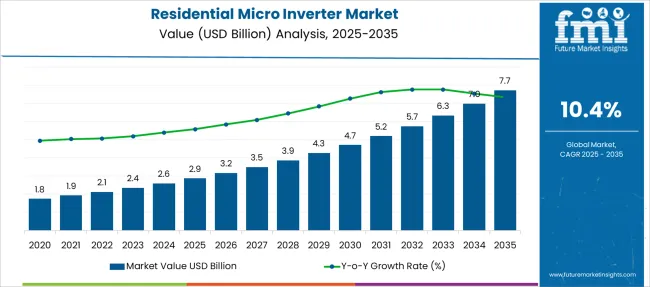

The Residential Micro Inverter Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 7.7 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period.

| Metric | Value |

|---|---|

| Residential Micro Inverter Market Estimated Value in (2025E) | USD 2.9 billion |

| Residential Micro Inverter Market Forecast Value in (2035F) | USD 7.7 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

Rising consumer demand for energy independence, coupled with government incentives promoting clean energy, has accelerated the integration of micro inverters into residential solar installations. Enhanced safety features, improved energy harvest through panel-level optimization, and ease of installation have further propelled market acceptance. The growing emphasis on grid stability and the need for smart, connected energy solutions are also encouraging the deployment of microinverter systems.

Future growth is expected to be fueled by advancements in power electronics, expansion of smart grid infrastructure, and heightened awareness of environmental sustainability. Increasing investments in residential solar projects and supportive regulatory frameworks are paving the way for broader adoption and market expansion.

The market is segmented by phase, connectivity, and region. By Phase, the market is divided into single-phase and three-phase. In terms of Connectivity, the market is classified into on-grid and standalone. Regionally, the market is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

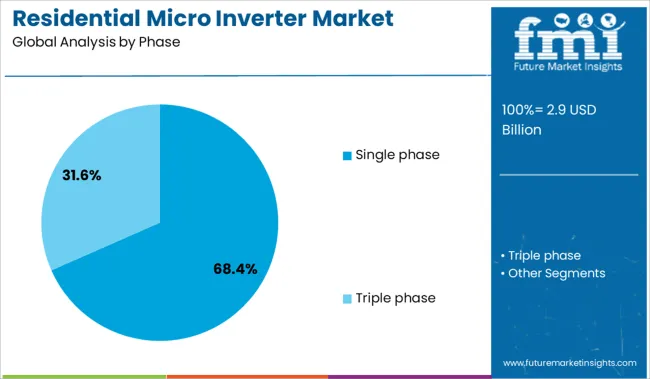

When segmented by phase, the single-phase segment is expected to hold 68.40% of the total market revenue in 2025, making it the leading phase segment. Its dominance is attributed to compatibility with most residential electrical systems, which predominantly use single-phase power.

The simplicity of installation and lower upfront costs compared to three-phase systems have driven widespread adoption among homeowners and solar installers. Operational reliability and efficiency gains from panel-level power conversion have further reinforced its market position.

The prevalence of single-phase infrastructure in residential areas has enabled faster deployment and scalability of microinverter solutions. These factors combined have ensured that the single-phase segment maintains a commanding share in the residential microinverter market.

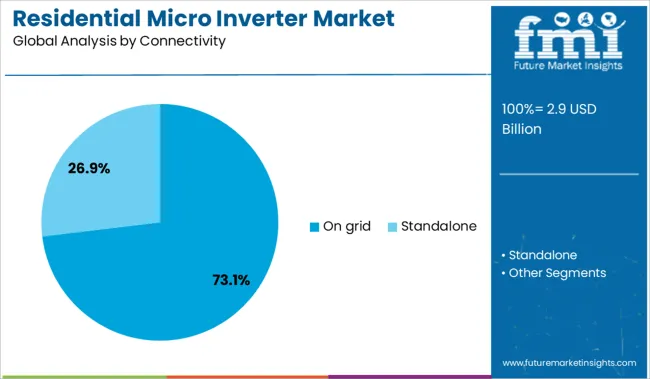

When segmented by connectivity, the on-grid segment is projected to account for 73.10% of the market revenue share in 2025, establishing it as the leading connectivity segment. This leadership stems from the widespread deployment of grid-tied solar systems, which allow homeowners to feed excess energy back to the utility grid.

On-grid systems offer financial incentives such as net metering and reduce dependence on battery storage, which lowers system costs. The ability to seamlessly integrate with existing grid infrastructure and contribute to grid stability has made on-grid microinverter solutions highly attractive.

Regulatory frameworks favoring grid interconnection and the rapid expansion of smart grid technologies are supporting this segment’s growth. These elements have collectively solidified the on-grid segment’s dominant market position.

Growing rooftop solar installations, consumer preference for optimized panel-level performance, and policy incentives are driving micro inverter adoption. Opportunities arise in smart home integration, grid edge services, and expanding solar access in emerging markets.

Demand for residential micro inverters is rising as homeowners install rooftop solar systems. Compared to traditional central inverters, micro inverters provide panel‑level conversion and independent output monitoring, improving energy harvest when panels are shaded or oriented differently. This enhanced efficiency appeals to homeowners seeking reliable returns on solar investments and smarter energy use.

Government rebates, feed‑in tariff schemes, and net metering policies in many regions further encourage residential solar installations. Additionally, increasing concerns about energy independence and rising utility rates are motivating property owners to build self‑consuming solar systems. As solar becomes a mainstream household utility, micro inverters are gaining traction across single and multi‑dwelling units, especially where system reliability and panel diagnostics matter most.

The micro inverter market offers growth potential through integration with smart energy management systems, battery storage, and home automation platforms. Inverters with app-based monitoring, remote diagnostics, and modular plug‑and‑play design make system upgrades easier for homeowners and installers. Partnerships with solar installers and home‑energy firms can bundle micro inverters with rooftop panels and storage solutions.

Community solar programs and residential aggregators in emerging markets present additional market access opportunities. Companies offering value-added features like dynamic load balancing, grid support functionality, and firmware updates can differentiate their products. Expansion into rentals, subscription-based solar-as-a-service models, and affordable micro inverter bundles in developing regions can drive broader adoption and revenue growth.

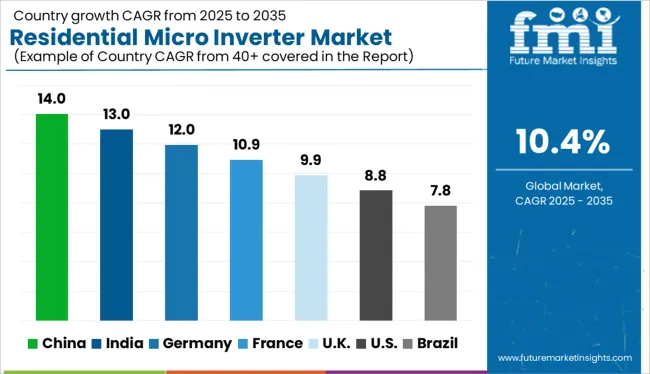

| Countries | CAGR |

|---|---|

| China | 14.0% |

| India | 13.0% |

| Germany | 12.0% |

| France | 10.9% |

| UK | 9.9% |

| USA | 8.8% |

| Brazil | 7.8% |

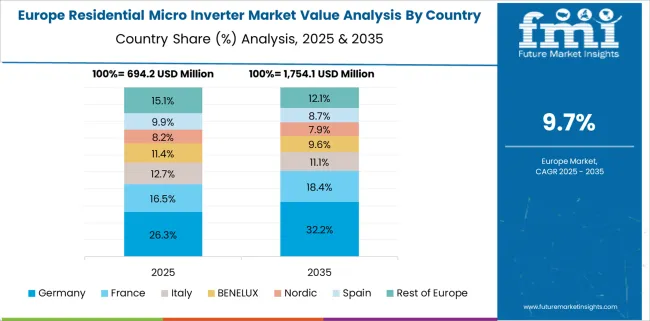

The global residential micro inverter market is projected to grow at a CAGR of 10.4% from 2025 to 2035, fueled by decentralized solar adoption, enhanced grid resilience demands, and evolving net metering policies. Within BRICS, China leads with a 14.0% CAGR, driven by aggressive rooftop solar expansion, supportive government subsidies, and local inverter manufacturing.

India follows closely at 13.0%, supported by national solar rooftop programs and residential electrification in semi-urban zones. Among OECD countries, Germany shows robust growth at 12.0%, propelled by high solar penetration, energy independence goals, and smart home integration. The United Kingdom (9.9%) aligns with decarbonization strategies and home energy efficiency trends, while the United States (8.8%) reflects steady adoption across suburban markets and solar-plus-storage upgrades. This report covers a detailed analysis of 40+ countries, and the top countries have been shared as a reference.

China is projected to lead the global residential micro inverter market with a strong CAGR of 14%, driven by surging rooftop solar adoption and favorable grid parity policies. The national push for decentralized solar in Tier-2 and Tier-3 cities is accelerating demand for low-voltage, modular inverter systems.

Government-backed subsidy programs and net metering reforms continue to favor micro inverter installations over traditional string systems. Domestic manufacturers are scaling up R&D around heat management, efficiency, and cloud-integrated control features to meet evolving homeowner expectations.

The residential micro inverter market in India is forecast to expand at a CAGR of 13%, supported by high electricity tariffs, increased solar awareness, and government schemes like PM-KUSUM. With rising consumer interest in home solar solutions, micro inverters are gaining popularity for their safety, ease of maintenance, and panel-level optimization.

Southern and western states are seeing strong adoption, aided by state-specific solar policies and utility incentives. The rise of solar-as-a-service models and EMI-based installations are making micro inverters accessible to middle-income households.

Germany is expected to witness a CAGR of 12% in the residential micro inverter segment, as energy transition efforts focus on decentralized power production. Strict building codes, feed-in tariff revisions, and a preference for energy independence are pushing households toward micro inverter systems.

Older PV installations are also being retrofitted with modern inverter technologies to enhance efficiency. Local inverter manufacturers are innovating on compact, low-noise units that integrate with battery storage. Environmental concerns and grid decarbonization efforts continue to support consistent micro inverter demand across the residential sector.

The United Kingdom is forecast to grow at a CAGR of 9.9%, driven by building decarbonization mandates, rising energy bills, and the Smart Export Guarantee (SEG). Demand is shifting toward micro inverters due to their superior safety features and compatibility with complex roof layouts. Residential solar growth is particularly strong in Scotland and the South of England.

Consumer awareness around self-consumption and backup energy systems is growing post-energy crisis, favoring micro inverter-based installations. Digital monitoring capabilities and grid resilience features are gaining importance in purchase decisions.

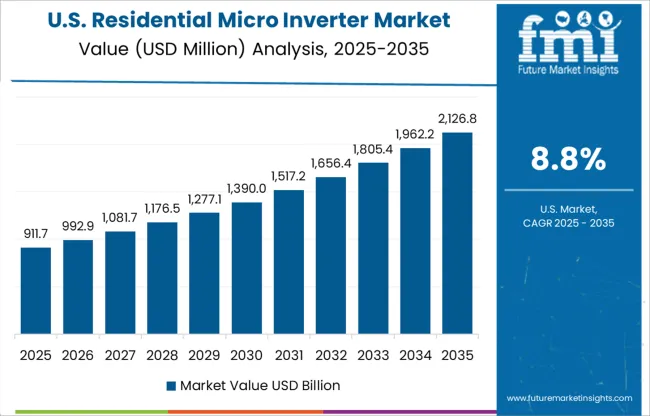

The United States residential micro inverter market is set to expand at a CAGR of 8.8%, fueled by California’s NEM 3.0 reforms and growing adoption of home solar across sunbelt states. Rising interest in energy resilience amid extreme weather events is leading consumers to adopt systems with real-time monitoring and fault isolation capabilities.

Federal tax credits and state-level rebates are boosting market penetration in both new builds and retrofits. Micro inverters are increasingly paired with residential energy storage, especially in wildfire-prone areas where grid outages are common.

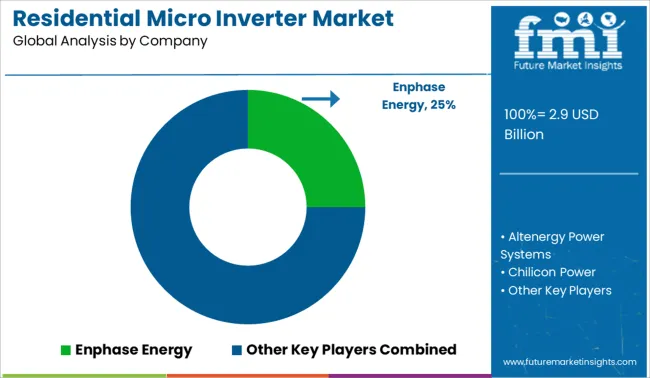

The residential micro inverter market is moderately consolidated, led by a few technologically advanced players focusing on high-efficiency, module-level power electronics. Enphase Energy holds a dominant market share, driven by its industry-leading IQ series, robust monitoring software, and strong installer partnerships across North America and Europe.

Tier 1 competitors such as SMA Solar Technology, Hoymiles, and Growatt offer scalable, cost-effective micro inverter solutions tailored for global residential solar deployments.

Tier 2 firms, including Altenergy Power Systems, Darfon Electronics, and Chisageess, target emerging markets with reliable, budget-friendly products. Tier 3 suppliers like Sparq Systems, TSUNESS, and Yotta Energy focus on innovation in storage integration, plug-and-play systems, and niche regional markets. Growth is fueled by rooftop solar adoption, smart home energy systems, and increasing demand for module-level optimization and safety.

On January 30, 2025, Enphase Energy announced its expansion into Vietnam and Malaysia, beginning shipments of its high-powered IQ8P microinverter (480 W AC output) with a 25-year warranty, supporting advanced residential solar modules.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Phase | Single phase and Triple phase |

| Connectivity | On grid and Standalone |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Enphase Energy, Altenergy Power Systems, Chilicon Power, Chisageess, Darfon Electronics, Envertech (Zhejiang Envertech), Fimer Group, Growatt New Energy, Hoymiles, Lead Solar Energy, NingBo Deye Inverter Technology, Sensata Technologies, SMA Solar Technology, Sparq Systems, TSUNESS, and Yotta Energy |

| Additional Attributes | Dollar sales by inverter phase, power rating, and rooftop system size; regional demand influenced by solar adoption rates, net metering policies, and energy independence trends; innovation in module-level monitoring, grid connectivity, and hybrid storage integration; cost dynamics shaped by silicon availability and installation labor; environmental impact of inverter disposal; and emerging use cases in smart homes and off-grid residential systems. |

The global residential micro inverter market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the residential micro inverter market is projected to reach USD 7.7 billion by 2035.

The residential micro inverter market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in residential micro inverter market are single phase and triple phase.

In terms of connectivity, on grid segment to command 73.1% share in the residential micro inverter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

On Grid Residential Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA