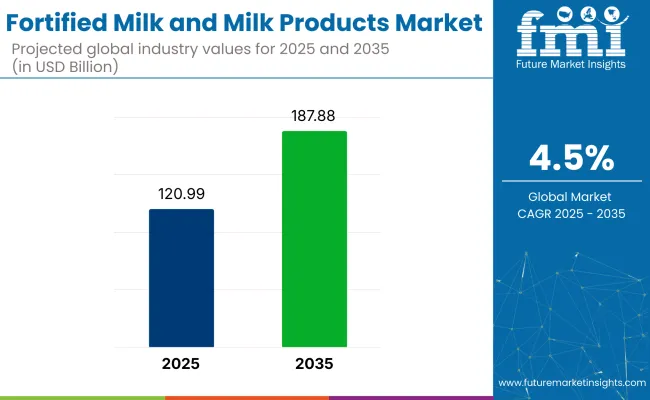

The global fortified milk and milk products market is estimated to reach a valuation of USD 120.99 billion in 2025 and is forecast to expand to USD 187.88 billion by 2035. This growth reflects a compound annual growth rate (CAGR) of 4.5% between 2025 and 2035. From 2020 to 2025, the market advanced at a CAGR of 3.7%, indicating an acceleration in consumer adoption and industry-level investments in nutrient-enhanced dairy solutions.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 120.99 Billion |

| Projected Global Industry Value (2035F) | USD 187.88 Billion |

| Value-based CAGR (2025 to 2035) | 4.5% |

This rise was driven primarily by public health mandates targeting vitamin A and D deficiencies, especially in regions such as South Asia and Sub-Saharan Africa. Regulatory interventions, such as India's 2020 directive under the Food Safety and Standards Authority, expanded the distribution of fortified milk through school meals and subsidized food programs.

The market register varying levels of share across its five parent markets. It contributes approximately 21% to the functional foods market, driven by increasing demand for nutrient-dense dairy. Within the dairy products market, its share stands at nearly 14%, as basic milk sees growing fortification.

In the nutraceuticals market, it represents around 9%, largely due to dairy’s role as a delivery format for bioactive ingredients. The infant and child nutrition market allocates close to 24% share to fortified dairy, given its prominence in early-age nutrition. In the clinical nutrition segment, the share is lower, estimated near 6%, as dairy-based fortification competes with medical-grade formulations. These percentages reflect how fortified dairy straddles both everyday consumption and targeted health use.

The primary growth driver remains the rising health awareness among consumers, especially in the context of preventive nutrition. As healthcare systems shift from treatment toward prevention, fortified foods, including dairy, have gained prominence for their dual role in everyday consumption and targeted health interventions. Governments and multilateral institutions have supported dairy fortification through public-private partnerships, school meal programs, and awareness campaigns. According to USA Department of Agriculture (USDA) announced a USD 11.04 million allocations through its Dairy Business Innovation Initiative (DBI).

This investment supports small and mid-sized dairy enterprises in creating and marketing value‑added products, such as fortified milk and dairy items, by funding technical assistance, business planning, and enhanced processing capabilities. Advances in fortification technologies have enabled nutrient integration without altering product taste or stability, making it easier for manufacturers to innovate. This combination of institutional backing, technological capability, and health-driven consumer preferences continues to shape the fortified milk and milk products market globally.

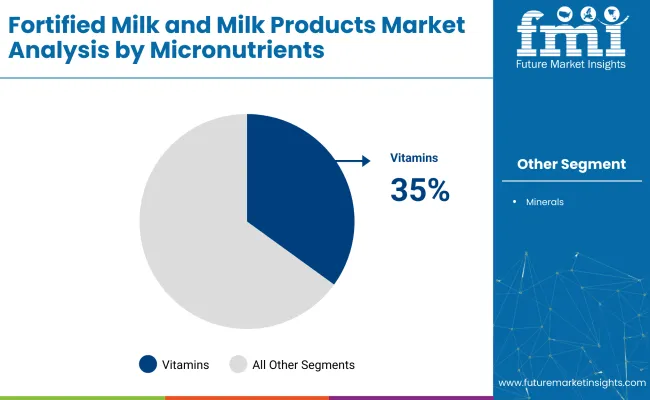

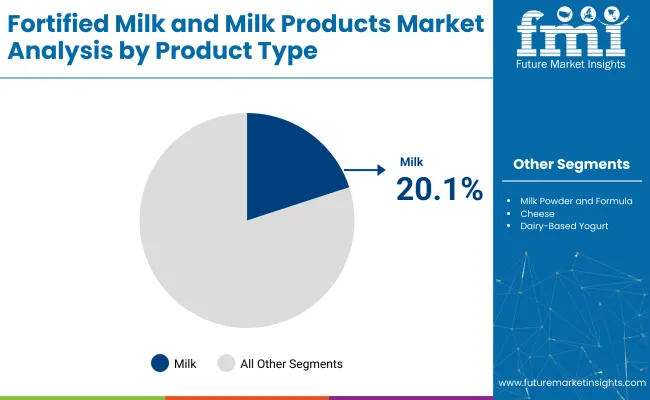

Vitamins dominate fortified dairy micronutrients because consumers trust their well-documented benefits and regulators actively back their inclusion, making deficiency prevention easy and affordable. Plain milk is the favored fortification vehicle owing to its universal consumption and minimal sensory impact, while modern trade stores steer distribution through superior assortment, reliable refrigeration, and tight brand partnerships that boost in-store discovery.

Vitamins are projected to lead the micronutrients segment, accounting for 35% of the global market share in 2025.

Milk is projected to lead the product type segment, accounting for 20.1% of the market share in 2025. It is one of the most universally consumed products across age groups, cultures, and geographies. Its liquid format allows for easy integration of micronutrients without altering sensory qualities, making it suitable for both household and institutional distribution.

Modern trade leads the fortified milk and milk products market by sales channel, accounting for an estimated 32% share in 2025.

Widespread micronutrient deficiencies have pushed fortified milk into national health programs and broader adult use. Simultaneously, rising health consciousness and modern retail channels have fueled demand for clean-label, nutrient-rich dairy offerings.

Micronutrient Deficiency Response Drives Fortification Initiatives

Growing micronutrient deficiency concerns have driven fortified milk adoption across households and institutions. Public health campaigns, clinical backing, and WHO guidelines on fortification have pushed manufacturers to expand dairy-based delivery formats. Governments in Asia, Africa, and Latin America have prioritized fortified dairy in nutrition programs targeting anemia and vitamin D deficiency. As a result, fortified dairy is no longer limited to pediatric use but has expanded into everyday adult consumption.

Consumer Health Focus Shapes Retail Distribution Strategies

Rising consumer awareness and retail have accelerated product uptake across developed and emerging regions. Modern trade and e-commerce platforms have enabled premium fortified dairy positioning with visible health claims and multi-pack options. Ingredient allows for stable nutrient incorporation without compromising texture or flavor. This balance of accessibility, efficacy, and taste continues to anchor fortified milk’s growth path.

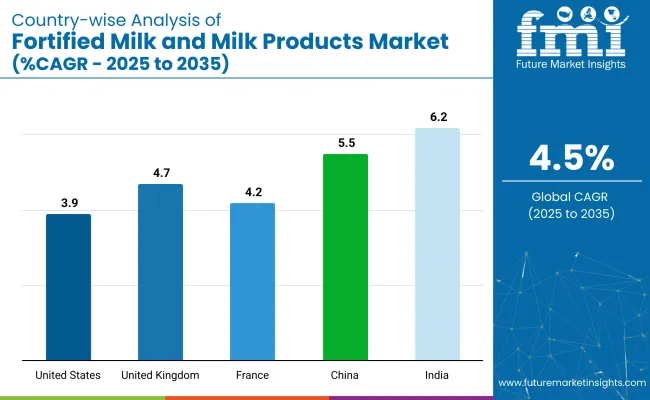

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

| United Kingdom | 4.7% |

| France | 4.2% |

| China | 5.5% |

| India | 6.2% |

The United States fortified milk and milk products market is projected to grow at 3.9% CAGR as school-meal fortification mandates roll out nationwide and single-serve nutrient-dense milks gain traction on digital grocery platforms. The United Kingdom fortified milk and milk products market is forecast at 4.7% CAGR, with Public Health England guidance prompting retailers to relabel own-brand milk with vitamin D and rely on microencapsulation to protect added nutrients.

The France fortified milk and milk products market is expected to rise at 4.2% CAGR after the National Nutrition and Health Program endorsed fortified lactose-free UHT milk and pharmacies began stocking portioned fortified yogurts for convalescent use.

The China fortified milk and milk products market is anticipated to achieve 5.5% CAGR as the National Nutrition Plan prioritizes fortified dairy in rural schools and premium fortified yogurt drinks feature prominently on leading e-commerce channels. The India fortified milk and milk products market is projected to reach a 6.2% CAGR under FSSAI fortification rules, cooperative network expansion, influencer campaigns, and improved rural cold-chain logistics that widen access to vitamin-enriched milk.

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The USA fortified milk and milk product market is projected to grow at 3.9% CAGR during the forecast period. Demand has been bolstered by widespread micronutrient deficiency screenings that identified vitamin D gaps across multiple age brackets. National School Lunch and Summer Food Service programs have mandated fortified options, prompting processors to upscale vitamin-rich fluid milk lines.

Retail chains have prioritized shelf space for calcium- and vitamin A-fortified dairy, a move reinforced by joint marketing agreements with leading cooperatives. Regulatory alignment between the Food and Drug Administration and state dairy boards has created clear fortification standards, reducing compliance risks for manufacturers.

The China fortified milk and milk product market is estimated to grow at 5.5% CAGR between 2025 and 2035. Rapid dietary shifts in urban centers have coincided with government campaigns addressing childhood stunting and widespread anemia. As part of the National Nutrition Plan (2021 to 2030), fortified milk distribution has been prioritized in kindergartens and rural boarding schools, leading large dairy firms to deploy on-site small-pack filling units.

E-commerce platforms have carried premium fortified yogurt drinks with tailored vitamin and mineral blends, supported by live-streamed nutrition advisory sessions that boost shopper confidence. Domestic processors have adopted near-farm UHT facilities to preserve freshness while integrating vitamin A and zinc premixes. Provincial subsidies covering testing fees have encouraged small and medium processors to comply with fortification standards, broadening supply in tier-three cities.

The UK fortified milk and milk product market is anticipated to grow at 4.7% CAGR from 2025 to 2035. Public Health England has advised year-round vitamin D supplementation, and fortified milk has been positioned as a simple dietary route for meeting those guidelines. Major supermarkets have rebranded own-label skimmed and semi-skimmed milk with added vitamin D and iodine, using front-of-pack summary icons that aid shopper recognition.

The Healthy Start scheme has included fortified fresh milk vouchers, extending nutrient intake among low-income families. Dairy processors have adopted microencapsulation techniques so vitamins remain stable through pasteurization without altering taste, a feature highlighted in advertising campaigns emphasizing bone support.

The India fortified milk and milk product market is expected to grow at 6.2% CAGR during the forecast period. Micronutrient malnutrition reports have catalyzed Food Safety and Standards Authority of India regulations that mandate vitamin A- and D-fortified packaged milk. State cooperative federations have rolled out low-cost fortified milk pouches through public distribution networks, enhancing rural penetration.

School Mid-Day Meal expansions now integrate fortified flavored milk, financed by combined central and state budgets, locking in predictable institutional volume. Private dairies have partnered with global premix suppliers to launch lactose-free fortified lines aimed at urban millennials sensitive to digestive wellness narratives.

The France fortified milk and milk product market is estimated to grow at 4.2% CAGR during the forecast period. The French national nutrition and health program has endorsed fortified dairy as a countermeasure to documented vitamin D and calcium shortfalls among seniors. Large cooperatives have converted select ultra-high-temperature lines to produce fortified lactose-free milk, responding to growing digestive health concerns while complying with Ministry of Agriculture guidelines. Pharmacies have started stocking single-portion fortified yogurts positioned for convalescent patients, blurring category lines between everyday dairy and medical nutrition.

Retailers have tested blockchain labels that verify micronutrient inclusion levels, improving traceability and consumer trust. Culinary schools have added fortified milk modules to curriculum, reinforcing professional acceptance and normalizing use in pâtisserie and sauce bases.

The fortified milk and milk products market is moderately consolidated, with major players including Arla Foods Ltd, FrieslandCampina, Fonterra Co-operative Group, Guangming Dairy Co. Ltd., and The Kraft Heinz Company. These companies drive competition by leveraging integrated supply chains, advanced fortification techniques, and strong retail partnerships.

For instance, Arla Foods Ltd focuses on vitamin D-fortified milk under its wellness portfolio, while FrieslandCampina offers multi-nutrient formulations targeting child nutrition. Fonterra emphasizes protein- and calcium-rich milk variants tailored for Asia-Pacific consumers. Guangming Dairy Co. Ltd. and China Modern Dairy Holdings Ltd. serve urban Chinese markets through fortified UHT milk lines. Nestlé S.A. and Dean Foods expand product penetration via retail partnerships, and Gujarat Cooperative Milk Marketing Federation Ltd. leads India's rural market with government-aligned fortified milk pouches.

Recent Fortified Milk and Milk Products Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 120.99 billion |

| Projected Market Size (2035) | USD 187.88 billion |

| CAGR (2025 to 2035) | 4.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in metric tons |

| Product Type Analyzed (Segment 1) | Milk, Milk Powder and Formula, Flavored Milk, Cheese, and Dairy-Based Yogurt. |

| Micronutrients Analyzed (Segment 2) | Vitamins and Minerals. |

| Sales Channel Analyzed (Segment 3) | Modern Trade, Convenience Stores, Departmental Stores, Drug Stores, and Online Stores. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Arla Foods Ltd, FrieslandCampina, Fonterra Co-operative Group, Guangming Dairy Co. Ltd., The Kraft Heinz Company, China Modern Dairy Holdings Ltd., Dean Foods, Nestlé S.A., Gujarat Cooperative Milk Marketing Federation Ltd., and SanCor Cooperatives United Limited. |

| Additional Attributes | Dollar sales, share, growth by region, product-type demand, consumer trends by age group, regulatory landscape, fortification ingredient usage, pricing benchmarks, distribution channel performance, private-label threat, and retail partnerships |

The industry is segmented into milk, milk powder and formula, flavored milk, cheese, and dairy-based yogurt.

The industry is segmented into vitamins and minerals.

The industry finds modern trade, convenience stores, departmental stores, drug stores, and online stores.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 120.99 billion in 2025.

It is forecasted to reach USD 187.88 billion by 2035.

The industry is anticipated to grow at a CAGR of 4.5% during this period.

Vitamins are projected to lead the market with a 35% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 6.2%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fortified Rice Market Size and Share Forecast Outlook 2025 to 2035

Fortified Eggs Market Analysis - Size, Growth, and Forecast 2025 to 2035

Fortified Pet Food Market Analysis by Form, Pet Type, and Distribution Channel Through 2035

Fortified Foods Market Analysis by Raw Material, Micronutrients, Application, Technology, Sales Channel, and Region from 2025 to 2035

Fortified Yeast Market Outlook - Growth, Demand & Forecast 2024 to 2034

Fortified Wine Market

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Sterilizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Protein Market - Size, Share, and Forecast 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA