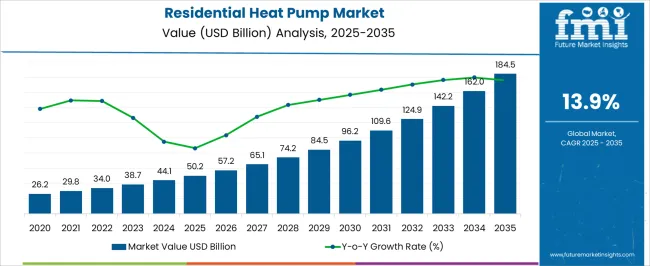

The residential heat pump sector is projected to advance from USD 50.2 billion in 2025 to USD 184.5 billion in 2035, recording a CAGR of 13.9%. The CAGR curve shows rapid acceleration, with values moving from 50.2 billion in 2025 to 74.2 billion in 2028 and 96.2 billion by 2030. This trajectory highlights a decisive shift in consumer and builder preferences toward efficient heating and cooling systems that reduce long-term energy costs.

Curve reflects more than incremental growth, pointing instead to widespread adoption across households where performance reliability and reduced operating expenses carry strong appeal. By 2031, values are expected to reach 109.6 billion, climbing to 142.2 billion in 2033 and closing at 184.5 billion in 2035. The CAGR-driven curve emphasizes the expansion of residential applications in both new housing projects and retrofit installations, with supportive regulations and incentives shaping broader adoption. Industry observers believe this progression validates heat pumps as a transformative category in home comfort solutions, displacing conventional systems at a notable pace. The long-term outlook suggests strong revenue potential, with the CAGR pattern underscoring how residential heat pumps are being positioned as integral assets in modern household infrastructure worldwide.

| Metric | Value |

|---|---|

| Residential Heat Pump Market Estimated Value in (2025 E) | USD 50.2 billion |

| Residential Heat Pump Market Forecast Value in (2035 F) | USD 184.5 billion |

| Forecast CAGR (2025 to 2035) | 13.9% |

The residential heat pump segment is estimated to account for nearly 26% of the HVAC market, about 34% of the residential heating equipment market, close to 29% of the renewable heating technologies market, nearly 18% of the building energy efficiency solutions market, and around 12% of the home appliances market. Collectively, this results in an aggregated share of approximately 119% across its parent sectors. This proportion highlights the growing reliance on heat pumps as a core residential heating and cooling solution, replacing conventional boilers and resistance heating systems. Their ability to provide both heating and cooling functions with notable energy efficiency has reinforced their adoption in both new housing projects and retrofit applications. Industry specialists view residential heat pumps not merely as appliances but as strategic assets that influence household energy consumption, utility savings, and compliance with evolving building codes. Demand has been supported by government incentives, rising energy costs, and a preference for integrated systems that improve comfort and long-term value.

Their presence across parent markets is regarded as transformative, as they drive innovation in HVAC design, shape investment in energy-efficient housing, and create new service models for installation and maintenance providers. As such, residential heat pumps are not considered a supplementary product but a cornerstone in the transition of residential heating landscapes, ensuring their significant weight across interconnected parent markets.

Government incentives, regulatory mandates for low-emission systems, and consumer awareness of energy cost savings are contributing to strong adoption. Technological advancements in compressor design, refrigerants, and smart control systems are further enhancing performance and expanding the suitability of heat pumps across diverse climate conditions. Increased investments in residential infrastructure, coupled with retrofitting programs for existing homes, are broadening the installation base.

The market outlook is strengthened by the growing penetration of connected and hybrid heat pump systems that integrate with solar PV and energy storage solutions, offering consumers greater energy autonomy. With global commitments to reduce building-sector carbon footprints, the residential heat pump market is poised to maintain its growth trajectory, supported by continuous product innovation and expanding distribution networks.

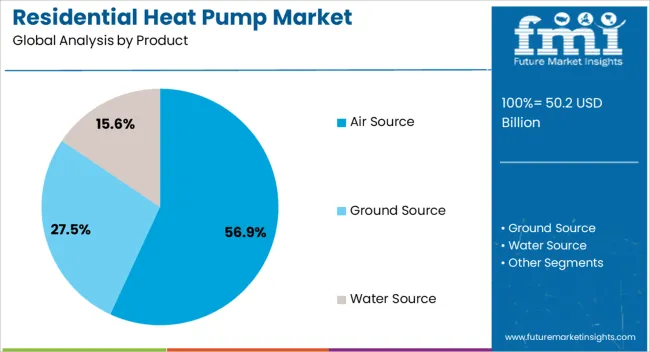

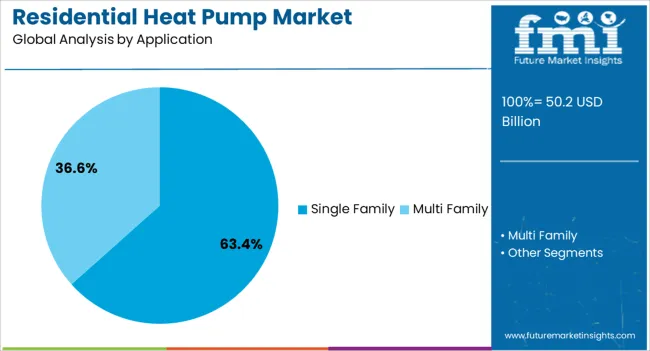

The residential heat pump market is segmented by product, application, and geographic regions. By product, residential heat pump market is divided into Air Source, Ground Source, and Water Source. In terms of application, residential heat pump market is classified into Single Family and Multi Family.

Regionally, the residential heat pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The air source product segment is projected to account for 56.9% of the Residential Heat Pump market revenue in 2025, making it the leading product category. This position is being reinforced by the segment’s relatively lower installation costs, simplified system design, and wide adaptability across varying building structures.

The ease of integration with existing heating and cooling systems has encouraged adoption in both new constructions and retrofitting projects. Improvements in low-temperature operational efficiency have expanded their deployment in colder climates, further boosting demand.

The segment’s growth is also supported by its compatibility with renewable energy sources, enabling homeowners to reduce reliance on fossil fuels As more households prioritize energy-efficient upgrades that offer long-term cost savings, air source heat pumps are being selected as a practical and environmentally aligned solution, reinforcing their dominant role in the market.

The single-family application segment is expected to capture 63.4% of the Residential Heat Pump market revenue in 2025, establishing itself as the most prominent application area. This leadership is being driven by the large number of single-family homes globally, combined with increased investment in energy-efficient heating solutions among homeowners.

Single-family dwellings often have the space and layout flexibility to accommodate heat pump installations without major modifications, making adoption more straightforward. Additionally, government incentive programs targeted toward individual homeowners have accelerated market penetration in this segment.

Growing consumer preference for sustainable home heating options that reduce utility costs and environmental impact is further strengthening the segment’s position. With ongoing construction of new single-family residences and the trend toward upgrading existing homes with modern HVAC systems, the single-family application is expected to maintain its dominance in the foreseeable future.

The residential heat pump market is expected to expand consistently, supported by rising adoption in energy-efficient heating and cooling solutions for households. Demand is driven by replacement of traditional systems, cost savings, and favorable policy incentives.

Opportunities are unfolding in hybrid models, smart integration, and all-climate solutions. Trends highlight inverter-based systems, refrigerant upgrades, and demand for quieter operations. However, challenges such as high upfront costs, installation complexities, and regional climate limitations continue to influence adoption rates, particularly in cost-sensitive and cold-weather markets worldwide.

The growing preference for energy-efficient and dual-function heating and cooling systems has reinforced demand for residential heat pumps. Households are adopting them to lower utility expenses and reduce reliance on traditional fossil fuel-based systems. Government incentives and rebate programs have accelerated installations, particularly in developed economies where policy frameworks favor efficient technologies.

Demand is being further driven by increased consumer awareness of lifetime cost savings and long-term reliability. Homebuilders are also incorporating heat pumps as standard features in new residential projects. With versatility across heating and cooling functions, heat pumps are viewed as an attractive replacement for conventional boilers and air conditioners. This demand surge highlights how residential heat pumps are being positioned as core household appliances that offer efficiency, reliability, and comfort.

Opportunities in the residential heat pump market are expanding through hybrid models, smart home integration, and climate-adaptable systems. Hybrid heat pumps combining electricity with gas or other backup heating sources are gaining traction in colder regions. Smart integration with IoT-based thermostats and energy management systems is creating opportunities for suppliers to differentiate their offerings. Opinions highlight that the strongest opportunities lie in all-climate models designed to perform efficiently even in extreme cold, widening the customer base in northern regions. Expansion into emerging markets with rising household electrification is also opening fresh growth avenues. Partnerships with housing developers for mass adoption in residential projects further strengthen opportunities. These factors illustrate how suppliers can capture long-term gains by focusing on versatility, connectivity, and climate adaptability in their heat pump portfolios.

Trends influencing the residential heat pump market revolve around inverter technology, refrigerant transitions, and demand for quieter operations. Inverter-based systems are trending as they deliver variable output, improved comfort, and energy savings. Transition toward eco-compliant refrigerants is shaping product innovation, as regulations push manufacturers to replace high-GWP refrigerants with alternatives. Opinions suggest that noise reduction has become a key trend, with consumers favoring models engineered for quiet operation in residential settings. Integration with home energy storage and renewable energy sources is also becoming visible as households seek resilient systems. Mini-split and ductless models are trending for retrofit applications, offering flexibility where central systems are impractical. Collectively, these trends reflect a market shifting toward consumer-driven performance features, reinforcing the role of heat pumps as advanced yet practical household solutions.

Challenges in the residential heat pump market include high upfront installation costs, technical complexities, and performance limitations in colder climates. Initial purchase and installation expenses often discourage adoption in cost-sensitive markets, even when long-term savings are apparent. Climate-specific constraints remain an issue, as traditional heat pumps may struggle to maintain efficiency in extreme cold. Retrofitting older homes with ductless or ducted systems adds complexity and labor costs. Shortages of skilled installers in certain regions further restrict large-scale adoption. Regulatory uncertainties around refrigerant transitions add another layer of challenge for manufacturers.

| Countries | CAGR |

|---|---|

| China | 18.8% |

| India | 17.4% |

| Germany | 16.0% |

| France | 14.6% |

| UK | 13.2% |

| USA | 11.8% |

| Brazil | 10.4% |

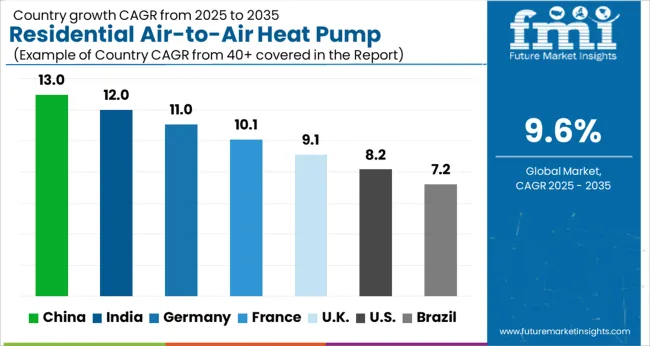

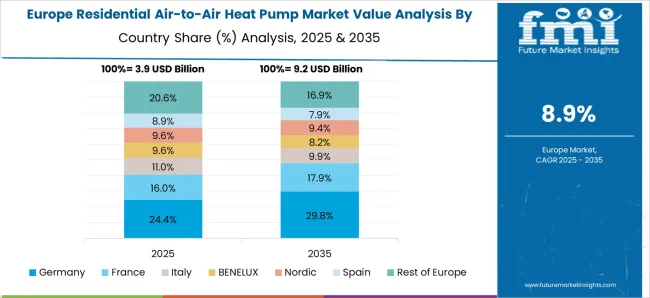

The global residential heat pump market is projected to expand at a CAGR of 13.9% between 2025 and 2035. China leads with 18.8%, followed by India at 17.4% and France at 14.6%. The United Kingdom is expected to grow at 13.2%, while the United States records 11.8%. Growth is driven by rising demand for energy efficient home heating and cooling, government backed incentives, and rapid adoption of air source and ground source technologies. Asian economies lead with large scale deployment programs and urban housing upgrades, while Europe’s trajectory is shaped by regulatory compliance and retrofitting projects. The USA shows steady but slower progress, where growth is supported by consumer rebates, electrification initiatives, and increasing preference for low carbon residential systems. This report includes insights on 40+ countries; the top markets are shown here for reference.

The residential heat pump market in China is forecast to grow at a CAGR of 18.8%. Expansion is propelled by urban housing development, government backed electrification campaigns, and large scale adoption of air source heat pumps. Domestic manufacturers scale production capacity, offering affordable models suited for both single family and multi unit dwellings. Increasing integration of heat pumps into district heating systems further reinforces demand. China’s policy driven incentives, coupled with strong export competitiveness, secure its position as the largest global market for residential heat pumps.

The residential heat pump market in India is projected to grow at a CAGR of 17.4%. Growth is anchored by rising middle class housing demand, expansion of smart city projects, and consumer preference for energy efficient appliances. Air source heat pumps are increasingly adopted in both urban and semi urban homes due to cost efficiency and versatility. Domestic appliance makers expand portfolios, while collaborations with global firms provide advanced technology access. Government campaigns encouraging clean heating and cooling adoption reinforce long term expansion opportunities.

The residential heat pump market in France is expected to expand at a CAGR of 14.6%. Expansion is supported by government incentives for household electrification, regulatory mandates targeting lower carbon heating, and consumer preference for renewable powered appliances. Air to water and ground source heat pumps are gaining traction in new builds and renovation projects. French manufacturers prioritize premium models with high efficiency ratings, catering to both domestic and export demand. With strong policy support and consumer acceptance, France remains one of the leading European markets for residential heat pumps.

The residential heat pump market in the UK is projected to grow at a CAGR of 13.2%. Growth is propelled by retrofitting programs, housing efficiency mandates, and rising consumer awareness of electric heating systems. Air source heat pumps dominate adoption due to suitability for the UK’s housing stock and moderate climate. Government incentives and funding schemes ease upfront costs, driving wider consumer participation. Installation networks are expanding, ensuring long term adoption across suburban and rural households. Though growth is slightly slower than France, the UK continues to gain traction through policy backed adoption.

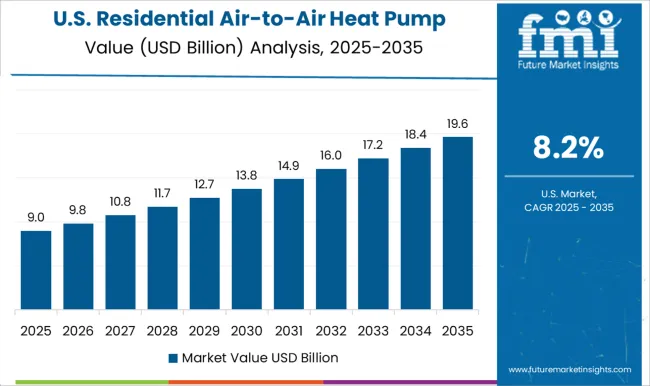

The residential heat pump market in the US is forecast to expand at a CAGR of 11.8%. Growth is steady, influenced by mature infrastructure but supported by electrification programs and household rebates. Demand is strongest in states with favorable climates for air source systems, though ground source and hybrid models are gaining attention in colder regions. USA manufacturers emphasize product efficiency, integration with smart thermostats, and incentives for low income households. While the pace is slower compared to Asia and Europe, steady federal and state policy support ensures long term growth opportunities.

Leading companies such as Daikin Industries, Mitsubishi Electric, Carrier, Johnson Controls, and Midea Group are focusing on technological innovation, introducing advanced inverter-driven and hybrid heat pump systems that enhance energy efficiency and reduce operational costs.

Strategic partnerships and collaborations with distributors, smart home solution providers, and renewable energy companies are being leveraged to expand market reach and integrate heat pumps with IoT and renewable platforms. Geographical expansion is another priority, with firms targeting emerging markets in Asia-Pacific and Latin America to tap into increasing urbanization and government incentives. After-sales service enhancement, including maintenance programs and installer training, is being emphasized to improve customer satisfaction and drive repeat adoption

| Item | Value |

|---|---|

| Quantitative Units | USD 50.2 Billion |

| Product | Air Source, Ground Source, and Water Source |

| Application | Single Family and Multi Family |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daikin, American Standard Heating and Air Conditioning, alpha innotec, Bosch Thermotechnology Corp., Carrier, Colmac Industries, Glen Dimplex Group, Kensa Heat Pump, Lennox International Inc., LG Electronics, Lochinvar, Mitsubishi Electric Corporation, OCHSNER, Rheem Manufacturing Company, SAMSUNG, STIEBEL ELTRON GmbH & Co. KG, Trane, Panasonic Corporation, and Vaillant |

| Additional Attributes | Dollar sales by product type (air-source, ground-source, water-source, hybrid), Dollar sales by application (single-family homes, multi-family residences, small residential complexes), Trends in replacement of traditional HVAC systems with energy-efficient heat pumps, Role of government incentives and building codes in adoption, Growth in demand for dual-heating and cooling solutions in varied climates, Regional installation trends across Europe, North America, and Asia Pacific. |

The global residential heat pump market is estimated to be valued at USD 50.2 billion in 2025.

The market size for the residential heat pump market is projected to reach USD 184.5 billion by 2035.

The residential heat pump market is expected to grow at a 13.9% CAGR between 2025 and 2035.

The key product types in residential heat pump market are air source, ground source and water source.

In terms of application, single family segment to command 63.4% share in the residential heat pump market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA