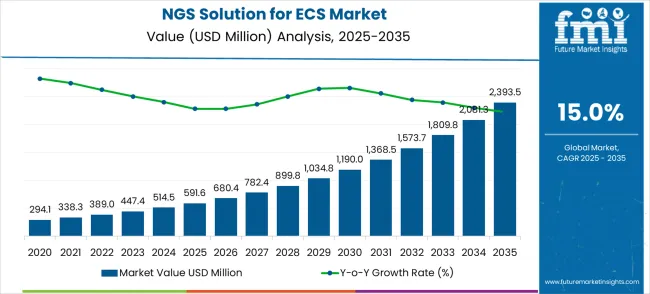

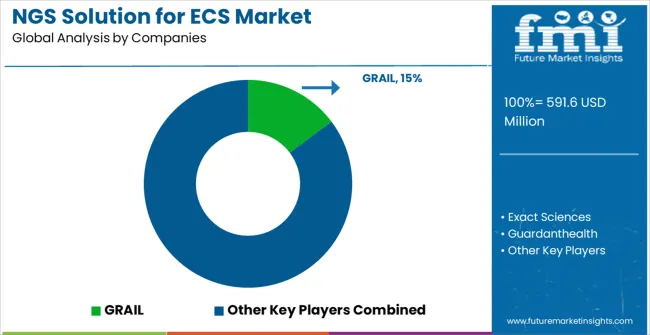

The global NGS solution for early cancer screening market is projected to grow from USD 591.6 million in 2025 to approximately USD 2,393.5 million by 2035, recording an absolute increase of USD 1,802 million over the forecast period. This translates into a total growth of 305%, with the market forecast to expand at a compound annual growth rate (CAGR) of 15.0% between 2025 and 2035. The overall market size is expected to grow by nearly 4.05X during the same period, supported by the rising adoption of precision medicine approaches and increasing demand for non-invasive cancer detection technologies following growing healthcare awareness and early diagnosis initiatives worldwide.

Between 2025 and 2030, the NGS solution for early cancer screening market is projected to expand from USD 591.6 million to USD 1,189.9 million, resulting in a value increase of USD 598.3 million, which represents 33.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of liquid biopsy technologies in clinical practice, increasing regulatory approvals for multi-cancer early detection tests, and growing awareness among healthcare providers about the importance of early cancer screening for improved patient outcomes. Technology companies are expanding their NGS-based screening portfolios to address the growing complexity of cancer genomics and personalized medicine requirements across hospitals and clinical laboratories.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 591.6 million |

| Forecast Value in (2035F) | USD 2,393.5 million |

| Forecast CAGR (2025 to 2035) | 15% |

The NGS solution for early cancer screening market holds a significant position in these parent markets. Within the next-generation sequencing (NGS) market, it commands a share of approximately 3.5%, driven by the increasing applications of NGS in cancer detection. In the cancer diagnostics market, the share is higher, around 5.2%, as early screening solutions are gaining traction among healthcare providers and patients. Molecular diagnostics, with a 2.8% share, reflects its growing role in the identification of cancer-related biomarkers through NGS technology. The liquid biopsy market, which facilitates non-invasive cancer detection, shows a 4.1% share for NGS-based screening solutions. Lastly, in personalized medicine, the NGS solution contributes around 3.3%, aligning with the shift towards individualized treatment plans. This market is poised for growth as NGS technologies evolve and the demand for early cancer detection increases across the healthcare sector.

Market expansion is being supported by the dramatic increase in cancer incidence rates worldwide and the corresponding need for advanced screening technologies that enable detection of multiple cancer types through single blood tests. Modern healthcare systems are emphasizing preventive care approaches that rely on molecular-level cancer detection and circulating tumor DNA analysis to identify malignancies at their earliest, most treatable stages. Even minimal tumor burden detection capabilities can significantly impact patient survival rates and treatment outcomes through early intervention strategies.

The growing understanding of cancer genomics and increasing demand for personalized medicine approaches are driving adoption of NGS-based screening solutions from established biotechnology companies with comprehensive regulatory approvals and clinical validation. Healthcare providers and payers are increasingly recognizing the cost-effectiveness of early detection following successful implementation results and patient outcome improvements. Clinical guidelines and screening protocols are establishing evidence-based requirements for NGS technologies that demonstrate proven sensitivity, specificity, and clinical utility across diverse patient populations.

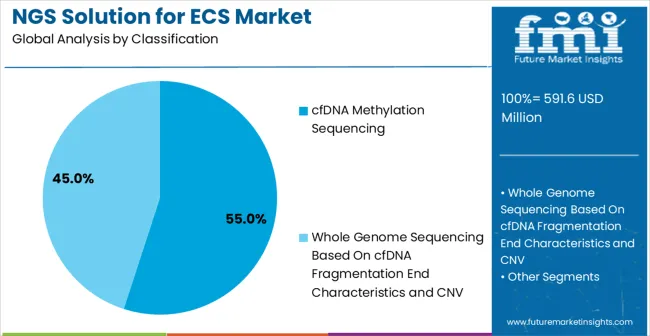

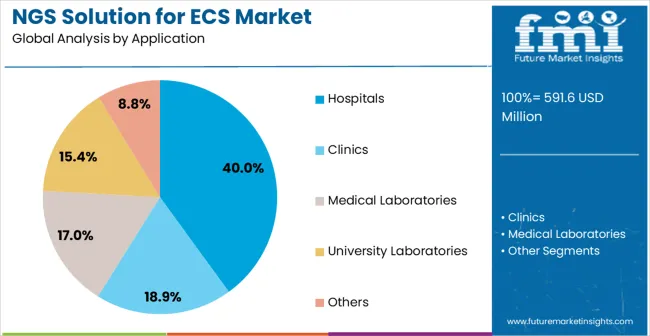

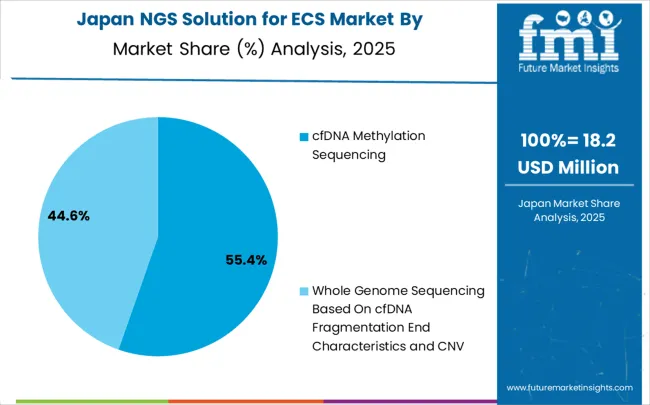

The market is segmented by technology type, end-use, and region. cfDNA methylation sequencing is projected to account for 55% of the NGS early cancer screening market by 2025, offering high sensitivity and early-stage cancer detection. The hospitals segment is expected to capture 40% market share, driven by increasing adoption of NGS technologies for precise, early cancer diagnosis and personalized treatment. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

cfDNA methylation sequencing is expected to account for 55% of the NGS solution market for early cancer screening in 2025, driven by its high sensitivity and specificity. This technology is the most clinically validated for multi-cancer early detection, offering comprehensive cancer detection through tissue-of-origin identification and methylation pattern analysis. Its dominance is further supported by extensive clinical trial validation and regulatory development by leading technology firms. cfDNA methylation sequencing excels at detecting cancer-specific methylation signatures across various tumor types while maintaining low false-positive rates, which is crucial for screening applications. By analyzing circulating cell-free DNA methylation patterns released from tumor cells, this technology enables early-stage cancer detection and tissue-of-origin classification in a single assay, making it ideal for population-based screening and clinical use.

The hospitals segment is projected to account for 40% of the NGS solution for early cancer screening market in 2025, maintaining its dominant position. This leading share is driven by the increasing adoption of next-generation sequencing (NGS) technologies in hospital settings, where early cancer detection is critical. Hospitals benefit from the precision and speed of NGS solutions, enabling early diagnosis and personalized treatment planning for cancer patients. As healthcare facilities invest in advanced diagnostic tools to enhance clinical outcomes, the demand for NGS solutions is expected to grow. The hospitals segment will continue to lead as more hospitals integrate NGS technologies into their oncology departments, offering comprehensive cancer screening and diagnostic services.

The NGS solution for early cancer screening market is advancing rapidly due to breakthrough clinical validation results and growing healthcare system adoption of precision medicine approaches. However, the market faces challenges including high test costs and reimbursement limitations, need for extensive clinical validation across diverse populations, and varying regulatory requirements across different healthcare markets. Technology advancement efforts and health economics research continue to address adoption barriers and demonstrate clinical value propositions.

The growing implementation of population-based cancer screening initiatives is driving systematic adoption of NGS technologies at healthcare systems, government health programs, and preventive care organizations. Large-scale screening programs equipped with comprehensive clinical decision support provide population health benefits and demonstrate cost-effectiveness for healthcare systems while expanding market opportunities for technology providers. These programs are particularly valuable for addressing cancer disparities and improving early detection rates across diverse demographic groups and geographic regions.

Modern NGS screening companies are incorporating machine learning algorithms and artificial intelligence platforms that improve cancer detection accuracy and reduce false-positive rates through advanced pattern recognition and data integration. Integration of multi-omics data analysis and predictive modeling enables more precise risk stratification and personalized screening recommendations. Advanced analytics also support integration with electronic health records and clinical decision support systems for comprehensive patient management and follow-up care coordination.

| Country | CAGR (2025-2035) |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| Brazil | 15.8% |

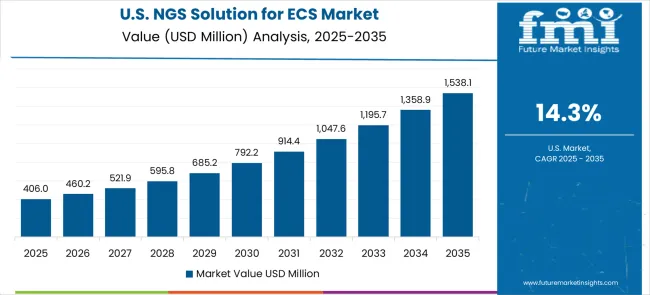

| United States | 14.3% |

| United Kingdom | 12.8% |

| Japan | 11.3% |

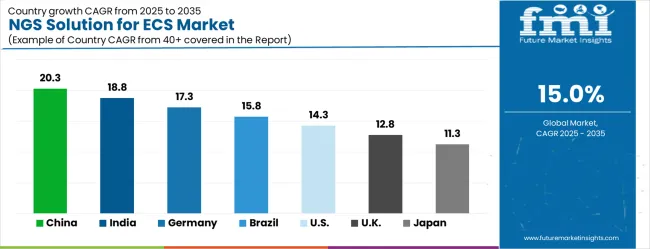

The NGS solution for early cancer screening market is experiencing explosive growth, with China leading at a 20.3% CAGR through 2035, driven by massive healthcare infrastructure investment, government-supported cancer prevention initiatives, and rapidly expanding genomics capabilities. India follows at 18.8%, supported by growing healthcare accessibility, increasing cancer awareness, and developing precision medicine infrastructure. Germany grows robustly at 17.3%, emphasizing clinical excellence, regulatory leadership, and comprehensive cancer care integration. Brazil records 15.8%, implementing advanced screening technologies into expanding healthcare systems. The United States shows strong growth at 14.3%, focusing on clinical validation, regulatory approval, and healthcare system adoption. The United Kingdom demonstrates solid expansion at 12.8%, supported by NHS integration and clinical research leadership. Japan maintains steady growth at 11.3%, driven by aging population needs and precision medicine advancement. Overall, China and India emerge as the leading drivers of global NGS Solution for Early Cancer Screening market expansion.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The NGS solution for early cancer screening market in China is growing rapidly, with a projected CAGR of 20.3%. China’s healthcare infrastructure, government initiatives promoting early cancer detection, and increasing awareness about cancer prevention are major drivers of market growth. The country’s focus on expanding healthcare access, combined with rising demand for non-invasive, highly accurate screening methods, is fueling the adoption of NGS technologies. China’s robust pharmaceutical and biotechnology sectors further support the growth of early cancer screening solutions.

The NGS solution for early cancer screening market in India is projected to grow at a CAGR of 18.8%, supported by increasing awareness of cancer and the demand for cost-effective, non-invasive diagnostic technologies. India’s healthcare system is gradually shifting towards preventive care, with more hospitals and diagnostic centers adopting NGS technologies for early detection of cancer. The growing number of cancer cases in India, along with government healthcare initiatives, is further fueling the market for early cancer screening solutions.

The NGS solution for early cancer screening market in Germany is expected to grow at a CAGR of 17.3%, driven by the country’s advanced healthcare system and strong focus on precision medicine. Germany is known for its high-quality healthcare services and robust research infrastructure, which supports the development and adoption of NGS technologies in early cancer screening. The increasing demand for personalized medicine, combined with rising healthcare spending, is contributing to the market’s growth.

The NGS solution for early cancer screening market in Brazil is projected to grow at a CAGR of 15.8%, as the country continues to improve its healthcare infrastructure and diagnostic capabilities. With increasing cancer incidence and the need for cost-effective screening solutions, Brazil is rapidly adopting NGS technologies for early detection. The government’s focus on improving healthcare access and the rise of health insurance coverage further support the growth of early cancer screening solutions in the country.

The NGS solution for early cancer screening market in the United States is expected to grow at a CAGR of 14.3%, fueled by increasing investments in precision medicine and biotechnology. The USA market is characterized by widespread adoption of NGS technologies for various applications, including early cancer detection. The growing demand for non-invasive diagnostic tools, coupled with rising awareness about cancer prevention, is contributing to the rapid adoption of NGS-based solutions.

The NGS solution for early cancer screening market in the United Kingdom is growing at a CAGR of 12.8%, with increasing focus on early cancer detection and personalized medicine. The UK has made significant strides in integrating NGS technologies into healthcare systems, with ongoing research and clinical trials enhancing the application of NGS in early cancer detection. Government funding for healthcare innovation and rising healthcare awareness are also contributing to the growth of the NGS solution market.

The NGS solution for early cancer screening market in Japan is expected to grow at a CAGR of 11.3%, driven by advancements in healthcare technology and increasing demand for precision diagnostics. Japan’s focus on aging population healthcare and early disease detection is fueling the adoption of NGS solutions. The market is further supported by strong research activities, government-backed healthcare initiatives, and rising investments in biotechnology.

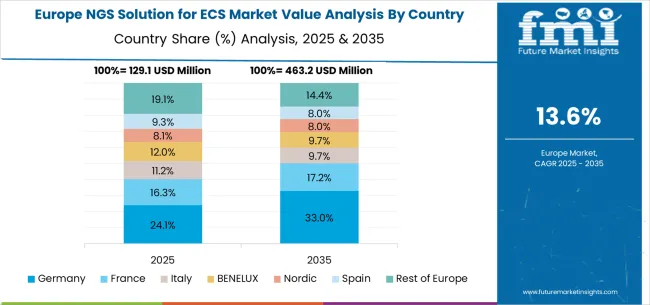

The NGS (Next Generation Sequencing) solution for early cancer screening market in Europe is projected to grow from USD 129.1 million in 2025 to USD 463.2 million by 2035, registering a CAGR of 13.6% over the forecast period. Germany will lead, expanding from 24.1% in 2025 to 33.0% by 2035, supported by its advanced healthcare infrastructure, genomics R&D ecosystem, and cancer prevention programs. France will contribute 16.3% in 2025, rising to 17.2% by 2035, reflecting strong adoption in clinical research and oncology diagnostics. Italy is projected to hold 11.2% in 2025, softening to 9.7% by 2035, reflecting steady but slower adoption in precision medicine.

The BENELUX region will account for 9.1% in 2025, declining to 8.0% by 2035, due to consolidation of specialized research hubs. The Nordic countries will hold 9.3% in 2025, easing to 8.6% by 2035, reflecting moderate demand growth despite their strong genomics research capacity. Spain will capture 9.3% in 2025, declining to 8.0% by 2035, reflecting slower deployment of cancer genomics technologies. Meanwhile, the Rest of Europe will decline from 19.1% in 2025 to 14.4% by 2035, as investments remain concentrated in Western European oncology innovation clusters.

The NGS solution for early cancer screening market is defined by intense competition among pioneering biotechnology companies, established diagnostics providers, and emerging precision medicine platforms. Companies are investing heavily in clinical validation programs, regulatory approval strategies, artificial intelligence integration, and comprehensive clinical support services to deliver accurate, reliable, and clinically actionable screening solutions. Strategic partnerships, clinical evidence generation, and global market expansion are central to establishing market leadership and clinical adoption. GRAIL, Inc. leads with comprehensive multi-cancer early detection technology and extensive clinical validation programs demonstrating population-level screening effectiveness. Exact Sciences provides established liquid biopsy platforms with proven clinical utility and broad healthcare system adoption. Guardant Health, Inc. offers specialized cancer screening solutions with focus on Chinese market requirements and regulatory compliance. Akery delivers innovative screening technologies with emphasis on clinical accessibility and cost-effectiveness.

Foundation Medicine provides comprehensive genomic profiling with established clinical utility in oncology care pathways. Illumina Inc. offers foundational sequencing technologies and platform solutions that enable screening test development and implementation. Hangzhou New Horizon Health Technology Co. Ltd., Berry Oncology Co. Ltd., and Genetron Health (Beijing) Co. Ltd. provide specialized solutions for Asian markets with regulatory compliance and clinical validation. Yeasen Biotechnology Co., Ltd., Guangzhou Burning Rock Dx Co. Ltd., BGI Genomics Co. Ltd., and Jiangsu Huayuan Biotechnology Co. Ltd. offer comprehensive screening solutions, technological innovation, and clinical support across regional and international markets.

Next-generation sequencing (NGS) solutions for early cancer screening represent transformative diagnostic technologies enabling detection of malignancies before clinical symptoms appear, with the global market valued at USD 591.6 million in 2025 and projected to reach USD 2,393.5 million by 2035, growing at an exceptional 15.0% CAGR. These advanced molecular diagnostic platforms utilize circulating tumor DNA (ctDNA) analysis, including cfDNA methylation sequencing, whole genome sequencing based on cfDNA fragmentation patterns, and copy number variation (CNV) analysis to detect cancer signatures in blood samples. Market expansion is driven by increasing cancer incidence, growing awareness of early detection benefits, technological advances in liquid biopsy, and healthcare system emphasis on preventive medicine. However, scaling requires coordinated efforts across clinical validation, regulatory approval, healthcare integration, and cost-effective implementation.

National Cancer Screening Programs: Integrate NGS-based liquid biopsy testing into national cancer screening guidelines and reimbursement frameworks. Establish population-based screening programs targeting high-risk demographics while gathering real-world evidence on clinical utility and cost-effectiveness.

Healthcare Infrastructure Investment: Fund construction of specialized molecular diagnostic laboratories equipped with high-throughput NGS platforms, automated sample processing systems, and bioinformatics computing infrastructure. Provide grants for hospitals and clinics upgrading their diagnostic capabilities to support early cancer screening programs.

Regulatory Pathway Optimization: Develop expedited approval pathways for breakthrough early cancer detection technologies while maintaining rigorous clinical validation requirements. Create regulatory frameworks addressing unique challenges of asymptomatic screening applications and multi-cancer detection platforms.

Research and Development Funding: Finance large-scale clinical trials validating NGS screening effectiveness across diverse populations and cancer types. Support research programs developing next-generation biomarkers, improving test sensitivity and specificity, and reducing false-positive rates.

Healthcare Professional Training: Establish comprehensive education programs for oncologists, primary care physicians, and laboratory technicians on liquid biopsy interpretation, clinical implementation, and patient counseling for early cancer screening results.

Clinical Evidence Development: Coordinate multi-institutional clinical trials demonstrating NGS screening impact on cancer mortality reduction and healthcare outcomes. Establish standardized clinical endpoints and follow-up protocols enabling comparison of different screening technologies and approaches.

Laboratory Quality Standards: Develop comprehensive quality assurance frameworks for NGS-based cancer screening including sample collection protocols, DNA extraction procedures, sequencing quality metrics, and bioinformatics analysis validation. Create proficiency testing programs ensuring laboratory competency and result reliability.

Biomarker Validation Guidelines: Establish rigorous validation criteria for circulating tumor DNA biomarkers including analytical sensitivity, clinical sensitivity, specificity, and positive predictive value requirements. Develop standardized reference materials and control samples for assay validation and quality control.

Clinical Implementation Guidelines: Create evidence-based recommendations for patient selection, screening intervals, result interpretation, and follow-up protocols. Develop clinical decision support tools helping physicians integrate NGS screening results with traditional risk factors and imaging studies.

Health Economics Research: Conduct comprehensive cost-effectiveness analyses comparing NGS screening with conventional screening methods and demonstrating economic value through early detection and treatment cost savings.

Ultra-Sensitive Detection Technologies: Develop next-generation NGS platforms with enhanced sensitivity for detecting low-frequency circulating tumor DNA variants in asymptomatic individuals. Advance molecular barcoding technologies and error correction algorithms minimizing technical artifacts and improving signal-to-noise ratios.

Multi-Cancer Detection Platforms: Create comprehensive screening panels capable of simultaneously detecting multiple cancer types using integrated biomarker approaches including methylation patterns, fragmentation profiles, copy number variations, and protein signatures.

Artificial Intelligence Integration: Implement machine learning algorithms for pattern recognition in complex genomic datasets, improving cancer detection accuracy and reducing false-positive rates. Develop AI-driven risk stratification models integrating genomic data with clinical variables and imaging results.

Point-of-Care Testing Solutions: Advance portable NGS technologies enabling decentralized cancer screening in community health settings and underserved populations. Develop simplified sample-to-result platforms reducing turnaround time and enabling same-visit patient counseling.

Data Integration and Analytics: Create comprehensive bioinformatics platforms integrating multi-omics data with electronic health records, enabling personalized screening recommendations and longitudinal monitoring capabilities.

Clinical Workflow Integration: Develop streamlined protocols for incorporating NGS screening into routine clinical practice including patient education, informed consent procedures, and result communication strategies. Implement electronic health record integration enabling seamless test ordering and result reporting.

Laboratory Operations Excellence: Establish high-throughput sample processing capabilities with automated DNA extraction, library preparation, and sequencing workflows. Implement comprehensive quality management systems ensuring reproducible results and regulatory compliance.

Multidisciplinary Care Coordination: Create tumor boards and consultation networks supporting primary care physicians with complex case interpretation and follow-up recommendations. Develop referral pathways connecting screening results with appropriate diagnostic and treatment specialists.

Patient Support Services: Establish genetic counseling programs helping patients understand screening results, implications for family members, and appropriate follow-up care. Develop patient education materials and support groups addressing psychological aspects of early cancer detection.

Real-World Evidence Generation: Participate in clinical registries and outcome studies tracking long-term effectiveness of NGS screening programs. Contribute to post-market surveillance initiatives monitoring test performance and clinical utility in diverse populations.

Clinical Development Investment: Finance large-scale clinical validation studies demonstrating NGS screening effectiveness and supporting regulatory approval submissions. Structure investments with milestones tied to clinical trial enrollment, primary endpoint achievement, and regulatory approval success.

Technology Innovation Funding: Back companies developing breakthrough technologies including ultra-sensitive detection methods, artificial intelligence algorithms, and integrated multi-omics platforms. Support joint ventures between established diagnostics companies and innovative biotechnology startups.

Market Access and Commercialization: Fund commercial launch activities including health economics studies, reimbursement dossier development, and clinical evidence generation supporting payer coverage decisions. Support expansion into international markets with favorable regulatory and reimbursement environments.

Infrastructure Development: Invest in specialized laboratory networks and service providers supporting NGS screening implementation. Finance construction of regional testing centers and mobile screening units expanding access to underserved populations.

Digital Health Integration: Support companies developing comprehensive cancer screening platforms integrating NGS testing with risk assessment tools, patient management systems, and population health analytics. Finance development of digital therapeutics supporting cancer prevention and early intervention strategies.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 591.6 million |

| Technology Type | cfDNA Methylation Sequencing, Whole Genome Sequencing Based on cfDNA Fragmentation End Characteristics, Copy Number Variation (CNV) Analysis, and Integrated Multi-Omics Approaches |

| End-Use | Hospitals, Clinics, Medical Laboratories, University Laboratories, and Other Healthcare Facilities |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | GRAIL, Inc., Exact SciencesCorporation, Guardant Health Inc., Akery, Foundation Medicine, Inc., Illumina Inc., Hangzhou New Horizon Health Technology Co. Ltd., Berry Oncology Co. Ltd., Genetron Health (Beijing) Co. Ltd., Yeasen Biotechnology Co., Ltd., Guangzhou Burning Rock Dx Co. Ltd., BGI Genomics Co. Ltd., Jiangsu Huayuan Biotechnology Co. Ltd. |

| Additional Attributes | Dollar sales by technology type, end-use sector, and cancer detection scope, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established biotechnology companies and emerging precision medicine providers, healthcare system preferences for validated versus investigational screening approaches, integration with electronic health records and clinical decision support systems |

The global NGS solution for early cancer screening market is estimated to be valued at USD 591.6 million in 2025.

The market size for the NGS solution for early cancer screening market is projected to reach USD 2,393.5 million by 2035.

The NGS solution for early cancer screening market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in NGS solution for early cancer screening market are cfdna methylation sequencing and whole genome sequencing based on cfdna fragmentation end characteristics and cnv.

In terms of application, hospitals segment to command 40.0% share in the NGS solution for early cancer screening market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

NGS-based AMR Detection Market Analysis Size and Share Forecast Outlook 2025 to 2035

NGS Sample Preparation Market Size and Share Forecast Outlook 2025 to 2035

Tungsten Disulphide Nanoparticles Market

Tungsten Metal Powder Market

Tungsten Carbide Market

Slingshot/3 Wheeled Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Fillings and Toppings Companies

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Smart Rings Market Size and Share Forecast Outlook 2025 to 2035

Shortenings Market Size, Growth, and Forecast for 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Phosphotungstic Acid Market Size and Share Forecast Outlook 2025 to 2035

Gas Fittings & Components Market – Market Demand & Safety Insights 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Grid Packings Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA