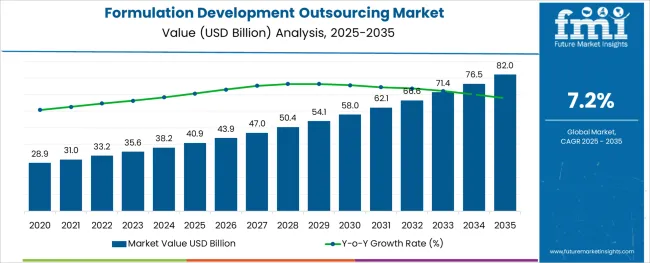

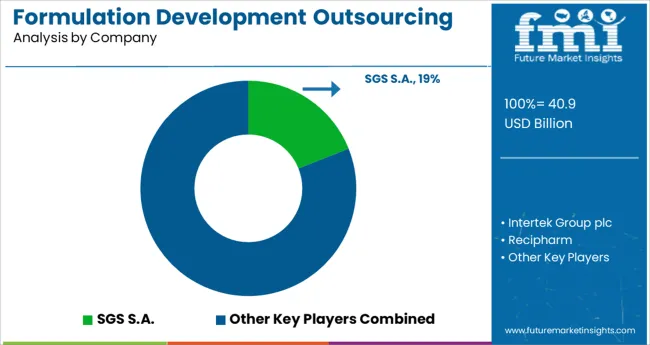

The Formulation Development Outsourcing Market is estimated to be valued at USD 40.9 billion in 2025 and is projected to reach USD 82.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

The formulation development outsourcing market is experiencing sustained growth due to increasing complexity in drug formulations, rising R&D costs, and the need for specialized expertise across pharmaceutical pipelines. Pharmaceutical and biotech companies are leveraging external formulation partners to reduce time-to-market, control costs, and access regulatory and scientific capabilities.

The outsourcing trend has been further amplified by expanding clinical pipelines, the demand for differentiated drug delivery systems, and advancements in solubility enhancement technologies. Contract development and manufacturing organizations (CDMOs) are investing heavily in analytical capabilities, preformulation platforms, and technology transfer processes to support early- and late-phase formulation development.

Regulatory emphasis on quality-by-design (QbD) and patient-centric formulation development is reinforcing demand for end-to-end outsourcing partnerships. Looking forward, the market is expected to benefit from the growth in biologics, pediatric formulations, and high-potency APIs that require precise formulation design and containment strategies.

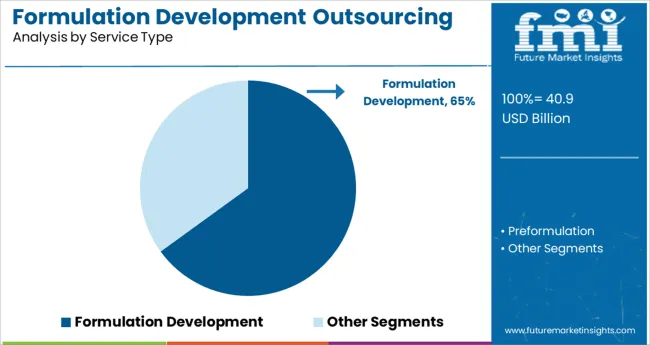

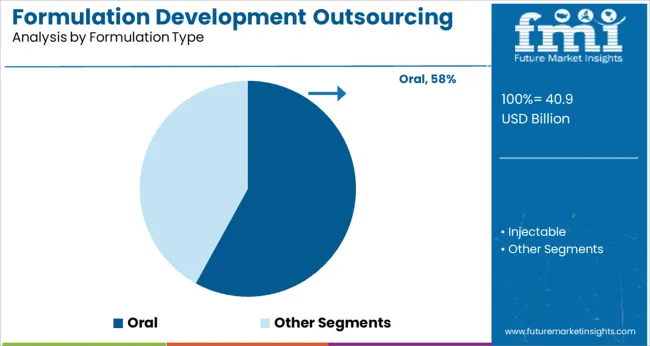

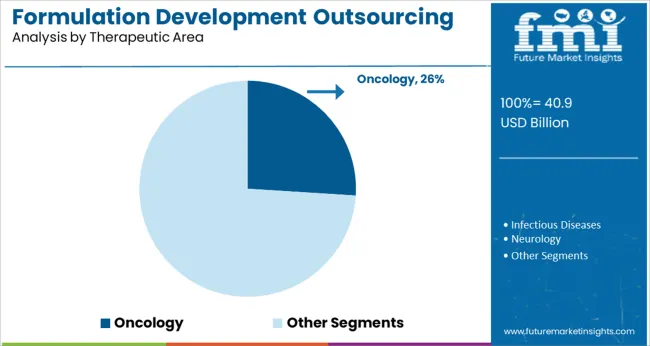

The market is segmented by Service Type, Formulation Type, and Therapeutic Area and region. By Service Type, the market is divided into Formulation Development and Preformulation. In terms of Formulation Type, the market is classified into Oral and Injectable. Based on Therapeutic Area, the market is segmented into Oncology, Infectious Diseases, Neurology, Hematology, Respiratory, Cardiovascular, Dermatology, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Formulation development services are projected to dominate with a 65.0% revenue share in 2025, establishing them as the leading service type in this market. This leadership is being driven by the increased outsourcing of early-stage drug development activities that require specialized formulation strategies to improve bioavailability, stability, and patient compliance.

As drug molecules become more complex, including poorly soluble APIs and targeted delivery systems, formulation expertise is being increasingly sourced externally. CDMOs offering integrated preclinical to commercial-scale capabilities are being favored for their technical proficiency and regulatory alignment.

Furthermore, the growing number of orphan drugs and niche indications has elevated the need for agile formulation development workflows that can accommodate small batch sizes and accelerated development timelines.

Oral formulations are expected to hold 58.0% of the total market revenue in 2025, making them the most widely outsourced formulation type. This segment’s growth is underpinned by the dominance of oral delivery routes in clinical pipelines due to their non-invasiveness, patient convenience, and cost-effectiveness.

Demand for modified-release, taste-masked, and bioavailability-enhanced oral dosage forms is increasing, especially in chronic and pediatric therapies. CDMOs are expanding their offerings in solid oral dose technologies including hot-melt extrusion, spray drying, and microencapsulation to address solubility challenges.

Regulatory familiarity and high patient acceptability further reinforce the preference for outsourcing oral formulations. As sponsors prioritize patient-centric drug design, oral dosage platforms continue to offer the best balance of adherence, scalability, and affordability.

Oncology is anticipated to contribute 26.0% of the total revenue share in 2025, leading the formulation development outsourcing market by therapeutic area. The surge in oncology-focused R&D pipelines, driven by both large pharma and emerging biotech firms, is creating robust demand for formulation outsourcing in this segment.

High-potency active pharmaceutical ingredients (HPAPIs), targeted therapies, and personalized medicines in oncology require sophisticated formulation techniques and stringent containment protocols. CDMOs with high-containment infrastructure and cytotoxic handling capabilities are being increasingly relied upon to ensure safety, precision, and regulatory compliance.

Additionally, the push toward patient-specific therapies in oncology has intensified demand for small-batch, flexible formulation services. As oncology trials continue to dominate the global clinical landscape, the need for external formulation expertise is expected to remain strong.

Based on geography, North America dominates the formulation development outsourcing market by capturing the highest share during the forecast period.

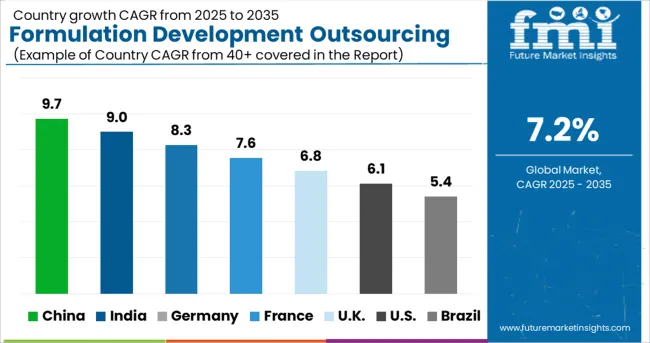

The increasing number of approved drugs and the development of a vaccine in the region is growing the demand for formulation development outsourcing in the region. The countries such as China and India are leading the market and accelerating market growth.

The Europe market is predicted to secure better growth in the market due to rising government-supportive activities and rising chronic disorders during the forecast period. In addition, United Kingdom & Germany are the leading countries in the market due to rising sedentary lifestyles.

The cancer research institutes in the United Kingdom are supporting and collecting funds for several pharmaceutical firms and clinics to innovate early drug developments during the forecast period.

On the other hand, the North American region is also in a queue to drive the market size by capturing a good market share during the forecast period. Rising clinical trials and growing chronic diseases in the USA have been propelling the market size in recent years.

In addition, the development of anti-cancer drugs and bioavailability in the region accelerates the demand for formulation development outsourcing.

Pharmaceutical manufacturers are playing an essential role in the formulation development outsourcing market by innovating and focusing on oncology formulation development and other drug development. The key playing industries are together developing efficient drugs and gene therapies that strengthen the biotech sector.

Moreover, the adoption of new methods availability and pharmaceutical services by key market players accelerates the market size during the forecast period. Some of the key players are providing clinical, drug substance development, and medical goods to patients.

Currently, the formulation development outsourcing market players are competing in the market to upsurge their business by developing and innovating several unique products that drive consumer demand.

However, they are capturing maximum profit in the market by adopting several marketing tactics and methodologies. Some of the commonly used marketing strategies include partnerships, mergers, acquisitions, and product launches, among others.

Global marketers are spending billions of bucks in developed and developing regions to provide sufficient treatment to patients. Although, growing uncountable medical services and facilities are meeting the patient needs in the urban areas during the forecast period.

The pharmaceutical industry's pursuit of novel and efficient medicines continues to fuel longer-term growth, and clinical research for both new and existing COVID-19 medications continues to flourish. Contrast Research Organizations, or CROs, and biotechnology start-up businesses began creating formulations to fight disease.

The majority of pharmaceutical businesses employ it to cut down on the amount of time spent on formulation development outsourcing services due to trial-related investment. The growing emphasis of biopharmaceutical companies that have developed academic relationships is attributed to the formulation development outsourcing market growth.

The demand for formulation development outsourcing services is anticipated to increase as a result of the rising Research and Development expenditures. Small and medium-sized pharmaceutical enterprises that lack the capacity for formulation development frequently use formulation development services.

To remain competitive and adaptable, pharmaceutical companies are increasingly concentrating on their Research and Development efforts. The patent expiration of important pharmaceuticals was accelerated due to the growing significance of novel drugs and their use.

Most pharmaceutical companies, who are the main market drivers of the formulation development outsourcing market, are increasing the outsourcing of their formulation services as a result of this. Cancer research in the United Kingdom supports early drug development and provides funding to numerous pharmaceutical firms.

Formulation development outsourcing market growth is anticipated to be constrained by rising instrument prices needed for testing, diagnosis, and treatment. Structure changes in the pharmaceutical industry also affect the growth of the formulation development outsourcing market share.

The rise in price and demand for various pharmaceuticals and raw materials can have a significant negative impact on the market value of formulation development outsourcing.

With a revenue share of 76.6% in 2024, the formulation development segment dominated the market for formulation development outsourcing. Every stage of clinical trials requires the development of a formulation, and the quantity of clinical research has greatly expanded over time.

The market for formulation development outsourcing is projected to benefit if a sizable number of businesses outsource formulation development services. The rising frequency of chronic diseases, including cancer, diabetes, HIV, and other illnesses, is also encouraging the need for formulation development by increasing the demand for producing novel medicines.

In 2024, the oral segment dominated the market for formulation development outsourcing, accounting for the highest revenue share at 63.6%.

Tablets, capsules, syrups, and powders are a few examples of oral formulations. As they are primarily used to treat some common disorders like migraines, infectious diseases, fever, and diabetes, among others, oral formulations have grown significantly in formulation development outsourcing market share.

One of the main factors contributing to oral formulations' great acceptability is their self-administrability and lack of need for a skilled physician to provide the medication. Additionally, compared to others, these formulations have more design flexibility, which increases their demand for formulation development outsourcing.

In the formulation development outsourcing market, the injectable formulation sector is anticipated to grow at the quickest rate (7.8% CAGR). The primary driver for its quickest growth is the high bioavailability of injectable formulations, which results in an instantaneous commencement of effect.

If the medications are poorly absorbed, injectable forms are favored. This type of formulation is also frequently chosen in medical situations, which is propelling the market even more.

The cancer therapeutic area dominated the formulation development outsourcing market share and accumulated the greatest revenue share of 24.5% in 2024. The quickest CAGR during the projection period is also anticipated for this market category.

The need for innovative cancer medicines has been greatly influenced by the fact that cancer is one of the leading causes of mortality around the globe. Additionally, a sizable number of organizations finance cancer research.

For instance, the World Cancer Research Fund International offers investigator-initiated trials of more than GBP 300,000 over a three-year period. Additionally, the NCI generously funds a lot of cancer research.

With a revenue share of 39.1% in 2024, Asia Pacific dominated the market for formulation development outsourcing. The quickest CAGR of 8.1% over the forecast period is also anticipated for the area.

One of the main factors contributing to the greatest formulation development outsourcing market share is the existence of a sizable number of CROs providing affordable formulation development services. Public groups are also making efforts to shorten the time it takes for drugs to be approved in the area.

It is predicted that Europe would have the second-largest formulation development outsourcing market share. The market in this region is being driven by the government's supportive activities, sedentary lifestyles, and rising chronic disorders.

In North America, the market for formulation development outsourcing maintained a sizable proportion of 26.8% in 2024. For instance, a large number of clinical trials are carried out in the USA.

In addition, public USA organizations provide financial assistance for the research. As a result, the market in this area is being driven by the rising incidence of chronic diseases and the development of new medications.

Key players are active in the creation of novel therapeutics, as the majority of the medications are approaching the point of patent expiration. Pharmaceutical companies are outsourcing formulation development services to CROs in this situation to save time and money on a number of clinical trials and assessment studies, which could propel market expansion in the area.

Presently, there are several market players that are becoming fiercely competitive in the formulation development outsourcing market share. Few of the competitors are likely to capture the maximum portion of the formulation development outsourcing market.

Due to the presence of numerous major competitors, the formulation development outsourcing market is fragmented.

Recent Developments

The global formulation development outsourcing market is estimated to be valued at USD 40.9 billion in 2025.

It is projected to reach USD 82.0 billion by 2035.

The market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types are formulation development and preformulation.

oral segment is expected to dominate with a 58.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Preformulation intermediates Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Aseptic Formulation Processing Market Size and Share Forecast Outlook 2025 to 2035

Bakuchiol Formulations Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Global Inhalation Formulation Market Analysis – Size, Share & Forecast 2024-2034

Niacinamide Formulations Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modified Release Formulations Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Custom Supplement Formulation Service Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Cosmetic Formulation Agents Market Size and Share Forecast Outlook 2025 to 2035

Oral Solid Dosage Pharmaceutical Formulation Market Size and Share Forecast Outlook 2025 to 2035

Demand for Hybrid Protein Blends in Private Label Formulations in CIS Size and Share Forecast Outlook 2025 to 2035

Developmental and Epileptic Encephalopathies (DEE) Treatment Market Size and Share Forecast Outlook 2025 to 2035

IoT Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Low Code Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Cell Line Development Market Analysis – Growth & Industry Outlook 2025 to 2035

Cell Line Development Services Market Growth – Trends & Forecast 2025 to 2035

Leadership Development Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA