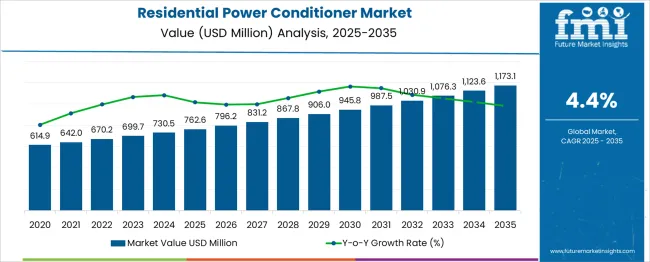

The Residential Power Conditioner Market is estimated to be valued at USD 762.6 million in 2025 and is projected to reach USD 1173.1 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period. Regulatory frameworks are expected to play a pivotal role in shaping market dynamics during this period, as governments globally implement standards to ensure electrical safety, energy efficiency, and grid reliability.

Mandatory compliance with energy efficiency norms, voltage stabilization requirements, and protection standards for residential installations is anticipated to drive the adoption of advanced power conditioners. The gradual tightening of regulations in key regions such as North America and Europe is likely to create a baseline demand for compliant power conditioning solutions. This regulatory push will encourage manufacturers to integrate features such as surge protection, harmonic mitigation, and automated voltage control, which are increasingly becoming requirements under national electrical codes and safety mandates. Incremental annual market growth, from USD 762.6 million in 2025 to USD 1,173.1 million in 2035, reflects the influence of these compliance-driven investments alongside steady consumer adoption of home energy management systems. Emerging markets are also expected to respond to regulatory reforms promoting energy efficiency and grid stability, resulting in moderate but consistent growth. Overall, the regulatory landscape acts as a key driver, ensuring that the Residential Power Conditioner Market expands steadily while aligning with evolving national and international safety and efficiency standards over the forecast period.

| Metric | Value |

|---|---|

| Residential Power Conditioner Market Estimated Value in (2025 E) | USD 762.6 million |

| Residential Power Conditioner Market Forecast Value in (2035 F) | USD 1173.1 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The residential power conditioner market is gaining strong traction due to the rising demand for stable and uninterrupted power supply across increasingly electrified households. Power-sensitive appliances such as HVAC systems, smart home devices, LED lighting, and home entertainment setups have accelerated the need for reliable voltage regulation and noise filtration solutions. Growth is being driven by grid instability in emerging regions, along with heightened consumer awareness about the long-term benefits of equipment protection and energy efficiency.

Technological innovations in electronic circuitry and smart connectivity are further enhancing product performance, allowing real-time diagnostics and adaptive load handling. Governments and utilities promoting residential energy efficiency have also provided a conducive regulatory environment for these systems.

With electricity consumption per household on the rise and infrastructure digitization expanding, the demand for compact, intelligent, and energy-efficient power conditioners is projected to increase steadily. The market outlook remains positive as OEMs integrate surge suppression, harmonic correction, and IoT-enabled monitoring into newer residential-grade models.

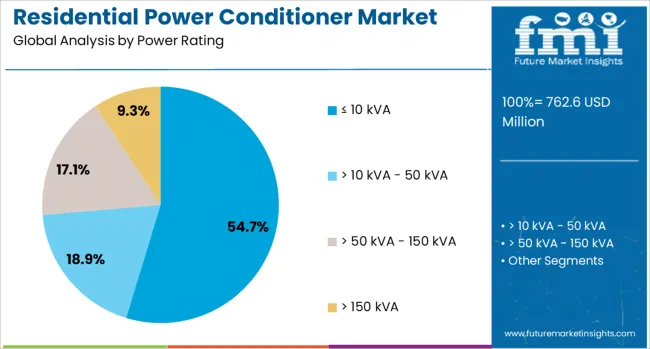

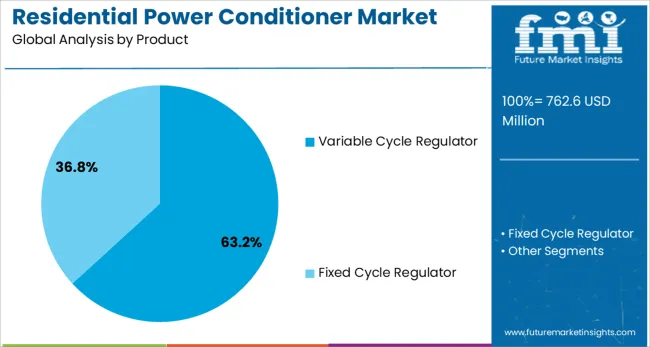

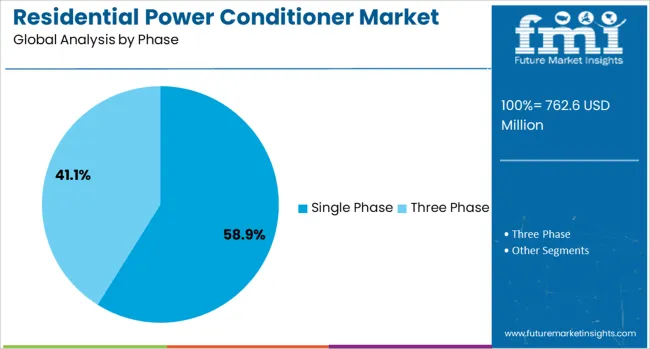

The residential power conditioner market is segmented by power rating, product phase, and geographic regions. By power rating, the residential power conditioner market is divided into ≤ 10 kVA, > 10 kVA - 50 kVA, > 50 kVA - 150 kVA, and> 150 kVA. In terms of the product, the residential power conditioner market is classified into Variable Cycle Regulator and Fixed Cycle Regulator. The residential power conditioner market is segmented into single-phase and three-phase. Regionally, the residential power conditioner industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The power rating segment up to 10 kVA is expected to contribute 54.7% of the total revenue share in the residential power conditioner market in 2025. This leading share is attributed to the widespread compatibility of low-capacity units with standard residential electrical systems.

These units are favored for their ability to manage voltage fluctuations in small to medium-sized homes, where typical loads include lighting, kitchen appliances, and personal electronics. Their compact size, lower cost, and energy efficiency have supported mass-market adoption across both urban and semi-urban residential clusters.

Continued development in switch-mode power supply technology and digital control systems has further optimized the performance of ≤ 10 kVA conditioners, ensuring reliable protection against voltage sags, surges, and harmonic distortions. The segment’s dominance is reinforced by utility-grade voltage inconsistency in densely populated regions, where homeowners seek low-maintenance and effective solutions to preserve appliance longevity and improve power quality.

The variable cycle regulator segment is projected to hold 63.2% of the residential power conditioner market revenue in 2025. This segment's dominance is being driven by its superior adaptability in real-time voltage correction without the need for manual intervention. These regulators are being adopted extensively in households with fluctuating utility supply due to their ability to modulate and maintain steady output under inconsistent grid conditions.

The segment's growth is supported by improvements in electronic control circuits, which allow finer voltage regulation across varying loads. Integration of microcontroller-based regulation and faster response times have also improved operational reliability and reduced energy losses.

Their extended service life, reduced maintenance needs, and compatibility with both conventional and smart home setups have contributed to the expanding customer base. As consumers prioritize safety and power efficiency, the variable cycle regulator has emerged as a preferred choice for residential applications, offering a balance of performance and affordability.

Single phase systems are anticipated to account for 58.9% of the residential power conditioner market share in 2025, reflecting their extensive use in standard home electrical configurations. The predominance of single phase supply in residential settings, particularly in urban and peri-urban households, has played a critical role in driving segment growth. Power conditioners designed for single phase operation offer simpler installation, lower cost, and optimized performance for typical household loads.

These systems have been enhanced through digital sensing technologies and compact power electronic designs that offer real-time correction for voltage imbalances and transients. Their integration with solar inverters, smart meters, and energy management systems has further improved appeal among energy-conscious consumers.

The continued electrification of homes, coupled with rising demand for uninterrupted performance of smart appliances, has reinforced the need for reliable power conditioning at the single phase level. Regulatory pushes for safer residential wiring and improved power quality have also indirectly supported growth in this segment.

The market has been growing due to the increasing demand for reliable electricity supply, voltage regulation, and protection of home appliances from power fluctuations. These systems have been widely utilized to improve power quality, prevent voltage spikes, and enhance the lifespan of electrical equipment. Market growth has been supported by technological advancements, energy-efficient designs, and rising awareness about power reliability. Increasing residential construction, urban electrification, and the adoption of smart home technologies have further strengthened the deployment of residential power conditioners globally.

The rising consumption of electricity and proliferation of electronic appliances in households have been major drivers of the residential power conditioner market. Power conditioners have been deployed to maintain voltage stability, reduce frequency variations, and prevent damage to sensitive devices such as computers, HVAC systems, and home entertainment systems. In regions with frequent voltage fluctuations or unstable grids, homeowners have relied on these systems to ensure uninterrupted power supply. Integration with home automation and energy management systems has enabled real-time monitoring and optimized energy usage. The growth of urban housing developments and multi-dwelling units has increased the need for scalable and efficient power conditioning solutions. These factors have collectively reinforced the adoption of residential power conditioners to safeguard appliances and improve overall household energy reliability.

Technological innovations in residential power conditioners have improved efficiency, reliability, and operational flexibility. Modern units have been designed with advanced voltage regulation, surge suppression, harmonic filtering, and real-time monitoring capabilities. Smart sensors and IoT-enabled connectivity have allowed homeowners to track power quality remotely, automate protective measures, and reduce energy wastage. Inverter-based designs and digital control systems have optimized response times to voltage fluctuations while minimizing energy losses. Compact, modular, and aesthetically designed units have facilitated integration into modern residences without occupying excessive space. These advancements have enabled residential power conditioners to meet stringent safety standards, support increasing electronic loads, and deliver consistent performance, thereby driving higher adoption in both developed and emerging housing markets.

The growing adoption of solar panels, rooftop photovoltaic systems, and home-based renewable energy solutions has influenced the residential power conditioner market. These systems have been deployed to regulate voltage from fluctuating renewable energy sources and ensure consistent supply to household appliances. Power conditioners have been integrated with inverters, batteries, and energy storage systems to optimize load management and prevent damage from voltage spikes or harmonic distortions. In regions promoting decentralized renewable energy and off-grid applications, residential power conditioners have been considered essential for safe and efficient operation. The ability to harmonize conventional grid electricity with renewable energy inputs has further expanded their relevance, especially in areas where energy self-sufficiency and sustainable power usage are prioritized.

The increasing prevalence of smart home technologies and energy-efficient appliances has created significant growth opportunities for the residential power conditioner market. Devices such as smart thermostats, lighting systems, and entertainment hubs require stable voltage and power protection. Residential power conditioners have been used to prevent damage from voltage sags, spikes, and harmonics, while ensuring optimal performance of connected appliances. Rising consumer awareness about energy conservation, safety, and appliance longevity has supported adoption. The governments and utility providers have promoted the installation of energy-efficient home systems, creating incentives for integrated power conditioning solutions. The convergence of smart home adoption, renewable energy integration, and energy efficiency awareness is expected to expand the deployment of residential power conditioners further globally.

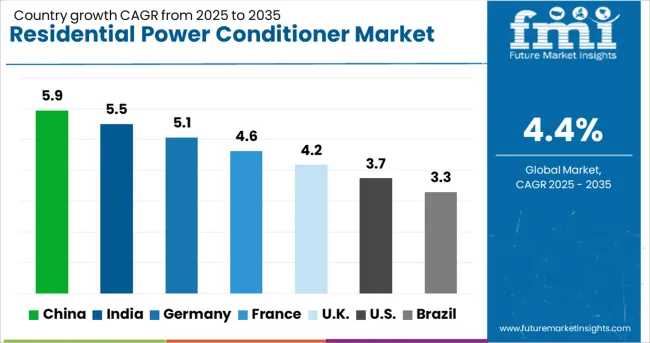

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The market is projected to expand at a CAGR of 4.4% globally between 2025 and 2035, driven by rising concerns over power quality and the increasing penetration of home electronics. China, with a 5.9% CAGR, is expected to lead due to growing middle-class adoption of smart appliances and rising voltage fluctuation complaints in tier-2 urban zones. India follows with a 5.5% CAGR, backed by frequent power surges in semi-urban areas and greater awareness of surge protection for connected homes. In Germany, projected at 5.1% growth, demand is being shaped by the transition to energy-efficient residences and decentralized energy systems. The UK market is estimated to grow at 4.2%, where power conditioners are increasingly being integrated with solar PV and home battery setups. The US, at 3.7%, is witnessing growth from residential retrofitting projects and increased smart grid integration. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is anticipated to witness a CAGR of 5.9% in the residential power conditioner market between 2025 and 2035. During 2020 to 2024, growth was led by Tier 1 cities where voltage regulation issues intensified with rooftop solar and EV charging loads. Deployment of residential surge protectors and line conditioners expanded in Jiangsu, Guangdong, and Zhejiang due to frequent grid disturbances. From 2025 onward, expansion is expected to shift toward smart in-home power conditioners integrated with home automation systems. Higher adoption of GaN-based semiconductors is expected to reduce form factor and increase efficiency for urban households.

India’s market is projected to expand at a CAGR of 5.5% during 2025–2035. Between 2020 and 2024, residential adoption increased in states such as Uttar Pradesh, Tamil Nadu, and West Bengal, driven by unstable low-voltage conditions. Growth was also supported by subsidies under the Saubhagya scheme and rising inverter penetration in semi-urban zones. From 2025 forward, demand is expected to rise in Tier 2 cities for sine-wave conditioners designed for sensitive appliances. Manufacturers are moving toward hybrid units that integrate surge protection, UPS switching, and real-time diagnostics via mobile apps.

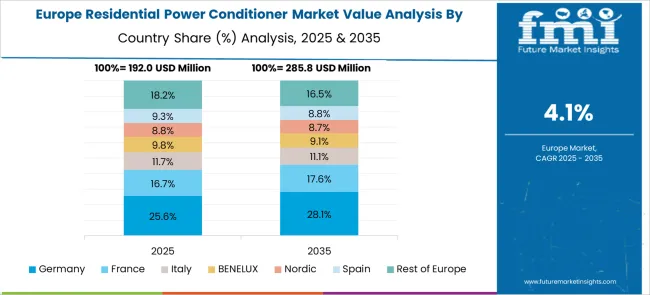

Germany is forecasted to grow at a CAGR of 5.1% through 2035. In the 2020–2024 period, market demand surged in suburban regions due to increased use of home office electronics, solar inverters, and electric heat pumps. The Energiewende policy prompted investments in household-level voltage balancing, especially in older buildings with outdated grid interfaces. Looking ahead, digital energy monitoring and AI-controlled voltage stabilization will be key drivers. Premium models that integrate with domestic energy storage systems and PV inverters will see the highest uptake across Bavaria, Baden-Württemberg, and Saxony.

The United Kingdom is set to expand at a CAGR of 4.2% between 2025 and 2035. From 2020 to 2024, power conditioners gained traction in areas experiencing voltage sag due to grid strain from EV charging stations and heat pump rollouts. Installations rose in southern England and Midlands as older row homes faced more frequent electrical inconsistencies. From 2025 onward, dual-function conditioners with surge protection and low-pass filtering will cater to users with high-end audio, HVAC, and smart security systems. Market players are expected to promote compact, plug-and-play designs tailored for retrofitting.

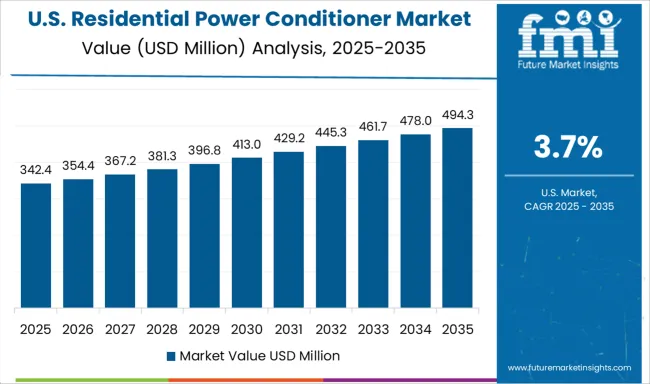

The United States is projected to grow at a CAGR of 3.7% in the residential power conditioner market between 2025 and 2035. Between 2020 and 2024, consumer interest rose in storm-prone states like Florida and Texas due to surges and grid instability. Homeowners increasingly opted for whole-house voltage regulators and surge protectors alongside backup generators and solar batteries. From 2025 onward, market growth will be supported by the Inflation Reduction Act, which offers incentives for residential energy upgrades. Integration with IoT-based home energy management systems is expected to accelerate adoption in new construction and smart homes.

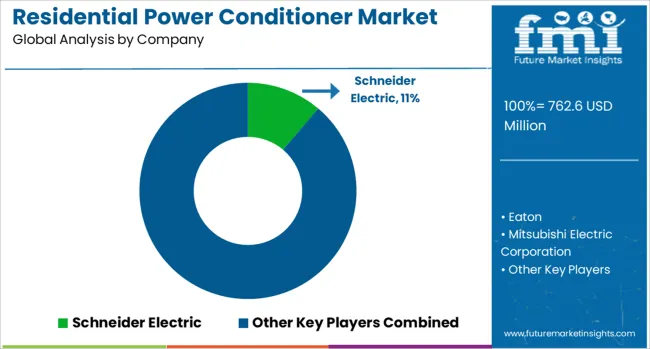

Residential power conditioner demand has been influenced by fluctuating voltage quality, prompting global OEMs to introduce advanced stabilization solutions. Schneider Electric held the highest market share at 11.2%, supported by robust distribution networks and smart grid-compatible products. Eaton and Mitsubishi Electric Corporation expanded their portfolios by introducing wall-mounted and rack-mount solutions with adaptive load balancing features. ABB and Panasonic have invested in hybrid systems combining voltage regulation and noise filtration, addressing residential and light commercial applications.

Emerson Electric and Delta Electronics strengthened their positions through high-performance conditioners integrated with renewable power setups. Legrand and AMETEK have been recognized for their durable, maintenance-free conditioners. Indian manufacturers like SERVOMAX LIMITED and SPECTRUMSTAB INDIA gained momentum with cost-effective, localized designs. Brands such as Furman, Hubbell, and Sollatek continue to serve niche segments like home theaters and small business offices. Growth has been accelerated by rising smart home installations and a shift toward energy-resilient infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 762.6 Million |

| Power Rating | ≤ 10 kVA, > 10 kVA - 50 kVA, > 50 kVA - 150 kVA, and > 150 kVA |

| Product | Variable Cycle Regulator and Fixed Cycle Regulator |

| Phase | Single Phase and Three Phase |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, Eaton, Mitsubishi Electric Corporation, ABB, Panasonic, Emerson Electric Co., Legrand, Delta Electronics, Inc., AMETEK Inc., Fuji Electric, Hubbell, Furman, SERVOMAX LIMITED, SOLAHD, Sollatek, NEELKANTH POWER SOLUTIONS, SPECTRUMSTAB INDIA PVT. LTD., Static Power, Unico, LLC, and Vishay |

| Additional Attributes | Dollar sales by power rating (≤ 10 kVA, 10–50 kVA, >150 kVA) and type (fixed-cycle vs variable-cycle regulators), demand dynamics across solar-plus-storage and EV-ready homes, regional strength in North America with fastest growth in Asia‑Pacific, innovation in IoT-enabled voltage regulation, and environmental impact through energy efficiency and device protection. |

The global residential power conditioner market is estimated to be valued at USD 762.6 million in 2025.

The market size for the residential power conditioner market is projected to reach USD 1,173.1 million by 2035.

The residential power conditioner market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in residential power conditioner market are ≤ 10 kva, > 10 kva - 50 kva, > 50 kva - 150 kva and > 150 kva.

In terms of product, variable cycle regulator segment to command 63.2% share in the residential power conditioner market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Three Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cycle Regulator Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA