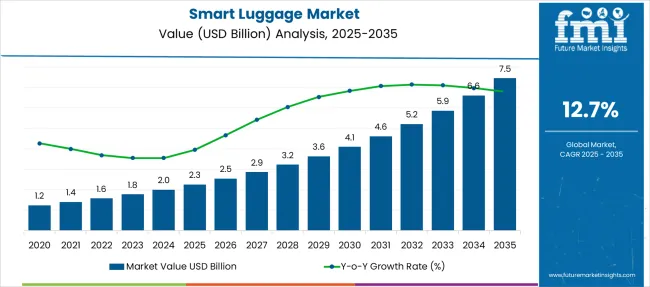

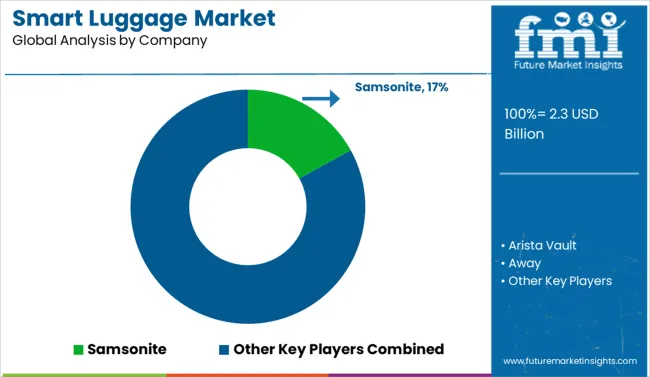

The Smart Luggage Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 7.5 billion by 2035, registering a compound annual growth rate (CAGR) of 12.7% over the forecast period. When analyzed into two 5-year blocks, the market shows distinct growth dynamics. Between 2025 and 2030, the value increases from USD 2.3 billion to USD 4.1 billion, adding USD 1.8 billion in net value. This period records a compound growth rate of approximately 12.5%, driven by the initial adoption of embedded tracking systems, biometric locks, and app-synced location features. Travelers in North America and Western Europe have been early adopters, with companies such as Samsonite integrating GPS modules and USB charging docks into premium luggage categories.

The second 5-year block from 2030 to 2035 shows an accelerated addition of USD 3.4 billion, moving from USD 4.1 billion to USD 7.5 billion. This nearly doubles the growth contribution compared to the previous phase, indicating growing market maturity and a shift toward volume expansion in the Asia Pacific and Middle East regions. Adoption by budget and mid-range luggage brands, including American Tourister and Xiaomi, has been linked to this scale-up. Smart tags, solar-powered charging banks, and predictive weight sensors are being incorporated to cater to digitally connected travelers, suggesting that product diversification and price accessibility will drive gains beyond 2030.

The smart luggage market intersects with five diverse parent markets. Approximately 30% is derived from the global travel luggage industry, where innovation in baggage design has prompted integration of tech-enabled features. Roughly 25% originates from the connected travel ecosystem, where smart tags, app syncing, and proximity sensors align with tech-savvy consumer behavior. Nearly 20% is linked to personal travel gear, covering modular add-ons like power banks and integrated scales. The consumer IoT segment contributes around 15%, driven by Bluetooth and GPS-enabled luggage components. The remaining 10% stems from lifestyle and luxury accessories, where brand positioning and feature-rich products attract premium segment buyers seeking convenience and exclusivity during transit.

The market is expanding quickly as travelers seek integrated solutions that combine functionality, security, and technology. Embedded features such as GPS tracking, biometric locks, and proximity sensors are becoming standard, allowing users to monitor and secure their luggage remotely. Bluetooth-enabled scales and mobile app integration provide real-time weight updates and alerts, reducing airport hassles. Some models now incorporate USB charging ports powered by removable batteries, addressing airline compliance while supporting mobile connectivity. AI features are emerging to personalize travel behavior and optimize usage patterns. Demand is increasing across both leisure and business segments, particularly in urban and tech-driven regions.

| Metric | Value |

|---|---|

| Smart Luggage Market Estimated Value in (2025E) | USD 2.3 billion |

| Smart Luggage Market Forecast Value in (2035F) | USD 7.5 billion |

| Forecast CAGR (2025 to 2035) | 12.7% |

The smart luggage market is advancing steadily as modern travelers increasingly demand technology-integrated solutions that offer convenience, security, and real-time tracking. Growing international air traffic, rising tech-savvy travel demographics, and the push toward digitally connected mobility are creating significant momentum in this space.

Airlines’ evolving baggage policies and the need for efficient handling are influencing innovation in modular luggage features like self-weighing, remote locking, and real-time location tracking. Battery regulation compliance, lightweight design improvements, and integration with mobile ecosystems are reshaping product development.

Integration of smart luggage with travel platforms and insurance ecosystems is expected to unlock new revenue channels and drive consumer adoption. The rising preference for smart accessories among frequent flyers, corporate travelers, and digital nomads is projected to stimulate long-term market expansion further.

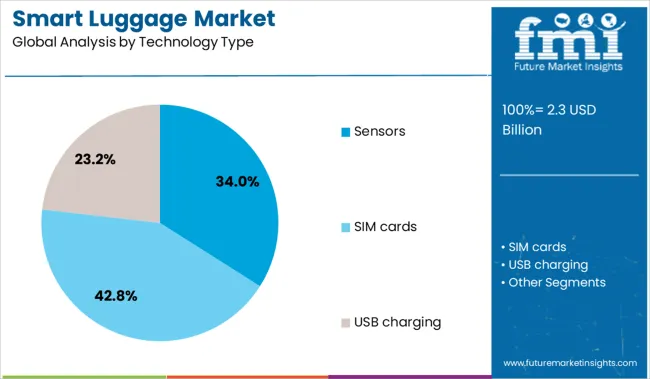

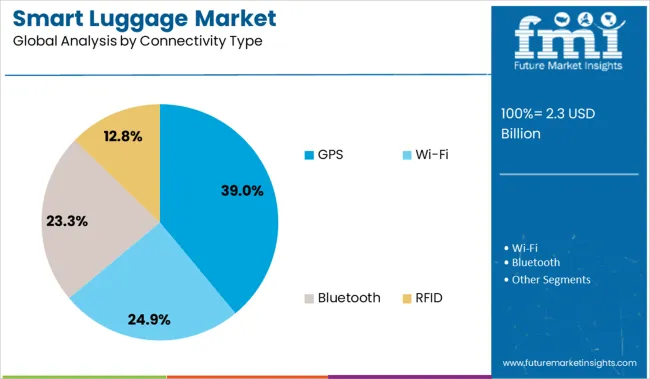

The market is segmented by technology type, size category, connectivity type, shell type, material type, application type, and region. By technology type, it includes sensors, SIM cards, and USB charging, enabling advanced functionality for smart luggage solutions. In terms of size category, the segmentation comprises small (55 cm), medium (64 cm), and large (77 cm) sizes, addressing diverse travel needs. Based on connectivity type, it includes GPS, Wi-Fi, Bluetooth, and RFID for enhanced tracking and security features. By shell type, the market is divided into hard shell and soft shell designs. Material type segmentation includes polycarbonate, canvas, plastic, nylon, and polyester, offering durability and style options. By application type, it covers real-time tracking, proximity alerts, remote locking, digital scaling, and other smart features. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Sensors are projected to account for 34.0% of the total revenue share in the smart luggage market by 2025, positioning them as the dominant technology segment. This leadership is being driven by rising adoption of embedded sensors that enable features such as auto-locking, weight sensing, and tamper alerts.

The ability to provide travelers with real-time feedback on handling conditions, location, and movement has reinforced consumer trust and convenience. Advances in miniaturization and battery optimization have enabled continuous sensor functionality without compromising luggage weight or design.

Additionally, integration of environmental sensors for humidity and pressure detection is enhancing protection of sensitive belongings during long-haul flights. As travel behaviors increasingly prioritize security and automation, sensor-driven luggage systems are gaining broad acceptance among both leisure and business travelers.

The medium-sized luggage category, specifically the 64cm dimension, is forecast to hold a 42.0% share of the smart luggage market in 2025, making it the leading size preference. This dominance is being shaped by the size’s versatility-offering enough capacity for multi-day travel while remaining within standard airline checked-bag guidelines.

Travelers have increasingly favored this size due to its balance between portability and storage, especially for international or mixed-mode journeys. Manufacturers have focused innovation efforts on this segment, incorporating smart locks, built-in chargers, and digital compartments, while maintaining weight limits.

The medium size also supports more ergonomic designs, which appeal to both solo travelers and families. Its ability to accommodate tech integrations without compromising mobility or aesthetics has established it as the preferred category in premium and mid-range product tiers..

GPS-enabled connectivity is expected to account for 39.0% of the smart luggage market’s revenue in 2025, making it the leading connectivity segment. The segment’s strength is being attributed to growing concerns around baggage loss, theft, and delayed handling, especially at busy international hubs.

GPS tracking enables real-time monitoring of luggage location independent of airline systems, improving traveler confidence and reducing dependence on customer service queries. Integration with mobile apps and push notifications allows users to receive proactive alerts about luggage movement, enhancing the overall travel experience.

Advancements in low-power GPS modules and improved battery life have made the technology more feasible in compact luggage formats. As airline mishandling incidents continue to gain visibility, demand for independently traceable, GPS-integrated luggage is anticipated to remain strong across frequent flyer and premium travel segments.

The smart luggage market is witnessing strong adoption as travelers prioritize convenience, safety, and connectivity in baggage solutions. Features such as GPS tracking, integrated USB charging, remote locking, and built-in weight sensors are gaining prominence among frequent flyers and business travelers. Airline collaborations and app-based interfaces have enhanced functionality, enabling seamless travel experiences. Growth is supported by increasing reliance on mobile technology, which drives demand for connected travel accessories. Premium luggage brands and tech-driven startups are investing in smart product portfolios to capture rising interest in digitally enhanced travel gear.

Smart luggage has emerged as a preferred option for travelers seeking convenience and security during transit. GPS and Bluetooth-based tracking systems help prevent baggage misplacement, while built-in weight sensors provide compliance with airline baggage restrictions. Integrated USB charging ports have become essential for business travelers requiring device connectivity on the go. Collaboration between luggage manufacturers and airlines has improved adoption, especially with TSA-approved smart locks and battery compliance systems. Mobile app integration offers travelers real-time updates and remote control options, aligning with increasing digitalization in the travel sector. The ability to combine storage functionality with advanced travel utilities has positioned smart luggage as an essential component of modern travel solutions.

Despite technological advantages, smart luggage adoption faces hurdles due to safety concerns surrounding lithium-ion batteries, which have led several airlines to restrict the usage of certain models. Regulatory ambiguity regarding battery removal before check-in creates complexity for both travelers and manufacturers. High pricing remains a critical barrier, limiting penetration into mid-range and economy travel segments. Added weight from electronic components has raised concerns over practicality and ease of handling. Fragmented technology standards across brands, including app ecosystems and charging formats, have impacted interoperability and after-sales support. Repair complexity for electronic parts and limited global service networks further challenge long-term product reliability and consumer confidence in the category.

| Country | CAGR |

|---|---|

| China | 17.1% |

| India | 15.9% |

| Germany | 14.6% |

| France | 13.3% |

| UK | 12.1% |

| USA | 10.8% |

| Brazil | 9.5% |

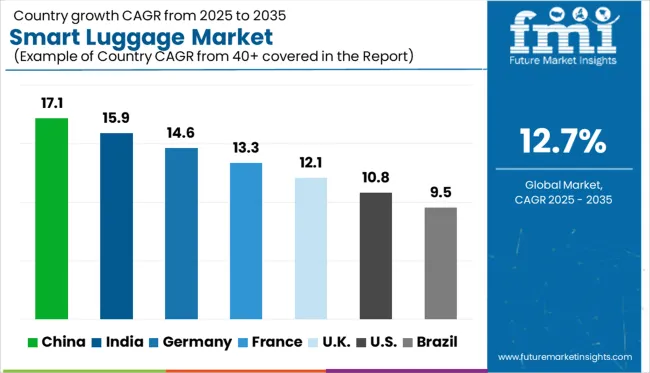

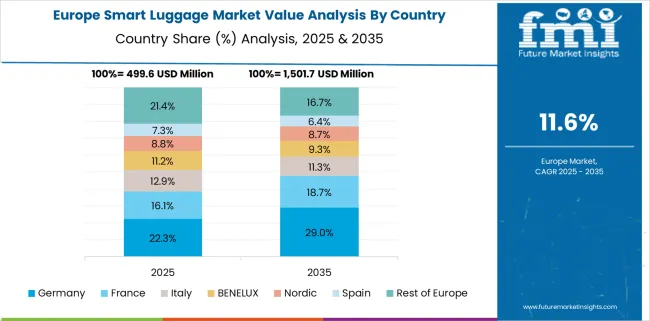

The global smart luggage market is expected to grow at a 12.7% CAGR from 2025 to 2035, supported by rising adoption of IoT-integrated travel gear, embedded GPS tracking, and app-enabled lock systems. China leads with 17.1%, fueled by connected luggage production and integration of battery-powered features in premium brands. India follows at 15.9%, driven by growth in air travel, digital-first luggage brands, and increased adoption of smart carry-ons for business travelers. Germany, at 14.6%, emphasizes advanced security features and durability for frequent flyers. France grows at 13.3%, supported by luxury luggage manufacturers introducing smart enhancements. The United Kingdom, at 12.1%, focuses on app-controlled locks and compliance with aviation safety norms. The report includes analysis of over 40 countries, with five profiled below for reference.

China is projected to grow at a 17.1% CAGR, driven by strong manufacturing capabilities and advanced travel accessory integration. Domestic brands are embedding IoT sensors, GPS modules, and biometric locks into premium and mid-tier luggage. Growth is fueled by rising domestic and international air travel and e-commerce-driven luxury luggage demand. Battery-enabled carry-ons with integrated USB charging ports have become a preferred choice for frequent travelers. Partnerships between luggage brands and airlines enable app-based baggage tracking for enhanced passenger convenience. Compliance with aviation battery safety regulations significantly influences product design and manufacturing standards, shaping the competitive landscape in China.

India is anticipated to register a 15.9% CAGR, driven by rapid digitization and rising air travel demand. Domestic luggage brands are incorporating RFID tracking, app-enabled smart locks, and integrated charging ports to target frequent travelers. E-commerce platforms play a crucial role in accelerating adoption through bundled tech-based offerings and loyalty-driven discounts. Mobile-based luggage management apps offering real-time tracking and proximity alerts are gaining traction. Manufacturers are also introducing modular designs with detachable battery units to enhance affordability and compliance with airline regulations. Adherence to BIS standards for electronics integration is emerging as a priority for Indian smart luggage makers.

Germany is forecasted to grow at a 14.6% CAGR, driven by premium smart luggage demand among frequent flyers and corporate travelers. Manufacturers are introducing fingerprint-enabled locks, GPS tracking, and anti-theft alerts in advanced designs. Aviation safety standards heavily influence product development for battery-powered luggage systems. Retailers are promoting luggage integrated with app-based interfaces for trip synchronization and baggage status updates. Eco-conscious buyers are increasingly choosing smart luggage designs that incorporate sustainable materials. Strategic collaborations with airport operators aim to strengthen real-time baggage monitoring and digital integration at major hubs, enhancing passenger experience and operational reliability.

France is expected to record a 13.3% CAGR, supported by luxury brands incorporating connected technologies into premium luggage lines. Key innovations include GPS tracking systems, electronic locks, and integrated weight sensors for compliance with airline policies. Retailers report strong adoption of mobile app-based luggage solutions that provide airline notifications and weight monitoring. NFC-based authentication is gaining importance for ownership verification and theft prevention in premium categories. Digital personalization features such as electronic ID tags are enhancing the appeal of luxury luggage. French consumers prefer high-end designs that combine aesthetic appeal with advanced functional elements for modern travel.

The United Kingdom is projected to grow at a 12.1% CAGR, influenced by post-Brexit trade complexities and the adoption of digital security solutions. British luggage manufacturers are integrating cloud-based tracking platforms for multi-airport connectivity. AI-powered notifications and predictive alerts are being added to smart luggage applications for proactive loss prevention. Lightweight luggage models equipped with TSA-compliant locks, USB charging ports, and modular battery systems dominate demand. Retailers and airport operators are evaluating integration of SCV platforms to provide travelers with real-time baggage visibility and seamless monitoring throughout journeys, enhancing travel efficiency and consumer trust in smart luggage solutions.

The smart luggage market is led by Samsonite through its innovative luggage lines featuring integrated charging ports and GPS tracking systems. The brand focuses on combining durability with advanced connectivity, making it a dominant player in both premium and mid-tier segments. Rimowa and Delsey maintain strong positions in the luxury and premium categories, emphasizing high-quality materials along with tech-enabled locks and mobility-enhancing features. Their strategies center on design aesthetics blended with functionality for international travelers. Emerging lifestyle brands such as Away and Horizn Studios cater to younger, tech-savvy travelers with GPS-enabled luggage, app-based interfaces, and integrated power banks, creating an ecosystem tailored for frequent flyers. Innovators like Barracuda, Neit, and Trunkster target urban consumers through collapsible, space-saving designs and portability-focused engineering. Startups such as Arista Vault and Lugloc offer niche functionalities including anti-theft alarms and real-time location tracking, aligning with the rising demand for security-driven features. Competitive differentiation in the smart luggage market revolves around lightweight material innovation, durability, embedded IoT technology, advanced app ecosystems, integrated security measures, and compliance with airline safety regulations.

Key Developments in the Smart Luggage Market

Leading players are investing in IoT-driven connectivity, biometric security features, and integrated power solutions to enhance travel convenience. Samsonite continues to scale GPS-enabled systems and USB charging modules, while Rimowa and Delsey strengthen premium offerings through app-based smart lock technology and durable composite materials. Emerging brands like Away and Horizn Studios prioritize direct-to-consumer channels, digital marketing, and subscription-based warranties to engage younger travelers. Startups such as Arista Vault focus on AI-powered anti-theft features and real-time tracking solutions. Sustainability is gaining prominence through eco-friendly materials and modular designs for repairability and compliance with airline lithium battery regulations.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Technology Type | Sensors, SIM cards, and USB charging |

| Size Category | Medium (64cm), Small (55cm), and Large (77 cm) |

| Connectivity Type | GPS, Wi-Fi, Bluetooth, and RFID |

| Shell Type | Hard shell and Soft shell |

| Material Type | Polycarbonate (Others), Canvas, Plastic, Nylon, and Polyester |

| Application Type | Real-time tracking, Proximity alerts, Remote locking, Digital scaling, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsonite, Arista Vault, Away, Barracuda, Bluesmart, Delsey, Horizn Studios, Lugloc, Neit, Planet Traveler, Reden, Rimowa, Samsara, Tripp, and Trunkster |

| Additional Attributes | Dollar sales in the smart luggage market are distributed across smart suitcases, backpacks, and duffel bags, with smart suitcases accounting for the largest share. Demand continues to rise for features such as GPS tracking, integrated charging ports, biometric locking systems, and remote access locks, which enhance convenience and security for travelers. Connectivity technologies, including Bluetooth, GPS, and RFID are increasingly embedded to support real-time monitoring and theft prevention. Market expansion is supported by growth in global air travel, rapid digital adoption in travel accessories, and increasing disposable income levels. North America leads in adoption, primarily the United States, followed by Europe and Asia-Pacific. Key brands such as Samsonite, Away, Delsey, and Horizn Studios prioritize product innovation, premium material selection, and compliance with airline safety regulations to secure a competitive advantage. |

The global smart luggage market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the smart luggage market is projected to reach USD 7.5 billion by 2035.

The smart luggage market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in smart luggage market are sensors, sim cards and usb charging.

In terms of size category, medium (64cm) segment to command 42.0% share in the smart luggage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA