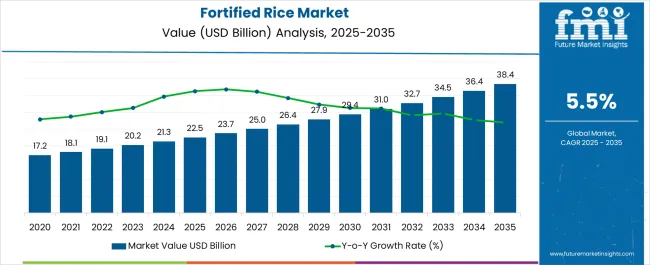

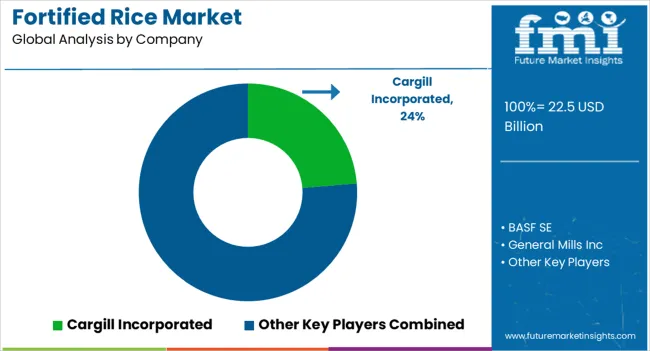

The Fortified Rice Market is estimated to be valued at USD 22.5 billion in 2025 and is projected to reach USD 38.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Fortified Rice Market Estimated Value in (2025 E) | USD 22.5 billion |

| Fortified Rice Market Forecast Value in (2035 F) | USD 38.4 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The fortified rice market is expanding steadily owing to the increasing prevalence of micronutrient deficiencies and the growing recognition of rice as a staple food that can serve as an effective medium for nutrition delivery. Governments, non governmental organizations, and international health agencies are actively promoting rice fortification programs to address malnutrition, particularly in Asia and Africa where rice consumption is highest.

Advancements in processing technologies have enhanced nutrient stability and bioavailability, supporting large scale adoption. Rising consumer awareness of health and wellness, coupled with the food industry’s commitment to addressing hidden hunger, is driving strong growth.

Regulatory frameworks encouraging fortification standards are further reinforcing the market’s long term potential, making fortified rice a critical solution for improving global nutrition security.

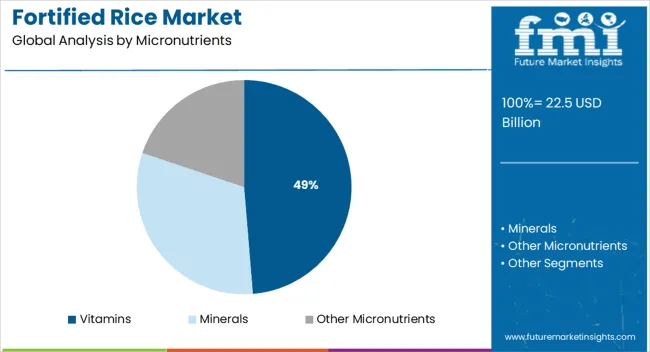

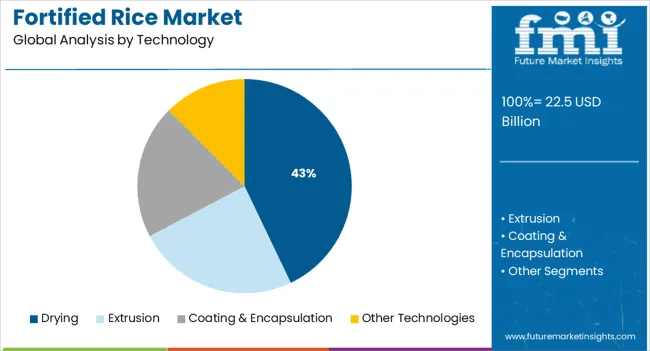

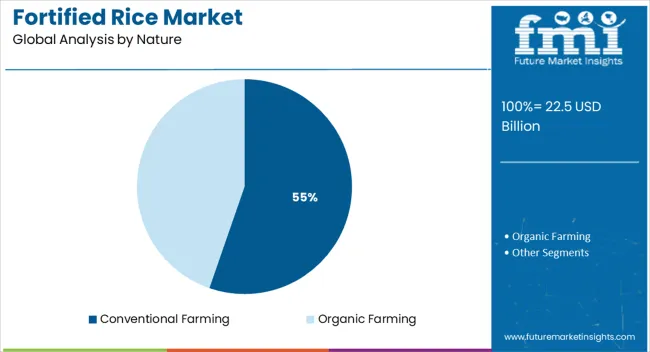

The market is segmented by Micronutrients, Technology, Nature, Distribution Channel, and End-Use and region. By Micronutrients, the market is divided into Vitamins, Minerals, and Other Micronutrients. In terms of Technology, the market is classified into Drying, Extrusion, Coating & Encapsulation, and Other Technologies. Based on Nature, the market is segmented into Conventional Farming and Organic Farming. By Distribution Channel, the market is divided into Modern Trade, Convenience Stores, Departmental Stores, Drug Stores, Online Stores, and Other Distribution Channels. By End-Use, the market is segmented into Residential and Commercial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vitamins segment is expected to hold 48.70% of total market revenue by 2025 within the micronutrient category, positioning it as the most prominent contributor. Growth is being driven by widespread deficiencies in essential vitamins such as A, D, and B complex across large population groups.

Fortification with vitamins ensures improved immunity, reduced risk of malnutrition related diseases, and enhanced public health outcomes. This approach has been strongly supported by national health programs and international aid initiatives that focus on combating hidden hunger.

As a result, vitamins continue to dominate as the leading micronutrient category within the fortified rice market.

The drying technology segment is projected to contribute 42.90% of total market revenue by 2025 under the technology category, making it the most widely adopted method. Drying technology is favored due to its cost effectiveness, scalability, and ability to preserve nutrient stability throughout processing and storage.

Its compatibility with large scale production has further enhanced its use in government procurement and public distribution systems.

The efficiency of drying technology in ensuring uniform nutrient distribution without compromising rice quality has solidified its position as the leading technology in fortified rice production.

The conventional farming segment is anticipated to account for 55.30% of total market revenue by 2025 under the nature category, establishing its dominance. Conventional farming practices remain the most accessible and widely practiced method of rice cultivation across key producing regions.

Their lower production costs, well established supply chains, and scalability for mass distribution support their leadership in the market. The integration of fortification into conventionally grown rice ensures affordability and availability for large populations, particularly in developing nations.

Consequently, conventional farming continues to hold the largest share in the nature category of the fortified rice market.

The global fortified rice market recorded a CAGR of 6.4% over the past 10 years. The market is expected to record a CAGR of close to 5.5% over the forecast period.

Adding essential micronutrients to rice, such as calcium, vitamin B12, iron, and folic acid, is a cost-effective complementary strategy for improving the nutritional content of rice. To solve malnutrition problems in any region, rice can be fortified. Rice is categorized into different varieties and is known for its nutrient-rich nature.

These changes in growth rate have been attributed to an improvement in end user demand in key economies and their growing populations, as well as the slow/rapid adoption of the market during the first half of the forecast period.

Infertile soil and inherent inefficiencies, for example, lead to the loss of nutrients in black rice, which is rich in proteins, fiber, carbohydrates, antioxidants, and anthocyanins. As a result, food fortification has emerged as a key strategy used by international organizations to tackle nutrient deficiencies all over the world, including the UN Food and Agriculture Organization (FAO) and the World Health Organization (WHO).

| Historical CAGR (2020 to 2025) | 6.4% |

|---|---|

| Historical Market Value (2025) | USD 19.14 billion |

| Forecast CAGR | 5.5% |

Consumption of Rice in Different Cuisines is on the Rise

Over the past decade, global rice consumption has grown radically. From 2008 to 2009 crop year produced 21.3 million metric tons, while from 2024 to 2025 crop year produced 509.87 million metric tons. In Asia Pacific, rice is much more than just food, so a significant portion of this consumption can be attributed to them.

Approximately 154.9 million metric tons of rice were consumed by China in 2024, whereas 103.5 million metric tons were consumed by India. India's rice consumption per capita in 2024 reached around 6.8 kilograms. The availability of fortified rice due to an expanding retail network and rising consumer awareness of health issues are attracting customers.

Malnutrition Incidence in Low-income Countries is being addressed by Government Initiatives

In 2024, nearly 17.7 lacs (1.7 million) Indian children suffered from severe acute malnutrition, according to the Women and Child Development Ministry. Somalia, with a 50.8 Hunger Index in 2024, was the world's most malnourished country, according to the International Food Policy Research Institute's Hunger Index.

International organizations like the World Health Organization and the Food and Research Organization have adopted food fortification as a core strategy to rehabilitate the situation. At the individual level, the government is doing its part to solve the problem.

As an example, in 2024, the government in India announced that fortified rice would be distributed in the country under the Mid-Day Meal and Public Distribution System schemes by 2025.

Post-pandemic Unemployment, Rising Inflation, and Environmental Hazards

As pesticide use disrupts biotic communities in the soil, pesticide use in conventional agriculture is the primary reason for the disruption of the soil carbon sequestration process. Pesticides kill the worms and insects that break down dung and leaf litter and maintain soil nutrients; as a result, fertility issues are rising at an unprecedented rate.

According to a report published by CMIE in 2025, with a 1.09% hike in unemployment rates in metropolitan areas in India, the unemployment rate reached 9.3%. However, soaring unemployment and inflation rates worldwide pose a severe threat to the aforementioned market.

The unemployment rate in rural areas, on the other hand, increased from 6.44% to 7.28% by 0.84%. A global wave of staggering inflation has also been unleashed as a result of rising crude oil prices. Together, these factors hinder the fortified rice market.

Based on its nature, the fortified rice market can be divided into two segments. The non-organic segment accounted for the significant share in 2025, primarily because conventionally produced cereal grains are readily available. The objective of conventional farming is to boost crop yields as much as possible without using pesticides.

Conventional farming curbs expenses and maximizes farmers' revenue by utilizing less labor and producing more on a smaller amount of land; therefore, farmers' revenue is maximized. Non-organic rice can be obtained around the corner regardless of geography, unlike organic rice. Despite this, the organic segment is expected to record at the considerable rate with a CAGR of 8.6% between 2025 and 2035.

Due to conventional farming's shortcomings, such as harmful effects on the environment, health problems, adverse effects on animals, a high risk of plant bugs, and many others, the demand for organic products is soaring as consumers become increasingly aware of their health and environmental health.

Fortified rice is distributed offline (supermarkets, convenience stores, brick-and-mortar stores) and online. In 2025, the offline segment held the significant share. This growth can be attributed to its comprehensive presence in both metropolitan and rural areas.

In contrast, online or e-commerce services are often subject to certain requirements, such as a suitable infrastructure to function properly; otherwise, doorstep delivery is not feasible. The majority also prefer shopping offline because of advantages such as instant purchases, hassle-free returns, bulk purchases, bargains, and quality checks.

The growing existence of modern outlets like supermarkets has attracted billions of consumers worldwide because of their well-established nature, easy shopping, lucrative sales, and one-stop shopping experience. It is expected that online shopping will grow at the significant rate with a 7.7% CAGR during the forecast period.

This growth can be attributed to technological advancements like Google maps and e-banking. All-weather network access, the time-saving nature of e-commerce purchases, and the increasing number of smartphone users are driving people to online platforms.

It is common for Asian countries excluding Japan (APEJ) to possess centralized rice milling industries, which facilitate rice fortification. Having a reliable channel to reach people in dire need of nutrition, these countries have significant safety nets, which distribute fortified rice subsidized to populations below the poverty line.

As a result of the presence of world-leading rice-growing countries in the region, Asia Pacific held the significant share of the overall market in 2025, accounting for 43% of the overall market. India produces more than 170 million tons of rice every year. The majority of rice is produced in Asian countries, including the Philippines, Indonesia, Bangladesh, Vietnam, Pakistan, and Thailand.

According to a report, nearly 85-90% of global rice consumption is accounted for by Asian countries, and nearly 60% is accounted by Indonesia, India, and China. Asia Pacific is expected to be the significant segment over the forecast period. This growth is owing to high incidences of malnourishment in Asia Pacific.

Rising disposable incomes with the flourishing of economies, increasing health consciousness among people, and soaring government initiatives to eradicate nutrient deficiency problems. According to the 2020 Census, the population of Asia Pacific was 17.2 million, but in 2020 it is 4912.3 million.

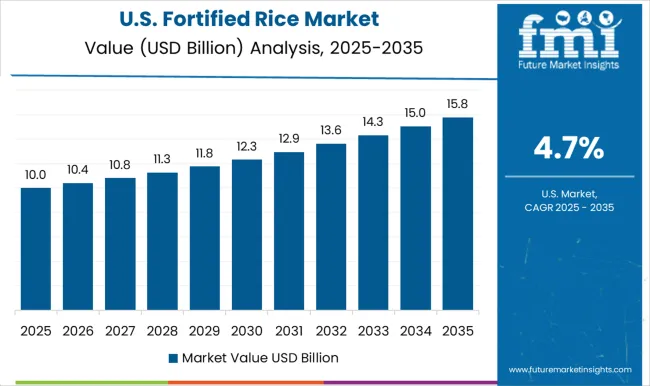

The United States dominates the fortified rice market in North America with a total market share of 51% in 2025 and is projected to continue exhibiting high demand through over the forecast period. The United States fortified rice market is estimated to record a CAGR of 3.8% and is projected to surpass the value of USD 22.5 billion in 2025.

A significant supply of raw materials is readily available in the United States to create fortified rice, which has led to tremendous growth in the fortified rice market. Several factors are driving the fortified rice market in the United States., including increased nutrition and health expenditures, disposable income, and consumer awareness of healthy foods.

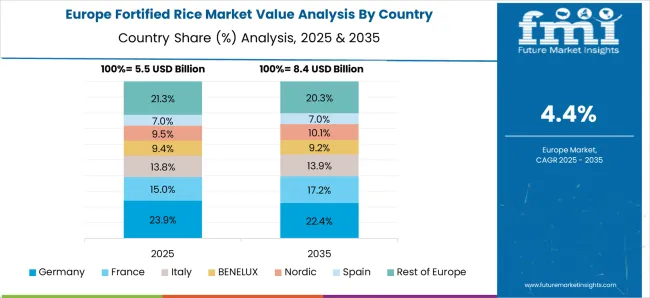

Germany dominates the fortified rice market in Europe, with a share of 30%. The fortified rice market in Germany is estimated to record a CAGR of 3.7%. Due to the increasing number of people with gluten allergies and coeliac disease, gluten-free products are becoming more popular. Both adults and children are being diagnosed with gluten allergies and coeliac disease at an increased rate; thus, gluten-free products help to drive market growth in Germany.

China holds a 40% share in Asia Pacific and is projected to record a CAGR of over 9.2%. The market size of USD 38.4 billion is expected to reach by 2035. With more than 210 million tons of production, China is the world's second-largest rice producer, and it accounts for almost 20% of the market for fortified rice. A significant part of the reason for the growth of fortified rice is due to factors such as the presence of world-leading rice-producing manufacturers in China.

While fortified rice may be affordable, it can be tough to start a business based on the price of raw materials. As the availability of cost-effective raw materials increases, fortified rice products are expected to be introduced soon, providing ample growth opportunities.

When a variety of businesses offer the same product, the market will expand significantly. With the emergence of food start-ups, this rising potential has spurred food companies to take advantage of it. Companies and producers will develop cost-effective solutions to meet demand.

For fortified rice production, fixed costs, such as initial capital investment for equipment and facilities, are primarily influenced by the choice of technology. Among the various technologies, coating and encapsulation require relatively lower capital investments.

Several strategies are employed by key manufacturers to compete in an increasingly competitive environment, including new product launches and approvals, mergers and acquisitions, partnerships, and collaborations. The prominent companies are as follows:

Recent Development:

A coalition of key players in the global fortified rice market, including private and public sectors, is focusing on addressing growth barriers to the implementation of fortified rice around the world.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; The Middle East and Africa; East Asia |

| Key Countries Covered | The United States, Canada, Brazil, Mexico, Chile, Peru, Germany, the United Kingdom, Spain, Italy, France, Russia, Poland, China, India, Japan, Australia, New Zealand, GCC Countries, North Africa, South Africa, and Türkiye |

| Key Segments Covered | Micronutrients, Technology, Distribution Channel, Region |

| Key Companies Profiled | Cargill Incorporated; BASF SE; General Mills Inc; Willmar International Ltd; Aroma Fields; KRBL Ltd; Bunge Ltd; REI Agro Ltd; LT Foods; Hain Celestial (Tida Rice) |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global fortified rice market is estimated to be valued at USD 22.5 billion in 2025.

The market size for the fortified rice market is projected to reach USD 38.4 billion by 2035.

The fortified rice market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in fortified rice market are vitamins, minerals and other micronutrients.

In terms of technology, drying segment to command 42.9% share in the fortified rice market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Fortified Milk and Milk Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fortified Eggs Market Analysis - Size, Growth, and Forecast 2025 to 2035

Fortified Pet Food Market Analysis by Form, Pet Type, and Distribution Channel Through 2035

Fortified Foods Market Analysis by Raw Material, Micronutrients, Application, Technology, Sales Channel, and Region from 2025 to 2035

Fortified Yeast Market Outlook - Growth, Demand & Forecast 2024 to 2034

Fortified Wine Market

Rice Bran Fatty Alcohols Market Size and Share Forecast Outlook 2025 to 2035

Rice Water Skincare Market Forecast and Outlook 2025 to 2035

Rice Water Haircare Market Size and Share Forecast Outlook 2025 to 2035

Rice Shampoo Bar Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil for Skin Care Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil Infusions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Rice Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Rice Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Rice Derivative Market Size and Share Forecast Outlook 2025 to 2035

Rice Polishing Machines Market Size and Share Forecast Outlook 2025 to 2035

Rice Water Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil Market Analysis by Type, End User, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA