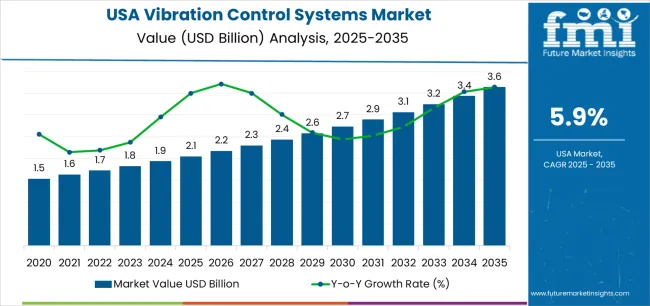

The USA vibration control systems demand is valued at USD 2.1 billion in 2025 and is expected to reach USD 3.6 billion by 2035, supported by a CAGR of 5.9%. Demand is driven by the need to manage structural and equipment-level vibration across industrial machinery, automotive platforms, aerospace assemblies, and building infrastructure. Rising precision requirements in manufacturing, along with the need to reduce noise, mechanical wear, and operational instability, encourages continuous use of isolation mounts, damping materials, and active vibration controls. Adoption is also influenced by stricter operational standards in sectors that rely on high-accuracy instrumentation.

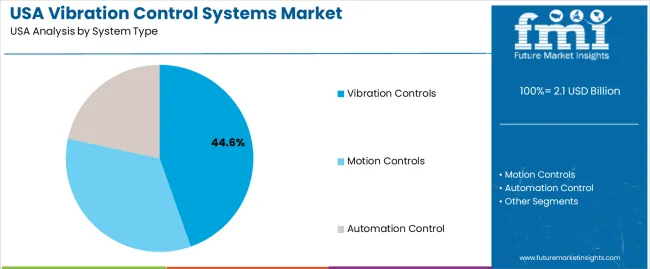

Vibration controls represent the leading system type. Their broad use across rotating equipment, HVAC systems, automotive components, and sensitive electronics supports steady procurement. These systems help maintain operational continuity by limiting vibration-induced deviation, protecting bearings and structural components, and improving measurement reliability in environments with sustained dynamic loads.

The West, South, and Northeast remain the principal growth regions. These areas host extensive industrial facilities, automotive supply networks, aerospace clusters, and high-density commercial infrastructure that depend on reliable vibration mitigation solutions. Their concentration of research laboratories and advanced manufacturing sites further reinforces demand for high-performance isolation and damping products. HUTCHINSON, DynaTronic Corporation Ltd., Cooper Standard, GERB, and Technical Manufacturing Corporation are the key suppliers. Their portfolios include elastomeric mounts, tuned mass dampers, active control modules, and engineered isolation solutions designed for machinery foundations, vehicle systems, and structural applications.

Growth-momentum analysis shows a strong early-period trajectory between 2025 and 2029 as industrial plants, automotive manufacturers, and infrastructure operators expand adoption of isolation mounts, dampers, and active-control units. Early momentum is reinforced by equipment-modernisation programs in machining, energy production, and process industries, where stabilising precision equipment reduces wear, improves output quality, and supports regulatory compliance for noise and structural vibration limits.

From 2030 to 2035, growth momentum shifts toward a more predictable pattern as deployment stabilises across mature industrial segments. Procurement becomes increasingly tied to lifecycle replacement, asset-management schedules, and incremental improvements in elastomer formulations, tuned-mass technology, and electronically controlled damping systems. Broader integration with condition-monitoring platforms and predictive-maintenance software sustains consistent demand without generating steep acceleration. The overall momentum profile reflects a transition from early investment-driven expansion to a stable, operations-focused phase supported by long equipment lifecycles, steady industrial utilisation, and ongoing reliability requirements across USA manufacturing, transportation, and energy sectors.

| Metric | Value |

|---|---|

| USA Vibration Control Systems Sales Value (2025) | USD 2.1 billion |

| USA Vibration Control Systems Forecast Value (2035) | USD 3.6 billion |

| USA Vibration Control Systems Forecast CAGR (2025 to 2035) | 5.9% |

Demand for vibration control systems in the USA is increasing because industries require improved reliability, precision and structural integrity for machinery, vehicles and infrastructure. Equipment such as high-speed manufacturing lines, electric vehicle motors and data-centre cooling systems generate vibration that can shorten component lifespan, reduce product quality and increase maintenance costs. Adoption of advanced sensors, real-time analytics and isolation technologies supports investment in vibration control solutions.

Growth is further driven by expansion in sectors such as aerospace & defense, automotive electrification and semiconductor manufacturing which demand tight vibration tolerances. Domestic regulatory and safety standards that emphasise worker safety, noise and vibration limits reinforce deployment of these systems. Constraints include high upfront cost of advanced vibration control equipment and integration complexity when retrofitting existing facilities. Skilled labour for installation and calibration may be limited, and some companies may delay investment until clear return-on-investment cases emerge.

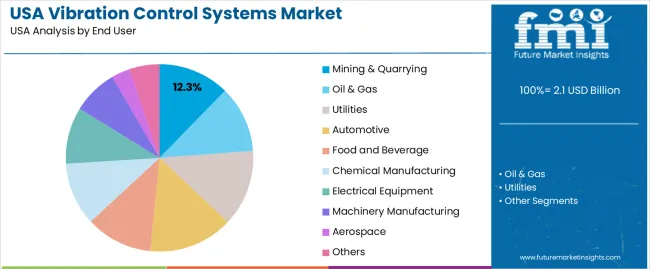

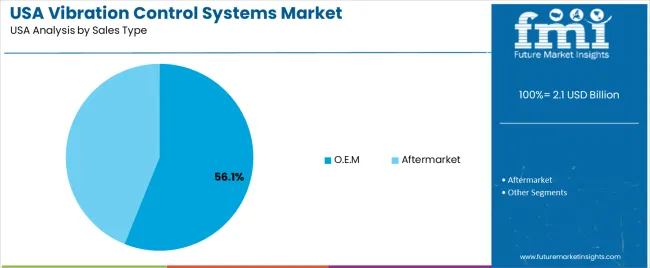

Demand for vibration control systems in the United States reflects operational requirements across industries seeking stable machine performance, reduced equipment wear, and controlled motion dynamics. System-type distribution is shaped by the need to minimise vibration, manage movement, or support automated mechanical adjustments. End-user patterns reflect the varied operating environments in heavy industries, utilities, manufacturing, and specialised sectors requiring controlled mechanical stability. Sales-type distribution highlights how original-equipment integration and aftermarket maintenance both sustain system usage across machinery lifecycles.

Vibration-control systems hold 44.6% of national demand and represent the leading system type. They are used to maintain equipment stability, reduce oscillations, and improve operational reliability across rotating machinery, pumps, compressors, and heavy-duty industrial assets. Motion-control systems represent 33.8%, supporting controlled mechanical movement in applications requiring precision handling, alignment, or dynamic adjustment. Automation-control systems account for 21.6%, enabling integrated monitoring and real-time corrective adjustments within automated production environments. System-type distribution reflects the need to protect equipment from wear, maintain production consistency, and reduce downtime in industries operating under continuous load or variable mechanical stress.

Key drivers and attributes:

The automotive sector holds 14.6% of national demand and forms the largest end-user segment. Manufacturers use vibration and motion-control solutions to stabilise powertrain components, manage noise and harshness, and maintain durability in assembly lines. Utilities represent 13.2%, relying on vibration-stable rotating equipment in power-generation and distribution systems. Mining and quarrying account for 12.3%, where heavy machinery requires high-load vibration control. Food and beverage and oil and gas each hold 11.5%, supporting pumps, mixers, and process systems. Chemical manufacturing represents 10.9%, electrical equipment 9.8%, machinery manufacturing 7.8%, aerospace 3.2%, and others 5.2%. End-user distribution reflects equipment intensity, load patterns, and operational precision requirements.

Key drivers and attributes:

OEM supply holds 56.1% of national demand and represents the dominant sales type. Vibration-control components are integrated directly into machinery during manufacturing, ensuring alignment with original equipment specifications and lifecycle performance requirements. The aftermarket represents 43.9%, supporting replacement, upgrade, and maintenance needs across ageing equipment, high-vibration environments, and long-duration industrial use. End users depend on aftermarket sourcing to maintain operational continuity, manage performance degradation, and extend equipment lifespan. Sales-type distribution reflects the balance between initial integration and ongoing maintenance needs in industries where vibration management plays a continuous operational role.

Key drivers and attributes:

In the United States, demand for vibration control systems is rising as industries seek solutions to reduce downtime, extend asset life, and improve industrial safety. Heavy infrastructure segments such as power generation, petrochemical plants, and industrial manufacturing, deploy vibration monitoring and control for turbines, compressors, large motors, and rotating equipment. The expansion of data centres, renewable energy installations and industrial automation also heightens sensitivity to vibration issues in sensitive equipment and support structures. Increased service-activity in managing mechanical health and reliability further stimulates adoption of vibration control systems.

Budget constraints, long equipment lifecycles and competing preventive approaches restrain growth. Vibration control systems involve significant investment in sensors, control devices, vibration dampers or isolation mounts, and installation of monitoring networks, which may impact purchase decisions especially in cost-sensitive facilities. Many existing assets have long operational lifetimes and may operate without upgraded vibration solutions if current performance is acceptable, which slows new system uptake. Some users favour preventive maintenance and periodic inspections over continuous vibration‐control systems, which can reduce the perceived need for full-scale deployments.

Manufacturers are integrating vibration sensors, IoT connectivity, real-time analytics and remote diagnostics into control systems to enable early fault detection, predictive maintenance alerts and trending analysis. The growth of renewable-energy applications, such as wind turbines, offshore platforms, and modular generator sets increases demand for vibration control systems optimized for new energy and mechanical designs. There is also a rising preference for modular vibration isolation and damping systems that can retrofit existing machinery with minimal downtime and integrate into condition monitoring frameworks. These trends support continued growth of vibration-control system demand in the USA industry.

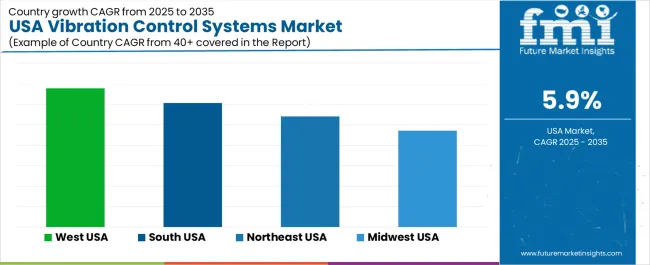

Demand for vibration control systems in the USA is increasing through 2035 as industrial plants, commercial buildings, energy facilities, and transportation operators adopt advanced isolation and damping technologies. These systems support machinery stability, reduce structural vibration, improve equipment life, and enhance operational consistency in settings where rotating equipment, HVAC units, compressors, generators, and automated machines run daily. Growth is shaped by modernization of industrial facilities, upgrades in building mechanical systems, and wider adoption of precision manufacturing where vibration tolerance is low. Regional demand varies with industrial density, construction activity, and energy-sector presence. The West leads with 6.8% CAGR, followed by the South (6.1%), the Northeast (5.4%), and the Midwest (4.7%).

| Region | CAGR (2025-2035) |

|---|---|

| West | 6.8% |

| South | 6.1% |

| Northeast | 5.4% |

| Midwest | 4.7% |

The West grows at 6.8% CAGR, supported by strong industrial modernization, high commercial-building density, and active energy infrastructure across California, Washington, and Oregon. Data centers adopt isolation systems to protect servers from vibration-related instability, especially in regions where seismic considerations influence equipment installation. Manufacturing facilities rely on damping solutions for precision machining, robotics, and semiconductor processing. Commercial buildings install isolation mounts for HVAC units and rooftop machinery to control transmitted vibration. Renewable-energy sites use vibration-control components for turbines, drive systems, and power-conversion equipment. These varied applications sustain demand throughout major metropolitan and industrial corridors.

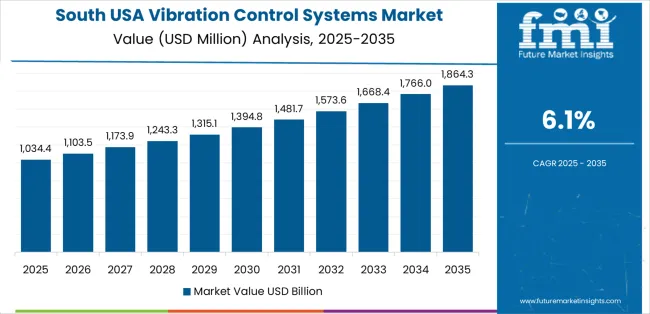

The South grows at 6.1% CAGR, supported by extensive industrial activity across Texas, Georgia, Alabama, Tennessee, and the Carolinas. Manufacturing plants use vibration-control components in automotive production, chemical facilities, food processing, and metalworking operations. Energy infrastructure, including refineries, gas-processing plants, and power-generation facilities relies on isolation systems for pumps, compressors, and rotating equipment. Distribution hubs install vibration-control supports for conveyors and automated handling systems. Commercial buildings deploy mounts and isolation bases for HVAC machinery to reduce noise and vibration. Strong industrial expansion across multiple sectors reinforces steady demand.

The Northeast grows at 5.4% CAGR, supported by commercial-building renovations, dense mechanical-system installations, and advanced manufacturing across New York, Massachusetts, Pennsylvania, and neighboring states. Hospitals, laboratories, and research facilities rely on vibration isolation to protect imaging devices, analytical equipment, and precision instruments. High-rise commercial buildings integrate mounts and dampers for HVAC units and mechanical floors. Pharmaceutical and electronics manufacturers adopt vibration-control systems to maintain process stability. Transit infrastructure, including subways and commuter rails, uses damping systems for operational noise and equipment vibration. These applications maintain steady regional procurement.

The Midwest grows at 4.7% CAGR, influenced by heavy manufacturing, automotive production, agricultural processing, and industrial machinery operations across Michigan, Ohio, Illinois, Wisconsin, and Minnesota. Factories use vibration-control mounts for stamping machines, machining centers, and conveyor systems. Automotive assembly plants rely on isolation systems to support robotics and precision tools. Agricultural-processing sites install vibration dampers on compressors, blowers, and rotating machinery. Commercial and public buildings use vibration-control systems for HVAC units and mechanical equipment. While growth is moderate, essential industrial activity sustains stable equipment demand.

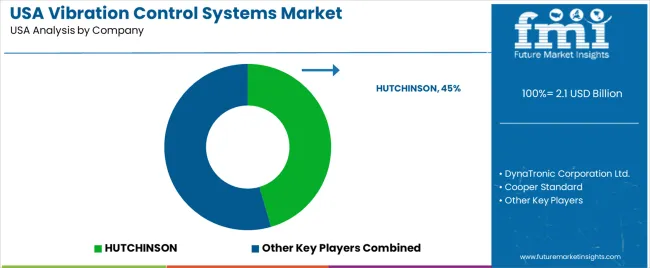

Demand for vibration-control systems in the USA is shaped by a concentrated group of engineering and materials-technology suppliers supporting industrial machinery, automotive platforms, precision equipment, and infrastructure applications. HUTCHINSON holds the leading position with an estimated 45.5% share, supported by controlled elastomer-formulation capability, consistent damping performance, and long-standing integration with USA automotive and industrial OEMs. Its position is reinforced by reliable fatigue resistance and predictable behaviour under variable dynamic loads.

DynaTronic Corporation Ltd. and Cooper Standard follow as significant participants. DynaTronic provides damping and isolation solutions used in manufacturing systems, HVAC equipment, and structural installations, supported by stable vibration-attenuation characteristics and consistent engineering support. Cooper Standard maintains a strong presence through automotive bushings, mounts, and isolators designed for controlled stiffness and long-duration durability across light-vehicle and heavy-vehicle platforms.

GERB contributes capability with spring-damping and seismic-isolation systems widely used in turbine installations, heavy machinery foundations, and precision-equipment environments. Technical Manufacturing Corporation supports additional demand with high-stability isolation platforms designed for laboratories and semiconductor facilities, emphasizing controlled low-frequency performance and structural rigidity.

Competition across this segment centers on damping consistency, fatigue resistance, load-handling capacity, material stability, and integration flexibility. Demand remains steady as USA industries expand precision manufacturing, upgrade rotating-equipment foundations, and adopt isolation systems designed to reduce vibration-induced wear, enhance equipment accuracy, and support long-term operational reliability across industrial and infrastructure settings.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| System Type | Vibration Controls, Motion Controls, Automation Control |

| End User | Mining & Quarrying, Oil & Gas, Utilities, Automotive, Food and Beverage, Chemical Manufacturing, Electrical Equipment, Machinery Manufacturing, Aerospace, Others |

| Sales Type | O.E.M, Aftermarket |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | HUTCHINSON, DynaTronic Corporation Ltd., Cooper Standard, GERB, Technical Manufacturing Corporation |

| Additional Attributes | Dollar sales by system type, end-user industry, and sales type categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of vibration and motion control solution providers; advancements in active and passive vibration isolation, automation-integrated control systems, and shock absorption technologies; integration with industrial machinery, energy sector operations, aerospace equipment stability, and automotive component manufacturing in the USA. |

The global demand for vibration control systems in USA is estimated to be valued at USD 2.1 billion in 2025.

The market size for the demand for vibration control systems in USA is projected to reach USD 3.6 billion by 2035.

The demand for vibration control systems in USA is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in demand for vibration control systems in USA are vibration controls, motion controls and automation control.

In terms of end user, mining & quarrying segment to command 12.3% share in the demand for vibration control systems in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vibration Screening Machine Market Size and Share Forecast Outlook 2025 to 2035

Vibration Damping Levelling Feet Market Size and Share Forecast Outlook 2025 to 2035

Vibration Fiber Optic Perimeter Alarm System Market Size and Share Forecast Outlook 2025 to 2035

Vibration Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vibration Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vibration Isolation System industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Vibration Analyzer Market Growth – Trends & Forecast 2025-2035

Vibration Level Switch Market Analysis by Technology, Industry, Application, and Region through 2035

Vibration Control Systems Market Growth - Trends & Forecast 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Anti-Vibration Mounts Market

Noise Vibration Harshness (NVH) Testing Market

Tower Vibration Control System Market Size and Share Forecast Outlook 2025 to 2035

Noise And Vibration Coatings Market Size and Share Forecast Outlook 2025 to 2035

Bonding Honeycomb Vibration Isolation Platform Market Size and Share Forecast Outlook 2025 to 2035

Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA