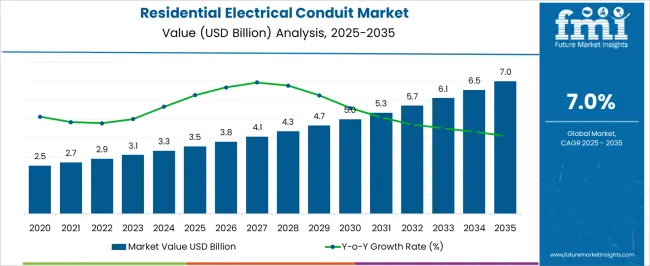

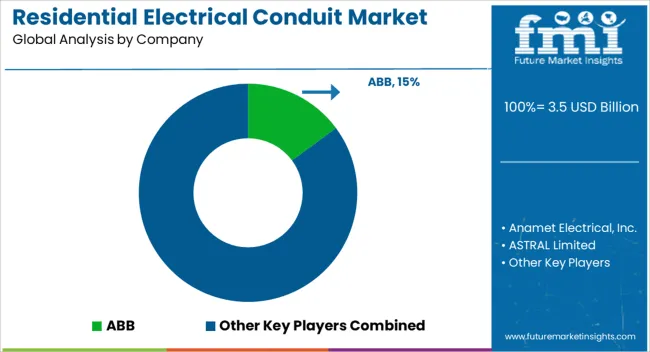

The residential electrical conduit market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 7.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

The residential electrical conduit market is valued at USD 3.5 billion in 2025 and is expected to reach USD 7.0 billion by 2035, with a CAGR of 7.0%. From 2021 to 2025, the market grows from USD 2.5 billion to USD 3.5 billion, passing through intermediate values of USD 2.7 billion, 2.9 billion, 3.1 billion, and 3.3 billion. This early growth phase is driven by the increasing demand for electrical infrastructure in residential construction and renovation, coupled with the need for improved safety and durability in wiring systems. The rise in urbanization and growing housing projects, particularly in developing regions, contributes to the steady increase in conduit adoption.

Between 2026 and 2030, the market continues its upward trajectory, moving from USD 3.5 billion to USD 5.0 billion, with intermediate values of USD 3.8 billion, 4.1 billion, and 4.3 billion. The market experiences stronger growth during this period, as more builders and homeowners opt for modern electrical systems to meet increasing energy demands and safety standards. From 2031 to 2035, the market reaches USD 7.0 billion, with values progressing through USD 5.3 billion, 5.7 billion, 6.1 billion, and 6.5 billion. This late phase is marked by the maturation of residential infrastructure, continued regulatory pressure on safety standards, and the growing integration of smart home technologies, further driving demand for electrical conduits.

| Metric | Value |

|---|---|

| Residential Electrical Conduit Market Estimated Value in (2025 E) | USD 3.5 billion |

| Residential Electrical Conduit Market Forecast Value in (2035 F) | USD 7.0 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The construction market is the largest contributor, accounting for approximately 35-40%, as electrical conduits are essential in new residential construction projects for safe wiring and power distribution. The electrical equipment and supplies market follows with around 25-30%, as conduits are a critical part of electrical installations and infrastructure. The demand for wiring systems in residential buildings drives the need for high-quality conduit products. The home improvement market contributes about 15-18%, as more homeowners engage in DIY projects and home renovations, which often require electrical installations.

Conduits are necessary for safe and durable wiring systems in these projects. The renewable energy market accounts for approximately 10-12%, with the rising trend of integrating solar panels and other renewable energy solutions into homes. These systems require specialized wiring protection, driving the demand for electrical conduits. Finally, the plumbing and HVAC market contributes around 8-10%, as residential projects often require integrated systems that include both plumbing and electrical conduits. This creates additional demand for conduit solutions during construction and renovation.

The residential electrical conduit market is experiencing stable growth as urbanization, housing developments, and renovation activities continue to rise globally. The increasing demand for safe, code-compliant electrical infrastructure in new residential constructions and retrofit projects has reinforced the importance of durable conduit systems.

Emphasis on structured electrical wiring and enhanced fire safety has led to broader adoption of standardized conduit solutions. Moreover, technological advancements in smart homes and electrical load requirements have prompted homeowners and contractors to invest in high-performance conduit systems that offer long-term reliability and ease of installation.

The market is poised for further growth due to expanding residential construction in emerging economies, stricter building regulations, and growing awareness of the long-term benefits of quality electrical conduit installations. The convergence of energy-efficient housing policies and improved electrical planning continues to influence product innovation and market expansion

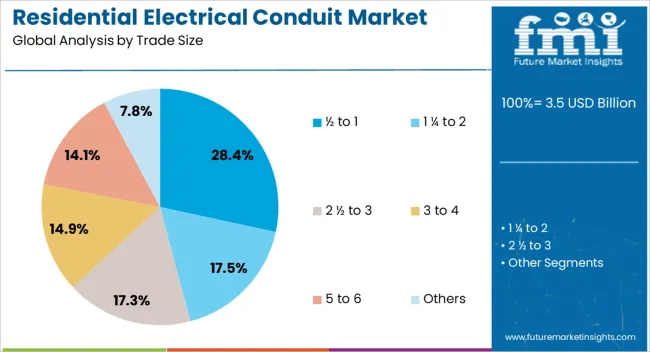

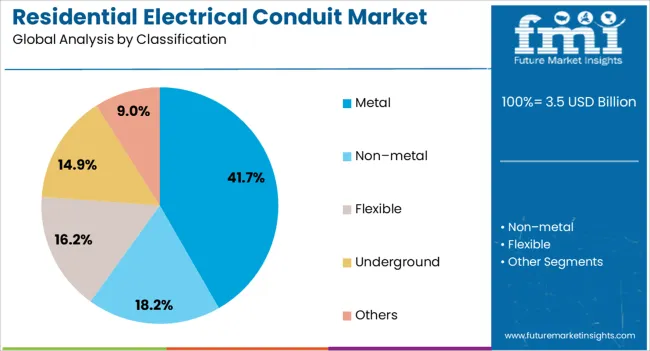

The residential electrical conduit market is segmented by trade size, classification, and geographic regions. By trade size, residential electrical conduit market is divided into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and others. In terms of classification, residential electrical conduit market is classified into metal, non–metal, flexible, underground, and others. Regionally, the residential electrical conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ½ to 1 trade size segment represents 28.4% of the residential electrical conduit market, owing to its widespread use in low to medium-load residential electrical applications. This size range is preferred for its ease of handling, cost-effectiveness, and compatibility with standard residential wiring systems. It is extensively utilized in both new housing units and remodeling projects, offering flexibility in routing electrical conductors through walls, ceilings, and floors.

The segment has maintained consistent demand due to its suitability for lighting circuits, receptacles, and small appliances, where high voltage or heavy current is not required. Additionally, the growing trend toward concealed wiring and aesthetically driven electrical installations further supports its adoption.

The ability to meet safety codes and accommodate common conductor sizes makes this segment a standard choice for electricians and contractors. As residential electrical infrastructure becomes more structured and regulated, the ½ to 1 trade size segment is expected to retain its prominence in the market

The metal segment dominates the classification category with a 41.7% market share, driven by its robust performance in protecting electrical conductors against physical and environmental damage. Metal conduits, including steel and aluminum variants, are widely used in residential settings where mechanical protection, grounding, and fire resistance are critical.

This segment has gained preference due to its durability, recyclability, and compliance with residential building codes that require higher safety standards. Metal conduits are particularly favored in regions prone to rodent intrusion, extreme weather, or seismic activity where added protection is essential.

The segment also benefits from advancements in corrosion-resistant coatings and lightweight construction, making installation more efficient. With a growing focus on safety and longevity in residential electrical systems, the demand for metal conduit solutions is anticipated to remain strong, especially in high-density housing and upscale residential projects that prioritize long-term performance and code adherence

Electrical conduits are essential components used to protect wiring systems in homes, ensuring the safe distribution of electricity and preventing damage from environmental factors. The market is driven by increased construction activities, rising safety standards, and the growing need for energy-efficient homes. Furthermore, the shift toward smart homes, where advanced electrical systems and automation require robust wiring protection, is fueling demand for high-quality conduits. However, challenges such as fluctuating material costs, installation complexities, and regulatory compliance requirements may hinder growth. Opportunities exist in the development of lightweight, durable, and environmentally-friendly conduit materials.

The growing demand for residential electrical conduit systems is largely driven by the need for safe, efficient, and durable electrical installations. With increased concerns over electrical hazards, fire safety, and electrical system performance, conduits play a crucial role in protecting wiring from physical damage and environmental factors like moisture and heat. As more homes adopt complex electrical systems, such as home automation and smart technologies, the need for reliable conduit solutions is increasing. Rising construction and renovation activities across the globe, particularly in emerging economies, are contributing to the growing adoption of residential electrical conduits. This demand for safer, more efficient electrical systems is set to continue as regulatory standards around electrical safety become stricter.

The residential electrical conduit market faces several challenges related to material costs, installation difficulties, and regulatory compliance. Fluctuations in raw material prices, such as for PVC, steel, and aluminum, can impact the overall cost of electrical conduit systems, making it difficult for manufacturers to offer competitive pricing. Additionally, the installation of electrical conduits requires skilled labor, which can add to project costs and complexity. Varying regulations across regions regarding conduit specifications, fire resistance, and environmental performance complicate market entry for international suppliers. Navigating these regulatory challenges while maintaining product quality and meeting safety standards will be key to success in this market.

Opportunities in the residential electrical conduit market are emerging with the development of lightweight, durable, and eco-friendly conduit materials. As consumers and builders increasingly seek cost-effective and high-performance electrical solutions, manufacturers are focusing on developing conduits that are not only easy to install but also offer enhanced durability and resistance to wear and tear. Additionally, there is rising interest in eco-friendly conduit solutions that reduce environmental impact. Materials such as recycled plastics, biodegradable options, and conduit systems with lower carbon footprints are gaining traction as demand for greener building solutions grows. Companies that can offer innovative, sustainable, and cost-effective conduit solutions are well-positioned to capture market share.

The residential electrical conduit market is witnessing trends related to the integration of electrical systems in smart homes and the development of advanced conduit systems. As smart home technology becomes more mainstream, electrical systems require additional protection and organization, driving demand for more sophisticated conduit solutions. Flexible conduits that can be easily routed around obstacles and provide better protection for high-performance wiring are gaining popularity. Additionally, new innovations, such as multi-functional conduit systems that combine protection with integrated cable management or energy-efficient features, are becoming more common. These advancements in conduit systems are responding to the growing complexity of residential electrical installations and the demand for higher levels of safety, performance, and convenience.

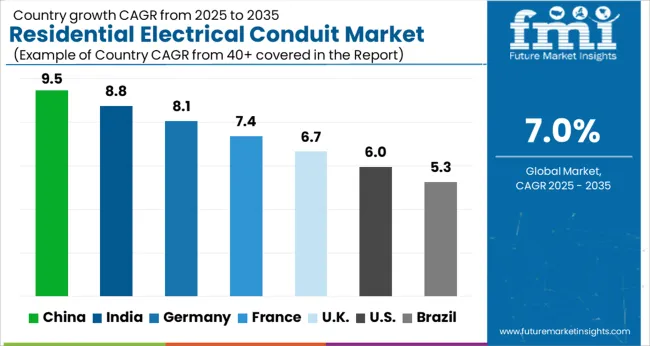

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

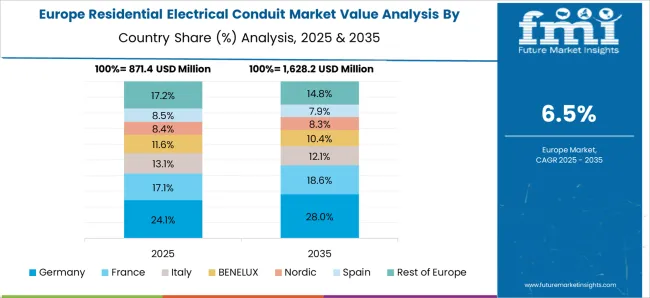

The global residential electrical conduit market is expected to grow at a CAGR of 7.0% from 2025 to 2035. China leads with the highest growth rate of 9.5%, followed by India at 8.8%. France, the UK, and the USA show moderate growth rates of 7.4%, 6.7%, and 6.0%, respectively. The market is driven by the expanding residential real estate sectors, increasing focus on electrical safety, and growing demand for energy-efficient and high-quality electrical systems. As urbanization continues and housing demand rises globally, the market for electrical conduits is expected to experience steady growth. The analysis spans over 40+ countries, with the leading markets shown below

The residential electrical conduit market in China is expected to grow at a CAGR of 9.5% from 2025 to 2035. As China continues to urbanize at a rapid pace, the demand for residential buildings, along with their infrastructure needs, is on the rise. The growth of the construction and real estate sectors, driven by both private and government investments in housing, is a key factor boosting the demand for electrical conduits. China's push for modernization in urban infrastructure and the increasing emphasis on safe, efficient electrical systems further propels market growth. The need for electrical conduits to organize and protect wiring in residential construction is a growing trend, especially as safety standards and regulations are becoming stricter. The adoption of advanced materials like PVC and HDPE in conduit production is also contributing to the market's expansion.

The residential electrical conduit market in India is anticipated to grow at a CAGR of 8.8% from 2025 to 2035. The Indian market is being propelled by the ongoing expansion of residential real estate, along with increasing investments in urban infrastructure. The demand for safe and organized electrical wiring systems is rising as more residential areas are being developed, especially in metropolitan cities. The construction sector’s rapid growth, driven by government housing projects and the booming middle-class population, is contributing to the demand for electrical conduits. As electricity consumption increases in residential sectors, the need for efficient, long-lasting electrical systems becomes more critical. This, in turn, boosts the demand for high-quality electrical conduits that ensure the safety and protection of wiring installations.

The residential electrical conduit market in France is expected to grow at a CAGR of 7.4% from 2025 to 2035. As a developed country with a strong focus on maintaining high standards in construction and electrical safety, France’s demand for residential electrical conduits is growing steadily. The country’s residential real estate sector is expanding, particularly in suburban and peri-urban areas, as more people opt for energy-efficient homes and apartments. With a focus on sustainable building practices and long-term energy savings, the market for conduits used in residential wiring systems is increasing. France’s preference for high-quality and durable materials for electrical installations is driving demand for premium conduit products, such as PVC and metal conduits.

The UK residential electrical conduit market is projected to grow at a CAGR of 6.7% from 2025 to 2035. The demand for electrical conduits in the UK is primarily driven by the expanding housing market and government initiatives aimed at addressing the housing shortage. As more residential buildings are constructed, the need for safe, effective, and compliant electrical systems is rising. The UK’s focus on improving the energy efficiency of homes has spurred the adoption of better insulation and wiring protection systems. This is contributing to an increased need for high-quality electrical conduits that ensure both safety and efficiency in residential construction.

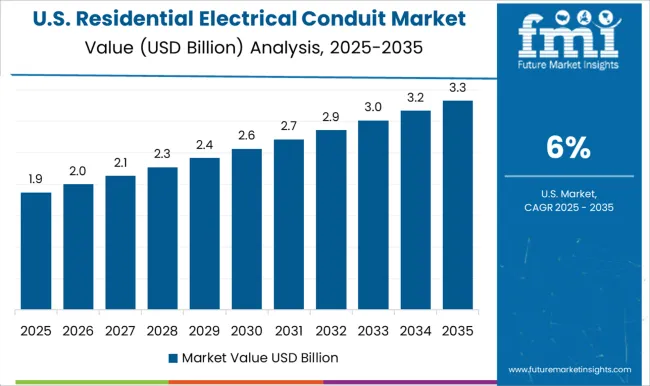

The USA residential electrical conduit market is anticipated to grow at a CAGR of 6.0% from 2025 to 2035. As the demand for new housing continues to rise in the USA, particularly in suburban areas, the market for electrical conduits is expected to expand. Residential construction is a significant driver of this growth, as electrical systems are a critical part of every new home. The USA market is seeing increasing demand for advanced materials in conduit systems, such as non-corrosive, fire-resistant, and environmentally-friendly options. The growing awareness of safety standards and energy efficiency is further boosting the adoption of high-quality electrical conduits.

The residential electrical conduit market is driven by demand for reliable, durable, and safe electrical systems in homes. Leading players like ABB and Schneider Electric compete by offering comprehensive conduit systems that emphasize easy installation and long-lasting performance. ABB focuses on providing high-quality conduit solutions designed to ensure safety and regulatory compliance in residential electrical installations. Their product offerings highlight advanced materials that offer protection from fire and electrical hazards. Schneider Electric follows a similar strategy, concentrating on creating flexible conduit systems for residential wiring that balance performance and safety. Their products are marketed with emphasis on simplicity in installation and a robust design to prevent accidents.

Atkore and Hubbell target high-performance needs with their specialized conduit solutions. Atkore offers steel and PVC conduits known for their durability and protection against mechanical damage and environmental stress. Their products are particularly highlighted for their resistance to corrosion and impact, ideal for high-risk residential applications. Hubbell, on the other hand, provides versatile conduit systems that prioritize both safety and ease of use, making their products suitable for a variety of residential wiring needs. CANTEX INC. and Electri-Flex Company focus on flexibility and weather resistance in their offerings, catering to homeowners needing adaptable conduit solutions that can withstand extreme temperatures and moisture.

Champion Fiberglass, Inc. and Anamet Electrical, Inc. offer more specialized conduit products. Champion Fiberglass specializes in lightweight, corrosion-resistant fiberglass conduits, ideal for installations where durability and weather resistance are crucial. Anamet Electrical provides flexible metal conduit systems that offer enhanced protection and are marketed for their ability to conform to various residential wiring needs while providing secure electrical pathways. Product brochures from these companies highlight features like ease of installation, safety benefits, and material durability. Many brochures focus on fire resistance, moisture protection, and the long-term reliability of their conduit systems, positioning their products as essential for safe and efficient residential electrical installations.

| Items | Values |

|---|---|

| Quantitative Units | USD 3.5 billion |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Classification | Metal, Non–metal, Flexible, Underground, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Anamet Electrical, Inc., ASTRAL Limited, Atkore, Austro Pipes, CANTEX INC., Champion Fiberglass, Inc., Electri-Flex Company, Guangdong Ctube Industry Co., Ltd., HellermannTyton, Hubbell, legrand, Liberty Electric Products, Schneider Electric, Tubecon, Wienerberger AG, and Zekelman Industries |

| Additional Attributes | Dollar sales of conduits span PVC, steel, flexible, and fiberglass, applied in residential, commercial, and industrial use. Growth is driven by safety, smart homes, durability, with strong demand in North America, Europe, and Asia-Pacific. |

The global residential electrical conduit market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the residential electrical conduit market is projected to reach USD 7.0 billion by 2035.

The residential electrical conduit market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in residential electrical conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of classification, metal segment to command 41.7% share in the residential electrical conduit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA