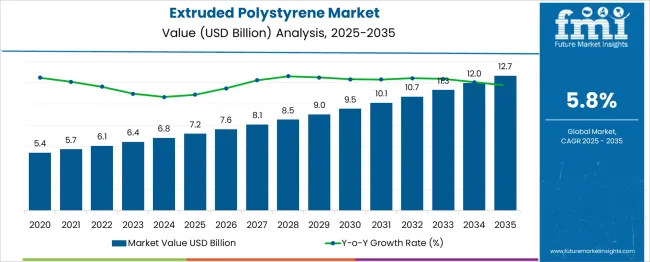

The global extruded polystyrene market is expected to grow from USD 7.2 billion in 2025 to approximately USD 12.7 billion by 2035, recording an absolute increase of USD 5.5 billion over the forecast period. This translates into a total growth of 76.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.8%between 2025 and 2035. The overall market size is expected to grow by nearly 1.76X during the same period, supported by increasing demand for thermal insulation in construction, rising energy efficiency requirements, and growing focus on eco-efficient building materials.

Between 2025 and 2030, the extruded polystyrene market is projected to expand from USD 7.2 billion to USD 9.4 billion, resulting in a value increase of USD 2.2 billion, which represents 40.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising construction activities in emerging markets, increasing demand for energy-efficient building materials, and growing penetration of green building standards. Construction companies and insulation manufacturers are expanding their extruded polystyrene product portfolios to address the growing demand for high-performance thermal insulation solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 7.2 billion |

| Forecast Value in (2035F) | USD 12.7 billion |

| Forecast CAGR (2025 to 2035) | 6% |

From 2030 to 2035, the market is forecast to grow from USD 9.4 billion to USD 12.7 billion, adding another USD 3.3 billion, which constitutes 60% of the ten-year expansion. This period is expected to be characterized by expansion of eco-efficient construction practices, integration of advanced manufacturing technologies, and development of next-generation insulation solutions. The growing adoption of net-zero building standards and energy-efficient construction materials will drive demand for premium extruded polystyrene products with enhanced thermal performance and environmental credentials.

Between 2020 and 2025, the extruded polystyrene market experienced steady expansion, driven by increasing focus on energy efficiency in buildings and growing awareness of thermal insulation benefits. The market developed as construction companies recognized the need for effective insulation solutions to meet stringent building codes and environmental regulations. Government initiatives promoting energy-efficient construction and green building certifications began emphasizing the importance of high-performance insulation materials in reducing energy consumption and carbon footprint.

Market expansion is being supported by the increasing demand for energy-efficient construction materials and the corresponding need for effective thermal insulation solutions. Modern construction practices are increasingly focused on reducing energy consumption and meeting stringent building codes that require high-performance insulation materials. Extruded polystyrene's superior thermal resistance, moisture resistance, and structural strength make it a preferred choice for foundation, wall, and roof insulation applications.

The growing emphasis on eco-efficient construction and green building standards is driving demand for extruded polystyrene products that contribute to energy savings and environmental eco-efficiency. Consumer preference for energy-efficient buildings that reduce heating and cooling costs is creating opportunities for advanced insulation solutions. The rising influence of building codes and energy efficiency regulations is also contributing to increased product adoption across residential, commercial, and industrial construction projects.

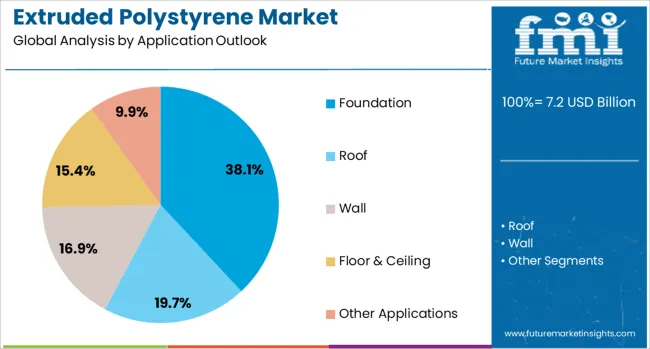

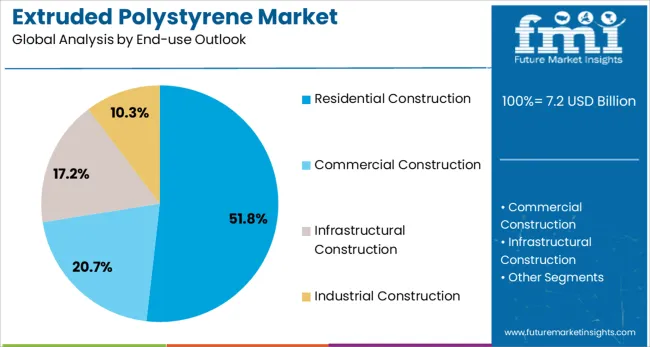

The market is segmented by application, end-use, and region. By application, the market is divided into foundation, roof, wall, floor & ceiling, and other applications. Based on end-use, the market is categorized into residential construction, commercial construction, infrastructural construction, and industrial construction. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The foundation application is projected to account for 38.1% of the extruded polystyrene market in 2025, reaffirming its position as the category's primary application. Construction professionals increasingly understand the importance of proper foundation insulation in preventing thermal bridging, moisture infiltration, and energy loss. Extruded polystyrene's excellent compressive strength and moisture resistance make it ideal for below-grade applications where it must withstand soil pressure and potential water exposure.

This application forms the foundation of most construction insulation strategies, as it represents the most critical area for preventing heat loss and structural damage. Building code requirements and energy efficiency standards continue to strengthen the demand for high-performance foundation insulation. With construction practices evolving toward more eco-efficient and energy-efficient methods, foundation insulation aligns with both regulatory compliance and long-term building performance goals. Its widespread adoption across residential, commercial, and industrial construction ensures sustained dominance, making it the central growth driver of extruded polystyrene demand.

Residential construction is projected to represent 51.8% of extruded polystyrene demand in 2025, underscoring its role as the preferred end-use segment for thermal insulation applications. Homeowners and builders gravitate toward extruded polystyrene for its excellent insulation properties, durability, and ability to reduce energy costs over the building's lifetime. Positioned as a long-term investment, extruded polystyrene insulation offers both immediate construction benefits and ongoing energy savings for residential properties.

The segment is supported by the growing trend toward energy-efficient home construction, where insulation plays a central role in meeting building codes and green building standards. Residential renovation and retrofitting projects are increasingly incorporating extruded polystyrene insulation to improve existing homes' energy performance. As homeowners prioritize energy efficiency and comfort, extruded polystyrene-based insulation systems will continue to dominate demand, reinforcing their essential positioning within the residential construction market.

The extruded polystyrene market is advancing steadily due to increasing demand for energy-efficient construction materials and growing emphasis on eco-efficient building practices. However, the market faces challenges including raw material price volatility, environmental concerns regarding foam plastics, and competition from alternative insulation materials. Innovation in manufacturing processes and recycling technologies continue to influence product development and market expansion patterns.

The growing adoption of green building certifications and stringent energy codes is driving demand for high-performance insulation materials like extruded polystyrene. Building standards such as LEED, ENERGY STAR, and passive house requirements emphasize the importance of thermal insulation in achieving energy efficiency targets. Government regulations and incentives for energy-efficient construction are encouraging builders to specify premium insulation materials that meet or exceed performance requirements.

Modern extruded polystyrene manufacturers are incorporating advanced production technologies to improve product consistency, reduce environmental impact, and enhance thermal performance. Manufacturing innovations include improved blowing agents, enhanced surface textures for better adhesion, and specialized formulations for specific applications. These technological advances enable manufacturers to produce higher-quality products while reducing production costs and environmental footprint.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.3% |

| China | 7.8% |

| Brazil | 4.4% |

| UK | 5.5% |

| Germany | 6.7% |

| USA | 4.9% |

| France | 6.1% |

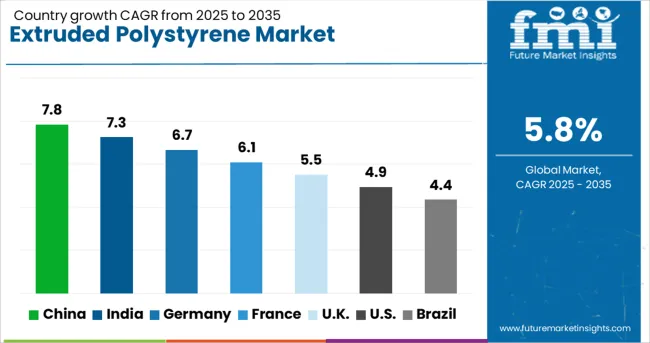

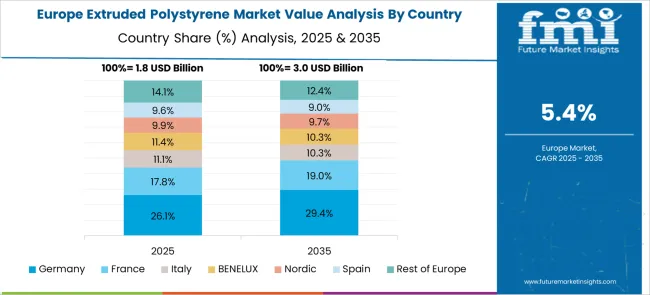

The extruded polystyrene market is experiencing steady growth globally, with China leading at a 7.8% CAGR through 2035, driven by massive construction activities, urbanization, and increasing adoption of energy-efficient building materials. India follows closely at 7.3%, supported by growing construction sector, rising infrastructure investments, and increasing awareness of thermal insulation benefits. Germany shows solid growth at 6.7%, emphasizing high-performance insulation materials and eco-efficient construction practices. France records 6.1%, focusing on energy-efficient building standards and renovation projects. The UK shows 5.5% growth, prioritizing retrofitting and net-zero construction targets. The USA demonstrates 4.9% growth, driven by residential construction recovery and energy code requirements.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from extruded polystyrene in China is projected to exhibit strong growth with a CAGR of 7.8% through 2035, driven by extensive urbanization, infrastructure development, and increasing adoption of energy-efficient construction materials. The country's massive construction sector and growing emphasis on building energy efficiency are creating significant demand for high-performance insulation products. Major domestic and international insulation manufacturers are establishing comprehensive production facilities to serve the growing population of construction projects across tier-1 and tier-2 cities.

Revenue from extruded polystyrene in India is expanding at a CAGR of 7.3%, supported by increasing construction activities, growing infrastructure investments, and rising awareness of thermal insulation benefits. The country's expanding construction sector and increasing adoption of modern building practices are driving demand for effective insulation solutions. International insulation manufacturers and domestic producers are establishing distribution networks to serve the growing demand for quality insulation materials.

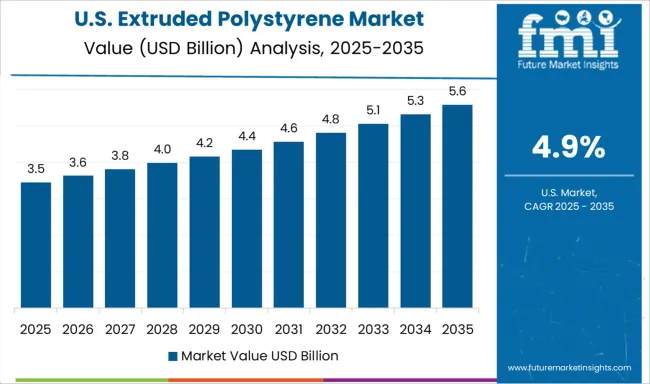

Demand for extruded polystyrene in the USA is projected to grow at a CAGR of 4.9%, supported by residential construction recovery and stringent energy code requirements. American builders are increasingly focused on energy-efficient construction practices and high-performance building materials. The market is characterized by strong demand for premium insulation products that meet or exceed building code requirements for thermal performance and moisture resistance.

Revenue from extruded polystyrene in Germany is projected to grow at a CAGR of 6.7% through 2035, driven by the country's stringent energy efficiency requirements, advanced building standards, and consumer preference for high-performance construction materials. German builders consistently demand premium insulation products that deliver superior thermal performance while maintaining long-term durability and environmental responsibility.

Revenue from extruded polystyrene in the UK is projected to grow at a CAGR of 5.5% through 2035, supported by rising focus on building retrofitting and commitment to net-zero construction targets. British builders and property owners value energy efficiency, thermal performance, and long-term building eco-efficiency, positioning extruded polystyrene as a core component of energy-efficient construction strategies.

Revenue from extruded polystyrene in France is projected to grow at a CAGR of 6.1% through 2035, supported by the country's emphasis on eco-efficient construction practices, energy efficiency regulations, and premium building materials. French builders prioritize thermal performance, moisture resistance, and long-term durability, making extruded polystyrene insulation a trusted choice in the premium construction segment.

Revenue from extruded polystyrene in Brazil is projected to grow at a CAGR of 4.4% through 2035, supported by expanding construction activities, increasing infrastructure investments, and growing awareness of thermal insulation benefits. Brazilian builders are increasingly recognizing the value of effective insulation in reducing energy costs and improving building comfort in diverse climate conditions.

The extruded polystyrene market is characterized by competition among established building materials companies, specialty insulation manufacturers, and regional production facilities. Companies are investing in advanced manufacturing technologies, eco-efficient production practices, product innovation, and distribution network expansion to deliver effective, reliable, and accessible insulation solutions. Manufacturing efficiency, product performance, and market coverage are central to strengthening competitive positioning and market presence.

Owens Corning leads the market with significant global presence, offering comprehensive extruded polystyrene product lines with focus on thermal performance and building applications. DuPont de Nemours Inc. provides advanced insulation materials with emphasis on innovation and high-performance applications. Kingspan Group delivers integrated building envelope solutions that incorporate extruded polystyrene insulation systems. BASF SE focuses on chemical expertise and advanced material formulations for superior insulation performance.

Carlisle Construction Materials (CCM) emphasizes commercial and industrial construction applications with specialized product offerings. Knauf Insulation provides comprehensive insulation solutions across multiple building applications and geographic markets. Austrotherm focuses on European markets with premium extruded polystyrene products for demanding applications. Rmax specializes in polyiso and extruded polystyrene insulation systems for commercial construction. URSA offers mineral wool and extruded polystyrene insulation products with focus on thermal and acoustic performance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 7.2 billion |

| Application | Foundation, Roof, Wall, Floor & Ceiling, Other Applications |

| End-use | Residential Construction, Commercial Construction, Infrastructural Construction, Industrial Construction |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, India, Brazil, Japan, South Korea, Australia and 40+ countries |

| Key Companies Profiled | Owens Corning, DuPont de Nemours Inc., Kingspan Group, BASF SE, Carlisle Construction Materials (CCM), Knauf Insulation, Austrotherm, Rmax, and URSA |

| Additional Attributes | Dollar sales by application and end-use segments, regional demand trends, competitive landscape, builder preferences for thermal performance characteristics, integration with green building standards, innovations in manufacturing processes, eco-efficient production practices, and advanced insulation technologies |

The global extruded polystyrene market is estimated to be valued at USD 7.2 billion in 2025.

The market size for the extruded polystyrene market is projected to reach USD 12.7 billion by 2035.

The extruded polystyrene market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in extruded polystyrene market are foundation, roof, wall, floor & ceiling and other applications.

In terms of end-use outlook, residential construction segment to command 51.8% share in the extruded polystyrene market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Extruded Plastics Market Size and Share Forecast Outlook 2025 to 2035

Extruded Snacks Market Size and Share Forecast Outlook 2025 to 2035

Extruded Cereals Market

Extruded Soy Products Market

Co Extruded Films Market Size and Share Forecast Outlook 2025 to 2035

Rolled Or Extruded Aluminum Rods Bars And Wires Market Size and Share Forecast Outlook 2025 to 2035

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Polystyrene Films Market Size and Share Forecast Outlook 2025 to 2035

Polystyrene Packaging Market Analysis - Size & Growth Forecast 2025 to 2035

Expanded Polystyrene for Packaging Market Insights – Growth & Forecast 2025 to 2035

Expanded Polystyrene Market

Specialty Polystyrene Resin Market Growth – Trends & Forecast 2024-2034

Expandable Polystyrene Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA