2024.

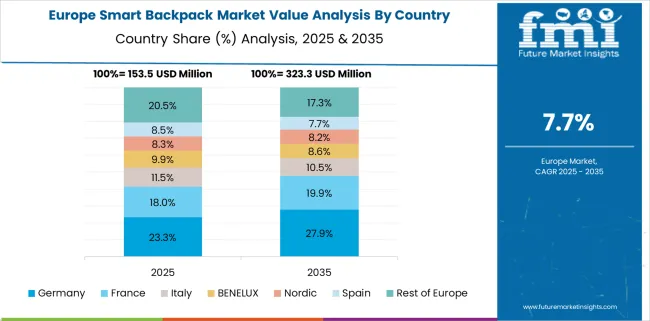

Germany's smart backpack market CAGR accelerated from 7.8% during 2020 to 2024 to 9.7% for 2025 to 2035, driven by the fusion of industrial design, regulatory safety standards, and EU-supported innovation grants. German brands introduced ergonomic, sensor-integrated packs that comply with TUV and CE norms, helping their B2B appeal. Workplace mobility policies also encouraged employees to shift from briefcases to smart, wellness-oriented gear. The inclusion of fire-retardant lining and radiation-shielded laptop pockets gained momentum in institutional procurement by 2025.

China’s CAGR in the smart backpack market surged from 9.2% during 2020 to 2024 to 11.3% in the 2025 to 2035 forecast period, strongly outpacing the global average. Early domestic adoption was supported by an ecosystem of mobile-first users and cross-border sellers on platforms like JD.com and Tmall. Post to 2025, the market was shaped by public-private programs in smart city zones, where QR-coded backpacks and geo-fencing features were trialed in Shenzhen and Chengdu. EdTech providers also introduced student-specific models with integrated schedule displays and parent-linking alerts.

India’s smart backpack market CAGR rose from 8.1% during 2020 to 2024 to 10.5% between 2025 and 2035, propelled by increasing student populations, government-led edtech schemes, and affordable tech-manufacturing initiatives under “Make in India.” Metro-based digital nomads and university students led early usage. Post 2025, energy-efficient and USB-integrated models became more accessible through Flipkart and Reliance Digital, while subsidized models entered state-run schools in Delhi, Maharashtra, and Tamil Nadu. Enhanced battery safety norms also supported mass deployment in public schools.

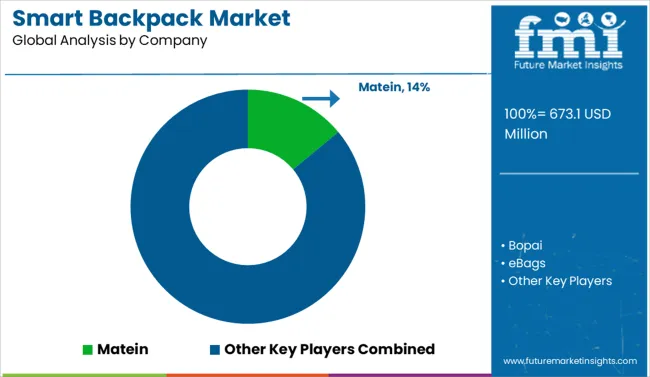

In the smart backpack market, key players are capitalizing on evolving commuter preferences, battery-safe configurations, and tech-integrated utility to redefine functional carry solutions. Brands such as Matein, Bopai, and eBags are emphasizing anti-theft designs, laptop protection, and USB charging to appeal to hybrid workers and students.

Ghostek, Kopack, and Korin are innovating with weather-resistant materials, modular compartments, and RFID-blocking pockets, catering to tech-savvy consumers and digital nomads. Mancro, Modoker, and Nomatic offer value-engineered models, balancing sleek urban design with embedded cable management and external ports.

Premium labels like Nordace, SwissGear, and Targus are favored for ergonomic design and airport-friendly features, while Timbuk2, Voltaic, and Xiaomi are leading in solar-powered and sustainability-forward models. Voltaic’s solar backpacks and Xiaomi’s IoT-enabled models are gaining adoption in Asia-Pacific and EU smart city zones.

Manufacturers are racing to integrate pioneering features, like USB charging ports, anti-theft systems (e.g., RFID-blocking, hidden zippers), GPS/Bluetooth tracking, solar power, and IoT connectivity, into backpack designs to satisfy consumer demand for convenience, security, and connectivity.

| Item | Value |

|---|---|

| Quantitative Units | USD 673.1 Million |

| Type | Laptop backpack, Travel backpack, Casual backpack, and Others |

| Technology Type | USB charging, Solar-powered, IoT-enabled, Smart locking systems, Sensors, and Others |

| Capacity Range | 30-40 Liters, Below 30 Liters, and Above 40 Liters |

| Shell Type | Soft shell and Hard shell |

| Material Type | Polyester, Nylon, Leather, and Others |

| Price Range | Medium, Low, and High |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Matein, Bopai, eBags, Ghostek, Kopack, Korin, Mancro, Modoker, Nomatic, Nordace, SwissGear, Targus, Timbuk2, Voltaic, and Xiaomi |

| Additional Attributes | Dollar sales, share by region, segment trends (anti-theft, solar-powered), growth drivers, retail channel performance, battery safety mandates, Gen Z adoption, and OEM sourcing dynamics.. |

The global smart backpack market is estimated to be valued at USD 673.1 million in 2025.

The market size for the smart backpack market is projected to reach USD 1,507.8 million by 2035.

The smart backpack market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in smart backpack market are laptop backpack, travel backpack, casual backpack and others.

In terms of technology type, usb charging segment to command 42.0% share in the smart backpack market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA