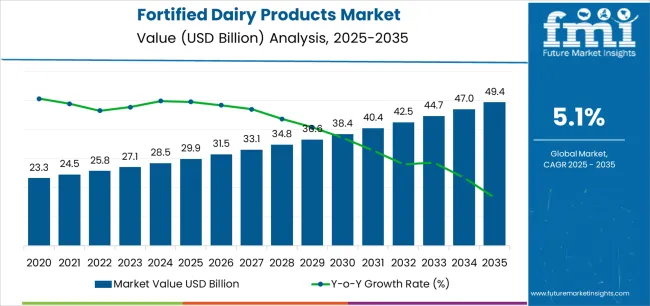

The Fortified Dairy Products Market is estimated to be valued at USD 29.9 billion in 2025 and is projected to reach USD 49.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The Fortified Dairy Products market is witnessing significant growth driven by increasing consumer awareness regarding nutrition and health benefits of dairy fortification. Rising demand for functional foods, coupled with a growing focus on preventive healthcare, is shaping the market's future outlook. Urbanization, rising disposable incomes, and evolving dietary habits are contributing to the adoption of fortified dairy products across age groups.

The market is further supported by government initiatives promoting micronutrient supplementation and nutritional labeling, which encourage healthier food choices. Continuous innovation in fortification technologies has enhanced product quality and bioavailability of essential nutrients, making fortified dairy products a preferred choice among health-conscious consumers.

Additionally, growing demand from regions with high prevalence of micronutrient deficiencies is driving adoption, while retail expansion and modern distribution channels improve product accessibility As consumer preference shifts toward nutrient-enriched foods and lifestyle diseases rise, the Fortified Dairy Products market is expected to experience sustained expansion across both developed and emerging regions.

| Metric | Value |

|---|---|

| Fortified Dairy Products Market Estimated Value in (2025 E) | USD 29.9 billion |

| Fortified Dairy Products Market Forecast Value in (2035 F) | USD 49.4 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

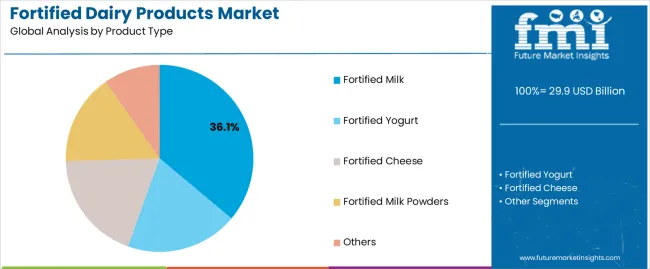

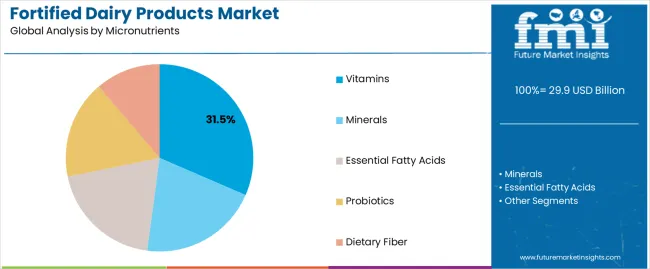

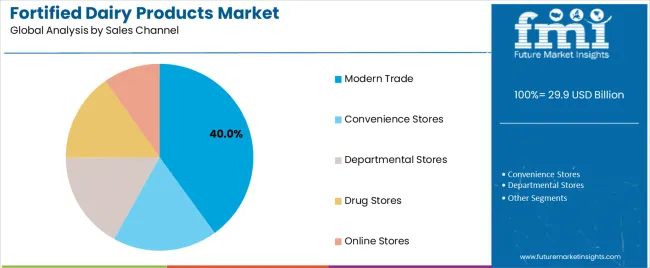

The market is segmented by Product Type, Micronutrients, and Sales Channel and region. By Product Type, the market is divided into Fortified Milk, Fortified Yogurt, Fortified Cheese, Fortified Milk Powders, and Others. In terms of Micronutrients, the market is classified into Vitamins, Minerals, Essential Fatty Acids, Probiotics, and Dietary Fiber. Based on Sales Channel, the market is segmented into Modern Trade, Convenience Stores, Departmental Stores, Drug Stores, and Online Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fortified milk segment is projected to hold 36.10% of the Fortified Dairy Products market revenue share in 2025, making it the leading product type. This dominance is driven by consumer preference for milk as a daily staple and its suitability as a vehicle for nutrient fortification. Fortified milk provides essential vitamins and minerals in a convenient form, supporting bone health, immunity, and overall wellness.

The segment has benefited from increasing product availability in both liquid and powder forms, catering to diverse consumer needs. Enhanced fortification technologies have improved nutrient stability and taste, further encouraging adoption. Consumer trust in milk as a source of essential nutrients, combined with rising awareness about dietary deficiencies, reinforces the growth of fortified milk.

Retail presence, pricing strategies, and partnerships with health campaigns have also supported its dominant position As health-conscious consumption rises, fortified milk continues to maintain its leading share in the product type segment.

The vitamins segment is expected to capture 31.50% of the Fortified Dairy Products market revenue share in 2025, establishing it as the leading micronutrient category. Growth is driven by the increasing awareness of vitamin deficiencies and their impact on health, including immunity and energy metabolism. Fortified dairy products enriched with vitamins offer convenient solutions to meet daily nutritional requirements.

Advances in fortification processes have enhanced vitamin stability and bioavailability, making these products more effective and appealing to consumers. Health-focused campaigns and educational initiatives have further fueled the adoption of vitamin-fortified products.

The segment’s growth is supported by increasing regulatory support and rising demand from urban populations prioritizing preventive health The ease of consumption, combined with the perceived health benefits, ensures that vitamin fortification remains a key driver in the overall market.

The modern trade segment is projected to account for 40.00% of the Fortified Dairy Products market revenue in 2025, making it the leading sales channel. This growth is driven by the expansion of organized retail chains, supermarkets, and hypermarkets, which provide extensive product visibility and easy access for consumers. Modern trade enables the display of a wide variety of fortified dairy products, promoting informed purchase decisions.

Promotional strategies, product bundling, and loyalty programs implemented through modern retail further encourage consumer adoption. The availability of fortified dairy products in high-traffic retail formats ensures convenience and accessibility, particularly in urban regions.

Integration of cold chain logistics and efficient supply networks has enhanced product quality and shelf life, strengthening consumer confidence As organized retail continues to expand, modern trade is expected to remain the dominant channel, driving revenue growth in the Fortified Dairy Products market.

| Particular | Value CAGR |

|---|---|

| H1 | 3.9% (2025 to 2035) |

| H2 | 4.5% (2025 to 2035) |

| H1 | 4.1% (2025 to 2035) |

| H2 | 4.9% (2025 to 2035) |

The compounded annual growth rate (CAGR) for fortified dairy products has shown a notable improvement, reflecting an optimistic market trajectory. Primarily, the CAGR for H1 was 3.9 % for the period of 2025 to 2035, which has increased to 4.1% for the period of 2025 to 2035. Similarly, H2 saw an increase from 4.5% (2025 to 2035) to 4.9% (2025 to 2035). This upward trend indicates a significant strengthening in the outlook, which can be attributed to several key factors.

Growing consumer awareness regarding the importance of nutrition and health. Fortified dairy products, enriched with essential vitamins, minerals, and probiotics, cater to this demand by providing enhanced nutritional value compared to non-fortified counterparts. This shift in consumer behavior is driving the increased adoption of fortified dairy products.

Rising Demand for Vitamin-Fortified Dairy Products

The demand for vitamin-fortified dairy products is experiencing substantial growth as consumers increasingly prioritize their nutritional intake. Vitamin fortification addresses deficiencies common in many populations, particularly those related to vitamins A, D, and E. Fortified milk is a primary product in this category, offering enhanced levels of these essential vitamins.

For instance, vitamin D fortification is crucial for bone health and calcium absorption, making it a key selling point in regions with high incidences of vitamin D deficiency. Vitamin A fortification supports vision and immune health, while vitamin E acts as a powerful antioxidant. Yogurts and cheeses fortified with these vitamins are also gaining popularity, as they provide convenient and tasty options for consumers looking to boost their nutrient intake.

The trend is fueled by increasing health awareness, with consumers seeking products that offer specific health benefits in addition to basic nutrition

Expansion of Probiotic-Fortified Dairy Products

Probiotic-fortified dairy products are witnessing rapid expansion as the link between gut health and overall well-being becomes more widely recognized. These products, particularly yogurts, are fortified with beneficial bacteria such as Lactobacillus acidophilus and Bifidobacterium bifidum, which help promote a healthy digestive system.

The growing consumer interest in probiotics is driven by scientific research highlighting the benefits of a healthy gut microbiome, including enhanced immunity, better digestion, and potential mental health benefits. Companies are responding to this demand by developing new probiotic strains and improved delivery methods that ensure the survival and efficacy of these bacteria in the digestive tract.

This innovation is making probiotic-fortified yogurts more effective and appealing, contributing to their increasing share. Additionally, the introduction of synbiotic products, which combine probiotics with prebiotics (food for the probiotics), is further enhancing the functional benefits offered to consumers.

Increased Availability of Mineral-Fortified Dairy Products

The for mineral-fortified dairy products is expanding, particularly with the fortification of iron, calcium, and iodine. These minerals are essential for various bodily functions and addressing widespread deficiencies is critical for public health. Iron-fortified products, such as milk and cheese, are crucial in combating anemia, especially in developing regions where iron deficiency is prevalent.

These products help in improving hemoglobin levels and reducing the incidence of anemia-related health issues. Calcium-fortified dairy products, including milk, yogurt, and cheese, continue to be in high demand due to their critical role in bone health and preventing osteoporosis. This is particularly important for children and the elderly. Iodine fortification in milk and cheese helps address thyroid-related health issues, such as goiter, by ensuring adequate iodine intake.

As consumer awareness of these health benefits increases, manufacturers are expanding their range of mineral-fortified products to meet the demand. This trend is also supported by government initiatives and regulations aimed at reducing micronutrient deficiencies through food fortification.

From 2020 to 2025, the global sales of fortified dairy products experienced steady growth of 4.1% which was driven by increasing consumer awareness of the health benefits associated with nutrient-enhanced foods. The industry saw significant advancements in product innovation, with companies introducing a variety of fortified dairy options, including milk, yogurt, cheese, and infant formula enriched with essential vitamins and minerals.

This period also benefited from robust marketing campaigns and greater availability of these products in both developed and emerging regions. However, the growth was somewhat tempered by the high costs associated with fortification processes and the challenges of maintaining product taste and texture. Despite these hurdles, the fortified dairy sector maintained a positive growth trajectory, reflecting a global shift towards healthier eating habits.

Looking in the future to 2025 to 2035, the demand for fortified dairy products is projected to be moderate, with a compound annual growth rate (CAGR) of This optimistic forecast is fueled by several factors, including ongoing advancements in fortification technology, which are expected to lower costs and improve product quality.

Additionally, increasing consumer health consciousness, supportive government policies, and rising incidences of nutrient deficiencies globally will drive the sales. Emerging regions, particularly in Asia-Pacific and Latin America, are anticipated to contribute significantly to this growth due to improving economic conditions and expanding middle-class populations.

Furthermore, the introduction of new fortified products tailored to specific health needs and demographic segments is expected to enhance penetration and consumer adoption. Overall, the fortified dairy products sales are poised for robust expansion, reflecting a growing global emphasis on nutrition and wellness.

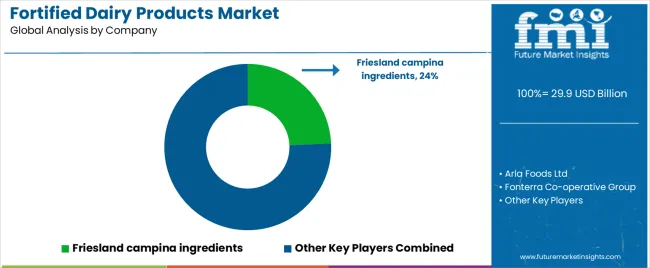

Tier 1 companies, who are key players in the fortified dairy products industry, hold a dominant share of approximately 50-55% globally. These top-tier organizations have large production capacities and provide a wide array of products by utilizing their knowledge of manufacturing and packaging in several formats. They have a large geographic reach and offer a wide range of product offerings.

Tier 2 firms, are mid-tier players with significant income and influence. They usually operate in particular regions and possess between 20-25% of the value share. These medium-sized businesses continue to have a significant presence both domestically and abroad, using their in-depth knowledge of regional markets to exert.

The table below shows sales from sales in key countries, along with estimated growth rates of the Fortified Dairy Products sector.

| Countries | CAGR (2035) |

|---|---|

| USA | 5.1% |

| India | 6.3% |

| China | 6.0% |

| Germany | 4.1% |

| Japan | 5.5% |

In the USA, the fortified dairy products market is projected to grow at a CAGR of 5.1% by 2035. This growth is driven by increasing consumer awareness of health and wellness, leading to a higher demand for nutrient-enriched foods. The aging population and the rise in chronic diseases such as osteoporosis and cardiovascular issues are also significant factors, as consumers seek products that offer added health benefits.

Additionally, strong government regulations and initiatives promoting nutritional fortification in food products further boost market growth. The presence of major market players and continuous product innovation also contribute to the expansion of the fortified dairy sector in the USA.

India’s fortified dairy products industry is expected to achieve a CAGR of 6.3% by 2035, driven by growing awareness of nutritional deficiencies and the benefits of fortified foods are key drivers, especially among young and health-conscious consumers. he fortification of milk powder is experiencing significant growth due to the emergence of numerous startups focused on producing fortified milk powder and milk.

These innovative companies are leveraging advanced technologies and innovative approaches to meet the rising demand for nutrient-enriched dairy products, enhancing accessibility and availability across the country

In China, the fortified dairy products sales are anticipated to grow at a CAGR of 6.0% by 2035. The primary drivers include rising health consciousness among consumers and an increasing focus on improving dietary quality. Government policies are trying to reduce nutrient deficiencies and promoting public health play a crucial role in market growth.

The Chinese market also benefits from the rapid development of e-commerce platforms, which provide easier access to a wide range of fortified dairy products. The presence of international dairy brands and their efforts to introduce innovative and high-quality fortified products cater to the growing demand for health-enhancing food options.

| Segment | Product Type - Fortified Milk Powders |

|---|---|

| Value Share (2025) | 36.1% |

Fortified milk powders are designed to address the specific nutritional needs of these age groups, ensuring adequate intake of essential vitamins and minerals that are crucial for their growth and development. As a result, this segment is projected to hold a significant value share of 36.1% by 2025.

These products often contain added nutrients such as calcium, vitamin D, iron, and DHA, which are vital for bone health, cognitive development, and overall growth. The rise in health consciousness among parents, coupled with greater awareness of the long-term benefits of proper nutrition during early childhood, is driving this demand.

Overall, the fortified milk powder segment's substantial value share reflects the increasing prioritization of infant and child nutrition, highlighting a significant growth area within the fortified dairy products

| Segment | Micronutrients - Vitamins |

|---|---|

| Value Share (2025) | 31.5% |

Fortified dairy products enriched with vitamins is experiencing extensive growth, with this segment projected to hold a value share of 31.5% by 2025. This growth is driven by a widespread consumer shift towards healthier dietary choices, driven by increasing awareness of the health benefits associated with vitamin intake.

Fortified dairy products, including milk, yogurt, and cheese, are being increasingly enriched with essential vitamins such as A, D, E, and B-complex, which play critical roles in immune function, bone health, and overall wellness. This trend is particularly pronounced in developed markets where consumers are more health-conscious and willing to invest in premium, health-enhancing food products.

Emerging markets are also contributing significantly to the growth of this segment. The presence of global dairy giants and local companies alike, introducing innovative products and expanding their fortified product lines, further boosts the market. Overall, the increasing demand for vitamin-enriched dairy products underscores the global trend towards preventive healthcare and the growing emphasis on nutrition.

The Fortified Dairy Products industry is highly competitive, with top players controlling substantial shares with their wide range of product offers and large manufacturing capabilities. Tier 1 businesses, which include titans of the players featured in the report are Arla Foods Ltd, Fonterra Co-operative Group, FrieslandCampina, Guangming Dairy Co., Ltd., China Modern Dairy Holdings Ltd., The Kraft Heinz Company, Dean Foods, Gujarat Cooperative Milk Marketing Federation Ltd., Nestle S.A., SanCor Cooperatives United Limited, Danone, General Mills

These businesses provide a broad range of applications in the food and beverage sector by utilizing their extensive experience, cutting-edge technologies, and extensive product lines. Their devoted clientele and robust geographic reach serve to further solidify their position as the industry leaders.

As per Product Type, the industry has been categorized into Fortified Milk, Fortified Yogurt, Fortified Cheese, Fortified Milk Powders and Others (Butter and Margarine)

As per the End Use, the industry is sub-segmented into Vitamins, Minerals, Essential Fatty Acids, Probiotics, Dietary Fiber

Modern Trade, Convenience Stores, Departmental Stores, Drug Stores, Online Stores Channel are key channels selling the products

Industry analysis has been carried out in key countries of the regions such as North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global fortified dairy products market is estimated to be valued at USD 29.9 billion in 2025.

The market size for the fortified dairy products market is projected to reach USD 49.4 billion by 2035.

The fortified dairy products market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in fortified dairy products market are fortified milk, fortified yogurt, fortified cheese, fortified milk powders and others.

In terms of micronutrients, vitamins segment to command 31.5% share in the fortified dairy products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fortified Rice Market Size and Share Forecast Outlook 2025 to 2035

Fortified Eggs Market Analysis - Size, Growth, and Forecast 2025 to 2035

Fortified Pet Food Market Analysis by Form, Pet Type, and Distribution Channel Through 2035

Fortified Foods Market Analysis by Raw Material, Micronutrients, Application, Technology, Sales Channel, and Region from 2025 to 2035

Fortified Yeast Market Outlook - Growth, Demand & Forecast 2024 to 2034

Fortified Wine Market

Fortified Milk and Milk Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA