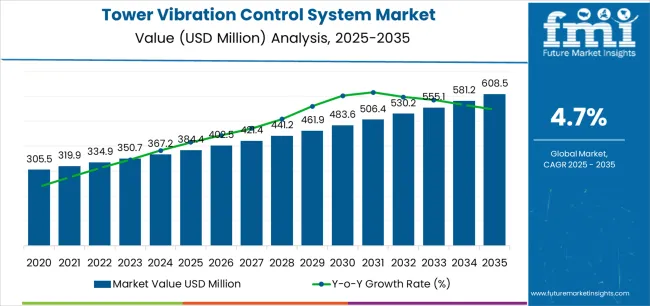

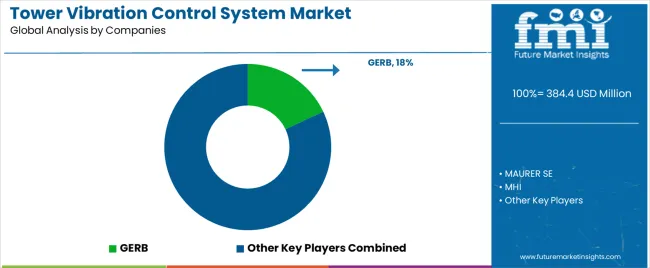

The tower vibration control system market is valued at USD 384.4 million in 2025 and is projected to reach USD 608.5 million by 2035, advancing at a CAGR of 4.7%. Market growth is supported by increasing construction of high-rise structures, wind turbines, and transmission towers that require advanced damping technologies to maintain structural stability under dynamic load conditions. Expanding urban infrastructure, rising adoption of renewable energy installations, and stricter structural safety regulations are further contributing to consistent demand.

Active tower vibration control systems account for the leading market share, favored for their adaptability, precise real-time response, and integration capability with smart monitoring systems. These systems use actuators and sensors to counteract oscillations caused by wind, seismic activity, and operational vibration, ensuring longer structural lifespan and reduced maintenance costs. Passive and semi-active systems remain in demand for retrofitting and cost-sensitive applications.

Asia Pacific leads global growth due to large-scale infrastructure development and rapid wind power expansion in China and India. Europe and North America maintain stable demand supported by modernization of existing structures and adoption of digital monitoring solutions. Prominent market participants include GERB, MAURER SE, MHI, Flow Engineering, Enidine, TVS Acoustics, Deicon, Woelfel, Engiso, and ESM GmbH, alongside companies such as Vibratec, TESolution,.

The tower vibration control system market presents an absolute dollar opportunity of approximately USD 224.1 million between 2025 and 2035, reflecting the expanding demand for advanced vibration mitigation technologies in energy, telecom, and infrastructure sectors. This notable rise in market value underscores a steady shift toward high-performance damping solutions that enhance structural stability and extend the lifespan of towers subjected to dynamic wind and seismic loads.

From 2025 to 2030, a significant portion of this opportunity will stem from the wind energy sector, as the deployment of taller, more flexible wind turbine towers drives the need for precision-engineered vibration control systems. The telecom segment will also contribute substantially, driven by the ongoing expansion of 5G networks and high-frequency antenna installations.

Between 2030 and 2035, the absolute dollar opportunity will be further supported by infrastructure modernization projects, particularly in developing regions focusing on sustainable and resilient design standards. Manufacturers offering smart, sensor-integrated damping systems will capture the largest share of this incremental value. The USD 224.1 million absolute dollar opportunity highlights a decade of consistent, technology-driven growth potential within the global tower vibration control ecosystem.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 384.4 million |

| Market Forecast Value (2035) | USD 608.5 million |

| Forecast CAGR (2025-2035) | 4.7% |

The tower vibration control system market is expanding as rising wind-energy infrastructure and high-rise construction demand solutions for structural stability and service-life extension. Systems such as tuned-mass dampers, active vibration suppression units and hybrid control devices become integral in tall-tower and wind-turbine‐tower designs where wind loads and seismic events induce oscillations. Engineers incorporate vibration control to reduce fatigue in tower members, minimise maintenance downtime and meet stricter regulatory requirements for structural safety.

The innovations in sensor integration, real-time monitoring and adaptive control algorithms enhance the performance of vibration mitigation solutions in towers. Growth is supported by rising global investments in renewable energy, especially onshore and offshore wind projects, and urbanisation that drives taller commercial towers in earthquake-prone zones. Constraints include high upfront costs for advanced vibration control systems, complexity of retrofit installation in existing towers and limited standardisation of control solutions for varied tower geometries.

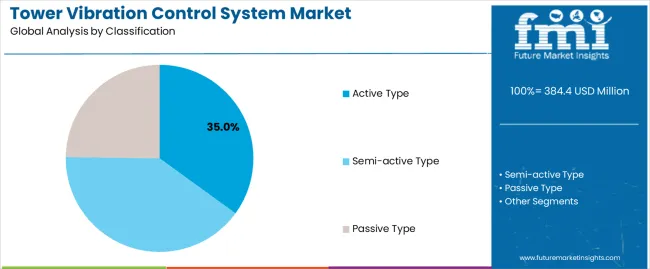

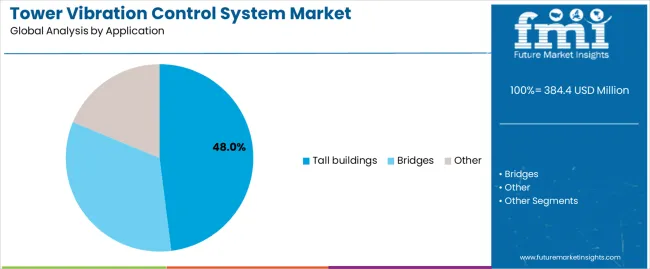

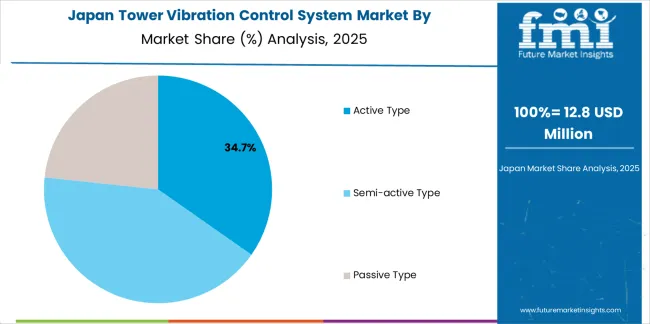

The tower vibration control system market is segmented by classification and application. By classification, the market is divided into active type, semi-active type, and passive type systems. Based on application, the market is categorized into tall buildings, bridges, and other structural applications. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The active type segment holds the leading position in the tower vibration control system market, capturing approximately 35.0% of the total share in 2025. Active vibration control systems utilize sensors, actuators, and feedback mechanisms to counter external forces such as wind or seismic motion in real time. These systems are characterized by their adaptability, allowing structural responses to be dynamically managed across a wide range of frequencies and environmental conditions. Their dominance stems from growing implementation in high-rise structures and complex infrastructure projects that require precise control performance and long-term structural safety.

The semi-active type segment ranks second, offering a hybrid approach that balances real-time adaptability with reduced energy consumption. Passive systems, while less costly, have limited response flexibility and are mainly deployed in smaller or static applications. The market trajectory favors active systems due to advancements in sensor technology, real-time data processing, and integration with structural health monitoring frameworks.

Key factors supporting the active type segment include:

Tall buildings account for approximately 48.0% of the tower vibration control system market in 2025. This dominance reflects the increasing incorporation of advanced vibration mitigation technologies in high-rise and supertall structures to improve occupant comfort, structural performance, and compliance with building safety codes. Active and semi-active control systems have become essential for mitigating wind-induced oscillations and seismic responses in dense urban construction zones, particularly in Asia-Pacific and the Middle East.

Bridges represent a secondary application area, where vibration control systems are deployed to minimize dynamic loads from traffic and environmental forces. The “other” category includes towers, chimneys, and industrial structures requiring stability enhancement under operational loads.

Primary dynamics driving demand from tall buildings include:

Rapid infrastructure development, wind energy expansion, and tower safety standards are driving market growth.

The tower vibration control system market is driven by large-scale construction of telecommunication, transmission, and wind-turbine towers that require stable operational performance and structural durability. Rising investments in wind energy projects and high-rise steel structures have accelerated the adoption of advanced damping systems to manage dynamic loads and reduce fatigue failures. Regulatory requirements related to seismic safety, structural vibration control, and wind-load performance further strengthen market demand. Continuous technological advancements in tuned mass dampers, viscous dampers, and hybrid control devices are improving vibration mitigation efficiency, enabling cost-effective and reliable tower performance across utility and industrial sectors.

High installation costs, complex retrofitting, and material price fluctuations restrict adoption.

The deployment of tower vibration control systems involves significant initial investment, including design customization, engineering validation, and on-site calibration. Retrofitting existing tower structures with damping devices often requires substantial technical adaptation and downtime, deterring adoption in cost-sensitive projects. Material cost fluctuations, particularly in metals and composite components used in damper manufacturing, add further constraints to budget predictability. The limited availability of skilled professionals for installation and maintenance creates operational challenges in emerging markets. These factors collectively reduce scalability and delay widespread deployment across developing regions.

IoT integration, predictive maintenance, and modular retrofit systems define the evolving market outlook.

Key market trends highlight the integration of smart sensors and Internet of Things (IoT)-enabled monitoring systems that provide real-time vibration analytics and predictive maintenance insights. The Asia-Pacific region is witnessing strong growth driven by wind power expansion and 5G telecommunication infrastructure upgrades. Manufacturers are increasingly developing modular, lightweight, and retrofit-compatible vibration control systems to support quick installation in existing towers. The convergence of digital monitoring, structural engineering innovation, and ecofriendly-focused design is shaping the next phase of global market development.

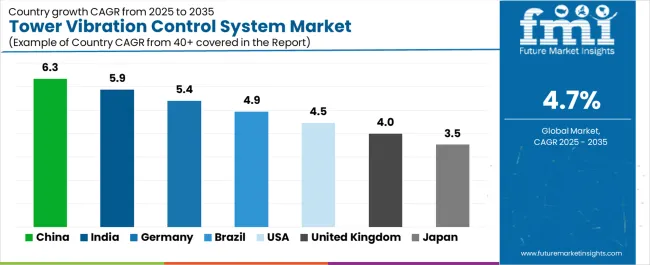

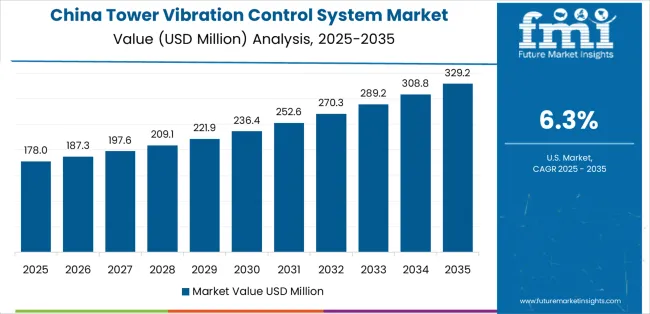

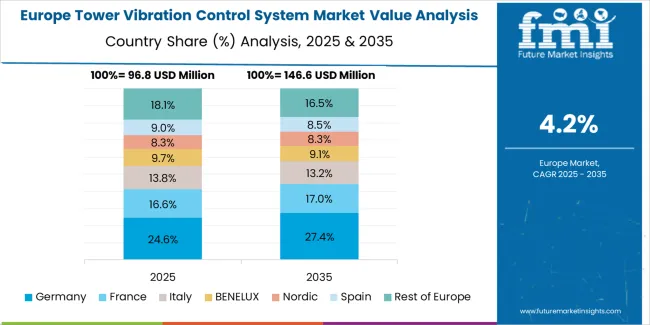

The global tower vibration control system market is expanding steadily, driven by demand for structural safety, renewable energy deployment, and precision engineering technologies. China leads the market with a 6.3% CAGR, followed by India at 5.9%, supported by infrastructure development and wind energy growth. Germany’s 5.4% growth reflects industrial modernization, while Brazil’s 4.9% rate stems from expanding energy and telecommunication sectors. The United States grows at 4.5%, focusing retrofitting and smart monitoring adoption. The United Kingdom and Japan, at 4.0% and 3.5% respectively, maintain gradual progress through technology integration and advanced manufacturing programs focused on structural resilience.

| Country | CAGR (%) |

|---|---|

| China | 6.3 |

| India | 5.9 |

| Germany | 5.4 |

| Brazil | 4.9 |

| USA | 4.5 |

| UK | 4.0 |

| Japan | 3.5 |

China leads the global tower vibration control system market with a 6.3% CAGR, supported by strong investments in wind energy infrastructure, construction modernization, and industrial safety frameworks. Government projects focused on renewable energy generation and tall-structure safety compliance are driving the installation of advanced damping and monitoring systems. Domestic manufacturers are enhancing production capacity for vibration isolation devices integrated with sensor technologies. Expanding high-rise construction across coastal cities and inland industrial zones supports market growth. Continuous technology transfer from global suppliers is strengthening China’s position in tower stability engineering and smart infrastructure safety applications.

Key Market Factors:

India’s market grows at 5.9% CAGR, driven by the expansion of wind energy projects, communication infrastructure, and smart city developments. The country’s renewable energy roadmap has prioritized tower stability and performance optimization across high-capacity turbine installations. Engineering firms are collaborating with international technology providers to implement vibration damping systems that enhance operational life cycles. Local production of isolation materials and actuators is increasing through government-backed industrial incentives. The implementation of vibration control in telecommunication and transmission towers is also expanding, supported by policy initiatives promoting resilient infrastructure and localized manufacturing of advanced mechanical components.

Market Development Factors:

Germany’s tower vibration control system market records 5.4% CAGR, driven by advanced research in mechanical engineering, renewable power systems, and structural health monitoring. The country’s industrial base emphasizes high-precision vibration control in wind energy applications and telecommunication networks. German engineering firms are investing in adaptive damping solutions using active and semi-active technologies to improve efficiency under variable load conditions. National ecofriendly targets encourage integration of vibration mitigation measures across industrial infrastructure. Partnerships between research institutes and private firms are enhancing real-time monitoring systems, ensuring structural durability and compliance with safety regulations.

Key Market Characteristics:

Brazil’s market grows at 4.9% CAGR, reflecting investment in renewable energy generation and modernization of communication infrastructure. Government-backed projects to enhance grid reliability and urban connectivity are driving adoption of vibration mitigation systems. Domestic engineering companies are collaborating with multinational firms to introduce damping materials suited to tropical and high-wind conditions. The energy sector’s focus on wind turbine performance optimization is boosting demand for tower stability technologies. The development of regional manufacturing clusters supports the local production of vibration control components, improving supply efficiency and reducing import dependency.

Market Development Factors:

The United States records 4.5% CAGR, supported by modernization of energy infrastructure, communication systems, and industrial safety upgrades. Federal programs promoting renewable energy expansion and grid stability have led to increased adoption of tower vibration control technologies. Companies are integrating predictive maintenance and real-time monitoring tools into vibration management frameworks. Engineering firms are retrofitting aging structures with smart damping systems to comply with updated safety regulations. The ongoing focus on improving operational reliability and extending asset lifespans across the energy and telecom sectors maintains steady market demand nationwide.

Key Market Factors:

The United Kingdom’s market expands at 4.0% CAGR, driven by renewable energy projects and infrastructure resilience programs. Offshore wind farms and national communication networks are incorporating vibration control systems for long-term operational safety. Engineering consultancies are implementing damping solutions within design frameworks to comply with structural performance codes. Government policies under ecofriendly and decarbonization initiatives are encouraging integration of smart monitoring and vibration isolation technologies. Collaboration between European suppliers and UK engineering firms is improving component innovation and testing capabilities. Market growth is sustained through consistent investment in advanced mechanical systems and safety-oriented engineering design.

Market Development Factors:

Japan’s tower vibration control system market grows at 3.5% CAGR, reflecting its focus on precision engineering, seismic safety, and long-term structural performance. The country’s infrastructure programs mandate use of advanced damping and control technologies for high-rise, energy, and communication towers. Domestic manufacturers produce hybrid damping systems optimized for compact applications in urban and coastal regions. Research collaborations among universities, engineering firms, and material scientists are advancing intelligent sensor integration and structural response modeling. Continuous investment in high-quality manufacturing standards ensures product reliability, supporting consistent demand across energy, industrial, and public infrastructure applications.

Market Characteristics:

The tower vibration control system market exhibits moderate concentration with nearly twenty notable players competing globally. GERB holds the leading position with an estimated 18.0% market share, supported by its long-standing expertise in vibration isolation technologies and engineering design for high-rise, wind, and industrial structures. The company’s competitive strength lies in its integrated manufacturing capabilities and consistent performance validation across large infrastructure projects.

MAURER SE and MHI follow as key competitors, leveraging extensive experience in dynamic structural systems and mechanical damping solutions. Their product diversification and engineering partnerships with construction and energy sectors enhance competitiveness in both custom and standardized installations. Flow Engineering, Enidine, and TVS Acoustics compete regionally through tailored vibration control systems that focus on cost optimization and adaptability to varied tower configurations.

Mid-tier specialists such as Deicon, Woelfel, and Engiso contribute to innovation in smart damping technologies and digital monitoring, strengthening the transition toward sensor-integrated vibration control solutions. European firms including ESM GmbH, Vibratec, TESolution, AMC, and LISEGA SE maintain stable market positions through advanced materials research and compliance with international building standards.

Emerging participants like Mageba-group, Thornton Tomasetti, and CTS Industries are expanding footprints through engineering consultancy and project-specific installations. Competitive differentiation in this market is primarily defined by engineering precision, lifecycle performance, and customization capacity, with growth opportunities driven by rising demand for vibration mitigation in tall structures and renewable energy towers.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Classification | Active Type, Semi-active Type, Passive Type |

| Application | Tall Buildings, Bridges, Other |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | GERB, MAURER SE, MHI, Flow Engineering, Enidine, TVS Acoustics, Deicon, Woelfel, Engiso, ESM GmbH, Vibratec, TESolution |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape featuring vibration control and damping solution providers; integration with tall structure and bridge safety systems; advancements in active and semi-active vibration suppression technologies. |

The global tower vibration control system market is estimated to be valued at USD 384.4 million in 2025.

The market size for the tower vibration control system market is projected to reach USD 608.5 million by 2035.

The tower vibration control system market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in tower vibration control system market are active type, semi-active type and passive type.

In terms of application, tall buildings segment to command 48.0% share in the tower vibration control system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tower Crane Rental Market Growth – Trends & Forecast 2025 to 2035

Tower Crane Market Growth - Trends & Forecast 2025 to 2035

Tower Mounted Amplifier Market by Type, by Technology, by End User & Region Forecast till 2035

Analyzing Tower Mounted Amplifier Market Share & Industry Leaders

UK Tower Mounted Amplifier Market Trends – Size, Share & Growth 2025-2035

USA Tower Mounted Amplifier Market Growth – Demand, Trends & Forecast 2025-2035

Japan Tower Mounted Amplifier Market Report – Demand, Trends & Industry Forecast 2025-2035

Remote Towers Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Rental Market Size, Growth, and Forecast 2025 to 2035

Germany Tower Mounted Amplifier Market Analysis - Growth, Applications & Outlook 2025 to 2035

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Cat Trees & Towers Market

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Transmission Towers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA