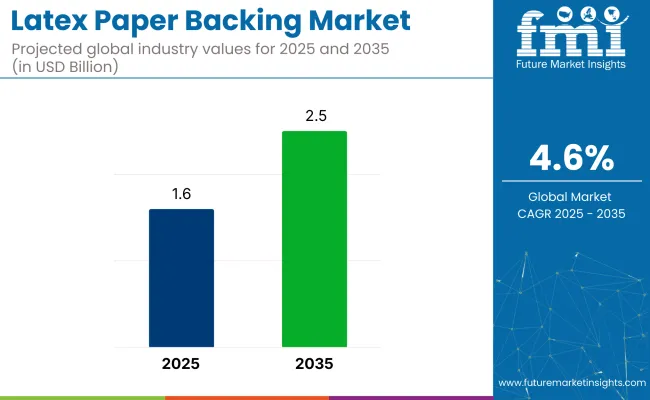

The global latex paper backing market is projected to reach from USD 1.6 billion in 2025 to USD 2.5 billion by 2035, registering a CAGR of 4.6%. This growth is supported by rising use in labels, masking tapes, sandpaper, and specialty packaging.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 1.6 billion |

| Market Size (2035) | USD 2.5 billion |

| CAGR (2025 to 2035) | 4.6% |

Latex-saturated paper offers flexibility, tear resistance, and moisture tolerance, making it suitable for abrasive production and industrial printing. Manufacturers are increasingly selecting latex backings for their performance and durability benefits, aiming to meet both operational requirements and shifting regulatory standards across end-use industries.

The latex paper backing market holds a small but specialized share within its parent markets. In the Paper & Pulp Industry, it accounts for <1%, as most paper products are uncoated or use alternative treatments. In the Adhesive & Sealant Industry, it represents 2-3%, since latex-backed papers are used in tapes and labels but compete with synthetic films.

The Packaging Materials Market allocates 1-2% to latex-backed papers, primarily for specialty packaging and release liners. In Construction & Building Materials, its share is <1%, limited to niche applications like flooring underlayment. The Specialty Coatings & Laminates Market contributes 3-5%, as latex coatings enhance durability in industrial papers. Also, the latex paper backing market is a minor but high-value segment, driven by demand for water resistance, flexibility, and eco-friendliness compared to plastic alternatives.

The Asia-Pacific region is anticipated to record the highest growth, fueled by industrial development, consumer goods exports, and infrastructure activity in China, India, and Southeast Asia. As performance expectations increase and material selection adapts to changing priorities, latex paper backing continues to gain relevance across end-use sectors, reinforcing its position in both industrial and packaging-related applications through 2035.

The industry is witnessing strong demand across multiple segments due to the increasing requirement for flexible, durable, and high-strength substrates in industrial and commercial applications. Key investments are concentrated in paper types, coating formats, and automotive-linked end uses.

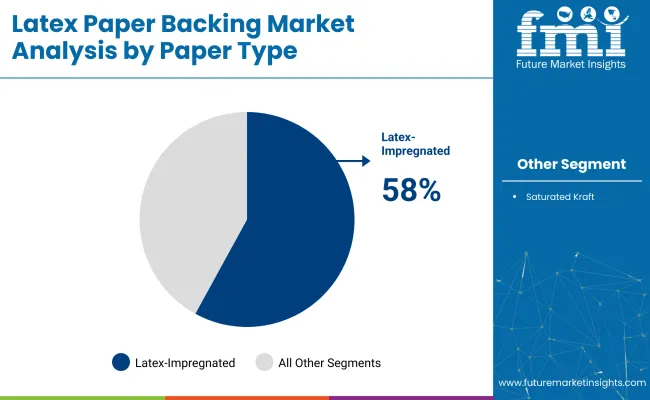

In 2025, latex-impregnated paper is expected to dominate the paper type category, holding an estimated 58% market share. Its superior flexibility, tear resistance, and enhanced moisture performance make it a preferred substrate for abrasive products like sandpaper and polishing discs. Companies such as Mondi Group, Ahlstrom, and Nitto Denko Corporation have ramped up production capacities and technical grades to meet industrial demand.

Single-sided coated latex paper is projected to lead with 63% of the total coating type share in 2025. This dominance stems from its cost-effectiveness and widespread use in masking tapes, labels, and pressure-sensitive adhesives. Single-coated substrates provide sufficient barrier protection and adhesion for light to medium-duty applications. Leading players such as Fasson(Avery Dennison), Munksjö, and Intertape Polymer Group utilize this format for efficient coating and streamlined production.

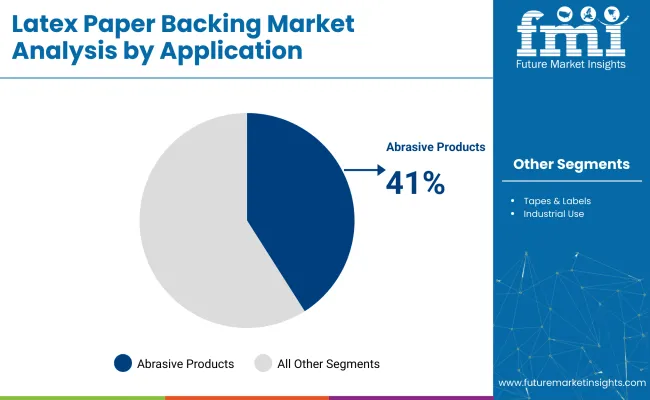

The abrasive products segment accounts for an estimated 41% market share in 2025, driven by extensive use in surface finishing and shaping processes. Latex paper’s ability to conform under pressure without tearing is essential in sandpapers and polishing pads used in automotive refurbishing, metal fabrication, and furniture polishing. Companies like Saint-Gobain, 3M, and Klingspor are leveraging latex-backed abrasive products to deliver consistent performance and durability.

With a 36% share in 2025, the automotive sector remains the largest end-user of latex paper backing due to its high reliance on masking tapes, polishing pads, and sanding materials during production and repair phases. From pre-paint masking to post-finish polishing, latex-backed papers offer excellent dimensional stability and surface adaptability. Companies such as Tesa SE, Norton, and Nippon Paper Industries supply specialized grades tailored for auto body shops and OEM lines.

The industry is driven by rising demand in medical and industrial applications, technological advancements, and eco-friendly trends. Key players are focusing on innovation and expanding production capacities to meet diverse industry needs while addressing environmental concerns.

Recent Market Trends in The Industry

Challenges in Faced by Suppliers

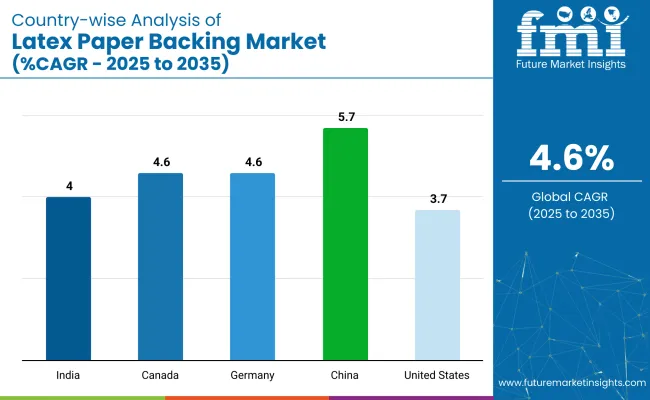

| Countries | CAGR (%) |

|---|---|

| China | 5.7% |

| Canada | 4.6% |

| Germany | 4.6% |

| India | 4.0% |

| United States | 3.7% |

Global demand for Latex Paper Backing is projected to grow at a 4.5% CAGR from 2025 to 2035. Among the five profiled markets out of 40 covered, China leads at 5.7%, followed by Canada and Germany at 4.6% each, India at 4.0%, and the United States at 3.7%.

These growth rates translate to a +27% premium for China, +2% for both Canada and Germany, -11% for India, and -18% for the USA compared to the baseline. Divergence in growth is attributed to strong industrial and packaging expansion in China, stable application demand in Canada and Germany, and comparatively slower adoption in the USA and India due to industry saturation and infrastructure gaps.

The report covers a detailed analysis of 40+ countries, with the top five countries shared as a reference.

The USA latex paper backing market is projected to grow at 3.7% CAGR between 2025 and 2035, driven by its large-scale automotive refinishing sector and advancements in commercial printing formats. The industry is considered mature, yet fresh opportunities are seen in masking and decorative applications where flexibility and precision are key.

The usage of single-sided coated latex paper remains dominant, among high-volume label converters and masking tape manufacturers. Due to the USA's regulatory guidelines on safe adhesives and coatings, domestic producers have been favoring latex-based solutions that offer environmental compliance and mechanical reliability across varying surfaces.

In Canada, the latex paper backing market is likely to expand at a 4.6% CAGR from 2025 to 2035, benefiting from growing adoption across construction adhesives, paint masking, and tape backing applications. The colder climate presents challenges for certain materials, giving an edge to latex paper for its adaptability and consistent tensile performance. Canadian importers are gradually favoring high-density grammage options, with demand rising from private-label tape converters and flexographic print services.

Germany is expected to register a 4.6% CAGR in its latex paper backing market during the forecast period, led by its advanced manufacturing base on efficient labeling solutions. The preference for German-engineered paper coatings has propelled growth in automated die-cut labeling and abrasion-resistant industrial tapes. Latex-backed substrates are increasingly favored in precision coating industries where reliability and consistent adhesion are important.

China is projected to lead global growth in the latex paper backing industry, registering a 5.7% CAGR from 2025 to 2035. The country’s vast industrial base in electronics, automotive, and consumer packaging has bolstered demand for durable, coated backing papers.

Import substitution strategies are prompting local manufacturers to invest in premium latex formulations that offer improved elongation and smoother printability. Increasing exports of pressure-sensitive products and decorative laminates have also pushed demand for reliable, high-performance backing materials, particularly in tier 1 and tier 2 manufacturing hubs.

India’s latex paper backing industry is projected to grow at 4.0% CAGR between 2025 and 2035, with expanding use in labeling, decorative laminates, and flexible masking applications. Growth is centered around the country's burgeoning construction and automotive accessories sectors, where cost-effective yet flexible materials are preferred. Rising investments in domestic tape manufacturing units and flexographic printing lines have made latex paper a strategic material.

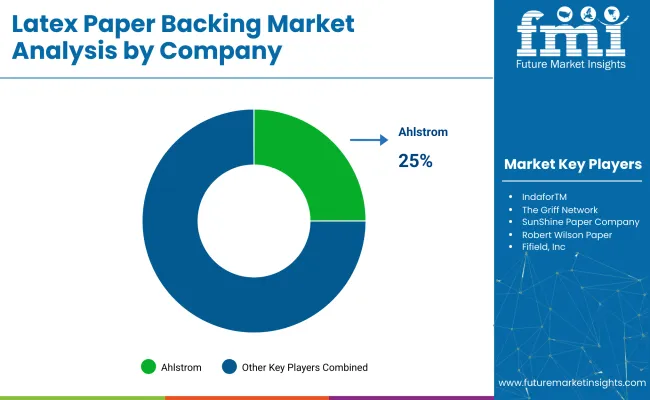

leading Market Player: - Ahlstrom with Industry Share 25%

The latex paper backing industry includes both long-established suppliers and rising regional producers. Ahlstrom remains a front-runner with its Indafor™ series, which has gained demand in automotive and masking applications due to its durability and adhesion control.

The Griff Network is focusing on production upgrades and backward integration to enhance supply reliability. SunShine Paper Company and Robert Wilson Paper are investing in performance-grade materials to support heavy-duty usage. On the other hand, players like Hubei Yuli Abrasive Belts Group and Abrasive Now Co., Ltd. are strengthening their regional footprint through specialized offerings and price competitiveness.

The industry presents moderate entry barriers due to the need for precise coating capabilities, capital investment, and regulatory compliance. While still fragmented, signs of consolidation are emerging as mid-tier players acquire smaller firms to expand their product mix and gain access to established distribution channels.

Recent Latex Paper Backing Industry News

| Attribute | Details |

|---|---|

| Market Size (2025) | USD 1.6 billion |

| Projected Market Size (2035) | USD 2.5 billion |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Paper Types Analyzed | Saturated Kraft, Latex-impregnated Paper |

| Coating Types Analyzed | Single-Sided, Double-Sided |

| Applications Analyzed | Abrasive Products (Sandpaper, Polishing Pads), Tapes & Labels (Masking Tape Backing, Durable Labels, Industrial Use (Waterproofing Layers, Friction Products) |

| End-Use Industries Analyzed | Automotive, Woodworking, Construction, Industrial Adhesives |

| Regions Covered | North America, Latin America, Europe, Asia-Pacific, Middle East & Africa |

| Countries Covered | United States, Germany, China, Japan, India, Brazil, South Korea |

| Key Players | Ahlstrom, Indafor ™, The Griff Network, SunShine Paper Company, Robert Wilson Paper, Norton (Saint-Gobain), Mask-Off Company, Inc., Fifield, Inc., Hubei Yuli Abrasive Belts Group Co., Ltd., Abrasive Now Co., Ltd. |

| Additional Attributes | Dollar sales, share by paper and coating type, usage breakdown by abrasive and label applications, rising demand in the automotive and construction sectors, growth in flexible packaging and wood finishing uses, development of recyclable and low-VOC latex coatings, regional production shifts toward Asia-Pacific, and increasing customer preference for durable yet eco-conscious paper solutions. |

Saturated Kraft, Latex-impregnated Paper

Single-Sided, Double-Sided

Abrasive Products (Sandpaper, Polishing Pads), Tapes & Labels (Masking Tape Backing, Durable Labels), Industrial Use (Waterproofing Layers, Friction Products)

Automotive, Woodworking, Construction, Industrial Adhesives

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

The market is projected to grow from USD 1.6 billion in 2025 to USD 2.5 billion by 2035, registering a CAGR of 4.6%.

Single-sided coating leads with a 63% industry share in 2025.

The automotive industry holds a 36% share in 2025.

China leads with a 5.7% CAGR from 2025 to 2035.

Ahlstrom (25% market share), The Griff Network, Norton (Saint-Gobain), Hubei Yuli Abrasive Belts Group, and SunShine Paper Company are among the leading suppliers focused on coating innovation and regional expansion.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA