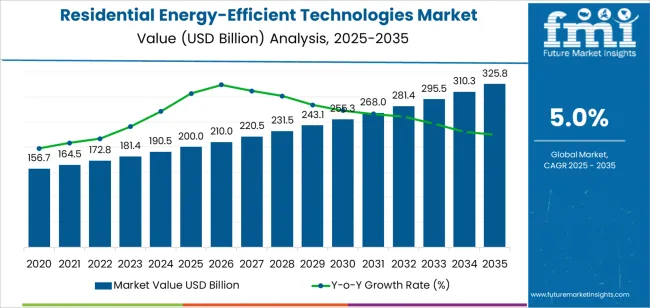

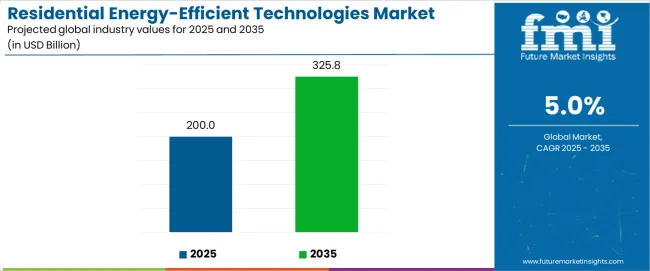

The global residential energy-efficient technologies market is valued at USD 200.0 billion in 2025. It is slated to reach USD 325.8 billion by 2035, recording an absolute increase of USD 125.8 billion over the forecast period. This translates into a total growth of 62.9%, with the market forecast to expand at a CAGR of 5.0% between 2025 and 2035. The market size is expected to grow by nearly 1.63X during the same period, supported by increasing eco-friendly requirements and energy cost reduction demands, growing smart home technology adoption, and rising emphasis on advanced energy-efficient solutions across diverse residential buildings, commercial facilities, and institutional applications.

Between 2025 and 2030, the residential energy-efficient technologies market is projected to expand from USD 200.0 billion to USD 254.8 billion, resulting in a value increase of USD 54.8 billion, which represents 43.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing energy efficiency regulations and eco-conscious mandates, rising adoption of smart building technologies, and growing demand for energy-saving solutions in residential and commercial applications. Energy-efficient technology manufacturers and building operators are expanding their technology capabilities to address the growing demand for reliable and effective energy-efficient solutions that ensure operational excellence and cost optimization.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 200.0 billion |

| Forecast Value in (2035F) | USD 325.8 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

From 2030 to 2035, the market is forecast to grow from USD 254.8 billion to USD 325.8 billion, adding another USD 71.0 billion, which constitutes 56.4% of the ten-year expansion. This period is expected to be characterized by the expansion of smart energy management systems and IoT integration, the development of next-generation energy-efficient technologies, and the growth of specialized applications in net-zero buildings and precision energy management. The growing adoption of green building practices and smart home strategies will drive demand for residential energy-efficient technologies with enhanced performance and intelligent operational capabilities.

Between 2020 and 2025, the residential energy-efficient technologies market experienced steady growth from USD 166.3 billion to USD 200.0 billion, driven by increasing energy costs and growing recognition of energy-efficient technologies as essential solutions for enhancing building operations and providing comprehensive energy management support in diverse residential and commercial applications. The market developed as building owners and energy managers recognized the potential for advanced energy-efficient technology to enhance energy savings, improve operational efficiency, and support eco-conscious objectives while meeting environmental regulatory requirements. Technological advancement in smart systems and automated controls began emphasizing the critical importance of maintaining energy effectiveness and environmental standards in challenging building environments.

Market expansion is being supported by the increasing global energy costs and environmental regulations driven by climate change concerns and policy initiatives, alongside the corresponding demand for advanced energy-efficient technologies that can enhance operational efficiency, enable effective energy management, and maintain eco-friendly standards across various residential buildings, commercial facilities, institutional properties, and smart building applications. Modern building owners and energy managers are increasingly focused on implementing energy-efficient technology solutions that can improve energy savings, enhance operational efficiency, and provide consistent performance in demanding building conditions.

The growing emphasis on eco-consciousness and cost optimization is driving demand for residential energy-efficient technologies that can support comprehensive energy management initiatives, enable effective energy reduction, and ensure regulatory compliance effectiveness. Energy-efficient technology industry manufacturers' preference for integrated building platforms that combine operational excellence with environmental capabilities and cost efficiency is creating opportunities for innovative residential energy-efficient technology implementations. The rising influence of energy performance metrics and environmental compliance requirements is also contributing to increased adoption of residential energy-efficient technologies that can provide superior energy outcomes without compromising operational reliability or eco-friendly standards.

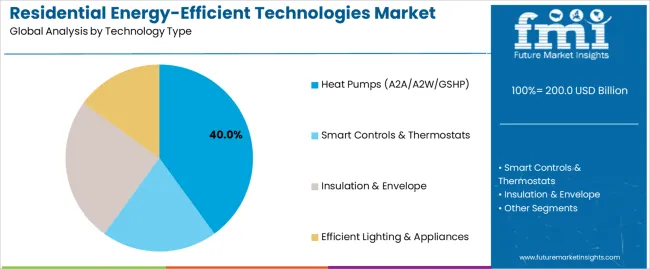

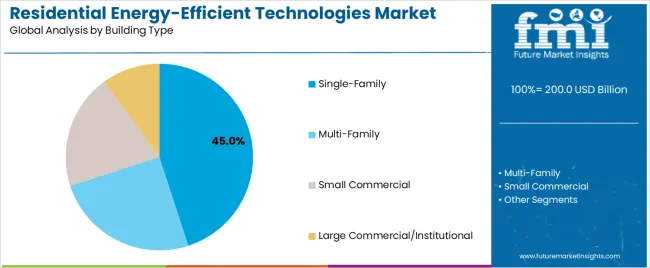

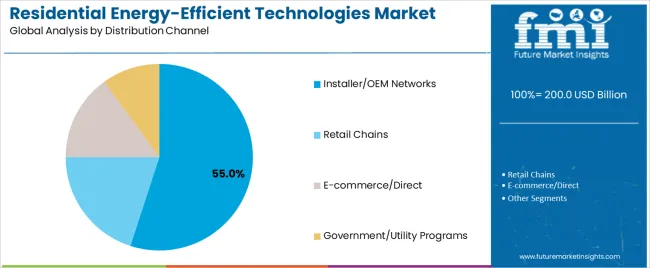

The market is segmented by technology type, building type, distribution channel, and region. By technology type, the market is divided into heat pumps, smart controls & thermostats, insulation & envelope, and efficient lighting & appliances. Based on building type, the market is categorized into single-family, multi-family, small commercial, and large commercial/institutional. By distribution channel, the market is split between installer/OEM networks, retail chains, e-commerce/direct, and government/utility programs. By region, the market is divided into North America, Europe, Asia-Pacific, and Rest of World.

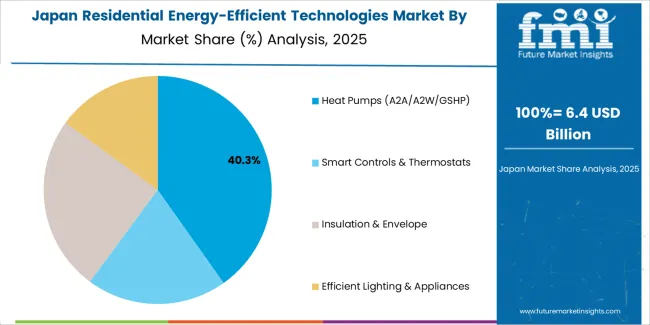

The heat pumps technology type segment is projected to maintain its leading position in the residential energy-efficient technologies market in 2025 with a 40.0% market share, reaffirming its role as the preferred technology for comprehensive energy efficiency and building climate control operations. Building owners and energy managers increasingly utilize heat pumps for their superior energy efficiency capabilities, excellent performance characteristics, and proven effectiveness in heating and cooling applications across various building types while maintaining operational efficiency and eco-friendly standards. Heat pump technology's proven effectiveness and energy versatility directly address the building requirements for efficient climate control and reliable energy outcomes across diverse residential applications and operational settings.

This technology type segment forms the foundation of modern energy-efficient buildings, as it represents the technology with the greatest contribution to energy efficiency and established operational record across multiple building applications and energy protocols. Energy-efficient technology industry investments in advanced heat pump technologies continue to strengthen adoption among building operators and energy managers. With increasing demand for energy-efficient solutions and proven energy capabilities, heat pumps align with both operational objectives and environmental requirements, making them the central component of comprehensive energy-efficient building strategies.

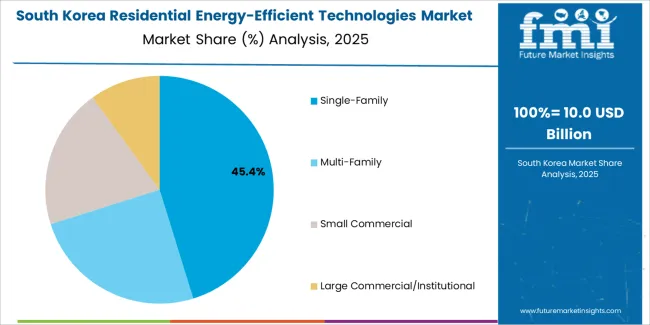

The single-family building type segment is projected to represent the largest share of residential energy-efficient technology applications in 2025 with a 45.0% market share, underscoring its critical role as the primary application for energy-efficient equipment across residential properties, homeowner installations, and private building operations. Building owners prefer single-family applications for energy-efficient technologies due to their exceptional accessibility benefits, comprehensive control advantages, and ability to support individual property optimization while maintaining operational standards and cost efficiency objectives. Positioned as essential applications for residential energy efficiency, single-family properties offer both operational advantages and economic benefits.

The segment is supported by continuous innovation in residential technology and the growing availability of integrated home energy platforms that enable superior energy performance with enhanced control and improved operational coordination. Homeowners are investing in comprehensive energy efficiency programs to support increasingly demanding eco-friendly standards and cost reduction requirements for effective and continuous energy management operations. As residential energy standards advance and efficiency requirements increase, the single-family segment will continue to dominate the market while supporting advanced residential energy-efficient technology utilization and energy optimization strategies.

The installer/OEM networks distribution channel segment is projected to maintain the largest share of residential energy-efficient technology distribution in 2025 with a 55.0% market share, highlighting its fundamental role in professional installation, technical support, and energy optimization. Building owners prefer installer/OEM networks for their comprehensive service benefits, technical expertise, and proven effectiveness in supporting various energy-efficient applications with superior installation profiles and consistent service outcomes. This segment represents the backbone of residential energy-efficient technology distribution across multiple building settings and energy protocols.

The installer/OEM networks segment benefits from ongoing technological advancement in installation methods and the expanding adoption of service-focused operations in critical energy applications. Professional installation demand continues to grow due to increasing technical complexity requirements, rising service quality needs, and the requirement for distribution solutions that can support comprehensive energy services while maintaining installation effectiveness. As energy operations become more service-focused and complexity requirements increase, the installer/OEM networks segment will continue to drive market growth while supporting advanced residential energy-efficient technology distribution and energy optimization strategies.

The residential energy-efficient technologies market is advancing steadily due to increasing energy costs and environmental regulations driven by climate change concerns and policy initiatives, growing adoption of smart building technologies that require energy-efficient solutions providing enhanced operational efficiency and eco-conscious effectiveness across diverse residential buildings, commercial facilities, institutional properties, and smart building applications. The market faces challenges, including high initial investment costs and payback periods, complex installation requirements and technical expertise needs, and competition from traditional energy systems and cost optimization pressures. Innovation in smart energy systems and IoT integration continues to influence product development and market expansion patterns.

The growing adoption of smart building approaches is driving demand for advanced energy-efficient equipment that address digital requirements including automated energy management, improved system integration, and enhanced operational control in residential and commercial settings. Smart energy applications require advanced residential energy-efficient technologies that deliver superior integration performance across multiple energy parameters while maintaining reliability and operational effectiveness. Building operators are increasingly recognizing the competitive advantages of smart energy-efficient equipment integration for operational efficiency and energy enhancement, creating opportunities for innovative technologies specifically designed for next-generation smart building operations.

Modern building owners are incorporating renewable energy systems and advanced eco-friendly technologies to enhance environmental performance, address energy independence requirements, and support comprehensive environmentally responsible objectives through optimized energy systems and intelligent building management. Leading companies are developing green platforms, implementing renewable integration systems, and advancing smart energy-efficient technologies that maximize building effectiveness while supporting environmental stewardship approaches. These technologies improve building outcomes while enabling new market opportunities, including eco-conscious building applications, renewable integration systems, and precision energy management.

The expansion of advanced efficiency systems, control technologies, and intelligent energy capabilities is driving demand for residential energy-efficient technologies with enhanced performance capacity and specialized building capabilities. These advanced applications require specialized energy platforms with precise control systems and exceptional operational reliability that exceed traditional building requirements, creating premium market segments with differentiated energy propositions. Manufacturers are investing in advanced efficiency capabilities and control system development to serve emerging building applications while supporting innovation in advanced energy-efficient equipment and smart building sectors.

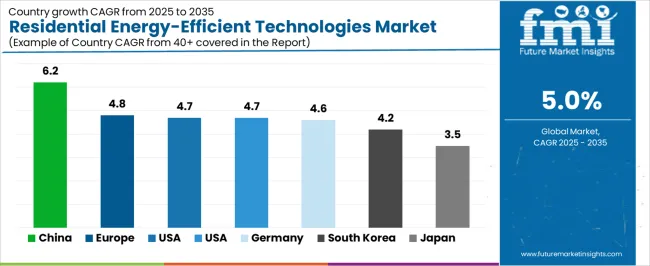

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.2% |

| Brazil | 5.8% |

| USA | 4.7% |

| UK | 4.7% |

| Germany | 4.6% |

| South Korea | 4.2% |

| Japan | 3.5% |

The residential energy-efficient technologies market is experiencing solid growth globally, with China leading at a 6.2% CAGR through 2035, driven by expanding urbanization and growing eco-friendly requirements, alongside increasing investment in smart building technologies and environmentally responsible modernization initiatives. Brazil follows at 5.8%, supported by energy efficiency expansion programs, growing residential development, and increasing demand for advanced energy-efficient technologies in domestic and regional markets. The USA shows growth at 4.7%, emphasizing energy efficiency innovation, building excellence, and advanced technology development. The UK demonstrates 4.7% growth, supported by energy efficiency system advancement and technology adoption. Germany records 4.6%, focusing on building innovation and energy technology development. South Korea exhibits 4.2% growth, emphasizing building modernization and energy applications. Japan shows 3.5% growth, emphasizing quality standards and specialized energy applications.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

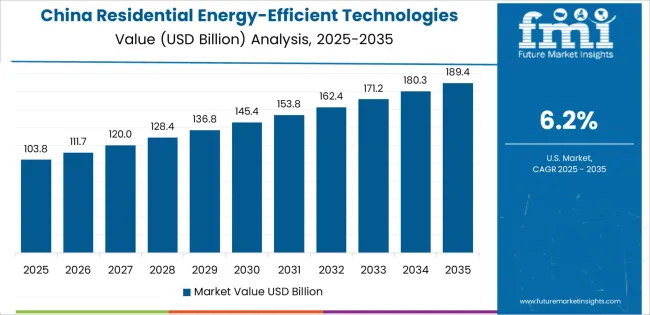

Revenue from residential energy-efficient technologies in China is projected to exhibit strong growth with a CAGR of 6.2% through 2035, driven by expanding urbanization infrastructure and rapidly growing energy-efficient technology sector supported by increasing building requirements and advanced energy technology adoption. The country's substantial building system and increasing investment in energy technologies are creating substantial demand for residential energy-efficient technology solutions. Major energy technology manufacturers and building companies are establishing comprehensive residential energy-efficient technology capabilities to serve both domestic markets and export opportunities.

Demand for residential energy-efficient technologies in Brazil is expanding at a CAGR of 5.8%, supported by energy efficiency modernization initiatives, growing residential development, and strategic position as a building hub for Latin American markets. Brazil's residential development and energy technology advancement are driving sophisticated residential energy-efficient technology capabilities throughout building sectors. Leading developers and energy technology companies are establishing extensive operational facilities to address growing domestic building and regional market demand.

Revenue from residential energy-efficient technologies in the USA is anticipated to grow at a CAGR of 4.7%, driven by the country's energy technology leadership, building innovation capabilities, and precision manufacturing excellence supporting high-performance residential energy-efficient technology applications. The USA's building expertise and energy technology innovation are driving demand for specialized residential energy-efficient technology solutions throughout building sectors. Leading energy technology manufacturers and building companies are establishing comprehensive innovation programs for next-generation building technologies.

Demand for residential energy-efficient technologies in the UK is anticipated to expand at a CAGR of 4.7%, supported by the country's building system excellence, energy technology innovation leadership, and pioneering eco-conscious advancement initiatives including green operations and precision energy development. The UK's building heritage and energy expertise are supporting investment in advanced residential energy-efficient technology technologies. Major builders and energy technology companies are establishing comprehensive operational programs incorporating residential energy-efficient technology advancement and building innovation.

Revenue from residential energy-efficient technologies in Germany is growing at a CAGR of 4.6%, driven by the country's building innovation, energy technology development initiatives, and emphasis on advanced energy solutions for residential and commercial applications. Germany's building research excellence and operational commitments are supporting investment in advanced residential energy-efficient technology technologies. Major builders and energy technology companies are establishing comprehensive operational programs incorporating advanced residential energy-efficient technology configurations.

Demand for residential energy-efficient technologies in South Korea is expanding at a CAGR of 4.2%, supported by the country's building modernization, energy technology expertise, and strong emphasis on advanced energy solutions for comprehensive residential and commercial applications. South Korea's building sophistication and operational innovation focus are driving sophisticated residential energy-efficient technology capabilities throughout building sectors. Leading builders and energy technology companies are investing extensively in advanced energy technologies.

Revenue from residential energy-efficient technologies in Japan is projected to grow at a CAGR of 3.5%, supported by the country's quality excellence standards, specialized building capabilities, and strong emphasis on high-specification energy technologies for advanced residential and commercial building sectors. Japan's quality sophistication and building excellence are driving demand for premium residential energy-efficient technology products. Leading builders and energy technology companies are investing in specialized capabilities for advanced building applications.

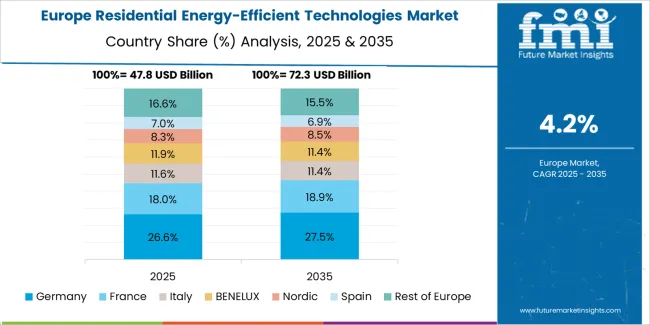

The residential energy-efficient technologies market in Europe is projected to grow from USD 56.0 billion in 2025 to USD 91.2 billion by 2035, registering a CAGR of 5.0% over the forecast period. Germany is expected to maintain its leadership position with a 23.9% market share in 2025, declining slightly to 23.5% by 2035, supported by its advanced energy technology industry and building innovation capabilities.

France follows with a 18.6% share in 2025, projected to reach 18.9% by 2035, driven by comprehensive building development and energy technology applications. The United Kingdom holds a 16.5% share in 2025, expected to increase to 16.8% by 2035 due to energy efficiency initiatives. Italy commands a 11.0% share, while Spain accounts for 7.6% in 2025. The Rest of Europe region is anticipated to maintain momentum, with its collective share remaining stable at 22.4% by 2035, attributed to increasing energy technology adoption in Nordic countries and emerging Eastern European building systems implementing advanced energy technologies.

The Japanese residential energy-efficient technologies market demonstrates a mature and precision-focused landscape, characterized by advanced integration of heat pump technologies with existing building infrastructure across residential facilities, energy networks, and operational systems. Japan's emphasis on quality excellence and operational precision drives demand for high-reliability residential energy-efficient technology solutions that support comprehensive building initiatives and regulatory requirements in energy operations. The market benefits from strong partnerships between international energy providers like Daikin, Carrier, and domestic building leaders, including established builders and energy companies, creating comprehensive service ecosystems that prioritize operational quality and building precision programs. Building centers in major operational regions showcase advanced residential energy-efficient technology implementations where energy systems achieve operational improvements through integrated building programs.

The South Korean residential energy-efficient technologies market is characterized by strong international single-family application presence, with companies like Trane, Bosch, and Mitsubishi Electric maintaining dominant positions through comprehensive system integration and operational services capabilities for building modernization and energy applications. The market is demonstrating a growing emphasis on localized operational support and rapid deployment capabilities, as Korean builders increasingly demand customized solutions that integrate with domestic building infrastructure and advanced energy systems deployed across major construction centers and operational facilities. Local building companies and regional energy integrators are gaining market share through strategic partnerships with global providers, offering specialized services including operational training programs and certification services for energy specialists. The competitive landscape shows increasing collaboration between multinational energy companies and Korean building specialists, creating hybrid service models that combine international building expertise with local market knowledge and operational relationship management.

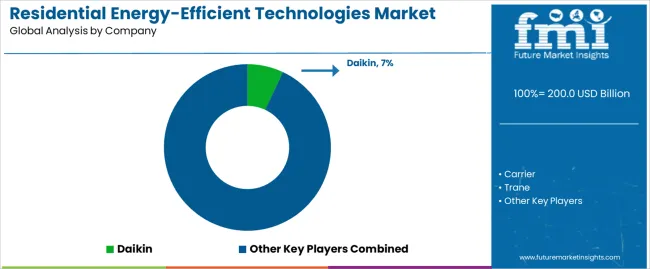

The residential energy-efficient technologies market is characterized by competition among established energy equipment manufacturers, specialized building solution providers, and diversified smart building technology companies. Companies are investing in advanced energy technology development, eco-friendly innovation, product portfolio expansion, and application-specific solution development to deliver high-performance, energy-effective, and technologically advanced residential energy-efficient technology solutions. Innovation in smart energy systems advancement, IoT integration, and advanced control technologies is central to strengthening market position and competitive advantage.

Daikin leads the market with a 7.0% share, offering comprehensive residential energy-efficient technology solutions with a focus on energy reliability, advanced heat pump systems, and integrated building platforms across diverse residential and commercial distribution channels. The company has announced major technology advancement initiatives and investments in smart energy and environmentally responsible technologies to support growing global demand for advanced energy-efficient equipment and effective building capabilities. Other key players, including Carrier, provide innovative building solutions with emphasis on energy excellence and efficiency technologies, while Trane delivers specialized energy equipment with a focus on advanced systems and building applications. Bosch offers comprehensive energy solutions with residential energy-efficient technology offerings for multiple building categories, and Mitsubishi Electric provides advanced energy technologies with emphasis on heat pump systems and operational optimization. Panasonic, LG, Signify, Honeywell, and Schneider Electric contribute to market competition through specialized energy capabilities and building technology expertise.

Residential energy-efficient technologies represent a specialized building equipment segment within construction and energy applications, projected to grow from USD 200.0 billion in 2025 to USD 325.8 billion by 2035 at a 5.0% CAGR. These building equipment products primarily heat pumps, smart controls & thermostats, insulation & envelope, and efficient lighting & appliances configurations for multiple applications serve as critical energy tools in single-family homes, multi-family buildings, small commercial facilities, and large commercial/institutional properties where energy efficiency, cost effectiveness, and environmental responsibility are essential. Market expansion is driven by increasing energy costs, growing energy-efficient technology adoption, expanding building development, and rising demand for advanced eco-friendly solutions across diverse residential, commercial, institutional, and building sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 200.0 billion |

| Technology Type | Heat Pumps, Smart Controls & Thermostats, Insulation & Envelope, Efficient Lighting & Appliances |

| Building Type | Single-Family, Multi-Family, Small Commercial, Large Commercial/Institutional |

| Distribution Channel | Installer/OEM Networks, Retail Chains, E-commerce/Direct, Government/Utility Programs |

| Region | North America, Europe, Asia-Pacific, Rest of World |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | USA, Germany, France, UK, Japan, South Korea, China, Brazil, and 40+ countries |

| Key Companies Profiled | Daikin, Carrier, Trane, Bosch, Mitsubishi Electric, Panasonic |

| Additional Attributes | Dollar sales by technology type and building type category, regional demand trends, competitive landscape, technological advancements in energy production, building development, eco-friendly innovation, and operational performance optimization |

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

Eastern Europe

The global residential energy-efficient technologies market is estimated to be valued at USD 200.0 billion in 2025.

The market size for the residential energy-efficient technologies market is projected to reach USD 325.8 billion by 2035.

The residential energy-efficient technologies market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in residential energy-efficient technologies market are heat pumps (a2a/a2w/gshp), smart controls & thermostats, insulation & envelope and efficient lighting & appliances.

In terms of building type, single-family segment to command 45.0% share in the residential energy-efficient technologies market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA