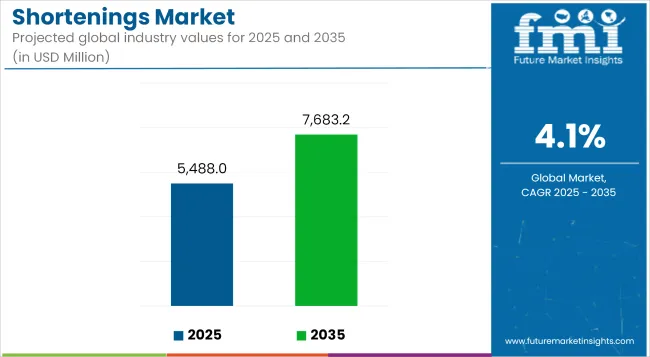

The shortenings market, valued at USD 5,488.0 million in 2025, is poised to reach approximately USD 7,683.2 million by 2035, reflecting sustained growth at a CAGR of 4.1%. With rising applications across bakery, confectionery, and food processing sectors, the market has been gaining momentum across both developed and developing economies. Particularly in processed baked goods, shortenings are being increasingly preferred for their performance in imparting flakiness, volume, and shelf stability.

Growth in this market has been underpinned by the increasing demand for clean-label and non-hydrogenated variants, coupled with technological advancements in fat structuring and emulsification. A clear trend toward plant-based and sustainable fat sources is reshaping product development pipelines.

However, regulatory scrutiny over trans fats and saturated fat content continues to restrain broader adoption, particularly in regions with strict labeling norms. Simultaneously, reformulation initiatives and strategic innovation in palm-free alternatives are being prioritized by manufacturers.

Shelf-life enhancement, mouthfeel optimization, and performance in high-heat applications are among the critical areas being optimized. The market is also witnessing diversification of shortenings into newer end-use sectors such as RTE meals and industrial frying.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 5,488.0 Million |

| Projected Global Industry Value (2035F) | USD 7,683.2 Million |

| Value-based CAGR (2025 to 2035) | 4.1% |

Vegetable oil-based shortenings will be dominating the landscape with over 56.7% market share, supported by their versatile melting profiles and compatibility with both traditional and clean-label formats. Bakery applications will continue to account for the highest usage, comprising an estimated 34.5% of the market in 2025, propelled by evolving consumer preferences for premium and artisanal textures.

By 2035, new product launches are expected to focus on multi-functional shortenings that cater to both flavor retention and health-positioned claims. Demand will likely strengthen in Asia Pacific and the Middle East, where processed food production and consumption are rapidly expanding. Innovations aimed at achieving trans-fat-free status without compromising on texture will be central to future differentiation.

Foodservice applications are expected to contribute over 16.4% of the global shortenings market in 2025, driven by demand from QSR chains and institutional kitchens prioritizing oil stability and yield. Shortenings optimized for deep frying extend fry life, reduce oil absorption, and enhance crispness consistency-key to large-scale operations.

In regions like Southeast Asia and the Middle East, where fried foods are culinary staples, adoption is accelerating with a preference for palm-based and blended formulations that offer cost-effectiveness and flavor neutrality. Regulatory influences, such as mandatory trans-fat restrictions by the Food Safety and Standards Authority of India (FSSAI) and Gulf Standards Organization (GSO), have prompted reformulations toward interesterified fats and high-oleic bases.

Industry players like Bunge Loders Croklaan and Cargill have launched frying shortenings tailored for reuse cycles and oxidative resistance, aligning with operator profitability and food quality standards. Continued innovation in emulsifier incorporation and anti-foaming properties is likely to define competitive differentiation.

Additionally, the sector is witnessing interest in shortening formats compatible with filtration systems and minimal waste protocols. With dine-in and delivery growth in emerging markets, demand for frying shortenings with enhanced performance metrics and labeling compliance is forecast to expand steadily through 2035.

Plant-based reformulation-specific shortenings are projected to capture over 10.2% of the market by 2030, reflecting heightened demand for animal-free and clean-label ingredients across meat analogues and vegan bakery applications. These shortenings are engineered to mimic the functionality of lard, tallow, or dairy-based fats without compromising on sensory characteristics such as mouthfeel, aeration, or spreadability.

The shift is being led by innovation-centric companies like AAK and IOI Loders Croklaan, who are developing specialty palm-free and coconut-oil-derived shortenings featuring optimized solid fat content (SFC) curves and rapid crystallization behavior. Europe and North America represent early adoption hubs, influenced by vegan labeling norms under EFSA and FDA guidance and increasing scrutiny over saturated fat levels.

Formulators are also leveraging these shortenings to meet sustainability pledges by reducing animal-derived input dependencies. Custom shortening systems with soy, shea, or rice bran oil fractions are gaining traction as viable drop-in solutions.

Such specialized ingredients also support allergen-free and non-GMO declarations, enabling brand differentiation in plant-forward formulations. As plant-based growth spills into segments like dairy-free pastries, frozen desserts, and spreads, the demand for high-performance vegan-compatible shortenings is likely to intensify.

Development of shortenings with lower trans-fat and non-hydrogenated options

Market for shortenings has also shifted remarkably due to the new general trend towards taking healthier foods. Classically, shortenings were hydrogenated to enable the product to remain in the solid state at room temperature with higher trans- fats. However, due to increasing concern over health consequences of trans-fats, there have been attempts towards creating shortening with less or zero trans-fat.

BI has also reported that to achieve similar functional properties like traditional shortenings such as flakiness and tender crumbly texture, companies are using the money to carry out research and development on the new healthier substitutes.

Some of these innovations are; In order to avoid spoilt oils, innovation has led to the use of natural antioxidants besides having different types of oils ground together to the desirable butter consistency. This trend has special implications to markets that have over the recent past, adopted strict rules in regulating trans-fat content, leading to healthier formulations from manufacturers.

Rising demand for natural and clean-label ingredients in food products

The consumer today is very selective when choosing what to eat and this is largely because people are conscious of synthesized additives and preservatives added to their food. This has led to an increase in the market of clean label products which are products with list of ingredients that are easy to understand. The clean label concept that best defines the new trend among shoppers has therefore led to the modification of food shortenings for cleaner labels.

Clean label shortenings can actually employ natural antioxidants like vitamin E and rosemary extract that would prolong product shelf life and literally eliminate synthetic ingredients. In addition, processing techniques have been improved in order to retain the primary characteristics of the components.

This mechanism corresponds to the general trend of increasing the transparency of labels on food products, as people try to make conscious decisions. Therefore, clean label products are perceived not only to be healthy, but also to be more trustworthy, which also led to demand increase.

Expansion of vegan and plant-based shortening products to cater to dietary preferences

The advancement in the vegan, plant-based diets market remains persistent and immensely affecting the shortenings market mainly. The shortenings that were previously in use are products of tenderisations of animal fats such as lard and butter; these are gradually being replaced by plant-based shortenings. These veggie-based margarines utilise coconut, palm, sunflower and soy oils to come up with products that will be marketable to vegan consumers.

The trend is therefore of ethical nature alongside health concerns since plant based diets are perceived as healthier and sustainable. Manufacturers are also paying much attention towards its functionality where plant-based shortenings must perform as well as animal-based ones in terms of texture and flavors amongst others. Besides the qualification of the new end markets, this entry into plant-based shortenings fits well with consumers’ rising concerns with sustainable and ethical consumption.

Growing trend of local production to reduce carbon footprints and support local economies

Environmental issues and sustainability have turned out to be central in the determination of the food production systems in the contemporary society. Production of shortenings locally is on the rise given that it contributes to abatement of the carbon footprints as well as stimulation of local economies. The control of product carbon impact could also be improved by purchasing raw materials locally so that there is little transportation required for materials.

Bringing economic benefits to the local farmers by stable income, it also reduces the negative impact to the environment. The localization trend also turns into the advantage as applied to the supply chain: the best quality and freshness are guaranteed.

In addition, consumers are also have trend and preferences in buying locally products because the consumers feel that these product have better quality and they also support the local industries. With this model being adopted by more firms, there is likely to be change towards sustaining and community as a focal point on the side of the shortening industry.

Tier 1: In the shortening market, Cargill Incorporated, Bunge Limited and Archer Daniels Midland Company can be considered leading Tier 1 players. It means that they could have broad production facilities, elaborate delivery systems, and extremely wide cross-national coverage, which enabled them to dominate a good part of the market demand. They are able to set industry standards and prices using their capabilities and in turn push for higher innovation ad technology.

Tier 2: In Tier 2, involved manufacturers include Lonza Group AG, Palsgaard, RIKEN VITAMIN Co., Ltd., and AAK Kamani Pvt Ltd. Although they are largely comparatively smaller to the Tier 1 firms, such companies wield considerable power in the market place, especially the regional markets. The fact is that their market penetration is usually much higher, thanks to specific knowledge about specific industries, as well as product specialization, when developing goods that meet definite requirements of a client.

Tier 3: Mallet & Company, Inc., Natu’oil Services Inc., Western Pacific Oils Inc., Agarwal Industries Ltd., Roberts Manufacturing Co. Ltd, Stratas Holdings Ltd, Carotino SDN BHD, PT.Tiido Pratama Indah. ICC Indonesia, THE J.M. Smucker Company, and Edible Oils Ltd are in the Tier 3 companies. These firms mainly act within a certain geographical area or country and are tailored to deliver goods and services to small specified segments of markets. Both their market strategies focus on specialization and, therefore, the delivery of products to suit the requirements of clients.

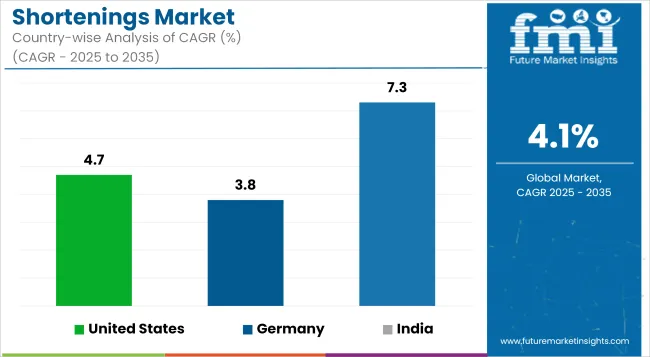

The following table shows the estimated growth rates of the significant three geographies sales. USA and Germany are set to exhibit high consumption, recording CAGRs of 8.3% and 7.9%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 4.7% |

| Germany | 3.8% |

| India | 7.3% |

Increased population and ready access to convenient foods has increased the demand for ready to use shortenings. These shortenings are used as raw materials in the manufacture of many different food items, including pre-cooked meals, snacks, cakes and cookies, and pastries. They are very useful because of the convenience they afford to the food manufacture businesses.

Pre-made shortenings are time-saving tools, which allow to reach targeted mouthfeel, taste, and formulation in food items. They are intended to improve the quality and storability of products; properties that are vital for the standardized production and packaging of convenience foods. Today, people have a very tight schedule to fulfill hence they are in constant search of products that require less effort while preparing and consuming. These expectations are well met by ready-to-use shortenings so as to ensure that food products retain its qualities as well as taste in the long-run.

In Germany for instance, bakeries use very advanced systems or mixing and kneading of doughs that feature accuracy in engineering creativity as well as digital systems. These systems guarantee that the dough will be mixed according to the right degree of coarseness needed for the product where accurate consistencies of specific shortenings are vital. Through this process, bakeries are able to get a constant procedure with little involvement from man.

The future has come with smart ovens that are fitted with sensors as well as the artificial intelligence feature. And these ovens always can control the conditions of baking and change temperature, humidity, and baking time. This particular control is important for products that require shortenings since it facilitates equal distribution to prevent and cure stickiness issues which would lead to failure in getting crispy pastries as well as soft cakes.

India has witnessed an increasing urban middle income population base with increased disposable income and attitude towards premium and convenience food products including bakery products. This demographic shift in the consumption pattern sustains a continuously stable market demand for high quality shortenings for various applications, special diet requirements, and luxury products.

The large and growing population of urban consumers exercises immense pressure on markets to grow as well as pushes producers to develop more shortening products for the markets. From this pool of consumers, a need for high quality shortenings for baked goods and convenience foods has been driven.

Producers are introducing endless sorts of shortening that can address different clients’ consuming patterns, for example, withhold trans-fat, low saturated fat, or fortified shortenings. Such innovations help make sure that consumers cannot be forced to abstain from tasty foods while making healthier choice.

Companies in the shortening market space are presenting good competition amidst the leaders and contenders of which some have made strong points to consolidate their position. Cargill Incorporated boasts a vast and global supply chain and a powerful base of research and development, and the company can adapt and manufacture a variety of high-quality shortening products. They are central to meet the needs of the segment of the food market ranging from bakeries to confectionery.

Mallet & Company deals in bakery shortenings, to meet several requirements of commercial bakers and give the baked products a specific textural and shelf stability thereby being first choice of the commercial baker. Formerly Lonza Group AG is a specialty chemicals concern now exploring its health related shortening solutions, capitalizing on the trend towards healthier and fortified food ingredients.

Being in agribusiness, Bunge Limited is able to drive home the benefits of environmentally friendly shortenings that health conscious people would embrace. Since each company develops different concepts, based on which they produce shortening which they deem more important, including the concepts of innovation, sustainability, and health, the competition remains high and active in the market of these products, and, thus, the leaders of those industries will further define the development of the shortening market aligned with the shifts in consumers’ demands.

By Nature industry has been categorized into Organic and Conventional

By source oil, soyabean oil, sunflower seed oil, maize, Groundnut Oil, Coconunt Oil, Lard, Butter

By Form industry has been categorized into Powder and Block

By end user industry has been categorized HoReCa, Bakery, Confectionary, Processed Food, Household Retailers

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

The market is expected to grow at a CAGR of 4.1% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 7,683.2 million.

North America is expected to dominate the global consumption

Cargill Incorporated, Mallet & Company, Inc., Lonza Group AG, Bunge Limited, Archer Daniels Midland Company

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Emulsified Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA