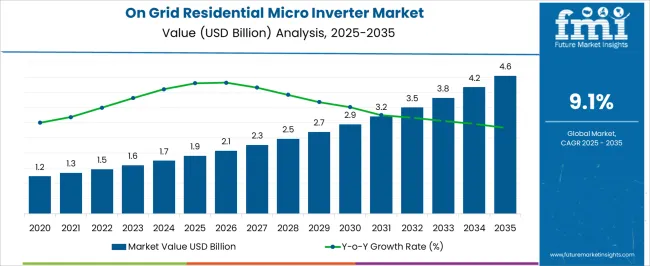

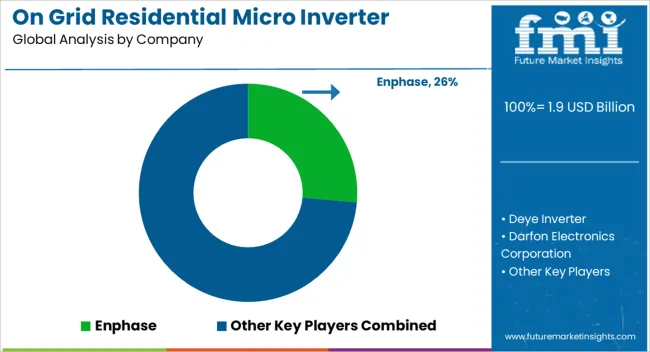

The global on-grid residential micro inverter market is anticipated to be USD 1.9 billion in 2025 and is expected to reach USD 4.6 billion by 2035, witnessing a CAGR of 9.1% across the forecast horizon. An inflection point mapping of this market shows how growth momentum shifts at key thresholds, signaling transitions in adoption behavior, technological confidence, and investment intensity. In the early phase from USD 1.2 billion to USD 1.9 billion, growth remains gradual as consumers and residential installers focus on system reliability, payback periods, and regulatory approvals, which keeps the adoption curve in a cautious build-up mode.

The first major inflection point appears near the USD 2.3 billion to USD 2.7 billion range, where a visible uptick in installations occurs due to falling component prices, improved efficiency ratings, and expanded government incentive programs, indicating that market acceptance accelerates beyond the early adopter segment.

The second inflection emerges around the USD 3.5 billion to USD 4.2 billion bracket, where mainstream adoption dominates and the market begins scaling rapidly on the back of aggregated residential demand, financing models, and bundled rooftop solutions offered by installers. Post this phase, growth shows signs of stabilizing toward USD 4.6 billion by 2035 as the market approaches maturity, with expansion driven by replacement demand and incremental upgrades rather than new installations. This inflection point mapping highlights where strategic interventions, marketing intensity, and R&D investments can create maximum leverage, helping stakeholders anticipate demand surges and allocate resources effectively for sustained market positioning.

| Metric | Value |

|---|---|

| On Grid Residential Micro Inverter Market Estimated Value in (2025 E) | USD 1.9 billion |

| On Grid Residential Micro Inverter Market Forecast Value in (2035 F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

The on-grid residential micro inverter market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the residential solar photovoltaic (PV) installations market, which accounts for about 40% share, as micro inverters are widely used to convert DC power from individual solar panels into AC power for grid connection, improving system efficiency and reliability. The smart grid and energy management systems sector contributes around 25%, driven by the integration of advanced monitoring, data analytics, and remote control features that enable homeowners to optimize energy usage and feed surplus power back to the grid.

The energy storage and battery solutions market holds close to 15% influence, supported by the growing trend of pairing micro inverters with residential energy storage systems to enhance self-consumption and backup power capabilities. The electrical components and power electronics industry adds nearly 12%, as advancements in semiconductors, thermal management, and circuit design directly enhance the performance and durability of micro inverters. The government policy and incentive programs market contributes close to 8%, as tax credits, net metering policies, and renewable energy subsidies continue to drive consumer adoption and reduce upfront installation costs.

The distribution of market influence shows that residential solar adoption and smart energy management form the backbone of this market, while storage integration, electronic innovation, and policy support continue to expand its commercial reach. This interconnected ecosystem demonstrates that the on-grid residential micro inverter market is supported by multiple industries, ensuring steady demand, operational efficiency, and consistent year-on-year growth.

The on-grid residential micro inverter market is undergoing accelerated expansion, supported by increasing residential solar PV adoption and grid modernization efforts. Rising electricity costs and supportive government incentives have driven homeowners toward solar energy, where micro inverters offer enhanced system performance and safety advantages over traditional string inverters. Market growth is further reinforced by growing consumer awareness of module-level monitoring, improved energy harvesting, and easier maintenance, all of which are facilitated by micro inverter technology.

The shift toward smart homes and decentralized power generation is also playing a critical role in market development. As the residential solar sector continues to mature, micro inverters are being increasingly favored for their scalability and resilience in partial shading conditions.

While initial capital investment remains a consideration, falling component costs and improved energy yields have bolstered return on investment, making micro inverters an attractive choice for residential users. The market outlook remains favorable, with technological advancements and regulatory support expected to sustain adoption rates in both mature and emerging solar economies.

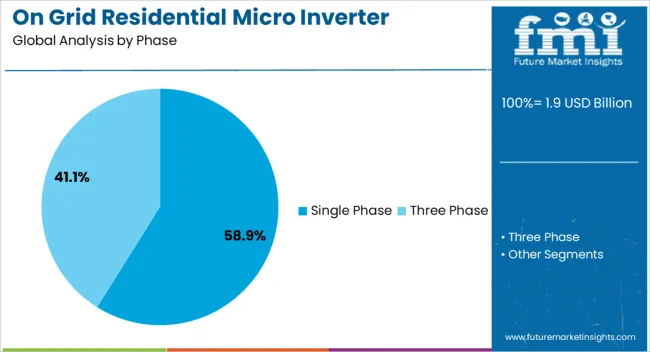

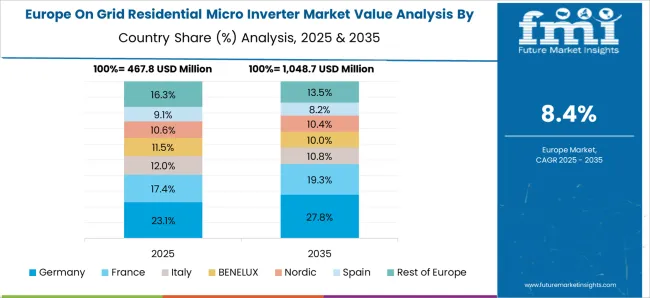

The on grid residential micro inverter market is segmented by phase, and geographic regions. By phase, on grid residential micro inverter market is divided into Single Phase and Three Phase. Regionally, the on grid residential micro inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single phase segment dominates the on-grid residential micro inverter market, accounting for approximately 58.9% of the total share. This leadership position is largely due to the inherent compatibility of single phase systems with standard residential electrical infrastructure. Micro inverters used in single phase configurations are preferred for their simplified installation, lower upfront cost, and seamless integration with existing home electrical panels.

The segment has witnessed increased adoption across urban and suburban areas, where rooftop solar installations are becoming more prevalent among individual homeowners. Additionally, single phase inverters support module-level power optimization, which enhances system reliability and performance even under variable sunlight conditions. Their compact design and minimal wiring requirements contribute to ease of deployment, making them a preferred choice for small to medium-scale residential solar setups.

Regulatory frameworks favoring net metering and grid interconnectivity have further propelled demand for single phase micro inverters. With continued advancements in system efficiency and smart grid compatibility, this segment is expected to maintain its market leadership over the forecast period.

The on-grid residential micro inverter market is being shaped by rising rooftop solar installations, demand for module-level power optimization, supportive government policies, and ongoing technological advancements. Homeowners are seeking reliable and efficient energy solutions to reduce electricity costs and increase energy independence. Micro inverters provide improved performance, fault detection, and real-time monitoring, making them suitable for residential use. Incentive programs and regulatory support are reducing initial investment barriers, while technological improvements are enhancing product efficiency and lifespan. These combined dynamics are accelerating adoption, strengthening market growth, and positioning on-grid residential micro inverters as a critical component of modern home solar systems.

The on-grid residential micro inverter market is growing with the increasing adoption of rooftop solar systems in residential sectors. Homeowners are seeking reliable and efficient solutions to convert solar energy into usable electricity while staying connected to the main grid. Micro inverters are preferred for their ability to maximize power output from each panel, improving overall system efficiency. Growing electricity costs, energy security concerns, and interest in self-consumption are encouraging households to invest in solar power. The expansion of residential solar installations is directly boosting demand for on-grid micro inverters, supporting stable market growth across urban and suburban regions.

Micro inverters offer module-level power conversion, which reduces energy losses caused by shading, panel mismatch, or dirt accumulation. This feature ensures that each solar panel operates at its maximum potential, enhancing overall system performance. Homeowners benefit from improved energy yields, higher reliability, and simplified system design. Real-time monitoring of individual panels enables quick detection of faults, lowering maintenance costs. These operational advantages are making micro inverters a preferred choice over traditional string inverters for residential applications. The demand for module-level optimization is pushing manufacturers to develop more efficient and durable on-grid residential micro inverter solutions for rooftop solar systems.

Government incentives, tax credits, and rebate programs are accelerating the adoption of on-grid residential micro inverters. Policies promoting renewable energy installations, net metering schemes, and feed-in tariffs are encouraging homeowners to invest in solar energy systems. Regulatory standards for grid connectivity and safety are ensuring product reliability and boosting consumer confidence. Many countries in North America, Europe, and Asia-Pacific are offering financial support to reduce initial costs, making solar systems with micro inverters more accessible. These policy frameworks are reducing payback periods, stimulating market demand, and fostering widespread deployment of on-grid residential micro inverters in diverse regions.

Manufacturers are introducing advanced micro inverter designs with enhanced conversion efficiency, improved heat management, and extended product lifespans. Integration with smart energy management systems, home batteries, and grid-tied monitoring platforms is improving energy utilization and grid stability. Features such as remote diagnostics, wireless communication, and plug-and-play installation are simplifying deployment for residential users. Technological advancements are also enabling higher power handling capacities and better compatibility with evolving solar module designs. These improvements are increasing consumer adoption, helping manufacturers expand their market presence, and driving the overall growth of the on-grid residential micro inverter market globally.

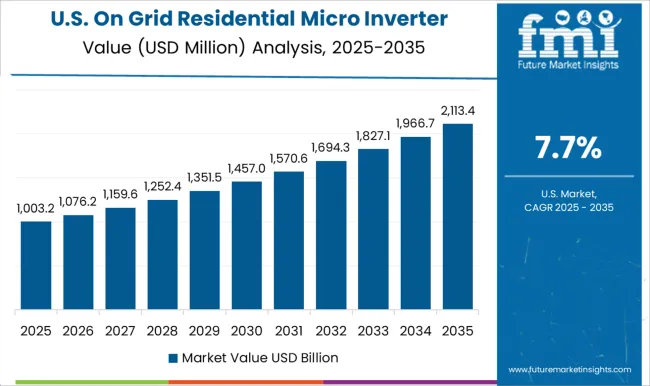

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| France | 9.6% |

| U.K. | 8.6% |

| U.S. | 7.7% |

| Brazil | 6.8% |

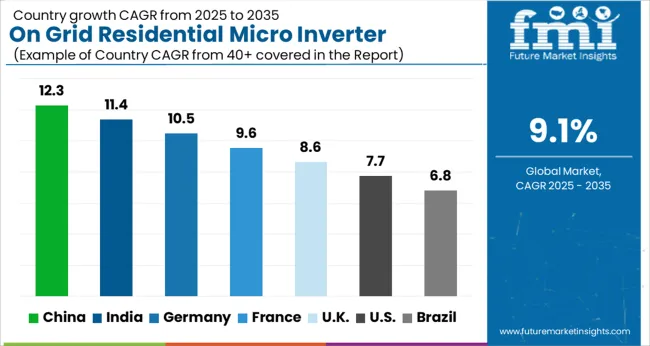

The global on-grid residential micro inverter market is projected to grow at a CAGR of 9.1% from 2025 to 2035. China leads with 12.3%, followed by India at 11.4%, Germany at 10.5%, the U.K. at 8.6%, and the U.S. at 7.7%. Growth is driven by rising rooftop solar installations, favorable net metering policies, and increasing consumer demand for energy efficiency. BRICS countries, particularly China and India, are scaling production capacity, installation networks, and component supply chains to meet growing domestic demand. OECD nations such as Germany, the U.K., and the U.S. emphasize high-efficiency inverter technologies, grid stability, and regulatory compliance to enhance system performance and market reach. The analysis spans over 40+ countries, with the leading markets detailed below.

The on grid residential micro inverter market in China is projected to grow at a CAGR of 12.3% from 2025 to 2035, driven by widespread adoption of rooftop solar systems and government incentives for renewable energy. Rapid urban housing expansion and increasing residential energy demand are encouraging homeowners to install micro inverter-based solar systems for improved efficiency and safety. Domestic manufacturers are scaling production and introducing high-performance, cost-effective micro inverters to meet growing demand. Grid modernization efforts and smart energy management solutions are enhancing integration of distributed solar generation. Supportive policies, subsidies, and low-interest financing for residential solar projects further strengthen market penetration.

The on grid residential micro inverter market in India is expected to grow at a CAGR of 11.4% from 2025 to 2035, supported by expanding solar power capacity and government-led clean energy initiatives. Increasing electricity costs and frequent grid outages are pushing households toward solar power systems with micro inverters for reliable energy supply. Residential rooftop solar adoption is gaining momentum, with net metering policies and state-level subsidies driving installations. Domestic and international players are investing in local manufacturing and distribution networks to serve this fast-growing segment. Awareness campaigns and government-backed programs are encouraging homeowners to adopt solar energy, fueling demand for micro inverters.

The on grid residential micro inverter market in Germany is projected to grow at a CAGR of 10.5% from 2025 to 2035, driven by strong demand for distributed solar generation and stringent renewable energy targets. Homeowners are increasingly choosing micro inverters for improved system performance, safety, and monitoring capabilities. Government incentives, feed-in tariffs, and tax benefits are fostering widespread rooftop solar adoption. Technological advancements in micro inverter efficiency and smart home integration are further boosting appeal. German firms are actively developing advanced products with improved conversion efficiency and long operational lifespans, supporting both domestic and export markets.

The on grid residential micro inverter market in the U.K. is expected to grow at a CAGR of 8.6% from 2025 to 2035, supported by rising residential solar adoption and government renewable energy programs. Homeowners are investing in solar systems with micro inverters to reduce electricity bills and improve system reliability. Incentives such as feed-in tariffs, zero-VAT on solar installations, and grants under energy efficiency schemes are driving uptake. The market is benefiting from growing awareness of clean energy and increased availability of financing options. Advancements in real-time monitoring and energy storage integration further enhance the appeal of micro inverter systems for residential use.

The on grid residential micro inverter market in the U.S. is projected to grow at a CAGR of 7.7% from 2025 to 2035, driven by strong demand for residential solar energy and federal clean energy policies. Tax credits, rebates, and net metering schemes are accelerating adoption across various states. Homeowners prefer micro inverters for their ability to maximize energy output, ensure safety, and allow panel-level monitoring. Growing interest in energy independence and resilience against power outages further supports demand. Manufacturers are expanding distribution channels and offering financing solutions to make micro inverter systems more accessible, sustaining market growth.

Competition in the on grid residential micro inverter market is shaped by conversion efficiency, ease of installation, system reliability, and compatibility with smart energy platforms. Enphase dominates this space with its high-efficiency microinverters, known for module-level power optimization, rapid shutdown compliance, and seamless integration with energy storage and monitoring platforms. Deye Inverter competes with single-phase microinverters designed for small residential rooftops, offering fanless designs, high MPPT accuracy, and Wi-Fi-enabled monitoring systems. Darfon Electronics Corporation focuses on compact and lightweight microinverters tailored for urban rooftop installations, promoting ease of handling and quick deployment with plug-and-play wiring architectures.

Fimer Group differentiates through advanced power electronics, providing microinverters with high energy yield, thermal resilience, and modular designs suitable for various panel types. Fenice Energy positions itself by integrating microinverters into turnkey residential solar packages, emphasizing simplified installation, performance monitoring, and energy optimization for households. Sparq System brings to market quad-port microinverters that serve multiple panels simultaneously, lowering per-panel costs and minimizing rooftop component density. Sensol competes with smart energy products offering real-time monitoring, AI-based fault detection, and compact microinverter configurations for space-limited rooftops. Statcon Energiaa leverages its power electronics expertise to provide microinverters optimized for Indian grid conditions, focusing on high surge tolerance, extended warranty support, and cost competitiveness. SunEvo Solar supplies residential PV systems featuring integrated microinverters with robust thermal protection and flexible mounting solutions. Solis Solar competes with grid-tied inverter solutions offering strong performance under partial shading, multiple MPPT channels, and compact form factors for rooftop designs.

Tata Power Solar participates in this market through end-to-end residential solar offerings featuring microinverter-based designs, emphasizing reliability, long-term performance guarantees, and a nationwide service network. Mid-sized and regional firms differentiate through specialized features like rapid shutdown compliance, enhanced thermal dissipation, and wireless monitoring integration.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Phase | Single Phase and Three Phase |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Enphase, Deye Inverter, Darfon Electronics Corporation, Fimer Group, Fenice Energy, Sparq System, Sensol, Statcon Energiaa, SunEvo Solar, Solis Solar, and Tata Power Solar |

| Additional Attributes | Dollar sales, share, installation trends, regional adoption, competitor landscape, pricing benchmarks, efficiency ratings, regulatory compliance, grid connectivity, warranty and service programs, distribution channels, consumer preferences. |

The global on grid residential micro inverter market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the on grid residential micro inverter market is projected to reach USD 4.6 billion by 2035.

The on grid residential micro inverter market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in on grid residential micro inverter market are single phase and three phase.

In terms of , segment to command 0.0% share in the on grid residential micro inverter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Online Sweepstakes Platform Market Size and Share Forecast Outlook 2025 to 2035

One-Box Electronic Hydraulic Brake (EHB)System Market Size and Share Forecast Outlook 2025 to 2035

Online Food Delivery and Takeaway Market Size and Share Forecast Outlook 2025 to 2035

Online Clothing Rental Market Size and Share Forecast Outlook 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

On-orbit Satellite Servicing Market Forecast and Outlook 2025 to 2035

Onshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Onsite Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

On-shelf Availability Solution Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Oncology Based Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Online Airline Booking Platform Market Size and Share Forecast Outlook 2025 to 2035

On-site Preventive Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

On-Board Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Online To Offline Commerce Market Size and Share Forecast Outlook 2025 to 2035

On-Demand Logistics Market Size and Share Forecast Outlook 2025 to 2035

Online Travel Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Onboard Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Global On-Demand Repair Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Online Fitness Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA