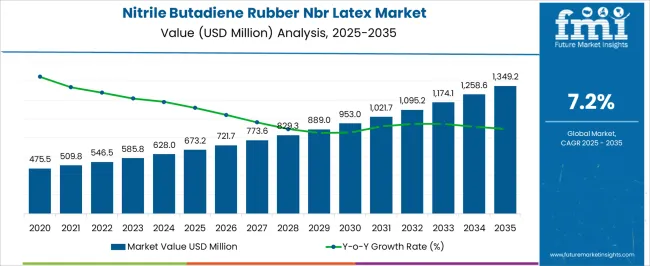

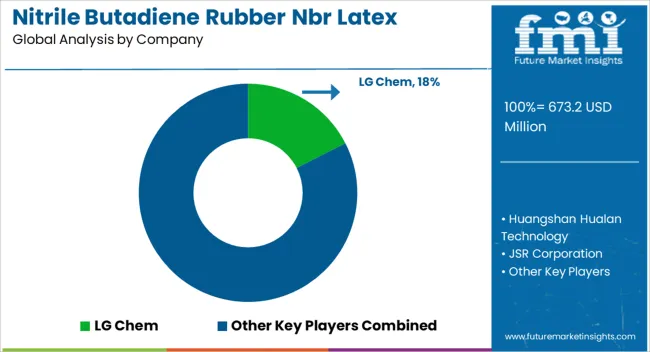

The Nitrile Butadiene Rubber (NBR) Latex Market is estimated to be valued at USD 673.2 million in 2025 and is projected to reach USD 1349.2 million by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period. The growth rate volatility index, based on the annual increments in market value, indicates a relatively stable and steady expansion throughout the forecast period. The yearly increases range between USD 48.5 million and USD 91.0 million, reflecting controlled and consistent growth without sudden fluctuations. For example, the market value increases from USD 673.2 million in 2025 to USD 721.7 million in 2026, followed by gradual gains that steadily rise each year.

The smallest annual increment is observed early in the forecast, while the later years’ experience slightly larger gains, showing a moderate acceleration as market adoption expands. The stability of growth rate volatility suggests a predictable market environment with limited risk. This pattern supports the view that demand for Nitrile Butadiene Rubber NBR Latex is increasing in a measured manner, influenced by steady industry consumption and technological improvements. The growth rate volatility index for this market points to low fluctuation and consistent year-on-year progress. The steady trend provides confidence for stakeholders and investors seeking reliable growth in the NBR Latex sector over the next decade.

| Metric | Value |

|---|---|

| Nitrile Butadiene Rubber (NBR) Latex Market Estimated Value in (2025 E) | USD 673.2 million |

| Nitrile Butadiene Rubber (NBR) Latex Market Forecast Value in (2035 F) | USD 1349.2 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

The NBR latex market is undergoing significant growth, fueled by increasing demand for high-performance elastomers across industrial and specialty chemical sectors. Enhanced properties such as oil resistance, mechanical strength, and flexibility have expanded its application across multiple end-use industries.

Market momentum is being reinforced by stringent safety standards in healthcare and the push for synthetic alternatives in glove manufacturing and polymer blending. Advancements in emulsion polymerization techniques and raw material optimization are enabling manufacturers to tailor particle size and performance to specific application needs.

Additionally, ongoing investments in R&D and formulation upgrades are driving the development of cross-linked and customized latex grades for targeted performance. The global shift toward PVC modification and compound reinforcement is further enhancing the relevance of NBR latex in formulation-intensive applications.

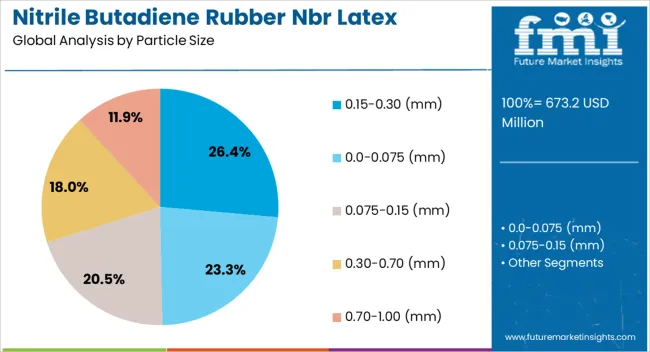

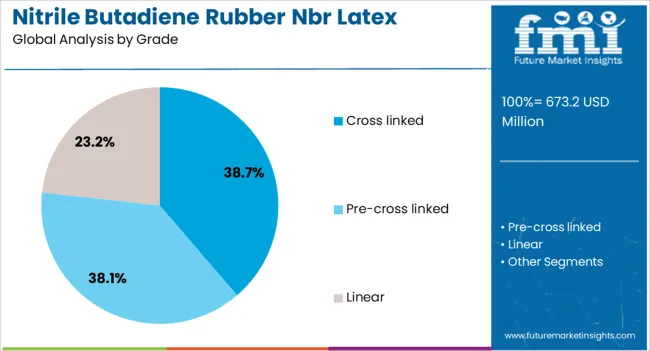

The nitrile butadiene rubber (NBR) latex market is segmented by particle size, grade, application, end use, and geographic regions. By particle size, the nitrile butadiene rubber (NBR) latex market is divided into 0.15-0.30 (mm), 0.0-0.075 (mm), 0.075-0.15 (mm), 0.30-0.70 (mm), and 0.70-1.00 (mm). In terms of the grade of the nitrile butadiene rubber (NBR), the market is classified into cross-linked, pre-cross-linked, and Linear.

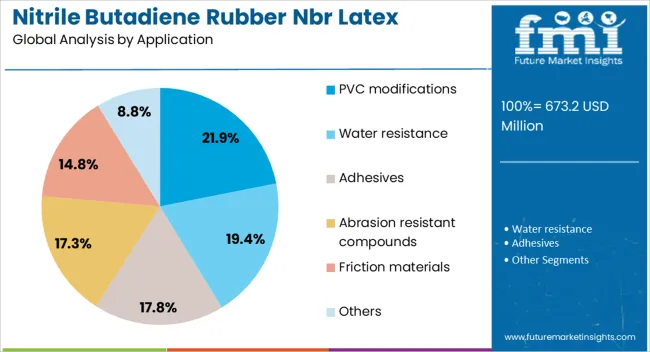

Based on the application of the nitrile butadiene rubber (NBR) latex market, it is segmented into PVC modifications, Water resistance, Adhesives, abrasion-resistant compounds, Friction materials, and Others. By end use, the nitrile butadiene rubber (NBR) latex market is segmented into Automotive, Construction, Footwear, Consumer goods, and Others. Regionally, the nitrile butadiene rubber (nbr) latex industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 0.15–0.30 mm particle size segment is anticipated to contribute 26.40% of the total market revenue in 2025, emerging as the leading size category. This range offers an optimal balance between dispersion and film-forming characteristics, enabling better adhesion in coatings, foams, and polymer blends.

Its stability in high-speed processing environments has led to widespread usage in automated manufacturing settings. The ability to maintain emulsion uniformity and reduce agglomeration during storage and mixing has also favored its adoption across various downstream applications.

As precision in latex behavior becomes increasingly critical for performance consistency, the 0.15–0.30 mm segment continues to outperform larger or finer particle alternatives.

The cross linked grade segment is projected to hold 38.70% of the NBR latex market’s revenue share in 2025, securing its place as the dominant grade type. This leadership is being driven by enhanced tensile strength, abrasion resistance, and thermal stability offered by cross-linking, making it ideal for demanding industrial and medical applications.

The ability to withstand high shear conditions during processing, while retaining elasticity, has made this grade preferable in glove production and chemical-resistant coatings. Moreover, advances in vulcanization and curing systems have improved scalability and batch consistency.

The segment’s rising demand is also influenced by global regulatory emphasis on product safety and long-term durability.

PVC modifications are expected to account for 21.90% of total market revenue in 2025, ranking as the leading application area for NBR latex. This segment’s growth is being supported by increased demand for improved impact resistance, flexibility, and weatherability in PVC-based products.

The incorporation of NBR latex enhances low-temperature performance and anti-migration properties, making it suitable for construction, automotive, and wire & cable applications. Compatibility with plasticizers and other formulation components has streamlined blending processes and reduced compound failure rates.

As manufacturers seek material enhancements that extend product lifecycle and meet evolving safety standards, PVC modification with NBR latex is gaining momentum as a preferred performance upgrade strategy.

The NBR latex market has witnessed steady growth driven by its diverse industrial applications including protective gloves, adhesives, coatings, and automotive components. NBR latex is preferred for its exceptional resistance to oils, chemicals, and abrasion, offering durable performance where exposure to harsh substances occurs. The healthcare sector’s demand for disposable gloves, accelerated by increased hygiene awareness and safety protocols, has significantly contributed to market expansion. Advancements in latex polymerization and formulation have enhanced product stability, elasticity, and environmental compliance.

The healthcare industry remains a key driver for NBR latex, primarily due to the rising demand for disposable gloves that offer superior protection and chemical resistance. NBR gloves provide advantages over natural rubber alternatives by reducing allergic reactions and increasing puncture resistance. Hospitals, clinics, and laboratories prioritize these gloves for infection control and occupational safety. Industrial sectors including automotive manufacturing, chemical processing, and food handling also utilize NBR gloves extensively to safeguard workers from oils, solvents, and contaminants. Trends toward powder-free, hypoallergenic, and thicker gloves have expanded consumer acceptance and comfort. Regulatory mandates emphasizing workplace safety have further solidified the importance of NBR latex gloves, leading to continuous innovation and growing production capacity globally.

Technological advancements in NBR latex production have improved polymer chain stability, film formation, and resistance to heat and chemicals, boosting product performance across applications. Enhanced polymerization processes and additive integration have enabled faster curing times and improved elasticity, critical for glove manufacturing and coating durability. These innovations have also expanded the use of NBR latex in adhesives, sealants, paints, and construction materials, especially where resistance to oils and solvents is required. Efforts toward developing bio-based and environmentally friendly formulations have gained traction, aligning with tightening regulations and consumer preferences for sustainable materials. Manufacturers focus on balancing performance, cost-effectiveness, and ecological impact to remain competitive and compliant within evolving industrial landscapes.

The automotive industry is a significant consumer of NBR latex due to its application in sealants, adhesives, and gaskets that require oil and fuel resistance. Growth in vehicle production, particularly in emerging markets, has increased demand for durable and flexible NBR-based components that can withstand exposure to harsh chemicals and temperature variations. Similarly, the construction sector leverages NBR latex in coatings and sealants used for waterproofing, corrosion protection, and surface durability. Rising infrastructure development projects and renovations worldwide drive steady consumption. The combination of flexibility, chemical resistance, and cost-efficiency offered by NBR latex makes it an attractive material for various industrial uses, supporting sustained market growth amid expanding manufacturing activities.

The NBR latex market is affected by volatility in key raw materials, including butadiene and acrylonitrile, both derived from petrochemical feedstocks sensitive to crude oil price fluctuations and geopolitical factors. This unpredictability impacts production costs and supply chain stability. Additionally, environmental regulations aimed at minimizing emissions and chemical waste from synthetic rubber manufacturing have increased compliance costs and operational constraints. Manufacturers are investing in cleaner production technologies and recycling to mitigate environmental impact. Trade policies and import-export restrictions on raw chemicals introduce further complexity to global logistics and market accessibility. Strategic sourcing, innovation, and regulatory alignment are critical for manufacturers to sustain competitiveness and ensure resilient growth in this evolving market.

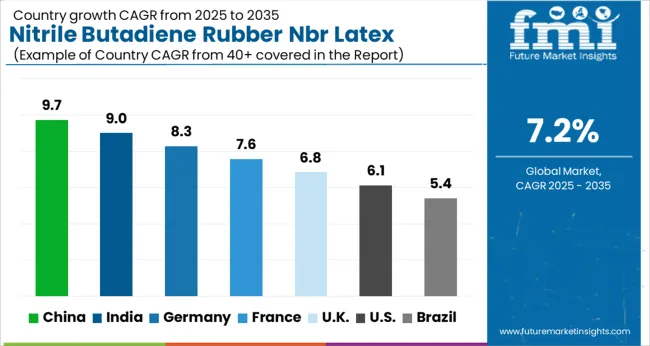

The market is projected to grow at a CAGR of 7.2% between 2025 and 2035, driven by expanding demand in automotive, medical, and industrial applications. China leads with a 10.0% CAGR, supported by large-scale manufacturing and rising consumption in glove production. India follows at 9.0%, fueled by growing healthcare awareness and increased industrial use. Germany, growing at 8.0%, benefits from advanced material technologies and stringent quality standards. The UK, at 7.0%, experiences steady demand from automotive and medical sectors. The USA, with a 6.0% CAGR, reflects ongoing innovation in synthetic rubber compounds and growing protective equipment markets. This report includes insights on 40+ countries; the top markets are shown here for reference.

The nitrile butadiene rubber latex industry in China is expected to advance at a CAGR of 10% from 2025 to 2035, fueled by extensive demand across automotive, medical, and industrial domains. Major manufacturers have invested heavily in improving latex quality, emphasizing elasticity and resistance to chemicals and oils. The glove manufacturing industry continues to be a primary consumer, especially with expanding exports to global markets. Government policies encouraging domestic chemical production and innovation in eco-friendly formulations have accelerated growth. Collaborations between latex producers and end-users have led to development of specialized grades suited for medical and industrial applications. Rising focus on sustainable manufacturing processes further strengthens the competitive landscape.

The market in India is anticipated to grow at a CAGR of 9% through 2035, driven by increasing demand from glove manufacturers and automotive parts producers. Companies focus on enhancing latex purity and batch consistency to satisfy stringent export quality standards. The healthcare sector is a key growth area, with rising need for protective gloves and medical devices. Industrial applications including seals and gaskets have also contributed to market expansion. Government initiatives supporting chemical industry upgrades and foreign investments provide a favorable environment for sustained growth. Manufacturing hubs in southern and western India are emerging as production centers for latex products.

In Germany, the market is set to expand at a CAGR of 8% from 2025 to 2035, backed by strong demand in medical devices and industrial applications. Manufacturers prioritize high-performance latex grades with enhanced resistance to oils, chemicals, and wear. Compliance with strict environmental and safety standards guides product innovation, including the use of recycled raw materials. Research efforts focus on biodegradable and low-emission latex compounds. The automotive and healthcare industries continue to be major consumers, supporting steady demand growth amid tightening regulations. German companies engage in partnerships with research institutes to accelerate technological advancements.

The market in the United Kingdom is forecast to grow at a CAGR of 7% between 2025 and 2035, driven primarily by demand for protective gloves and automotive components. Latex formulations are being optimized to improve durability and reduce allergenic compounds. The sector responds to evolving regulatory frameworks requiring higher product safety and quality standards. Collaborations between manufacturers and healthcare providers have intensified to develop latex products tailored to medical needs. The automotive aftermarket remains a significant segment, with increased usage of latex in seals and gaskets enhancing performance under varied conditions.

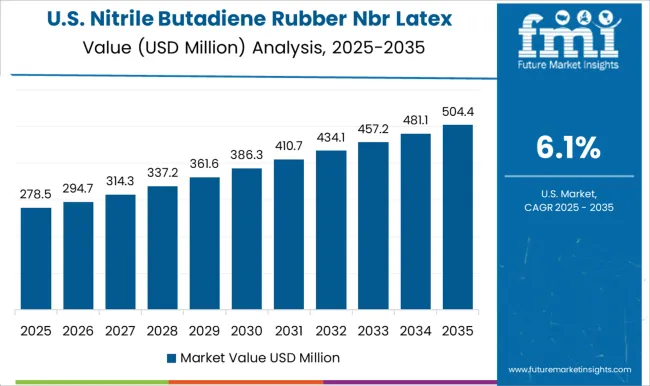

The industry in the United States is expected to advance at a CAGR of 6% from 2025 to 2035, influenced by demand from healthcare and industrial sectors. Innovations focus on allergy-free and high-durability latex formulations, increasing competitiveness. The sector benefits from large-scale production facilities and significant investment in research and development. Regulatory emphasis on personal protective equipment usage in healthcare settings and manufacturing processes continues to drive market demand. Increased focus on environmentally friendly production methods is supporting sustainable growth strategies.

The nitrile butadiene rubber (NBR) latex market is driven by major chemical producers offering versatile synthetic latex used in automotive, medical, and industrial applications. LG Chem stands out with a wide range of high-quality NBR latex products emphasizing oil resistance and mechanical strength. JSR Corporation leverages advanced polymerization techniques to provide consistent product quality and tailor formulations for specific end-use requirements. Huangshan Hualan Technology and Nitriflex S.A. have strengthened their presence through capacity expansions and focused product development targeting gloves, adhesives, and coatings sectors. OMNOVA Solutions supplies specialty NBR latex grades designed for enhanced flexibility and chemical resistance. Saudi Aramco and SIBUR benefit from integrated petrochemical operations, enabling cost-efficient production and supply chain control. Sinopec and Taprath Polymers serve growing regional markets with a broad product portfolio supporting applications in seals, hoses, and belts. Zeon Chemicals emphasizes research and development to improve polymer performance and develop environmentally friendly alternatives. The competitive landscape revolves around continuous product innovation, expansion of production capacity, and strategic collaborations with downstream manufacturers. Entry barriers include high capital investment, complex polymerization processes, regulatory compliance, and the need for strong technical expertise in polymer chemistry, limiting new entrants and consolidating market leadership among key players.

| Item | Value |

|---|---|

| Quantitative Units | USD 673.2 Million |

| Particle Size | 0.15-0.30 (mm), 0.0-0.075 (mm), 0.075-0.15 (mm), 0.30-0.70 (mm), and 0.70-1.00 (mm) |

| Grade | Cross linked, Pre-cross linked, and Linear |

| Application | PVC modifications, Water resistance, Adhesives, Abrasion resistant compounds, Friction materials, and Others |

| End Use | Automotive, Construction, Footwear, Consumer goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LG Chem, Huangshan Hualan Technology, JSR Corporation, Nitriflex S.A., OMNOVA Solutions, Saudi Aramco, SIBUR, Sinopec, Taprath Polymers, and Zeon Chemicals |

| Additional Attributes | Dollar sales by product form and end-use industry, demand dynamics across gloves manufacturing, automotive components, and industrial seals, regional trends in production and consumption across Asia-Pacific, North America, and Europe, innovation in synthetic latex formulations, improved chemical resistance, and hypoallergenic variants, environmental impact of raw material sourcing, processing emissions, and disposal challenges, and emerging use cases in medical-grade protective equipment, automotive lightweighting, and oil-resistant sealing solutions. |

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acetonitrile Market Growth - Trends & Forecast 2025 to 2035

Valeronitrile Market Growth - Trends & Forecast 2025 to 2035

Acrylonitrile Market

Acrylonitrile Butadiene Styrene Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Carboxylated Nitrile Rubber Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Styrene Acrylonitrile (ASA) Resin Market- Growth & Demand 2025 to 2035

Bio Butadiene Market Size and Share Forecast Outlook 2025 to 2035

Polybutadiene Market

Polybutadiene Rubber Market

Styrene-Butadiene-Styrene (SBS) Block Copolymer Market Size, Growth, and Forecast 2025 to 2035

Styrene Butadiene Rubber Market 2024-2034

Solution Styrene Butadiene Rubber (S-SBR) Market Size and Share Forecast Outlook 2025 to 2035

Latex Paper Backing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Latex Mattress Market Growth & Forecast 2025-2035

Non-Latex Condom Market Trends – Size, Demand & Forecast 2024-2034

Middle East and Africa Latex Foil Balloons Market Size and Share Forecast Outlook 2025 to 2035

Rubber Track for Defense and Security Market Size and Share Forecast Outlook 2025 to 2035

Rubber Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA