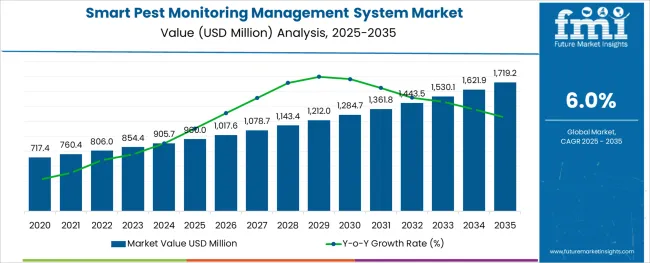

The Smart Pest Monitoring Management System Market is estimated to be valued at USD 960.0 million in 2025 and is projected to reach USD 1719.2 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Component and End-User and region. By Component, the market is divided into Hardware and Software & Services. In terms of End-User, the market is classified into Commercial, Residential, Agriculture, and Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

The travel ban adversely impacted the activities relating to the import and export of insecticides and pesticides from one place to another. However, the overall demand for smart pest monitoring management systems is likely to increase in the years to come as industries have now attained normalcy in their operational conditions. These systems are much in demand owing to the growing number of rodents, bugs, and pests across different industries.

The global demand for smart pest monitoring management systems is projected to increase at a CAGR of 8% during the forecast period between 2025 and 2035, reaching a total of USD 1,740.09 Million in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2024, sales witnessed significant growth, registering a CAGR of 6%.

The increasing rate of organic farming pushing the growth of the market

Organic farming is a unique and fast-growing segment, inhibiting the growth of smart pest-monitoring management systems. The area under organic farming is rapidly growing across the world. According to FiBL statistics, the area under organic cultivation across the world was 717.4 million hectares in 2020, which increased by 8.4% and reached 905.7 million hectares in 2024.

Smart pest monitoring management systems help in easing the handling of attributes like low-to-no re-entry intervals and post-harvest intervals. Similarly, innovations in the area of smart pest monitoring management systems, coupled with a growing consumer awareness about the negative impact of poor pest monitoring, are expected to boost the adoption rate in the near future.

Moreover, the need for timely pest control is vital to evade feeding damages on fields. This boosts the demand for Integrated Pest Management (IPM). IPM improves and increases food availability and farm productivity. In April 2025, the California Department of Pesticide Regulation invested USD 3.75 million to fund 10 research projects exploring IPM tools to address the needs of agricultural, non-agricultural, and urban pest management needs.

The 2024 to 2025 Department of Pesticide Regulation Grants Programs depicts a 617% increase from last year’s investment to boost safer and more sustainable pest management methods. The growing usage of IPM is immensely contributing to the growth of the smart pest monitoring management system market.

Increased regional initiatives to drive the adoption of a Smart Pest Monitoring Management System

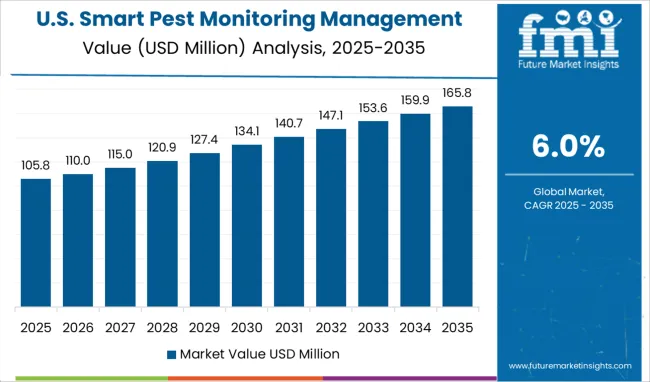

Various North American industries, including automotive, chemical, rubber, and others are expanding their manufacturing base. Furthermore, rising agriculture activities make this region one of the largest consumers of smart pest monitoring management systems. Thus, the rising manufacturing industries are influencing the development of the regional smart pest monitoring management system market growth.

Increasing Investments are Spurring Demand for smart pest monitoring management system

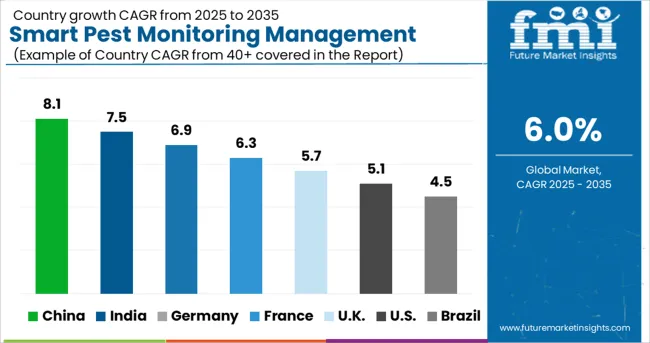

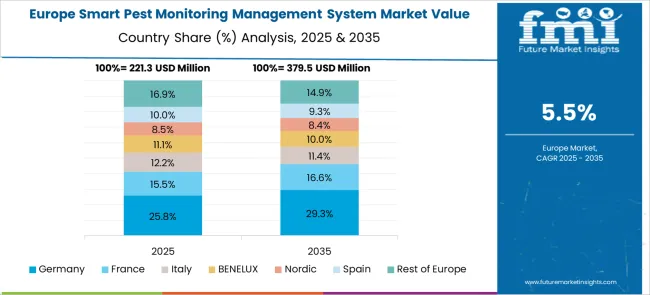

The Europe smart pest monitoring management system market size is anticipated to register commendable growth from 2025 to 2035, due to a rise in demand for consumer-based goods and warehouses. Germany and France are the top countries in the smart pest monitoring management system market in Europe. The three leading industries in the region are the automotive, food & beverage, and pharmaceutical industries.

Hardware Segment To Lead the Component Type of Smart Pest Monitoring Management System

Based on components, the smart pest monitoring management system market is segmented into hardware and software & services. The hardware segment holds a larger share. Based on hardware, it comprises smart monitoring traps, mechanical rats and mouse traps, sensors, and GPS drones, among others.

Some key startups in the Smart Pest Monitoring Management System Market include-

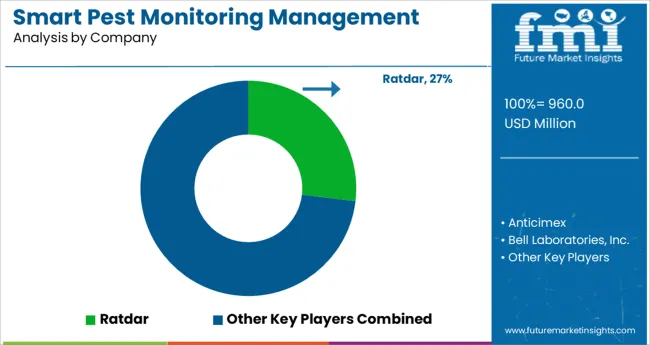

Key players in the smart pest monitoring management system market are Anticimex, Bell Labs, Bayer AG, Corteva, Ecolab, and Rentokil Initial PLC.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 960.0 million |

| Market Value in 2035 | USD 1719.2 million |

| Growth Rate | CAGR of 8% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered |

Component, End-User, Region |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, India, Malaysia, Singapore, Thailand, China, Japan, South Korea, Australia, New Zealand, Israel, GCC Countries, South Africa |

| Key Companies Profiled |

Ratdar; Anticimex; Bell Laboratories Inc.; Bayer AG; Corteva; EFOS d.o.o; SnapTrap B.V; Pelsis Group; VM Products; Rentokil Initial Plc.; Futura GmbH; PestWest USA; Ratsense; Ecolab |

| Customization | Available Upon Request |

The global smart pest monitoring management system market is estimated to be valued at USD 960.0 million in 2025.

It is projected to reach USD 1,719.2 million by 2035.

The market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types are hardware and software & services.

commercial segment is expected to dominate with a 47.6% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA