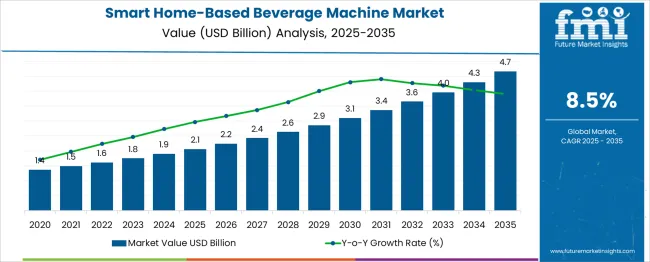

The Smart Home-Based Beverage Machine Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period. Between 2025 and 2030, the market is anticipated to expand from USD 2.1 billion to USD 3.1 billion, indicating strong growth momentum. Year-on-year analysis shows incremental gains, moving from USD 2.2 billion in 2026 to USD 2.4 billion in 2027 and reaching USD 2.6 billion in 2028.

These increases are supported by growing consumer inclination toward convenience-oriented smart appliances and integration with IoT ecosystems in modern kitchens. By 2029, the market is projected to reach USD 2.9 billion, and is expected to reach USD 3.1 billion by 2030. The adoption rate is expected to strengthen further as manufacturers introduce personalized brewing options, energy-efficient designs, and app-controlled functionalities.

Expanding demand for premium and specialty beverages at home, coupled with advancements in AI-enabled automation, will drive wider usage across residential spaces. Competitive differentiation will focus on multi-beverage compatibility and subscription-based ingredient models. These factors position smart beverage machines as a central component in connected home solutions, providing both functional convenience and enhanced user experience in the evolving smart appliance landscape.

| Metric | Value |

|---|---|

| Smart Home-Based Beverage Machine Market Estimated Value in (2025 E) | USD 2.1 billion |

| Smart Home-Based Beverage Machine Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The smart home-based beverage machine market holds a niche but fast-growing share within its parent markets. In the smart kitchen appliances market, it represents approximately 10–12%, driven by increasing adoption of connected coffee makers and multi-beverage systems. Within the home automation and connected devices market, its share is smaller at around 3–4%, as this space includes lighting, security, and HVAC systems alongside appliances.

In the beverage preparation appliances market, the share is higher at 15–18%, given the surge in demand for automated coffee and specialty drink machines in households. The consumer electronics for home market sees a modest contribution of 2–3%, as entertainment and computing devices dominate that category. Within the IoT-enabled home appliances market, smart beverage machines account for about 8–10%, reflecting growing integration of voice assistants and mobile app control features.

This market’s expansion is propelled by a preference for convenience, customization, and premium in-home beverage experiences. Innovations such as AI-driven brewing profiles, energy efficiency, and compatibility with virtual assistants enhance consumer appeal. While still a specialized segment, the increasing shift toward smart kitchens and connected lifestyles indicates significant potential for these machines to capture higher shares in the coming years as connected home ecosystems mature globally.

Rising disposable incomes, combined with growing awareness of health and wellness, have driven demand for intelligent beverage solutions that deliver café-quality drinks at home. The integration of IoT capabilities and voice-assistant compatibility has further elevated consumer expectations, making such machines a central part of modern kitchens. Future growth is expected to be fueled by advancements in energy-efficient designs, expanded beverage options, and seamless integration with broader smart home ecosystems.

Competitive differentiation through enhanced user interfaces and sustainability-focused features is paving the way for long-term adoption and deeper market penetration.

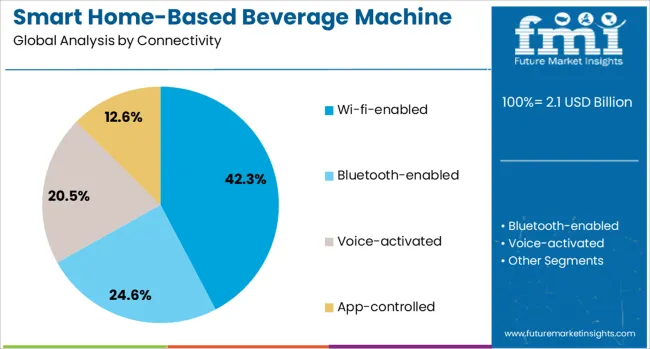

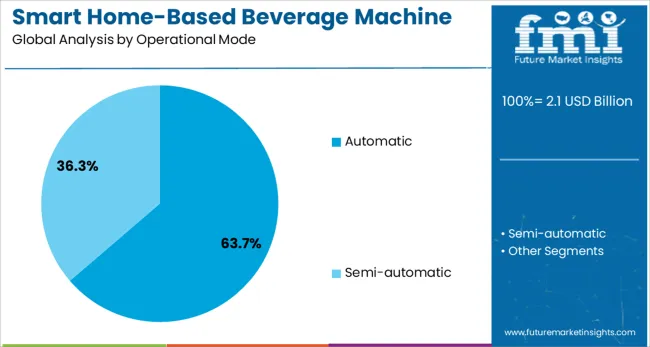

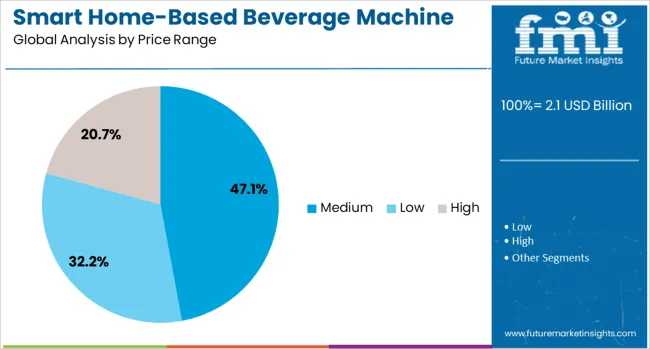

The smart home-based beverage machine market is segmented by connectivity, operational mode, price range, end use, distribution channel, and geographic regions. The connectivity of the smart home-based beverage machine market is divided into Wi-Fi-enabled, Bluetooth-enabled, Voice-activated, and App-controlled. The operational mode of the smart home-based beverage machine market is classified into Automatic and Semi-automatic. Based on the price range, the smart home-based beverage machine market is segmented into Medium, Low, and High.

The smart home-based beverage machine market is segmented by end use into Households and Commercial. The distribution channel of the smart home-based beverage machine market is segmented into Online and Offline. Regionally, the smart home-based beverage machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by connectivity, the wi-fi-enabled subsegment is anticipated to command 42.3% of the total market revenue in 2025, emerging as the leading connectivity choice. This dominance is attributed to consumers’ growing preference for real-time control and monitoring of devices through smartphones and voice assistants.

The ability to remotely customize beverage settings, receive maintenance alerts, and access firmware updates has positioned wi-fi-enabled machines as a premium offering within the market. Enhanced interoperability with existing smart home systems has also contributed to wider acceptance, creating a more integrated and user-friendly experience.

This combination of convenience, control, and seamless connectivity has strengthened the leadership of this segment in meeting modern lifestyle expectations.

In terms of operational mode, the automatic subsegment is projected to account for 63.7% of the market revenue in 2025, establishing itself as the most preferred mode of operation. This leadership has been driven by consumers’ increasing demand for effortless and consistent beverage preparation without the need for manual intervention.

Automatic machines offer precision, speed, and repeatability, which align well with busy routines and the desire for consistent quality. The incorporation of sensors, pre-programmed recipes, and self-cleaning functions has enhanced the appeal of automatic solutions, allowing users to enjoy a premium experience with minimal effort.

These features have significantly improved user satisfaction, contributing to the sustained dominance of the automatic segment.

When analyzed by price range, the medium segment is expected to capture 47.1% of the market revenue in 2025, making it the most prominent pricing tier. This segment’s leadership can be attributed to its optimal balance of affordability and advanced features, appealing to a broad base of middle-income consumers seeking value without compromising on quality.

Medium-priced machines often integrate essential smart functionalities and durable components while remaining accessible to a wider audience. This price point has resonated particularly well with cost-conscious consumers who are unwilling to pay premium prices but still desire modern conveniences and reliability.

The widespread acceptance of this segment reflects its ability to meet the expectations of functionality, aesthetics, and budget considerations simultaneously.

The smart home-based beverage machine market is growing as connected appliances become integral to modern living. In 2024, consumers increasingly adopted smart coffee, tea, and juice machines offering programmable and app-controlled features.

By 2025, integration with home automation systems accelerated demand for appliances that provide convenience, energy efficiency, and personalization. Manufacturers delivering machines with seamless smart-home compatibility, intuitive interfaces, and enhanced functionality are positioned to lead in this evolving segment.

Consumers have shown a strong preference for appliances that deliver ease of use and integration with connected home systems. In 2024, beverage machines featuring remote control via apps and compatibility with voice assistants became widely adopted. By 2025, these machines were commonly integrated into home automation platforms, enabling scheduled brewing and personalized settings for coffee, tea, and other beverages. This trend reflects a clear shift toward convenience-driven purchasing decisions. Brands that offer user-friendly designs, robust connectivity, and reliable performance are positioned to maintain an advantage in this expanding category.

The addition of IoT-driven functions in beverage machines is creating opportunities for product differentiation. In 2024, advanced models began offering real-time diagnostics, ingredient monitoring, and automatic software updates. By 2025, predictive maintenance and usage analytics became key selling points, transforming these appliances into intelligent home solutions. This evolution indicates that smart beverage machines can deliver more than convenience—they can function as data-driven lifestyle tools. Manufacturers focusing on IoT integration, automated alerts, and compatibility with smart dashboards are likely to capture significant market share in this innovation-driven segment.

In 2024 and 2025, the premium pricing of smart beverage machines created notable adoption barriers for middle-income households. Devices equipped with connectivity features, advanced brewing systems, and automated dispensing were sold at significantly higher costs than conventional coffee makers or blenders. This price disparity was observed to discourage consumers in markets where affordability dictates purchasing choices. Additionally, subscription-based pod systems added recurring expenses, increasing total ownership costs. Retailers in regions such as Asia and Latin America reported slower uptake compared to North America and Europe. The inability to balance advanced functionality with cost-efficiency remains a persistent hurdle affecting category expansion.

During 2024 and 2025, personalization emerged as a strong differentiator in smart beverage systems. Machines enabled users to create unique flavor combinations, adjust brew strength, and control temperature settings through mobile interfaces. Brands introduced AI-assisted recommendation features that allowed consumers to replicate café-style beverages at home. This customization capability influenced higher engagement, especially in premium markets where consumers seek curated experiences. New launches integrated companion apps that stored user preferences, enhancing repeat usage and loyalty. Retail activity showed increased attention toward models offering tailored recipes, suggesting personalization as a key competitive element in the future of smart beverage solutions.

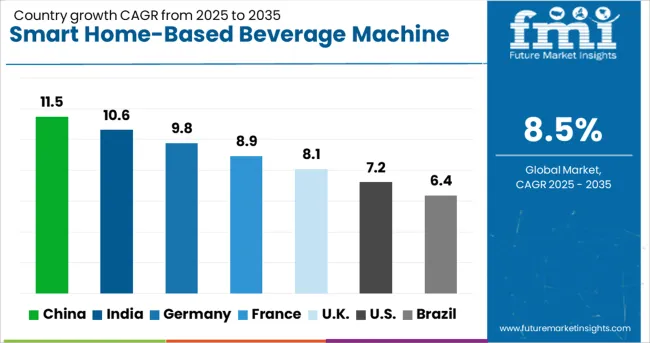

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

The global smart home-based beverage machine market is projected to grow at a CAGR of 8.5% from 2025 to 2035. China leads with 11.5%, followed by India at 10.6% and Germany at 9.8%. France records 8.9%, while the United Kingdom posts 8.1%. Growth is driven by the increasing adoption of IoT-enabled kitchen appliances, rising demand for personalized beverages, and integration with smart home ecosystems. China and India dominate due to expanding urban households and e-commerce-driven sales. Germany focuses on premium coffee and multifunction beverage systems, while France and the UK emphasize compact, energy-efficient designs for modern kitchens.

China is forecast to grow at 11.5%, fueled by tech-savvy consumers and high penetration of connected appliances. AI-enabled beverage machines dominate adoption for customized drink preparation. Manufacturers integrate app-controlled features and voice assistant compatibility to enhance convenience. Rapid expansion of e-commerce platforms accelerates market reach across major urban centers.

India is expected to grow at 10.6%, supported by an expanding middle class and rising preference for automated kitchen solutions. Compact, affordable beverage machines dominate demand among urban households. Manufacturers develop multi-drink machines catering to tea, coffee, and health beverages. Growth in online retail and subscription-based models strengthens consumer engagement.

Germany is projected to grow at 9.8%, driven by high demand for premium coffee systems integrated with smart features. Energy-efficient machines dominate installations in eco-conscious households. Manufacturers innovate with IoT-based diagnostics and predictive maintenance systems. Growth of connected kitchens under smart living concepts accelerates product penetration.

France is forecast to grow at 8.9%, supported by strong coffee culture and rising interest in gourmet beverage systems. Compact, aesthetically designed machines dominate urban homes with limited kitchen space. Manufacturers develop app-controlled features to enable remote customization of drinks. Integration with home automation platforms enhances appeal among tech-savvy consumers.

The UK is projected to grow at 8.1%, driven by demand for automated coffee and beverage systems in modern households. Manufacturers introduce AI-driven machines offering beverage personalization and energy optimization. Partnerships with coffee brands for capsule-based systems gain momentum. Smart connectivity features remain critical for attracting premium consumers.

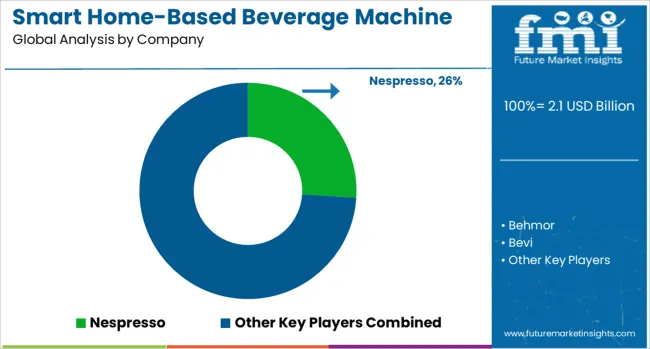

The smart home-based beverage machine market is moderately consolidated, with Nespresso holding a significant leadership position through its connected coffee brewing systems and strong global brand recognition. Its IoT-enabled machines, integrated with mobile apps and smart assistants, make it a preferred choice among premium consumers.

Key players include Behmor, Bevi, Breville, BSH, Café Appliances, Coway, De’Longhi, Hamilton Beach, Hurom, Illy, Jura, Kuvings, Lavazza, and Smart Soda. These companies offer a wide range of connected beverage machines designed for coffee, tea, juice, and customized drink preparation. Their strategies emphasize convenience, energy efficiency, and personalization through smart technology integration.

Market growth is driven by increasing adoption of smart home ecosystems, rising demand for premium and specialty beverages, and consumer preference for personalized brewing experiences. Innovations such as app-based scheduling, voice assistant compatibility, and automated cleaning systems are reshaping the market. Additionally, players are focusing on modular designs and multi-functional appliances that combine coffee brewing, soda-making, and juice extraction in one system.

Expanding e-commerce channels and direct-to-consumer models are further accelerating adoption, especially in urban households. Emerging companies are targeting niche segments like health-focused beverages and sustainable capsules, creating competitive differentiation in this fast-evolving category.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Connectivity | Wi-fi-enabled, Bluetooth-enabled, Voice-activated, and App-controlled |

| Operational Mode | Automatic and Semi-automatic |

| Price Range | Medium, Low, and High |

| End Use | Households and Commercial |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nespresso, Behmor, Bevi, Breville, BSH, Café Appliances, Coway, De’Longhi, Hamilton Beach, Hurom, Illy, Jura, Kuvings, Lavazza, and Smart Soda |

| Additional Attributes | Dollar sales by machine type (coffee, tea, soda), regional demand trends, competitive landscape, consumer preferences for app-controlled and personalized brewing, integration with smart home systems, innovations in AI beverage customization and self-cleaning features. |

The global smart home-based beverage machine market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the smart home-based beverage machine market is projected to reach USD 4.7 billion by 2035.

The smart home-based beverage machine market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in smart home-based beverage machine market are wi-fi-enabled, bluetooth-enabled, voice-activated and app-controlled.

In terms of operational mode, automatic segment to command 63.7% share in the smart home-based beverage machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA