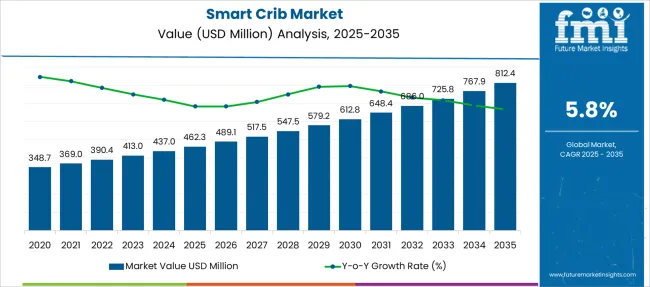

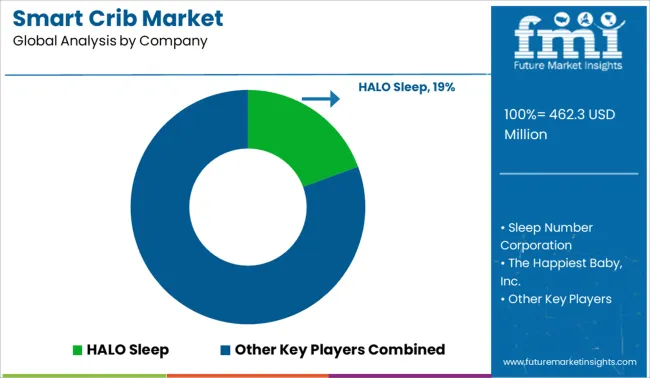

The Smart Crib Market is estimated to be valued at USD 462.3 million in 2025 and is projected to reach USD 812.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Smart Crib Market Estimated Value in (2025 E) | USD 462.3 million |

| Smart Crib Market Forecast Value in (2035 F) | USD 812.4 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The smart crib market is showing steady growth as parents increasingly seek multifunctional and technologically advanced nursery furniture. The growing focus on child safety, comfort, and convenience has encouraged adoption of cribs equipped with features such as automatic rocking, sleep monitoring, and soothing sounds.

Innovations in materials and design have also played a role, offering durable and eco-friendly options that appeal to modern families. Rising disposable incomes and expanding awareness about infant sleep health have contributed to higher demand.

Retail availability has expanded through online platforms and specialty baby stores, making smart cribs more accessible. With growing urbanization and the trend towards smart homes, consumer interest in connected baby products is expected to continue rising. Segment growth is anticipated to be driven by convertible cribs that adapt as the child grows, wood as the preferred material, and medium-priced products that balance quality with affordability.

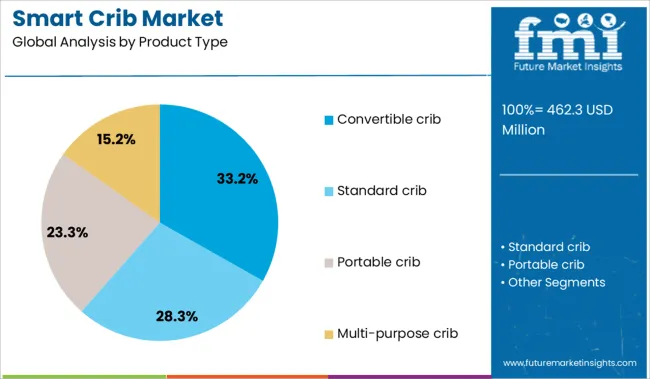

The market is segmented by Product Type, Material, Price, Age Group, End-Use, and Distribution Channel and region. By Product Type, the market is divided into Convertible crib, Standard crib, Portable crib, and Multi-purpose crib.

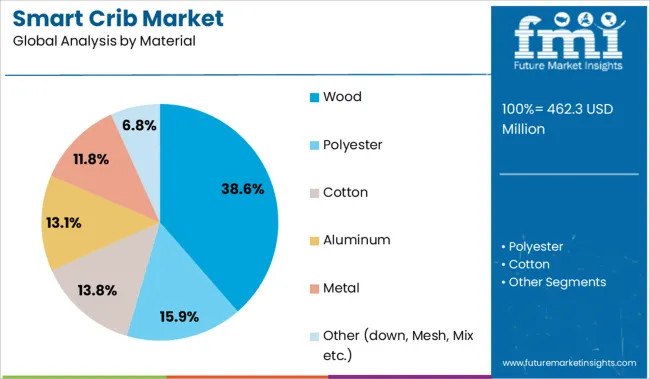

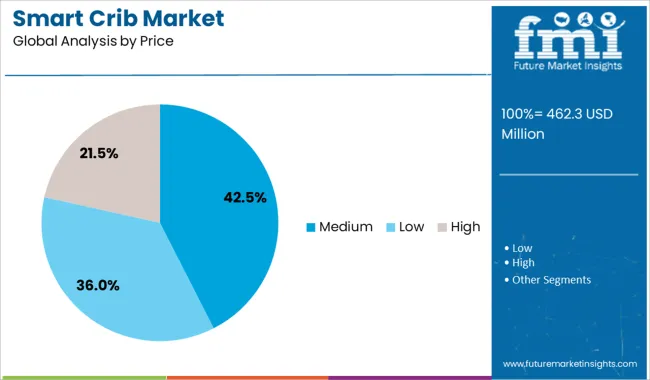

In terms of Material, the market is classified into Wood, Polyester, Cotton, Aluminum, Metal, and Other (down, Mesh, Mix etc.). Based on Price, the market is segmented into Medium, Low, and High. By Age Group, the market is divided into Infant (6-12), Newborn (0-6), and Toddler (1-3).

By End-Use, the market is segmented into Residential, Commercial, Baby care center, Maternity hospitals & healthcare clinics, and Other (baby asylums, playcenters). By Distribution Channel, the market is segmented into Online, Company websites, E-commerce, Offline, Hypermarket/supermarket, Specialty store, and Other retailers stores.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The convertible crib segment is projected to hold 33.2% of the smart crib market revenue in 2025, making it the leading product type. Growth in this segment is supported by consumer preference for cribs that offer extended usability beyond infancy. Convertible cribs can be transformed into toddler beds or daybeds which enhances value and reduces the need for additional furniture purchases.

This adaptability is particularly attractive to parents looking for cost-effective and space-saving solutions. The segment has benefited from designs that combine safety standards with modern aesthetics.

With families increasingly prioritizing long-term functionality in nursery furniture, the convertible crib segment is expected to maintain its dominant market position.

The wood segment is expected to contribute 38.6% of the smart crib market revenue in 2025, positioning it as the leading material type. Wood has been favored for its natural look, durability, and perceived safety compared to synthetic alternatives. Parents and caregivers have preferred wooden cribs due to their sturdy construction and timeless design that complements various nursery themes.

The availability of sustainably sourced and non-toxic wood products has also enhanced consumer confidence.

Additionally, wood’s versatility allows manufacturers to incorporate smart features without compromising structural integrity. As eco-consciousness grows among consumers, the wood segment is anticipated to continue leading the market.

The medium price segment is projected to represent 42.5% of the smart crib market revenue in 2025, establishing it as the preferred price range. This segment’s growth is driven by its appeal to middle-income families seeking quality smart cribs with advanced features at accessible prices. The balance between affordability and functionality makes medium-priced cribs a practical choice for many consumers.

Retailers have responded by offering competitively priced products that do not compromise on safety and technology integration.

Furthermore, financing options and promotional discounts have made medium-priced smart cribs attractive to a broader audience. As demand for technologically enhanced nursery furniture grows, the medium price segment is expected to retain its market leadership.

Smart crib demand is being shaped by the convergence of infant sleep tech, mobile-enabled monitoring, and sensor-based automation. Features like responsive rocking, AI-driven sleep tracking, real-time breathing alerts, and app-controlled noise systems are gaining traction. These products are redefining nursery care by offering round-the-clock support to caregivers. With growing interest in connected parenting, cribs are evolving into central hubs of caregiving, blending safety monitoring, comfort regulation, and predictive analytics.

Smart cribs integrated with AI and sensor-driven technologies are becoming essential components in connected nurseries. Demand for smart sleepers are rising to prevent sleep disruptions. Cradlewise smart crib uses built-in cameras and machine learning to detect micro-movements, automatically soothing babies based on behavioral patterns. These products provide real-time data on sleep quality, respiration, and activity levels, allowing parents to intervene when needed. The convenience of remote monitoring via smartphones, combined with data-backed alerts, eases anxiety for new parents. In households with limited caregiving support, such intelligent automation bridges critical gaps in infant supervision, positioning smart cribs as more than luxury items—they serve a functional caregiving role that traditional cradles cannot.

Smart cribs operate in a gray zone between baby furniture and connected health devices, which leads to inconsistent safety oversight. The snoo, despite being widely adopted, lacks FDA classification as a medical device, limiting the credibility of its sleep safety claims. There are no standardized benchmarks for EMF exposure, biometric sensor calibration, or app security protocols in this segment. As a result, brands differ widely in product quality and risk mitigation. Several crib models have faced scrutiny for weak data encryption, posing privacy risks through unprotected audio-video feeds. High price points further restrict accessibility, with models costing over a thousand dollars often unaffordable for middle-income families. Without regulatory clarity and cost parity, widespread trust and adoption remain limited, particularly outside urban, tech-savvy markets

|

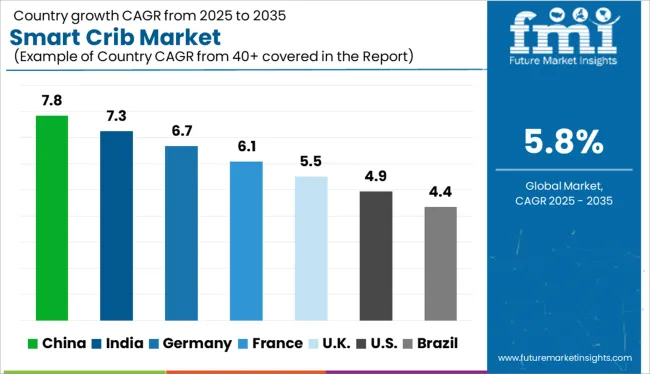

Country |

CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global smart crib market is projected to expand at a CAGR of 5.8% from 2025 to 2035. China leads with 7.8%, which suggests mass adoption of AI-driven nursery furniture and platform-integrated smart ecosystems. India follows at 7.3% and remains driven by sensor-enabled crib adoption in tier-1 metros. Germany and France, at 6.7% and 6.1% respectively, show premium segment strength with emphasis on modular features. The United Kingdom, growing at 5.5%, remains driven by high-value conversions in legacy crib brands. BRICS countries reflect a faster scale in production and price-led innovation, whereas OECD markets emphasize child safety certifications, voice assistant compatibility, and multi-device pairing integration in product roadmaps. The report includes an analysis of over 40 countries, with five profiled below for reference.

Sales of smart cribs in China are projected to expand at a CAGR of 7.8% from 2025 to 2035. AI-integrated parenting platforms have become a cornerstone of consumer appeal, combining real-time monitoring, adaptive mattress functionality, and voice assistant compatibility. Domestic manufacturers are bundling these cribs with mobile health dashboards and night-time alert systems, enhancing user interactivity. Machine learning-based comfort adjustment and modular upgrades are reinforcing platform loyalty. Direct-to-consumer models via e-commerce dominate distribution, with bundled subscriptions offering added stickiness. As competition intensifies, precision in sensor systems, app responsiveness, and cradle automation are emerging as key value markers.

Demand for smart cribs in India is growing at a CAGR of 7.3% between 2025 and 2035. The segment is regulated through BIS and QCO mandates on toxicity thresholds and electrical safety. Bluetooth-based cribs must pass WPC certification, while data tracking is impacted by the Digital Personal Data Protection Act. In terms of product, demand is focused on app-connected cribs with automated swinging, lullaby playback, and contactless infant biometrics. Growth is strongest in metro cities with pediatric networks and digital-first households. Integration with wellness apps and home security platforms is redefining product expectations. Competitive positioning remains defined by feature-to-price optimization, regional customization, and hybrid crib architecture for evolving parenting demands.

The smart crib market in Germany is projected to grow at a CAGR of 6.7% between 2025 and 2035. Market demand is shaped by ergonomic construction, EMF-compliant sensors, and modular nursery systems. CE-certified safety is a prerequisite, along with tactile crib interfaces and low-decibel movement components. Product differentiation hinges on sleep quality features, material traceability, and smart integration with pediatric support tools. Manufacturers prioritize energy efficiency and multilingual alert systems as part of their design strategy. Cribs with ventilation optimization, silent motors, and adjustable positioning dominate retail displays. The market contrasts sharply with BRICS due to its compliance-first culture and lack of price-based positioning.

Demand for smart cribs in France is expanding at a CAGR of 6.1% between 2025 and 2035. Government subsidies and health system endorsements have accelerated consumer interest in certified smart nursery furniture. Demand is centered on contactless sleep tracking, dual-motion cradle systems, and music therapy integration. Buyers in metropolitan areas prefer pharmacy-led retail models with bundled aftercare. Cribs with thermal monitoring, vibration controls, and audio response are becoming standard in premium segments. Parents increasingly favor non-wearable health features over traditional baby monitors. This behavioral pivot, combined with policy-led safety promotion, is defining brand strategy. Repeat purchases are influenced by modular upgrades and warranty-backed installation services.

The UK smart crib market is forecast to grow at a CAGR of 5.5% between 2025 and 2035. The earlier 2020–2024 period reflected limited demand tied to niche digital adoption, with premium units sold via e-commerce. In contrast, 2025–2035 is set to witness price-banded product segmentation, high-street visibility, and feature parity across brands. Audio-visual integration, motion sensors, and app-synced control modules are driving replacement purchases. Crib brands are refitting legacy units with smart modules to address growing interest in voice command, night vision, and modular expandability. Retailers are moving beyond online platforms into pharmacy chains and specialty baby stores to attract the mid-tier buyer.

The smart crib market comprises a mix of infant tech innovators, legacy baby care brands, and companies building connected nursery ecosystems. HALO Sleep leads, offering responsive sleep systems prioritizing infant safety and parent convenience. The Happiest Baby, Inc. has gained widespread recognition through the Snoo Smart Sleeper, which combines motion-triggered soothing and pediatrician-approved sleep training. 4moms and Hatch Baby compete with multi-functional, app-synced cribs featuring audio, light control, and sleep tracking. Established brands like Graco, Chicco, and Fisher-Price maintain retail reach but offer limited automation. Premium players including BabyBjörn and Silver Cross focus on design aesthetics and whisper-quiet mechanics. Competition is now shaped by real-time sensor performance, ergonomic sleep surfaces, and smart home interoperability across platforms.

| Item | Value |

|---|---|

| Quantitative Units | USD 462.3 Million |

| Product Type | Convertible crib, Standard crib, Portable crib, and Multi-purpose crib |

| Material | Wood, Polyester, Cotton, Aluminum, Metal, and Other (down, Mesh, Mix etc.) |

| Price | Medium, Low, and High |

| Age Group | Infant (6-12), Newborn (0-6), and Toddler (1-3) |

| End-Use | Residential, Commercial, Baby care center, Maternity hospitals & healthcare clinics, and Other (baby asylums, playcenters) |

| Distribution Channel | Online, Company websites, E-commerce, Offline, Hypermarket/supermarket, Specialty store, and Other retailers stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | HALO Sleep, Sleep Number Corporation, The Happiest Baby, Inc., SNOOZA, Smartbe Intelligent Stroller Inc., Hatch Baby Inc, 4moms (Thorley Industries, LLC, Baby Bjorn (BabyBjörn AB), Silver Cross (D.F. Holdings Ltd.), Snoo Smart Sleeper, Fisher-Price, Babyzen SAS, Chicco, Graco, and Mothercare |

| Additional Attributes | Dollar sales for smart cribs are segmented by functionality, including built-in monitors, adjustable heights, and automated rocking, with rising demand for IoT integration and biometric safety features. OEMs and select contract developers contribute turnkey smart modules. Innovations are centered on app-connected designs and the use of eco-friendly, hypoallergenic materials, particularly gaining traction in North America and Europe. |

The global smart crib market is estimated to be valued at USD 462.3 million in 2025.

The market size for the smart crib market is projected to reach USD 812.4 million by 2035.

The smart crib market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in smart crib market are convertible crib, standard crib, portable crib and multi-purpose crib.

In terms of material, wood segment to command 38.6% share in the smart crib market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA