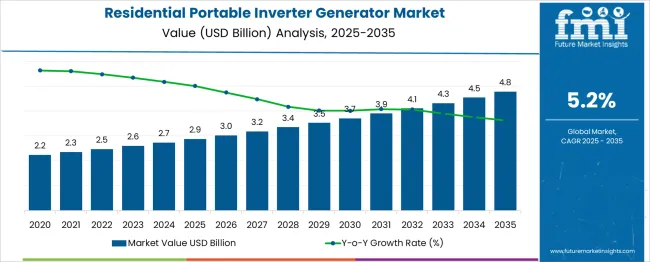

The Residential Portable Inverter Generator Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 4.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. Price evolution and average selling price (ASP) trends in this market reflect a combination of steady demand growth, incremental technological enhancements, and cost optimization strategies by manufacturers.

The market trajectory from USD 2.9 billion in 2025 to USD 4.8 billion in 2035 indicates a gradual but consistent increase in unit values and revenue contribution, driven by product upgrades, efficiency improvements, and enhanced features such as quieter operation, higher fuel efficiency, and inverter stability. Over the forecast period, incremental increases in ASP are expected as manufacturers integrate smart control systems, battery storage compatibility, and IoT-enabled monitoring into residential generators.

Initial years show modest growth from USD 2.9 billion to USD 3.5 billion by 2030, reflecting standard market adoption and limited premium pricing. Post-2030, ASP growth accelerates slightly as consumer preference shifts toward higher-end, feature-rich units, contributing to a market value of USD 4.8 billion by 2035.

The competitive pricing pressure from emerging regional manufacturers may counterbalance ASP growth, necessitating cost-efficiency improvements in production, logistics, and component sourcing. The market demonstrates a steady upward trend in price and ASP, underpinned by technology adoption, feature differentiation, and incremental value addition across the 2025–2035 period.

| Metric | Value |

|---|---|

| Residential Portable Inverter Generator Market Estimated Value in (2025 E) | USD 2.9 billion |

| Residential Portable Inverter Generator Market Forecast Value in (2035 F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

Rising instances of power outages, coupled with growing demand for clean and stable electricity for sensitive appliances, are accelerating adoption. Advancements in inverter technology have improved fuel efficiency, reduced noise levels, and minimized emissions, making these generators more appealing for residential users. Increasing urbanization, higher disposable incomes, and greater awareness of energy resilience are also driving the market forward.

Future growth is anticipated to be supported by innovation in lightweight materials, digital controls, and integration with renewable energy systems. Consumer preferences are shifting toward sustainable and user-friendly solutions, paving the way for broader penetration across diverse residential settings.

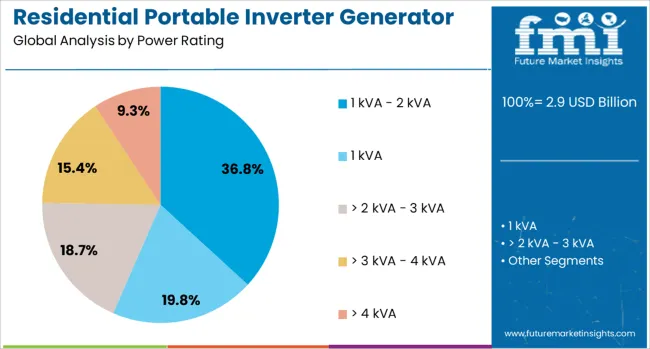

The residential portable inverter generator market is segmented by power rating, power source, and geographic regions. By power rating, the residential portable inverter generator market is divided into 1 kVA - 2 kVA, 2 kVA, 3 kVA - 4 kVA, and 4 kVA.

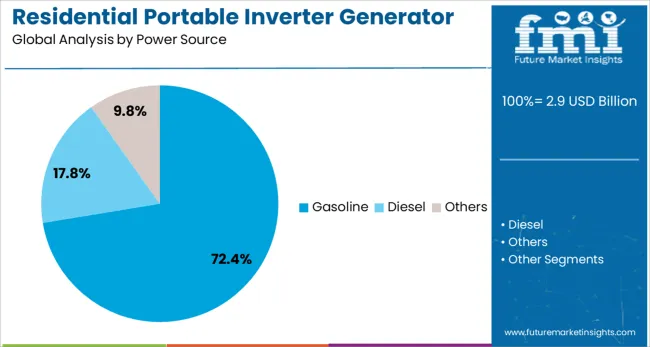

In terms of power source, the residential portable inverter generator market is classified into Gasoline, Diesel, and others. Regionally, the residential portable inverter generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by power rating, the 1 kVA to 2 kVA segment is expected to hold 36.8% of the total market revenue in 2025, positioning it as the leading power rating category. This dominance is being driven by the segment’s suitability for most household and recreational applications that require moderate power output.

Compact size, light weight, and ease of transport have made generators in this range particularly attractive for residential users seeking convenience and reliability. Their ability to efficiently power essential appliances without excessive fuel consumption has further reinforced their appeal.

Increased focus on energy efficiency and affordability has supported adoption within this segment, as consumers opt for right-sized solutions that balance performance with cost-effectiveness. The versatility of this power range for both indoor backup and outdoor leisure activities has solidified its leadership in the market.

Segmented by power source, gasoline-powered generators are projected to account for 72.4% of the market revenue in 2025, maintaining a clear lead over other fuel types. This leadership is being supported by the widespread availability and affordability of gasoline, which enhances convenience for residential users.

The relatively lower upfront cost of gasoline-powered units, combined with established fueling infrastructure, has bolstered their preference in the market. Technological improvements have also mitigated traditional drawbacks such as noise and emissions, making these generators more acceptable for residential environments.

Consumers have continued to favor gasoline units due to their quick start capability, portability, and suitability for intermittent use without significant maintenance requirements. The combination of cost advantages, operational ease, and reliable performance has entrenched the gasoline segment at the forefront of the residential portable inverter generator market.

Advancements in inverter technology, fuel efficiency, and compact design have supported market growth. Rising residential electrification, smart home adoption, and awareness of uninterrupted power supply requirements have further strengthened the deployment of portable inverter generators globally.

The increasing reliance on electricity for household appliances, home offices, and smart devices has been a primary driver of the residential portable inverter generator market. Consumers have increasingly sought reliable power sources during grid instability, blackouts, or maintenance periods. Portable generators have been preferred due to their ease of transportation, compact size, and capability to supply stable, clean electricity suitable for sensitive electronics. Seasonal weather events, natural disasters, and regional power disruptions have further reinforced the adoption of inverter generators in residential settings. Additionally, urban households with limited space have favored units that combine portability with high output, enabling temporary power supply without compromising convenience or safety. This growing dependence on uninterrupted power has fueled widespread deployment of residential portable inverter generators across both developed and emerging markets.

Technological innovations have significantly improved the performance, efficiency, and usability of residential portable inverter generators. Modern units are equipped with advanced inverter systems that produce stable voltage and frequency, protecting sensitive electronics from damage. Fuel-efficient engines, quiet operation designs, and lightweight construction have improved consumer convenience and reduced operational costs. Digital monitoring systems, USB outlets, and parallel connectivity options have enhanced versatility for powering multiple devices simultaneously. Low-emission and environmentally friendly models with hybrid fuel options have addressed regulatory and sustainability concerns. Compact, ergonomic designs have facilitated easy storage and portability, making these generators suitable for a variety of residential applications, including outdoor activities, remote areas, and emergency backup, further increasing market adoption globally.

The proliferation of smart home devices and connected appliances has increased the demand for portable inverter generators in residential settings. Home automation systems, security cameras, heating and cooling units, and entertainment systems require stable and uninterrupted electricity. Portable inverter generators have been deployed to provide clean power that prevents damage to sensitive devices while supporting backup energy needs. Integration with solar panels, battery storage, and energy management systems has further expanded applications in residential environments. Urban homeowners, particularly in regions with frequent power disruptions, have favored inverter generators for their compactness, ease of use, and reliable performance. This intersection of technology adoption, home automation, and the need for uninterrupted power has driven the growth of residential portable inverter generators.

Energy-efficient and eco-friendly portable inverter generators have presented significant growth opportunities in the residential market. Manufacturers have developed units with improved fuel economy, reduced carbon emissions, and lower noise levels to meet regulatory requirements and consumer preferences. Renewable energy integration, such as hybrid solar-inverter systems, has further enhanced market potential. Portable designs that support modular expansion and parallel operation have allowed households to scale power output based on demand. Rising environmental awareness, government incentives for clean energy solutions, and the growing demand for off-grid power in suburban and rural areas have reinforced adoption. The combination of energy efficiency, environmental responsibility, and consumer convenience is expected to drive continued growth of residential portable inverter generators globally.

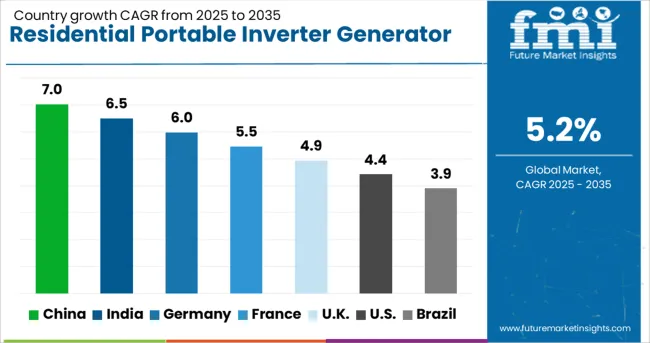

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

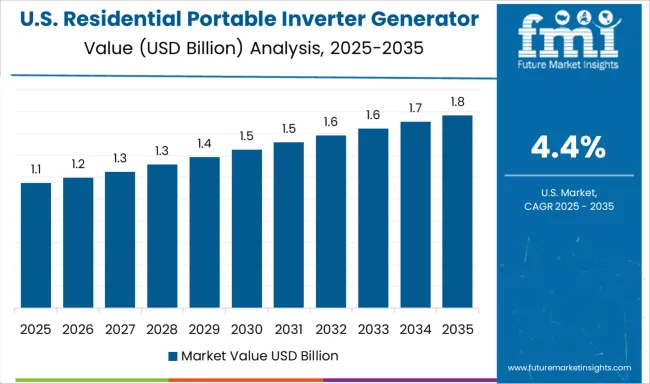

| USA | 4.4% |

| Brazil | 3.9% |

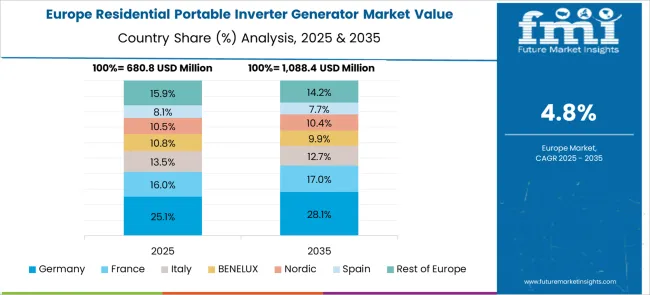

The market is expected to grow at a CAGR of 5.2% between 2025 and 2035, driven by rising demand for backup power solutions and increasing adoption of energy-efficient inverter technology. China leads with a 7.0% CAGR, supported by widespread residential electrification and growing consumer preference for reliable power sources. India follows at 6.5%, with growth fueled by expanding urban and semi-urban households and increased power backup needs. Germany, at 6.0%, benefits from strong energy efficiency initiatives and technological advancements. The UK, growing at 4.9%, focuses on residential energy resilience, while the USA, at 4.4%, experiences steady adoption due to demand for portable and sustainable backup power solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The Chinese market is projected to expand at a CAGR of 7.0% from 2025 to 2035, fueled by increasing residential power backup requirements and rising demand for energy-efficient inverter solutions. Adoption is driven by the need for reliable electricity in urban and semi-urban housing projects. Domestic manufacturers are introducing lightweight, low-noise generators to cater to residential environments. Strategic collaborations with battery and inverter technology providers are improving efficiency and runtime. The focus on environmental compliance and emission standards is shaping product development. Increasing consumer awareness about safe power backup solutions is contributing to steady growth.

The Indian market is expected to grow at a CAGR of 6.5%, supported by rising power outages and demand for uninterrupted electricity supply in residential sectors. Local manufacturers are producing compact and fuel-efficient inverter generators. High adoption is observed in urban apartments and gated communities where reliable backup power is crucial. Government incentives for energy-efficient electrical devices are enhancing market potential. Partnerships between generator producers and residential developers are accelerating deployment. The shift toward renewable-compatible inverter systems are further encouraging adoption.

Germany is anticipated to expand at a CAGR of 6.0%, driven by demand for low-emission and highly efficient portable generators in homes. Consumers are prioritizing environmentally friendly and quiet models suitable for residential settings. Domestic and European manufacturers are investing in inverter technology upgrades and smart monitoring systems. Adoption is particularly strong in new housing and renovation projects focused on energy efficiency. Government regulations on emissions are shaping product specifications and market preferences.

The United Kingdom is forecast to grow at a CAGR of 4.9% due to demand in suburban and urban housing projects requiring backup power. Consumers are favoring compact, portable generators with low operational noise. Local manufacturers are collaborating with European inverter technology suppliers to enhance product performance. Residential communities are increasingly adopting fuel-efficient solutions to comply with environmental regulations. Awareness campaigns regarding safe generator usage are supporting market expansion.

The United States market is projected to expand at a CAGR of 4.4%, driven by demand for portable, reliable power solutions in homes. Adoption is concentrated in areas prone to grid interruptions and severe weather conditions. Manufacturers are focusing on lightweight, fuel-efficient, and emission-compliant inverter generators. Strategic alliances with residential construction firms and retailers are boosting distribution. Consumer preference for plug-and-play designs and smart energy management features is accelerating adoption.

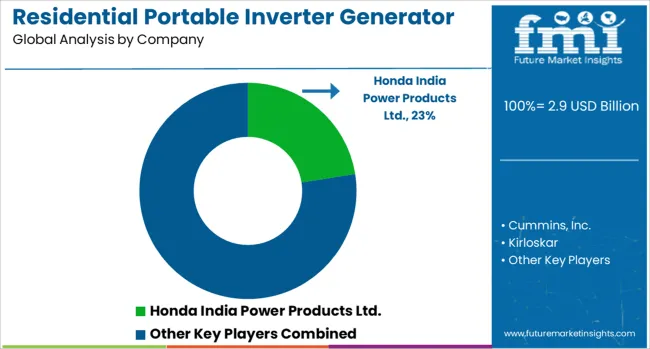

The market is defined by a combination of established global power equipment brands and emerging specialized manufacturers offering compact, efficient, and low-noise solutions for home use. Honda India Power Products Ltd. leads the market with reliable, fuel-efficient inverters known for quiet operation and advanced engine technology.

Cummins, Inc. leverages its global expertise in power solutions to provide robust and durable residential generators. Kirloskar focuses on affordable, compact models tailored for Indian households, while Briggs & Stratton delivers versatile generators with advanced inverter technology and user-friendly features. Kohler Co. integrates high-performance engines with inverter systems, ensuring stable power output for sensitive electronic appliances.

Generac Power Systems Inc. offers residential inverters with smart connectivity options and automatic voltage regulation. Yamaha Motor Co., Ltd. emphasizes noise reduction and portability, appealing to urban and suburban households. Caterpillar, Atlas Copco, and Wacker Neuson SE provide heavy-duty portable inverters with enhanced durability and long operating life.

Deere & Company and Champion Power Equipment cater to home and small commercial applications, while DuroMax, Westinghouse Electric Corporation, A-iPower Corp., and WEN Products offer cost-effective, lightweight inverters with easy maintenance. Entry barriers include high engineering precision requirements, stringent safety certifications, and brand recognition. Manufacturers combining reliability, quiet operation, and energy efficiency remain positioned to capture expanding residential demand for portable inverter power solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Power Rating | 1 kVA - 2 kVA, 1 kVA, > 2 kVA - 3 kVA, > 3 kVA - 4 kVA, and > 4 kVA |

| Power Source | Gasoline, Diesel, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honda India Power Products Ltd., Cummins, Inc., Kirloskar, Briggs & Stratton, Kohler Co., Generac Power Systems Inc., Yamaha Motor Co., Ltd., Caterpillar, Atlas Copco, Wacker Neuson SE, Deere & Company, Champion Power Equipment, DuroMax Power Equipment, Westinghouse Electric Corporation, A-iPower Corp., and WEN Products |

| Additional Attributes | Dollar sales by generator capacity and fuel type, demand dynamics across home backup power, outdoor recreational use, and small commercial applications, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in fuel efficiency, noise reduction, and inverter technology for stable power output, environmental impact of emissions, fuel consumption, and battery disposal, and emerging use cases in smart home energy integration, off-grid living, and emergency preparedness solutions. |

The global residential portable inverter generator market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the residential portable inverter generator market is projected to reach USD 4.8 billion by 2035.

The residential portable inverter generator market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in residential portable inverter generator market are 1 kva - 2 kva, 1 kva, > 2 kva - 3 kva, > 3 kva - 4 kva and > 4 kva.

In terms of power source, gasoline segment to command 72.4% share in the residential portable inverter generator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA