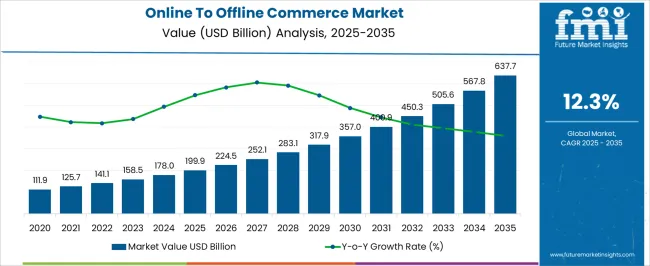

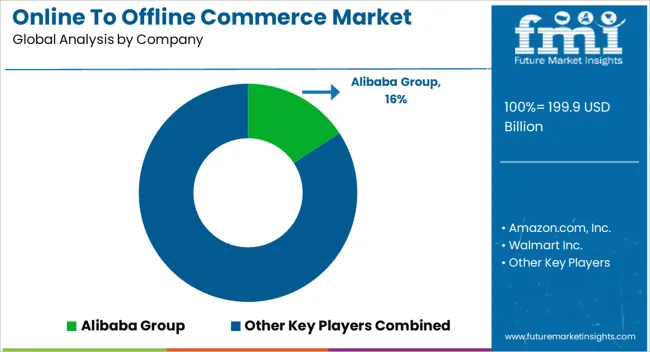

The Online To Offline Commerce Market is estimated to be valued at USD 199.9 billion in 2025 and is projected to reach USD 637.7 billion by 2035, registering a compound annual growth rate (CAGR) of 12.3% over the forecast period.

| Metric | Value |

|---|---|

| Online To Offline Commerce Market Estimated Value in (2025 E) | USD 199.9 billion |

| Online To Offline Commerce Market Forecast Value in (2035 F) | USD 637.7 billion |

| Forecast CAGR (2025 to 2035) | 12.3% |

The online to offline commerce market is gaining strong momentum, supported by the rapid expansion of digital ecosystems and the rising preference for integrated shopping experiences. Growth is being driven by the increasing penetration of smartphones, digital payment adoption, and greater internet accessibility in both developed and emerging economies. Consumers are increasingly engaging in online discovery before completing purchases in physical or localized channels, which is encouraging retailers and service providers to strengthen their online presence while enhancing offline fulfillment capabilities.

Businesses are adopting omni-channel strategies to capture consumer attention, while partnerships between digital platforms and offline retailers are expanding reach and improving customer convenience. Investments in logistics, delivery optimization, and real-time analytics are creating stronger synergies between the online and offline environments.

Regulatory initiatives promoting digital payments and secure transaction frameworks are further supporting the sector’s growth As consumer expectations continue to evolve toward convenience, personalization, and instant delivery, the market is positioned to witness significant expansion with innovative models redefining commerce across multiple sectors.

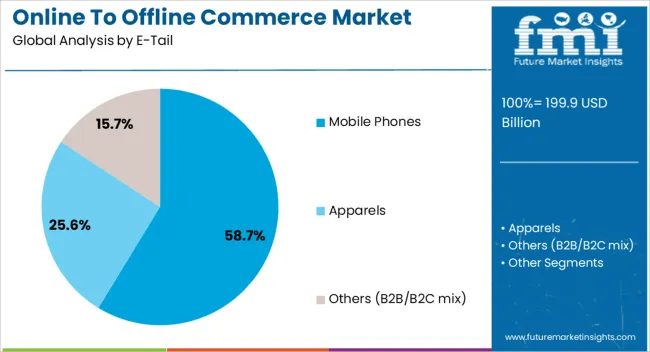

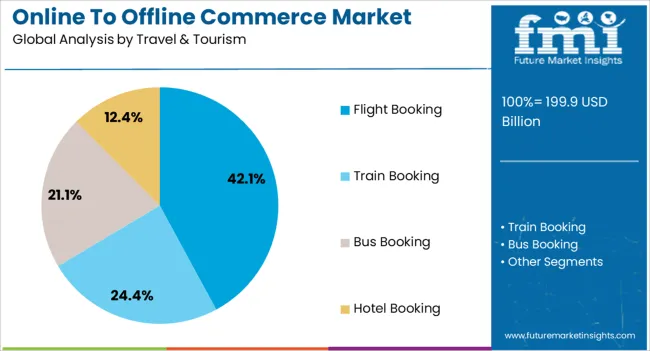

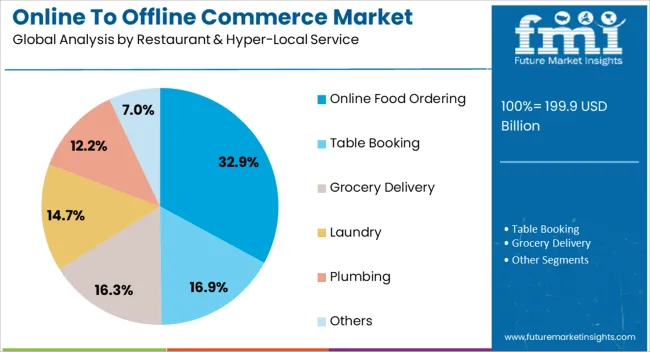

The online to offline commerce market is segmented by e-tail, travel & tourism, restaurant & hyper-local service, and geographic regions. By e-tail, online to offline commerce market is divided into Mobile Phones, Apparels, and Others (B2B/B2C mix). In terms of travel & tourism, online to offline commerce market is classified into Flight Booking, Train Booking, Bus Booking, and Hotel Booking. Based on restaurant & hyper-local service, online to offline commerce market is segmented into Online Food Ordering, Table Booking, Grocery Delivery, Laundry, Plumbing, and Others. Regionally, the online to offline commerce industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mobile phones subsegment within the e-tail category is projected to hold 58.7% of the online to offline commerce market revenue share in 2025, establishing itself as the leading product category. This leadership is being influenced by the increasing reliance on smartphones as essential consumer devices, coupled with frequent upgrade cycles and expanding availability of financing options. The segment’s strength is also supported by widespread consumer adoption of online browsing for specifications, price comparisons, and promotions before completing purchases through offline or hybrid channels.

Retailers are leveraging digital platforms to showcase a broad range of mobile devices while offering offline touchpoints for product trials, ensuring greater consumer confidence in purchase decisions. The rising presence of mid-range and budget-friendly smartphones has further expanded accessibility, fueling demand in both urban and semi-urban markets.

Additionally, the growing influence of flash sales, exchange offers, and bundled service packages is reinforcing consumer engagement in this segment As mobile technology continues to advance and 5G adoption increases, the mobile phones category is expected to retain its leadership in the e-tail segment.

The flight booking subsegment within travel and tourism is anticipated to account for 42.1% of the online to offline commerce market revenue share in 2025, making it the dominant contributor in this category. Its leadership is being supported by the increasing preference for digital platforms to compare fares, manage bookings, and access promotional offers, while still engaging with offline channels for ancillary services and customer support. Airlines and travel service providers are investing heavily in hybrid distribution models that integrate online discovery with offline travel agency partnerships, ensuring wider reach across consumer groups.

Enhanced user experience through mobile applications and secure digital payment systems is further accelerating adoption in this segment. Demand is also being reinforced by rising air travel volumes, both for leisure and business purposes, as global connectivity improves and disposable incomes increase.

Real-time fare updates and personalized recommendations are shaping consumer choices, while loyalty programs and bundled travel offerings are promoting retention With ongoing recovery in global travel demand and technological advancements in booking platforms, the flight booking segment is expected to maintain its leadership within the travel and tourism category.

The online food ordering subsegment within restaurant and hyper-local service is expected to capture 32.9% of the online to offline commerce market revenue share in 2025, positioning it as the leading subsegment. Its growth is being influenced by changing consumer lifestyles, rising urbanization, and increasing demand for convenient dining options. Digital platforms are offering a wide variety of cuisine choices, personalized recommendations, and flexible payment solutions, which are encouraging higher engagement.

The ability to place orders online with offline fulfillment through delivery or takeaway services is creating a seamless hybrid experience that resonates strongly with urban consumers. Partnerships between restaurants and digital aggregators are enhancing service reach, while promotional discounts and loyalty programs are further boosting adoption. Expanding investments in cloud kitchens and delivery infrastructure are also supporting growth by ensuring faster service and wider coverage.

The segment is further reinforced by the increasing role of real-time tracking and digital feedback mechanisms in improving consumer trust and satisfaction As disposable incomes rise and demand for on-demand food services grows, online food ordering is expected to remain the leading driver in the restaurant and hyper-local services segment.

Online to offline commerce is a business model that draws potential customers from online channels to physical store. Over the years, this idea has evolved with the evolution of e-commerce industry. Currently, e-commerce companies are highly investing in acquiring clients as a part of Omni channel strategy, in order to enhance customer experience.

Few of the e-commerce companies having both online presence and offline presence are leveraging two different channel as a complementary to each other. The idea behind online to offline e-commerce model is to create awareness of product and services, allow potential customers to search different offering online and then purchase the product in brick and mortar stores.

The online to offline e-commerce have attained new heights in the recent past with e-commerce companies making their presence in hyper-local service category, online booking of movie and passenger tickets, and booking restaurants.

Recently, market has witnessed e-commerce players slowly and gradually launching their own brick and mortar stores and vice versa. In-fact, e-commerce companies which were merely a marketplace (platforms) are now establishing their delivery centers to enhance customer experience.

A consumer in online to offline model searches for the product online; however, purchases it through an offline channel. A local store which hesitated to sell their products online due to the discounting nature of online marketplaces, finds this model lucrative.

Additionally, few products such as jewelry and electronics products are explored by customers online; however, due to the dynamics of certain products and its associated price are purchased offline. “Touch and Feel” factor is driving the online to offline commerce market.

Irrespective of these facts, the road ahead is not as smooth as it seems for e-commerce players, as the e-commerce industry is facing challenges on multiple fronts. E-commerce is relatively new industry as compared to brick and mortar stores owing to which the majority of online retailers lack digital marketing skills and do not have a proper governance structure to operate.

This has led to certain significant challenges in the e-commerce industry especially, in the emerging economies, where consumers explores products on a particular online platform and eventually purchase it from a different well-established brick and mortar store.

In the North America region, entire e-commerce ecosystem is well established. E-Commerce has led the way and established a surrounding ecosystem that is encouraging to include online to offline commerce. With the presence of leading e-commerce players in the USA, North America represents potential opportunity in online-to- offline e-commerce market.

Asia-Pacific region holds the largest market opportunity for online to offline e-commerce business models during the forecast period. Increasing penetration of smartphone and growing internet infrastructure in the countries such as China and India are paving the way for the growth of online to offline commerce market. Significant private venture capital investments to the start-ups in this regions has led to increased expenditure on marketing and promotional activities with an aim of acquiring customers, which would facilitate customers' loyalty and in turn customer retention.

Alibaba Group Holding Limited, Amazon.com, Inc., Wal-Mart Stores, Inc., Flipkart.com, and IKEA are some the key players of the global online to offline e-commerce market.

Online to Offline E-Commerce Market Segments

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

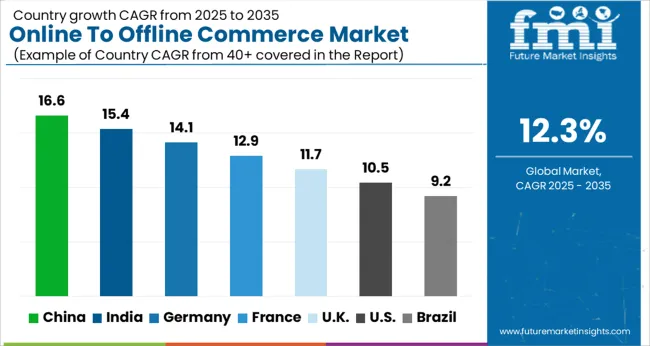

| Country | CAGR |

|---|---|

| China | 16.6% |

| India | 15.4% |

| Germany | 14.1% |

| France | 12.9% |

| UK | 11.7% |

| USA | 10.5% |

| Brazil | 9.2% |

The Online To Offline Commerce Market is expected to register a CAGR of 12.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 16.6%, followed by India at 15.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 9.2%, yet still underscores a broadly positive trajectory for the global Online To Offline Commerce Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 14.1%. The USA Online To Offline Commerce Market is estimated to be valued at USD 74.5 billion in 2025 and is anticipated to reach a valuation of USD 201.5 billion by 2035. Sales are projected to rise at a CAGR of 10.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 9.5 billion and USD 5.6 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 199.9 Billion |

| E-Tail | Mobile Phones, Apparels, and Others (B2B/B2C mix) |

| Travel & Tourism | Flight Booking, Train Booking, Bus Booking, and Hotel Booking |

| Restaurant & Hyper-Local Service | Online Food Ordering, Table Booking, Grocery Delivery, Laundry, Plumbing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alibaba Group, Amazon.com, Inc., Walmart Inc., JD.com, Inc., Rakuten, Inc., Groupon, Inc., eBay Inc., Target Corporation, Best Buy Co., Inc., Flipkart Pvt Ltd, and Zomato Media Pvt Ltd |

The global online to offline commerce market is estimated to be valued at USD 199.9 billion in 2025.

The market size for the online to offline commerce market is projected to reach USD 637.7 billion by 2035.

The online to offline commerce market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types in online to offline commerce market are mobile phones, apparels and others (b2b/b2c mix).

In terms of travel & tourism, flight booking segment to command 42.1% share in the online to offline commerce market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Online Paint Editor App Market Size and Share Forecast Outlook 2025 to 2035

Customer Analytics in E-commerce Market by Component by Application & Region Forecast till 2035

Online Sweepstakes Platform Market Size and Share Forecast Outlook 2025 to 2035

Tower Vibration Control System Market Size and Share Forecast Outlook 2025 to 2035

Online Food Delivery and Takeaway Market Size and Share Forecast Outlook 2025 to 2035

Online Clothing Rental Market Size and Share Forecast Outlook 2025 to 2035

Tool Holders Market Size and Share Forecast Outlook 2025 to 2035

Tobacco Packaging Market Size and Share Forecast Outlook 2025 to 2035

Top Loading Cartoning Machine Market Forecast and Outlook 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Tobacco Films Market Size and Share Forecast Outlook 2025 to 2035

Toilet Roll Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

TOC Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Tool Box Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Total Reflection X-Ray Fluorescence Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Tow Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Topical Anti-infective Drugs Market Size and Share Forecast Outlook 2025 to 2035

Touch Controller IC Market Size and Share Forecast Outlook 2025 to 2035

Torrified Wheat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA