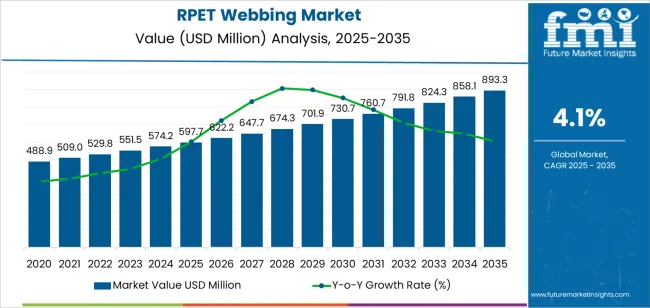

The global RPET webbing market is expected to grow from USD 597.7 million in 2025 to approximately USD 893.2 million by 2035, recording an absolute increase of USD 295.5 million over the forecast period. This translates into a total growth of 49.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.1% between 2025 and 2035. The overall market size is expected to grow by 1.5X during the same period, supported by increasing demand for sustainable textile applications, expanding environmental responsibility requirements across consumer product sectors, and the growing adoption of recycled material solutions that meet comparable performance characteristics to virgin materials in outdoor equipment and industrial manufacturing applications.

The RPET webbing sector demonstrates robust expansion patterns driven by corporate sustainability commitments, particularly in outdoor equipment manufacturing where brand positioning emphasizes environmental stewardship. Consumer awareness regarding plastic waste recycling provides substantial market momentum, with purchasing preference shifts toward recycled content products supporting premium pricing acceptance. Manufacturing investments in recycled polyester processing across Asia Pacific and European production centers create procurement opportunities, while established brands implement sustainable sourcing requirements that mandate minimum recycled content specifications.

Material performance characteristics position RPET webbing as viable alternatives to virgin polyester in most applications. These recycled products deliver comparable tensile strength, abrasion resistance, and processing compatibility that traditional materials provide. Technical specifications for breaking strength, colorfastness, and dimensional stability establish quality requirements that favor experienced producers with comprehensive recycling and manufacturing capabilities. Supply chain relationships between RPET webbing manufacturers and outdoor equipment brands create switching incentives through sustainability reporting requirements, consumer marketing benefits, and corporate environmental commitments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 597.7 million |

| Market Forecast Value (2035) | USD 893.2 million |

| Forecast CAGR (2025-2035) | 4.1% |

| SUSTAINABILITY REQUIREMENTS | ENVIRONMENTAL RESPONSIBILITY STANDARDS | RECYCLED MATERIAL ACCEPTANCE |

|---|---|---|

| Corporate Environmental Commitments | Circular Economy Requirements | Material Certification Standards |

| Continuous expansion of corporate sustainability programs across consumer brands driving sustained demand for recycled content materials. | Modern manufacturing operations require recycled materials delivering environmental benefits and comparable performance characteristics. | Regulatory requirements establishing recycled content benchmarks favoring certified RPET materials. |

| Consumer Preference Shifts | Brand Positioning Demands | Supply Chain Transparency Requirements |

| Growing consumer awareness regarding plastic waste and environmental impact creating sustained RPET webbing demand supporting product differentiation. | Outdoor equipment manufacturers and consumer goods producers investing in recycled materials offering sustainability credentials while maintaining product performance. | Quality standards requiring verified recycled content and traceability documentation in material sourcing. |

| Regulatory Momentum | Processing Capability Focus | Environmental Impact Reporting |

| Increasing extended producer responsibility regulations and recycled content mandates requiring adoption of post-consumer recycled materials. | Webbing manufacturers with proven recycled material processing capabilities required for sustainable textile applications. | Diverse reporting requirements and environmental standards driving need for certified recycled materials. |

| Category | Segments Covered |

|---|---|

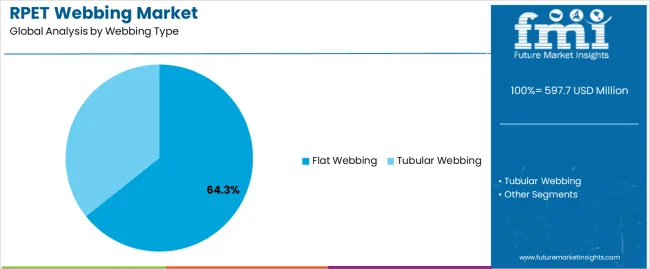

| By Webbing Type | Flat Webbing, Tubular Webbing |

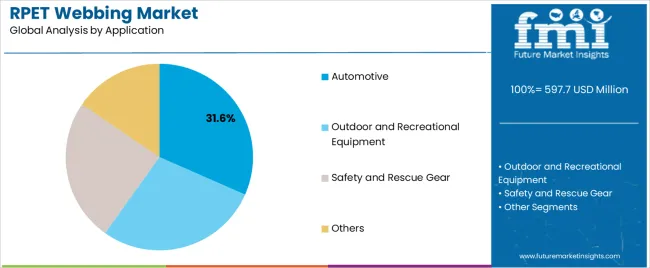

| By Application | Automotive, Outdoor and Recreational Equipment, Safety and Rescue Gear, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Flat Webbing |

|

| Tubular Webbing |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Automotive |

|

| Outdoor and Recreational Equipment |

|

| Safety and Rescue Gear |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Corporate Sustainability Programs | Recycled Material Supply Constraints | Ocean Plastic Recovery Integration |

| Continuous expansion of corporate environmental commitments across consumer brands driving sustained RPET demand for material procurement. | Collection infrastructure limitations and recycled PET bottle supply fluctuations affecting material availability and cost predictability. | Integration of ocean-bound plastic recovery programs, coastal collection initiatives, and marine debris processing enabling premium sustainability positioning. |

| Consumer Environmental Awareness | Performance Perception Challenges | Certification and Traceability Systems |

| Increasing consumer preference for recycled content products creating demand for sustainable webbing solutions. | Concerns regarding recycled material performance consistency and long-term durability requiring extensive education and validation. | Development of comprehensive recycling certification programs and blockchain traceability providing verified recycled content documentation. |

| Regulatory Momentum | Cost Premium Pressure | Mechanical Recycling Technology |

| Growing extended producer responsibility legislation and recycled content mandates creating compliance-driven RPET adoption. | Higher costs for certified recycled materials compared to virgin polyester presenting barriers in price-sensitive applications. | Enhanced mechanical recycling processes and fiber quality optimization providing improved material consistency and performance reliability. |

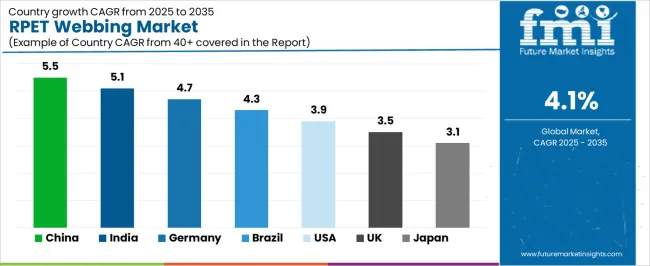

| Country | CAGR (2025-2035) |

|---|---|

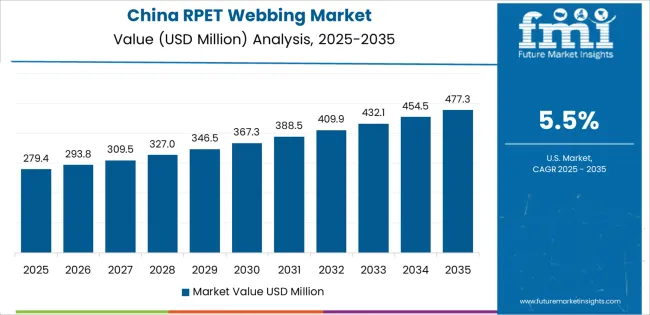

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| Brazil | 4.3% |

| USA | 3.9% |

| UK | 3.5% |

| Japan | 3.1% |

Revenue from RPET webbing in China is projected to exhibit strong growth with a market value of USD 205.7 million by 2035, driven by expanding recycling infrastructure and comprehensive sustainable textile manufacturing development creating substantial opportunities for RPET suppliers across automotive applications, outdoor equipment sectors, and consumer goods industries. The country's established polyester recycling capacity and expanding environmental awareness are creating significant demand for both standard and premium RPET webbing products. Major textile manufacturers and recycling facilities are establishing comprehensive production systems to support large-scale RPET manufacturing operations and meet growing domestic and export demand for sustainable material solutions.

Automotive interior component manufacturing programs are supporting widespread adoption of RPET materials across trim production operations, driving demand for recycled content webbing products. Outdoor equipment manufacturing expansion and sustainable consumer goods production growth are creating substantial opportunities for RPET suppliers requiring reliable performance and environmental certification. Export-oriented production and international sustainability standard compliance are facilitating adoption of certified RPET specifications throughout major manufacturing regions.

Revenue from RPET webbing in India is expanding to reach USD 64.3 million by 2035, supported by extensive textile manufacturing capacity and comprehensive recycling industry development creating sustained demand for RPET materials across diverse application categories and specialized product segments. The country's growing environmental awareness and expanding outdoor equipment manufacturing are driving demand for recycled webbing solutions that provide sustainability credentials while supporting cost-effective production requirements. Textile manufacturers and recycling facilities are investing in RPET processing capabilities to support growing manufacturing operations and export market demand.

Textile sector growth and sustainable material adoption are creating opportunities for RPET webbing across diverse manufacturing segments requiring environmental certification and competitive processing costs. Recycling infrastructure development and quality standard advancement are driving investments in RPET supply chains supporting technical requirements throughout major industrial regions. Outdoor equipment manufacturing growth and automotive component production programs are enhancing demand for recycled materials throughout major production centers.

Demand for RPET webbing in Germany is projected to reach USD 31.6 million by 2035, supported by the country's leadership in circular economy implementation and advanced recycling technologies requiring sophisticated RPET systems for automotive and outdoor equipment applications. German manufacturers and brands are implementing high-quality RPET materials that support environmental objectives, operational performance, and comprehensive sustainability protocols. The market is characterized by focus on material traceability, recycled content verification, and compliance with stringent environmental standards.

Automotive manufacturing investments are prioritizing recycled materials that demonstrate comparable performance and environmental benefits while meeting German quality and sustainability standards. Circular economy programs and extended producer responsibility initiatives are driving adoption of certified RPET materials that support environmental objectives and regulatory requirements. Research and development programs for sustainable materials are facilitating adoption of advanced RPET capabilities throughout major automotive and consumer goods centers.

Revenue from RPET webbing in Brazil is growing to reach USD 89.9 million by 2035, driven by environmental awareness development programs and increasing sustainable product manufacturing creating sustained opportunities for RPET suppliers serving both domestic production operations and export market requirements. The country's expanding recycling infrastructure and growing consumer environmental consciousness are creating demand for RPET materials that support sustainability objectives while maintaining performance standards. Manufacturers and brands are developing sustainable material strategies to support market positioning and environmental commitments.

Automotive component manufacturing programs and outdoor equipment production expansion are facilitating adoption of RPET materials capable of supporting sustainability requirements and competitive cost structures. Consumer goods manufacturing development and promotional products programs are enhancing demand for recycled materials that support environmental marketing and brand differentiation. Recycling capacity additions and sustainable manufacturing initiatives are creating opportunities for local RPET production capabilities.

Demand for RPET webbing in USA is projected to reach USD 92.6 million by 2035, driven by outdoor brand sustainability commitments and corporate environmental programs supporting recycled content adoption and comprehensive material responsibility. The country's established outdoor recreation industry and leading consumer brands are creating demand for certified RPET materials that support environmental positioning and consumer expectations. Webbing manufacturers and textile suppliers are maintaining comprehensive recycled material capabilities to support diverse application requirements.

Outdoor equipment manufacturing and sustainable consumer product programs are supporting demand for certified RPET materials that meet environmental standards and performance requirements. Corporate sustainability initiatives and brand environmental commitments are creating opportunities for recycled webbing that provides verified sustainability credentials. Material transparency and environmental reporting programs are facilitating adoption of certified RPET specifications throughout major manufacturing facilities.

Revenue from RPET webbing in UK is growing to reach USD 48.9 million by 2035, supported by environmental policy leadership and sustainable manufacturing capabilities serving outdoor equipment and consumer goods applications. Post-Brexit environmental regulations have maintained stringent recycled content requirements while creating opportunities for domestic recycling infrastructure development. Consumer environmental awareness supports premium positioning for recycled content products.

Outdoor equipment manufacturing and sustainable consumer goods applications drive consistent RPET consumption, with established brands and environmental organizations providing stable demand channels. Extended producer responsibility requirements and plastic packaging tax initiatives favor certified recycled materials with comprehensive documentation and traceability capabilities. Brand consolidation trends concentrate sustainable sourcing decisions with larger operations while creating opportunities for specialized recycled material solutions.

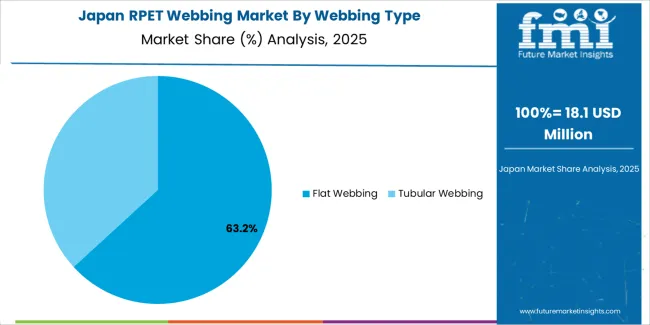

Demand for RPET webbing in Japan is projected to reach USD 50.9 million by 2035, expanding at a CAGR of 3.1%, driven by quality-focused sustainability programs and precision manufacturing capabilities supporting environmental standards and comprehensive recycling applications. The country's established quality tradition and growing environmental consciousness are creating demand for high-specification RPET products that support operational performance and sustainability objectives. Manufacturers maintain comprehensive quality capabilities to support exacting material requirements.

Automotive component manufacturing and precision consumer goods production programs are supporting demand for certified RPET materials that meet rigorous quality and environmental standards. Sustainability verification systems and recycled content documentation requirements are creating opportunities for premium RPET products that provide comprehensive environmental credentials. Quality manufacturing and environmental compliance programs are facilitating adoption of certified RPET capabilities throughout major industrial facilities.

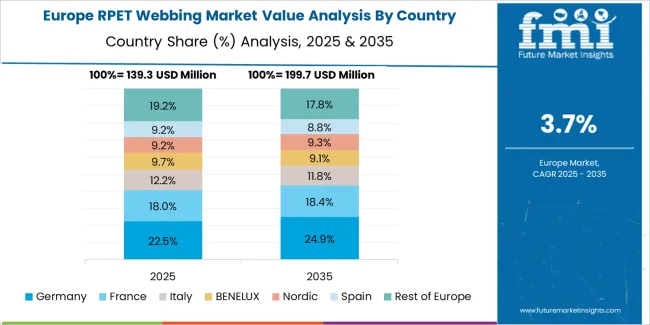

The RPET webbing market in Europe is projected to grow from USD 142.8 million in 2025 to USD 218.4 million by 2035, registering a CAGR of 4.4% over the forecast period. Germany is expected to maintain its leadership position with a 27.3% market share in 2025, declining slightly to 26.8% by 2035, supported by its advanced circular economy policies and major sustainable textile production facilities including established recycling infrastructure.

France follows with a 18.6% share in 2025, projected to reach 19.2% by 2035, driven by comprehensive environmental legislation and outdoor equipment manufacturing capabilities at major production centers. The United Kingdom holds a 16.4% share in 2025, expected to decrease to 15.9% by 2035 due to post-Brexit trade adjustments while maintaining strong environmental standards. Italy commands a 14.2% share, while Spain accounts for 11.8% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 11.7% to 12.8% by 2035, attributed to increasing RPET adoption in Eastern European textile facilities and growing sustainable manufacturing operations implementing recycled material systems.

Japanese RPET webbing operations reflect the country's quality-focused approach to sustainability and sophisticated environmental expectations. Major outdoor equipment brands and automotive component manufacturers maintain rigorous material qualification processes that often exceed international standards, requiring extensive testing documentation, performance validation protocols, and environmental certification audits that can take 12-18 months to complete. This creates high barriers for new RPET suppliers but ensures consistent material quality that supports product reliability and environmental claims.

The Japanese market demonstrates unique application preferences, with significant demand for precisely controlled recycled content verification and specific quality characteristics ensuring performance equivalence to virgin materials. Companies require exact material composition documentation and comprehensive traceability records that differ from Western requirements, driving demand for certified processing capabilities and detailed environmental reporting.

Regulatory oversight through the Ministry of the Environment emphasizes comprehensive recycling verification and material traceability requirements that match international standards. The environmental labeling system requires detailed recycled content documentation, creating advantages for suppliers with transparent recycling processes and comprehensive certification systems.

Supply chain management focuses on relationship-based partnerships rather than purely transactional procurement. Japanese companies typically maintain long-term supplier relationships spanning years, with ongoing quality reviews emphasizing material consistency and environmental verification over price competition. This stability supports investment in specialized recycling equipment and quality control systems tailored to Japanese specifications and enables collaborative sustainability program development.

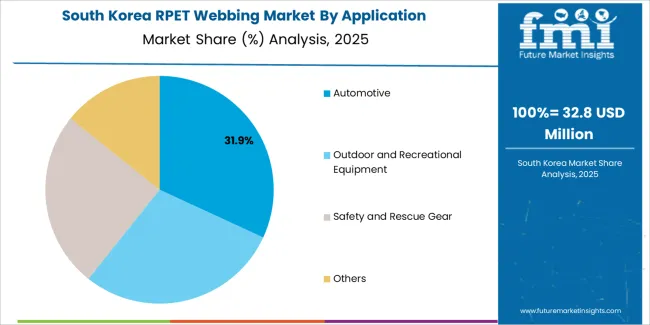

South Korean RPET webbing operations reflect the country's growing environmental awareness and quality-oriented manufacturing approach. Major outdoor equipment manufacturers and automotive component suppliers drive sophisticated RPET procurement strategies, establishing relationships with certified suppliers to secure consistent material quality and environmental documentation for their operations targeting both domestic and international markets.

The Korean market demonstrates particular strength in applying RPET materials to consumer-facing products, with companies integrating sustainability messaging into product positioning designed for environmentally conscious consumers. This marketing focus creates demand for verified recycled content specifications and comprehensive environmental documentation, requiring suppliers to provide detailed certification and traceability support.

Regulatory frameworks emphasize waste reduction and recycling promotion, with Ministry of Environment standards encouraging recycled material adoption. This creates opportunities for RPET suppliers who can demonstrate environmental benefits and material performance equivalence. The regulatory environment particularly favors suppliers with comprehensive recycling documentation and quality assurance systems.

Supply chain efficiency remains important given Korea's focus on export-oriented manufacturing and brand reputation protection. Companies increasingly pursue supply agreements with certified RPET manufacturers to ensure material quality while supporting corporate sustainability commitments. Technical support investments enable material optimization and performance verification during product development programs.

Profit pools are consolidating around integrated manufacturers with recycled polyester processing capabilities and established brand relationships. Value is migrating from commodity webbing to certified RPET materials where environmental documentation, recycled content verification, and sustainability credentials command premiums. Several competitive archetypes define market structure: global textile companies with comprehensive recycling operations and international certification portfolios; specialized RPET webbing manufacturers focusing on outdoor equipment and automotive applications with deep sustainability expertise; regional recycling facilities backward-integrating into webbing production; and conventional webbing manufacturers adding RPET product lines to meet customer sustainability requirements.

Switching incentives favor RPET adoption through corporate sustainability reporting benefits, consumer marketing advantages, and environmental regulation compliance. Brand commitments to recycled content create demand pull that overcomes traditional material qualification barriers. Performance specifications for breaking strength and durability approaching virgin material equivalence establish quality thresholds that capable RPET producers can meet. However, recycled material supply constraints and cost premiums periodically challenge market expansion.

Market dynamics favor manufacturers with comprehensive recycling certification documentation spanning multiple environmental standards and recycled content verification systems. Sustainability communication capabilities that support brand marketing, environmental reporting, and consumer education create differentiation in outdoor equipment and automotive segments. Supply chain integration from PET bottle collection through final RPET webbing production enables traceability control and environmental claim substantiation. Geographic proximity to outdoor equipment manufacturing clusters and automotive assembly centers reduces logistics costs and enables responsive technical support, particularly valuable in European and North American markets where sustainability requirements concentrate.

Consolidation continues as RPET manufacturers seek scale economies to support recycling infrastructure investments and certification management. Vertical integration opportunities attract outdoor brands seeking direct recycling control and supply security. E-commerce platforms enable direct sales to small equipment manufacturers emphasizing sustainability credentials. Do now: secure outdoor brand partnerships through comprehensive environmental certifications and recycled content documentation; establish recycling collection networks in regions with strong environmental awareness. Option: develop ocean plastic recovery programs providing premium sustainability positioning and brand differentiation.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Global textile companies with recycling | Integrated operations, certification portfolios | Multi-application RPET, environmental documentation, global supply |

| Specialized RPET manufacturers | Sustainability expertise, brand relationships | Technical support, recycled content verification, environmental marketing |

| Regional recycling facilities | Supply control, local presence | Vertical integration, traceability documentation, cost management |

| Conventional manufacturers adding RPET | Existing customer base, production infrastructure | Product line expansion, sustainability positioning, market retention |

| Items | Values |

|---|---|

| Quantitative Units | USD 597.7 million |

| Webbing Type | Flat Webbing, Tubular Webbing |

| Application | Automotive, Outdoor and Recreational Equipment, Safety and Rescue Gear, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Germany, China, India, Brazil, United Kingdom, Japan, and other 40+ countries |

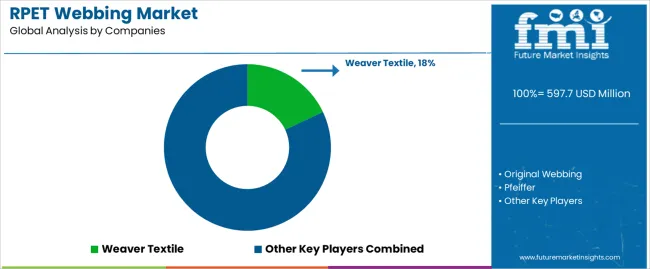

| Key Companies Profiled | Weaver Textile, Original Webbing, Pfeiffer, Huida Webbing, Eternes Industry & Development, National Webbing Products, Strapworks, Jude Webbing, BOLIN WEBBING, Qiheng Weaves, ChangYe Webbing, ACWF, Fuwei |

| Additional Attributes | Dollar sales by webbing type/application, regional demand, competitive landscape, flat vs. tubular adoption, recycling certification integration, and sustainability innovation driving environmental performance, material quality, and circular economy advancement |

The global rpet webbing market is estimated to be valued at USD 597.7 million in 2025.

The market size for the rpet webbing market is projected to reach USD 893.3 million by 2035.

The rpet webbing market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in rpet webbing market are flat webbing and tubular webbing.

In terms of application, automotive segment to command 31.6% share in the rpet webbing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Environmentally Friendly RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Carpet and Rug Market Size and Share Forecast Outlook 2025 to 2035

The Carpet & Upholstery Cleaning Services Market is segmented by service type and application from 2025 to 2035.

Carpet Extraction Cleaner Market Analysis- Trends, Growth & Forecast 2025 to 2035

Carpet and Rug Shampoo Market Analysis – Trends, Growth & Forecast 2025-2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Flooring and Carpets Market - Trends, Growth & Forecast 2025 to 2035

Middle East Flooring and Carpet Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Webbing Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Nylon Webbing Market Size and Share Forecast Outlook 2025 to 2035

Tubular Webbing Market Size and Share Forecast Outlook 2025 to 2035

Flat Nylon Webbing Market Size and Share Forecast Outlook 2025 to 2035

Aramid Flame Retardant Webbing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA