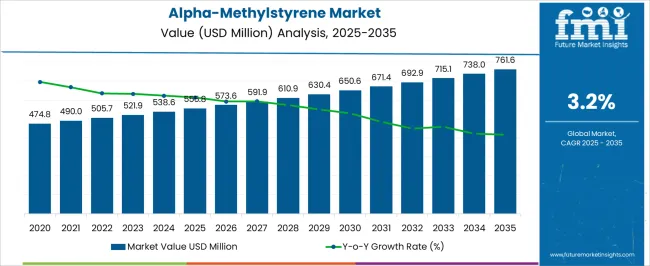

The alpha-methylstyrene market is estimated to be valued at USD 555.8 million in 2025 and is projected to reach USD 761.6 million by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period. Regulatory frameworks play a significant role in shaping the trajectory of this market, particularly due to the chemical’s application in resins, adhesives, and plastics. Environmental and safety regulations are among the most influential factors. In North America and Europe, stringent controls regarding volatile organic compounds and emissions influence production costs and compliance requirements.

Manufacturers in these regions must invest in cleaner technologies, which can slightly moderate growth but also encourage innovation in safer formulations. In contrast, Asia Pacific operates under relatively flexible regulatory conditions, enabling higher output and cost competitiveness, thereby shifting a larger share of global capacity toward the region. Trade policies and chemical safety directives, such as REACH in Europe and TSCA in the United States, further dictate market accessibility. Compliance with these standards requires rigorous testing, documentation, and supply chain transparency, which adds to operational complexity.

The stricter regulations are also fostering demand for higher-quality and safer derivatives of alpha methylstyrene. This dual effect highlights a market shaped by compliance pressures on one side and innovation opportunities on the other, reinforcing gradual yet steady expansion.

| Metric | Value |

|---|---|

| Alpha-Methylstyrene Market Estimated Value in (2025 E) | USD 555.8 million |

| Alpha-Methylstyrene Market Forecast Value in (2035 F) | USD 761.6 million |

| Forecast CAGR (2025 to 2035) | 3.2% |

Demand has been rising due to its essential role as a co-monomer and intermediate in the production of resins, adhesives, and polymers. Market growth is being influenced by increasing consumption of engineering plastics and specialty resins in end-use sectors such as automotive, electronics, and construction.

Insights from corporate presentations and manufacturing industry news highlight the rising preference for high-performance materials, which is elevating the demand for Alpha-Methylstyrene due to its thermal and chemical resistance properties. In addition, sustainability-focused advancements in production processes are contributing to improved yields and reduced environmental impact, enhancing overall market attractiveness.

The future outlook is being shaped by investments in capacity expansion, along with strategic supply chain partnerships observed across major producers.

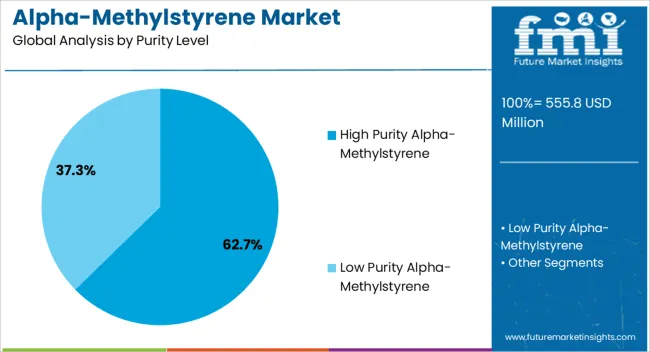

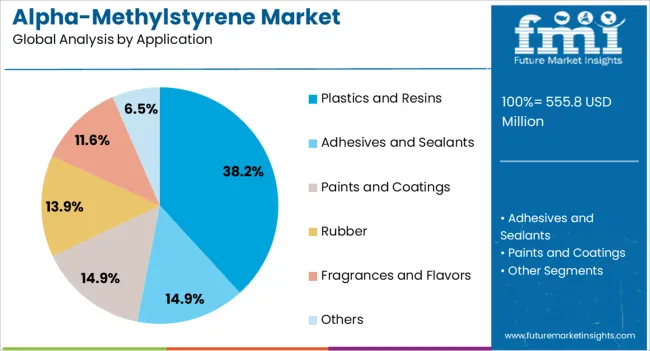

The alpha-methylstyrene market is segmented by purity level, application, end-use, and geographic regions. By purity level, the alpha-methylstyrene market is divided into High Purity Alpha-Methylstyrene and Low Purity Alpha-Methylstyrene. In terms of application, the alpha-methylstyrene market is classified into Plastics and Resins, Adhesives and Sealants, Paints and Coatings, Rubber, Fragrances and Flavors, and Others.

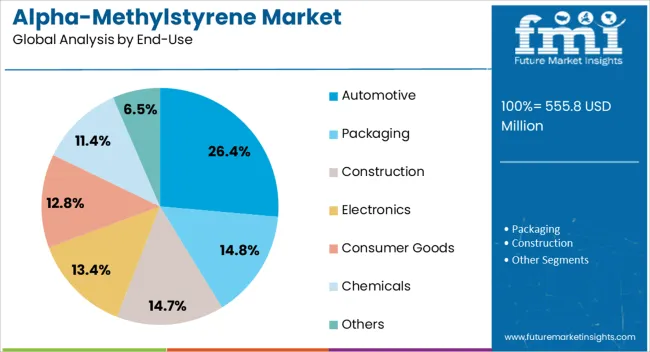

Based on end-use, the alpha-methylstyrene market is segmented into Automotive, Packaging, Construction, Electronics, Consumer Goods, Chemicals, and Others. Regionally, the alpha-methylstyrene industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high purity Alpha-Methylstyrene segment is projected to hold 62.7% of the market revenue share in 2025, making it the most dominant segment by purity level. This leadership has been supported by increasing demand for highly refined intermediates in the synthesis of high-quality resins and specialty chemicals.

Production trends reported in industry bulletins and technical datasheets suggest that high purity grades offer superior performance characteristics, making them ideal for applications where material consistency and precision are critical. Advancements in purification technologies are also reinforcing the segment’s prominence, enabling manufacturers to meet stringent quality requirements for use in sensitive applications such as electronic coatings and automotive polymers.

Additionally, procurement trends from large-scale manufacturers indicate a growing preference for high-purity Alpha-Methylstyrene due to its ability to improve end-product stability and durability. These factors are contributing to the consistent growth and sustained preference for high-purity variants within the global Alpha-Methylstyrene market.

The plastics and resins segment is expected to account for 38.2% of the Alpha-Methylstyrene market revenue share in 2025, securing its position as the leading application segment. This dominance has been driven by the segment’s widespread use in manufacturing heat-resistant polymers and impact modifiers, as noted in manufacturing industry updates and raw material sourcing reports. Alpha-Methylstyrene is being increasingly used in acrylonitrile butadiene styrene and other thermoplastics due to its ability to enhance strength and thermal stability.

Its role in resin formulations for coatings and adhesives is also being expanded, owing to performance benefits observed in product trials and formulation research. The segment’s growth is further supported by consistent demand from the packaging, construction, and consumer goods industries.

Industry newsletters have pointed to increasing substitution of traditional monomers with Alpha-Methylstyrene in specialty resins, given its cost and performance advantages. These trends have collectively reinforced the leading position of plastics and resins in the application landscape of this market.

The automotive segment is projected to represent 26.4% of the Alpha-Methylstyrene market revenue share in 2025, establishing itself as the most significant end-use industry. Growth in this segment has been supported by increased usage of high-performance resins and polymer blends in automotive components, aimed at improving vehicle efficiency, weight reduction, and thermal resistance.

Insights from OEM supplier reports and automotive material trends indicate that Alpha-Methylstyrene is being utilized in under-the-hood applications, electronic housings, and structural plastic parts due to its durability and heat-resistant characteristics. Regulatory emphasis on fuel efficiency and vehicle lightweighting is encouraging the replacement of metal parts with engineered plastics, further boosting the demand for Alpha-Methylstyrene-based materials.

Additionally, automotive manufacturers are investing in materials that offer improved recyclability and performance balance, and this has positively influenced the demand for this compound. These combined factors are supporting the steady growth of Alpha-Methylstyrene in the automotive end-use segment.

The market has been witnessing steady demand across various industries due to its role as a chemical intermediate in the production of resins, polymers, and adhesives. It is a byproduct of the cumene oxidation process used in phenol and acetone production. Industries have utilized alpha-methylstyrene for its ability to improve the heat resistance, impact strength, and durability of end products. The demand for specialty resins, coatings, and engineered plastics has been instrumental in shaping the global consumption of alpha-methylstyrene.

The use of alpha-methylstyrene has been primarily observed in resin and polymer manufacturing, especially in acrylonitrile butadiene styrene (ABS) resins and polycarbonate blends. Its inclusion in resins has improved mechanical properties, heat resistance, and chemical stability, making it a valuable intermediate. The automotive and electronics industries have relied heavily on ABS resins for durable and lightweight components. Alpha-methylstyrene has also been applied in adhesives, coatings, and sealants, enhancing performance attributes. Growing industrialization and increased demand for engineering plastics have further stimulated the use of alpha-methylstyrene in resin formulations. This has positioned it as a critical chemical building block supporting the continuous expansion of polymer-based product applications across global manufacturing sectors.

Adhesives and coatings industries have demonstrated consistent adoption of alpha-methylstyrene due to its capability to enhance hardness, gloss, and wear resistance. Its role in improving the drying properties and stability of paints and varnishes has been recognized. Sealants and pressure-sensitive adhesives have also incorporated alpha-methylstyrene as a performance enhancer. Growing infrastructure projects, demand for industrial maintenance coatings, and packaging solutions have expanded the need for high-performance adhesives and coatings, driving alpha-methylstyrene utilization. The versatility of the chemical in blending with other resins has enabled manufacturers to tailor formulations for specific performance requirements. This segment has emerged as a major consumer base, reinforcing the market position of alpha-methylstyrene in construction, packaging, and protective surface treatment industries.

The market has been closely linked with the dynamics of the phenol and acetone industries, as it is generated as a co-product during their production. Variations in phenol and acetone demand, especially in applications such as bisphenol A, polycarbonate, and phenolic resins, have directly influenced alpha-methylstyrene supply and pricing. When phenol production has expanded, the availability of alpha-methylstyrene has increased, creating an oversupply scenario at times. Conversely, reduced phenol output has tightened supply conditions. This dependency has made the alpha-methylstyrene market sensitive to fluctuations in raw material trends and downstream product demand. The interconnected nature of production and consumption has reinforced the importance of balanced supply management in maintaining stability and competitiveness across end-user industries.

Alpha-methylstyrene has been increasingly recognized for its role in specialty chemical applications beyond traditional resin and adhesive markets. It has been applied in lubricant additives, wax formulations, and plasticizers, contributing to performance improvements. Manufacturers have explored innovative synthesis techniques and purification methods to ensure high-purity alpha-methylstyrene suitable for specialized uses. Developments in polymer modification and specialty blends have broadened its scope, opening new opportunities across diverse industries. The push for high-performance materials in automotive, aerospace, and electronics has created favorable conditions for advanced applications. This evolving role has not only diversified market opportunities but also encouraged innovation in production processes, ensuring that alpha-methylstyrene remains relevant in an increasingly competitive specialty chemicals landscape.

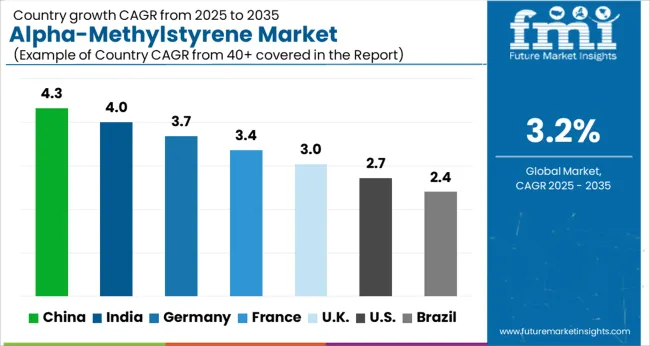

The market is expected to grow at a CAGR of 3.2% from 2025 to 2035, influenced by its use in resins, adhesives, coatings, and plastic additives. China leads with a 4.3% CAGR, supported by rising polymer production and large-scale industrial demand. India follows at 4.0%, driven by expanding chemical manufacturing and increased use in specialty plastics. Germany, at 3.7%, benefits from its advanced chemical sector and steady demand in automotive materials. The UK, growing at 3.0%, sees applications in coatings and adhesives for construction and packaging industries, while the USA, at 2.7%, reflects stable demand across resins and lubricant additives. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 4.3% from 2025 to 2035, supported by the rising demand for ABS resins and adhesives. The chemical is extensively used in the production of plastics, coatings, and polymer intermediates, which are integral to China’s automotive and electronics sectors. Investments in large-scale chemical production facilities are enhancing supply stability. Additionally, local manufacturers are exploring eco-friendly production methods to meet evolving regulatory frameworks. Expansion of downstream industries is expected to keep demand momentum strong over the forecast period.

India is expected to register a CAGR of 4% in the market between 2025 and 2035, driven by expanding demand in adhesives, coatings, and resins. Rising investment in petrochemical infrastructure is improving domestic production capabilities. The increasing adoption of ABS plastics in the automotive and packaging sectors is also propelling growth. Government support for the chemicals industry and collaborations with global suppliers are encouraging technology adoption. With rising consumption of engineered plastics, India is poised to strengthen its role as an emerging player in the alpha methylstyrene market.

Germany is anticipated to witness a CAGR of 3.7% in the market during 2025 to 2035. The chemical’s demand is closely tied to the automotive and industrial coatings sectors, which are major users of ABS and polymer intermediates. Strict environmental standards are encouraging manufacturers to develop efficient and sustainable production methods. Research initiatives in polymer chemistry are enhancing applications in specialty resins and adhesives. Growth will remain steady due to strong demand for engineered plastics across automotive, electronics, and industrial sectors.

The United Kingdom is forecast to expand at a CAGR of 3% in the market between 2025 and 2035. The rising use of high-performance plastics in packaging and automotive applications is influencing demand. Local manufacturers are emphasizing imports of intermediates and collaborations with international suppliers to meet requirements. With increasing consumer preference for lightweight automotive materials and sustainable packaging solutions, alpha methylstyrene adoption is expected to rise steadily. Investment in green chemistry initiatives is further shaping market direction in the region.

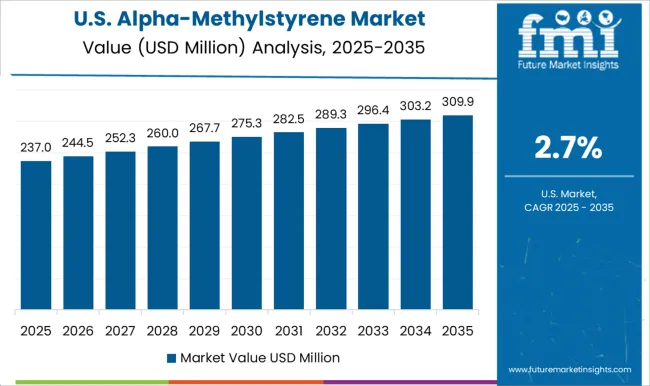

The market in the United States is expected to record a CAGR of 2.7% from 2025 to 2035, influenced by the growing need for engineered plastics and adhesives. Adoption of ABS resins in automotive lightweighting and consumer electronics is sustaining demand. Domestic chemical producers are focusing on expanding capacity and developing advanced polymer applications. Regulatory frameworks are encouraging the transition toward sustainable production technologies. The steady demand from packaging and coatings sectors will continue to provide stability to the market.

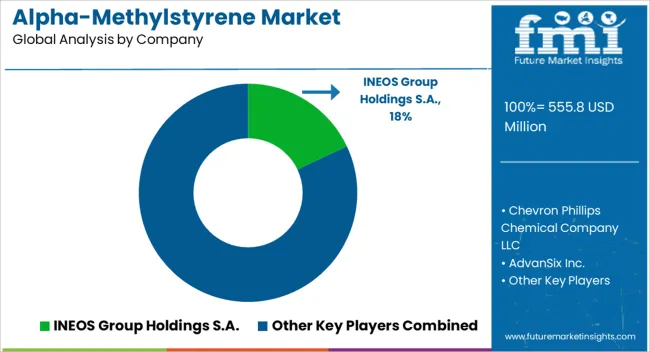

The market is shaped by the presence of major petrochemical companies and regional manufacturers who ensure a consistent supply to diverse end-use industries. This chemical plays a critical role in the production of ABS resins, waxes, coatings, adhesives, and other specialty polymers. INEOS Group Holdings S.A. holds a dominant position due to its large-scale petrochemical operations and established global network. Chevron Phillips Chemical Company LLC and AdvanSix Inc. strengthen North American supply chains by integrating advanced production technologies with strong distribution capabilities. In Asia, Mitsui Chemicals, Inc. and Lotte Chemical Corporation remain crucial participants as they provide high-quality materials for resin production across automotive, consumer goods, and packaging industries.

Epsilon Carbon Private Limited is emerging as a significant Indian producer, leveraging cost advantages and expanding export potential. Kumho P&B Chemicals Inc. has built a competitive base in South Korea with a strong focus on downstream derivatives. Altivia Petrochemicals, LLC caters to regional demand in the United States with an emphasis on specialty chemicals, while Qufu Xindi Chemical Research Limited Company ensures cost-effective solutions from China, supporting the market with competitive supply. The overall market structure is moderately consolidated, with competition influenced by production efficiency, pricing, and strategic partnerships. Increasing demand for ABS resins in automotive interiors, electronic housings, and durable consumer goods continues to drive investments and strengthen the role of these key players in global supply networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 555.8 Million |

| Purity Level | High Purity Alpha-Methylstyrene and Low Purity Alpha-Methylstyrene |

| Application | Plastics and Resins, Adhesives and Sealants, Paints and Coatings, Rubber, Fragrances and Flavors, and Others |

| End-Use | Automotive, Packaging, Construction, Electronics, Consumer Goods, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | INEOS Group Holdings S.A., Chevron Phillips Chemical Company LLC, AdvanSix Inc., Mitsui Chemicals, Inc., Epsilon Carbon Private Limited, Kumho P&B Chemicals Inc., Altivia Petrochemicals, LLC, Qufu Xindi Chemical Research Limited Company, and Lotte Chemical Corporation |

| Additional Attributes | Dollar sales by grade and end-use industry, demand dynamics across plastics, adhesives, paints, and specialty chemicals, regional trends in styrene copolymer and resin production, innovation in polymerization and recovery technologies, environmental impact of handling and disposal in manufacturing processes, and emerging use cases in heat-resistant plastics, performance coatings, and advanced elastomers. |

The global alpha-methylstyrene market is estimated to be valued at USD 555.8 million in 2025.

The market size for the alpha-methylstyrene market is projected to reach USD 761.6 million by 2035.

The alpha-methylstyrene market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in alpha-methylstyrene market are high purity alpha-methylstyrene and low purity alpha-methylstyrene.

In terms of application, plastics and resins segment to command 38.2% share in the alpha-methylstyrene market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA