The form-fill-seal (FFS) equipment market is projected to grow from USD 9.6 billion in 2025 to USD 15.0 billion by 2035, registering a CAGR of 4.6% during the forecast period. Sales in 2024 reached USD 9.3 billion, reflecting steady growth driven by increasing demand for automated and efficient packaging solutions across food, pharmaceuticals, and consumer goods sectors.

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 9.6 billion |

| Projected Size, 2035 | USD 15.0 billion |

| Value-based CAGR (2025 to 2035) | 4.6% |

FFS equipment accounts for approximately 6% of the global packaging machinery market (estimated at USD 53 billion in 2024) and 35% of the broader industrial automation equipment market (USD 150 billion). Within the flexible packaging equipment segment (USD 18 billion), FFS holds a notable 51.6% share, underscoring its dominance in pouch, sachet, and bag production. It also represents about 0.85% of the global packaging industry (USD 1.1 trillion), illustrating its pivotal role in high-speed, integrated packaging lines worldwide.

The demand continues on the back drop of rising need for hygienic packaging in the food and beverage industry, advancements in pharmaceutical packaging, and the surge in e-commerce requiring flexible packaging options. The market's expansion is further supported by innovations in FFS equipment designs and materials, enhancing their efficiency and appeal to various industries.

Innovations include the development of energy-efficient machines, integration of IoT for real-time monitoring, and the use of advanced materials to enhance the environmental friendliness of packaging. Advancements in manufacturing technologies are improving the speed and accuracy of FFS machines, making them suitable for a wider range of products.

These innovations align with consumer preferences for sustainable packaging and are expected to propel market growth in the coming years. In FFS equipment market, the manufacturers are focusing on producing machines that can handle biodegradable and recyclable packaging materials.

The FFS equipment market is poised for significant growth, driven by increasing demand in the food and beverage, pharmaceutical, and personal care industries for automated and sustainable packaging solutions. Companies investing in innovative, eco-friendly technologies are expected to gain a competitive edge.

The market's expansion is further supported by the growing e-commerce sector and the shift towards flexible packaging. With continuous advancements in materials and manufacturing processes, the FFS equipment market is set to offer lucrative opportunities for stakeholders over the forecast period.

The below table presents the expected CAGR for the global form fill seal equipment market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 4.0%, followed by a higher slight high growth rate of 5.2% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 4.0% |

| H2(2024 to 2034) | 5.2% |

| H1(2025 to 2035) | 2.6% |

| H2(2025 to 2035) | 6.6% |

Moving into the subsequent period, from H1 2024 to H2 2035, the CAGR is projected to decrease to 2.6% in the first half and increase to 6.6% in the second half. In the first half (H1) the market witnessed a decrease of 140 BPS while in the second half (H2), the market witnessed an increase of 140 BPS.

The market is segmented on the basis of equipment type, packaging type, end-use industry, and region. By equipment type, the market is categorized into horizontal form fill seal (HFFS) equipment, vertical form fill seal (VFFS) equipment, and pre-made pouch fill and seal equipment. In terms of packaging type, the market includes bags & pouches, sachets, stick packs, and blister packs & strip packs.

Based on end-use industry, the market is segmented into food & beverages, pharmaceuticals, personal care & cosmetics, chemicals & fertilizers, and pet food. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Vertical form fill seal (VFFS) equipment has been projected to account for 47.2% of the global form fill seal equipment market by 2025, driven by its suitability for packaging granular, powdered, and low-viscosity products at high speeds. VFFS systems have been widely integrated into snack foods, cereals, grains, and powdered beverages operations due to their compact footprint, vertical gravity-feed design, and lower overall cost of ownership.

Flexible film compatibility across polyethylene, polypropylene, and multilayer barrier films has allowed VFFS machines to be deployed in both ambient and modified atmosphere packaging (MAP) formats. Servo-driven sealing jaws, PLC-based controls, and automated changeovers have further enhanced throughput in large-volume facilities.

Global food manufacturers and contract packers have preferred VFFS units for their ability to support continuous production, vertical space optimization, and quick bag length adjustments. Extended shelf-life products such as spices, milk powders, and dry mixes have particularly benefited from gas flushing and vacuum sealing options offered by modern VFFS models.

Market growth has been further supported by investments in integrated weighing, dosing, and inspection modules, making VFFS equipment suitable for lean and semi-automated production lines. Energy efficiency incentives and hygiene compliance certifications have also influenced equipment replacement cycles in developed economies.

The food and beverage industry has been estimated to contribute 58.6% of the global form fill seal equipment market by 2025, owing to stringent hygiene requirements, high packaging volumes, and continuous product innovation. Application areas have included snacks, confectionery, dairy products, sauces, condiments, and frozen foods, with a strong emphasis on shelf stability and visual appeal.

Flexible dosing capabilities have allowed manufacturers to use the same equipment line for liquids, solids, and viscous products, reducing downtime and SKU-specific investments. Integration with vision inspection systems, nitrogen flushing modules, and recyclable film feeders has enabled alignment with both regulatory and sustainability mandates.

Major global food brands have expanded use of VFFS and HFFS equipment for portion-controlled servings and single-use packs to cater to e-commerce and on-the-go retail formats. Clean-in-place (CIP) compatibility and contamination control have been pivotal in dairy, baby food, and ready-meal processing lines.

Automation mandates and labor cost pressures in North America, Europe, and East Asia have accelerated equipment upgrades in the food sector. Localized packaging mandates and a growing shift toward recyclable mono-material films have further propelled demand for advanced form fill seal equipment among food process.

VFFS Equipment Powers Growth in Ready-to-Eat Meals and Convenience Foods

Ready-to-eat meals and convenience foods have the largest demand for use of VFFS equipment. Consumers are demanding noodles, soups, and microwaveable meals quickly because of lifestyles that are very busy and their preference for meals prepared quickly, fast. In this regard, companies such as Nestlé, Unilever, and Kraft Heinz prefer VFFS technology in their packaging since their products are lighter, compact and easy to stock.

This is suited by the VFFS machines as long as there is a high requirement for high-speed, automated packaging solutions in handling wide ranges of product sizes and formats. There also is consistent sealing, accurate portioning, and minimal waste of the product without compromising the quality of the product itself. Other benefits associated with MAP, among them extend the shelf life thereby meeting consumers demand for fresh preservative free convenient foods.

E-commerce Growth Drives Demand for Small-Size Packaging via VFFS

The increasing popularity of small-size packages in e-commerce is generating an enormous demand for Vertical Form Fill Seal (VFFS) equipment. Growth in grocery service by online retailers such as Amazon and Walmart boosts the demand for single-serve or small-size package formats, which is meeting the rising convenience and portioning needs of consumers.

Products like snack foods, beverages, and personal care such as shampoos and conditioners are found in more and more compact easy-to-use pouches, ideal for online shopping. Those smaller packages aren't only great for consumers as they save the space but it also helps cost-effective and saves space shipping e-commerce retailers.

For those packaging types, VFFS equipment is most ideal because of the high speed, flexibility, and precision they can offer to package. Therefore, with respect to the types and sizes that different products take, VFFS technology can meet the increasing demand for the small, compact packages suited for online commerce distribution.

Delicate Products Drive Shift from VFFS to Gentle Packaging Solutions

Products like fresh fruits and vegetables and other delicate baked goods, such as croissants and cakes, are very difficult to be packaged with VFFS. They cannot be roughly handled and easily break or deform when high-speed processing is used. These high-speed, efficient, and high-volume machines are not ideal for handling such delicate items because the pressure applied to seal and fill the package could ruin the quality of the products.

For example, Dole (fresh fruits and vegetables packager), and Flowers Foods (baked goods manufacturer) may desire much slower, more gentle packaging to give their business more control over product handling. Alternatives exist in the mode of flow wrapping or vacuum sealing, which does not handle a product roughly that would compromise items' integrity besides ensuring freshness is maintained. Not very often have VFFS machines been picked for such products types.

Tier 1 company leaders are characterized by high production technology and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within Tier 1 include Robert Bosch GmbH, Viking Masek Global Packaging Technologies, Premier Tech Chronos.

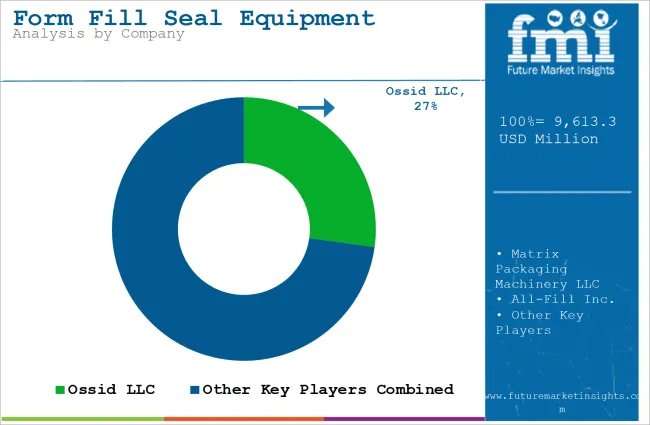

Tier 2 companies are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in Tier 2 include Ossid LLC, Matrix Packaging Machinery LLC, All-Fill Inc., General Packaging Company, and Nichrome India Ltd.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the industry analysis for the form fill seal equipment market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. USA is anticipated to remain at the forefront in North America, with a CAGR of 3.8% through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 5.8% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

| Canada | 3.2% |

| Brazil | 4.5% |

| Argentina | 4.1% |

| Germany | 3.3% |

| China | 5.3% |

| India | 5.8% |

Among the strongest growth drivers for this USA Form Fill Seal (FFS) equipment market is the massive demand for the convenience food by changing lifestyles within the consumer itself. Consumers look for fast to prepare meals, along with hectic times at work while working from homes, and instant noodle, ready-to-eat snacks, as well as microwave-able meals enjoy an ever-soaring popularity.

Now, companies such as General Mills and Campbell Soup are packing their products with the help of VFFS machines in lighter and more compact pouches. Convenience and portability are other major reasons, as the market of the USA favors sustainable packaging, and due to that, companies have to move toward recyclable and biodegradable materials to fulfill the FFS equipment requirement.

This, again, brings out the critical importance of FFS equipment in supplying packaging solutions that meet convenience needs as well as nutritional needs while consumer preferences change toward healthier and portion-controlled meals.

Premium and organic food products in Germany are currently driving the increase in higher investment in the region for FFS equipment. Germany has recently experienced health and environmentally conscious consumer trends increasingly opt for organic, plant-based, and sustainably sourced food products. Others who are beneficiary of the trend include Alnatura and Bio Company through organic snacks, beverages, and pre-cooked foodstuffs whose production necessitates effective and environmentally-friendly packaging solutions.

VFFS machines are meant to pack such products in green pouches with freshness levels that ensure the consumer adheres to his or her sustainability preferences. Portion-controlled packaging is a fast-growing demand in the organic food sector, because consumers prefer to have less but more convenient small packages that fit in with healthy eating habits.

The general trend of the German market in improving recyclability and reducing waste also pushes for further innovation in the FFS field, where more manufacturers adjust the growing need for biodegradable and recyclable materials.

Key players operating in the form fill seal equipment market are investing in the development of innovative sustainable solutions and also entering into partnerships. Key form fill seal equipment providers have also been acquiring smaller players to grow their presence to further penetrate the form fill seal equipment market across multiple regions.

Recent Industry Developments in the Form Fill Seal Equipment Market

In October 2024, HMC Products, a pioneer in the production of horizontal form fill seal machines and aftermarket support, was acquired by ProMach.

In terms of material type, the industry is divided into below plastic, paper, and aluminum foil.

In terms of product type, the industry is segregated into horizontal form fill seal (HFFS) equipment and vertical form fill seal (VFFS) equipment.

By packaging type, the market is divided into Pouches, Sachets, Stick Packs, Bags, Bottles, Cups, and Trays.

The market is classified by end use such as food & beverage, cosmetics, electronics, stationary, pharmaceuticals, and chemicals.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa have been covered in the report.

The global form fill seal equipment industry is projected to witness CAGR of 4.6% between 2025 and 2035.

The global form fill seal equipment industry stood at USD 9.3 billion in 2024.

The global form fill seal equipment industry is anticipated to reach USD 15.0 billion by 2035 end.

South Asia & Pacific region is set to record the highest CAGR of 5.2% in the assessment period.

The key players operating in the global form fill seal equipment industry include Ossid LLC, Matrix Packaging Machinery LLC, All-Fill Inc., Robert Bosch GmbH, General Packaging Company, Viking Masek Global Packaging Technologies, Premier Tech Chronos, Nichrome India Ltd.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Form Fill Seal Equipment Manufacturers

Formable Films Market Size and Share Forecast Outlook 2025 to 2035

Formalin Market Size and Share Forecast Outlook 2025 to 2035

Formalin Vials Market Size and Share Forecast Outlook 2025 to 2035

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Formaldehyde-Free Resin Market Growth & Demand 2025 to 2035

Form Automation Software Market – Digitizing Workflows

Formate Brines Market

Form-Fill-Seal (FFS) Films Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in the Form Fill Seal Machine Industry

Competitive Overview of Form-Fill-Seal (FFS) Films Suppliers

Form Fill Seal Machine Market Analysis by Semi-automatic and Automatic Through 2034

Information Security Consulting Market

Preformulation intermediates Market Size and Share Forecast Outlook 2025 to 2035

AI-Formulated Custom Serums Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Performance Elastomer Market Growth – Trends & Forecast 2024-2034

Performance tires Market

Walform Machine Market

Paraformaldehyde Market Size and Share Forecast Outlook 2025 to 2035

Platform Lifts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA