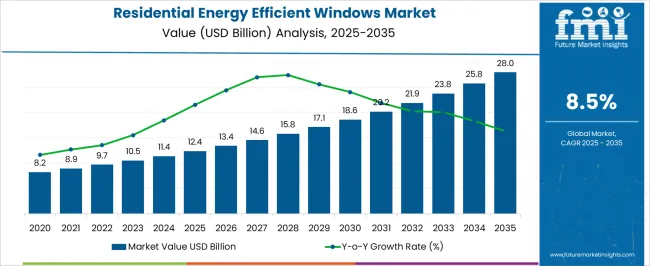

The residential energy efficient windows market is projected to grow from USD 12.4 billion in 2025 to USD 28.0 billion by 2035, reflecting a CAGR of 8.5%. This growth represents an absolute dollar opportunity of USD 15.6 billion over the decade. Starting at USD 8.2 billion in the early years, the market experiences steady expansion, reaching USD 18.6 billion by 2030. For companies in construction, home improvement, and building materials, this growth indicates substantial revenue potential.

The absolute dollar opportunity from 2025 to 2035 emphasizes consistent annual gains, with the market rising from USD 12.4 billion to USD 28.0 billion. Incremental growth moves from USD 13.4 billion in 2026 to USD 25.8 billion in 2034, culminating at USD 28.0 billion in 2035.

This predictable expansion allows companies to plan capacity, partnerships, and marketing strategies effectively. Capturing market share during this period ensures meaningful revenue gains while minimizing investment risk. Companies entering or scaling operations in alignment with these trends can maximize returns and secure a strong foothold in the evolving residential energy efficient windows market.

| Metric | Value |

|---|---|

| Residential Energy Efficient Windows Market Estimated Value in (2025 E) | USD 12.4 billion |

| Residential Energy Efficient Windows Market Forecast Value in (2035 F) | USD 28.0 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

A breakpoint analysis of the residential energy efficient windows market highlights periods of steady and accelerated growth. From 2025 to 2028, the market grows from USD 12.4 billion to USD 14.6 billion, with annual increments of around USD 0.8–1.0 billion. This early-stage period represents a stable phase where companies can establish operations, optimize supply chains, and assess demand patterns.

Early engagement during this period sets the stage for capturing higher-value opportunities in subsequent years. The next breakpoint occurs between 2030 and 2035, as the market expands from USD 18.6 billion to USD 28.0 billion, reflecting larger annual increments averaging USD 1.6–2.0 billion. This stage represents accelerated growth and significant absolute dollar opportunity, making strategic positioning essential. Companies entering or scaling operations during this phase can capture substantial revenue gains and strengthen competitive positioning.

The residential energy efficient windows market is expanding steadily, driven by rising energy conservation awareness and the growing demand for sustainable housing solutions. Policy initiatives promoting reduced energy consumption in buildings, coupled with stricter building codes and efficiency standards, have accelerated adoption.

Advances in glass coatings, frame materials, and gas-filled glazing units have significantly improved thermal insulation and reduced heat transfer, enhancing both comfort and cost savings for homeowners. Consumer preference for solutions that lower utility bills and improve indoor climate control has further boosted demand.

Additionally, the increasing rate of home renovations and retrofits in mature markets, alongside rapid new housing construction in emerging economies, has widened the customer base. The market’s growth is also supported by incentives such as tax credits, subsidies, and financing programs targeting residential energy efficiency upgrades. Moving forward, double glazing, replacement installations, and smaller-unit window counts are expected to dominate segmental trends, driven by their cost-effectiveness, ease of installation, and strong alignment with energy performance goals.

The residential energy efficient windows market is segmented by glazing type, adoption, number of windows, and geographic regions. By glazing type, residential energy efficient windows market is divided into Double glazing and Triple low-E glazing. In terms of adoption, residential energy efficient windows market is classified into Replacement and Insulation. Based on number of windows, residential energy efficient windows market is segmented into Up to 6 units, >6 to 10 units, and >10 units. Regionally, the residential energy efficient windows industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

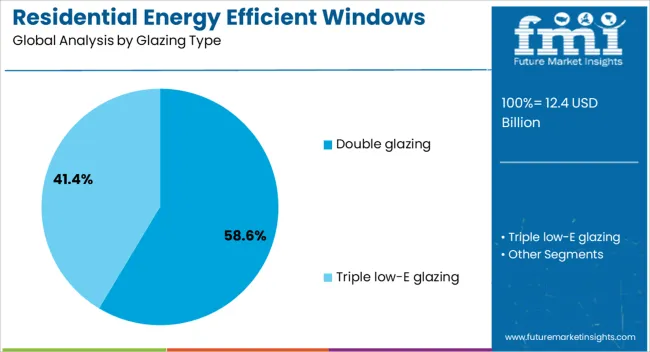

The double glazing segment is projected to hold 58.6% of the residential energy efficient windows market revenue in 2025, maintaining its position as the leading glazing type. This segment’s dominance is supported by its proven ability to provide substantial insulation improvements at a cost point accessible to a broad consumer base.

Double glazing units utilize two panes of glass separated by an insulating layer, significantly reducing heat loss and improving energy efficiency compared to single-pane options. Industry data and manufacturer reports have highlighted that double glazing offers an optimal balance of thermal performance, noise reduction, and affordability, making it attractive for both new builds and retrofit projects.

The segment’s leadership is further reinforced by its widespread availability, compatibility with various frame materials, and compliance with energy efficiency regulations in multiple markets. As more households seek practical upgrades that deliver measurable energy savings, double glazing is expected to retain its dominant share.

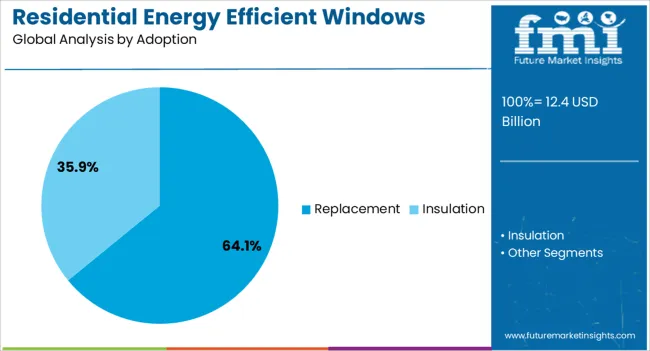

The replacement segment is projected to contribute 64.1% of the residential energy efficient windows market revenue in 2025, reflecting strong demand from homeowners upgrading existing windows to improve energy performance. This growth is driven by aging housing stock in developed regions, where replacing outdated windows offers an immediate and tangible improvement in insulation and utility cost savings.

Renovation trends, supported by government-backed incentive programs and rising consumer interest in home energy audits, have fueled replacement activity. Industry reports have also noted that replacement projects typically require less disruption compared to new construction, increasing their appeal to homeowners.

The ability to integrate modern double or triple glazing technology into existing frames or openings has made replacement a cost-effective and high-impact solution. As energy efficiency targets continue to tighten and property owners seek to enhance home value, the replacement segment is expected to sustain its market leadership.

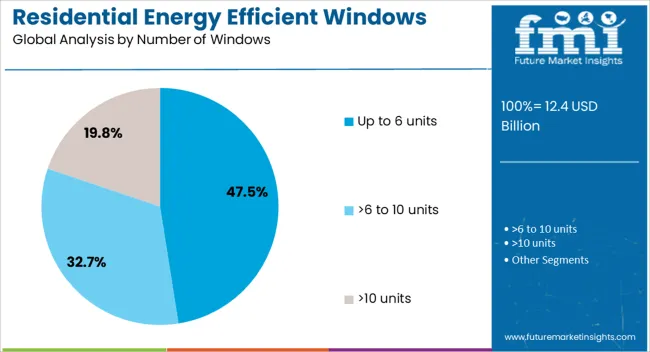

The up to 6 units segment is projected to account for 47.5% of the residential energy efficient windows market revenue in 2025, securing its place as the leading category by unit count. This segment’s dominance reflects the prevalence of smaller-scale window projects in individual homes and apartments, where targeted upgrades can deliver significant energy savings.

Many homeowners opt to replace or install energy efficient windows in key living areas first, balancing budget constraints with performance improvements. This approach is particularly common in older properties or multi-family residences where phased upgrades are preferred.

Additionally, contractor feedback indicates that smaller unit counts allow for faster installation timelines and lower overall project costs, encouraging uptake among budget-conscious consumers. As energy efficiency awareness spreads and homeowners seek incremental but impactful improvements, the up to 6 units category is expected to maintain its strong position in the market.

The residential energy efficient windows market is growing due to increasing focus on energy savings, green building standards, and sustainable home design. North America and Europe lead in adoption of high-performance double- and triple-glazed windows with low-emissivity coatings, whereas Asia-Pacific shows rapid growth due to urbanization, rising disposable income, and government incentives. Key manufacturers differentiate through frame materials, thermal performance, and customization options. Market expansion is fueled by building energy codes, homeowner awareness, and incentives for retrofitting older homes with energy-efficient solutions.

Energy-efficient windows vary in U-value, solar heat gain coefficient, and insulating glass performance. European and North American homeowners prioritize double- or triple-glazing with low-emissivity coatings for maximum energy savings and comfort. In contrast, Asia-Pacific buyers often focus on cost-effective double-glass units to balance performance and affordability. Differences in thermal efficiency impact indoor comfort, energy bills, and compliance with building codes. Leading manufacturers provide certified high-performance products, while regional suppliers offer standard-grade solutions. These contrasts influence adoption rates, consumer choice, and regional market competitiveness, particularly between high-end and budget-conscious segments.

Window frame materials and designs vary across regions. North America and Europe favor uPVC, aluminum-clad, or wood-composite frames for aesthetics, durability, and thermal performance. Asia-Pacific markets often adopt aluminum or basic uPVC frames for cost-sensitive residential projects. Differences in design and material affect longevity, insulation, maintenance, and consumer perception. Manufacturers offering customizable, high-quality frames gain preference among premium buyers, while regional producers focus on standardized solutions for large-scale housing projects. These contrasts shape product differentiation, supplier competitiveness, and regional market penetration.

Energy efficiency regulations and building codes differ across regions. Europe implements strict standards under EU Energy Performance directives, and North America provides tax incentives and rebates for retrofitting. Asia-Pacific countries are introducing building efficiency codes but adoption is inconsistent. Differences in regulatory support and incentives impact project feasibility, consumer adoption, and supplier strategies. Companies aligned with local regulations can expand market share more effectively, while those ignoring compliance face barriers. Policy-driven contrasts guide supplier focus on certified products for regulated markets versus standard solutions in emerging regions, shaping global market dynamics.

Window production depends on glass sourcing, frame material availability, and fabrication capacity. Europe and North America rely on automated, high-quality production lines ensuring consistent performance, whereas Asia-Pacific production emphasizes volume and cost-efficiency. Supply chain reliability, including logistics and raw material availability, impacts delivery timelines and pricing.

Manufacturers with integrated production and diversified sourcing maintain steady supply for residential and commercial projects, while smaller suppliers may face delays. Differences in manufacturing capability and supply consistency directly influence regional competitiveness, adoption rates, and ability to meet growing residential energy efficiency demand.

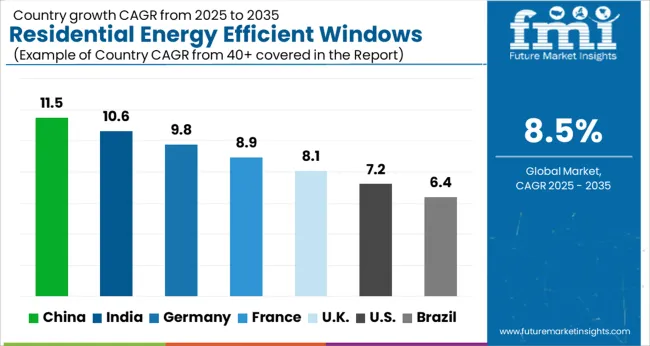

| Countries | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

The global residential energy efficient windows market was projected to grow at an 8.5% CAGR through 2035, driven by demand in residential construction, retrofitting, and sustainable building applications. Among BRICS nations, China recorded 11.5% growth as large-scale production facilities were commissioned and compliance with building and performance standards was enforced, while India at 10.6% growth saw expansion of manufacturing units to meet rising regional demand in housing developments. In the OECD region, Germany at 9.8% maintained substantial output under strict building and safety regulations, while the United Kingdom at 8.1% relied on moderate-scale operations for residential and commercial projects. The USA, expanding at 7.2%, remained a mature market with steady demand across residential construction and retrofit segments, supported by adherence to federal and state-level building codes and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Residential energy efficient windows market in China is growing at a CAGR of 11.5%. Between 2020 and 2024, growth was driven by rising urbanization, government initiatives for energy efficient housing, and increasing consumer awareness of energy conservation. Manufacturers focused on double and triple glazed windows, low emissivity coatings, and insulated frames to reduce energy consumption. In the forecast period 2025 to 2035, growth is expected to accelerate with wider adoption in residential construction, retrofitting of older buildings, and integration of smart window technologies. Rising environmental regulations, incentives for green buildings, and increased focus on sustainable housing will further support market expansion. China remains a leading market due to large construction sector, energy efficiency programs, and growing residential demand.

Residential energy efficient windows market in India is growing at a CAGR of 10.6%. Historical period 2020 to 2024 saw growth supported by residential construction, urbanization, and government programs promoting energy efficiency. Manufacturers focused on insulated frames, low emissivity coatings, and multi-pane glass solutions. In the forecast period 2025 to 2035, market growth is expected to continue with adoption in new housing projects, retrofitting older buildings, and integration with smart home solutions. Incentives for energy efficient construction, rising awareness of sustainability, and growth of residential real estate will drive market expansion. India is projected to maintain strong growth due to urban housing development and increasing energy efficiency initiatives.

Residential energy efficient windows market in Germany is growing at a CAGR of 9.8%. Between 2020 and 2024, growth was supported by demand for green buildings, renovation of older homes, and government energy efficiency regulations. Manufacturers focused on high performance glazing, insulated frames, and low emissivity coatings. In the forecast period 2025 to 2035, market growth is expected to continue steadily with adoption in retrofit projects, new residential constructions, and integration of smart and automated window systems. Strict energy standards, technological innovation, and sustainability programs will further support adoption. Germany remains a key European market due to strong regulatory environment and focus on energy efficient housing.

Residential energy efficient windows market in the United Kingdom is growing at a CAGR of 8.1%. During 2020 to 2024, adoption was driven by residential renovations, energy efficiency programs, and government incentives. Manufacturers focused on double glazing, insulated frames, and low emissivity glass. In the forecast period 2025 to 2035, market growth is expected to continue with adoption in new residential projects, retrofitting, and smart window integration. Environmental policies, consumer awareness, and green construction initiatives will further support market expansion. The United Kingdom market reflects steady growth with emphasis on energy savings, sustainability, and compliance with building codes.

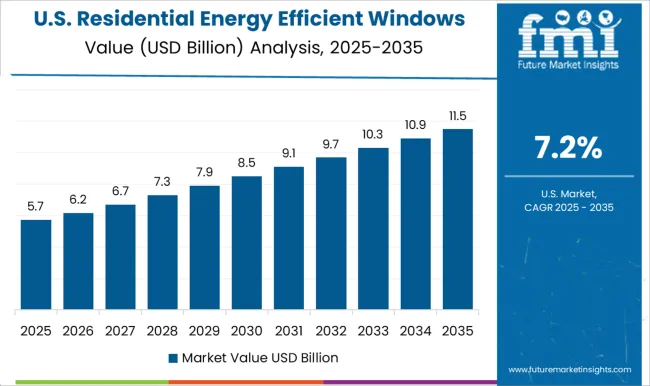

Residential energy efficient windows market in the United States is growing at a CAGR of 7.2%. Historical period 2020 to 2024 saw growth driven by new residential construction, home retrofitting, and incentives for energy efficient windows. Manufacturers focused on double and triple glazed units, insulated frames, and low emissivity glass. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption in new housing projects, renovations, and smart home integration. Government energy efficiency programs, green building certifications, and consumer demand for lower energy costs will further support expansion. The United States market demonstrates stable growth with focus on energy savings, sustainable construction, and innovative window technologies.

Key participants such as Andersen Corporation, Pella Corporation, and Velux Group have leveraged extensive R&D and brand recognition to expand their presence across North America and Europe, while regional players in Asia-Pacific and Latin America target growing urban housing developments with cost-effective, energy-saving solutions.

Competitive differentiation is largely driven by product performance, including U-factor and solar heat gain coefficient ratings, as well as customization options, installation services, and compliance with local energy efficiency standards. Manufacturers increasingly integrate smart window technologies, low-emissivity coatings, and double- or triple-glass units to enhance thermal efficiency and reduce energy costs. Strategic collaborations with construction companies and distributors further enhance market reach and brand loyalty. The market’s competitive dynamics are also influenced by growing consumer awareness of energy costs, government regulations promoting energy efficiency, and incentives for green building practices.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.4 Billion |

| Glazing Type | Double glazing and Triple low-E glazing |

| Adoption | Replacement and Insulation |

| Number of Windows | Up to 6 units, >6 to 10 units, and >10 units |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AeroShield, Atrium Corporation, Andersen Corporation, Builders First Choice, Champion Window, Fenesta, French Steel Company, Jeld-Wen, Milgard Manufacturing, Marvin Windows & Doors, Nordik Windows, Pella Corporation, Soft-Lite Windows, and YKK AP |

| Additional Attributes | Dollar sales vary by window type, including double-glazed, triple-glazed, and low-E windows; by frame material, spanning uPVC, aluminum, and wood; by application, such as new residential construction and renovations; by end-use, covering single-family homes and multi-family residences; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising energy efficiency regulations, sustainable building initiatives, and demand for thermal and acoustic insulation. |

The global residential energy efficient windows market is estimated to be valued at USD 12.4 billion in 2025.

The market size for the residential energy efficient windows market is projected to reach USD 28.0 billion by 2035.

The residential energy efficient windows market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in residential energy efficient windows market are double glazing and triple low-e glazing.

In terms of adoption, replacement segment to command 64.1% share in the residential energy efficient windows market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA