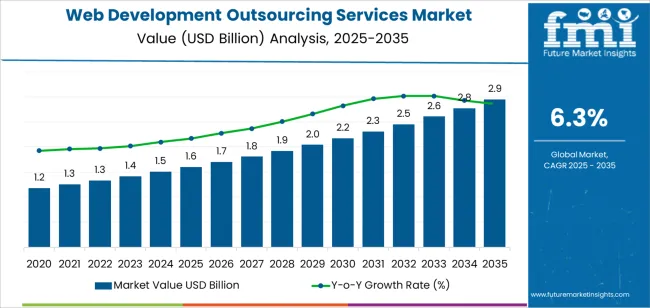

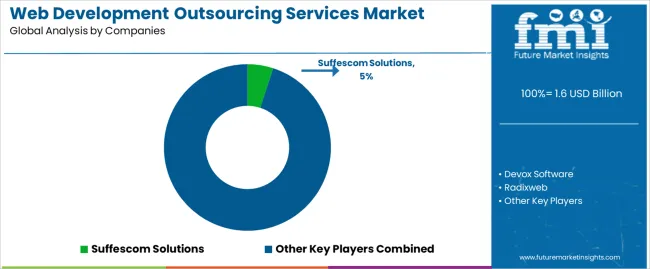

The web development outsourcing services market grows from USD 1.6 billion in 2025 to USD 3.0 billion by 2035 at a CAGR of 6.3%, creating an absolute dollar opportunity of USD 1.4 billion. Market growth from 2025 to 2030 lifts revenue to USD 2.2 billion as monthly outsourced workloads increase from 1.6 million to 2.2 million service hours, reflecting the Late Growth Stage of the maturity curve. Small and mid-size enterprises account for 48–52% of spending during this phase, supported by expanding e-commerce ecosystems and rising adoption of frameworks such as React, Angular, Vue, and Node.js, each growing 8–12% annually within outsourced projects. Cloud-native modernization contributes 25–28% of project volume, and SLA requirements exceeding 99% uptime reinforce vendor selection standards.

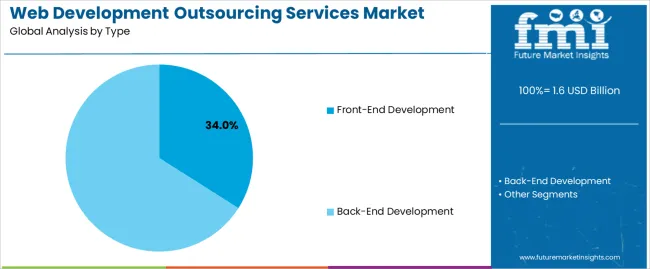

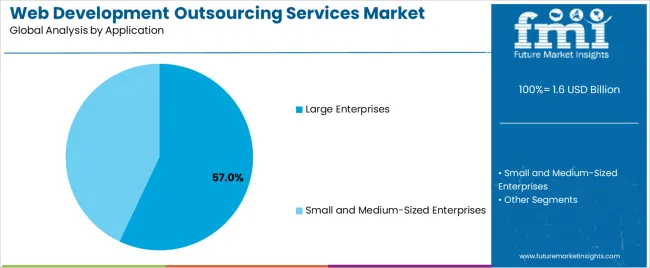

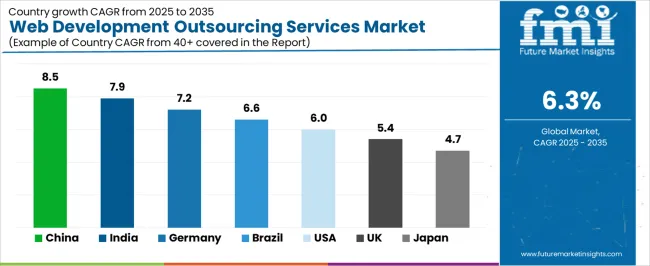

From 2030 to 2035, the market advances to USD 3.0 billion as workloads reach 2.8–3.0 million service-hours per month. This period marks the Early Maturity Stage, driven by large enterprises and regulated sectors, which together generate 40–45% of new contracts. Front-end development leads with a 34.0% share, while large enterprises represent 57.0% of application demand. Country-level expansion is led by China at 8.5% CAGR, India at 7.9%, and Germany at 7.2%, followed by Brazil at 6.6%, the USA at 6.0%, the UK at 5.4%, and Japan at 4.7%. Competitive prominence includes Suffescom Solutions, Devox Software, Radixweb, ScienceSoft, Classic Informatics, Intellectsoft, Digital Silk, Dotsquares, Infinum, Bilberrry, Saigon Technology, DICEUS, 365 Outsource, Rollout IT, GetDevDone, InternetDevels, Aimprosoft, NarraSoft, IT Craft, and Tigren.

Between 2030 and 2033, the market enters a moderate acceleration stage, with growth still moving upward but at a slower pace. This period reflects maturing outsourcing practices, more standardized project workflows, and rising competition from no-code and low-code development tools that partially reduce reliance on outsourced custom builds. After 2033, the market transitions to a deceleration phase as outsourcing demand plateaus in mature regions, though ongoing upgrades, maintenance services, and specialized development needs keep the market advancing through 2035.

Between 2025 and 2030, the Web Development Outsourcing Services Market grows from USD 1.6 billion to approximately USD 2.2 billion, supported by a rise in monthly outsourced workloads from around 1.6 million to 2.2 million service-hours. During this period, the industry is positioned in the Late Growth Stage of the maturity curve, driven by strong adoption among mid-size enterprises and digital-first organizations, which together account for 48-52 % of market spending. Demand intensifies for full-stack frameworks such as React, Angular, Vue, and Node.js, each recording 8-12 % CAGR usage growth within outsourced projects. Cloud-native modernization represents 25-28 % of total outsourcing activity, while SLA performance thresholds above 99 % uptime and rapid 2-4-week sprint cycles become decisive vendor selection criteria.

From 2030 to 2035, the market expands from USD 2.2 billion to USD 3.0 billion, with global outsourced development workloads increasing to roughly 2.8-3.0 million service-hours per month. In this phase, the industry enters the Early Maturity Stage of the adoption lifecycle as large enterprises and regulated sectors generate 40-45 % of new outsourcing contracts. Project focus shifts to long-term product lifecycle management, legacy-to-cloud migrations, and platform re-architecture. AI-assisted development tools deliver 15-20 % productivity gains, influencing pricing structures and delivery timelines. Provider consolidation accelerates, with firms employing 500+ engineers gaining operational advantage for multi-year DevOps, cybersecurity, and observability engagements. Implementation of zero-trust security, multi-cloud integration, and automated monitoring tools grows to 20-25 % of total outsourced service scope.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.6 billion |

| Market Forecast Value (2035) | USD 3.0 billion |

| Forecast CAGR (2025-2035) | 6.3% |

Demand for web development outsourcing services is increasing as organizations seek scalable, cost-efficient access to technical expertise for building and maintaining digital platforms. Companies rely on outsourced teams to deliver front-end interfaces, content-management systems, e-commerce functionality, and application integrations without expanding internal headcount. Businesses facing rapid product cycles and cross-device performance requirements favor vendors that provide structured project management, code reviews, and continuous deployment support. Service providers strengthen capabilities in modern frameworks-including React, Angular, and Node.js-while refining QA processes to ensure accessibility compliance, page-load optimization, and reliable API communication. Growth accelerates as small and mid-size firms adopt remote development models to control budget exposure and reduce time-to-market for new online services.

Market expansion is also supported by the increasing complexity of cybersecurity, cloud hosting, and data-privacy requirements. Companies outsource development to specialists who integrate secure coding practices, identity-management protocols, and containerized deployment pipelines aligned with regulatory standards. Providers enhance collaboration through version-control systems, automated testing suites, and transparent communication workflows to maintain project visibility across time zones. Enterprises pursuing digital transformation programs use outsourcing partnerships to supplement internal architecture teams, enabling parallel development and rapid scaling during peak demand. Although vendor selection risk and IP protection concerns remain challenges, improved auditing frameworks, contractual controls, and long-term support agreements strengthen client confidence. These factors collectively drive continued adoption of outsourced web development across technology, retail, finance, and public-sector organizations.

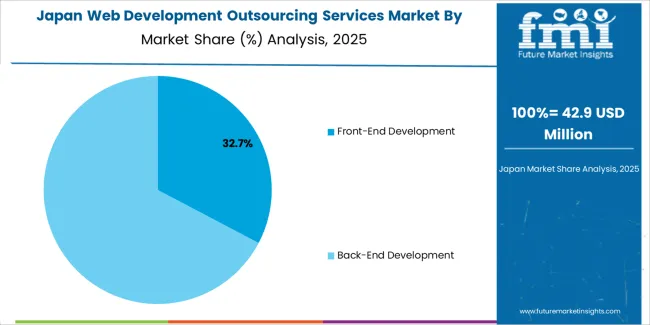

The web development outsourcing services market is segmented by type, application, and region. By type, it is divided into front-end development and back-end development. Based on application, the market is categorized into large enterprises and small and medium-sized enterprises. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differing project scopes, technical requirements, and regional outsourcing patterns that shape demand for specialized web development functions.

The front-end development segment accounts for approximately 34.0% of the global web development outsourcing services market in 2025, making it the leading type category. Its position is supported by the consistent need for user-facing interfaces that work across devices, browsers, and operating systems. Organizations outsource front-end work to secure stable interface performance, responsive layouts, and codebases aligned with evolving usability standards. Outsourcing partners apply established frameworks and testing workflows that help streamline iterative design changes while maintaining predictable rendering across varied environments.

Demand is reinforced by the rapid updates required for customer-facing portals, e-commerce platforms, and internal dashboards that rely on frequent content revision. Suppliers improve component libraries, accessibility compliance, and performance optimization practices that address page-load targets and device variability. Large outsourcing hubs in East Asia and South Asia offer development capacity that supports continuous release cycles common in digital service operations. Front-end tasks remain widely outsourced because they depend on labor-intensive coding, structured testing, and adaptable design practices that benefit from distributed development teams. The segment maintains its lead through its alignment with ongoing digital interface refreshes and the steady requirement for user-experience consistency across enterprise and consumer web applications.

The large enterprises segment represents about 57.0% of the total web development outsourcing services market in 2025, making it the dominant application category. Large organizations outsource development tasks to manage complex digital infrastructures that span customer portals, internal systems, and cross-platform applications. These organizations often maintain continuous development pipelines that require scalable staffing, specialized technical knowledge, and rapid turnaround for updates and feature integration.

Outsourcing partners provide structured project management, version-control practices, and technical specialization that support enterprise requirements for security, data-handling compliance, and long-term maintainability. Enterprises also rely on external teams to address varying workloads linked to product expansions, seasonal demand, and multi-region platform rollouts. Growth in this segment is reinforced by digital transformation initiatives in North America, Europe, and East Asia, where organizations expand their web architectures to support cloud migration, analytics integration, and multi-tenant application environments. Large enterprises maintain their leading position because their broad operational footprints and continuous update cycles generate sustained need for outsourced development capacity that offers technical depth, cost control, and workflow stability.

The web development outsourcing services market is expanding as organizations seek cost-efficient, scalable support for website design, application development and digital platform maintenance. Companies outsource to access broader technical expertise, accelerate delivery cycles and reduce operational overhead. Growth is supported by rising digital transformation across industries, global availability of skilled developers and increasing demand for custom web solutions. Adoption is limited by communication challenges, data-security concerns and inconsistencies in delivery quality across service providers. Firms offering outsourcing services are strengthening project-management capabilities, transparent workflows and specialized development models to meet varied client expectations.

Demand grows as businesses shift operations online and require complex, responsive and secure web platforms. Many organizations lack in-house development teams capable of supporting evolving frameworks, integration needs or continuous updates. Outsourcing enables rapid access to specialized skills, supports multi-time-zone development cycles and shortens project timelines. Startups and mid-size firms benefit from scalable engagement models that allow periodic or long-term development support. The expansion of ecommerce, cloud services and mobile-friendly applications continues to reinforce the role of outsourced development partners.

Barriers include data-protection risks, time-zone gaps, cultural differences and inconsistent communication practices. Some organizations face challenges ensuring code quality, meeting compliance standards or managing intellectual-property safeguards. Cost overruns may occur when project specifications change or when provider capabilities are misaligned with client needs. Smaller firms may hesitate to outsource due to concerns about transparency and long-term support reliability. These issues encourage clients to invest more time in vendor evaluation and project governance before adopting outsourced development models.

Key trends include greater adoption of agile and DevOps workflows, expansion of full-stack development capabilities and growing demand for API-driven architectures. Providers are offering specialized services in UI/UX design, cloud-native development and security-focused builds. Automation tools support faster testing and deployment, while nearshore and hybrid outsourcing models help reduce communication barriers. Interest is rising in long-term partnership structures that combine development, maintenance and continuous optimization. As digital ecosystems mature, outsourcing firms increasingly differentiate through domain expertise, scalable delivery teams and integrated quality-assurance frameworks.

| Country | CAGR (%) |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| Brazil | 6.6% |

| USA | 6.0% |

| UK | 5.4% |

| Japan | 4.7% |

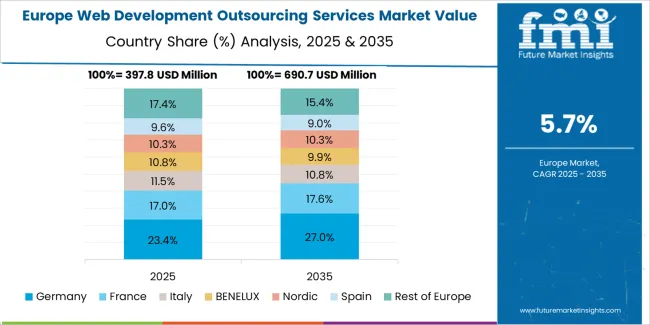

The web development outsourcing services market continues to expand across key regions, with China leading at an 8.5% CAGR through 2035 due to strong IT service scalability, competitive development costs, and rising digital transformation initiatives. India follows at 7.9%, supported by its globally dominant outsourcing ecosystem, large skilled developer base, and increasing demand for enterprise and e-commerce solutions. Germany grows at 7.2%, driven by rising nearshoring demand and advanced engineering capabilities in cloud-native and secure web development. Brazil records 6.6%, benefiting from rapid digital adoption across businesses. The USA, at 6.0%, remains a high-value market emphasizing specialized and complex development services, while the UK (5.4%) and Japan (4.7%) focus on secure, scalable, and innovation-driven outsourcing partnerships.

China is experiencing rapid expansion in the web development outsourcing services market, projected to grow at a CAGR of 8.5% through 2035. Large domestic IT talent pools and extensive technology parks support scalable service delivery for international clients. Providers focus on full-stack development, cloud-native applications, and agile delivery models to meet enterprise requirements. Competitive pricing, multilingual teams, and growing proficiency in modern frameworks increase client retention. Increasing regional data-centre capacity and favorable business zones reinforce service competitiveness. Partnerships with global consultancies and focus on cybersecurity compliance continue to strengthen China as a major outsourcing hub for enterprise web projects globally.

India is recording robust growth in the web development outsourcing services market, forecast to grow at a CAGR of 7.9% through 2035. A large, English-proficient engineering workforce and growing startup ecosystem drive sustained service exports. Vendors emphasize scalable agile teams, API-first architectures, and low-code platforms to accelerate delivery timelines. Cost-competitive engagement models combined with quality-assurance processes increase repeat business. Expansion of regional delivery centres and investments in cloud infrastructure broaden service resilience. Collaboration with global product companies and emphasis on developer upskilling reinforce India as a primary offshore partner for digital transformation initiatives worldwide. Training programs support continuous talent development.

Germany is seeing steady growth in the web development outsourcing services market, forecast to expand at a CAGR of 7.2% through 2035. Demand from industrial clients and enterprise software units drives need for secure, compliant development workflows. Vendors emphasize ISO-aligned processes, robust code-review practices, and documentation standards to meet strict procurement criteria. Strong engineering education and experience with complex backend systems support high-value project delivery. Partnerships with system integrators and cloud providers improve deployment reliability. Increasing focus on data-protection compliance and modular architecture design encourages German enterprises to adopt outsourced development for digital transformation programs. Skilled QA teams support validation.

Brazil is showing consistent expansion in the web development outsourcing services market, projected to grow at a CAGR of 6.6% through 2035. Increasing digital initiatives across retail, banking, and logistics sectors create steady demand for web applications and integrations. Local providers scale teams for e-commerce platforms, payment integrations, and mobile-first design requirements. Improvements in payment APIs, regional compliance, and multilingual support enhance cross-border client engagement. Growth of nearshore delivery models reduces latency for American customers. Investments in developer training, cloud adoption, and DevOps practices continue to elevate Brazil as a pragmatic outsourcing destination for regional digital projects, driving ongoing demand.

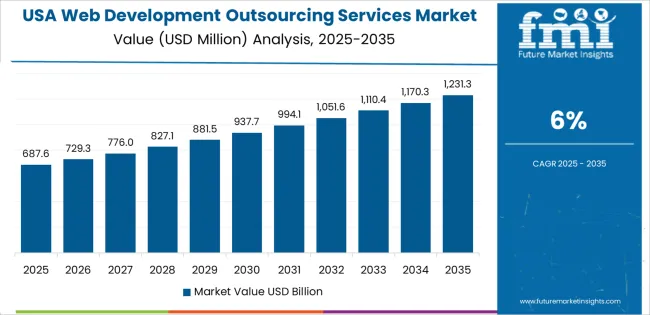

United States market demand for web development outsourcing services is advancing at a CAGR of 6.0% through 2035. Large enterprises and startups alike rely on external development teams to accelerate product roadmaps and scale engineering capacity. Vendors specialize in cloud-native architectures, serverless functions, and secure API gateways to meet compliance and performance objectives. Time-zone overlap and strong project management practices enable predictable delivery for distributed teams. Emphasis on observability, continuous delivery pipelines, and automated testing reduces cycle times. Strategic partnerships with SaaS vendors and cloud providers enhance integration capabilities and support complex enterprise-grade web solutions. Staff certifications improve client confidence.

United Kingdom web development outsourcing services are forecast to grow at a CAGR of 5.4% through 2035. Demand from financial services, retail, and public-sector digital programmes generates steady work for frontend and backend teams. Providers prioritize accessibility, cross-browser compatibility, and compliance with domestic data-handling standards to meet procurement requirements. Emphasis on progressive web apps, headless CMS implementations, and API-first integrations enables rapid feature delivery. Growth in payment-card and contactless transaction interfaces encourages specialized security design work. Collaboration with local agencies and private clients supports recurring project pipelines and sustained service engagements across metropolitan and regional markets throughout the whole country.

Japan is experiencing measured growth in the web development outsourcing services market, expected to expand at a CAGR of 4.7% through 2035. Demand from electronics manufacturers, enterprise systems integrators, and specialized software firms supports steady project flow. Providers emphasize meticulous code quality, comprehensive test coverage, and careful localization to meet exacting client requirements. Focus on minimal-latency integrations and refined UI performance aligns with domestic user expectations. Investments in developer training, strict QA processes, and modular architecture practices support dependable delivery schedules. Ongoing collaboration with hardware and embedded teams sustains niche outsourcing opportunities across industrial and consumer digital projects nationwide delivery.

The global web development outsourcing services market is highly fragmented, shaped by firms offering custom development, UI/UX design, maintenance, and platform integration for clients across technology, retail, healthcare, and finance. Suffescom Solutions and Devox Software hold strong positions through full-cycle development services aimed at start-ups and mid-size enterprises. Radixweb and ScienceSoft maintain long-standing reputations built on enterprise-grade engineering, modernization, and complex integration work. Classic Informatics and Intellectsoft emphasize scalable teams and multi-technology expertise suited for global clients seeking long-term development partnerships. Digital Silk and Dotsquares strengthen competition through brand-focused development, e-commerce builds, and multi-platform digital solutions. Infinum and Bilberrry support upper-tier clients by combining product strategy with engineering depth.

Saigon Technology, DICEUS, and 365 Outsource expand regional supply with cost-efficient development models for both agile product teams and legacy system support. Rollout IT and GetDevDone contribute specialized capabilities in front-end frameworks, CMS development, and rapid prototyping. InternetDevels and Aimprosoft provide nearshore and offshore options tailored for European and North American clients. NarraSoft, IT Craft, and Tigren broaden market availability through flexible outsourcing, full-stack development, and e-commerce specialization. Competition across this market is shaped by delivery speed, engineering quality, and the ability to scale teams. Strategic differentiation depends on domain expertise, transparent communication, and long-term maintenance capabilities, while future advantage will rely on security compliance, cloud-native proficiency, and integration of AI-assisted development tools.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Front-End Development, Back-End Development |

| Application | Large Enterprises, Small and Medium-Sized Enterprises |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Suffescom Solutions, Devox Software, Radixweb, ScienceSoft, Classic Informatics, Intellectsoft, Digital Silk, Dotsquares, Infinum, Bilberrry, Saigon Technology, DICEUS, 365 Outsource, Rollout IT, GetDevDone, InternetDevels, Aimprosoft, NarraSoft, IT Craft, Tigren |

| Additional Attributes | Dollar sales by type and application categories, forecast CAGR 2025 to 2035 (6.3%), absolute dollar opportunity USD 1.4 billion, monthly outsourced service-hours metrics, regional adoption trends across East Asia, South Asia, Europe, and North America, common tech stacks and framework demand (React, Angular, Vue, Node.js), AI-assisted productivity gains (15-20%), SLA and uptime expectations, security/compliance emphasis, nearshore/offshore & hybrid delivery models, provider consolidation and scale advantages |

The global web development outsourcing services market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the web development outsourcing services market is projected to reach USD 2.9 billion by 2035.

The web development outsourcing services market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in web development outsourcing services market are front-end development and back-end development.

In terms of application, large enterprises segment to command 57.0% share in the web development outsourcing services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enterprise Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Website Builder Tool Market Size and Share Forecast Outlook 2025 to 2035

Web Scraping Software Market Size and Share Forecast Outlook 2025 to 2035

Web Real-Time Communication (WebRTC) Solution Market Analysis - Size, Share, and Forecast 2025 to 2035

Webbing Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Web Performance Optimization (WPO) Solution Market Size and Share Forecast Outlook 2025 to 2035

Web3 Gaming Market Report - Growth & Forecast 2025 to 2035

Web3 Messaging Tools Market Report - Growth & Forecast 2025 to 2035

Web Conferencing Market Analysis 2025 to 2035 by Component, Deployment, End-Use, and Region-Forecast from 2025 to 2035

Web Content Management Market Insights – Growth & Forecast through 2034

Web 3.0 Blockchain Market Report – Growth, Demand & Forecast 2024-2034

Web Based e-Detailing Market

RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Nylon Webbing Market Size and Share Forecast Outlook 2025 to 2035

Secure Web Gateway Market Analysis – Growth & Forecast 2019-2029

Tubular Webbing Market Size and Share Forecast Outlook 2025 to 2035

Sealant Web Film Market Size and Share Forecast Outlook 2025 to 2035

Corporate Web Security Market Size and Share Forecast Outlook 2025 to 2035

AI-driven Web Scraping Market Analysis - Growth & Forecast 2025 to 2035

Flat Nylon Webbing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA