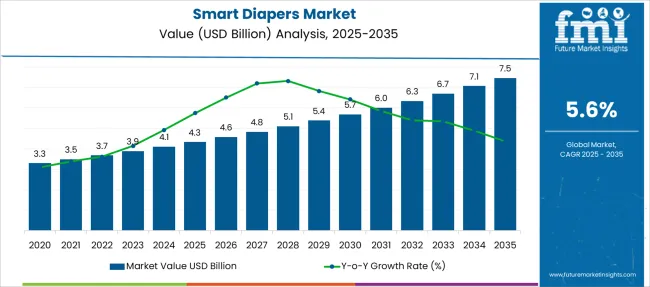

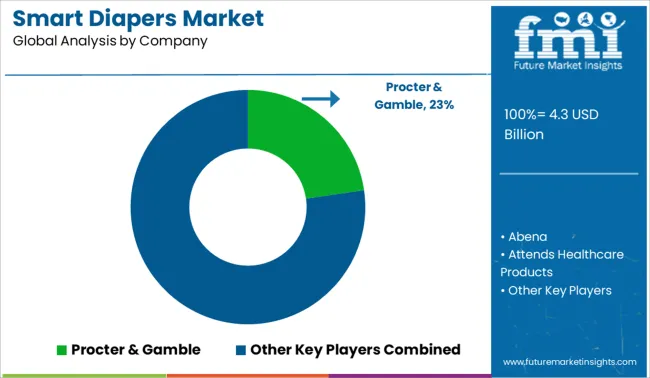

The Smart Diapers Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 7.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Smart Diapers Market Estimated Value in (2025 E) | USD 4.3 billion |

| Smart Diapers Market Forecast Value in (2035 F) | USD 7.5 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The smart diapers market is expanding rapidly as technology integration in baby care products becomes increasingly important to parents and caregivers. Innovations like Bluetooth sensors enable real-time monitoring of a baby’s condition providing timely alerts that improve comfort and health outcomes.

The convenience offered by these smart devices has raised awareness and acceptance among modern parents. The growing focus on infant hygiene and health coupled with rising disposable incomes in many regions supports market growth.

Additionally technological advances have improved sensor accuracy and battery life while reducing costs making smart diapers more accessible. Retail expansion and increased online availability have also contributed to greater adoption rates. The demand for smart diapers is expected to increase as parents seek solutions that reduce diaper rash infections and enhance caregiving efficiency. Segment growth is expected to be driven by Bluetooth sensor technology the baby end-use group and products priced in the medium range.

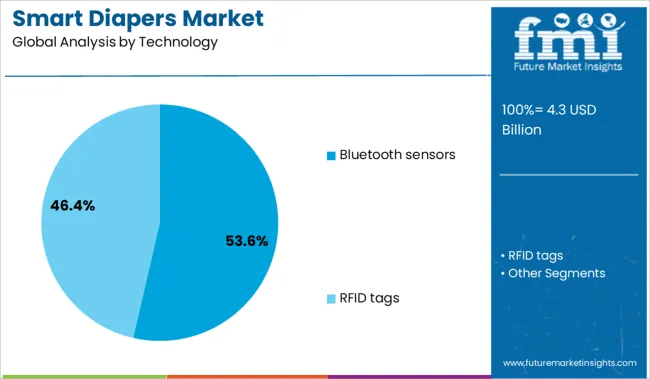

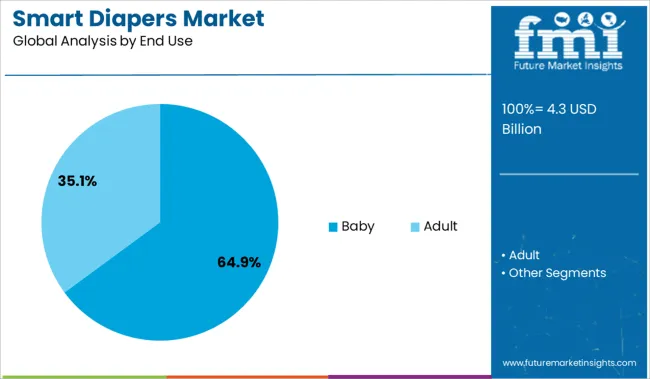

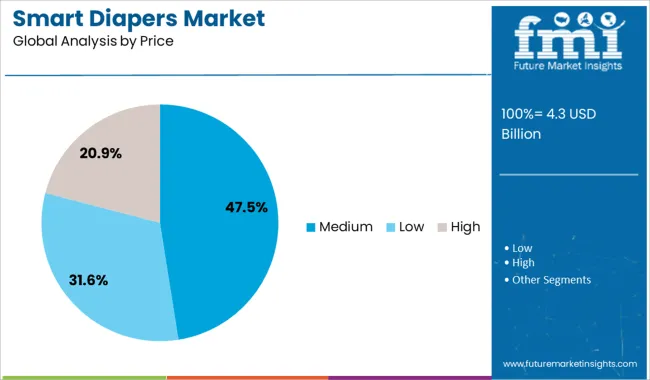

The market is segmented by Technology, End Use, Price, and Distribution Channel and region. By Technology, the market is divided into Bluetooth sensors and RFID tags. In terms of End Use, the market is classified into Baby and Adult. Based on Price, the market is segmented into Medium, Low, and High.

By Distribution Channel, the market is divided into Offline, Supermarkets/hypermarkets, Specialty stores, Others, Online, E-commerce platforms, and Company websites. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Bluetooth sensors segment is projected to hold 53.6% of the smart diapers market revenue in 2025 due to the value these sensors provide in remote monitoring. The integration of Bluetooth allows for wireless transmission of moisture and temperature data to caregivers enabling proactive diaper changes. This technology enhances infant comfort and reduces the risk of skin irritation or infections.

Manufacturers have prioritized this technology for its compatibility with smartphones and wearable devices allowing seamless real-time alerts. Adoption has been accelerated by increasing digital literacy among parents and the availability of user-friendly mobile applications.

The ability to remotely monitor infants has made Bluetooth-enabled smart diapers highly attractive in both developed and emerging markets supporting this segment’s growth.

The baby segment is expected to represent 64.9% of the smart diapers market revenue in 2025 maintaining its dominant position. This segment’s growth is largely driven by parental concerns about infant health hygiene and the convenience smart diapers offer in tracking wetness and diaper status.

Increasing awareness about diaper rash prevention and improved comfort has encouraged parents to adopt advanced diaper technologies. The segment benefits from demographic trends including increasing birth rates in some regions and a higher willingness among millennial parents to invest in smart baby care products.

The integration of smart diapers with parenting apps and health monitoring platforms has also supported growth in this segment. Demand from this group is expected to remain strong as caregivers prioritize child well-being and convenience.

The medium price segment is projected to account for 47.5% of smart diapers market revenue in 2025 due to its appeal to middle-income consumers seeking a balance between quality and affordability. This segment covers products that offer essential smart features without premium pricing making them accessible to a broader audience.

The medium price range is attractive for parents who want reliable technology and good performance without high costs. Retailers have expanded their offerings in this price bracket to meet growing consumer demand for affordable smart baby products.

Seasonal promotions and subscription models have also helped drive sales within this segment. As awareness of smart diaper benefits spreads the medium price segment is expected to lead market revenue.

Smart diapers have witnessed accelerated adoption due to increasing demand for connected health tracking in caregiving environments. Parents and healthcare professionals now prefer solutions that offer real-time notifications for moisture levels, skin temperature, and diaper saturation to avoid discomfort or skin issues. This trend has been especially prominent in hospitals, eldercare homes, and households where continuous observation is challenging. The integration of Bluetooth or RFID sensors in disposable diapers enables automatic alerts via smartphones, reducing the need for manual checks. This convenience has led to operational efficiency in care facilities, improved comfort for wearers, and better hygiene management overall. Companies specializing in intelligent hygiene products are positioning themselves as enablers of care automation, offering products that combine reliability with data accessibility. The trend toward non-invasive caregiving tools has continued to drive the relevance of smart diapers in modern health monitoring systems.

Expanding adoption of smart diapers in neonatal ICUs and eldercare settings has opened a substantial growth opportunity for manufacturers and healthcare system integrators. Elderly patients with incontinence and bedridden conditions often require continuous monitoring, which smart diapers now facilitate through embedded sensors and mobile-linked dashboards. Similarly, preterm infants or those under critical care benefit from non-invasive moisture detection without disrupting rest cycles. Medical institutions have started evaluating these tools not just for convenience but as part of broader health data tracking frameworks. Future growth depends on achieving interoperability with electronic health records, ensuring data privacy, and maintaining sensor durability during prolonged usage. Brands that can provide end-to-end monitoring systems—with wearable integration, caregiver alert features, and centralized reporting—are likely to emerge as preferred vendors in hospital procurement cycles. This shift from household adoption to institutional deployment marks a pivotal opportunity for market scale.

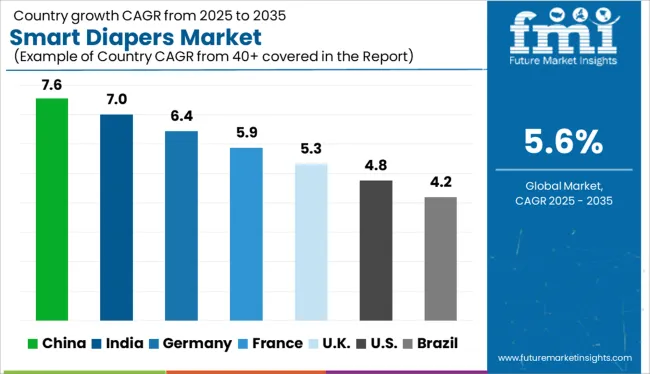

| Country | CAGR |

|---|---|

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The smart diapers industry is projected to grow globally at a 5.6% CAGR from 2025 to 2035. China leads growth among the 40 analyzed markets with a 7.6% CAGR, followed by India at 7.0% and Germany at 6.4%. France stands slightly above the global benchmark at 5.9%, while the United Kingdom lags at 5.3%. Higher growth in China and India is shaped by increasing digitization of infant and elderly care and expansion of domestic wearables. Germany benefits from sensor-embedded healthcare systems, while France shows demand across institutional elderly care. The UK demonstrates modest uptake with emphasis on retail-focused innovations rather than systemic healthcare integration.

The smart diapers market in China is expected to grow at a robust 7.6% CAGR, supported by an expanding ecosystem of IoT-enabled infant and adult hygiene products. Domestic brands and tech startups are partnering to integrate Bluetooth sensors into wearable care items. Smart diaper penetration is high in urban pediatric clinics and eldercare centers. Companies like Simbicare and Monit China are pioneering multi-function diapers with moisture and temperature tracking. The proliferation of AI-backed parenting apps also supports rapid product scaling.

The smart diapers market in India is forecast to expand at a 7.0% CAGR, led by increased awareness in both pediatric and geriatric care. Tier-1 cities show the highest traction, particularly for app-connected diapers sold via online-first platforms. Domestic innovation is emerging in reusable sensor modules with extended battery life. Startups like Tyzag are collaborating with hospitals for clinical trials and pilot deployments. India’s growing wearable medical devices market is expected to cross-integrate with the hygiene care segment.

Germany is on track to register a 6.4% CAGR in the smart diapers sector, supported by progressive digital health policies and demand from eldercare institutions. Hospitals and rehabilitation centers in states like Bavaria and North Rhine-Westphalia have begun deploying smart diaper systems in elderly wards to reduce infections and improve care efficiency. Partnerships between medical device makers and diaper manufacturers have produced hybrid offerings that include RFID moisture indicators and alert systems for nursing staff.

The smart diaper industry in France is expanding at a 5.9% CAGR, aligned with digitization in elderly care and infant health sectors. Government-backed initiatives for smart hospitals and public eldercare institutions include pilot deployments of sensor-enabled incontinence management solutions. Key players like Ontex and Verily have initiated collaborations for predictive alert systems. Despite slower household penetration, institutional adoption supports moderate growth. France’s healthcare reimbursement structure is also being evaluated for coverage of such connected care products.

The United Kingdom smart diapers market is growing at a 5.3% CAGR, reflecting gradual but steady adoption in home-based eldercare and pediatric wellness. UK consumers are showing interest in moisture-sensing disposable diapers, especially in high-income urban households. However, the absence of large-scale institutional trials and limited NHS reimbursement has slowed category expansion. Private healthcare providers are exploring pilot use in assisted living settings. Domestic startups are focusing on cloud-linked parental alert systems for infant care.

The smart diapers market is moderately consolidated, with Procter & Gamble holding a dominant market share through its sensor-integrated offerings designed for infant and elder care. Dominant players include Procter & Gamble, Kimberly-Clark, and Essity, each leveraging global distribution, trusted brands, and connected care technologies. Key players such as Abena, Drylock Technologies, Attends Healthcare Products, HARTMANN, Medline Industries, and Ontex cater to institutional and home healthcare channels with smart absorbent systems and caregiver support tools. Emerging players like Monit, Pixie Scientific, Simavita, Sinopulsar Technology, Sensassure, and Wonderkin focus on Bluetooth-enabled diapers, app-based alerts, and remote monitoring, targeting niche applications in tech-driven caregiving and senior wellness.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.3 Billion |

| Technology | Bluetooth sensors and RFID tags |

| End Use | Baby and Adult |

| Price | Medium, Low, and High |

| Distribution Channel | Offline, Supermarkets/hypermarkets, Specialty stores, Others, Online, E-commerce platforms, and Company websites |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Procter & Gamble, Abena, Attends Healthcare Products, Drylock Technologies, Essity, HARTMANN, Kimberly Clark, Medline Industries, Monit, Ontex, Pixie Scientific, Sensassure, Simavita, Sinopulsar Technology, and Wonderkin |

| Additional Attributes | Dollar sales by product type (wearable sensor-enabled vs passive smart), Dollar sales by form factor (disposable smart, reusable smart, sensor patches), Trends in moisture detection and leak-alert technologies, Use of Bluetooth/BLE and IoT connectivity in diaper monitoring, Growth of healthcare applications for incontinence and infant care, Regional patterns of smart diaper adoption and integration with caregiver apps. |

The global smart diapers market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the smart diapers market is projected to reach USD 7.5 billion by 2035.

The smart diapers market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in smart diapers market are bluetooth sensors and rfid tags.

In terms of end use, baby segment to command 64.9% share in the smart diapers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA