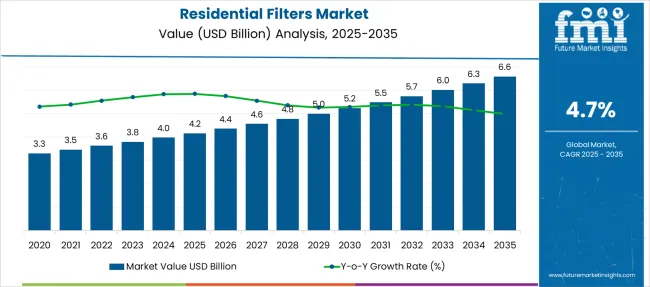

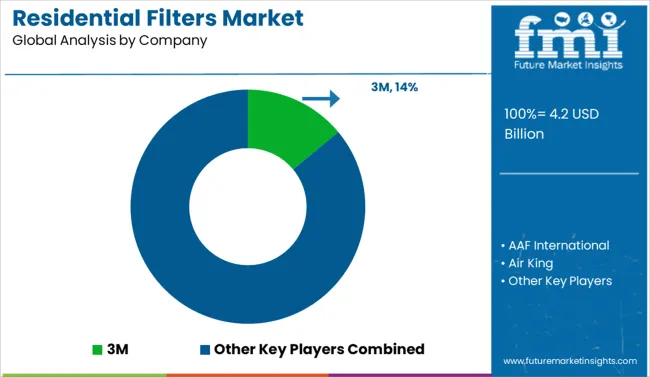

The Residential Filters Market is estimated to be valued at USD 4.2 billion in 2025 and is projected to reach USD 6.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| Residential Filters Market Estimated Value in (2025E) | USD 4.2 billion |

| Residential Filters Market Forecast Value in (2035F) | USD 6.6 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The residential filters market is undergoing steady growth, driven by heightened awareness of indoor air quality, stricter building codes, and growing health-consciousness among homeowners. Demand has been reinforced by increased incidences of respiratory illnesses and consumer preference for energy-efficient homes equipped with advanced filtration systems.

Manufacturers are focusing on developing cost-effective and high-performance filters to meet evolving efficiency standards while maintaining affordability. Future growth is expected to be supported by the adoption of smart HVAC systems, advancements in filter media technology, and rising renovation and retrofitting activities in mature housing markets.

Changing lifestyle patterns and regulatory emphasis on healthy living environments are creating further opportunities for product innovation and market expansion.

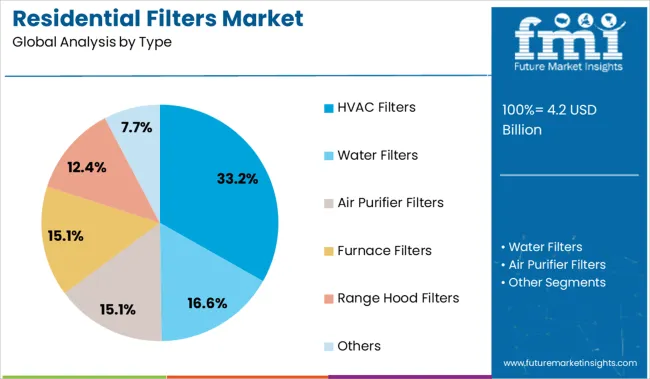

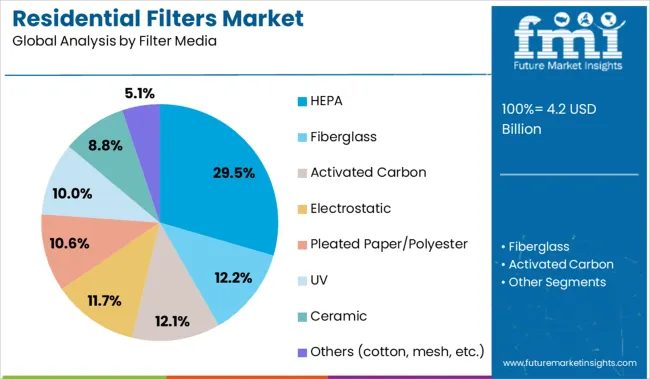

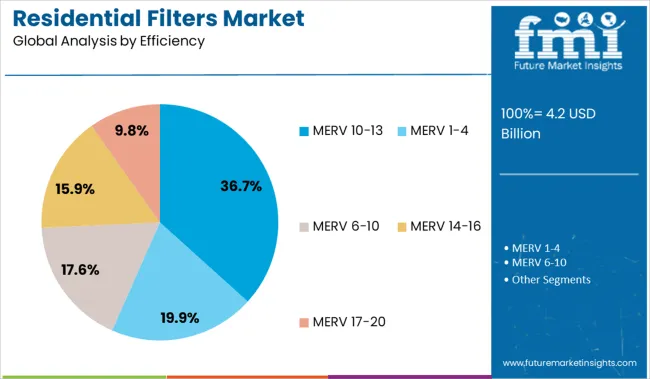

The residential filters market is segmented by type, filter media, efficiency, and application and geographic regions. The residential filters market is divided by type into HVAC Filters, Water Filters, Air Purifier Filters, Furnace Filters, Range Hood Filters, and Others. In terms of filter media, the residential filters market is classified into HEPA, Fiberglass, Activated Carbon, Electrostatic, Pleated Paper/Polyester, UV, Ceramic, and Others (cotton, mesh, etc.). Based on the efficiency of the residential filters, the market is segmented into MERV 10-13, MERV 1-4, MERV 6-10, MERV 14-16, and MERV 17-20. By application of the residential filters, the market is segmented into Air Filtration, Water Filtration, and Others (Refrigeration, Washing Machine, etc.). Regionally, the residential filters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, HVAC filters are expected to hold 33.2% of the total market revenue in 2025, making it the leading type segment. This leadership has been driven by widespread adoption of centralized heating and cooling systems in residential settings, which require regular replacement of filters to maintain optimal performance and indoor air quality.

The ability of HVAC filters to remove a wide range of airborne contaminants while supporting energy efficiency has strengthened their position. Enhanced consumer awareness about the importance of preventive maintenance and the role of HVAC filters in extending equipment life has also supported growth.

Manufacturers have responded by offering a variety of options tailored to different system requirements and homeowner preferences, further consolidating this segment’s dominance.

In terms of filter media, HEPA is projected to account for 29.5% of the market revenue share in 2025, making it the most prominent media type. This position has been driven by its proven ability to capture fine particulate matter and allergens, addressing growing consumer demand for cleaner indoor environments.

The high efficiency and reliability of HEPA media in trapping dust, pollen, pet dander, and microbial contaminants have made it a preferred choice among health-conscious homeowners. Increasing incorporation of HEPA filters into portable air purifiers and integrated HVAC systems has also expanded its use in residential applications.

Advances in manufacturing techniques enabling thinner and more durable HEPA media have improved airflow without compromising filtration efficiency, strengthening this segment’s appeal.

Segmenting by efficiency reveals that filters with MERV ratings between 10 and 13 are expected to hold 36.7% of the market revenue in 2025, ranking as the leading efficiency segment. This prominence has been driven by the balance these filters achieve between effective particle capture and system compatibility, aligning well with residential HVAC system capabilities.

Homeowners have favored this range due to its ability to remove most common indoor pollutants without placing excessive strain on equipment. Rising awareness of the benefits of mid to high efficiency filtration in preventing allergies and improving overall health has further propelled adoption.

The availability of affordable and widely compatible options within this range has supported its leadership, catering to a broad spectrum of households seeking improved air quality without significant upgrades to existing systems.

Growing interest in healthier home environments and allergy reduction is fueling the residential filters market. Opportunities emerge from smart air and water filtration systems, local manufacturing, and bundled service agreements.

Rising awareness about pollutants, allergens, and airborne irritants is encouraging households to invest in air filters. Many families now purchase HEPA or activated carbon filters to reduce dust, pollen, mold spores, and odours. Indoor smoking, pet dander, and cooking byproducts further amplify demand in kitchens and living spaces. Water filters are also in high demand as concerns grow about chlorine, microplastics, and heavy metal contaminants. Consumer shift towards non pharmaceutical preventive health behaviors is strengthening adoption. Retail and ecommerce channels, along with home improvement stores and utility rebate programmes, support sales. Device leasing models and filter subscription services simplify maintenance. These combined influences position residential filters as essential tools for everyday comfort and hygiene in urban and suburban homes.

Next phase growth lies in combining air or water filters with smart home systems for usage tracking and filter life alerts. Devices with app notifications remind users when filter replacements are due, while integrated sensors measure air quality or water turbidity in real time. Collaborations with local mechanical service firms or plumbing providers enable bundle offers that include installation, maintenance, and filter replacement. Local manufacturing reduces logistical lead times and allows custom designs suited to regional water quality or pollution concerns. Targeting new residence types such as rentals or serviced apartments with subscription models further expands reach. Partnerships with healthcare providers or wellness platforms can reinforce value messaging and accelerate adoption among health conscious consumers, families with young children, and elderly households.

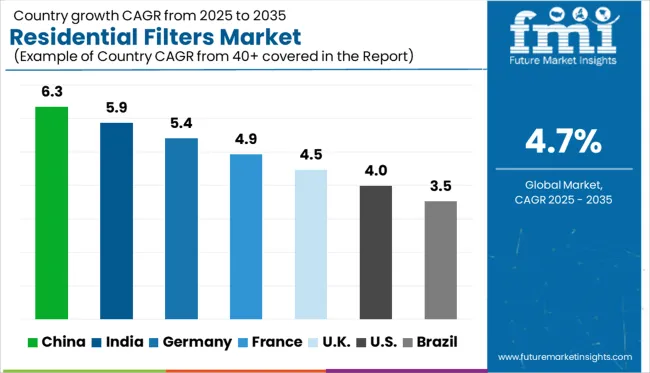

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

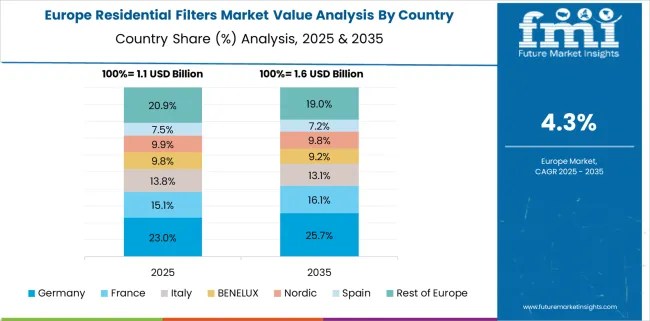

The global residential filters market is forecast to grow at a CAGR of 4.7% from 2025 to 2035, propelled by heightened awareness of indoor air quality, water purification demands, and health-focused infrastructure upgrades. BRICS countries are spearheading growth, with China expanding at 6.3% CAGR due to rapid urbanization, rising disposable incomes, and strong air and water filtration mandates. India follows with 5.9%, driven by smart city initiatives, growing middle-class adoption, and increasing penetration of advanced filtration systems. Germany, part of the OECD, is registering a 5.4% CAGR, reflecting demand for high-efficiency particulate systems and eco-certified solutions. The UK (4.5%) and US (4.0%) demonstrate steady growth, shaped by home renovation cycles and technological upgrades in mature filter markets. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is expected to lead global growth in the residential filters market with a CAGR of 6.3%, reflecting rapid urbanization and mounting concerns over indoor air quality. Unlike the United States, where market expansion is maturing, China continues to register new installations across second- and third-tier cities. Regulatory focus on PM2.5 and VOC reduction is pushing households toward higher-grade HEPA and activated carbon filters. As smart home ecosystems expand, filter compatibility with connected air systems is becoming a major value driver.

Residential filters market in India is projected to grow at a CAGR of 5.9%, with rising middle-class awareness and frequent seasonal pollution spikes driving demand. Unlike Germany, where growth is anchored in sustainability regulation, India’s momentum is more reactive, responding to worsening AQI conditions. Growth is centered in metro areas, with Delhi NCR, Mumbai, and Bangalore accounting for the largest share. However, cost remains a barrier to broader rural adoption. Domestic manufacturing and imports are both increasing to meet volume needs.

In Germany, the market for residential filters is expected to expand at a CAGR of 5.4%, reflecting a stable, sustainability-conscious consumer base. In contrast to India’s reactive demand patterns, Germany’s growth is rooted in long-term energy efficiency goals and indoor environmental standards. Consumers are increasingly opting for eco-certified, recyclable filters compatible with energy-efficient HVAC systems. While demand is less volatile than in China, purchasing behavior is consistent and highly brand loyal.

The United Kingdom is on track to register a CAGR of 4.5% in its residential filters market, driven by health-conscious urban consumers and aging housing stock with poor ventilation. While slower than growth in Germany or India, the market benefits from rising awareness of indoor allergens and mold. Unlike China, where entire building blocks are retrofitted at scale, the UK market is fragmented, with DIY and portable filters leading demand. Economic pressures have limited high-end filter adoption, shifting focus to mid-range, multipurpose units.

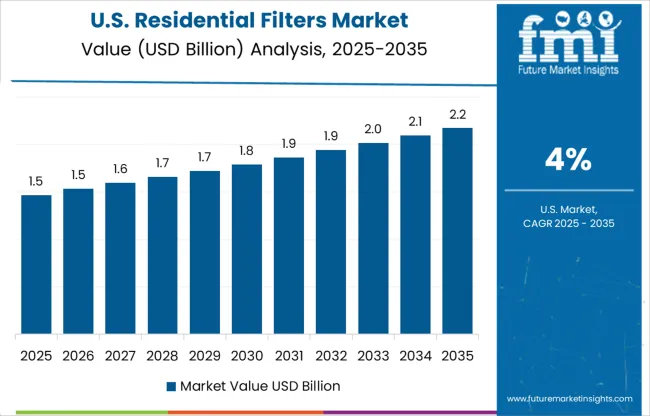

In the United States, the residential filters market is expected to grow at a CAGR of 4%, the lowest among the top five. Despite being a mature market with high product penetration, most sales are replacement-driven rather than new installations. Unlike in China or India, where first-time buyers dominate, US consumers are focused on filter performance, MERV ratings, and energy impact. Seasonal demand peaks during wildfire seasons and pollen-heavy months. The market leans toward e-commerce, with subscription models gaining traction for filter replacement.

The residential filters market is fragmented, with a wide range of players offering diverse filtration technologies across air and water categories. 3M, through its Filtrete brand, leads with advanced air filtration solutions, driven by innovation in electrostatic and allergen-reducing filters. Competitors like Honeywell, Dyson, and Blueair focus on HEPA and smart air purifiers, targeting premium and health-conscious segments. In water filtration, Brita, Puronics, and Greenway maintain strong brand recognition. Emerging eco-conscious trends have pushed companies like Coway and Air King to develop sustainable and energy-efficient solutions. Strategic differentiation lies in filtration efficiency, IoT integration, brand trust, and health-centric marketing.

On March 12, 2025, Carrier released its first Environmental Product Declaration (EPD) for North American residential HVAC systems, disclosing lifecycle impacts, CO₂ emissions, energy usage, and resource consumption for the Comfort™ Fan Coil and Performance™ Compact Heat Pump lines.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.2 Billion |

| Type | HVAC Filters, Water Filters, Air Purifier Filters, Furnace Filters, Range Hood Filters, and Others |

| Filter Media | HEPA, Fiberglass, Activated Carbon, Electrostatic, Pleated Paper/Polyester, UV, Ceramic, and Others (cotton, mesh, etc.) |

| Efficiency | MERV 10-13, MERV 1-4, MERV 6-10, MERV 14-16, and MERV 17-20 |

| Application | Air Filtration, Water Filtration, and Others (Refrigeration, Washing Machine, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, AAF International, Air King, Blueair, Brita, Coway, Dyson, Filtrete, Greenway, Honeywell, Lennox International, Puronics, Trane, Vornado, and Whirlpool |

| Additional Attributes | Dollar sales by filter type, filtration technology, and housing type; regional demand driven by air and water quality concerns, urbanization, and regulatory standards; innovation in smart filters, HEPA efficiency, and eco-friendly materials; cost dynamics shaped by replacement cycles, energy usage, and distribution models; environmental impact from disposable filter waste; and emerging use cases in smart homes, allergy prevention, and sustainable living solutions. |

The global residential filters market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the residential filters market is projected to reach USD 6.6 billion by 2035.

The residential filters market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in residential filters market are hvac filters, water filters, air purifier filters, furnace filters, range hood filters and others.

In terms of filter media, hepa segment to command 29.5% share in the residential filters market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA