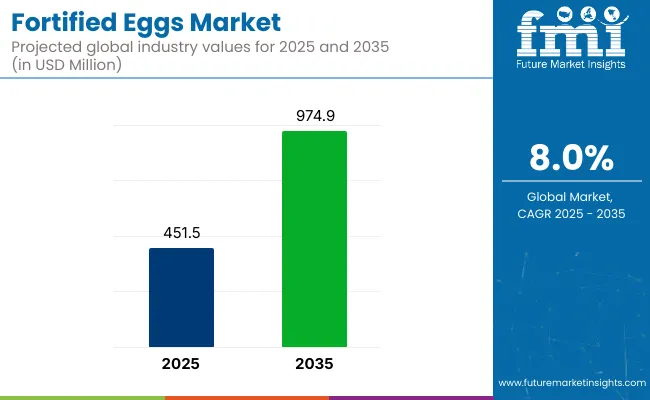

The global fortified eggs market is valued at USD 451.5 million in 2025 and is projected to reach USD 974.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 8.0%.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 451.5 million |

| Projected Value (2035) | USD 974.9 million |

| CAGR (2025-2035) | 8.0% |

Factors contributing to this growth include the rising consumer preference for health-conscious foods and the increasing awareness about the nutritional benefits of fortified eggs, such as those enriched with omega-3 fatty acids, vitamins, and minerals. Additionally, the growing trend toward functional foods and personalized nutrition is expected to drive the demand for fortified eggs as consumers seek products that contribute to heart health, cognitive function, and overall well-being.

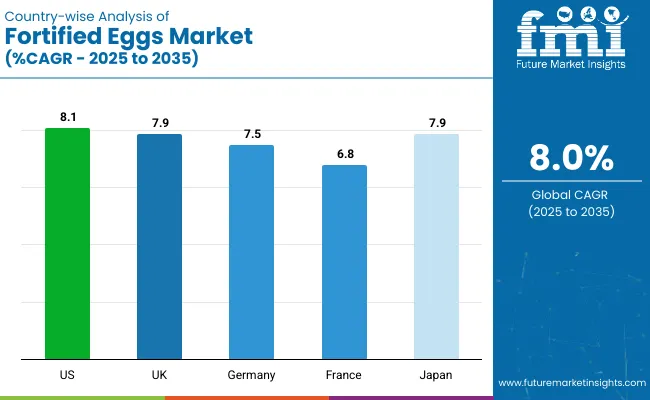

In 2025, the USA is expected to remain the largest market for fortified eggs, growing at a significant CAGR of 8.1% due to its health-conscious population and rising demand for omega-3 and vitamin D-enriched eggs.

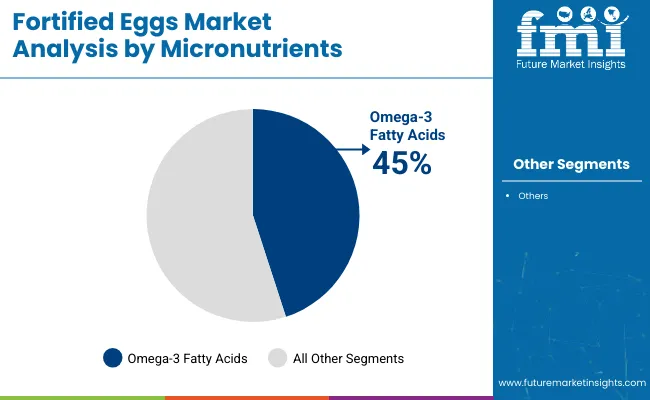

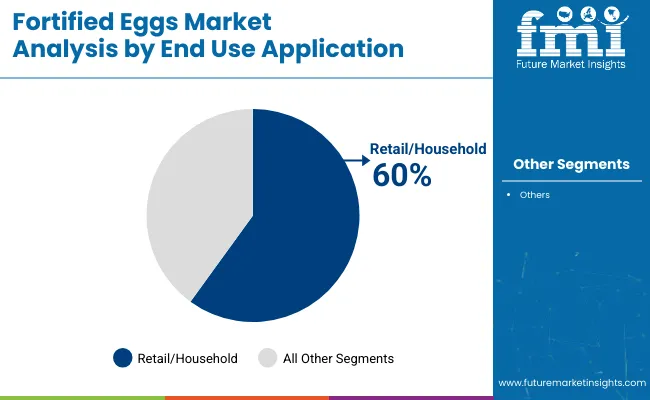

Meanwhile, the UK. and Germany closely follow this rapid growth with prominent CAGRs of 7.9% and 7.5% respectively. By micronutrients, omega-3 fatty acids account for a market share of 45%, while the retail/household segment by end-use application holds a prominent share of 60% in 2025.

The market holds a relatively small share within its parent markets. In the functional foods market, it accounts for a small portion, typically under 5%, as fortified eggs are just one category within the broader functional food spectrum. In the organic food market, the share is also small, likely under 3%, given the dominance of organic produce and other food items.

Within the nutritional supplements market, fortified eggs contribute to a niche segment, likely under 2%. In broader markets like dairy products, food and beverage, and health and wellness, the market share of fortified eggs is similarly limited but growing steadily.

Looking ahead, the market is poised for continued innovation. Companies are focusing on AI-driven poultry nutrition optimization and bio-fortification techniques to improve the nutritional profile of eggs. Additionally, developments in smart food packaging and real-time nutritional tracking are expected to enhance consumer engagement and drive demand for fortified eggs. Sustainable farming practices, including regenerative agriculture, will likely become a key theme in the industry as consumer demand for ethically produced, nutrient-enriched food continues to rise.

The global fortified eggs market is segmented into the following categories:bymicronutrients, end-use application, and region. By micronutrients, itincludes vitamins, omega-3 fatty acids, and others (such as minerals and trace elements). By end use application, itincludes food processing, food service industry, and retail/household. By region, it covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, the Middle East and Africa.

Omega-3 fatty acids will dominate this segment, accounting for approximately 45% of the market share in 2025. These eggs are particularly popular in North America and Europe, where the demand for heart-healthy and brain-boosting foods is rising.

The omega-3 fatty acids, sourced from flaxseeds, fish oil, and algae, are added to the eggs, providing essential nutrients. Vitamins, especially Vitamin D and B12, also play a crucial role in the market, though omega-3 remains the most lucrative segment.

Retail/household will account for 60% of the market share in 2025. The strong performance of this segment is attributed to growing consumer awareness about the health benefits of fortified eggs. These eggs are easily accessible in supermarkets and health food stores, which has boosted their popularity. The food service industry is expanding, with more cafes and restaurants incorporating fortified eggs into their offerings. However, the food processing segment still remains less dominant, primarily due to the focus on direct consumer sales.

Recent Trends in the Fortified Eggs Market

Challenges in the Fortified Eggs Market

The market is projected to grow at varying rates across these countries. The USA leads with the highest growth, expected to grow at a CAGR of 8.1% from 2025 to 2035, driven by strong consumer demand for omega-3 and vitamin-enriched eggs. The UK and Japan follow closely with a CAGR of 7.9%, supported by increasing interest in functional foods and health-conscious diets.

Germany shows steady growth at 7.5%, benefiting from its focus on sustainable food production and health-driven consumer behavior. France has the slowest growth, at 6.8%, though it still reflects solid demand for nutrient-dense eggs.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA is projected to remain the largest market for fortified eggs, with a CAGR of 8.1% from 2025 to 2035. This growth is driven by the increasing consumer awareness of the health benefits of omega-3 and vitamin-enriched eggs, particularly among health-conscious consumers.

The country’s demand for nutrient-dense, high-protein foods and the growing trend towards organic and sustainable food production will continue to boost the market. A well-established retail sector and a growing presence in the foodservice industry will further fuel this expansion.

The fortified eggs revenuein the UK is projected to grow at a CAGR of 7.9% from 2025 to 2035, driven by the increasing consumer demand for functional foods, particularly those enriched with omega-3 and vitamins.

The country’s focus on wellness and health, along with government-led health campaigns encouraging functional food consumption, is expected to sustain market growth. The expanding retail and food service sectors will continue to provide more opportunities for fortified egg products to reach a larger audience.

The sales of fortified eggs in Germany areexpected to grow at a CAGR of 7.5% from 2025 to 2035, driven by a strong consumer base focused on natural and functional foods. Consumers are becoming increasingly health-conscious, contributing to the demand for nutrient-enriched eggs, especially those fortified with omega-3 and vitamins. The country’s high food safety standards, emphasis on sustainable food production, and a well-developed retail sector will support steady market growth in this region.

In France, the revenue from fortified eggs is expected to grow at a CAGR of 6.8% from 2025 to 2035. This growth is fueled by rising consumer interest in health and wellness products, particularly omega-3 and vitamin-enriched eggs. The market is also supported by the French preference for organic and sustainable farming practices. Though the demand for fortified eggs is growing steadily, France's focus on renewable energy and environmental sustainability will shape the future of food production, encouraging innovation in egg fortification.

The fortified eggs demand in Japan is projected to see steady growth in the fortified eggs market, with a CAGR of 7.9% from 2025 to 2035. This growth is driven by the demand for high-protein diets and functional foods, particularly among Japan’s aging population. Omega-3 and vitamin D-enriched eggs are gaining popularity due to their health benefits. Japan’s focus on high-quality food production and the rising consumer awareness about nutrition will continue to propel the market forward, particularly in retail and foodservice sectors.

The market is moderately consolidated, with key players like Eggland’s Best, Cal-Maine Foods, Vital Farms, Clover Stornetta Farms, Inc. capturing a significant portion of the market share. These companies are focusing on innovation, sustainability, and expanding their product offerings to meet the growing consumer demand for nutrient-enriched eggs.

They are competing through strategies such as pricing, partnerships, technological advancements, and sustainability initiatives. With increasing awareness of health benefits, these companies aim to diversify their portfolios and improve production efficiency through innovation in egg fortification and feed technology.

Eggland’s Best leads the fortified eggs market with a strong focus on omega-3 and vitamin-enriched eggs. Their innovative approach includes AI-driven poultry nutrition optimization and sustainable feed fortification. Companies like Vital Farms emphasize pasture-raised eggs, while Cal-Maine Foods focuses on large-scale production and distribution. These companies invest heavily in both operational efficiency and consumer engagement to maintain their competitive edge.

Recent Fortified Eggs Industry News

Eggland’s Best introduced a new range of organic, vitamin D-fortified eggs in partnership with sustainable farming initiatives in early 2025.

In February 2025, Clover Sonoma (formerly Clover Stornetta Farms, Inc.) launched a new Pasture Raised Organic A2 4% Whole Milk, expanding its premium dairy offerings with a focus on organic and specialty nutrition

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 451.5 million |

| Projected Market Size (2035) | USD 974.9 million |

| CAGR (2025 to 2035) | 8.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020-2024 |

| Projections Period | 2025-2035 |

| Market Analysis Parameters | Revenue in USD millions/Volume in Units |

| By Micronutrient s | Vitamins, Omega-3 fatty acids, Others (minerals, selenium, DHA) |

| By End Use Application | Food Processing, Food Service Industry, Retail/Household |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, South Korea, Brazil, India, Australia |

| Key Players | Clover Stornetta Farms, Inc., Eggland's Best, Inc., Oakdell , NutriPlus , Boulder Brands USA, Inc., Farm Pride Foods Ltd., Vital Farms, Wilcox, Organic Valley, Nutrigroupe , and Suguna Foods |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The market is valued at USD 451.5 million in 2025.

The market is forecasted to reach USD 974.9 million by 2035, reflecting a CAGR of 8.0%.

Omega-3 fatty acids are expected to lead the market with a 45% share in 2025.

Retail/household is expected to hold a 60% share of the market in 2025.

The USA is anticipated to be the fastest-growing market with a CAGR of 8.1% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Fortified Rice Market Size and Share Forecast Outlook 2025 to 2035

Fortified Milk and Milk Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fortified Pet Food Market Analysis by Form, Pet Type, and Distribution Channel Through 2035

Fortified Foods Market Analysis by Raw Material, Micronutrients, Application, Technology, Sales Channel, and Region from 2025 to 2035

Fortified Yeast Market Outlook - Growth, Demand & Forecast 2024 to 2034

Fortified Wine Market

Eggshell Membrane Powder Market Size and Share Forecast Outlook 2025 to 2035

Dried Eggs Market Insights – Shelf-Stable Nutrition & Industry Growth 2025 to 2035

Plant-Based Eggs Market Trends - Vegan Egg Substitutes & Industry Insights 2025 to 2035

Pasteurized Eggs Market

Demand for Plant-Based Eggs in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA