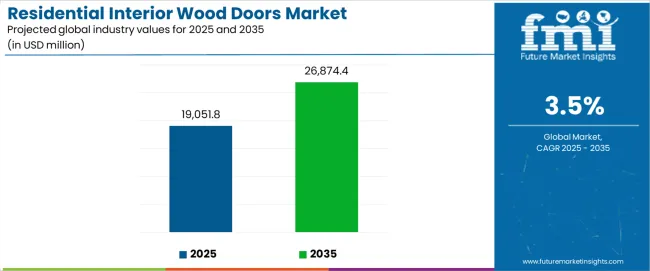

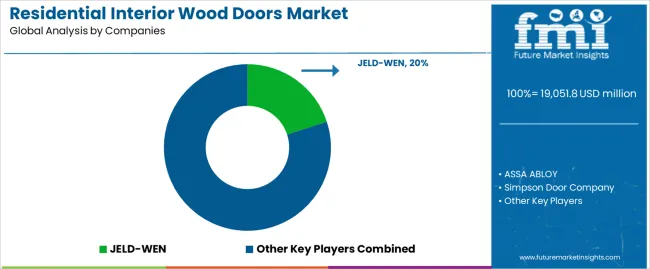

The global residential interior wood doors market, valued at USD 19,051.8 million in 2025 and projected to reach USD 26,874.4 million by 2035 at a CAGR of 3.5%, presents significant opportunities when analyzed through the lens of technology and manufacturing trends. The industry is increasingly influenced by the integration of advanced production processes, digital design platforms, and sustainable materials, which are reshaping how residential interior doors are designed, manufactured, and delivered to end consumers. As the overall market size expands by nearly 1.41X during this period, production efficiency and innovation in door construction technologies are expected to emerge as defining factors for competitive differentiation.

One of the most notable shifts in manufacturing is the adoption of automation and precision-driven technologies. Computer Numerical Control (CNC) machines and automated cutting systems are increasingly used to enhance accuracy, reduce waste, and allow for complex design customization. This technology is particularly relevant as demand for personalized and architecturally distinct interior doors grows among homeowners. Automation also supports faster production cycles, which is essential for addressing both large-scale residential projects and the rising demand in the home renovation segment. Integration of robotics in assembly and finishing lines ensures consistency in quality and scalability for global manufacturers.

Digital design and mass customization platforms are also changing how manufacturers interact with customers. Consumers are increasingly able to select door designs, finishes, and dimensions through online platforms that are directly linked to digital manufacturing systems. This trend shortens lead times and enhances customer satisfaction by combining flexibility with efficiency. Manufacturers adopting Industry 4.0 technologies, such as AI-driven predictive maintenance and real-time monitoring, are able to optimize operational costs and minimize downtime, which becomes critical as competition intensifies.

Material innovation represents another transformative dimension. Engineered wood, composite panels, and hybrid materials are being used to overcome limitations of traditional timber, ensuring durability, resistance to warping, and cost optimization. Surface finishing technologies, including UV-cured coatings, advanced laminates, and water-based paints, are enhancing both aesthetics and sustainability performance. Eco-friendly adhesives and resins are also being adopted in response to regulatory pressure and consumer awareness regarding indoor air quality. These technological shifts make wood doors more adaptable to modern requirements such as sound insulation, fire resistance, and energy efficiency.

Between 2025 and 2030, the residential interior wood doors market is projected to expand from USD 19,051.8 million to USD 22,627.5 million, resulting in a value increase of USD 3,575.7 million, which represents 45.7% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of smart home technologies, rising demand for energy-efficient door solutions, and growing emphasis on architectural aesthetics with enhanced design characteristics. Home improvement retailers and construction suppliers are expanding their product portfolios to address the growing demand for premium interior doors, custom design options, and specialty installation requirements.

| Metric | Value |

|---|---|

| Estimated Value (2025E) | USD 19,051.8 million |

| Forecast Value (2035F) | USD 26,874.4 million |

| Forecast CAGR (2025–2035) | 3.5% |

From 2030 to 2035, the residential interior wood doors market is forecast to grow from USD 22,627.5 million to USD 26,874.4 million, adding another USD 4,246.9 million, which constitutes 54.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of premium door manufacturing technologies, the integration of smart lock compatibility systems, and the development of multi-functional door platforms with enhanced acoustic and thermal insulation capabilities. The growing adoption of luxury home design practices will drive demand for residential interior wood doors with superior finishing options and compatibility with automated home systems across residential construction projects.

Between 2020 and 2025, the residential interior wood doors market experienced steady growth, driven by increasing demand for home renovation projects and growing recognition of interior doors as essential components for enhancing property value across residential remodeling, new construction, and luxury home development applications. The residential interior wood doors market developed as homeowners recognized the potential for premium doors to improve interior aesthetics while maintaining functional performance and enabling cost-effective property enhancement protocols. Technological advancement in manufacturing processes and custom design capabilities began emphasizing the critical importance of maintaining quality standards and style consistency in diverse residential environments.

Market expansion is being supported by the increasing global demand for home improvement solutions and the corresponding need for premium interior design elements that can provide superior aesthetic appeal and functional performance while enabling enhanced property value and design customization across various residential construction and renovation applications. Modern homebuilders and interior design specialists are increasingly focused on implementing door systems that can deliver architectural elegance, ensure durability performance, and provide consistent design integration throughout complex residential layouts and diverse interior styles. Residential interior wood doors' proven ability to deliver exceptional design versatility against changing trends, enable cost-effective installation, and support premium home value enhancement make them essential components for contemporary residential construction and home improvement operations.

The growing emphasis on residential luxury and interior design excellence is driving demand for residential interior wood doors that can support custom home requirements, improve interior aesthetics outcomes, and enable premium design implementation systems. Homeowners' preference for products that combine functional performance with architectural beauty and design flexibility is creating opportunities for innovative door implementations. The rising influence of smart homes and premium interior design practices is also contributing to increased demand for residential interior wood doors that can provide integrated technology compatibility, superior craftsmanship quality, and reliable performance across extended residential usage periods.

The residential interior wood doors market is poised for steady growth and transformation. As industries across residential construction, home improvement, interior design, and luxury home development seek solutions that deliver exceptional design quality, installation efficiency, and architectural compatibility, residential interior wood doors are gaining prominence not just as functional elements but as strategic enablers of modern home design practices and property value enhancement.

Rising luxury home construction in North America and expanding premium interior design initiatives globally amplify demand, while manufacturers are leveraging innovations in smart door technologies, custom design systems, and integrated hardware technologies.

Pathways like premium solid wood platforms, smart-enabled door systems, and specialized architectural solutions promise strong margin uplift, especially in luxury residential segments. Geographic expansion and technology integration will capture volume, particularly where local building codes and premium home construction are critical. Regulatory support around energy efficiency requirements, building safety standards, and residential quality standards give structural support.

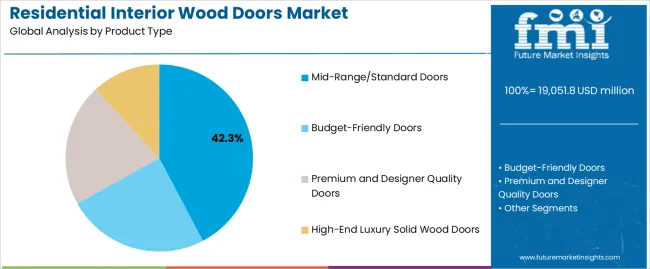

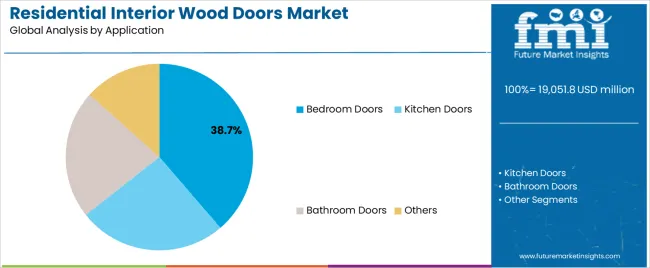

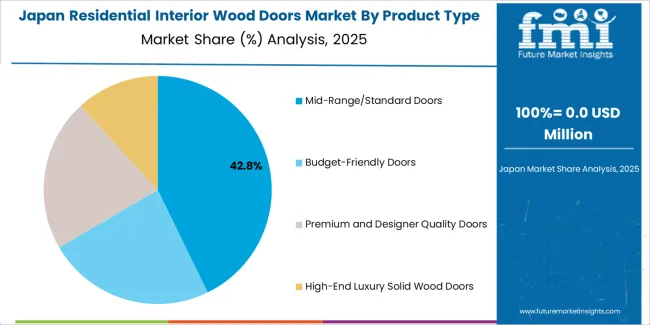

The residential interior wood doors market is segmented by product type, application, material grade, installation type, distribution channel, and region. By product type, the residential interior wood doors market is divided into budget-friendly doors, mid-range/standard doors, premium and designer quality doors, and high-end luxury solid wood doors. By application, it covers bedroom doors, kitchen doors, bathroom doors, and others. By material grade, the residential interior wood doors market includes engineered wood, solid wood, and composite wood systems. By installation type, it is categorized into pre-hung doors, slab doors, and complete door systems. By distribution channel, it covers home improvement stores, specialty retailers, online sales, and direct manufacturer sales. Regionally, the residential interior wood doors market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The mid-range/standard doors segment is projected to account for 42.3% of the residential interior wood doors market in 2025, reaffirming its position as the leading product category. Residential construction and home renovation projects increasingly utilize mid-range interior doors for their balanced combination of quality and affordability when operating across diverse residential applications, excellent cost-effectiveness characteristics, and design versatility in applications ranging from new home construction to renovation project management. Mid-range interior wood door technology's proven performance capabilities and broad style compatibility directly address the residential requirements for reliable door solutions in mainstream housing developments.

This product segment forms the foundation of modern residential construction operations, as it represents the door type with the greatest market acceptance and established demand across multiple application categories and housing sectors. Manufacturer investments in enhanced manufacturing processes and style variety continue to strengthen adoption among home builders and renovation contractors. With homeowners prioritizing value engineering and design flexibility, mid-range interior doors align with both performance requirements and budget considerations, making them the central component of comprehensive residential construction strategies.

Bedroom door applications are projected to represent 38.7% of residential interior wood doors demand in 2025, underscoring their critical role as the primary residential application requiring privacy-focused door technology for personal spaces, sound control, and interior design integration. Homeowners prefer bedroom doors for their exceptional privacy capabilities, acoustic performance characteristics, and ability to enhance interior aesthetics while ensuring functional performance throughout diverse residential design programs. Positioned as essential components for modern residential layouts, bedroom doors offer both functional advantages and design customization benefits.

The segment is supported by continuous innovation in privacy door technologies and the growing availability of specialized design systems that enable sound dampening applications with enhanced aesthetic integration and rapid installation capabilities. Additionally, homeowners are investing in premium bedroom door solutions to support luxury interior design and personal space optimization. As residential privacy requirements become more prevalent and interior design standards increase, bedroom applications will continue to dominate the application market while supporting advanced residential design implementation and personal space enhancement strategies.

The residential interior wood doors market is advancing steadily due to increasing demand for home improvement technologies and growing adoption of premium interior design solutions that provide superior aesthetic appeal and functional performance while enabling enhanced property value across diverse residential construction and renovation applications. However, the residential interior wood doors market faces challenges, including fluctuating raw material costs, skilled installation labor shortages, and the need for specialized design consultation and customization programs. Innovation in smart door capabilities and IoT-integrated systems continues to influence product development and market expansion patterns.

The growing adoption of smart home systems, IoT-enabled access control, and automated home management is enabling manufacturers to produce advanced residential interior doors with superior connectivity capabilities, enhanced security functionalities, and automated operation protocol compatibility. Advanced smart door systems provide improved home automation integration while allowing more efficient access control and consistent performance across various residential applications and technology environments. Manufacturers are increasingly recognizing the competitive advantages of smart door capabilities for product differentiation and premium market positioning.

Modern residential interior door producers are incorporating thermal insulation properties, sound dampening technologies, and integrated energy efficiency systems to enhance building performance, enable comfort optimization capabilities, and deliver value-added solutions to residential customers. These technologies improve home efficiency while enabling new performance capabilities, including temperature control, noise reduction, and reduced energy overhead. Advanced performance integration also allows manufacturers to support comprehensive building efficiency systems and residential comfort enhancement beyond traditional basic door functionality.

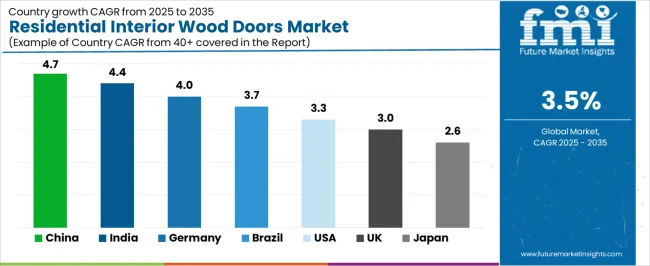

| Country | CAGR (2025–2035) |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4% |

| Brazil | 3.7% |

| United States (USA) | 3.3% |

| United Kingdom (UK) | 3% |

| Japan | 2.6% |

The residential interior wood doors market is experiencing steady growth globally, with China leading at a 4.7% CAGR through 2035, driven by the expanding residential construction programs, growing urban housing development, and significant investment in home improvement technology. India follows at 4.4%, supported by government initiatives promoting housing construction, increasing residential modernization demand, and growing interior design requirements. Germany shows growth at 4%, emphasizing premium home construction innovation and advanced building technology development.

Brazil records 3.7%, focusing on residential construction expansion and home improvement modernization. The USA demonstrates 3.3% growth, prioritizing home renovation standards and residential construction excellence. The UK exhibits 3% growth, emphasizing home improvement technology adoption and premium interior design development. Japan shows 2.6% growth, supported by residential renovation initiatives and quality construction concentration.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

Revenue from residential interior wood doors in China is projected to exhibit exceptional growth with a CAGR of 4.7% through 2035, driven by expanding residential construction programs and rapidly growing urban housing development supported by government initiatives promoting residential modernization. The country's strong position in door manufacturing and increasing investment in home improvement infrastructure are creating substantial demand for advanced residential interior door solutions. Major construction companies and property developers are establishing comprehensive door supply capabilities to serve both domestic residential demand and home improvement markets.

Revenue from residential interior wood doors in India is expanding at a CAGR of 4.4%, supported by the country's massive residential construction sector, expanding government support for housing modernization, and increasing adoption of interior design solutions. The country's initiatives promoting residential construction and growing homeowner awareness are driving requirements for advanced interior door capabilities. International suppliers and domestic manufacturers are establishing extensive production and service capabilities to address the growing demand for residential interior door products.

Revenue from residential interior wood doors in Germany is expanding at a CAGR of 4%, supported by the country's advanced residential construction capabilities, strong emphasis on building technology innovation, and robust demand for high-performance interior solutions in home construction and renovation applications. The nation's mature construction sector and quality-focused operations are driving sophisticated interior door systems throughout the residential industry. Leading manufacturers and technology providers are investing extensively in smart door systems and premium design technologies to serve both domestic and international markets.

Revenue from residential interior wood doors in Brazil is growing at a CAGR of 3.7%, driven by the country's expanding residential construction sector, growing housing development projects, and increasing investment in home improvement technology. Brazil's large residential market and commitment to housing modernization are supporting demand for efficient interior door solutions across multiple residential construction segments. Manufacturers are establishing comprehensive service capabilities to serve the growing domestic market and residential development opportunities.

Revenue from residential interior wood doors in the USA is expanding at a CAGR of 3.3%, supported by the country's advanced home improvement sector, strategic focus on residential renovation, and established premium interior design capabilities. The USA's home renovation leadership and technology integration are driving demand for interior wood doors in residential construction, home remodeling, and luxury home applications. Manufacturers are investing in comprehensive technology development to serve both domestic residential markets and international premium applications.

Revenue from residential interior wood doors in the UK is growing at a CAGR of 3%, driven by the country's focus on home improvement technology advancement, emphasis on residential renovation, and strong position in interior design development. The UK's established residential innovation capabilities and commitment to housing modernization are supporting investment in advanced door technologies throughout major residential regions. Industry leaders are establishing comprehensive technology integration systems to serve domestic residential operations and specialty interior design applications.

Revenue from residential interior wood doors in Japan is expanding at a CAGR of 2.6%, supported by the country's premium residential initiatives, growing quality construction sector, and strategic emphasis on residential technology development. Japan's advanced construction capabilities and integrated residential systems are driving demand for advanced interior wood doors in luxury home construction, premium renovation, and high-quality residential applications. Leading manufacturers are investing in specialized capabilities to serve the stringent requirements of premium construction and quality residential industries.

The residential interior wood doors market in Europe is projected to grow from USD 3,810.4 million in 2025 to USD 5,374.9 million by 2035, registering a CAGR of 3.5% over the forecast period. Germany is expected to maintain its leadership position with a 33.8% market share in 2025, declining slightly to 33.2% by 2035, supported by its strong premium construction sector, advanced home improvement technology capabilities, and comprehensive residential renovation industry serving diverse interior door applications across Europe.

France follows with a 19.2% share in 2025, projected to reach 19.6% by 2035, driven by robust demand for interior wood doors in luxury home construction, residential renovation programs, and premium interior design applications, combined with established home improvement infrastructure and architectural design expertise. The United Kingdom holds a 17.4% share in 2025, expected to reach 17.8% by 2035, supported by strong home improvement technology sector and growing residential renovation activities. Italy commands a 13.1% share in 2025, projected to reach 13.4% by 2035, while Spain accounts for 8.9% in 2025, expected to reach 9.2% by 2035.

The Netherlands maintains a 4.6% share in 2025, growing to 4.8% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Poland, and other nations, is anticipated to maintain momentum, with its collective share moving from 3% to 2% by 2035, attributed to increasing residential modernization in Eastern Europe and growing home improvement penetration in Nordic countries implementing advanced residential construction programs.

The residential interior wood doors market is characterized by competition among established door manufacturers, specialized interior design producers, and integrated home improvement solutions providers. Companies are investing in smart door technology research, design customization optimization, premium manufacturing system development, and comprehensive product portfolios to deliver consistent, high-performance, and application-specific residential interior door solutions. Innovation in IoT-enabled systems, custom design integration, and installation efficiency enhancement is central to strengthening market position and competitive advantage.

JELD-WEN leads the residential interior wood doors market with a strong market share, offering comprehensive residential interior door solutions, including advanced design systems with a focus on residential construction and home improvement applications. ASSA ABLOY provides specialized door technology capabilities with an emphasis on security integration and automated access systems. Simpson Door Company delivers innovative premium door products with a focus on solid wood platforms and luxury residential applications. TruStile Doors specializes in custom design and premium door technologies for high-end residential construction. Woodport Doors focuses on affordable door solutions and residential construction equipment. Lynden Doors offers specialized door platforms with emphasis on commercial, residential, and construction applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 19,051.8 million |

| Product Types | Budget-Friendly Doors; Mid-Range / Standard Doors; Premium & Designer Quality Doors; High-End Luxury Solid Wood Doors |

| Applications | Bedroom Doors; Kitchen Doors; Bathroom Doors; Others |

| Material Grades | Engineered Wood; Solid Wood; Composite Wood Systems |

| Installation Types | Pre-Hung Doors; Slab Doors; Complete Door Systems |

| Distribution Channels | Home Improvement Stores; Specialty Retailers; Online Channel Sales; Direct Manufacturer Sales |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+40 additional countries) |

| Key Companies Profiled | JELD-WEN; ASSA ABLOY; simpson Door Company; TruStile Doors; Woodport Doors |

| Additional Attributes | Dollar sales by product type & application category; Regional demand trends; Competitive landscape; Technological advancements in smart door systems; Custom design development; IoT integration innovation; Home improvement service integration |

The global residential interior wood doors market is estimated to be valued at USD 19,051.8 million in 2025.

The market size for the residential interior wood doors market is projected to reach USD 26,874.4 million by 2035.

The residential interior wood doors market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in residential interior wood doors market are mid-range/standard doors, budget-friendly doors, premium and designer quality doors and high-end luxury solid wood doors.

In terms of application, bedroom doors segment to command 38.7% share in the residential interior wood doors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA