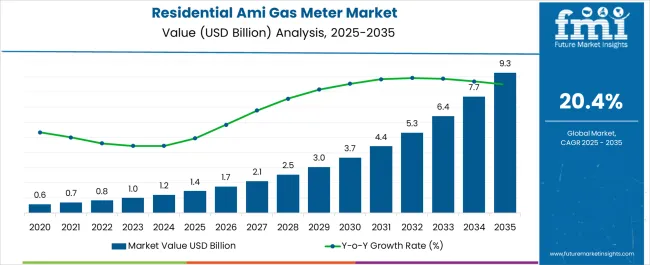

The Residential AMI Gas Meter Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 9.3 billion by 2035, registering a compound annual growth rate (CAGR) of 20.4% over the forecast period. Regulatory frameworks play a pivotal role in driving market expansion, as government mandates and energy policies increasingly require advanced metering infrastructure for accurate consumption tracking and efficient utility management.

Utilities are compelled to implement automated and remotely accessible gas metering solutions to comply with regulatory standards aimed at reducing operational inefficiencies, enhancing billing accuracy, and promoting energy conservation. In several regions, regulators have established clear timelines for the replacement of conventional meters with AMI-enabled devices, effectively accelerating adoption rates. These regulations are complemented by policies that incentivize utilities to deploy smart meters, including tax credits, subsidies, or penalties for non-compliance, which create a favorable market environment for manufacturers and service providers.

Furthermore, safety and environmental regulations concerning gas leak detection and emissions monitoring necessitate the integration of advanced sensing technologies within AMI meters, reinforcing regulatory influence on product development and deployment. By 2035, regulatory mandates are expected to remain a primary market driver, shaping investment decisions and technology adoption strategies. The alignment of AMI gas meter functionalities with evolving policy requirements ensures that regulatory impact continues to dictate both regional and global market trajectories, positioning compliance-driven deployment as a critical factor for sustained growth.

| Metric | Value |

|---|---|

| Residential AMI Gas Meter Market Estimated Value in (2025 E) | USD 1.4 billion |

| Residential AMI Gas Meter Market Forecast Value in (2035 F) | USD 9.3 billion |

| Forecast CAGR (2025 to 2035) | 20.4% |

The Residential AMI Gas Meter Market is experiencing consistent growth driven by the transition toward smart infrastructure, energy efficiency regulations, and the demand for real-time utility monitoring. Increasing urbanization and the need for accurate billing and consumption insights are prompting utility providers to adopt advanced metering technologies across residential areas.

The integration of AMI solutions allows for automated data collection, leak detection, and remote disconnect features, which collectively improve operational efficiency and consumer engagement. Additionally, government initiatives aimed at reducing energy losses and modernizing gas distribution networks are accelerating deployment in both developed and emerging regions.

The market outlook remains positive as stakeholders continue to invest in digital grid technologies that support transparency, conservation, and predictive maintenance.

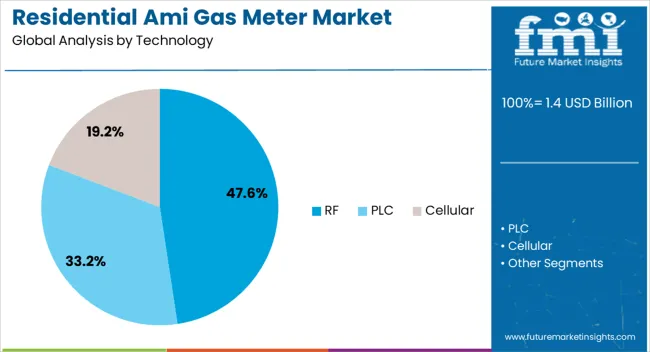

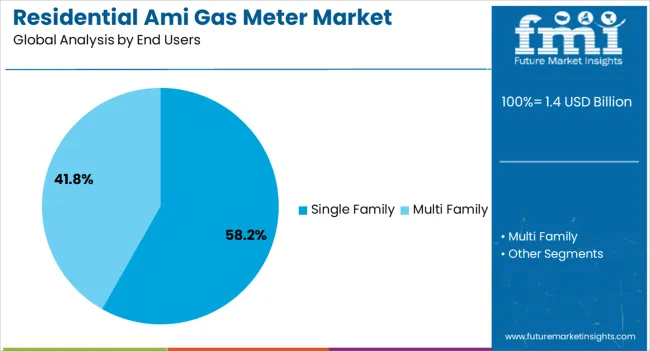

The Residential AMI Gas Meter Market is segmented by technology, end users, and geographic regions. By technology of the Residential AMI Gas Meter Market is divided into RF, PLC, and Cellular. In terms of end users of the Residential AMI Gas Meter Market is classified into Single Family and Multi Family. Regionally, the residential ami gas meter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The RF technology segment is projected to account for 47.60% of the total market revenue by 2025, making it the dominant technology category. This leadership is due to RF’s ability to support seamless two way communication between gas meters and utility systems, enabling real time consumption tracking and remote troubleshooting.

The technology requires minimal infrastructure upgrades and is known for its reliability and scalability in dense residential environments. Its wide adoption has been reinforced by its compatibility with existing smart grid architectures and its capacity to deliver timely usage data without physical meter access.

As utilities seek cost effective and efficient connectivity solutions, RF continues to lead due to its maturity, network performance, and ease of integration.

The single family segment is expected to represent 58.20% of total market revenue by 2025, positioning it as the largest end user group. This dominance is driven by widespread residential construction, particularly in suburban and rural areas where detached housing remains prevalent.

Single family homes typically require individual metering systems, making them ideal for AMI deployment to enhance billing accuracy and empower residents with detailed energy consumption insights. The ability to remotely monitor and manage usage patterns has been particularly valued by homeowners seeking to reduce costs and improve energy efficiency.

Furthermore, utility companies are prioritizing these households for smart meter rollouts due to their ease of access and straightforward integration with back end systems. As a result, the single family segment continues to lead in market share, supported by consistent housing demand and strong alignment with AMI deployment strategies.

The market has been expanding due to increasing adoption of smart metering technologies in residential energy management. These meters, which enable automated monitoring, remote data collection, and accurate billing, have been deployed to improve operational efficiency and customer service for utilities. Manufacturers have focused on improving connectivity, data security, and integration with advanced energy management systems. The market has been influenced by rising digital infrastructure investment, utility modernization initiatives, and regulatory mandates promoting energy efficiency, making AMI gas meters essential for optimized residential energy distribution networks.

The market has been significantly driven by the need for smart energy management in urban and suburban households. These meters have enabled utilities to remotely monitor consumption patterns, detect anomalies, and automate billing processes, reducing operational costs and minimizing manual interventions. Data collected from AMI gas meters has supported energy planning, demand forecasting, and peak load management, providing utilities with actionable insights to optimize gas distribution. Residential customers have benefited from transparent consumption information and timely billing notifications, enhancing energy awareness. Programs promoting smart grid adoption and sustainable energy initiatives have further reinforced market expansion. The growing trend of integrating gas meters with home automation and IoT systems has also contributed to adoption, positioning AMI gas meters as essential tools for efficient residential energy management and consumption control.

Technological innovation has played a critical role in the market by enhancing meter accuracy, reliability, and connectivity. Advanced sensors and digital measurement technologies have allowed precise gas flow monitoring, reducing errors in billing and leakage detection. Communication technologies, including RF mesh networks, cellular, and LPWAN, have enabled real-time data transmission to utility management platforms. Integration with smart home energy management systems and cloud-based analytics has improved energy tracking and reporting. Battery life optimization and low-power consumption designs have extended operational lifespan while reducing maintenance needs. Software and firmware enhancements have allowed remote configuration, diagnostics, and automated alerts for unusual usage. These technological developments have strengthened utility efficiency, customer satisfaction, and market growth, positioning AMI gas meters as reliable components of smart residential energy networks.

The market has been influenced strongly by regulatory frameworks and energy efficiency mandates. Government policies promoting smart metering, energy conservation, and greenhouse gas reduction have encouraged utilities to deploy advanced meters across residential sectors. Subsidy programs, grants, and incentives have facilitated the adoption of AMI gas meters in regions with high energy demand or aging infrastructure. Compliance with national standards for measurement accuracy, communication security, and interoperability has driven innovation in meter design. Energy efficiency targets set by local and regional authorities have reinforced deployment priorities, while smart grid initiatives have integrated gas metering into broader energy optimization efforts. Consequently, regulatory support and energy efficiency mandates have been critical factors ensuring sustained investment, adoption, and technological advancement in the Residential AMI Gas Meter Market.

The market has been further strengthened by aftermarket services, integration with energy management platforms, and IoT-enabled home solutions. Maintenance, calibration, and firmware updates have ensured consistent performance and extended device life. Integration with smart thermostats, utility portals, and home automation systems has enhanced user control and provided detailed energy consumption insights. Utilities have leveraged analytics platforms to optimize operational efficiency, detect irregularities, and forecast demand. Customization options, such as modular communication interfaces and remote connectivity solutions, have allowed meters to be adapted for diverse network infrastructures. The combination of these services and integration capabilities has expanded market reach, improved customer experience, and reinforced the role of residential AMI gas meters as essential components in intelligent energy distribution and consumption monitoring frameworks globally.

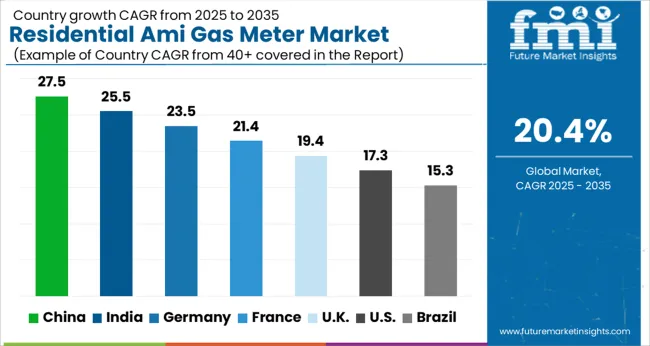

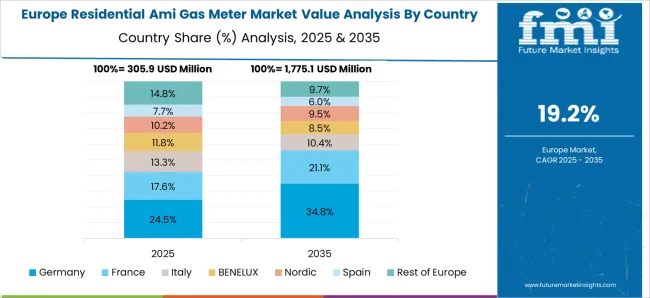

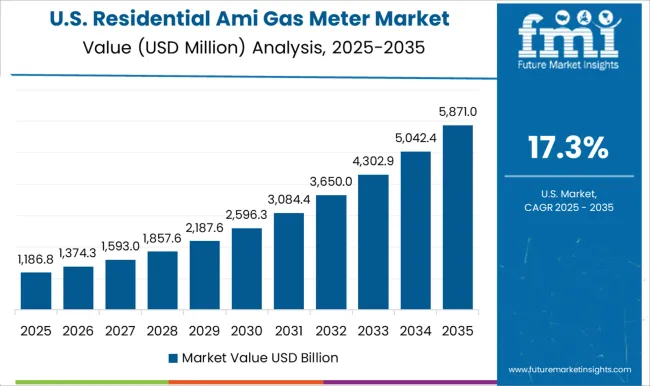

The market is projected to grow at a CAGR of 20.4% between 2025 and 2035, driven by rising smart metering adoption, government initiatives for energy efficiency, and integration with IoT-enabled utility management systems. China leads with a 27.5% CAGR, scaling rapidly through nationwide smart grid programs and advanced metering infrastructure deployment. India follows at 25.5%, expanding via government-backed smart utility projects and urban energy modernization. Germany, at 23.5%, advances through strong regulatory support and technology integration in residential energy networks. The UK, growing at 19.4%, focuses on digitized energy consumption management and pilot smart city programs. The USA, at 17.3%, experiences steady adoption due to utility modernization efforts and federal incentives. This report covers 40+ countries, with the top markets highlighted here for reference.

The market in China is projected to grow at a CAGR of 27.5%, driven by government initiatives for smart metering infrastructure and the increasing adoption of advanced energy management systems. Rising investments in digital gas distribution networks and IoT-enabled metering devices are fueling demand. Leading manufacturers are focusing on integrating real-time monitoring, data analytics, and remote control features to enhance operational efficiency. Urban and semi-urban residential expansions, coupled with policies supporting energy conservation, are expected to accelerate market penetration. The growing need for accurate billing and leak detection solutions is further boosting adoption across private housing and large residential complexes.

India is forecasted to grow at a CAGR of 25.5% due to rising demand for automated and precise gas measurement systems in residential areas. Policy initiatives promoting energy efficiency and the modernization of gas distribution networks are driving sales. Manufacturers are investing in smart metering technology with mobile and cloud connectivity. Adoption is increasing among multi-dwelling units, housing societies, and industrially linked residential zones. Strategic partnerships between technology providers and utility companies are accelerating market reach. The market is influenced by rising awareness about energy conservation and regulatory support for smart gas infrastructure.

Germany’s market is expected to expand at a CAGR of 23.5%, driven by stringent energy monitoring regulations and the need for efficient gas consumption tracking. Adoption in both urban housing and industrial-linked residential units is increasing. Manufacturers are focusing on technologically advanced meters with remote monitoring, accurate data logging, and predictive maintenance features. Collaborations with utility companies and energy solution providers are facilitating broader deployment. Consumer preference for reliable and long-lasting meters, along with government support for digital metering solutions, is expected to drive consistent market growth over the forecast period.

The market in the United Kingdom is forecasted to grow at a CAGR of 19.4%, supported by rising adoption of smart energy management systems in residential sectors. Manufacturers are introducing meters with enhanced data analytics, remote control capabilities, and secure cloud connectivity. Government programs encouraging energy conservation and smart metering upgrades are driving sales. Deployment in new housing projects and residential refurbishments is increasing steadily. Partnerships between utility providers and technology companies are expanding the reach of advanced gas metering solutions. Continuous innovation in automation and monitoring features is expected to influence market growth.

The United States market is projected to grow at a CAGR of 17.3% due to increasing modernization of gas distribution systems and rising consumer interest in automated energy solutions. Adoption is driven by residential complexes, multi-family units, and industrial-linked housing. Manufacturers are focusing on meters with high durability, accurate data capture, and advanced communication features. Strategic alliances with utility companies and energy management providers are enhancing deployment. Government initiatives promoting digital metering infrastructure and energy efficiency are supporting consistent market expansion.

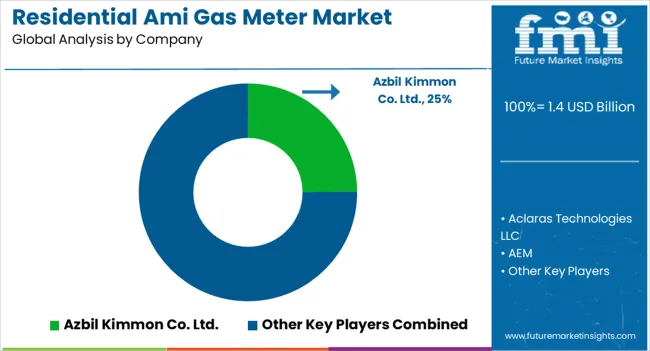

The market is dominated by leading technology and energy solutions companies including Azbil Kimmon Co. Ltd., Aclara Technologies LLC, and AEM. Azbil Kimmon focuses on highly accurate, automated metering solutions that enable efficient energy management and real-time consumption monitoring. Aclara Technologies offers advanced communication-enabled meters with integrated data analytics, helping utilities optimize operations and improve customer engagement. AEM provides smart gas meters with scalable connectivity options, emphasizing interoperability and reliability in residential applications. Other major players such as Chint Group, Eaton Corporation, and Emerson contribute robust metering solutions combining precision, durability, and advanced communication technologies. Honeywell International, Inc. and Itron, Inc. focus on high-performance meters with enhanced remote monitoring capabilities, enabling utilities to streamline operations and detect anomalies promptly.

Landis+Gyr, Osaki Electric Co., Ltd., and Schneider Electric SE offer comprehensive smart metering ecosystems that integrate with existing infrastructure, providing detailed usage data, improved billing accuracy, and enhanced energy efficiency. With rising adoption of automated meter reading and smart energy solutions, the Residential AMI Gas Meter market is increasingly driven by innovation, regulatory support, and the demand for reliable, connected energy infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Technology | RF, PLC, and Cellular |

| End Users | Single Family and Multi Family |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Azbil Kimmon Co. Ltd., Aclaras Technologies LLC, AEM, Chint Group, Eaton Corporation, Emerson, Honeywell International, Inc., Holley Metering, Itron, Inc., Landis+Gyr, Osaki Electric Co., Ltd., Peltek India, Schneider Electric SE, and Wasion Group |

| Additional Attributes | Dollar sales by meter type and installation segment, demand dynamics across residential and multi-unit buildings, regional trends in smart metering adoption, innovation in remote monitoring and data analytics, environmental impact of manufacturing and disposal, and emerging use cases in energy management and utility optimization. |

The global residential ami gas meter market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the residential ami gas meter market is projected to reach USD 9.3 billion by 2035.

The residential ami gas meter market is expected to grow at a 20.4% CAGR between 2025 and 2035.

The key product types in residential ami gas meter market are rf, plc and cellular.

In terms of end users, single family segment to command 58.2% share in the residential ami gas meter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA