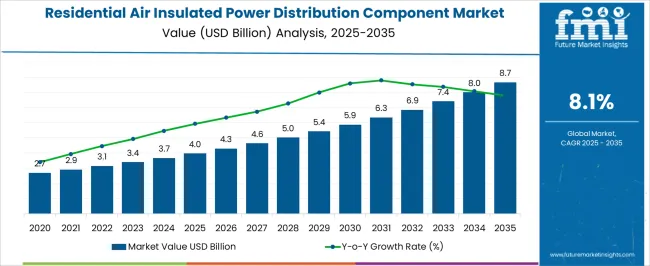

The residential air insulated power distribution component market is estimated to be valued at USD 4.0 billion in 2025 and is projected to reach USD 8.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period. During the early adoption phase from 2020 to 2024, growth was primarily driven by pilot deployments in residential complexes, multi-unit housing, and small commercial buildings, testing air-insulated switchgear and distribution panels.

Manufacturers increase production capacity, streamline supply chains, and enhance service networks, supporting wider market penetration and recurring demand. From 2030 to 2035, the market enters the consolidation phase, expected to reach 8.7 billion dollars by 2035 while maintaining a CAGR of 8.1%. Leading suppliers consolidate positions through long-term contracts, regional expansion, and standardized product offerings. Smaller players either specialize in niche applications or exit. Adoption stabilizes as most residential projects integrate air insulated distribution components.

Companies focus on operational efficiency, reliability, and lifecycle support. By 2035, the market exhibits mature competition, predictable growth, and standardized installation and maintenance practices, creating a structured and well-established industry landscape.

| Metric | Value |

|---|---|

| Residential Air Insulated Power Distribution Component Market Estimated Value in (2025 E) | USD 4.0 billion |

| Residential Air Insulated Power Distribution Component Market Forecast Value in (2035 F) | USD 8.7 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The residential air insulated power distribution component market is driven by a variety of end-use segments. Multi-Family Residential Complexes lead with approximately 30% of the market, as high-density housing requires reliable air insulated switchgear and distribution panels for safety and operational efficiency. Single-family homes contribute 20%, where homeowners increasingly adopt standardized distribution solutions during new construction or retrofits.

Gated Communities and Planned Townships account for 15%, deploying centralized distribution systems for efficient power management. Commercial and Mixed-Use Residential Buildings represent 12%, incorporating air insulated components for shared utilities and facility management. Hospitality and Hotels contribute 8%, ensuring stable power distribution across multiple units. Healthcare and Assisted Living Facilities account for 5%, focusing on reliability and uninterrupted power supply. Retail and Small Office Developments represent 4%, integrating compact distribution solutions.

Smaller segments, including Government Housing Projects and Educational Residential Campuses, make up the remaining 6%, providing specialized installations and pilot deployments. Revenue growth aligns with sector adoption, expanding from USD 2.7 billion in 2020 to USD 4.0 billion in 2025 and projected to reach USD 8.7 billion by 2035, reflecting a CAGR of 8.1%. Multi-family residential complexes and single-family homes remain primary drivers, while commercial, hospitality, and specialized facilities contribute incremental growth, shaping the market’s long-term expansion and adoption trajectory.

The residential air insulated power distribution component market is experiencing steady growth driven by increasing urbanization, rising electricity demand, and the need for reliable low voltage distribution systems in residential infrastructures. Growing emphasis on safety, compact design, and cost effectiveness has spurred the adoption of air insulated solutions over alternative insulation technologies.

Advancements in material engineering and arc fault protection systems have improved operational life and reduced maintenance requirements, further boosting adoption. Additionally, regulatory standards focusing on electrical safety and efficiency in residential buildings are influencing design innovations and component integration.

The market outlook remains positive as demand for modernized residential grids, integration with renewable energy sources, and smart monitoring systems continues to expand.

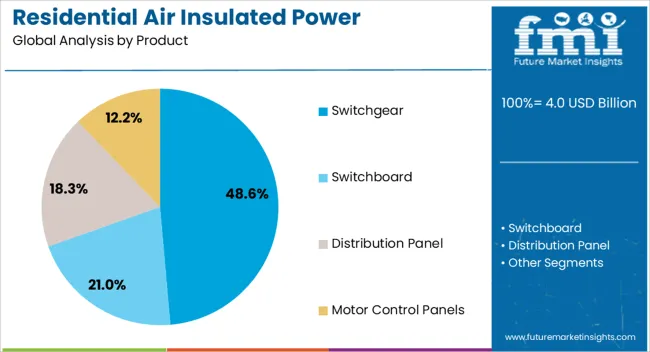

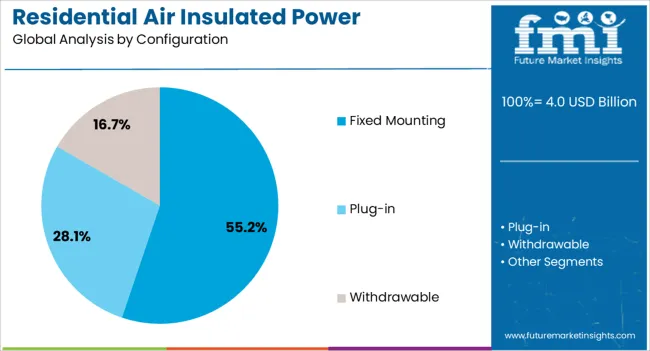

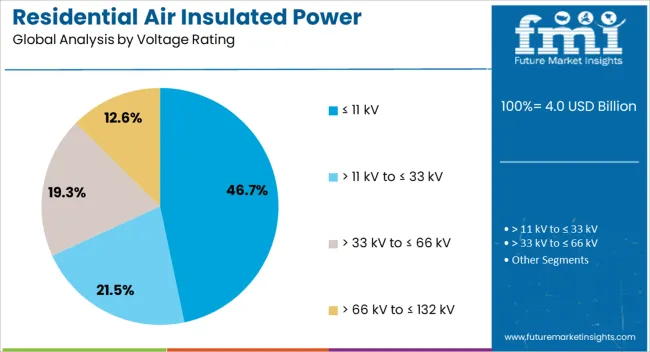

The residential air insulated power distribution component market is segmented by product, configuration, voltage rating, and geographic regions. By product, residential air insulated power distribution component market is divided into Switchgear, Switchboard, Distribution Panel, and Motor Control Panels. In terms of configuration, residential air insulated power distribution component market is classified into Fixed Mounting, Plug-in, and Withdrawable. Based on voltage rating, residential air insulated power distribution component market is segmented into ≤ 11 kV, > 11 kV to ≤ 33 kV, > 33 kV to ≤ 66 kV, and > 66 kV to ≤ 132 kV. Regionally, the residential air insulated power distribution component industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The switchgear segment is projected to account for 48.60% of the total market revenue by 2025 within the product category, making it the leading segment. This dominance is driven by its critical role in protecting electrical circuits, ensuring load management, and maintaining operational safety in residential power systems.

Switchgear solutions provide enhanced fault detection and rapid isolation capabilities, reducing downtime and safeguarding appliances and infrastructure. Continuous advancements in compact, modular designs have supported their adoption in space constrained residential environments.

With growing focus on reliable and efficient energy distribution, switchgear remains the preferred choice for residential installations.

The fixed mounting configuration segment is expected to hold 55.20% of the total market revenue by 2025 within the configuration category, positioning it as the most widely adopted option. This preference is attributed to its cost effectiveness, ease of installation, and minimal maintenance requirements compared to withdrawable configurations.

Fixed mounting systems offer stable performance, long service life, and reduced operational complexity, making them suitable for standard residential setups.

The combination of affordability and reliability has reinforced its dominance in residential power distribution applications.

The ≤ 11 kV voltage rating segment is forecasted to contribute 46.70% of the total market revenue by 2025 within the voltage rating category, making it the leading range. This growth is supported by its suitability for the majority of residential power distribution needs, aligning with regulatory standards and safety requirements.

Equipment in this voltage class offers high efficiency, reliable insulation, and optimal protection for residential circuits.

The widespread compatibility of ≤ 11 kV systems with existing distribution infrastructure further strengthens their market share, ensuring continued demand in upcoming residential developments.

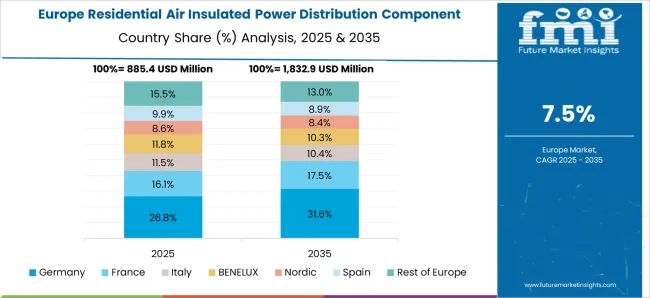

The residential air insulated power distribution component market is expanding due to rising urban electrification, smart home adoption, and upgraded residential grid infrastructure. North America and Europe lead with compact, safe, and standardized air-insulated switchgear for single- and multi-family dwellings. Asia-Pacific shows rapid growth driven by new housing projects, urbanization, and renewable integration. Manufacturers differentiate through modular design, safety mechanisms, and ease of installation. Regional variations in grid standards, voltage requirements, and residential density strongly influence adoption, deployment efficiency, and market competitiveness globally.

Adoption of air-insulated power distribution components is driven by the increasing demand for residential electrification and smart grid integration. North America and Europe focus on compact, standardized air-insulated switchgear capable of supporting automated metering, home energy management, and low-voltage protection in urban housing. Asia-Pacific markets emphasize cost-effective components for newly constructed apartments, single-family homes, and residential complexes. Differences in electrification pace, smart grid adoption, and residential voltage requirements affect component selection, installation standards, and adoption speed. Leading suppliers provide modular, pre-tested components with integrated safety and monitoring features, while regional manufacturers deliver practical, locally adapted solutions. Electrification contrasts shape adoption, efficiency, and competitiveness globally.

Compliance with safety standards, building codes, and electrical regulations strongly affects residential air-insulated component adoption. North America and Europe enforce strict IEC, NEC, and local codes ensuring overcurrent protection, insulation integrity, and operator safety. Asia-Pacific regulations vary; developed regions follow international norms, while emerging markets prioritize cost-effective compliance with regional standards. Differences in testing, certification processes, and regulatory rigor influence component acceptance, installation speed, and end-user confidence. Leading suppliers provide certified, code-compliant switchgear with robust safety features, while regional players offer practical, regulation-aligned options. Regulatory and safety contrasts shape adoption, credibility, and competitiveness globally.

Modular and compact designs are critical factors driving adoption in residential air-insulated power distribution. North America and Europe favor pre-assembled, modular units that simplify installation, reduce downtime, and allow for easy expansion in multi-unit residential buildings. Asia-Pacific markets adopt scalable components designed for flexible installation in dense urban housing and cost-sensitive projects. Differences in modularity, footprint, and compatibility with existing systems affect installation efficiency, maintenance, and scalability. Leading suppliers offer highly modular, plug-and-play units with built-in monitoring, while regional manufacturers provide practical, space-efficient designs. Design and installation contrasts shape adoption, operational convenience, and competitiveness globally.

Reliability, durability, and maintenance simplicity are key drivers for residential adoption of air-insulated power distribution components. North America and Europe prioritize components with long service life, low maintenance intervals, and integrated monitoring to prevent downtime and ensure safety. Asia-Pacific markets focus on robust, cost-effective units that withstand environmental stressors such as humidity, heat, and dust. Differences in reliability expectations, maintenance practices, and service support influence procurement decisions, operational continuity, and consumer trust. Leading suppliers offer advanced diagnostics, durable insulation, and maintenance-free designs, while regional players focus on practical, locally maintainable solutions. Reliability contrasts shape adoption, operational efficiency, and competitive positioning globally.

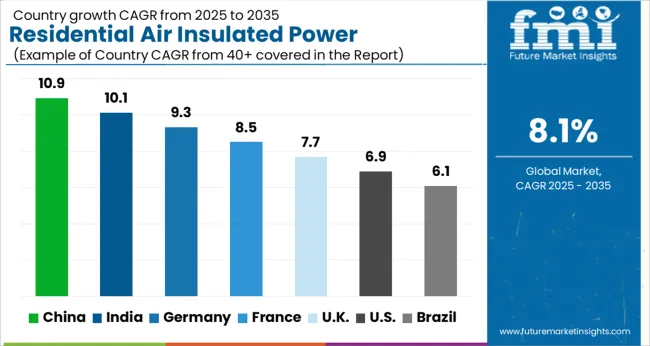

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

The global residential air insulated power distribution component market is projected to grow at an 8.1% CAGR through 2035, driven by demand in residential, commercial, and utility power networks. Among BRICS nations, China led with 10.9% growth as large-scale manufacturing and deployment across urban and suburban power grids were carried out, while India at 10.1% growth expanded installations to support expanding electricity distribution infrastructure. In the OECD region, Germany at 9.3% maintained consistent adoption under regulatory standards ensuring performance and safety, while the United Kingdom at 7.7% integrated components across residential and commercial networks. The USA, growing at 6.9%, advanced deployment across energy distribution systems while complying with federal and state-level quality and operational regulations. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The residential air insulated power distribution component market in China is projected to grow at a CAGR of 10.9%, driven by increasing urban residential development and modernization of electrical infrastructure. Adoption is being encouraged by components that provide reliable power distribution, compact design, and ease of installation in residential complexes. Manufacturers are being urged to supply durable, high performance, and safe components suitable for high density urban areas. Distribution through electrical contractors, utility companies, and authorized suppliers is being strengthened. Research in component efficiency, thermal performance, and safety enhancements is being conducted. Rising residential electricity demand, government electrification initiatives, and upgrading of power networks are considered key factors supporting the residential air insulated power distribution component market in China.

The residential air insulated power distribution component market in India is expected to grow at a CAGR of 10.1%, driven by modernization of residential electricity infrastructure and demand for reliable distribution systems. Adoption is being strengthened by components that ensure operational safety, improve efficiency, and reduce maintenance requirements. Manufacturers are being encouraged to provide cost effective, reliable, and high quality components. Distribution through electrical contractors, residential developers, and utility suppliers is being expanded. Training sessions and technical workshops are being conducted to promote proper installation and maintenance practices. Increasing urbanization, growth in electricity consumption, and upgrading of aging distribution networks are recognized as primary drivers of the residential air insulated power distribution component market in India.

Germany is experiencing steady growth in the residential air insulated power distribution component market at a CAGR of 9.3%, supported by demand for safe, efficient, and compact components for urban housing and smart residential complexes. Adoption is being encouraged by components that enhance reliability, minimize energy loss, and simplify installation. Manufacturers are being urged to supply technologically advanced, durable, and efficient components. Distribution through utility companies, residential developers, and electrical contractors is being maintained. Research in energy efficiency, compact design, and thermal management is being pursued. Rising emphasis on energy efficient homes, upgrading of residential grids, and increasing electrification are driving the residential air insulated power distribution component market in Germany.

The residential air insulated power distribution component market in the United Kingdom is projected to grow at a CAGR of 7.7%, driven by upgrades to residential electrical networks and demand for reliable power supply in modern housing projects. Adoption is being emphasized for components that provide operational reliability, safety, and compact installation features. Manufacturers are being encouraged to supply high quality, durable, and safe components. Distribution through electrical contractors, residential developers, and utility service providers is being strengthened. Demonstrations and technical sessions are being conducted to promote awareness of component advantages. Expansion of urban residential projects, regulatory standards for safety, and modernization of distribution systems are recognized as major factors supporting the residential air insulated power distribution component market in the United Kingdom.

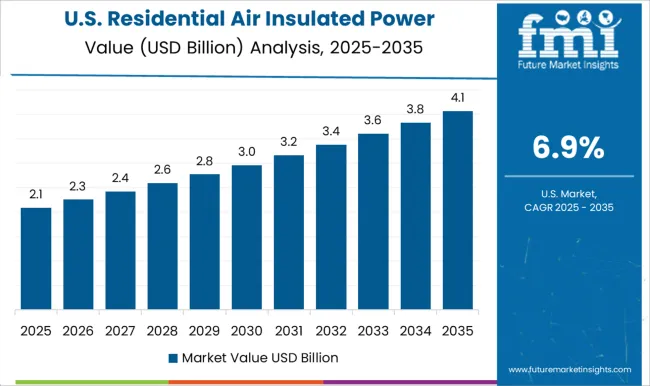

The residential air insulated power distribution component market in the United States is projected to grow at a CAGR of 6.9%, supported by modernization of residential electrical systems and increasing demand for compact distribution solutions. Adoption is being encouraged by components that enhance reliability, reduce energy loss, and ensure safe installation. Manufacturers are being urged to deliver durable, efficient, and high performance components. Distribution through electrical contractors, utility companies, and residential developers is being maintained. Research in improved thermal performance, safety enhancements, and energy efficiency is being conducted. Expansion of housing infrastructure, rising electricity demand, and upgrading of aging residential grids are considered key drivers of the residential air insulated power distribution component market in the United States.

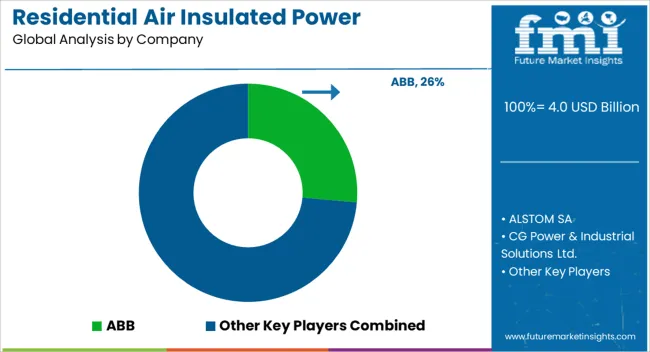

The residential air-insulated power distribution component (AIPDC) market is shaped by global electrical equipment manufacturers, regional distributors, and specialized residential power solution providers. Leading players such as Schneider Electric, ABB, Siemens, and Eaton maintain strong positions by offering diversified portfolios of air-insulated switchgears, circuit breakers, transformers, and busbar systems tailored for residential and small commercial power distribution networks.

Competitive differentiation is driven by product reliability, compact design, safety features, ease of installation, and compliance with international standards such as IEC and ANSI. Regional manufacturers, particularly in Asia-Pacific and Europe, compete by providing cost-effective solutions, customized designs, and local technical support for residential and urban infrastructure projects. Strategic partnerships with electrical contractors, utilities, and real estate developers enhance market reach and adoption. Innovation in modular designs, digital monitoring, and smart metering integration further strengthens competitive positioning. Companies prioritizing regulatory compliance, energy efficiency, and robust after-sales support are well-positioned to capture significant market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.0 Billion |

| Product | Switchgear, Switchboard, Distribution Panel, and Motor Control Panels |

| Configuration | Fixed Mounting, Plug-in, and Withdrawable |

| Voltage Rating | ≤ 11 kV, > 11 kV to ≤ 33 kV, > 33 kV to ≤ 66 kV, and > 66 kV to ≤ 132 kV |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, ALSTOM SA, CG Power & Industrial Solutions Ltd., Eaton, GE Grid Solutions, G&W Electric, Hitachi Energy, Lucy Group Ltd., L&T Electrical & Automation, Meiden Europe GmbH, Ormazabal, Powell Industries, Schneider Electric, and Siemens |

| Additional Attributes | Dollar sales vary by component type, including circuit breakers, switchgear, fuses, and distribution panels; by application, such as residential complexes, apartments, and standalone homes; by end-use, spanning utilities, property developers, and contractors; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising residential construction, grid modernization, and demand for reliable, compact power distribution solutions. |

The global residential air insulated power distribution component market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the residential air insulated power distribution component market is projected to reach USD 8.7 billion by 2035.

The residential air insulated power distribution component market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in residential air insulated power distribution component market are switchgear, switchboard, distribution panel and motor control panels.

In terms of configuration, fixed mounting segment to command 55.2% share in the residential air insulated power distribution component market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA