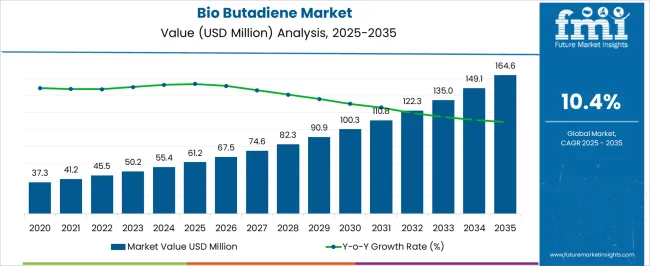

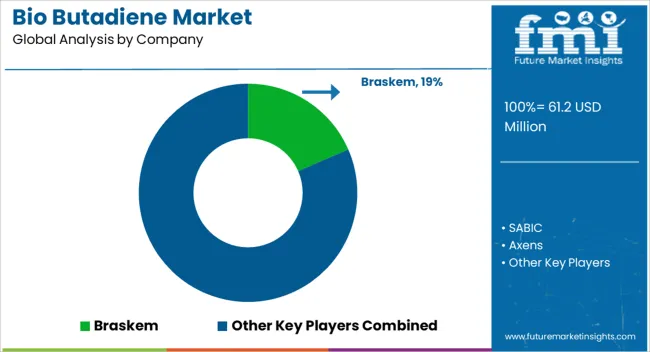

The Bio Butadiene Market is estimated to be valued at USD 61.2 million in 2025 and is projected to reach USD 164.6 million by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period. Evaluating rolling CAGR across this timeline reveals the market’s evolving acceleration and momentum year over year. The initial years show steady expansion, with market value increasing from USD 61.2 million to USD 74.6 million by 2027. During this period, the rolling CAGR remains close to the overall 10.4%, indicating consistent early growth momentum. Between 2028 and 2030, the CAGR slightly strengthens as values rise from USD 82.3 million to USD 110.8 million, suggesting growing adoption and market penetration.

Post-2030, the market enters a phase of accelerated expansion, with values increasing rapidly from USD 122.3 million in 2031 to USD 164.6 million by 2035. The rolling CAGR during this later phase surpasses earlier years, reflecting strengthening demand drivers such as bio-based chemical production and sustainability trends in the polymer industry. The rolling CAGR analysis highlights a market characterized by progressive acceleration rather than volatility. This upward momentum demonstrates the Bio Butadiene Market’s potential for sustained growth, driven by technological advancements and regulatory support favoring bio-based alternatives. The steady increase in CAGR across the forecast period makes this market attractive for strategic investments focused on long-term returns.

| Metric | Value |

|---|---|

| Bio Butadiene Market Estimated Value in (2025 E) | USD 61.2 million |

| Bio Butadiene Market Forecast Value in (2035 F) | USD 164.6 million |

| Forecast CAGR (2025 to 2035) | 10.4% |

The bio butadiene market is gaining momentum as sustainability regulations, feedstock innovation, and downstream demand from green manufacturing drive its commercial potential. Increasing regulatory pressure to reduce dependency on fossil-based raw materials is prompting chemical manufacturers to adopt bio-derived intermediates, with bio butadiene emerging as a strategic alternative.

Technological improvements in biomass-to-chemical conversion pathways and catalytic fermentation are accelerating commercial viability, while major players are investing in scalable pilot plants across Europe, Asia, and North America. Strategic partnerships between petrochemical giants and biotech innovators are fostering new supply chains that integrate bio-based C4 feedstocks into existing infrastructure.

Demand from tire, plastics, and rubber manufacturers is being reinforced by their decarbonization goals and customer sustainability requirements. Looking forward, incentives supporting bio-refinery development, trade liberalization in renewable chemicals, and advances in lignocellulosic biomass utilization are expected to broaden the market's long-term outlook.

The bio butadiene market is segmented by grade, source, end-use industry, and geographic regions. By grade, the bio butadiene market is divided into Industrial Grade and Laboratory Grade. In terms of the source of the bio-butadiene market, it is classified into Biomass-Based, Sugarcane, Corn, Cellulosic Biomass, Algae, Bio-Based Feedstocks, Bioethanol, Biobutanol, and Waste-Based Feedstocks. Based on end-use industry, the bio butadiene market is segmented into Automotive & Transportation, Consumer Goods, Chemical Processing, Building & Construction, Healthcare, and Others. Regionally, the bio butadiene industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

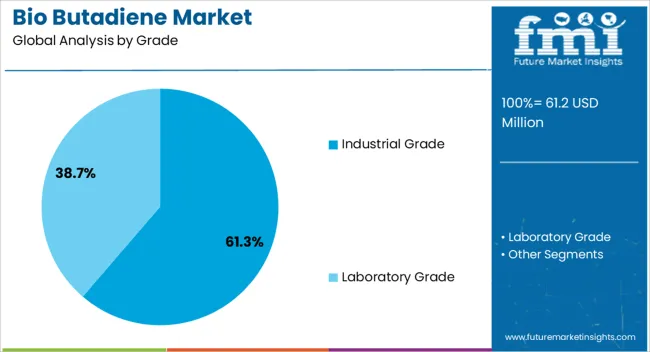

Industrial grade bio butadiene is projected to hold a dominant 61.3% share of the market revenue in 2025, making it the leading grade segment. Its prevalence is being driven by its widespread applicability across synthetic rubber, latex, and polymer production, which constitute core inputs in tires, hoses, and adhesives.

The industrial-grade category offers high thermal stability and chemical compatibility, meeting technical requirements for demanding automotive and construction applications. Enhanced compatibility with traditional polymerization technologies allows seamless substitution of fossil-based butadiene without modifying downstream processing.

As OEMs prioritize low-carbon materials, the demand for industrial-grade bio butadiene is expected to rise significantly, supported by robust end-user compliance initiatives and quality certification frameworks.

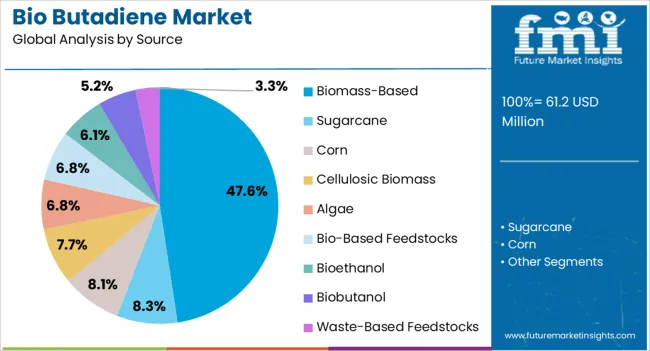

Biomass-based bio butadiene is expected to account for 47.6% of market revenue in 2025, positioning it as the most utilized feedstock segment. Its leadership is being fueled by growing interest in renewable raw materials derived from agricultural residues, lignocellulosic biomass, and organic waste streams.

Advances in catalytic conversion technologies and bio-refining efficiency have enabled competitive yields and scalability from biomass-derived sugars. Additionally, biomass-based production pathways are gaining traction due to their lower carbon footprint and enhanced alignment with life-cycle assessment (LCA) goals set by end-user industries.

Government subsidies and carbon credit mechanisms are further incentivizing investment in biomass processing infrastructure. The segment’s ability to provide regional feedstock diversity while lowering exposure to crude oil volatility continues to drive adoption across chemical and rubber manufacturing verticals.

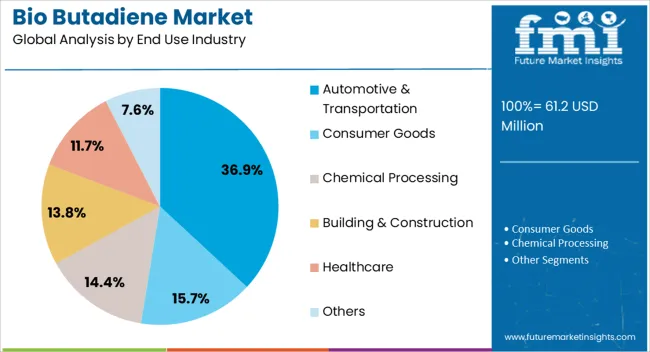

The automotive and transportation sector is projected to lead the bio butadiene market with a 36.9% revenue share in 2025. This segment’s dominance is being shaped by the growing need for sustainable tire materials and high-performance elastomers used in belts, seals, and vibration-absorbing components.

Regulatory mandates on vehicle emissions, coupled with OEM commitments to carbon neutrality, are pushing suppliers to integrate bio-based monomers into their product lines. Bio butadiene-based synthetic rubber matches the mechanical properties of petroleum-derived variants, enabling its use without reengineering performance parameters.

The rise of electric vehicles, which demand lightweight, high-durability components, is also influencing material innovation, with bio butadiene offering a viable path to reduce embedded carbon in supply chains. Tier-1 suppliers and tire manufacturers are increasingly embedding sustainable sourcing as a procurement criterion, accelerating demand within the automotive ecosystem.

The market is gaining momentum as industries seek sustainable alternatives to petrochemical-derived butadiene used in synthetic rubber and elastomer production. Bio butadiene, produced from renewable biomass sources, offers an eco-friendly solution that reduces greenhouse gas emissions and dependency on fossil fuels. Growing environmental regulations and increasing consumer preference for green products are accelerating demand. Advances in bioprocessing technologies, including fermentation and catalytic conversion, have improved production efficiency and scalability. The challenges such as high production costs and feedstock availability continue to affect market growth.

The rising global focus on sustainability and carbon footprint reduction has encouraged manufacturers to adopt bio-based raw materials like bio butadiene. It serves as a critical monomer in producing synthetic rubbers such as styrene-butadiene rubber (SBR) and polybutadiene rubber (PBR), which are widely used in automotive tires, industrial goods, and consumer products. The environmental benefits of bio butadiene, including lower lifecycle emissions and reduced reliance on crude oil, align with corporate sustainability goals and regulatory requirements. Increasing tire production and demand for eco-friendly automotive components contribute to the expanding market for bio butadiene as a sustainable rubber precursor.

Significant advancements in bio butadiene production methods have improved yield, purity, and cost-effectiveness. Technologies such as fermentation using engineered microorganisms and catalytic conversion of bioethanol have been optimized to increase bio butadiene output from renewable feedstocks like corn, sugarcane, and agricultural residues. Integration of bioprocesses with existing petrochemical infrastructure supports scalability and lowers capital expenditures. Research into novel catalysts and microbial strains continues to enhance conversion efficiency and reduce byproduct formation. These technological developments are critical to making bio butadiene competitive with traditional fossil-based counterparts, facilitating broader adoption in industrial applications.

Stringent environmental regulations targeting volatile organic compounds (VOCs) and greenhouse gas emissions have propelled interest in bio butadiene as a greener alternative. Government incentives, subsidies, and mandates promoting bio-based chemicals foster research, development, and commercialization efforts. International climate commitments encourage industries to transition toward renewable feedstocks, accelerating bio butadiene adoption. Public-private partnerships and funding initiatives support pilot projects and capacity expansion. Moreover, increasing consumer awareness and demand for sustainable products drive manufacturers to incorporate bio butadiene in their supply chains. These combined policy and market forces significantly influence the growth trajectory of the bio butadiene market.

Despite its environmental advantages, the bio butadiene market faces hurdles related to higher production costs compared to petroleum-based alternatives. Feedstock availability and price volatility impact manufacturing economics, especially in regions reliant on agricultural inputs. The complexity of scaling bioprocesses from laboratory to industrial scale poses technical and financial challenges. Infrastructure limitations and the need for significant capital investments restrict rapid market penetration. Efforts to improve process efficiency, diversify feedstock sources, and integrate with existing chemical production facilities are ongoing to address these challenges. Overcoming economic and supply chain constraints is essential for the sustainable growth of the bio butadiene market.

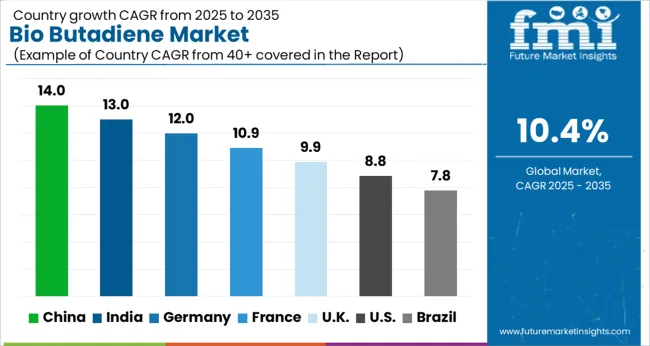

The market is forecasted to grow at a CAGR of 10.4% between 2025 and 2035, driven by increasing demand for sustainable and renewable chemical alternatives, along with rising environmental regulations. China leads with a 14.0% CAGR, supported by significant investments in bio-based chemical production and green manufacturing processes. India follows at 13.0%, fueled by expanding bio-refinery capacities and eco-friendly initiatives. Germany, growing at 12.0%, benefits from strong industrial focus on sustainable polymers and chemicals. The UK, at 9.9%, experiences growing adoption in the automotive and packaging industries. The USA, with an 8.8% CAGR, reflects innovation in bio-based product development and regulatory support for greener materials. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is poised to lead growth in the market with an anticipated CAGR of 14.0% from 2025 to 2035. The market expansion is supported by increased capacity in biorefinery infrastructure and government policies promoting bio-based chemical production as part of national environmental goals. Major chemical manufacturers such as Sinopec and CNOOC are enhancing bio butadiene synthesis through innovations in biomass conversion and catalytic processes. Demand from downstream applications including green tires, synthetic rubbers, and adhesives is growing rapidly. Collaborations between chemical producers and biotechnology firms have accelerated process efficiencies and cost reductions.

The market in India is projected to grow at a CAGR of 13.0% driven by a rising emphasis on renewable chemicals in automotive and industrial rubber manufacturing. Leading firms such as Reliance Industries and Jubilant Life Sciences are scaling up production using diverse biomass feedstocks including agricultural residues. Policy frameworks incentivizing bio-based chemical adoption and import substitution enhance market penetration. Increasing awareness of eco-friendly products among consumers is further supporting demand growth. Investments in R&D to improve fermentation and catalytic conversion processes are enabling cost competitiveness, encouraging wider industry adoption in tires, footwear, and consumer goods.

Germany is witnessing steady growth in bio butadiene demand at an estimated CAGR of 12.0%, propelled by a strong shift toward sustainable manufacturing and reduction of reliance on petrochemical sources. Key chemical producers such as BASF and Covestro are investing in advanced biotechnologies and process integration to improve yield and reduce production costs. Demand from the automotive sector, especially in eco-friendly tires and elastomeric components, remains significant. Government environmental policies mandating higher renewable content and circular economy principles strengthen the market foundation. Collaborative efforts between industry and research institutes focus on scalable production and novel catalytic pathways.

The United Kingdom is expected to advance at a CAGR of 9.9%, supported by growing focus on bio-based chemical manufacturing and circular economy initiatives. Companies including INEOS and Johnson Matthey are working on improving process efficiency and cost-effectiveness of bio butadiene production. Government policies on emission reductions and chemical waste management incentivize wider adoption. Increasing consumer preference for sustainable rubber products boosts demand in automotive and consumer sectors. Industry partnerships and pilot projects demonstrate commitment to scaling bio butadiene supply chains domestically.

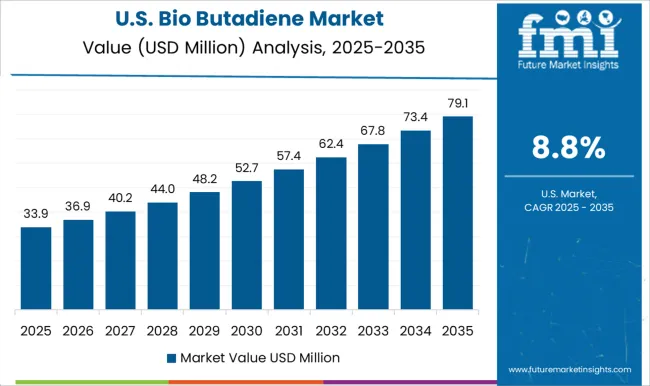

The United States market is forecast to grow at a CAGR of 8.8% over the next decade. Growth is driven by increased adoption of bio-based polymers and elastomers in automotive, packaging, and consumer product applications. Leading producers such as Genomatica and Braskem have made strides in developing efficient bioprocesses using renewable feedstocks. The expansion of sustainability mandates by corporations and federal programs encouraging low-carbon chemical manufacturing accelerate market growth. Investment in research and pilot plants for bio butadiene production continues to rise, improving market competitiveness and expanding application scope.

The market comprises established chemical producers and emerging bio-based technology companies offering sustainable alternatives to traditional petrochemical sources. Braskem and SABIC are prominent players leveraging extensive chemical manufacturing expertise to develop bio butadiene through advanced catalytic processes, targeting applications in synthetic rubber and plastics industries. Axens and Biokemik focus on refining bio-based feedstocks, optimizing conversion technologies that enhance yield and cost efficiency. ETB Catalytic Technologies provides specialized catalysts critical for efficient bio butadiene production, supporting industrial scalability. Evonik Industries and IFPEN invest in research and development to improve bio butadiene synthesis pathways, aiming to reduce environmental impact while maintaining product performance. Synthos and Trinseo contribute with integrated chemical solutions, focusing on expanding the bio butadiene supply chain for polymer manufacturing. Zeon Corporation rounds out the market with innovative approaches to bio-based monomers, integrating bio butadiene into high-performance elastomers. Growth in this market is supported by increasing demand for renewable raw materials and regulatory encouragement for bio-based chemicals. High entry barriers include significant capital requirements, complex process development, and the necessity to align with stringent quality standards. Leading providers capitalize on their technological capabilities and strategic partnerships to sustain leadership while advancing sustainable chemical production.

Companies are developing innovative bio-based production methods for butadiene, utilizing renewable feedstocks like biomass and sugars. Technologies such as fermentation-based processes and catalytic conversion are being explored to increase efficiency and reduce costs. Key players like Braskem, Genomatica, and LanzaTech are forming strategic partnerships with biotechnology firms to scale up bio-butadiene production. These collaborations aim to commercialize bio-based rubber and synthetic materials for automotive and industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 61.2 Million |

| Grade | Industrial Grade and Laboratory Grade |

| Source | Biomass-Based, Sugarcane, Corn, Cellulosic Biomass, Algae, Bio-Based Feedstocks, Bioethanol, Biobutanol, and Waste-Based Feedstocks |

| End Use Industry | Automotive & Transportation, Consumer Goods, Chemical Processing, Building & Construction, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Braskem, SABIC, Axens, Biokemik, ETB Catalytic Technologies, Evonik Industries, IFPEN, Synthos, Trinseo, and Zeon Corporation |

| Additional Attributes | Dollar sales by product grade and end-use industry, demand dynamics across automotive, synthetic rubber manufacturing, and plastics sectors, regional trends in production and consumption across Asia-Pacific, North America, and Europe, innovation in bio-based feedstocks, catalytic conversion processes, and sustainable polymer integration, environmental impact of renewable resource utilization, process emissions, and end-of-life recycling, and emerging use cases in eco-friendly tire manufacturing, bioplastic additives, and green elastomer composites. |

The global bio butadiene market is estimated to be valued at USD 61.2 million in 2025.

The market size for the bio butadiene market is projected to reach USD 164.6 million by 2035.

The bio butadiene market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in bio butadiene market are industrial grade and laboratory grade.

In terms of source, biomass-based segment to command 47.6% share in the bio butadiene market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bio-wax Market Forecast and Outlook 2025 to 2035

Biopsy Device Market Size and Share Forecast Outlook 2025 to 2035

Bioliquid Heat and Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocement Market Size and Share Forecast Outlook 2025 to 2035

Biomedical Refrigerator and Freezer Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bionic Glove's Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biopotential Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biomaterial Tester Market Size and Share Forecast Outlook 2025 to 2035

Biocompatible Materials Market Size and Share Forecast Outlook 2025 to 2035

Bio Based Paraxylene Market Size and Share Forecast Outlook 2025 to 2035

Biomass Pellets Market Size and Share Forecast Outlook 2025 to 2035

Biosimilar Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Biological Indicator Vial Market Size and Share Forecast Outlook 2025 to 2035

Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Biopolymer Injection Molders Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Biomass Gasification Market Size and Share Forecast Outlook 2025 to 2035

Biotech QMS Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA