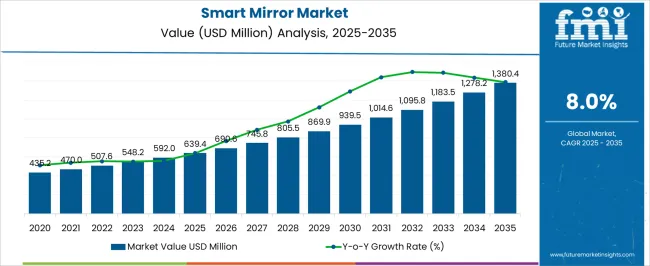

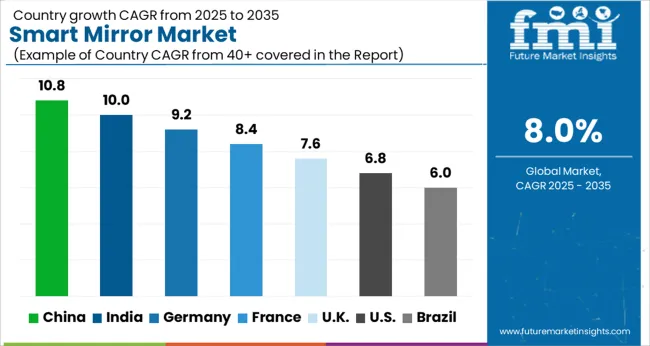

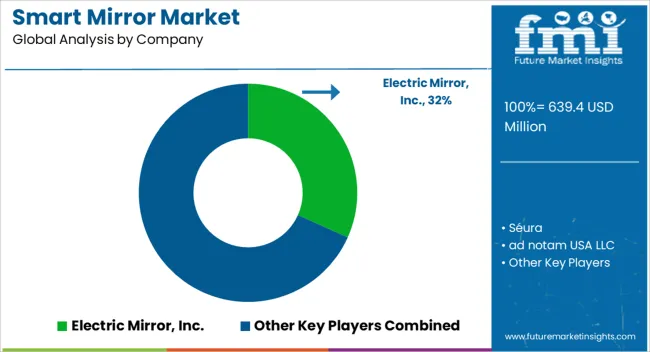

The Smart Mirror Market is estimated to be valued at USD 639.4 million in 2025 and is projected to reach USD 1380.4 million by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

| Metric | Value |

|---|---|

| Smart Mirror Market Estimated Value in (2025 E) | USD 639.4 million |

| Smart Mirror Market Forecast Value in (2035 F) | USD 1380.4 million |

| Forecast CAGR (2025 to 2035) | 8.0% |

The smart mirror market is experiencing notable expansion as consumers and enterprises increasingly seek connected, multifunctional, and space efficient technologies. Integration of smart features such as voice assistance, augmented reality, lighting controls, and health tracking has transformed mirrors into interactive devices across residential and commercial applications.

Growing consumer preference for home automation, along with increasing deployment of smart retail solutions in the fashion, automotive, and cosmetics industries, is fueling demand. Advancements in display technologies, sensor integration, and IoT connectivity are also enabling diverse functionalities that enhance user experience and convenience.

Rising disposable incomes and changing lifestyle patterns are accelerating the adoption of these premium products, especially in urban markets. The market outlook remains strong, with demand expected to grow steadily as smart living trends, energy efficiency priorities, and digital customer experiences continue to shape product development and consumer expectations.

The market is segmented by Installation Type, Application, and Distribution Channel and region. By Installation Type, the market is divided into Wall-Mounted and Free-Standing. In terms of Application, the market is classified into Residential and Commercial. Based on Distribution Channel, the market is segmented into Online and Offline. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

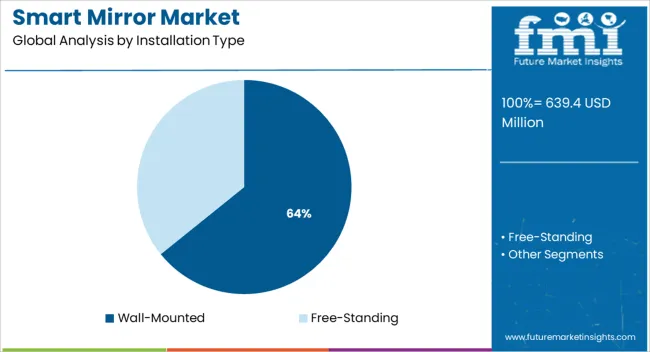

The wall mounted segment is projected to contribute 64.20% of total revenue by 2025 within the installation type category, making it the leading format. This dominance is being driven by increasing consumer preference for sleek and space saving home solutions that align with modern interior design trends.

Wall mounted smart mirrors are widely adopted in residential bathrooms, dressing areas, and entryways, offering features such as lighting adjustment, time and weather display, and voice control without occupying floor space. Additionally, their ease of integration with existing wall fixtures and compatibility with home automation systems have enhanced their desirability.

In commercial settings such as hotels, salons, and retail spaces, wall mounted designs are favored for their minimal footprint and interactive capabilities, reinforcing their leadership in the installation segment.

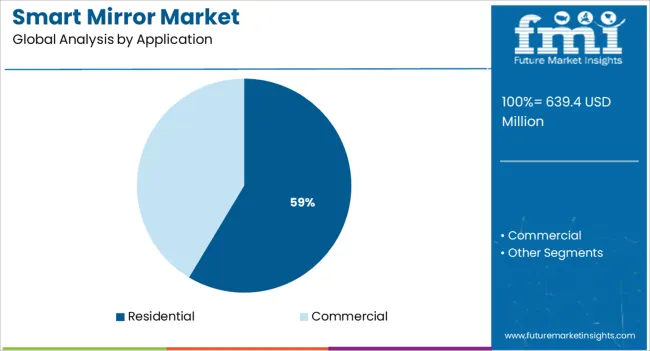

The residential segment is expected to account for 58.60% of total revenue by 2025 under the application category, positioning it as the primary end use. This growth is being fueled by the rising adoption of smart home ecosystems and the growing appeal of multifunctional devices that enhance lifestyle convenience.

Consumers are integrating smart mirrors into their homes for purposes such as personalized skincare analysis, fitness tracking, and virtual dressing, all supported by real time connectivity and intuitive user interfaces. Increasing awareness of health and wellness technologies has further encouraged adoption in households.

As urban living spaces become more compact and digitally enabled, the smart mirror is emerging as a staple in connected home solutions, securing its position as the top application segment.

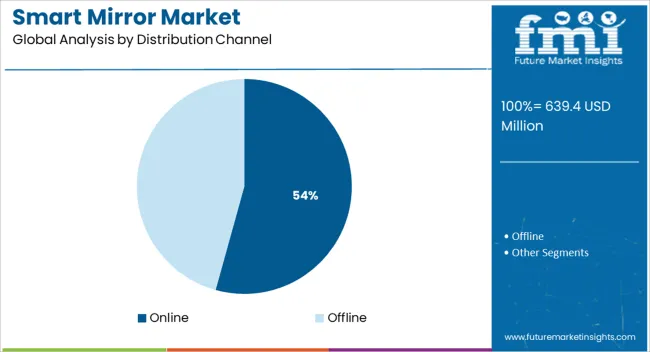

The online distribution channel is anticipated to contribute 54.30% of total market revenue by 2025, establishing it as the dominant sales route. This trend is driven by shifting consumer behavior toward e commerce platforms, which offer greater product variety, convenience, and access to reviews and comparisons.

The availability of customization options, bundled smart home packages, and digital assistance tools through online platforms has enhanced the purchasing experience. Additionally, manufacturers are increasingly leveraging direct to consumer sales models via online storefronts, allowing better control over pricing, branding, and customer engagement.

The rise in digital marketing, coupled with increasing consumer comfort with purchasing electronics online, continues to reinforce the channel’s dominance in the smart mirror market.

The global smart mirror market garnered USD 639.4 Million in 2025, expanding at a historical CAGR of 6%. Smart mirrors in stores are intended to improve customer shopping.

Recently, Visa and Monse approached Nobal Technologies, a company based in Calgary, to work on an innovative mirror that would let consumers examine and buy things through the touchscreen mirror.

The mirror’s underlying technology enables it to gather consumer information about shopping preferences, colors, styles, and trends to aid customers in making better purchasing decisions. Furthermore, companies like Magic Mirror are introducing new ways for retailers to make their products available. When consumers use a smart mirror to shop, it creates a hassle-free process for both consumers and retailers.

During the forecast period, the industry is also anticipated to be driven by rising expenditures on Research and Development and product development by the manufacturers. The estimation reveals that the industry is projected to secure a market value of USD 1,183.54 Million by 2035.

Growing Automation in Mirrors to Aid Market Growth

Smart mirrors allow consumers to access voice assistance and other preferred content through the apps inbuilt, which connect the mobile phone screen to the mirrored display.

These mirrors further allow users to access weather, stream entertainment, listen to music, access social media feeds, run downloadable applications, and more, which is expected to drive their demand in the residential segment. Developed countries are likely to witness tremendous growth in product adoption during the forecast period.

The industry is growing rapidly because smart mirrors combine a mirror with automation and monitoring features to show information over the home décor mirror. The combination of mirrors with intelligence and technology allows for interaction between smart mirrors and people by displaying information for carrying out daily tasks like running office programs, games, media players, and many more so that people can live an easier and more convenient life using this technology.

The demand for smart mirrors with built-in advanced technology is growing, and many manufacturers are working on product development to meet the increasing demand.

For instance, in January 2025, an Indian company named Wellnesys Inc. introduced ARIA, a smart mirror that combines AR/VR, computer vision, and smart sensing technologies to give users engaging and immersive digital experiences through smart TVs and smart mirrors. Companies are focusing on strategic acquisitions to expand their presence and reinforce their positions in the industry. In the near term, global companies are likely to acquire small- and medium-sized companies in a bid to facilitate regional expansion.

For instance, in June 2024, Lululemon, a manufacturer of women's fitness apparel, acquired the smart mirror manufacturer, Mirror, for USD 500 million as demand for at-home workout streaming surged due to the coronavirus pandemic.

The company Mirror provides smart mirrors that have an intuitive touch screen and lets consumers view & take part in exercise courses from the comfort of their own homes. In addition, the company will function as a separate division of Lululemon. Improving Lululemon’s “digital and interactive” was the primary goal behind the acquisition.

Increased Chances of Security Breach of Personal Data to Hinder Market Growth

A security breach of confidential data is one of the major restraining factors. This is due to the tracking of the personal data of users through smart mirrors. For instance, smart mirrors deployed in retail stores can easily track shoppers' buying experiences, and spending habits in the store.

Increase in the Number of Households in the Region to Increase Consumer Demand

North America emerged as the largest region in 2025 and accounted for the maximum share of more than 48% of the total revenue. The segment is expected to maintain its dominance over the forecast period owing to an increase in the number of households, coupled with the increasing number of manufacturers, and shifting preferences toward healthy drinks.

Increasing demand for a variety of smart mirrors from these regions is anticipated to drive the regional market. A growing number of product launches and investments in advanced technology are further expected to augment the region’s growth.

Increasing Investments in Product Penetration to Boost Regional Market

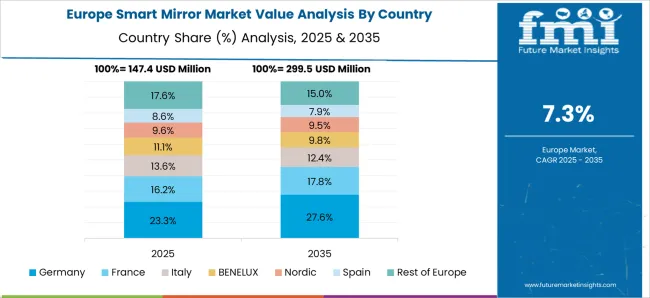

Europe is also expected to grow at a significant CAGR during the forecast period. Increasing product penetration in developed countries, such as the United Kingdom, Germany, and France, is likely to bode well with regional growth. Many regional and international players are launching their products in these countries where the population has a significant per-capita income to generate greater revenue and increase the customer base for their products. For instance, MirrorMedia Ltd., a United Kingdom-based smart mirror manufacturer offers a wide range of smart mirrors for residential and commercial applications.

Wall-Mounted Smart Mirror Segment to Boost the Growth of Outsourcing Pharma Industry

The wall-mounted smart mirror segment led the market in 2025 and accounted for the maximum share of 85.5% of the overall revenue. The segment is projected to expand further at the fastest growth rate during the forecast period. The growth of the segment can be attributed to the rising consumer preference for wall-mounted mirrors over free-standing smart mirrors. With free-standing mirrors, there is usually a higher risk of falling, which is decreased by wall-mounted mirrors. In addition, compared to ordinary mirrors, smart mirrors are quite expensive, which tends to increase consumer preference for wall-mounted installation-type smart mirrors.

A wall-mounted smart mirror may also conserve space and improve the appearance of a room. Moreover, increasing demand for smart housing facilities across the globe is driving the demand for smart bathrooms & personalized kitchen mirrors. Manufacturers are making customized smart mirrors for bathrooms and kitchens that are typically wall-mounted due to concerns about the associated risks and available space required for free-standing mirrors in bathrooms & kitchens. For instance, in January 2020, Kohler announced its new wall-mounted Verdera Voice smart mirror with Google Assistant built-in providing seamless integration of voice control for the bathroom space. All the above-mentioned factors strongly support the growth of the segment.

Commercial Application Segment to Dominate the Market

The commercial application segment dominated the global industry in 2025 and accounted for the largest share of more than 57% of the overall revenue. The segment is expected to register the fastest growth rate maintaining its dominant position throughout the forecast years. Furthermore, smart mirrors for commercial applications are expected to grow at the fastest CAGR during the forecast period. The key companies are launching new products with innovative designs and sizes specifically for the hospitality and commercial sectors. For instance, Prestop company, Electric Mirror, Inc., and ProDisplay have separate sets of product portfolios of smart mirrors for commercial applications.

The residential application segment is also expected to witness significant growth over the forecast period. This is attributed to the growth of the residential sector in most of the developed countries. For instance, governments of various countries, including Australia, the United States, and Canada, have planned strategies like concessions for first-time buyers, subsidies for veterans, the golden visa, low-cost affordable housing schemes, and reductions in transactional taxes, which are anticipated to spur the growth of the residential sector during the forecast period.

Offline Channel Segment is Estimated to Hold the Largest Share

The offline channels segment dominated the global industry in 2025 and accounted for the maximum share of 73.5% of the total revenue. The growth of the segment is driven by the increasing consumer preference for shopping in person. According to 2024 Raydiant's second annual State of Consumer Behavior Report, 33% of respondents prefer shopping at physical stores because they like to view, touch, and interact with actual products. In addition, 26% of respondents enjoy the overall shopping experience that a physical location offers, and 13% appreciate the immediate satisfaction that in-store shopping offers as opposed to waiting for delivery.

In the near future, this is anticipated to drive the segment growth and will maintain its dominant position in the market. However, the online channels segment is expected to grow at the fastest CAGR during the forecast period. The popularity of e-commerce channels is expected to increase over the projected period, compared to offline distribution channels, given the increasing number of market players marking their presence online.

Industry players have been offering customers the ability to place and track orders online on their own platforms, e-commerce sites, or third-party platforms like Shopify. In this regard, the emergence of high-end online shopping platforms is expected to act as a driver for the market in the forecast period.

Some of the key start-ups working towards smart mirror key trends for 2035 in the market are-

The smart mirror top manufacturers are focusing to increase their global influence and adopt strategies such as; acquisition, collaboration, and partnerships. Some of the recent key developments among leading companies of smart mirrors are:

| Report Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data | 2020 to 2025 |

| Expected Market Value in 2025 | USD 639.4 million |

| Projected Value in 2035 | USD 1380.4 million |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East & Africa; Oceania |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, India, Malaysia, Singapore, Thailand, China, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Segments Covered | Installation Type, Application, Distribution Channel, Region |

| Pricing | Available upon Request |

The global smart mirror market is estimated to be valued at USD 639.4 million in 2025.

The market size for the smart mirror market is projected to reach USD 1,380.4 million by 2035.

The smart mirror market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in smart mirror market are wall-mounted and free-standing.

In terms of application, residential segment to command 58.6% share in the smart mirror market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Fitness Mirror Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA