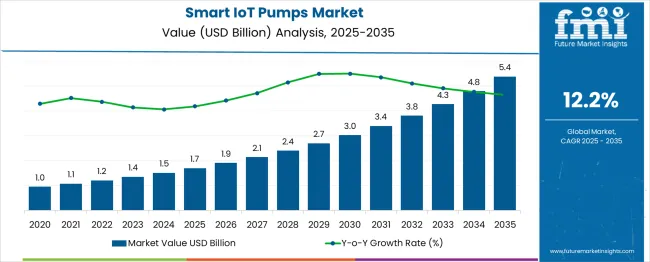

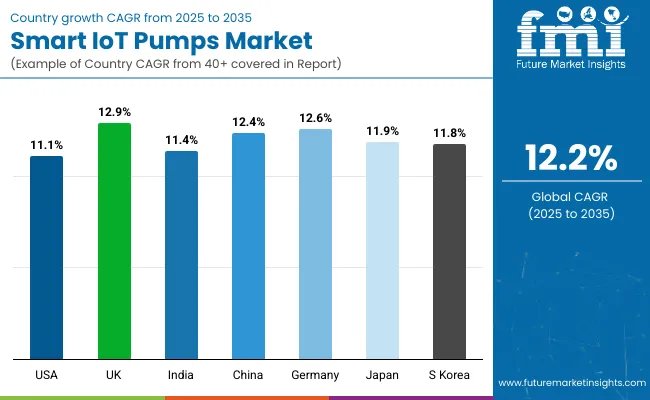

The smart IoT pumps market is projected to reach a valuation of USD 1.7 billion in 2025 and expand to USD 5.4 billion by 2035, reflecting a net increase of USD 3.7 billion over the decade. This translates to a total market expansion of 217.6%, with the compound annual growth rate (CAGR) estimated at 12.2%. Over the ten-year period, the market grows 3.1 in size.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.7 billion |

| Industry Value (2035F) | USD 5.4 billion |

| CAGR (2025 to 2035) | 12.2% |

During the first five-year period (2025 to 2030), the market rises from USD 1.7 billion to USD 3.0 billion, contributing USD 1.3 billion, which accounts for 35.1% of the total decade growth. This phase is characterized by steady integration of IoT-enabled pumps across water utilities, HVAC systems, and building automation networks. The surge in smart city infrastructure and municipal water monitoring drives initial demand, with centrifugal pumps embedded with sensor modules accounting for over 50% of installations.

In the second half from 2030 to 2035, the market grows from USD 3.0 billion to USD 5.4 billion, adding USD 2.4 billion, or 64.9% of total growth. This period witnesses accelerated adoption of AI-integrated pump diagnostics, energy optimization algorithms, and cloud-connected performance platforms. Positive displacement pumps and hybrid pumping systems see growing traction, while software platforms and predictive analytics surpass 50% of value share due to recurring SaaS and maintenance contracts in industrial and agricultural verticals.

From 2020 to 2024, the smart IoT pumps market grew from USD 0.96 billion to USD 1.51 billion, driven by hardware-centric adoption across water management, smart agriculture, industrial automation, and connected building systems. During this period, the competitive landscape was dominated by equipment manufacturers controlling nearly 70% of total revenue, with companies such as Sunyi Packaging, Silgan Dispensing, and Rieke Packaging leading development in sensor-integrated, remotely operable pumps.

Competitive differentiation relied on pump efficiency, embedded telemetry, and compatibility with existing SCADA and IoT frameworks, while software was typically bundled within OEM interfaces and not monetized independently. Service-based models had limited adoption, contributing less than 10% of market value, as early-stage buyers prioritized device performance and integration ease over digital subscriptions.

Demand for smart IoT pumps will expand to USD 5.4 billion in 2035, and the revenue mix will shift as software, predictive analytics, and remote maintenance services grow to over 45% share. Traditional hardware players face rising competition from digital-native vendors offering cloud-connected interfaces, usage pattern analytics, and edge-AI-driven energy optimization.

Major OEMs are pivoting to hybrid models, embedding remote configuration tools, condition-based alerts, and app-connected workflows to retain market share. Emerging players such as Frapak Packaging B.V., Sidel (Tetra Laval Group), and TPC (The Packaging Company) are gaining traction by specializing in open-protocol integration, circular IoT platforms, and sector-specific smart pump solutions.

The integration of real-time monitoring, predictive analytics, and wireless connectivity into pump systems is driving growth in the smart IoT pumps market. These pumps enable remote diagnostics, automatic performance optimization, and energy-efficient operations across industrial and municipal applications. Increasing demand for smart water management, energy conservation, and automation in fluid handling is fueling adoption across sectors such as utilities, building services, and manufacturing.

Centrifugal and positive displacement pumps embedded with IoT sensors have gained popularity due to their ability to transmit pressure, flow, and vibration data to cloud-based platforms. These features support condition-based maintenance, reduce downtime, and optimize asset utilization. The rise of Industry 4.0 and smart factory initiatives has further increased the demand for connected pump systems that integrate with SCADA and ERP environments.

Industries such as oil & gas, wastewater treatment, and HVAC systems are driving demand for intelligent pump technologies that can adapt dynamically to varying process loads. These systems support sustainability targets, cost reduction, and compliance with environmental mandates through data-driven decision-making and energy optimization.

Segment growth is expected to be led by centrifugal pump types, cloud-integrated monitoring systems in control categories, and wireless communication modules due to their scalability, interoperability, and role in enabling decentralized pump network management.

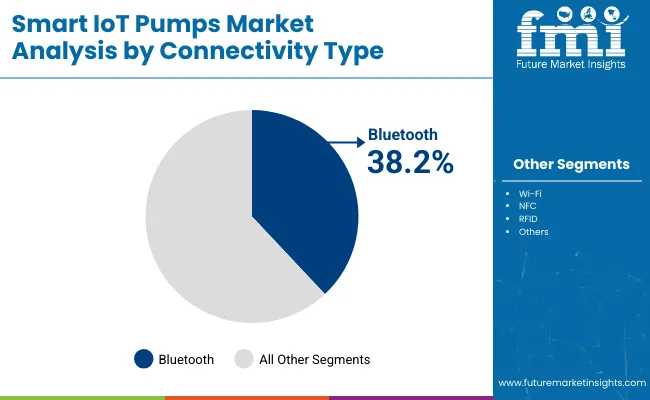

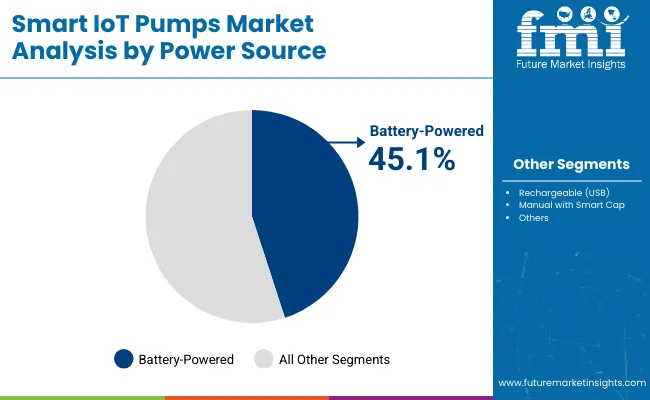

The market is segmented by connectivity type, power source, functionality, application, end-use industry, and region. Connectivity type includes Bluetooth, Wi-Fi, NFC, and RFID, enabling real-time communication, data sharing, and device integration across IoT ecosystems. Power source segmentation covers battery-powered, rechargeable (USB), and manual with smart cap, allowing for flexible deployment across home and clinical environments.

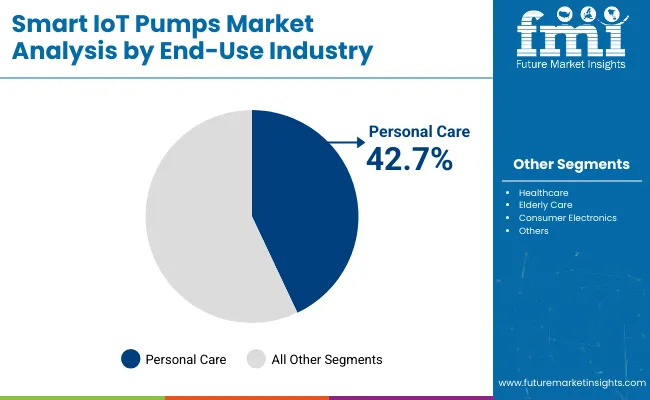

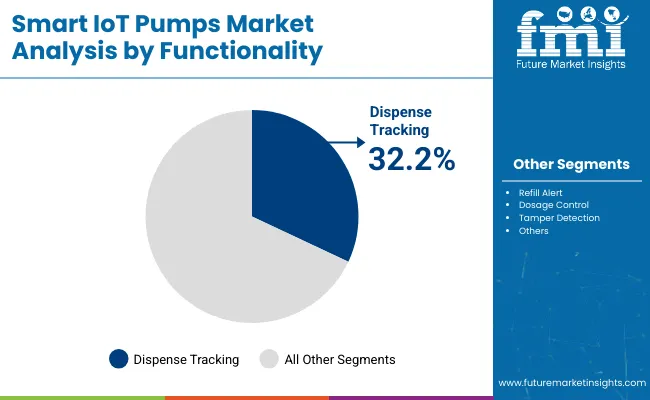

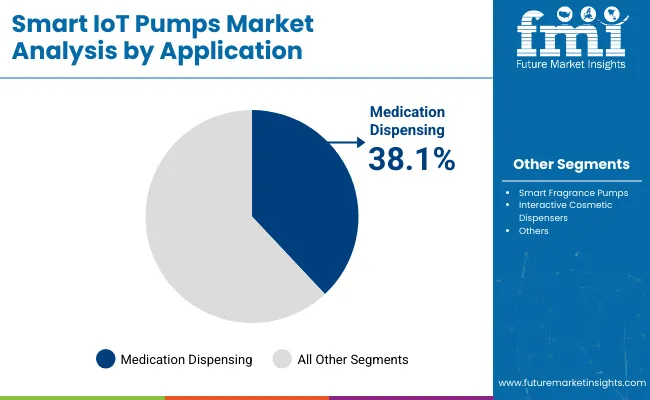

In terms of functionality, the segmentation includes dispense tracking, refill alert, dosage control, and tamper detection, supporting precision dispensing and user safety. Application areas comprise medication dispensing, smart fragrance pumps, and interactive cosmetic dispensers, reflecting the convergence of personalization and health monitoring. The end-use industry scope includes healthcare, personal care, elderly care, and consumer electronics, where smart automation and user behavior insights are increasingly valued. Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The Bluetooth-enabled segment is projected to hold the highest share of 38.2% in the Smart IoT Pumps Market by 2025. This dominance is primarily driven by the increasing integration of smart pumps with mobile apps and wearable devices, offering users real-time control, dosage precision, and refill alerts. Bluetooth technology allows pump systems to operate wirelessly and synchronize usage data with health and lifestyle apps, enhancing user convenience and product personalization.

manufacturers are embedding Bluetooth chips into pump packaging formats to allow consumers to monitor fluid consumption, track expiration dates, and receive automated reminders for replacements. The affordability and widespread compatibility of Bluetooth with most consumer electronics make it a default choice for smart packaging. With beauty, healthcare, and hygiene brands embracing connected packaging, Bluetooth-enabled smart pumps are rapidly evolving into a packaging standard for next-gen, user-interactive dispensing solutions.

The personal care segment is forecasted to lead the end-use industry in the smart IoT pumps market, accounting for a 42.7% share in 2025. This growth is attributed to rising consumer demand for connected beauty experiences, where smart packaging technologies offer dosing accuracy, application tracking, and personalized skincare regimens. IoT-enabled pumps are increasingly integrated into smart mirrors and skin diagnostic tools, creating seamless ecosystems for tech-savvy users.

Refillable formats enabled by smart pumps also support zero-waste initiatives, where brands aim to reduce single-use plastic through smart-enabled cartridges and pump-enabled reuse systems. Leading cosmetics companies are investing in sustainable IoT solutions that monitor usage behavior while minimizing environmental impact. As consumers shift toward eco-conscious and tech-integrated personal care routines, smart pump solutions are becoming essential in aligning product performance with digital lifestyles.

The battery-powered segment is expected to account for the highest share of 45.1% in 2025 in the smart IoT pumps market. This dominance stems from growing demand for portable and wire-free smart dispensing solutions across consumer and medical applications. Battery-powered units allow users to operate pumps independently of fixed power sources, making them ideal for home healthcare, cosmetic routines, and personal hygiene settings.

These pumps often integrate Bluetooth or Wi-Fi modules, and their rechargeable or replaceable battery systems enhance product sustainability and reusability. Their convenience aligns with increasing consumer preferences for clutter-free, minimalistic designs, especially in connected health and personal care environments.

The dispense tracking segment is projected to account for 32.2% share in 2025 in the smart IoT pumps market. This growth is driven by rising adoption of smart dispensing systems that monitor, record, and transmit dosing or usage data in real time. Brands in both the cosmetic and medical sectors are increasingly integrating this feature to promote product adherence, personalize refill recommendations, and track consumption patterns.

Dispense tracking provides users with instant feedback on usage history, supports parental or caregiver monitoring, and helps ensure proper dosage in regulated applications.

The medication dispensing application is projected to lead the smart IoT pumps market with a 38.1% share in 2025. This leadership is attributed to rising global interest in connected drug delivery systems that improve medication adherence, reduce dosing errors, and streamline remote patient monitoring. Smart pumps designed for medical use cases increasingly feature programmable dosing schedules, lockout features, and real-time alerts, ensuring safe and accurate dispensing of oral, dermal, or sublingual medications.

Their role in chronic disease management, elderly care, and home-based therapies is expanding rapidly, especially in response to the shift toward decentralized healthcare models. Integration with telehealth platforms and electronic health records further enhances their appeal in clinical environments.

Data overload, integration complexity, and high upfront costs hinder smart IoT pump deployment, even as demand rises in manufacturing, utilities, and water infrastructure for real-time monitoring, predictive maintenance, and energy-efficient, sensor-integrated pumping systems.

Remote Monitoring and Predictive Maintenance Driving Industrial Adoption

Smart IoT pumps are increasingly adopted in industries such as water utilities, chemical processing, oil & gas, and building automation due to their real-time monitoring and control capabilities. These pumps are embedded with sensors that continuously track parameters such as pressure, temperature, and flow, enabling early detection of anomalies and reducing downtime.

Integration with SCADA systems and cloud platforms allows operators to remotely manage multiple assets across locations, improving operational efficiency and safety. Predictive maintenance algorithms also reduce unplanned servicing and extend equipment lifespan. The demand for intelligent pumps is further supported by sustainability mandates and the growing need to optimize energy consumption across critical infrastructure.

High Costs and Complexity in System Integration

Despite their operational advantages, smart IoT pumps remain cost-prohibitive for many small and mid-sized enterprises. The initial investment includes not only the pump hardware but also the software, sensors, wireless modules, and data platforms required for full integration.

Added to this are cybersecurity concerns, as connected systems introduce new vulnerabilities within operational technology networks. Moreover, integrating smart pumps with legacy infrastructure or third-party systems can be technically challenging, requiring skilled IT-OT convergence and ongoing support. These issues collectively limit deployment in industries where budget constraints or low digital maturity restrict access to IoT-enabled solutions.

AI-powered Analytics and Cloud-native Pumping Solutions Gaining Ground

One of the most significant trends in the smart pump market is the adoption of AI-powered analytics and cloud-native control platforms. Manufacturers are embedding edge computing modules within pump systems to enable localized decision-making and reduce data latency.

These systems use machine learning models to optimize flow profiles, identify anomalies, and adapt pump performance in real-time. At the same time, cloud connectivity ensures seamless integration with enterprise-level dashboards, enhancing visibility across distributed assets. This digital transformation is being accelerated by decarbonization goals, water scarcity challenges, and smart city initiatives, which position intelligent pumping systems as a critical enabler of infrastructure modernization.

The global smart IoT pumps market is expanding rapidly, driven by advancements in sensor-enabled fluid control, predictive maintenance systems, and energy-efficient operations. Integration of Industrial Internet of Things (IIoT), cloud analytics, and remote diagnostics is transforming conventional pump systems into intelligent, self-monitoring solutions. Asia-Pacific is emerging as a key growth engine, with China and India investing heavily in smart water infrastructure and connected manufacturing.

In Europe, Germany and the UK are leading smart retrofit adoption for industrial automation and sustainability compliance. North America, led by the USA is witnessing strong demand for IIoT-based pumping solutions in building automation, utilities, and smart agriculture. Globally, cloud-integrated diagnostics, AI-enabled flow optimization, and real-time energy usage tracking are central to smart pump market evolution.

The smart IoT pumps market in the United States is projected to grow at a CAGR of 11.1% between 2025 and 2035. The surge is driven by advanced retrofitting of legacy fluid systems in utilities, HVAC systems, and industrial cooling applications. Federal energy-efficiency incentives and sustainability targets are accelerating the shift to smart pump systems with cloud-connectivity and energy monitoring features. OEMs are focusing on AI-enhanced control platforms that offer fault detection, leak prediction, and condition-based servicing.

The smart IoT pumps market in the United Kingdom is expected to grow at a CAGR of 12.9%, fueled by Industry 4.0 transformation across manufacturing and public utilities. Government-backed decarbonization initiatives and regulatory focus on water leakage control have driven demand for smart water and wastewater pump installations. In urban infrastructure, pump-as-a-service models and predictive diagnostics are gaining traction among local councils and smart city programs.

India is experiencing rapid growth in the smart IoT pumps market, forecast to expand at a CAGR of 11.4% through 2035. Demand is driven by smart irrigation systems, state-level water grid digitization programs, and adoption in process industries seeking efficiency and uptime. MSMEs and smart city mission projects are implementing IoT-enabled pumps for water reuse, leak detection, and flow automation. Local manufacturers are partnering with analytics providers to offer scalable, mobile-connected pump solutions.

The smart IoT pumps market in China is expected to grow at a CAGR of 12.4%, supported by large-scale industrial automation, smart city development, and robust digital infrastructure. Government-led initiatives for smart water conservation and predictive asset management are fueling the market. Integration of AI-driven diagnostics and 5G-based remote monitoring is helping local manufacturers deliver competitively priced yet high-tech smart pump systems for both industrial and municipal use.

The smart IoT pumps market in Germany is projected to grow at a CAGR of 12.6%, driven by adoption across automotive, pharmaceuticals, chemicals, and building automation sectors. Industry 4.0 strategies and the Green Deal framework are supporting real-time monitoring, fault prediction, and smart flow modulation. German OEMs are embedding AI algorithms into decentralized control units to optimize pressure, detect anomalies, and enhance life-cycle management.

The smart IoT pumps market in Japan is projected to grow at a CAGR of 11.9%, supported by high-precision industrial needs and government-driven sustainability goals. The integration of smart fluid systems in semiconductor fabs, biotech labs, and smart buildings is driving new installations. Japan's manufacturing sector emphasizes condition monitoring and energy management, leading to rapid adoption of pumps embedded with diagnostics, remote access platforms, and alert-triggered automation.

The smart IoT pumps market in South Korea is projected to grow at a CAGR of 11.8%, valued for its deployment in microelectronics, medical devices, and infrastructure automation. As the country advances its smart factory roadmap, pump systems are being networked into centralized control systems with real-time analytics and AI-based maintenance scheduling. Short-cycle and high-pressure operations in tech industries are leading use cases, supported by widespread 5G connectivity.

The smart IoT pumps market is moderately fragmented, with packaging automation leaders, fluid dispensing system manufacturers, and digitally enhanced pump solution providers competing across personal care, home care, pharmaceutical, and industrial fluid delivery applications. Global players such as Silgan Dispensing and Sidel (Tetra Laval Group) hold significant market share, driven by sensor-integrated pump designs, cloud-based monitoring systems, and closed-loop feedback for flow control and usage analytics. Their strategies increasingly emphasize Bluetooth/NFC-enabled smart closures, refill-tracking apps, and connected dispensers for both commercial and consumer-facing environments.

Established mid-sized players including Rieke Packaging, TPC (The Packaging Company), and Frapak Packaging B.V. are actively advancing adoption through semi-automated dispensing systems embedded with tamper alerts, metering capabilities, and adaptive triggers. These companies are addressing niche segments like precision cosmetic dispensing, medical dosing, and reusable container integration with smart-pump technologies aligned to sustainability and data-driven UX design.

Specialized providers such as Sunyi Packaging and TPC focus on cost-effective, application-specific smart pump modules for skincare, cleaning products, and refillable IoT-connected packaging. Their strength lies in agile development of modular pump designs with compatibility for multiple viscosities, cloud-based refill alerts, and customizable smart dispensing features suitable for smart home ecosystems and emerging refill-as-a-service (RaaS) models.

Key Development of Smart IoT Pumps Market

| Item | Value |

| Quantitative Units | USD 1.7 Billion |

| By Connectivity Type | Bluetooth, Wi-Fi, NFC, and RFID |

| By Power Source | Battery-powered, Rechargeable (USB), and Manual with Smart Cap |

| By Functionality | Dispense Tracking, Refill Alert, Dosage Control, and Tamper Detection |

| By Application | Medication Dispensing, Smart Fragrance Pumps, and Interactive Cosmetic Dispensers |

| By End-Use Industry | Healthcare, Personal Care, Elderly Care, and Consumer Electronics |

| Key Companies Profiled | Sunyi Packaging, Silgan Dispensing, Rieke Packaging, Frapak Packaging B.V., Sidel (Tetra Laval Group), TPC (The Packaging Company). |

| Additional Attributes | Integration of IoT for real-time monitoring and remote control, increased use in connected skincare and wellness routines, demand driven by aging population and remote medication adherence, rise in refillable smart dispensers with NFC pairing, development of app-based dosage scheduling systems, enhanced patient safety with tamper alerts and smart lockouts, growing deployment in ambient intelligence platforms, cross-industry applications in health-tech and consumer IoT , regional growth led by North America and East Asia, and innovation in battery optimization for extended smart pump life |

The global smart IoT pumps market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the smart IoT pumps market is projected to reach USD 5.4 billion by 2035.

The smart IoT pumps market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in the smart IoT pumps market include centrifugal pumps, positive displacement pumps, peristaltic pumps, and diaphragm pumps with integrated IoT features.

In terms of connectivity, the Bluetooth-enabled segment is expected to command the highest share of 38.2% in the smart IoT pumps market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA