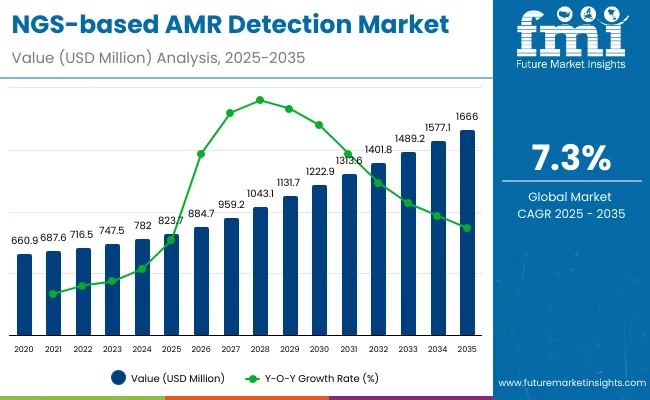

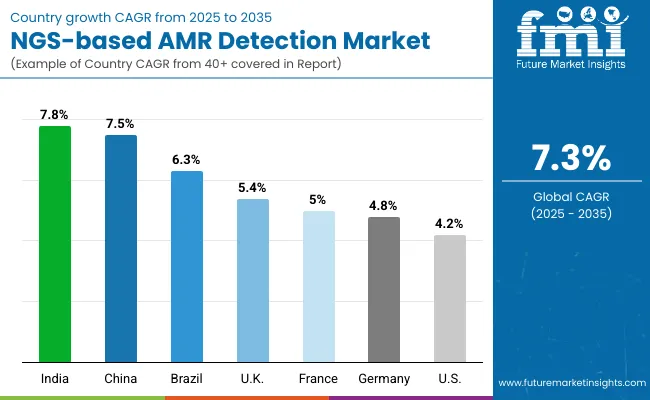

The global NGS-based AMR Detection Market is expected to reach a valuation of USD 823.7 million by 2025, growing to USD 1,666.0 million by 2035. This reflects an absolute increase of USD 842.6 million over the ten-year period, representing a 2.02X growth. The market is projected to expand at a robust compound annual growth rate (CAGR) of 7.3%, driven by the rising burden of antimicrobial resistance, advancements in NGS technologies, and increasing adoption in clinical and public health applications.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 823.7 million |

| Industry Value (2035F) | USD 1,666.0 million |

| CAGR (2025 to 2035) | 7.3% |

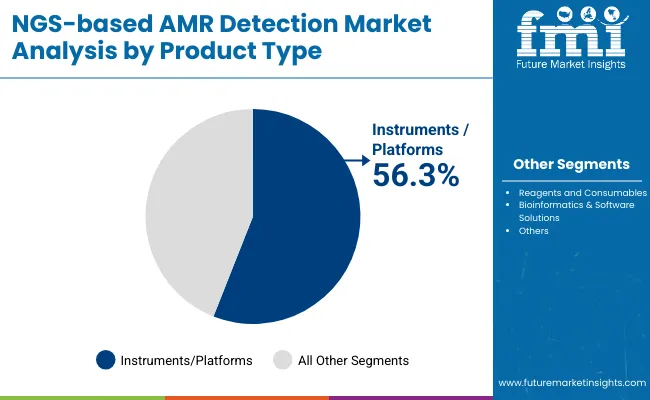

During the first five-year period from 2025 to 2030, the global NGS-based AMR Detection Market is projected to grow from USD 823.7 million to approximately USD 1,222.9 million, adding USD 399.2 million in value. This growth accounts for nearly 47.4% of the total market expansion expected over the 2025-2035 decade. Within the product type category, the Instruments/Platforms segment will maintain dominance, projected to hold around 58.5% share by 2030, supported by widespread adoption across hospitals, public health labs, and pharma companies. The Reagents and Consumables segment is expected to rise steadily, reaching approximately 29.5% share by 2030, driven by the recurring demand associated with routine sequencing workflows. Meanwhile, Bioinformatics & Software Solutions will see a relative decline, expected to hold below 12% share by 2030, reflecting a shift toward integrated and bundled platform offerings.

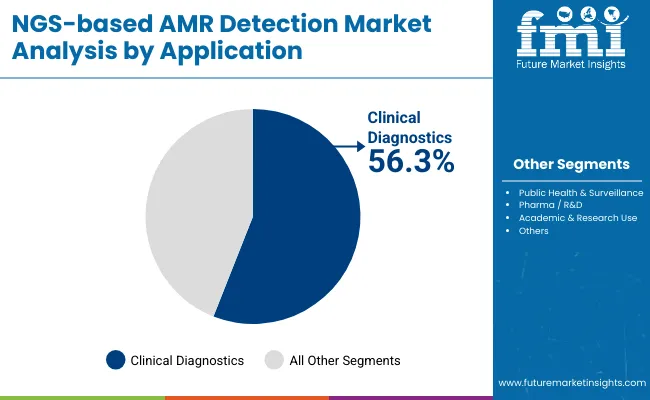

The second half from 2030 to 2035 contributes USD 443.4million which is equal to 52.6% of the total growth as the market jumps from USD 1,222.9million to USD 1,666.0million,accounting for 52.6% of the total decade-long market growth. This accelerated momentum will be driven by the deepening integration of NGS-based antimicrobial resistance (AMR) detection across clinical diagnostics and public health surveillance systems globally. Towards the end of 2035, Clinical Diagnostics and Public Health & Surveillance hold 78.7% cumulatively.

From 2020 to 2024, the global NGS-based AMR Detection Market expanded from USD 660.9million to USD 782.0million, reflecting a compound annual growth rate (CAGR) of 5.5%. This growth was largely driven by increasing awareness of antimicrobial resistance (AMR) and early adoption of NGS technologies for resistance gene detection in clinical and public health settings. Leading companies such as Illumina, QIAGEN, and Thermo Fisher Scientific collectively accounted for an estimated over 50% of global revenues, propelled by bundled offerings of sequencing instruments, reagent kits, and bioinformatics platforms.

These players have actively pursued strategies such as the launch of rapid library preparation kits, enhancements in cloud-based bioinformatics pipelines, and partnerships with academic and clinical laboratories to validate real-world applications of NGS in AMR surveillance and diagnostics. Their continued focus on workflow automation and integration with electronic health systems has further reinforced their competitive position during this period.

In 2025, the global NGS-based AMR Detection Market is projected to reach a value of approximately USD 823.7 million, fueled by the transition from conventional culture-based antimicrobial susceptibility testing to advanced, genomics-driven diagnostic ecosystems. This growth is being driven by increasing investments from hospitals, public health agencies, and pharmaceutical companies in precision diagnostics, real-time resistance surveillance, and genomic epidemiology. Healthcare institutions are actively adopting NGS platforms integrated with automated library prep, targeted AMR panels, and cloud-based bioinformatics tools to accelerate detection workflows and improve treatment decision-making. Regulatory alignment with global AMR action plans and support from agencies such as the CDC, ECDC, and WHO is further pushing the adoption of genomic sequencing in infectious disease labs. Additionally, user demand is shifting toward modular, scalable sequencing systems and plug-and-play informatics dashboards that can support both high-throughput and point-of-care use cases while ensuring rapid turnaround times and robust data interpretation.

NGS-based AMR Detection is experiencing robust growth as healthcare systems globally face intensifying pressure to combat rising antimicrobial resistance, improve diagnostic turnaround times, and support evidence-based infection management. Key drivers fueling market expansion include increasing incidence of multidrug-resistant infections, regulatory mandates for AMR surveillance, and the growing demand for precision diagnostics. The global healthcare industry is rapidly shifting toward genomic platforms that can deliver high-throughput, pathogen-specific resistance profiling with enhanced speed and accuracy compared to conventional methods.

Technological innovations such as automated sample prep kits, cloud-native bioinformatics pipelines, and customizable AMR gene panels are reducing time-to-result and minimizing human interpretation errors, delivering measurable clinical and operational benefits. The COVID-19 pandemic highlighted the importance of genomic surveillance infrastructure, which has since been extended to AMR tracking, accelerating adoption of NGS across hospitals and public health agencies. As healthcare budgets increasingly prioritize infection control, data-driven therapeutics, and diagnostic preparedness, vendors offering end-to-end sequencing solutions with integrated reporting and pathogen tracking are capturing significant market share.

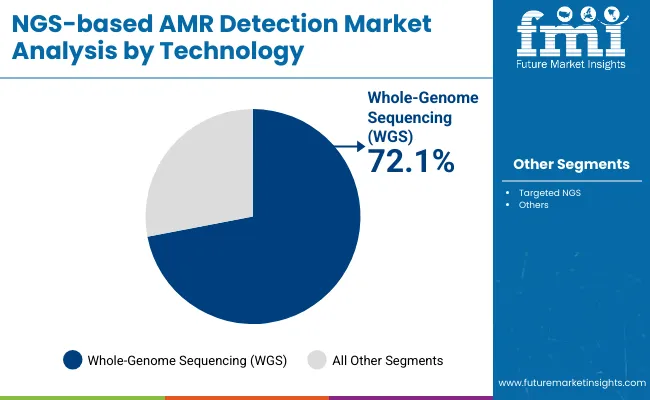

The market is segmented by Product Type, Technology, Application, End User, and region. Product include Instruments/Platforms, Reagents and Consumables, and Bioinformatics & Software Solutions. Technology classification covers Whole-Genome Sequencing (WGS) and Targeted NGS. By Application segment includes Clinical Diagnostics, Public Health & Surveillance, Pharma/R&D, and Academic & Research Use. Based on End User, the segmentation includes Hospitals & Clinical Laboratories, Public Health Agencies & Reference Labs, Pharmaceutical & Biotechnology Companies, and Academic & Research Institutes. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

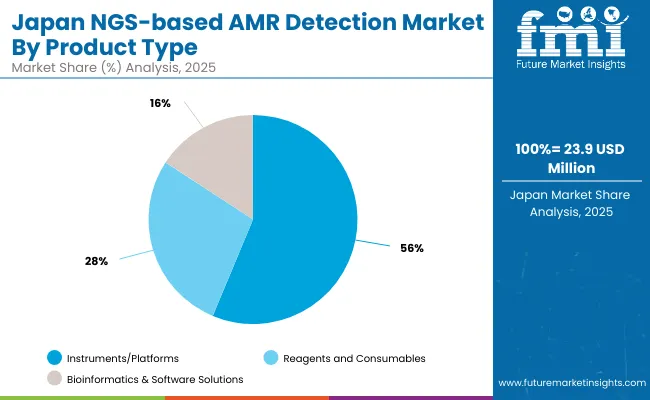

| Product Type | Market Share (%) |

|---|---|

| Instruments/Platforms | 56.3% |

| Reagents and Consumables | 27.9% |

| Bioinformatics & Software Solutions | 15.8% |

Instruments and platforms are expected to retain a dominant position in the NGS-based AMR Detection Market, accounting for approximately 56.3% of the market share in 2025. Their prominence is driven by the critical need for high-throughput, accurate sequencing systems capable of comprehensive antimicrobial resistance profiling. Healthcare providers, public health agencies, and pharmaceutical companies are increasingly investing in state-of-the-art sequencing platforms that offer rapid turnaround times, scalability, and integration with automated workflows. The adoption of these instruments is further propelled by ongoing advancements in sequencing technology, such as improved accuracy, longer read lengths, and enhanced multiplexing capabilities, which collectively support precise identification of resistance genes and mutations. Regulatory bodies and infection control protocols emphasize the importance of reliable and reproducible genomic data, encouraging institutions to upgrade from traditional methods to cutting-edge NGS platforms.

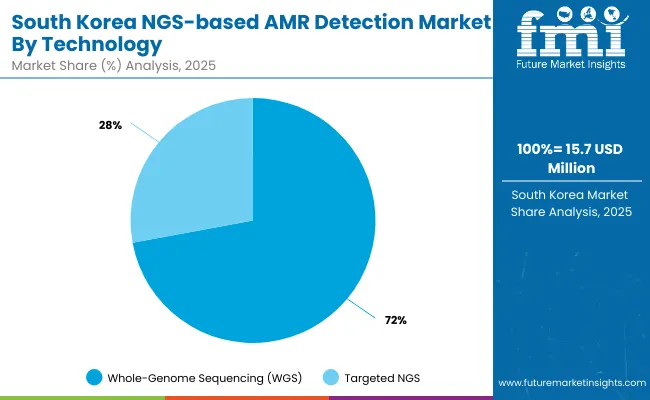

| Technology | Market Share (%) |

|---|---|

| Whole-Genome Sequencing (WGS) | 72.1% |

| Targeted NGS | 27.9% |

Whole-Genome Sequencing (WGS) has emerged as the leading technology in the NGS-based AMR Detection Market, projected to hold approximately 72.1% of the market share in 2025. This dominant position is driven by the growing demand for comprehensive and high-resolution profiling of antimicrobial resistance genes across diverse pathogens. Regulatory agencies and healthcare organizations are increasingly endorsing WGS for its unparalleled ability to provide detailed genomic insights, enabling accurate identification of resistance mechanisms, outbreak tracking, and epidemiological surveillance.

The rise of multidrug-resistant infections and the need for precision antimicrobial stewardship have further accelerated the adoption of WGS in clinical diagnostics, public health laboratories, and pharmaceutical R&D. WGS enables complete characterization of bacterial genomes, offering actionable data to guide treatment decisions and containment strategies. Additionally, advancements in sequencing speed, cost reduction, and bioinformatics tools have made WGS more accessible and practical for routine AMR detection workflows.

| Application | Market Share (%) |

|---|---|

| Clinical Diagnostics | 56.3% |

| Public Health & Surveillance | 22.4% |

| Pharma/R&D | 15.0% |

| Academic & Research Use | 6.3% |

Clinical Diagnostics is expected to retain a dominant position in the NGS-based AMR Detection Market, accounting for approximately 56.3% of the market share in 2025. This leadership is driven by the increasing adoption of next-generation sequencing technologies in hospitals and clinical laboratories for rapid, precise identification of antimicrobial resistance profiles. The rising prevalence of multidrug-resistant infections and the urgent need for tailored antibiotic therapies have underscored the value of NGS in improving patient outcomes through timely and accurate diagnostics.

Healthcare providers are increasingly integrating NGS-based AMR detection into routine diagnostic workflows, enabling comprehensive pathogen characterization and resistance gene identification in a single assay. This integration supports antibiotic stewardship programs and helps reduce empirical antibiotic use, mitigating the spread of resistance. Technological advancements in sequencing speed, cost-effectiveness, and user-friendly bioinformatics solutions further facilitate clinical adoption.

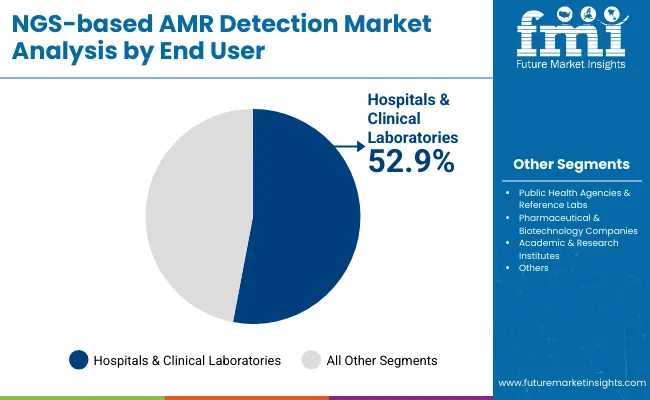

| End User | Market Share (%) |

|---|---|

| Hospitals & Clinical Laboratories | 52.9% |

| Public Health Agencies & Reference Labs | 24.7% |

| Pharmaceutical & Biotechnology Companies | 15.3% |

| Academic & Research Institutes | 7.1% |

Hospitals and Clinical Laboratories are expected to remain the largest end-user segment in the NGS-based AMR Detection Market, contributing approximately 52.9% of the market share in 2025. This dominance is driven by the increasing need for rapid, accurate, and comprehensive antimicrobial resistance detection in clinical settings where timely diagnosis directly impacts patient management and treatment outcomes. Hospitals perform the majority of infectious disease testing and require scalable, regulation-compliant sequencing solutions to meet growing demands from infection control and antibiotic stewardship programs.

The rising incidence of multidrug-resistant infections in healthcare facilities has accelerated investments in advanced NGS platforms and associated consumables to support high-throughput genomic surveillance and diagnostics. Additionally, hospital laboratories are upgrading their infrastructure to integrate automated workflows and bioinformatics tools that streamline data analysis and reporting, ensuring compliance with stringent healthcare regulations and quality standards.

Rising Incidence of Antimicrobial Resistance (AMR)

The rising incidence of antimicrobial resistance (AMR) is a significant driver accelerating the growth of the global NGS-based AMR Detection Market. According to the World Health Organization (WHO), bacterial AMR was directly responsible for 1.27 million deaths and contributed to nearly 4.95 million deaths globally in 2019. Without effective interventions, it is projected that AMR could lead to 10 million deaths annually by 2050, surpassing fatalities from cancer. This escalating threat has prompted urgent action from global health bodies, including the WHO’s Global Action Plan on AMR, which emphasizes the critical role of enhanced surveillance and research. Next-generation sequencing (NGS), particularly whole-genome sequencing (WGS), has emerged as a preferred technology for AMR surveillance due to its ability to provide high-resolution data on resistance genes, transmission patterns, and genetic mutations.

Platforms from leading companies like Illumina are increasingly used in public health agencies to track outbreaks, detect emerging resistance genes, and inform antimicrobial stewardship strategies. Additionally, initiatives such as the Global Antimicrobial Resistance Surveillance System (GLASS) advocate for the integration of genomics into routine AMR monitoring frameworks, further validating the role of NGS. These developments are propelling investment in NGS-based technologies by hospitals, public health labs, and pharmaceutical companies seeking faster, more comprehensive resistance profiling tools. As a result, the global surge in AMR prevalence is not only raising clinical concerns but also creating sustained demand for NGS-based diagnostic and surveillance solutions, driving market growth significantly.

Limited Standardization and Data Interpretation Complexity

The growth of the global NGS‑based AMR Detection Market is being hampered by the lack of standardized workflows and the complexity of interpreting sequencing data. As identified in expert reviews, the absence of unified protocols, from sample preparation and DNA extraction to library prep and bioinformatics analysis, undermines consistency across laboratories and complicates cross-study comparisons. There is, for example, no universally accepted reference reagents or clinical breakpoints for interpreting resistance-related genomic predictions, even as WGS becomes more central to AMR diagnosis and surveillance.

Moreover, the bioinformatics layer poses significant challenges: devising validated pipelines to reliably detect resistance determinants requires rigorous benchmarking and quality assurance measures, yet such robust resources remain scarce. This need for harmonized validation tools and performance metrics is especially pressing given the reliance on diverse platforms and analytical approaches. Laboratories also face hurdles in interpretation. Clinical metagenomic sequencing can yield vast, complex datasets that demand deep bioinformatics expertise to identify clinically actionable findings accurately. Many labs lack the specialized computational infrastructure and skilled personnel to filter out noise such as contaminating human DNA and to translate raw reads into reliable resistance profiles

Integration of AI-Driven Bioinformatics and Cloud-Based Analytics

The integration of AI-driven bioinformatics and cloud-based analytics is emerging as a major market trend propelling the global NGS‑based AMR Detection Market. As the volume and complexity of genomic data generated by NGS platforms continue to escalate, traditional bioinformatics is straining under the burden. AI-powered algorithms particularly those utilizing machine learning and deep learning are being deployed to accelerate and improve accuracy in variant calling, resistance gene identification, and data interpretation, transforming complex raw data into actionable insights. In parallel, cloud-native platforms are gaining traction due to their scalability, accessibility, and pay-as-you-go cost structure. These platforms enable widespread access to advanced analytics workflows, even for smaller labs with limited in-house infrastructure, while offering high-performance computing and storage capabilities. The synergy of AI-enhanced analysis and flexible cloud deployment is thus enabling faster, more reliable AMR detection and expanding adoption of NGS tools across clinical, public health, and research environments.

| Countries | CAGR |

|---|---|

| USA | 4.2% |

| Brazil | 6.3% |

| China | 7.5% |

| India | 7.8% |

| Europe | 5.1% |

| Germany | 4.8% |

| France | 5.0% |

| UK | 5.4% |

Asia Pacific is emerging as the fastest-growing region in the global NGS-based AMR Detection Market, projected to expand at a CAGR of 7.2% between 2025 and 2035. India, with a CAGR of 6.9%, is witnessing strong momentum due to government-backed antimicrobial resistance surveillance programs, increased investments in genomic laboratories, and the expansion of tertiary care hospitals equipped with next-generation sequencing (NGS) capabilities. China, growing at 7.2% CAGR, is advancing large-scale pathogen genomic monitoring across hospital networks and provincial centers for disease control (CDCs), driven by its national action plans to combat AMR. Regional growth is further supported by the WHO's GLASS initiative and APAC-specific collaborations such as Japan’s National Institute of Infectious Diseases (NIID), which is strengthening the role of Whole-Genome Sequencing (WGS) in AMR surveillance.

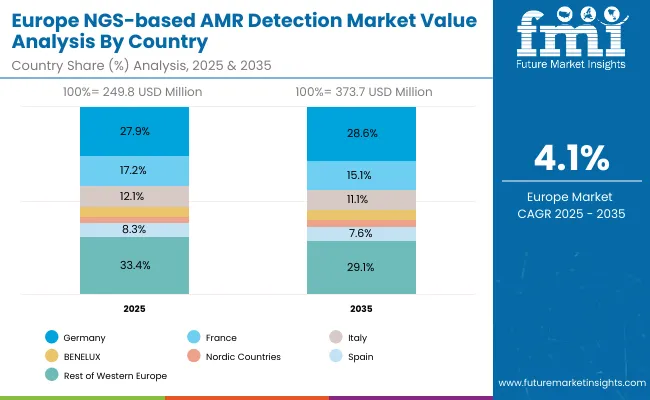

Europe is expected to grow at a CAGR of 7.1% through 2035, driven by robust policy frameworks, established AMR surveillance systems, and increased R&D funding for genomic diagnostics. Germany is projected to grow at 7.6% CAGR, supported by precision medicine initiatives and hospital modernization, contributing 28.9% of Europe’s total NGS-based AMR Detection Market by 2035. France (5.0% CAGR) benefits from national health reforms under the “Ségur de la santé” plan, which prioritizes public health genomics. The UK, growing at 6.3% CAGR, is reinforcing its commitment to AMR surveillance via the UKHSA and investments in pathogen genomics infrastructure through Genomics England and NHS partnerships.

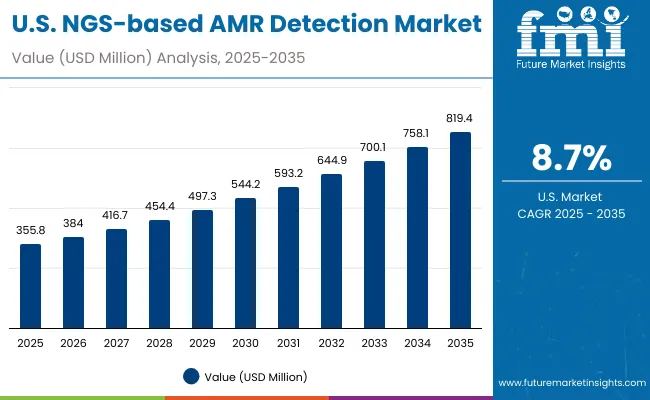

North America remains the largest and most mature region, led by the United States, which is projected to grow at a CAGR of 8.7% between 2025 and 2035. The USA market—valued at USD 355.8 million in 2025 and expected to reach USD 819.5 million by 2035—is driven by the integration of AI-enabled bioinformatics platforms, federal funding for AMR detection, and expansion of sequencing capacity in clinical and public health labs. Initiatives like the CDC’s Antibiotic Resistance Solutions Initiative and the National Action Plan for Combating Antibiotic-Resistant Bacteria are accelerating NGS deployment. The rise of cloud-based data analytics and real-time genomic surveillance tools is further fueling adoption across hospitals, academic centers, and reference labs.

The NGS-based AMR Detection Market in the United States is projected to grow at a CAGR of 8.7% between 2025 and 2035, rising from USD 355.8 million in 2025 to USD 819.4 million by 2035. This growth is largely driven by aggressive national efforts to combat antimicrobial resistance, spearheaded by federal initiatives such as the CDC's AR Solutions Initiative, NIH-funded genomic research programs, and interagency collaboration under the National Action Plan for Combating Antibiotic-Resistant Bacteria. Hospitals, public health labs, and pharmaceutical companies are scaling up NGS implementation to support rapid, high-throughput detection of resistance genes directly from clinical isolates and metagenomic samples. A push toward real-time genomic surveillance, AI-enabled analytics, and cloud-integrated sequencing pipelines is further advancing market maturity in the USA

The NGS-based AMR Detection Market in the United Kingdom is projected to grow at a CAGR of 6.3% through 2035, driven by nationwide efforts to bolster pathogen genomics and antimicrobial stewardship as part of the UK’s Five-Year National Action Plan on AMR (2019-2024) and its post-Brexit health security agenda. The country’s market share within Europe is expected to reach 19.1% by 2035, supported by sustained investments from NHS England and UKHSA (UK Health Security Agency) in decentralized sequencing infrastructure and bioinformatics capabilities. Programs such as the Genomics England Pathogen Genomics Service and NHS-led adoption of WGS in clinical microbiology labs are enhancing the real-time monitoring of drug-resistant infections and community outbreaks.

The NGS-based AMR Detection Market in Germany is projected to grow at a CAGR of 7.6% through 2035, reflecting one of the strongest growth trajectories in Western Europe. Germany is expected to maintain its lead within the European market, increasing its share from 27.9% in 2025 to 28.9% by 2035. The country’s robust healthcare infrastructure, well-funded public health system, and strong regulatory oversight are contributing to accelerated adoption of whole-genome sequencing (WGS) for AMR detection. Backed by federal investments through initiatives like Digital Healthcare Act (DVG) and the Krankenhauszukunftsgesetz (KHZG), hospitals and research centers are upgrading microbiology labs with next-generation sequencing systems to detect resistance determinants in real-time and inform therapeutic strategies.

Moreover, the German healthcare sector’s emphasis on evidence-based infection control, hospital hygiene law (IfSG §23), and rigorous antimicrobial stewardship programs is driving demand for sequencing platforms that deliver actionable, reproducible resistance data.

| Europe Countries | 2025 |

|---|---|

| Germany | 27.9% |

| France | 17.2% |

| Italy | 12.1% |

| BENELUX | 6.0% |

| Nordic Countries | 3.4% |

| Spain | 8.3% |

| Rest of Western Europe | 33.4% |

| Europe Countries | 2035 |

|---|---|

| Germany | 28.6% |

| France | 15.1% |

| Italy | 11.1% |

| BENELUX | 5.4% |

| Nordic Countries | 3.3% |

| Spain | 7.6% |

| Rest of Western Europe | 29.1% |

The NGS-based AMR Detection Market in India is expected to grow at a CAGR of 7.5% between 2025 and 2035, making it one of the fastest-expanding markets in the Asia Pacific region. This robust growth is being driven by the escalating burden of antimicrobial resistance (AMR), the increasing availability of sequencing technologies, and strong government commitment under the National Action Plan on AMR (NAP-AMR). As India continues to report high rates of multidrug-resistant infections, major hospitals, research institutes, and public health labs are adopting next-generation sequencing (NGS) for faster and more accurate detection of resistance patterns.

Leading public health agencies, including the Indian Council of Medical Research (ICMR) and National Centre for Disease Control (NCDC), have rolled out nationwide AMR surveillance programs that emphasize genomic analysis. Concurrently, India's private diagnostic labs and hospital chains are investing in in-house NGS platforms to enable localized, real-time AMR profiling, especially in ICUs, oncology, and transplant care units.

The NGS-based AMR Detection Market in China is projected to grow at a CAGR of 7.5% between 2025 and 2035, driven by the country’s expanding national genomics infrastructure and heightened focus on combating antimicrobial resistance. Under the Healthy China 2030 policy, China’s National Health Commission (NHC) and Center for Disease Control (CDC China) are ramping up genomic surveillance of AMR pathogens, creating a strong foundation for the widespread integration of next-generation sequencing (NGS) technologies in clinical and public health settings.

High-burden hospital-acquired infections (HAIs), especially involving carbapenem-resistant Enterobacteriaceae (CRE) and multidrug-resistant Pseudomonas aeruginosa, have spurred investments in whole-genome sequencing (WGS) platforms across top-tier hospitals and provincial CDCs. In addition, the Chinese government is funding regional AMR monitoring centers that utilize NGS for resistance gene tracking and outbreak detection.

The NGS-based AMR Detection Market in Japan is projected to reach approximately USD 23.8 million in 2025, growing at a CAGR of 6.1%, reflecting a focused but steadily expanding deployment of next-generation sequencing in antimicrobial resistance (AMR) detection primarily driven by public health initiatives and a precision medicine framework.

Japan’s growing concern over multidrug-resistant organisms (MDROs), especially in aging and immunocompromised populations, has prompted hospitals and public health agencies to invest in Whole-Genome Sequencing (WGS) tools, which dominate the technology segment with 72.1% share. This trend is further reinforced by government-backed surveillance programs like the Japan Nosocomial Infections Surveillance (JANIS), which increasingly utilize NGS data for resistance gene tracking and outbreak source identification.

The NGS-based AMR Detection Market in South Korea is projected to reach USD 15.6 million in 2025, growing to USD 25.01 million by 2035, with a forecast CAGR of 4.8%. Though relatively smaller in size compared to Western counterparts, South Korea represents a strategically important market within the Asia-Pacific region, driven by robust national healthcare IT systems, universal health coverage, and increasing investment in infectious disease surveillance.

The global NGS-based AMR Detection Market is moderately consolidated, with a mix of leading sequencing platform providers, molecular diagnostics companies, and niche AMR-focused biotech firms. The competitive environment is shaped by continual innovations in sequencing accuracy, bioinformatics pipelines, and regulatory-aligned diagnostic offerings.

Illumina, holding the largest individual market share at 31.4% in 2025, dominates the market with its widely adopted sequencing platforms such as the NextSeq and MiSeq systems. Its leadership is reinforced by high-throughput capabilities, strong distribution channels, and end-to-end bioinformatics tools tailored for microbial resistance gene analysis. Illumina’s continued investment in clinical-grade sequencing and partnerships with public health agencies (e.g., CDC’s AMD program) strengthens its position in AMR surveillance and hospital diagnostics.

Thermo Fisher Scientific, QIAGEN, and bioMérieux are key established players providing integrated workflows that combine sequencing platforms, sample prep kits, and informatics tailored to infectious disease diagnostics. Thermo Fisher’s Ion Torrent platforms are leveraged in both research and regulated diagnostics, while QIAGEN offers targeted panels and pathogen-specific AMR detection kits. bioMérieux continues to enhance its AMR footprint through sequencing-linked pathogen ID and resistance profiling, supported by its acquisition of companies such as BioFire and Invisible Sentinel.

Mid-sized firms like CD Genomics, Diagnostics Longwood SL, and Credence Genomics are gaining traction through cost-competitive sequencing services, customized AMR panels, and bioinformatics solutions for low- and middle-income country (LMIC) markets. These companies often work with local governments and research institutes to build AMR surveillance capacity at the population level.

Fraunhofer IGB and other emerging academic and public research institutions are contributing through open-source bioinformatics tools and regional pilot programs. Their work focuses on decentralized AMR tracking and novel detection methods-particularly in the context of zoonotic and environmental resistomes.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 823.7 million |

| Product type | Instruments/Platforms, Reagents and Consumables, and Bioinformatics & Software Solutions |

| Technology | Whole-Genome Sequencing (WGS) and Targeted NGS |

| Application | Clinical Diagnostics, Public Health & Surveillance, Pharma/R&D and Academic & Research Use |

| End User | Ho spitals & Clinical Laboratories, Public Health Agencies & Reference Labs, Pharmaceutical & Biotechnology Companies and Academic & Research Institutes |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | Illumina, QIAGEN, Thermo Fisher Scientific, BIOMÉRIEUX, Abbott, ACRO Biosystems, CD Genomics., Diagnostics Longwood SL, Credence Genomics, and Fraunhofer IGB |

| Additional Attributes | Dollar sales by Product Type and region s, adoption trends of Integration of AI-Driven Bioinformatics and Cloud-Based Analytics, and Rising Incidence of Antimicrobial Resistance (AMR) |

The global NGS-based AMR Detection Market is estimated to be valued at USD 823.70 million in 2025.

The market size for NGS-based AMR Detection Market is projected to reach USD 1,666.0 million by 2035.

The NGS-based AMR Detection Market is expected to grow at a CAGR of 7.3% during this period.

Key product types include Instruments/Platforms, Reagents and Consumables and Bioinformatics & Software Solutions.

The Clinical Diagnostics segment is projected to command 56.3% of the market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA