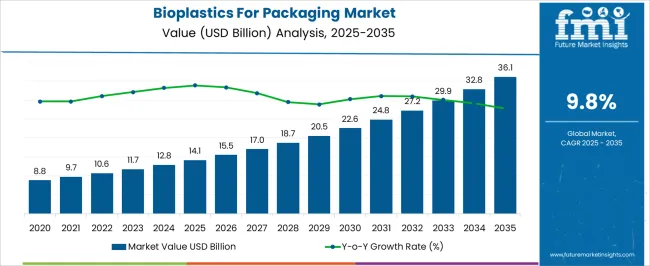

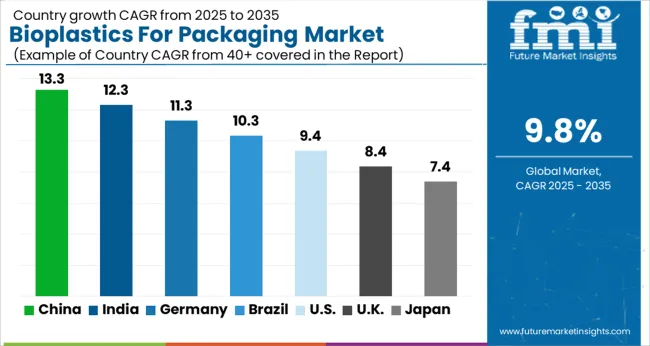

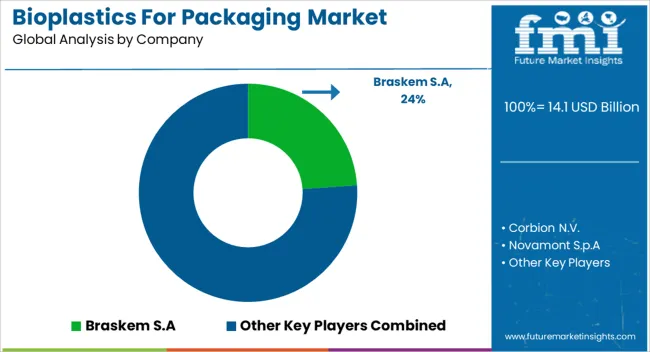

The Bioplastics For Packaging Market is estimated to be valued at USD 14.1 billion in 2025 and is projected to reach USD 36.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.8% over the forecast period.

| Metric | Value |

|---|---|

| Bioplastics For Packaging Market Estimated Value in (2025 E) | USD 14.1 billion |

| Bioplastics For Packaging Market Forecast Value in (2035 F) | USD 36.1 billion |

| Forecast CAGR (2025 to 2035) | 9.8% |

The bioplastics for packaging market is experiencing robust expansion as sustainability takes center stage across global supply chains. Rising consumer demand for eco friendly products, coupled with government regulations to curb single use plastics, has accelerated the adoption of bio based packaging solutions.

Technological innovations in biopolymer processing and material performance have improved durability, flexibility, and barrier properties, making bioplastics viable alternatives to traditional plastics. Leading food and beverage companies as well as consumer goods manufacturers are increasingly integrating bioplastic packaging to align with corporate sustainability goals and brand differentiation strategies.

Additionally, advances in compostable and recyclable materials are widening application potential across multiple sectors. The outlook remains positive as brands invest in circular economy initiatives and consumers continue to prioritize environmentally responsible packaging options.

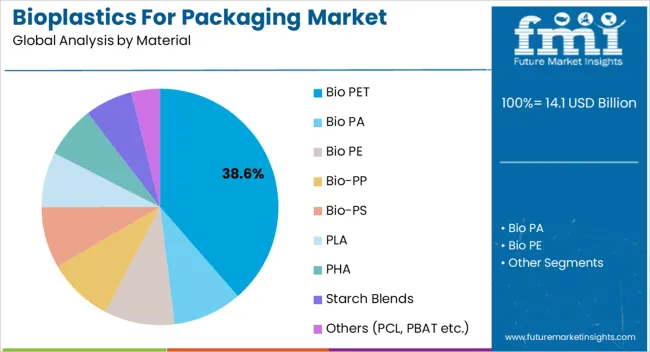

The bio PET material segment is projected to hold 38.60% of total revenue by 2025 within the material category, making it the dominant choice. This position is supported by its mechanical strength, transparency, and compatibility with existing PET recycling streams.

Bio PET has been widely adopted in applications requiring durability and clarity, particularly in food and beverage packaging. Its ability to provide high barrier protection while maintaining sustainability credentials has strengthened its market position.

Continuous investment in scaling bio based PET production is further reinforcing its prominence in the material segment.

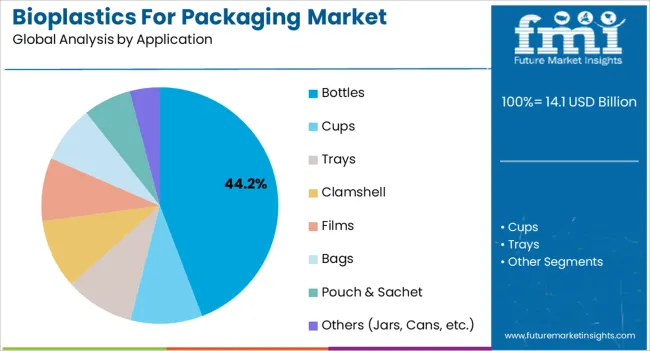

The bottles application segment is expected to account for 44.20% of total revenue by 2025 within the application category, positioning it as the leading area of use. The dominance of this segment is driven by strong demand for beverage and water bottles that combine durability with sustainable attributes.

Bio based bottles are being increasingly integrated by global brands aiming to reduce plastic footprints while maintaining product quality. Their ease of production, compatibility with recycling systems, and strong consumer acceptance continue to boost adoption rates.

As circular packaging models gain momentum, bottles remain at the forefront of bioplastics applications.

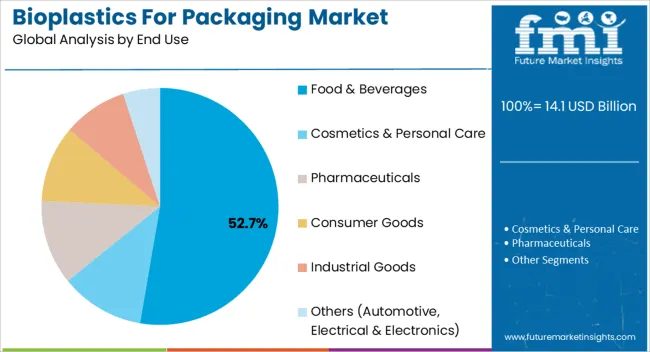

The food and beverages end use segment is projected to represent 52.70% of the total revenue by 2025, making it the largest end use category. Growth in this segment is being fueled by rising consumer demand for sustainable food packaging and the need for high quality barrier solutions to preserve freshness and safety.

Regulatory mandates around single use plastics in food packaging have accelerated adoption of bioplastic alternatives. Additionally, the industry’s focus on brand sustainability and environmentally conscious consumers has reinforced demand.

The combination of regulatory pressure, consumer preference, and industry innovation has ensured that food and beverages remain the leading end use for bioplastics in packaging.

Bio-based plastics are extensively employed in several markets like packaging, consumer electronics, catering products, construction, automotive, and various other sectors. The packaging from bioplastics has evolved over the past decade.

New innovative materials such as PLA, PHA, and Bio PBS create packaging solutions with new functionalities like biodegradability, breathability, an increase in material strength, etc. Other new material like PEF offers better barrier properties than traditional polymers and can be easily mechanically recycled.

As per international standards, such as ISO 17088, ASTM 6400 (USA), and EN13432 (Europe), biopolymers are certified compostable. All the aforementioned factors are instrumental in its use in the packaging industry.

There is a high demand for bioplastic packaging for wrapping organic food also premium branded products. Materials such as PLA, bio-PE, or bio-PET are used in rigid bioplastics applications such as cosmetic packaging, beverage bottles, etc. In food, packaging biodegradability is the most sought feature.

Flexible packaging solutions like films enable longer life of the products. When it comes to protecting food the performance of bioplastic packaging is comparable and sometimes better than existing conventional packaging. Thus, the growth of bioplastics for packaging market is expected to jump significantly.

Driven by the growth of the sustainable packaging market across the globe, the bioplastics for packaging industry is anticipated to rise at 10.3% CAGR from 2025 to 2035. Plastic plays an essential role in protecting, providing, and delivering high-quality products in every market segment to consumers across the globe.

In the plastic industry, the leading market segment is the packaging segment. The enormous consumption of conventional plastic in packaging has resulted in overarching problems such as climate change and the future shortage of fossil resources, which has proliferated the search for better alternatives for plastic packaging.

Bioplastics are eco-friendly alternative solutions to traditional plastic solutions. Today, there is a bioplastic alternative for almost every traditional plastic material and application.

Bioplastics are bio-based, biodegradable, or both and offer similar or in some cases even better properties and functionalities as conventional plastics, also offer more benefits such as reduction of carbon footprint, organic recycling, better functionalities, etc.

With the growing environmental awareness of consumers, consumers want to buy products that have minimal impact on the environment. Furthermore, the ever-growing big brands are turning to compostable plastics solutions.

Due to Government regulations, the manufacturers are looking for innovative ways to reduce their environmental footprint and tapping into advanced technical properties that bioplastics have to offer. All these factors are expected to significantly drive bioplastics for packaging market.

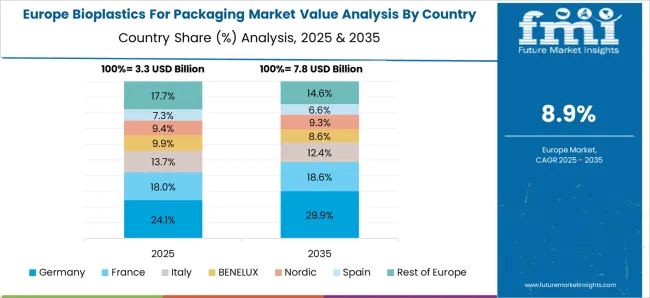

| Country | Germany |

|---|---|

| Market Share % (2025) | 6% |

According to European Bioplastics (EUBP), bioplastic is a promising global market that is projected to grow significantly in the coming years. Innovative biopolymers like bio-based PP, PLA, and others continue to show a high growth rate. Every year around 4% of the oil is used to produce plastics globally.

With the rising global environmental crisis and the cost of oil rises, the Government and manufacturers are forced to take action to switch to a natural alternative. Germany supports the use and consumption of certified bio-based and compostable bio-waste garbage bags in the bio-waste ordinance since 2020.

The increasing government initiatives and promotion of bioplastic usage are expected to boost the market. The circular economy is the top priority for environmental policy in Germany and its people are aware of the importance of reducing plastic waste by opting the bio-based plastics to minimize the reliance on inadequate fossil resources.

| Country | India |

|---|---|

| CAGR % (2025 to 2035) | 10.9% |

The Indian bioplastic for packaging is expected to expand at a CAGR of 10.9% during the forecast period.

According to Down to Earth, the Central Pollution Control Board report in 2020-19 specifies as much as 8.8 million metric tons of plastic waste generated in India. The single-use plastic packaging is on an exponential rise. So, in this pivotal time for bioplastic growth in India, the Indian Compostable Polymer Association was founded in 2020 to promote a sustainable circular economy and advocate compostable bioplastics in India.

In India, the increasing trend of supermarkets, malls, retail chains, and online shopping has created a huge demand for bags. The growing trend of outside food eating, quick-service restaurants, and food malls generated massive growth for single-serve cutlery and cups. Hence, bioplastic bags, and garbage waste bags made from renewable resources are gaining high momentum.

Bioplastic bags are also used in the industrial packaging of automobile parts, dust covers, and commercial applications in India due to the boom in the automobile sector. Thus, the increasing eco-awareness among consumers and stringent regulations imposed by the Government on single-use plastic consumption is expected to drive the Indian bioplastics for packaging market.

| Segment | Bio PET |

|---|---|

| Market Share % (2025) | 30.1% |

Bio PET segment is expected to hold more than 30.1% market share by 2025. Bio PET is a form of biodegradable plastic and has mechanical and physical properties that make it suitable for packaging applications. They can be easily decomposed biologically or by industrial composting. Bio PET is a strong and versatile material that is used to produce a variety of products such as bottles, custom food packaging, and others.

| Segment | Food & Beverages |

|---|---|

| Market Share % (2025) | 78.9% |

Food & beverages are considered to be the leading end-use for bioplastics for packaging market. Eating and drinking on the go have become a lifestyle. The cutlery, bags and the entire product spectrum can be made from bioplastics. These products can be used in sports events, street festivals, trains, plains, etc. On the back of these factors, the food & beverages segment is anticipated to hold ~78.9% of the market share throughout the forecast period.

The key manufacturers operating in the bioplastics for packaging industry are focusing on partnerships, expansion, and, innovative product launches to gain the customer’s attention.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value and Tones for Volume |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; and the Middle East & Africa (MEA) |

| Key Countries Covered | The United States, Canada, Brazil, Mexico, Germany, Italy, France, the United Kingdom, Spain, Poland, Russia, GCC Countries, South Africa, China, and India |

| Key Segments Covered | Material, Application, End Use, and Region |

| Key Companies Profiled | Braskem S.A; Corbion N.V.; Novamont S.p.A; NatureWorks LLC; Amcor Plc; Mondi Group; Tetra Pak International SA; ALPLA-Werke Alwin Lehner GmbH & Co KG; Berry Global Inc.; Uflex Ltd.; Toray Industries Inc.; BARBIER GROUP; Jolybar Group; Biome Bioplastics Limited; Plastipak Holdings, Inc.; Virent, Inc.; SECOS Group Limited; Evo & Co. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global bioplastics for packaging market is estimated to be valued at USD 14.1 billion in 2025.

The market size for the bioplastics for packaging market is projected to reach USD 36.1 billion by 2035.

The bioplastics for packaging market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in bioplastics for packaging market are bio pet, bio pa, bio pe, bio-pp, bio-ps, pla, pha, starch blends and others (pcl, pbat etc.).

In terms of application, bottles segment to command 44.2% share in the bioplastics for packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioplastics Market Analysis - Size, Share & Forecast 2025 to 2035

Evaluating Algae-Based Bioplastics Market Share & Provider Insights

Algae-Based Bioplastics Market Analysis – Growth & Forecast 2024-2034

Starch-Based Bioplastics Packaging Market Insights - Growth & Forecast 2025 to 2035

Formaldehyde Removal Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Form-Fill-Seal (FFS) Films Market Size and Share Forecast Outlook 2025 to 2035

Formable Films Market Size and Share Forecast Outlook 2025 to 2035

Forchlorfenuron Market Size and Share Forecast Outlook 2025 to 2035

Formalin Market Size and Share Forecast Outlook 2025 to 2035

Formalin Vials Market Size and Share Forecast Outlook 2025 to 2035

Foreign Trade Digital Service Market Size and Share Forecast Outlook 2025 to 2035

Forged and Casting Component Market Size and Share Forecast Outlook 2025 to 2035

Fortified Rice Market Size and Share Forecast Outlook 2025 to 2035

Fortifying Agent Market Size and Share Forecast Outlook 2025 to 2035

Forestry Equipment Market Size and Share Forecast Outlook 2025 to 2035

Forensic Imaging Market Size and Share Forecast Outlook 2025 to 2035

Forklift Battery Market Size and Share Forecast Outlook 2025 to 2035

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Forskolin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA