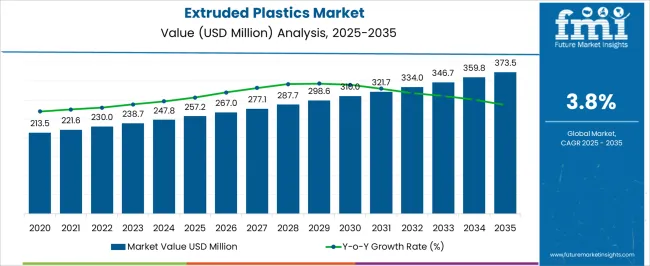

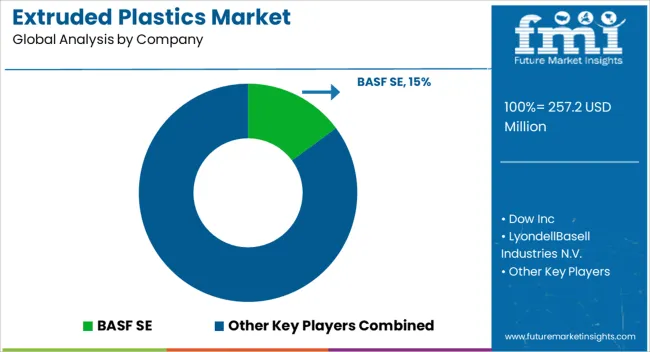

The extruded plastics market is estimated to be valued at USD 257.2 million in 2025 and is projected to reach USD 373.5 million by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period. From 2021 to 2025, the market progresses from USD 213.5 million to USD 257.2 million, moving through USD 221.6 million, 230.0 million, 238.7 million, and 247.8 million. Growth during this period is driven by the increasing demand for extruded plastic products across industries like packaging, automotive, and construction. Technological advancements in extrusion processes and material innovations contribute to consistent growth.

As plastic extrusion technology continues to improve, the adoption of new types of plastic products accelerates. This phase sees continued strong demand for extruded plastics, particularly in sectors such as food packaging, construction, and electronics. As industry needs evolve, ongoing advancements in extrusion technology and new applications for plastic products drive sustained market growth.

| Metric | Value |

|---|---|

| Extruded Plastics Market Estimated Value in (2025 E) | USD 257.2 million |

| Extruded Plastics Market Forecast Value in (2035 F) | USD 373.5 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

The plastic processing equipment market contributes approximately 25-30%, as extrusion is a primary method for shaping plastic materials, with demand for extruders and related machinery driving the need for new technologies in various industries. The packaging market is the largest contributor, accounting for around 35-40%, as extruded plastics are widely used in flexible and rigid packaging, including food containers, films, wraps, and bottles. Packaging continues to be a major growth driver, especially with the rise of e-commerce and consumer goods packaging. The construction and building materials market adds about 15-18%, with extruded plastics used in applications such as pipes, insulation materials, flooring, and siding. As global construction activities expand, so does the need for extruded plastic products.

The automotive market accounts for approximately 8-10%, as extruded plastics are used for lightweight automotive parts like bumpers, seals, and interior components, helping to meet demands for fuel-efficient vehicles. Finally, the consumer goods and electronics market contributes about 10-12%, where extruded plastics are used in manufacturing household appliances, electronics, and office equipment, due to their durability, versatility, and cost-effectiveness.

The extruded plastics market is advancing steadily, driven by rising demand across diverse industries such as packaging, construction, automotive, and consumer goods. Extrusion technology is favored for its cost efficiency, scalability, and ability to produce complex shapes with high precision. The market is benefiting from increasing usage of lightweight and durable plastic components that replace traditional materials like metal and wood.

Continuous innovations in polymer formulations and extrusion machinery have improved product quality, reduced energy consumption, and broadened application scope. The future outlook remains positive as manufacturers adopt sustainable practices, including the integration of bio-based and recycled plastics into extrusion processes.

Growing urbanization, infrastructure development, and heightened demand for hygienic and protective packaging solutions are expected to further bolster market growth. As end-users seek performance, cost-efficiency, and design flexibility, extruded plastics are positioned as an essential material in modern industrial manufacturing.

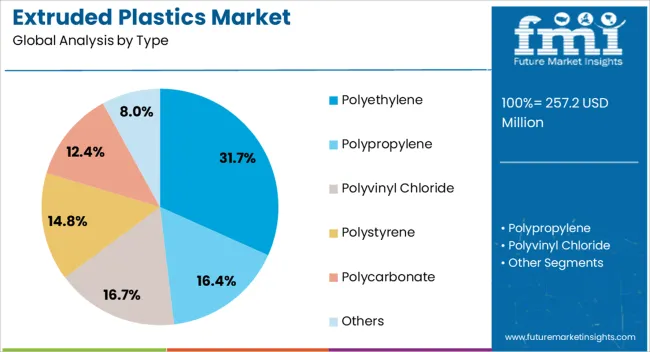

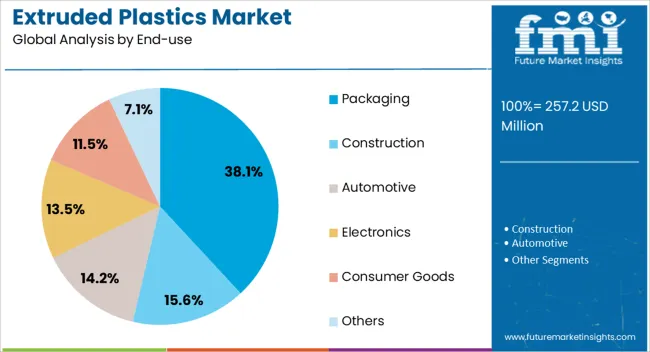

The extruded plastics market is segmented by type, application, end-use, and geographic regions. By type, extruded plastics market is divided into Polyethylene, Polypropylene, Polyvinyl Chloride, Polystyrene, Polycarbonate, and Others. In terms of application, extruded plastics market is classified into Profiles, Pipes and Tubes, Sheets and Films, Cables and Wires, Filaments, and Others. Based on end-use, extruded plastics market is segmented into Packaging, Construction, Automotive, Electronics, Consumer Goods, and Others.

Regionally, the extruded plastics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene segment commands a leading 31.7% share of the extruded plastics market, driven by its widespread use across applications requiring durability, chemical resistance, and flexibility. This thermoplastic polymer is favored for its low cost, ease of processing, and excellent mechanical properties, making it a staple in both commodity and specialty applications.

Polyethylene’s adaptability enables its use in pipes, films, sheets, and wire insulation, supported by high production volumes and global availability. Advancements in high-density and low-density polyethylene variants have expanded their use in structural and flexible products.

Market growth is further supported by increasing demand for sustainable packaging and the recyclability of polyethylene-based products. As extrusion technology continues to evolve, polyethylene remains a material of choice due to its reliability, versatility, and performance across a broad spectrum of industries

The profiles segment holds a 25.4% market share within the application category, reflecting its growing significance in construction, automotive, and industrial design sectors. Extruded plastic profiles are used extensively for creating structural components such as window frames, door trims, tubing, and customized sections due to their lightweight nature and design flexibility.

These profiles offer advantages such as resistance to moisture, chemicals, and corrosion, making them suitable for both indoor and outdoor applications. Market demand is being driven by infrastructure modernization, smart city initiatives, and the need for durable yet cost-effective building materials.

Technological improvements in die design and cooling systems have enhanced extrusion precision, enabling complex cross-sections and higher output efficiency. The segment is expected to maintain steady growth as industries prioritize customized and energy-efficient solutions that meet modern architectural and functional requirements.

The packaging segment leads the end-use category with a 38.1% share, underlining its critical role in driving demand for extruded plastics globally. Growth in this segment is primarily fueled by the increasing need for lightweight, flexible, and protective packaging solutions across food, pharmaceutical, and e-commerce sectors.

Extruded plastics offer key advantages such as transparency, barrier protection, sealability, and resistance to moisture and contamination, aligning with modern packaging requirements. As consumer expectations evolve toward convenience and sustainability, the market has seen a rise in the use of recyclable and biobased plastic materials.

Technological advancements in multilayer extrusion and film coating have further enhanced product functionality and shelf appeal. The continued expansion of retail and online shopping channels is expected to sustain high demand in this segment, positioning it as a cornerstone of the extruded plastics industry.

The extruded plastics market is growing as manufacturers prioritize cost-effective, versatile, and durable materials for applications across packaging, automotive, construction, and consumer goods. Demand is driven by the widespread use of plastic profiles, sheets, films, and pipes in both residential and industrial applications. Challenges include fluctuations in raw material prices, environmental concerns related to plastic waste, and competition from alternative materials such as bioplastics. Opportunities exist in advanced polymer formulations, innovative extruded products, and new applications in 3D printing and electric vehicle (EV) components. Trends highlight recycled plastic usage, improved extrusion technology, and multi-functional product designs.

Demand for extruded plastics is driven by their widespread application in industries such as packaging, construction, automotive, and consumer goods, where cost-effectiveness, durability, and versatility are essential. The extrusion process allows manufacturers to produce high-quality plastic products at scale, including profiles, pipes, sheets, and films. Growth in urbanization, infrastructure projects, and the e-commerce boom contributes to the increasing need for extruded plastics. Additionally, advancements in polymer formulations and extrusion techniques are enhancing material properties, enabling more efficient and customized solutions. As industries seek functional and adaptable packaging, extruded plastics remain crucial for both large-scale production and specialized applications.

Constraints in the market include fluctuations in raw material prices, such as polyethylene, polypropylene, and PVC, impacting the overall production costs of extruded plastics. Environmental concerns over plastic waste and recycling limitations also add pressure on manufacturers to explore alternative solutions. Additionally, extrusion equipment requires continuous technological improvements to boost efficiency, energy consumption, and speed. Regulatory challenges include compliance with environmental standards concerning recycling, waste disposal, and the use of certain additives. Buyers are increasingly looking for suppliers that offer competitive pricing, effective material solutions, and technical expertise to support product development while meeting regulatory requirements.

Opportunities are strongest in developing innovative extruded plastic products that meet the growing demand for high-performance materials in various industries. The need for lightweight, durable components in the automotive and construction sectors is driving advancements in extruded plastics for both structural and non-structural applications. Furthermore, improvements in extrusion technology, including 3D printing and multilayer extrusion, are opening new avenues for custom products and high-performance parts. The rise of electric vehicles (EVs) also presents demand for specialized extruded plastic components such as battery housings and interior panels. Suppliers offering tailored solutions, advanced extrusion technologies, and unique products are well-positioned to capture new opportunities.

Energy-efficient extrusion methods and optimized machinery are improving production capacity while reducing operational costs. Customization is gaining traction as manufacturers demand extruded plastics designed for specific applications, such as custom films for packaging or specialized automotive components. Advancements in material properties, including strength, flexibility, and heat resistance, are also key trends. Multi-functional products and 3D printing applications are expanding the possibilities for extruded plastics. Suppliers who integrate these trends into their offerings are positioned to lead the market as demand for custom and high-performance plastic products grows.

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

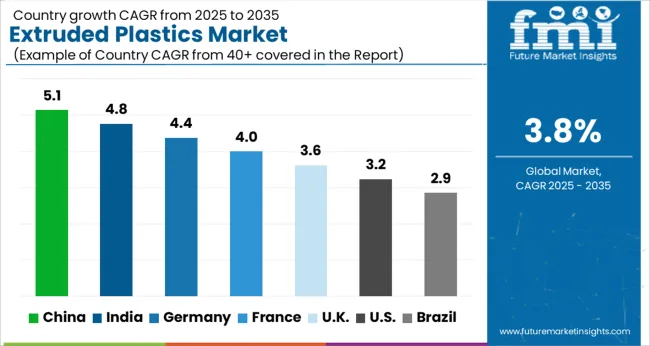

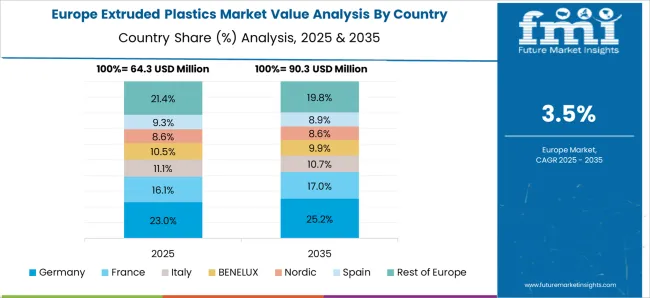

The global extruded plastics market is projected to grow at a CAGR of 3.8% from 2025 to 2035. China leads with a growth rate of 5.1%, followed by India at 4.8%, France at 4.0%, the UK at 3.6%, and the USA at 3.2%. Growth is driven by rising demand from the construction, packaging, and automotive industries. As urbanization continues, the need for extruded plastic pipes, profiles, and sheets grows. Additionally, the shift towards sustainable packaging and the growing use of lightweight materials in vehicles and construction further contributes to the market expansion. The analysis spans over 40+ countries, with the leading markets shown below.

The extruded plastics market in China is projected to grow at a CAGR of 5.1% from 2025 to 2035, driven by rapid industrialization, infrastructure development, and an expanding automotive and packaging sector. The demand for plastic pipes, profiles, sheets, and films is particularly high in the construction, automotive, and electronics industries. China’s large-scale manufacturing base, combined with its strong export capabilities, makes it a leading player in the global market for extruded plastics. The increasing adoption of plastic for packaging and the rise of eCommerce have further increased demand for extruded plastic films. The country’s growing focus on urbanization and infrastructure development is expected to sustain market growth, as plastic components are integral to building materials, transportation, and various consumer goods.

The extruded plastics market in India is expected to grow at a CAGR of 4.8% over the forecast period, supported by increasing demand from the packaging, construction, and automotive sectors. India’s growing middle class, coupled with rising disposable incomes, is leading to higher demand for plastic products in consumer goods, packaging, and construction materials. The country’s construction boom, particularly in the commercial and residential sectors, further drives the demand for extruded plastic products like pipes, profiles, and sheets. Furthermore, the rising demand for lightweight materials in the automotive industry is boosting the market for extruded plastics used in vehicle parts. The Indian government’s initiatives to promote manufacturing under the "Make in India" program also support domestic production and innovation in extruded plastic products.

The extruded plastics market in France is projected to grow at a CAGR of 4.0% from 2025 to 2035, driven by demand from the packaging, construction, and automotive sectors. The French market is heavily influenced by the ongoing demand for sustainable packaging solutions, and the increasing use of extruded plastics for food and beverage packaging is a significant trend. The growing construction sector, particularly in infrastructure and residential development, also supports market growth, with extruded plastic profiles and pipes used in a variety of building applications. The automotive industry’s shift toward lighter and more efficient materials, including extruded plastics, is contributing to the demand for such products.

The UK extruded plastics market is expected to grow at a CAGR of 3.6% over the forecast period. Demand is primarily driven by the construction and packaging sectors, with an emphasis on eco-friendly packaging solutions. Extruded plastic pipes, profiles, and sheets are increasingly used in both residential and commercial construction, contributing to the market’s steady growth. The USA is also witnessing rising demand for plastic products in the automotive sector, where lightweight, durable materials are in high demand. With growing awareness around the importance of sustainable and recyclable materials, the market is also leaning towards innovations in biodegradable plastics and recyclable extruded plastic products.

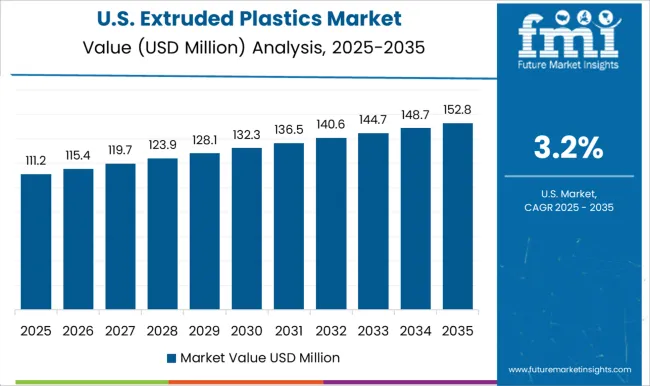

The USA market for extruded plastics is projected to grow at a CAGR of 3.2% from 2025 to 2035. Key drivers include increased demand from the construction, packaging, and automotive industries. Extruded plastics are commonly used in construction for insulation materials, profiles, and pipes, and this trend is expected to continue with ongoing infrastructure and residential developments. In the automotive sector, demand for lightweight materials that improve fuel efficiency and reduce emissions is increasing, thus driving the adoption of extruded plastics for vehicle parts. The USA packaging market’s shift towards sustainable packaging options is contributing to demand for extruded plastic films and products.

In the extruded plastics market, competition is driven by material innovation, product diversity, and market reach. BASF SE competes by offering high-performance polymers and additives, including solutions for automotive, construction, and packaging industries. Their extensive product portfolio emphasizes sustainability through advanced materials that improve energy efficiency and reduce environmental impact. Dow Inc. maintains a strong position with a broad range of thermoplastics, polyolefins, and specialty resins. The company's strategy focuses on developing high-performance plastics for sectors such as automotive, packaging, and consumer goods, while investing heavily in recyclability and circular economy initiatives.

LyondellBasell Industries N.V. emphasizes its leadership in polypropylene and polyethylene production, offering products widely used in consumer goods, packaging, and medical applications. Their strategy revolves around increasing manufacturing capacity and developing innovative, more sustainable material solutions. SABIC focuses on high-quality engineering plastics and polymers, with a significant presence in the automotive, electronics, and construction industries. Their materials are designed for weight reduction and improved durability, contributing to the sustainability goals of their customers. ExxonMobil Corporation and INEOS Group Holdings S.A. compete with a focus on large-scale production of polyolefins, catering to a broad spectrum of applications, including packaging and construction.

Formosa Plastics Corporation offers a wide range of plastics, including polyethylene and PVC, competing primarily in the packaging and construction sectors, where cost-efficiency and material availability are critical. Mitsubishi Chemical Holdings Corporation competes by producing specialized compounds for industrial applications, such as automotive parts and electrical components, often prioritizing advanced polymerization techniques for higher material performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 257.2 Million |

| Type | Polyethylene, Polypropylene, Polyvinyl Chloride, Polystyrene, Polycarbonate, and Others |

| Application | Profiles, Pipes and Tubes, Sheets and Films, Cables and Wires, Filaments, and Others |

| End-use | Packaging, Construction, Automotive, Electronics, Consumer Goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Dow Inc, LyondellBasell Industries N.V., SABIC, ExxonMobil Corporation, INEOS Group Holdings S.A, Formosa Plastics Corporation, Mitsubishi Chemical Holdings Corporation, TotalEnergies SE, Lanxess AG, Covestro AG, Eastman Chemical Company, Celanese Corporation, Solvay S.A, and Teijin Limited |

| Additional Attributes | Dollar sales by product type (HDPE, PVC, polystyrene, polypropylene, other), application (automotive, packaging, construction, electronics, consumer goods), and end-use industry (industrial, commercial, residential). Demand dynamics are influenced by growth in packaging, construction, and automotive sectors, alongside increasing regulatory pressures on sustainability. Regional trends highlight significant growth in North America, Europe, and Asia-Pacific, with rising demand for lightweight, durable, and eco-friendly plastics. |

The global extruded plastics market is estimated to be valued at USD 257.2 million in 2025.

The market size for the extruded plastics market is projected to reach USD 373.5 million by 2035.

The extruded plastics market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in extruded plastics market are polyethylene, polypropylene, polyvinyl chloride, polystyrene, polycarbonate and others.

In terms of application, profiles segment to command 25.4% share in the extruded plastics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Extruded Polystyrene Market Size and Share Forecast Outlook 2025 to 2035

Extruded Snacks Market Size and Share Forecast Outlook 2025 to 2035

Extruded Cereals Market

Extruded Soy Products Market

Co Extruded Films Market Size and Share Forecast Outlook 2025 to 2035

Rolled Or Extruded Aluminum Rods Bars And Wires Market Size and Share Forecast Outlook 2025 to 2035

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Plastics-To-Fuel (PTF) Market Size and Share Forecast Outlook 2025 to 2035

Bioplastics For Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bioplastics Market Analysis - Size, Share & Forecast 2025 to 2035

Foam Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Biopharma Plastics Market Size and Share Forecast Outlook 2025 to 2035

Corn-Based Plastics for Packaging Market Size and Share Forecast Outlook 2025 to 2035

Conductive Plastics Market Growth - Trends & Forecast 2025 to 2035

Transparent Plastics Market Size and Share Forecast Outlook 2025 to 2035

Thermoformed Plastics Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Algae-Based Bioplastics Market Share & Provider Insights

Breaking Down Market Share in the Fire Retardant Plastics Industry

Industry Share Analysis for Wire and Cable Plastics Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA