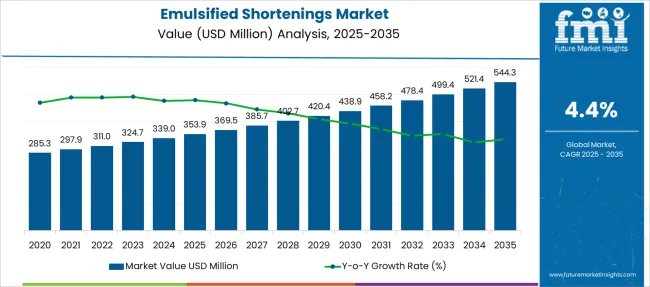

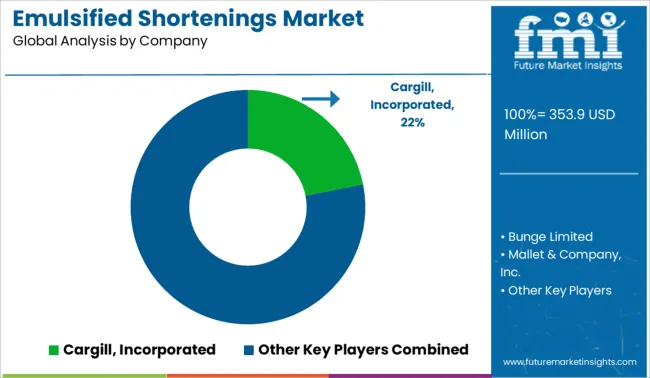

The Emulsified Shortenings Market is estimated to be valued at USD 353.9 million in 2025 and is projected to reach USD 544.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Emulsified Shortenings Market Estimated Value in (2025 E) | USD 353.9 million |

| Emulsified Shortenings Market Forecast Value in (2035 F) | USD 544.3 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The emulsified shortenings market is expanding steadily as food manufacturers seek ingredients that enhance product texture, shelf life, and nutritional profile. Growing consumer preference for cleaner labels and plant-based alternatives has encouraged the development and adoption of emulsified shortenings derived from natural sources.

The food processing industry has increasingly prioritized ingredient functionality to meet demands for better product performance and health-conscious formulations. Additionally, innovations in emulsification techniques have improved the stability and versatility of shortenings across various food applications.

Industry trends indicate a rise in demand for dry form emulsified shortenings due to their ease of handling and longer storage life. The market outlook remains positive as manufacturers focus on sustainable sourcing and clean-label positioning to capture evolving consumer preferences. Segmental growth is expected to be driven by the Dry form, Plant-based source, and the Food Processing end use.

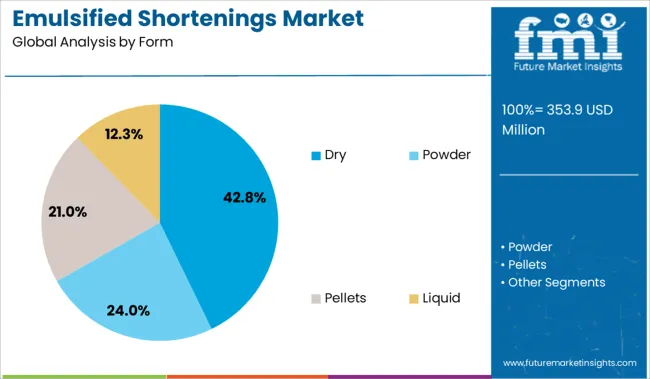

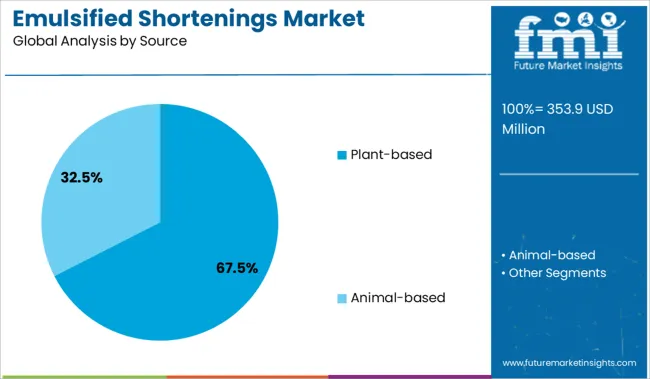

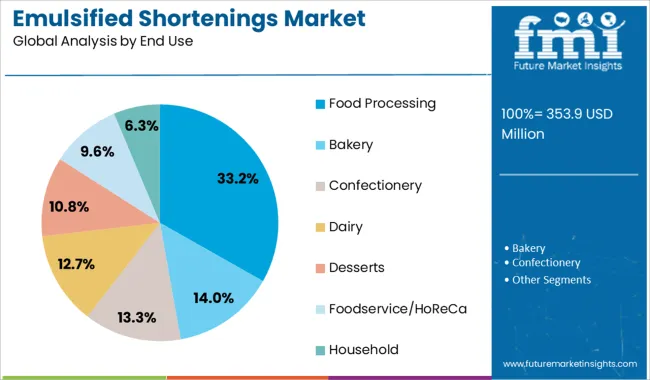

The market is segmented by Form, Source, End Use, and Distribution Channel and region. By Form, the market is divided into Dry, Powder, Pellets, and Liquid. In terms of Source, the market is classified into Plant-based and Animal-based. Based on End Use, the market is segmented into Food Processing, Bakery, Confectionery, Dairy, Desserts, Foodservice/HoReCa, and Household. By Distribution Channel, the market is divided into Direct Sales and Indirect Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Dry form segment is projected to hold 42.8% of the emulsified shortenings market revenue in 2025, maintaining its position as the preferred form type. This segment has gained traction due to its convenience in storage, handling, and transportation.

Dry emulsified shortenings offer longer shelf stability and reduced risk of microbial contamination compared to liquid or semi-solid forms. Food processors favor dry forms as they allow precise dosing and easier integration into dry mixes or dough formulations.

The dry form also aligns well with manufacturing processes that require consistent ingredient quality and minimal moisture content. As production efficiency and ingredient standardization become priorities in food manufacturing, the Dry segment is expected to sustain strong demand.

The Plant-based segment is anticipated to contribute 67.5% of the emulsified shortenings market revenue in 2025, dominating the source category. This growth is fueled by the rising consumer demand for plant-derived food ingredients driven by health, environmental, and ethical considerations.

Plant-based emulsified shortenings are preferred for their clean-label appeal and ability to replace traditional animal fats without compromising product texture or performance. Food manufacturers are increasingly reformulating products to meet vegetarian and vegan standards, further propelling this segment.

Additionally, advancements in plant oil processing have enhanced the functional properties of these shortenings, making them suitable for a wide range of bakery and snack applications. With growing focus on sustainability and health, the Plant-based segment is expected to maintain its leading market share.

The Food Processing segment is projected to account for 33.2% of the emulsified shortenings market revenue in 2025, remaining the primary end-use sector. This segment’s growth is driven by the expanding bakery, confectionery, and snack food industries that rely on emulsified shortenings to improve product quality and shelf life.

Food processors prioritize ingredients that ensure consistent dough handling, texture, and mouthfeel in finished products. The increasing demand for baked goods and processed snacks in emerging markets has further contributed to this segment’s expansion.

Moreover, regulatory emphasis on food safety and quality standards has encouraged the adoption of high-performance emulsified shortenings. As consumer preferences evolve toward healthier and more natural food options, food processing companies are expected to continue investing in innovative shortening solutions, keeping this segment at the forefront of market growth.

Emulsified shortenings are garnering immense popularity across diverse food & beverage sectors, on account of their ability to elevate taste, enhance texture, increase moisture, and improve mouth feel.

It also helps in increasing the volume of bakery products, improves crumb structure in cakes, assist in strengthening the gluten network in the dough, and enhances the structure of whipped products. Attributed to this, these shortenings are finding a wide range of applications in the preparation of various products such as dairy, bakery, confectionery, and desserts.

Hence, increasing consumption of cakes, brownies, bread, candies, ice creams, smoothies, chocolates, desserts, and others across the world is estimated to bolster the sales of emulsified shortenings in the global market.

There has been a significant increase in the prevalence of lifestyle diseases such as hypertension, obesity, diabetes, and others worldwide over the past few years. For instance, according the National Health and Nutrition Examination Survey, around 42.4% of the overall population, or more than 2 out of 5 adults between the ages 18 and 69 were reported to be suffering from obesity.

Hence, rising concerns regarding healthly lifestyle, and growing focus on decreasing the consumption of fatty & high-calorie foods such as cakes, ice creams, chocolates, and others are estimated to hinder the sales of emulsified shortenings in the market.

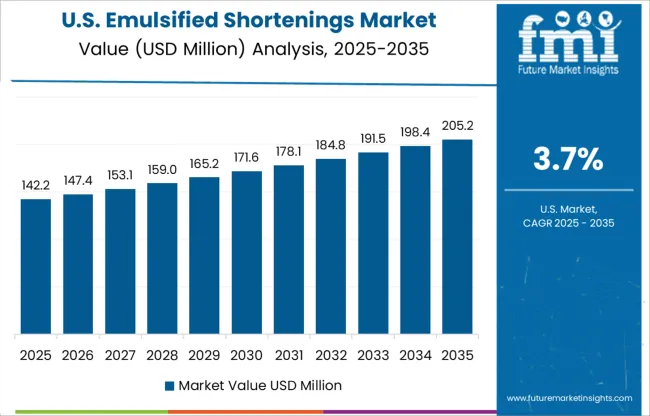

As per Future Market Insights, North America is projected to emerge as a highly remunerative market for emulsified shortenings during the forecast period 2025 to 2035.

Due to the shifting consumer preference towards adopting packed and convenience food, the consumption of quality bakery products such as pastries, bread, cakes, cookies, and others is increasing at a rapid pace. To capitalize on this trend, leading Hotels, Restaurants, and Café (HoReCa) industry players are aiming at launching novel outlets.

For instance, in March 2024, Levain Bakery, a USA based retail bakery announced opening a new outlet in Lower Manhattan, New York, the USA to expand its footprint. Since emulsified shortenings is used in preparing bakery products, a multiplicity of such developments is estimated to augment the demand for emulsified shortenings in the North America market.

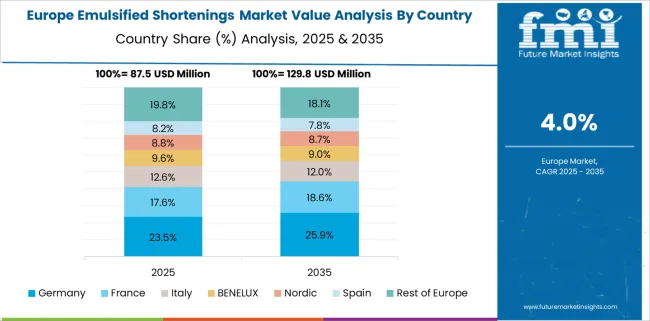

As per a study by FMI, Europe is estimated to register robust growth in the global emulsified shortenings market during the forecast period 2025 to 2035.

With growing adoption of novel additives shortenings for enhancing the texture, volume, and moisture of processed food products and rising shift towards adopting plant-based ingredients, key companies are focusing on launching novel products sourced from plants.

For instance, in 2020, Bunge Loders Croklaan B.V., A Netherlands-based producer of sustainable specialty oils and fats announced launching a new plant-based specialty emulsified shortenings Vream Elite, sourced from soy. It aids in maximizing the texture, taste, and functionality of cakes, icings, donuts, pies, and cookies. Such new product launches are anticipated to favor the growth in the Europe market.

Some of the leading players in the emulsified shortenings market are Cargill, Incorporated, Bunge Limited, Mallet & Company, Inc., Lonza Group AG, Palsgaard, Archer Daniels Midland Company, and others.

Leading manufacturers of emulsified shortenings in the global market are aiming at adoption strategies such as new product launch, production capacity expansion, acquisition, collaboration, and others for strengthen their footprint in the competitive market.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5% to 6% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Kilotons and CAGR from 2025-2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Form, Source, End Use, Region |

| Countries Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East and Africa |

| Key Companies Profiled | Cargill, Incorporated; Bunge Limited; Mallet & Company, Inc.; Lonza Group AG; Palsgaard; Archer Daniels Midland Company; Others |

| Customization | Available Upon Request |

The global emulsified shortenings market is estimated to be valued at USD 353.9 million in 2025.

The market size for the emulsified shortenings market is projected to reach USD 544.3 million by 2035.

The emulsified shortenings market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in emulsified shortenings market are dry, powder, pellets and liquid.

In terms of source, plant-based segment to command 67.5% share in the emulsified shortenings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shortenings Market Size, Growth, and Forecast for 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA