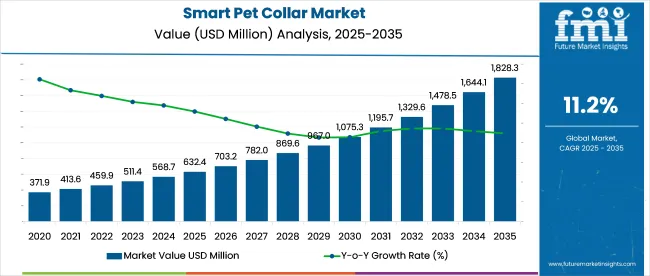

The smart pet collar market are forecast to grow from USD 632.4 million in 2025 to USD 1,820.7 million by 2035, with a CAGR of 11.2%. Demand is driven by GPS tracking, biometric sensing, and bundled subscription services that raise average revenue per unit. Manufacturers are improving battery efficiency and integrating low-latency chipsets.

OEM agreements are securing access to encrypted connectivity stacks, while regulatory compliance in North America and Europe is shaping firmware standards. Production is shifting closer to East Asia to shorten lead times. Dual-band GPS and eSIM functionality are being added alongside preventive health features.

The market accounts for approximately 6-8% of the broader pet tech market, reflecting increasing adoption of connected pet devices. Within the wearable technology market, its share remains limited at around 0.5-0.7%, given the dominance of human-focused wearables. In the IoT devices ecosystem, where smart home and industrial applications dominate, smart pet collars represent less than 0.3% of total devices.

As part of the GPS tracking and location services segment, they contribute about 1-2%, with use cases centered on geofencing and real-time pet tracking. In the animal health monitoring systems category, the share is higher at 4-5%, as collars equipped with biometric sensors gain ground for activity tracking, early illness detection, and behavior analysis in companion animals.

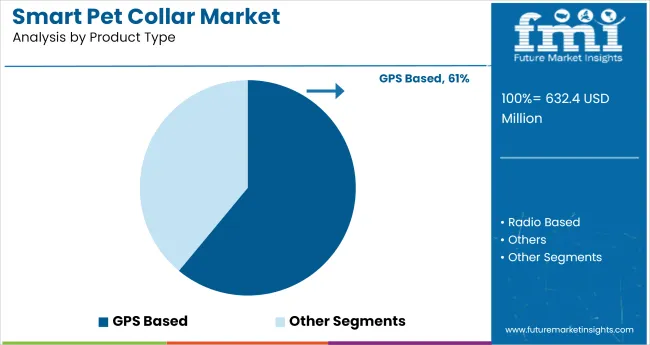

GPS tracking capabilities dominate market demand at 61% share, yet processing facilities struggle with regulatory compliance costs as European GDPR requirements and North American data security standards impose conflicting documentation and storage protocols. Manufacturing plants face implementation challenges when installing firmware update systems that accommodate over-the-air deployment while maintaining encrypted communication stacks demanded by security-conscious consumers.

Cross-functional tensions emerge prominently in product development cycles where hardware engineers prioritize component reliability while software development teams emphasize subscription service integration that generates recurring revenue streams essential for market viability.

eSIM functionality and dual-band GPS integration present particular operational challenges as telecommunications partnerships require negotiations with multiple carrier networks across 175+ countries where these devices operate. Processing facilities must manage inventory complexity when configuring devices for region-specific cellular frequency requirements that vary significantly between North American LTE-M networks and European 2G infrastructure still prevalent in rural areas. Supply chain managers encounter difficulties when coordinating component sourcing from East Asian suppliers while meeting delivery schedules that align with retail partner promotional calendars in primary markets.

Virtual fencing and behavioral feedback systems represent expanding functionality categories that require sophisticated algorithm development capabilities often unavailable within traditional pet accessory manufacturers. Engineering departments face integration challenges when combining geofencing alert systems with activity tracking databases that analyze behavioral patterns across pet populations exceeding 150 countries. Quality control teams must validate device accuracy across diverse environmental conditions ranging from dense urban obstacles that interfere with L1 GPS signals to remote wilderness areas where dual-band L5 frequency reception becomes critical for location reliability.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 632.4 million |

| Industry Value (2035) | USD 1,820.7 million |

| CAGR (2025 to 2035) | 11.2% |

Per capita spending on smart pet collars is increasing globally as pet owners seek advanced solutions for pet safety, health monitoring, and activity tracking. Smart collars equipped with GPS, biometric sensors, and connectivity features are gaining popularity among tech-savvy consumers who prioritize their pets’ well-being. Growth is driven by rising pet ownership, disposable incomes, and the trend toward pet humanization across various regions.

The smart pet collar market is experiencing significant growth driven by advancements in GPS tracking, health monitoring, and AI-powered features. Several companies are at the forefront of this innovation, offering products that enhance pet safety and well-being.

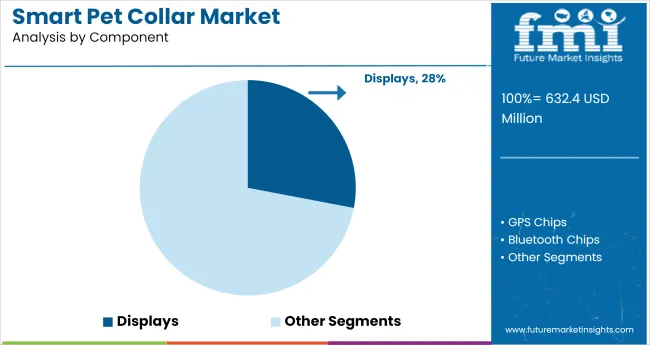

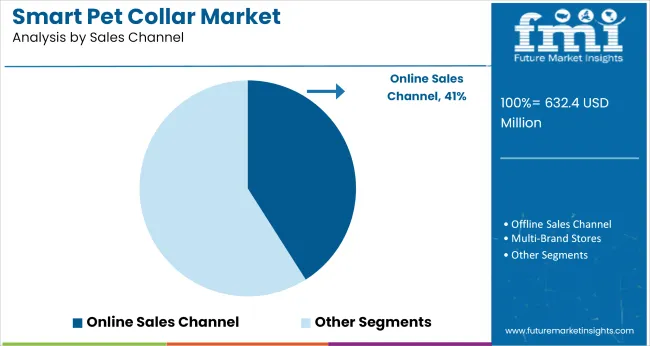

The industry is segmented by product type (GPS-based, others), component (displays, others), sales channel (online, others), price (mass/economic, premium), and application (tracking, training, monitoring, others). Regional analysis includes North America, Latin America, Western Europe, Eastern Europe, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

GPS-based collars are projected to lead the product type segment, accounting for 61% of the industry share in 2025. Brands like Tractive, Fi, and Whistle have popularized collars offering real-time location, escape alerts, and multi-pet tracking via mobile apps.

These products are particularly favored in dense metropolitansectors such as New York, London, and Tokyo. Integration with Apple Find My and Google Maps has improved accessibility and range precision. GPS collars are also being bundled with activity and health monitoring features to support lifestyle tracking.

Displays are expected to hold 28% of the component segment in 2025. Collars with built-in screens from brands like Wagz and PetBiz allow immediate access to pet stats, reducing reliance on smartphone apps. E-ink displays are gaining traction for their energy efficiency and visibility in outdoor conditions.

In dog parks and shared-use environments, visible alerts such as “needs rest” or “battery low” are helpful for caretakers. Display-enabled collars are also being used by dog walkers and pet boarders who require quick access to status updates without app logins.

Online sales are projected to contribute 41% share in 2025. Brands such as Halo Collar, Link My Pet, and PetPace drive most of their volume through D2C channels, offering firmware upgrades, warranties, and bundled services online.

Amazon and Chewy have become key third-party platforms for multi-brand visibility. E-commerce also allows for cross-selling of accessories like smart feeders and Wi-Fi-enabled pet doors. Online buyers benefit from customer reviews and video tutorials, which aid in adoption.

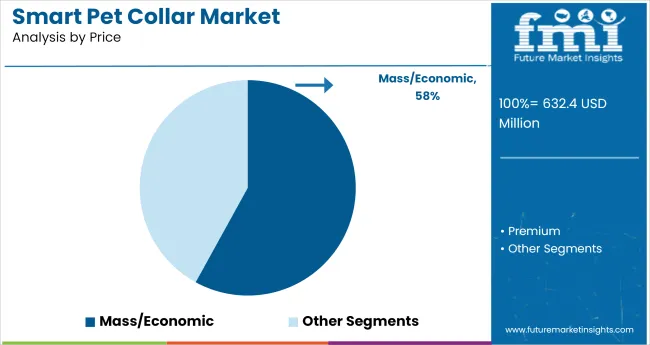

Mass/economic collars are forecasted to represent 58% of sales by 2025. Products like the FitBark GPS Dog Tracker and BARTUN Mini Pet Tracker offer basic tracking at half the cost of premium models. These devices are popular in multi-pet households and entry-level segments across India, Brazil, and Indonesia. Brands are focusing on modular software models, where users can unlock premium features over time. Bluetooth-only variants are also gaining traction in rural zones with limited mobile coverage.

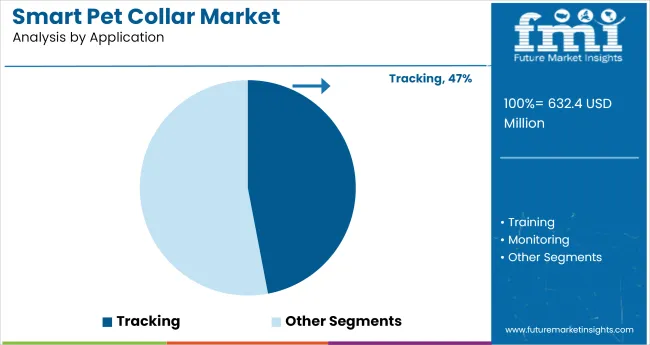

Tracking is expected to dominate the application segment, capturing 47% share in 2025. Pet owners use collars like Jiobit Smart Tag and Link AKC to monitor pet movements, enforce geofences, and review daily route history. For active pets or those prone to wandering, GPS + LTE combinations have become standard. Insurance providers such as Trupanion and Petplan are beginning to use collar data to assess claims. Veterinary groups in the USA and Europe are also integrating location logs into behavioral diagnostics.

The industry is being shaped by a convergence of pet humanization, remote monitoring needs, and expanding connected-device ecosystems. As spending on companion animal wellness continues to rise, manufacturers are prioritizing collars with GPS tracking, biometric monitoring, and app-based behavior alerts. The short battery cycles, regional connectivity issues, and limited standardization across platforms are posing operational challenges.

Surge in Demand for Connected Pet Health and Safety Tools

Pet owners are increasingly adopting smart collars that offer real-time location, heart rate monitoring, and boundary alerts. Integration with mobile apps allows data sharing with veterinarians and behaviorists, enhancing preventive care. The rise in pet insurance and wellness subscription models is reinforcing collar-linked diagnostics, mainly in metropolitan sectors.

Product Fragmentation, Connectivity Constraints, and User Fatigue

Hardware limitations, battery life inconsistencies, and app synchronization issues continue to hinder user retention. Connectivity lapses in rural or indoor settings reduce tracking accuracy. As collar SKUs proliferate, product differentiation is increasingly tied to subscription ecosystems and customer service experience rather than hardware alone.

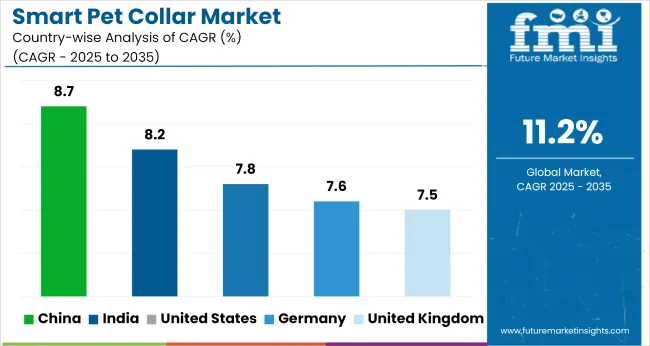

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 7.8% |

| United Kingdom | 7.5% |

| Germany | 7.6% |

| India | 8.2% |

| China | 8.7% |

The global smart pet collar market is projected to grow at an 11.2% CAGR from 2025 to 2035. China leads the profiled countries with 8.7%, although still 2.5 percentage points below the global pace. Growth is being supported by rising pet ownership and expanding demand for GPS-enabled, health-monitoring collars. India follows at 8.2%, with strong interest in activity-tracking features and growing availability through D2C platforms and pet care retailers.

The United States posts a 7.8% CAGR, while Germany and the United Kingdom trail closely at 7.6% and 7.5% respectively. These OECD markets are underperforming the global average by more than 3 points. Slower product upgrade cycles, stricter compliance around location tracking, and limited price accessibility outside core demand pockets are holding back broader adoption.

Demand for smart pet collar in the United States is expect to expand at a CAGR of 7.8% from 2025 to 2035. Demand is led by households investing in GPS tracking, health monitoring, and behavior analytics. Widespread integration with home automation systems enhances collar utility.

Retailers and e-commerce platforms are bundling collars with wellness services, driving adoption in households with multiple pets. The market benefits from a mix of regulated standards and high compatibility with smart devices.

The UK smart pet collar industry is anticipated to grow at a 7.5% CAGR through 2035. Demand is concentrated in households prioritizing pet safety and activity monitoring. Collars with geofencing, real-time alerts, and mobile app pairing are increasingly preferred. Consumers are responsive to pet well-being trends, particularly among dog owners. Industry share is shifting toward brands offering reliable support, simplified interfaces, and locally adapted pricing models.

Sales for smart pet collarsin Germanyare growing at a CAGR of 7.6% from 2025 to 2035. Tech-enabled pet care is gaining momentum, with consumers favoring collars offering GPS, temperature sensing, and real-time monitoring. Buyers prioritize EU-standard safety compliance and software integration with German-language platforms. Local manufacturers are scaling niche solutions with enhanced durability and low power usage, appealing to buyers with performance and quality expectations.

The smart pet collar industry in India is expanding at an 8.2% CAGR, fueled by a rising pet population in large cities and mid-sized towns. Online-first adoption dominates, with price-sensitive buyers opting for collars offering GPS and anti-theft features. Mobile app compatibility, Hindi-language UI, and wallet-friendly pricing have strengthened local brand traction. Health-focused features are gradually emerging, although demand remains strongest for tracking, zone alerts, and real-time location updates.

The Chinese market for smart pet collars is forecast to grow at an 8.7% CAGR from 2025 to 2035. Mass ownership of companion animals combined with in-house manufacturing strength has led to cost-efficient innovation. Feature-rich collars with AI behavior recognition, biometric sensors, and bilingual app support are being mass-produced. Local governments have begun promoting collar use in cities with dense pet populations, reinforcing public health and animal control goals.

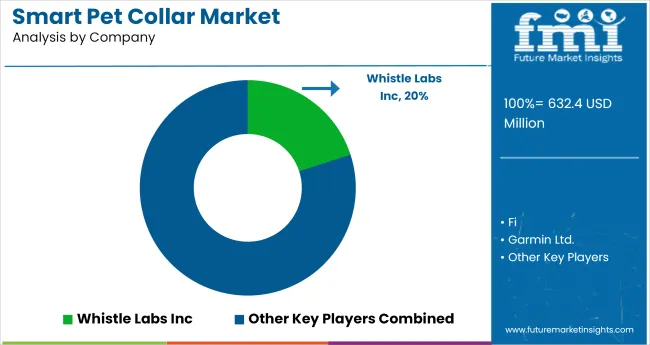

The smart pet collar market is evolving rapidly as leading companies integrate IoT connectivity, GPS tracking, and health monitoring to enhance pet safety and wellness. Whistle Labs Inc. holds a leading market share of around 20%, driven by its advanced GPS-enabled collars and health monitoring features. The company’s success stems from strong data analytics capabilities, cloud integration, and a subscription-based service model that supports real-time location tracking and biometric monitoring for pets.

Garmin Ltd. and Fi (Pet Wireless Inc.) compete closely by offering premium GPS and activity-tracking collars designed for durability, accuracy, and long battery life. Garmin leverages its global expertise in wearable technology and navigation, while Fi focuses on smart connectivity and lifestyle branding targeted at tech-savvy pet owners. Tractive GmbH strengthens its position in Europe through affordable GPS collars featuring geo-fencing and live tracking functions with multilingual app support.

PetPace Ltd. specializes in health monitoring for older or medically at-risk pets, offering collars equipped with temperature, pulse, and activity sensors. Wagz Inc. differentiates through app-based ecosystems integrating behavior tracking, nutrition insights, and geolocation services. Market competitiveness centers on health data accuracy, subscription scalability, and cross-device integration, with innovation focusing on AI-enabled pet health analytics and global IoT network expansion.

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 632.4 million |

| Projected Industry Size (2035) | USD 1,820.7 million |

| CAGR (2025 to 2035) | 11.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million units for volume |

| Product Types Analyzed (Segment 1) | GPS Based, Radio Based, Others |

| Components Analyzed (Segment 2) | Displays, GPS Chips, Bluetooth Chips, Sensors |

| Sales Channels Analyzed (Segment 3) | Online Sales Channel, Offline Sales Channel, Multi-Brand Stores, Supermarkets/Hypermarkets, Other Sales Channel |

| Price Tiers Analyzed (Segment 4) | Mass/Economic, Premium |

| Applications Analyzed (Segment 5) | Training, Tracking, Monitoring |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Whistle Labs Inc., Garmin Ltd., Fi (Pet Wireless Inc.), Tractive GmbH, PetPace Ltd., and Wagz Inc. |

| Additional Attributes | Dollar sales, share by product and application, real-time GPS tracking adoption, expansion in premium collar segment, regional e-commerce penetration and pet ownership patterns |

The segment is categorized into GPS Based, Radio Based, and Others.

This includes Displays, GPS Chips, Bluetooth Chips, and Sensors.

The industry is segmented into Online Sales Channel, Offline Sales Channel, Multi-Brand Stores, Supermarkets/Hypermarkets, and Other Sales Channel.

The segment is divided into Mass/Economic and Premium.

This segment covers Training, Tracking, and Monitoring.

Regional analysis includes North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, East Asia, and Middle East & Africa.

The industry is expected to reach USD 632.4 million in 2025.

The industry is forecasted to grow to USD 1,820.7 million by 2035.

The industry is projected to grow at a compound annual growth rate (CAGR) of 11.2% during the forecast period.

The tracking segment is expected to account for approximately 47% share in 2025.

China is expected to register the fastest growth with a CAGR of 8.7% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA