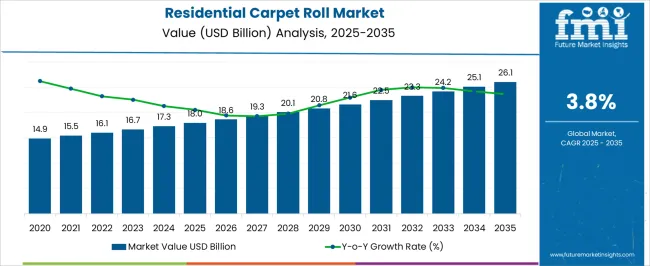

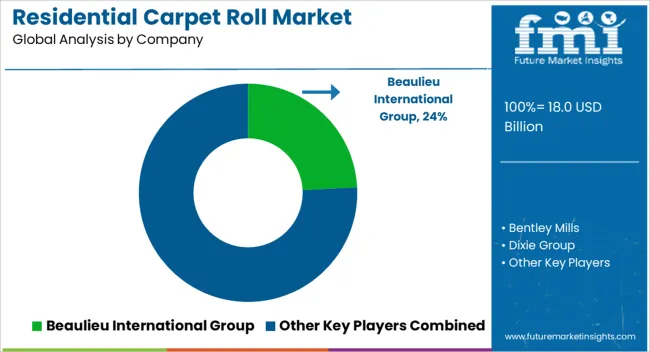

The residential carpet roll market is estimated to be valued at USD 18.0 billion in 2025 and is projected to reach USD 26.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period. Market seasonality in this industry is often influenced by economic factors, consumer sentiment, and season-specific trends. Typically, demand for residential carpets experiences a rise during the fall and spring, particularly in regions with cold climates, as homeowners tend to renovate their homes in preparation for colder months or post-spring cleaning.

These cycles also align with major home improvement retail events, such as promotions in the spring and fall. Additionally, in some geographic areas, the demand may peak around the start of new construction projects, during the summer months, as builders seek to complete interior fittings. In the long term, residential carpet roll demand is anticipated to continue rising, with steady growth supported by consumer spending, home improvement trends, and increasing demand for variety in designs and materials.

Manufacturers are expected to adapt to these cycles by aligning production and distribution strategies accordingly. With increased awareness about home aesthetics and flooring solutions, coupled with competitive pricing and product innovation, the market will likely remain robust, continuing its gradual expansion over the next few years.

| Metric | Value |

|---|---|

| Residential Carpet Roll Market Estimated Value in (2025 E) | USD 18.0 billion |

| Residential Carpet Roll Market Forecast Value in (2035 F) | USD 26.1 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The residential carpet roll market is shaped by five key interconnected parent markets, each contributing to its overall demand and expansion. The largest share, about 40%, comes from the residential housing market, as carpet rolls are essential for new home constructions, renovations, and replacements. Demand is driven by increasing home ownership, home renovation trends, and growing disposable incomes, especially in suburban and urban areas. The next largest contributor is the home improvement and renovation market, holding around 30%, as property owners continuously look to upgrade their interiors, boosting carpet roll sales. The commercial real estate sector, accounting for 15%, also impacts the market, as businesses and office spaces often require carpeting solutions for both aesthetic and functional purposes. The interior design and furnishing market makes up 10%, where carpet rolls serve as an important component in overall home styling. Finally, the environmental and sustainability market represents about 5%, where eco-friendly and recyclable carpet materials are gaining popularity, driven by increasing consumer awareness. As these segments continue to grow, the residential carpet roll market will remain robust, with the largest drivers coming from the residential housing, home improvement, and commercial sectors, supporting its steady expansion over the next few years.

The residential carpet roll market is experiencing steady expansion driven by rising consumer demand for home comfort, aesthetic appeal, and durable flooring solutions. Increased investments in home renovation, particularly in urban and suburban regions, are supporting the adoption of high quality carpet rolls.

Advancements in fiber technology and stain resistant treatments are enhancing the functional performance of carpets, making them suitable for high traffic residential areas. The market is also benefiting from evolving interior design trends that favor customization in texture, color, and pile height to match diverse lifestyle preferences.

Growing awareness of sustainable manufacturing practices and the use of eco friendly materials is further influencing consumer purchase decisions. The positive outlook is reinforced by the integration of innovative production techniques that improve carpet durability, ease of installation, and long term maintenance efficiency.

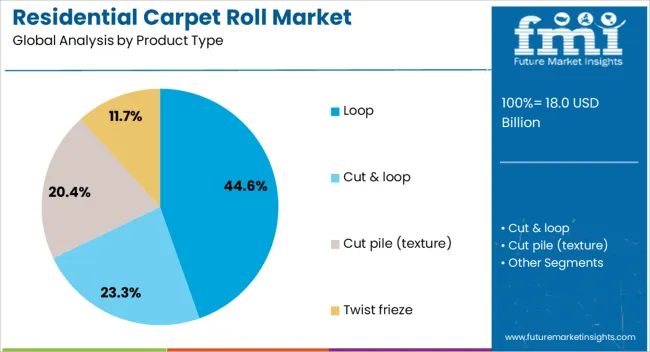

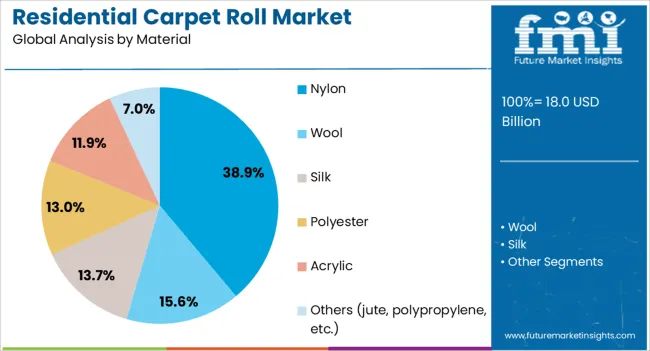

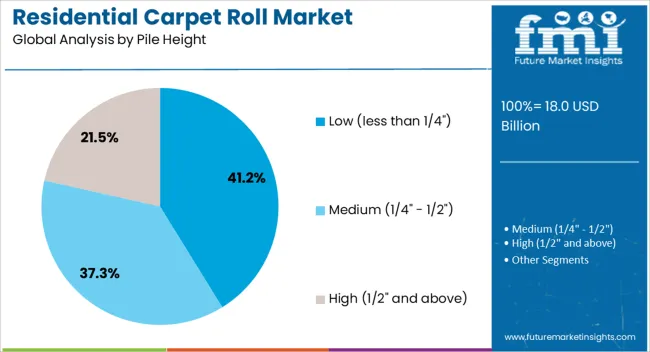

The residential carpet roll market is segmented by product type, material, pile height, thickness, design, price, distribution channel, and geographic regions. By product type, residential carpet roll market is divided into Loop, Cut & loop, Cut pile (texture), and Twist frieze. In terms of material, residential carpet roll market is classified into Nylon, Wool, Silk, Polyester, Acrylic, and Others (jute, polypropylene, etc.). Based on pile height, residential carpet roll market is segmented into Low (less than 1/4"), Medium (1/4" - 1/2"), and High (1/2" and above). By thickness, residential carpet roll market is segmented into Less than 6 mm, 6mm -10mm, 10mm - 15mm, and Above 15mm. By design, residential carpet roll market is segmented into Solid and Printed. By price, residential carpet roll market is segmented into Low, Medium, and High. By distribution channel, residential carpet roll market is segmented into Online and Offline. Regionally, the residential carpet roll industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The loop product type segment is projected to hold 44.60% of total market revenue by 2025 within the product type category, making it the leading segment. This dominance is attributed to its durability, resistance to wear, and ability to maintain appearance over time.

The structure of loop carpets supports high performance in areas subject to frequent use while offering a comfortable underfoot feel. These carpets are also preferred for their design versatility, with options in various loop heights and patterns.

As homeowners seek long lasting and low maintenance flooring solutions, loop carpets continue to maintain a strong market presence in residential settings.

The nylon material segment is expected to account for 38.90% of total market revenue by 2025 within the material category. This leadership is driven by nylon’s exceptional resilience, stain resistance, and color retention properties.

It is well suited for households with children and pets due to its ability to withstand spills and heavy foot traffic. Nylon carpets also offer a wide range of style and design choices, catering to various interior themes.

The balance of durability and aesthetic flexibility has positioned nylon as a preferred choice for modern residential flooring needs.

The low pile height segment, defined as less than 1/4 inch, is projected to capture 41.20% of total market revenue by 2025 within the pile height category. This segment’s popularity is driven by its ease of cleaning, resistance to crushing, and suitability for allergy conscious households.

Low pile carpets are favored in high traffic areas where minimal maintenance and long lasting appearance are priorities. Their compatibility with modern vacuum cleaners and efficiency in trapping less dust contribute to their dominance.

As consumers increasingly value functional, hygienic, and visually appealing flooring, low pile height options continue to lead in adoption across residential environments.

The residential carpet roll market's growth is driven by the demand for high-quality flooring in both residential and commercial properties. Key drivers include homeownership trends, the expansion of home improvement efforts, and eco-friendly solutions.

The demand for residential carpet rolls is primarily driven by the growing number of homeowners, as carpet remains a popular flooring choice for both new constructions and renovations. As homeownership increases across various regions, so does the need for residential carpet products. Carpet rolls are frequently chosen due to their affordability, comfort, and wide range of designs. Homeowners invest in carpet to enhance the interior aesthetic and functionality of living spaces. Property renovation trends, including room makeovers and floor replacements, further drive demand. The residential housing market holds the largest share of the market, positioning it as the central force shaping carpet roll sales.

The home improvement market plays a significant role in the growth of the residential carpet roll market. Renovation and remodeling projects are key drivers, as homeowners and contractors alike prioritize high-quality flooring options for refurbishments. Carpet rolls are highly sought-after for their ease of installation and ability to provide comfort and warmth to living spaces. The surge in DIY projects has also contributed to increased carpet roll purchases, as more homeowners choose to tackle flooring upgrades themselves. The growing focus on creating personalized, comfortable living environments ensures carpet rolls maintain a strong demand in this market.

Commercial properties, including offices, retail spaces, and hospitality establishments, significantly influence the residential carpet roll market. Businesses looking to enhance the appeal and functionality of their spaces frequently turn to carpet solutions. Carpet rolls are preferred due to their ease of maintenance and cost-effectiveness for large areas, making them suitable for high-traffic environments. The shift toward aesthetically appealing interiors, alongside increasing investments in commercial infrastructure, helps sustain carpet roll demand. Carpet rolls cater to both design-conscious business owners and property managers seeking practical solutions for large-scale installations, contributing to the market's growth trajectory.

Environmental concerns are pushing the residential carpet roll market toward more eco-conscious solutions. The demand for sustainable materials, such as recycled fibers and biodegradable options, is gaining traction among consumers. Although it remains a smaller segment, the eco-friendly market is expanding, with manufacturers increasingly offering carpets that use less energy in production or feature natural fibers.

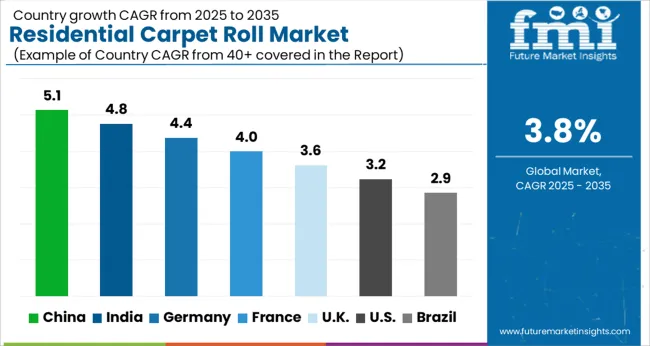

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

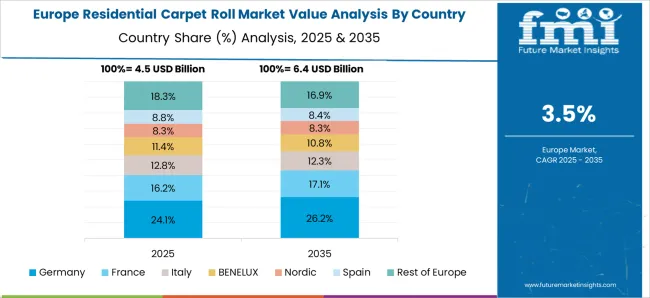

The global residential carpet roll market is projected to grow at a CAGR of 3.8% from 2025 to 2035, rising from USD 17.9 billion in 2025 to USD 26.1 billion in 2035. China leads the market expansion at 5.1%, followed by India at 4.8%, France at 4.0%, the UK at 3.6%, and the USA at 3.2%. Growth is supported by increasing demand for home renovations, rising disposable incomes, and the construction of new residential homes. China and India drive the largest demand due to rapid urbanization and growing housing markets. In contrast, European nations like France and the UK focus on remodeling, sustainable options, and expanding home improvement trends, while the USA continues to see steady growth fueled by housing market trends and consumer preferences for affordable, comfortable flooring solutions. The analysis spans across 40+ countries, with the leading markets detailed below.

The residential carpet roll market in China is projected to grow at a CAGR of 5.1% from 2025 to 2035, reaching USD 5.1 billion in 2025 and USD 7.8 billion in 2035. China’s booming real estate market, rapid urbanization, and growing demand for home renovations are driving the demand for carpet rolls. The increasing construction of residential complexes and government investments in infrastructure and housing are further boosting the market. Carpet rolls are widely used in both new residential properties and renovations, especially in urban areas, where the demand for flooring solutions is high. The market is also influenced by shifting consumer preferences towards eco-friendly and cost-effective products, with various manufacturers catering to different income groups. The availability of a wide range of designs, colors, and materials at competitive prices ensures that carpet rolls remain popular in residential settings across the country.

The residential carpet roll market in India is expected to grow at a CAGR of 4.8% from 2025 to 2035. The rise in disposable income, urban migration, and increasing demand for home interior upgrades are fueling this growth. As a developing economy with an expanding middle class, India’s demand for residential flooring solutions is accelerating, particularly in urban areas where modern living standards are becoming a priority. Carpet rolls are gaining popularity as an affordable and versatile flooring option in homes, especially in metros like Delhi, Mumbai, and Bangalore. As disposable income rises, more consumers are opting for carpets over traditional flooring methods. Manufacturers are also offering products in a variety of textures, colors, and price points to cater to the diverse Indian consumer base. E-commerce platforms and retail stores are increasing accessibility, which further drives adoption.

The residential carpet roll market in France is projected to expand at a CAGR of 4.0% from 2025 to 2035. The demand for residential carpets is supported by increasing homeownership, a focus on interior design, and the growing trend of renovating older homes. In France, where aesthetic appeal and home comfort are significant factors, carpets are widely used in living rooms, bedrooms, and hallways. The market is driven by a preference for eco-conscious products, and the demand for sustainable and recycled materials is on the rise. Carpet rolls are also becoming increasingly popular due to their ease of installation, durability, and affordability. With more consumers moving towards high-quality flooring solutions, domestic and international carpet manufacturers are innovating in terms of material composition and style to cater to French preferences for contemporary designs.

The residential carpet roll market in the UK is expected to grow at a CAGR of 3.6% from 2025 to 2035. As a key European market, the UK sees demand from both new residential constructions and home renovation projects. The trend of self-renovation and the rise in online sales of home improvement products are particularly notable. With home ownership and comfort being central to British consumer culture, carpets remain a popular choice for residential flooring. The market benefits from ongoing innovation in designs, colors, and materials, offering carpets that are durable, easy to clean, and stylish. As consumers seek better value for money, affordable, high-quality carpet rolls are becoming a preferred option, especially in urban areas. Environmental concerns have led to the rise in demand for carpets made from sustainable materials, further shaping the market’s growth in the UK

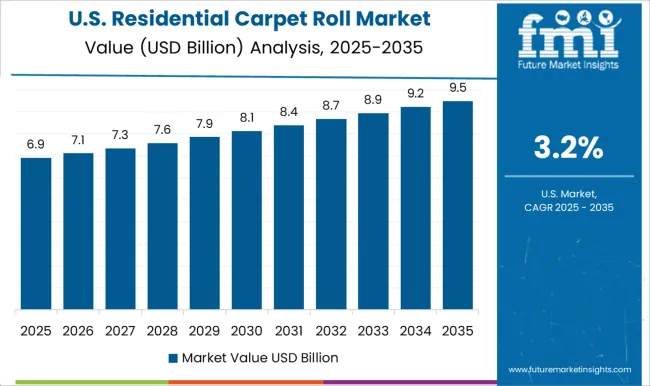

The residential carpet roll market in the USA is projected to grow at a CAGR of 3.2% from 2025 to 2035. Carpet rolls remain one of the most widely used flooring options in USA households, particularly for bedrooms, living rooms, and basements. The market benefits from the ongoing trend of home improvement, with homeowners prioritizing comfort and warmth in their homes. The availability of a wide variety of carpet rolls in terms of materials, designs, and prices ensures a broad consumer base, from budget-conscious buyers to premium customers. The USA market is driven by growing trends in DIY home improvement projects, with carpet rolls being a popular choice due to their ease of installation and low maintenance. The market is also benefiting from an increased demand for sustainable and eco-friendly carpet options.

The residential carpet roll market is characterized by intense competition among large flooring manufacturers, regional carpet producers, and design-focused niche brands. Leading players such as Mohawk Industries, Shaw Industries, Engineered Floors, Tarkett, and Mannington Mills dominate the global market through expansive product portfolios, wide distribution networks, and strong brand recognition. They compete by offering diverse patterns, colors, and fiber compositions to cater to varying consumer preferences and home décor trends.

Competitive differentiation is shaped by pricing, material quality, durability, stain resistance, and comfort underfoot. Large manufacturers leverage economies of scale and advanced tufting technologies to reduce production costs and deliver high-volume orders to retail chains and home improvement stores. Regional and local players often compete on customized designs, faster delivery times, and personalized service to capture niche customer segments. Strategic partnerships with interior designers, builders, and real estate developers are commonly used to drive bulk sales in residential projects. Overall, firms combining aesthetic innovation, cost efficiency, and strong retail presence are better positioned to strengthen their foothold in the residential carpet roll market.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.0 Billion |

| Product Type | Loop, Cut & loop, Cut pile (texture), and Twist frieze |

| Material | Nylon, Wool, Silk, Polyester, Acrylic, and Others (jute, polypropylene, etc.) |

| Pile Height | Low (less than 1/4"), Medium (1/4" - 1/2"), and High (1/2" and above) |

| Thickness | Less than 6 mm, 6mm -10mm, 10mm - 15mm, and Above 15mm |

| Design | Solid and Printed |

| Price | Low, Medium, and High |

| Distribution channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Beaulieu International Group, Bentley Mills, Dixie Group, Engineered Floors, Godfrey Hirst Carpets, Interface, J+J Flooring Group, Kraus Flooring, Masland Carpets, Milliken & Company, Mohawk Industries, Phenix Flooring, Shaw Industries Group, Stanton Carpet, and Tarkett |

| Additional Attributes | Dollar sales, market share, growth trends, and consumer preferences. Key metrics include regional demand, product performance, competition analysis, and pricing strategies, focusing on durability, design, and eco-friendliness. |

The global residential carpet roll market is estimated to be valued at USD 18.0 billion in 2025.

The market size for the residential carpet roll market is projected to reach USD 26.1 billion by 2035.

The residential carpet roll market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in residential carpet roll market are loop, cut & loop, cut pile (texture) and twist frieze.

In terms of material, nylon segment to command 38.9% share in the residential carpet roll market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA