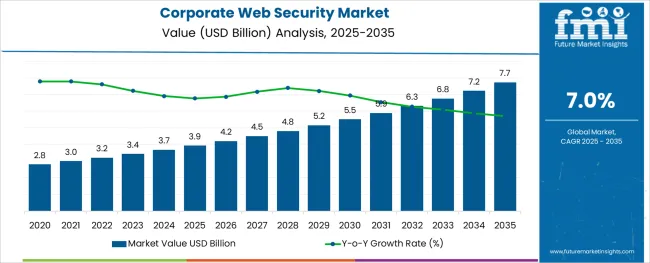

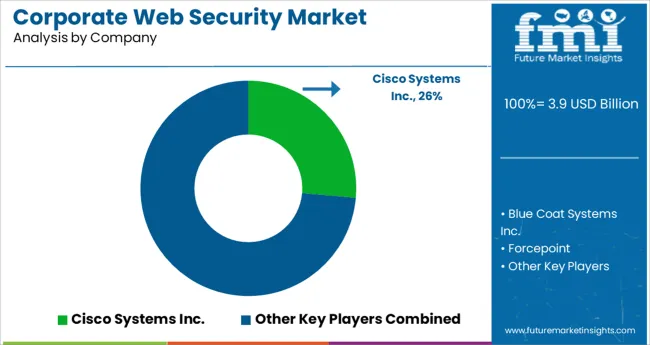

The Corporate Web Security Market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 7.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

The corporate web security market is expanding consistently as enterprises across the globe prioritize safeguarding their digital assets from increasing cyber threats. Rising incidents of phishing attacks, ransomware breaches and unauthorized access attempts have heightened the need for robust web security frameworks. Organizations are focusing on building secure network perimeters and enabling real-time threat monitoring capabilities.

The transition to remote work models and the adoption of hybrid IT infrastructures have further fueled the demand for scalable and adaptive security solutions. Cloud-based technologies and next-generation security protocols are enhancing the effectiveness of web protection services. Enterprises are also integrating artificial intelligence and machine learning tools to automate threat detection processes.

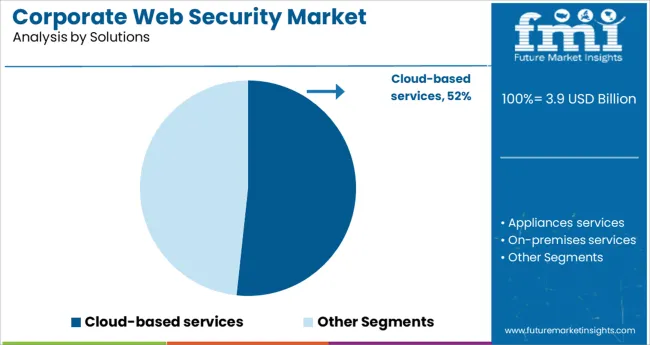

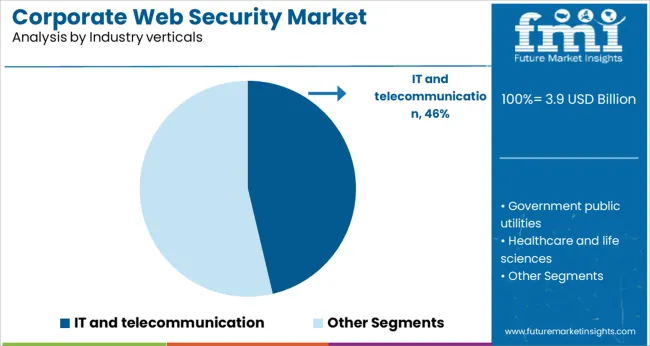

Future growth is expected to be shaped by the continuous evolution of cybersecurity compliance standards and the increasing need to protect enterprise data across complex digital ecosystems. Segmental growth is led by Cloud-based services in solutions and IT and telecommunication as the dominant industry vertical.

The market is segmented by Solutions and Industry verticals and region. By Solutions, the market is divided into Cloud-based services, Appliances services, On-premises services, and Hybrid solutions. In terms of Industry verticals, the market is classified into IT and telecommunication, Government public utilities, Healthcare and life sciences, and Others (includes retail, manufacturing and transportation). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Solutions and Industry verticals and region. By Solutions, the market is divided into Cloud-based services, Appliances services, On-premises services, and Hybrid solutions. In terms of Industry verticals, the market is classified into IT and telecommunication, Government public utilities, Healthcare and life sciences, and Others (includes retail, manufacturing and transportation). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Cloud-based services segment is projected to hold 51.7% of the corporate web security market revenue in 2025, sustaining its leadership among solutions. This segment has gained traction as businesses migrate their applications and data to the cloud where security risks differ from traditional network environments. Cloud-based security solutions have been chosen for their scalability, rapid deployment and seamless updates which address the dynamic nature of modern cyber threats.

These services allow companies to protect remote workforces and distributed IT infrastructures without the need for heavy on-premise installations. Enterprises have increasingly relied on centralized cloud management to streamline threat monitoring and policy enforcement across global operations.

As digital transformation accelerates and businesses embrace flexible IT frameworks, the Cloud-based services segment is expected to remain a preferred choice for securing web traffic and user access.

The IT and telecommunication segment is expected to contribute 46.3% of the corporate web security market revenue in 2025, maintaining its position as the top industry vertical. This segment’s prominence comes from its critical role in managing vast amounts of sensitive data and enabling uninterrupted connectivity for businesses and consumers.

The rapid expansion of digital communication channels and cloud-based services has exposed IT and telecom companies to evolving cyber threats that target both network infrastructure and customer data. These organizations have prioritized robust web security frameworks to safeguard data integrity and service continuity.

Additionally, regulatory compliance requirements have pushed the industry to adopt advanced security solutions that prevent data breaches and ensure privacy protection. As the sector continues to drive innovation in digital technologies and expands its service offerings, the IT and telecommunication segment is expected to sustain its leading position in web security adoption.

With rapid digital transformation across the globe, cyber-related attacks have become more and more imminent. The frequency of these incidents is increasing at an alarming rate and badly damaging the global economy. According to the World Bank, 10.5 million records are lost or stolen every month.

Cyberattacks can disrupt essential government services such as financial systems, healthcare, energy, and defense and can pose danger to national security as well.

This increase in the number of cyber-related attacks is prompting businesses to adopt efficient security solutions such as corporate web security and the trend is likely to continue in the future.

Furthermore, growing popularity of cloud computing services across both large and small enterprises is anticipated to play a significant role in determining the future of the global corporate web security market.

Despite its growing popularity, corporate web security market is facing multiple challenges that impact its growth across regions. Some of the major factors restraining the growth of corporate web security market include high costs associated with advanced security solutions, increasing bugs and software crash, and lack of awareness across some developing and underdeveloped regions.

Regions like Africa have the lowest penetration of internet security solutions. For instance, only around 20% of African states have the basic legal frameworks in place for countering cybercrime, as per the World Bank report.

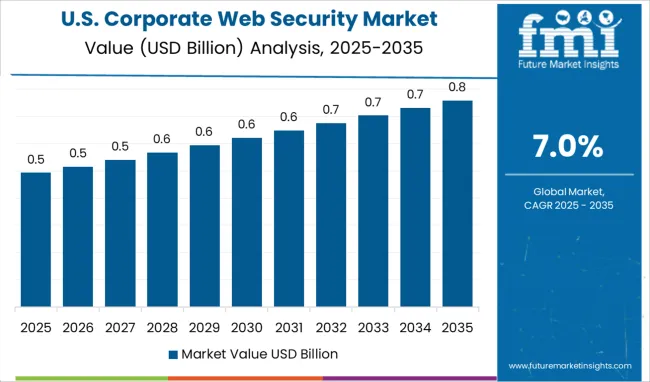

North America remains one of the most lucrative markets for corporate web security on account of rapid industrialization, growing awareness, increasing cyber-attacks and presence of leading market vendors.

Businesses across North America are increasingly adopting cloud-based technologies to increase their productivity and minimize costs. These businesses are highly dependent on internet and therefore more prone to cyber arracks. As a result, adoption of corporate web security has become a top priority of these organizations.

Cyber warfare has become a serious threat to the national security of countries like the United States. Various malicious hacking from domestic and foreign enemies were reported in the USA during 2024. In response to these rising threats, these North American countries are improving their cyber capabilities.

Moreover, various leading vendors based in America are turning their attention towards attractive markets of Asia and Africa. This will further expand the corporate web security market in the future.

Europe is expected to provide immense growth opportunities for corporate web security, with the UK leading the pack. European countries like the UK and Germany are witnessing significant rise in the demand for corporate web security solutions due to continuous threat of cyberattacks.

Amid rapid digitalization, businesses are quickly adapting and moving towards online platforms. This, however, increases the threat of hackers and other malware attacks, there has been substantial rise in the number of cyberattacks in countries like Germany and United Kingdom for instance, in 2025 a cyberattack struck two German fuel and oil distributors, Oittanking Deutschland GmbH and Mabanaft GmbH & Co KG Group and disrupted their operations and supply chain management.

Additionally, presence of leading agencies such as the European Commission and European Cyber Security Organization (ECS) is positively impacting the growth of corporate web security market in the region. These organizations are taking various initiatives to counter the rising cyberattacks in the region. For instance, in 2024 the European Commission invested 292 euro million in digital technologies and cybersecurity.

Some of the key participants present in the global corporate web security market include Barracuda Networks, Inc., Blue Coat Systems, Inc., Cisco Systems, Inc., Clearswift Ltd., McAfee, Inc., Sophos Ltd., Symantec Corporation, Trend Micro Incorporated, Trustwave Holdings, Inc., Webroot Inc. and Zscaler, Inc.

The global corporate web security market is highly competitive with leading vendors increasingly expanding the data loss prevention capabilities of their solutions. Besides this, they are focusing on establishing their bases in attracting markets of Asia and Africa.

| Report Attributes | Details |

|---|---|

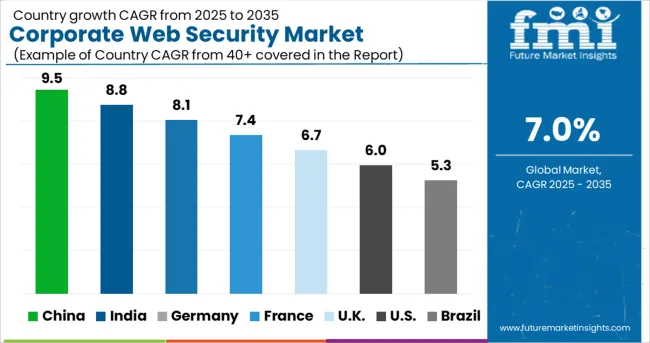

| Growth Rate | CAGR of 7.0% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Kilotons and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Solutions, Industry Verticals, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Barracuda Networks, Inc.; Blue Coat Systems, Inc.; Cisco Systems, Inc.; Clearswift Ltd.; McAfee, Inc.; Sophos Ltd.; Symantec Corporation; Trend Micro Incorporated; Trustwave Holdings, Inc.; Webroot Inc.; Zscaler, Inc |

| Customization | Available Upon Request |

The global corporate web security market is estimated to be valued at USD 3.9 billion in 2025.

It is projected to reach USD 7.7 billion by 2035.

The market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types are cloud-based services, appliances services, on-premises services and hybrid solutions.

it and telecommunication segment is expected to dominate with a 46.3% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corporate Wellness Solution Market Size and Share Forecast Outlook 2025 to 2035

Corporate Wellness Software Market Size and Share Forecast Outlook 2025 to 2035

Corporate Event Planner Market Size and Share Forecast Outlook 2025 to 2035

Leadership Training – AI-Powered Growth for Enterprises

Website Builder Tool Market Size and Share Forecast Outlook 2025 to 2035

Web Scraping Software Market Size and Share Forecast Outlook 2025 to 2035

Web Real-Time Communication (WebRTC) Solution Market Analysis - Size, Share, and Forecast 2025 to 2035

Webbing Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Web Performance Optimization (WPO) Solution Market Size and Share Forecast Outlook 2025 to 2035

Web3 Gaming Market Report - Growth & Forecast 2025 to 2035

Web3 Messaging Tools Market Report - Growth & Forecast 2025 to 2035

Web Conferencing Market Analysis 2025 to 2035 by Component, Deployment, End-Use, and Region-Forecast from 2025 to 2035

Web Content Management Market Insights – Growth & Forecast through 2034

Web 3.0 Blockchain Market Report – Growth, Demand & Forecast 2024-2034

Web Based e-Detailing Market

RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Nylon Webbing Market Size and Share Forecast Outlook 2025 to 2035

Secure Web Gateway Market Analysis – Growth & Forecast 2019-2029

Tubular Webbing Market Size and Share Forecast Outlook 2025 to 2035

Sealant Web Film Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA